Securing funding for your fintech app is a crucial step in turning your innovative ideas into a reality.

In a highly competitive market, understanding the various funding options and strategies can make all the difference.

Whether you’re starting out or looking to scale your fintech business, having the right financial backing is essential.

This guide explores how to get funding for a fintech app, covering everything from understanding your funding needs to exploring different funding options and learning from successful fintech funding stories.

Importance of Funding in the Fintech Market

In the highly competitive fintech market, securing adequate funding is essential for the success of any fintech startup.

Funding enables companies to invest in and develop a fintech app, ensuring they can create robust, secure, and feature-rich applications.

Adequate funding also allows startups to allocate resources towards marketing, compliance with FinTech Regulations & Compliance, and continuous innovation.

This is crucial in the fast-evolving fintech landscape.

Furthermore, the fintech sector is known for its high initial costs and operational expenses.

From developing cutting-edge features to integrating advanced technologies like AI in Fintech, funding helps startups overcome financial hurdles and scale their operations.

Whether you’re looking to start a fintech business, understanding the importance of funding can significantly impact your strategy and long-term success.

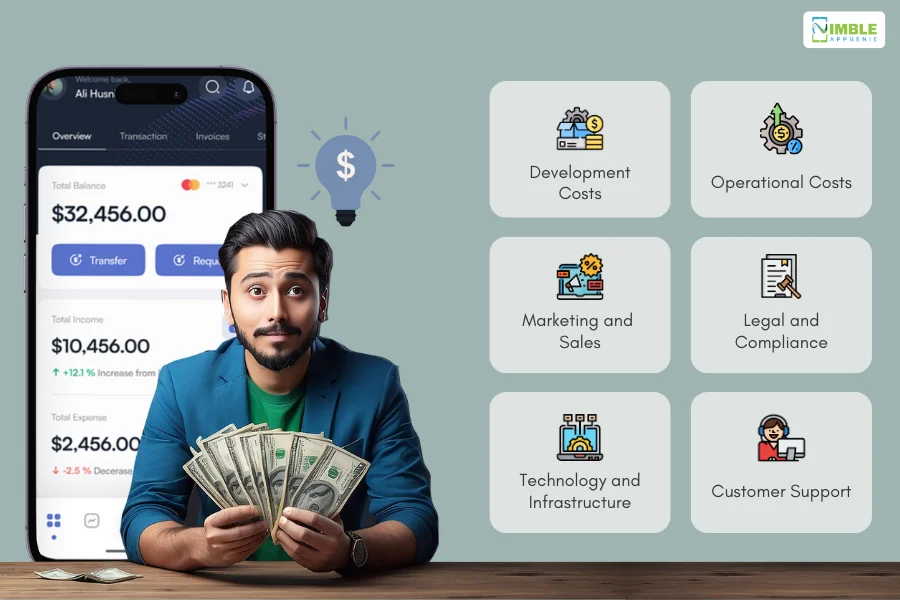

Understanding Your Funding Needs

Identifying and understanding your funding needs is a crucial step in securing financing for your fintech startup.

The amount of funding required can vary significantly based on several factors, including the complexity of your app, the features you intend to include, and the resources necessary for development and marketing.

Key Considerations for Funding Needs:

1] Development Costs

This includes expenses related to hiring developers, designers, and other technical staff. Development cost for a fintech app can vary based on complexity and the technology stack used.

2] Operational Costs

These are the ongoing costs of running your business, including salaries, office space, utilities, and other operational expenses.

3] Marketing and Sales

Budgeting for app’s marketing is essential to attract and retain users. This includes costs for digital marketing, PR campaigns, and sales strategies to penetrate the market effectively.

4] Legal and Compliance

Fintech startups need to comply with various regulations. Allocating funds for legal advice and compliance ensures that you adhere to FinTech Regulations & Compliance standards.

5] Technology and Infrastructure

This involves costs for servers, cloud services, cybersecurity measures, and any other technology infrastructure needed to support your app.

6] Customer Support

A crucial part of maintaining user satisfaction is having a reliable customer support system in place. This could involve setting up call centers, hiring support staff, and investing in CRM systems.

Understanding these components helps in crafting a realistic fintech app business plan that outlines your funding requirements and provides a clear picture to potential investors.

Properly evaluating these needs will help you secure the appropriate amount of funding to successfully develop and launch your fintech app.

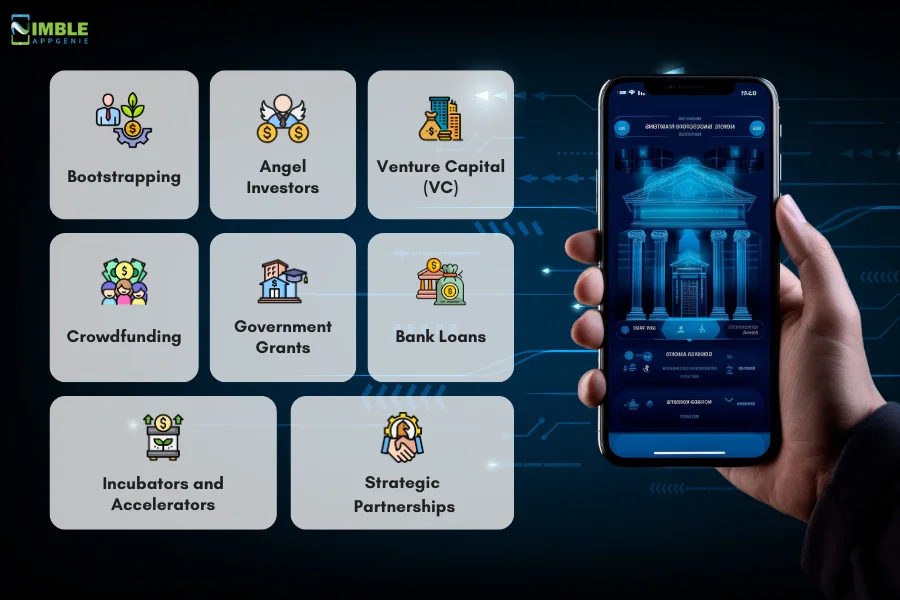

Exploring Fintech App’s Funding Options

Securing funding for a fintech app involves exploring a variety of funding options.

Each funding source offers unique benefits and comes with its own set of challenges. Let’s delve into the different avenues you can consider to raise money for your fintech app.

1. Bootstrapping

Bootstrapping involves self-funding your fintech app using personal savings or reinvesting profits from your business. This method is common among entrepreneurs who want to retain full control of their venture.

Advantages:

- Complete Control: You maintain full ownership and decision-making power without external interference.

- Equity Retention: No need to dilute ownership by giving away equity.

- Flexibility: You can implement changes and pivot strategies without needing approval from investors.

Challenges:

- Limited Resources: Funding is limited to personal savings, which can restrict growth and scalability.

- Financial Risk: Personal financial stability is at risk, especially if the business takes longer to become profitable.

- Slow Growth: Without significant funding, scaling the business quickly can be challenging.

Example: Many successful startups, such as Mailchimp and GoPro, began by bootstrapping before attracting external investment once they had proven their business models.

2. Angel Investors

Angel investors are affluent individuals who provide capital to startups in exchange for equity or convertible debt. They often invest during the early stages of a startup’s life cycle.

Advantages:

- Significant Funding: Angel investors can provide substantial amounts of capital, which is crucial during the initial stages.

- Mentorship and Guidance: Many angel investors bring valuable industry experience and can offer strategic advice.

- Networking Opportunities: Access to the investor’s network can open doors to additional funding and business partnerships.

Challenges:

- Equity Dilution: You will need to give up a portion of your company in exchange for the investment.

- Potential for Conflict: Differences in vision and strategy between founders and investors can lead to conflicts.

- Expectations for Growth: Investors will expect significant returns, which can add pressure to achieve rapid growth.

Example: Angel investors played a crucial role in the early success of companies like Google and Uber by providing the necessary capital and mentorship.

3. Venture Capital (VC)

Venture capital firms invest in startups with high growth potential in exchange for equity. They typically invest larger sums of money compared to angel investors and often participate in multiple rounds of funding.

Advantages:

- Large Funding Amounts: VCs can provide significant capital, which is essential for scaling operations and expanding market reach.

- Industry Expertise: VC firms often specialize in specific industries and can offer valuable insights and strategic guidance.

- Access to Resources: VCs can connect startups with legal, marketing, and recruitment resources, accelerating growth.

Challenges:

- Equity and Control: Significant equity is given up, and VCs may demand board seats or influence over major decisions.

- High Expectations: VCs expect substantial returns on their investments, leading to high pressure for rapid growth.

- Dilution: Multiple rounds of funding can lead to significant dilution of the founder’s equity stake.

Example: Companies like Airbnb and Stripe secured venture capital funding early on, which helped them scale rapidly and become industry leaders.

4. Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of people, typically via online platforms like Kickstarter, Indiegogo, or specialized equity crowdfunding sites.

Advantages:

- Validation: Successful crowdfunding campaigns can validate your product concept and market demand.

- No Equity Dilution (Reward-Based Crowdfunding): Funds are raised in exchange for rewards or pre-orders, not equity.

- Marketing Boost: Campaigns can generate buzz and media coverage, increasing visibility.

Challenges:

- Significant Effort: Campaigns require substantial marketing efforts to reach and convince potential backers.

- Uncertain Outcome: Success is not guaranteed, and failed campaigns can negatively impact your brand.

- Limited Funds (for Rewards-Based Crowdfunding): The amounts raised are often smaller compared to other funding options.

Example: Fintech startups like Monzo have successfully used equity crowdfunding to raise millions and build a loyal user base.

5. Government Grants

Government grants are non-repayable funds provided by federal, state, or local government bodies to support innovation and business growth in various sectors, including fintech.

Advantages:

- No Equity Dilution: Grants do not require giving up equity in your company.

- Credibility: Securing a grant can enhance your company’s credibility and attract further investment.

- Financial Support: Grants provide essential funding for research, development, and expansion.

Challenges:

- Highly Competitive: Grant applications are competitive, with strict eligibility criteria and detailed submission requirements.

- Time-Consuming: The application process can be lengthy and complex, requiring significant effort and documentation.

- Reporting Requirements: Recipients must often provide detailed progress reports and adhere to strict guidelines.

Example: In the UK, Innovate UK offers grants for innovative fintech projects, helping startups to develop and bring new technologies to market.

6. Bank Loans

Traditional bank loans involve borrowing a fixed amount of money from a bank, which must be repaid with interest over a specified period.

Advantages:

- Retain Ownership: You maintain full ownership of your company without giving up equity.

- Fixed Repayment Terms: Predictable repayment schedules and interest rates.

- Business Credit: Successfully repaying loans can build your business credit score, aiding future borrowing.

Challenges:

- Eligibility: Banks require a strong credit history and collateral, which can be a barrier for early-stage startups.

- Repayment Pressure: Regular repayments are required regardless of business performance.

- Limited Flexibility: Bank loans may not offer the flexibility needed for fast-changing fintech environments.

Example: Fintech startups with solid business plans and revenue projections can secure bank loans to finance their growth.

7. Incubators and Accelerators

Incubators and accelerators are programs designed to support early-stage startups by providing mentorship, resources, and sometimes funding in exchange for equity.

Advantages:

- Mentorship: Access to experienced mentors who provide guidance on business strategy, product development, and market entry.

- Resources: Access to office space, legal services, and other essential resources.

- Networking: Opportunities to connect with potential investors, partners, and other startups.

Challenges:

- Equity Dilution: Participation often requires giving up a portion of equity.

- Intensive Programs: Programs can be time-intensive, requiring significant commitment from founders.

- Competitive Entry: Gaining entry into reputable programs can be highly competitive.

Example: Y Combinator and Techstars are renowned accelerators that have helped fintech startups like Stripe and SendGrid achieve massive success.

8. Strategic Partnerships

Strategic partnerships involve collaborations with established companies that can provide funding, resources, and market access in exchange for a stake in your business or mutual benefits.

Advantages:

- Funding and Resources: Access to significant financial resources and industry expertise.

- Market Access: Leverage the partner’s market presence and customer base to accelerate growth.

- Shared Risk: Risk is shared between partners, reducing the burden on your startup.

Challenges:

- Complex Negotiations: Establishing terms that are favorable for both parties can be challenging.

- Potential Conflicts: Differences in objectives and strategies can lead to conflicts.

- Dependence: Over-reliance on the partner can be risky if the partnership ends.

Example: Fintech companies like Plaid have partnered with major financial institutions to expand their reach and capabilities.

Exploring these funding options for fintech apps provides a comprehensive understanding of the avenues available to secure the necessary resources for your startup. Each option has its own merits and drawbacks, and choosing the right mix of funding sources will depend on your specific business needs and strategic goals.

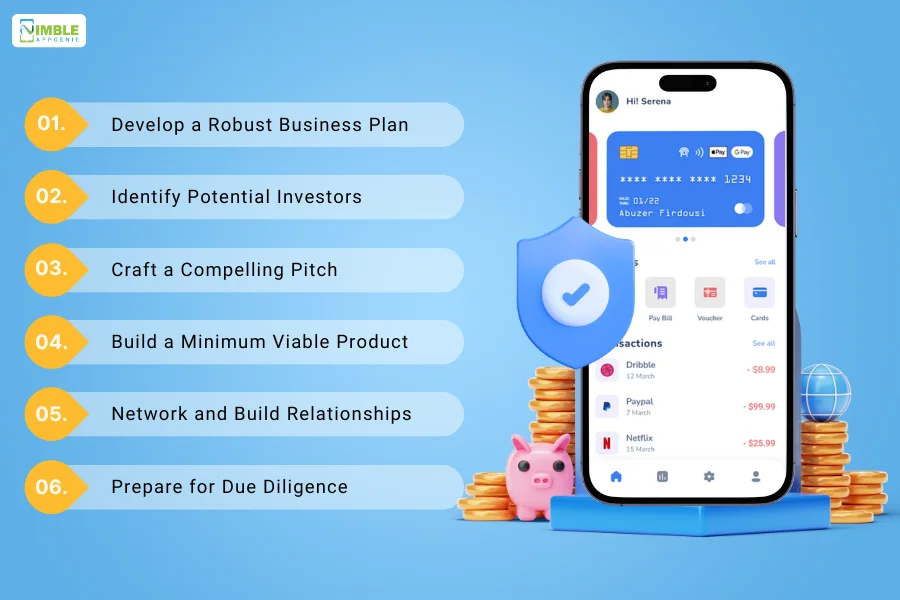

Securing Funding: A Step-by-Step Approach

Securing funding for your mobile app is a critical step that can determine the success and growth of your startup.

This process involves several key steps, each requiring careful planning and execution.

Here’s a comprehensive, step-by-step approach to securing funding for your fintech app:

♦ Develop a Robust Business Plan

A well-crafted business plan is the foundation of your funding journey.

It outlines your business goals, strategies, market analysis, financial projections, and the value proposition of your fintech app.

Key Components:

- Executive Summary: Brief overview of your business idea, including your mission, vision, and key objectives.

- Market Analysis: Detailed analysis of the fintech market, including target audience, market size, growth potential, and competition.

- Product/Service: Comprehensive description of your fintech app, highlighting its unique features, benefits, and how it addresses market needs.

- Marketing and Sales Strategy: Outline your strategies for attracting and retaining users, including marketing channels, sales tactics, and customer acquisition plans.

- Financial Projections: Detailed financial forecasts, including projected revenue, expenses, cash flow, and break-even analysis.

- Funding Requirements: Clear articulation of how much funding you need, how it will be used, and the expected return on investment.

Example: Successful fintech startups like Monzo and Revolut have raised significant funding by presenting clear and compelling business plans that highlight their market potential and growth strategies.

♦ Identify Potential Investors

Identifying the right investors is crucial for securing funding. Different investors have varying interests, investment capacities, and strategic objectives.

Types of Investors:

- Angel Investors: High-net-worth individuals who invest in their personal funds in early-stage startups. They often provide mentorship and industry connections.

- Venture Capitalists: Professional investment firms that invest larger sums of money in high-growth potential startups. They typically look for a significant return on investment within a few years.

- Crowdfunding Platforms: Online platforms where startups can raise small amounts of money from a large number of people. Popular crowdfunding platforms include Kickstarter, Indiegogo, and equity crowdfunding sites like Seedrs and Crowdcube.

- Strategic Partners: Established companies in fintech or related industries that can provide funding, resources, and market access in exchange for equity or strategic benefits.

Example: Stripe, a leading payment processing company, secured funding from renowned venture capital firms like Sequoia Capital and Andreessen Horowitz, which helped accelerate its growth and market reach.

♦ Craft a Compelling Pitch

Your pitch is your opportunity to capture the interest of potential investors and convince them to invest in your fintech app. A compelling pitch should be clear, concise, and engaging.

Components of a Winning Pitch:

- Elevator Pitch: A brief, attention-grabbing summary of your business idea that you can deliver in under a minute.

- Problem Statement: Clearly articulate the problem your fintech app solves and why it matters.

- Solution: Explain how your app addresses the problem and its unique value proposition.

- Market Opportunity: Highlight the market size, growth potential, and target audience for your app.

- Business Model: Outline how your app will generate revenue and achieve profitability.

- Traction: Provide evidence of market validation, such as user growth, revenue figures, partnerships, and customer testimonials.

- Team: Introduce your founding team and highlight their expertise, experience, and relevant skills.

- Financial Projections: Present realistic financial forecasts and key metrics that demonstrate the potential for growth and return on investment.

- Ask: Clearly state how much funding you are seeking and what you will use it for.

Example: Fintech company TransferWise (now Wise) effectively used a compelling pitch to secure funding from top investors, emphasizing its innovative solution to high international money transfer fees.

♦ Build a Minimum Viable Product (MVP)

It’s time for MVP development. An MVP is a basic version of your app that includes only the essential features. It allows you to test your ideas, gather user feedback, and demonstrate its potential to investors.

Benefits of an MVP:

- Market Validation: Test your app’s core features and value proposition in the real market.

- User Feedback: Gather valuable insights from early users to refine and improve your app.

- Cost Efficiency: Develop a functional prototype with minimal resources before investing heavily in full-scale development.

- Investor Confidence: Show investors that you have a tangible product and have taken the initial steps to validate your business idea.

Example: Monzo, a digital bank, launched an MVP of its app with basic banking features to test market demand and gather user feedback, which helped secure further funding for full-scale development.

♦ Network and Build Relationships

Building strong relationships with potential investors, industry experts, and mentors can significantly enhance your chances of securing funding.

Networking Strategies:

- Attend Industry Events: Participate in fintech conferences, startup pitch events, and networking meetups to connect with investors and industry leaders.

- Join Incubators and Accelerators: Programs like Y Combinator and Techstars offer mentorship, resources, and funding opportunities for early-stage startups.

- Leverage Social Media: Use platforms like LinkedIn and Twitter to connect with potential investors, share your progress, and build your online presence.

- Seek Referrals: Ask for introductions from your existing network, including mentors, advisors, and fellow entrepreneurs.

Example: Robinhood, a commission-free trading app, built strong relationships with key investors and industry influencers, which helped secure significant funding rounds.

♦ Prepare for Due Diligence

Due diligence is the process by which investors evaluate your business before investing. Being well-prepared can streamline this process and increase your chances of securing funding.

Due Diligence Checklist:

- Financial Records: Ensure your financial statements, tax records, and accounting practices are accurate and up-to-date.

- Legal Documentation: Prepare legal documents, including incorporation papers, intellectual property filings, and contracts with customers and suppliers.

- Business Plan: Have a detailed and comprehensive business plan ready for review.

- Market Research: Provide market analysis and data to support your business’s growth potential.

- Product Information: Document your app’s development progress, technical specifications, and user feedback.

- Team Profiles: Compile detailed profiles of your founding team, advisors, and key employees.

Example: Klarna, a leading BNPL company, successfully navigated the due diligence process by maintaining thorough and transparent records, which helped secure substantial investment from Sequoia Capital.

Following this step-by-step approach to securing funding ensures you are well-prepared and positioned to attract the right investors for your fintech app. Each step builds a solid foundation for your funding journey, increasing your chances of success in the competitive fintech market.

Some Common Mistakes To Avoid

Developing a fintech app is a complex process with numerous potential pitfalls.

Understanding these common mistakes and how to avoid them can save significant time, resources, and frustration.

Here are some critical mistakes to watch out for:

1. Ignoring Regulatory Compliance

Mistake: Many developers overlook or underestimate the importance of adhering to financial regulations and legal requirements, which can lead to significant legal and financial repercussions.

Solution: From the outset, ensure that your app complies with all relevant regulations, such as data protection laws (e.g., GDPR, CCPA), financial regulations, and industry standards. Engage with legal experts to navigate these complexities and regularly update your app to comply with changing laws.

Key Point: Compliance isn’t optional. Stay informed and proactive about legal requirements.

2. Inadequate Security Measures

Mistake: Security vulnerabilities can severely damage user trust and lead to data breaches, financial loss, and reputational harm.

Solution: Implement robust security measures such as encryption, multi-factor authentication, secure fintech APIs, and regular security audits. Prioritize user data protection and integrate security features throughout the development lifecycle.

Key Point: User data protection is paramount. Ensure your app is secure from the ground up.

3. Neglecting User Experience (UX)

Mistake: A poorly designed user interface can result in low user adoption and high churn rates.

Solution: Focus on creating a seamless, intuitive, and user-friendly interface. Conduct user testing, gather feedback, and iterate on your design to ensure it meets user needs and expectations.

Key Point: A great user experience is crucial for user retention and satisfaction.

4. Overlooking Scalability

Mistake: Failing to design for scalability can lead to performance issues as your user base grows.

Solution: Plan for scalability from the beginning. Use cloud services, microservices architecture, and efficient coding practices to ensure your app can handle increased traffic and transactions without compromising performance.

Key Point: Scalability is key to long-term success. Design your app to grow with your user base.

5. Insufficient Testing

Mistake: Rushing to launch without thorough testing can result in bugs, crashes, and a poor user experience.

Solution: Implement a rigorous testing process, including unit tests, integration tests, user acceptance tests, and performance tests. Address issues before they affect your users.

Key Point: Testing is critical. Don’t skip this step.

6. Lack of Clear Monetization Strategy

Mistake: Without a clear plan for generating revenue, sustaining your app in the long term can be challenging.

Solution: Develop a comprehensive monetization strategy that includes various revenue streams, such as transaction fees, subscription models, partnerships, and advertising.

Key Point: A solid monetization plan is essential for sustainability and growth.

7. Underestimating Development Time and Cost

Mistake: Many startups underestimate the time and cost required to develop a high-quality fintech app.

Solution: Create a detailed project plan and budget, considering all phases of development, including planning, design, development, testing, and launch. Factor in contingencies for unexpected challenges.

Key Point: Plan realistically. Understand the full scope of development time and cost.

8. Ignoring Market Research

Mistake: Launching an app without understanding the target market, user needs, and competition can lead to failure.

Solution: Conduct thorough market research to identify your target audience, understand their pain points, and analyze competitor offerings. Use these insights to shape your app’s features and value proposition.

Key Point: Market research is crucial for identifying opportunities and shaping your app’s direction.

9. Poor Customer Support

Mistake: Neglecting customer support can lead to user dissatisfaction and high churn rates.

Solution: Establish a robust customer support system to address user queries and issues promptly. Provide multiple support channels, such as chat, email, and phone support, and regularly train your support team.

Key Point: Good customer support builds trust and enhances user satisfaction.

10. Inadequate Marketing and User Acquisition Strategy

Mistake: Failing to effectively market your app can result in low user acquisition and growth.

Solution: Develop a comprehensive marketing strategy that includes digital marketing, social media campaigns, content marketing, and partnerships. Track and analyze user acquisition metrics to refine your approach.

Key Point: Effective marketing is essential for attracting and retaining users.

11. Not Keeping Up with Technology Trends

Mistake: Failing to stay updated with the latest technology trends can make your app outdated quickly.

Solution: Regularly update your app with the latest features and technologies. Stay informed about industry trends and advancements to keep your app competitive and relevant.

Key Point: Continuous improvement and adaptation are necessary to stay ahead.

12. Ignoring User Feedback

Mistake: Disregarding user feedback can result in an app that doesn’t meet user needs.

Solution: Actively seek and incorporate user feedback to improve your app. Use surveys, app reviews, and user testing to gather insights and make data-driven decisions.

Key Point: User feedback is invaluable. Use it to continuously improve your app.

13. Failing to Plan for Updates and Maintenance

Mistake: Neglecting post-launch updates and maintenance can lead to a decline in app performance and user satisfaction.

Solution: Plan for regular updates and maintenance to address bugs, introduce new features, and enhance performance. Allocate resources and budget for ongoing support.

Key Points: Ongoing updates and maintenance are essential for sustaining user engagement and app performance.

Real-Life Examples: Success Stories in BNPL App Development

Explore the top fintech apps that have revolutionized the industry with their innovative features and substantial funding rounds.

► Revolut

Revolut, a global financial super app, started with the idea of offering currency exchange services without hidden fees.

Over the years, it has expanded into a comprehensive financial service provider, offering everything from banking and trading to insurance and cryptocurrency services.

This innovative approach has attracted millions of users worldwide, making it one of the fastest-growing fintech companies.

Funding Rounds:

- Seed Round (2015): $2.3 million led by Balderton Capital.

- Series A (2016): $10 million led by Index Ventures.

- Series B (2017): $66 million led by Index Ventures and Ribbit Capital.

- Series C (2018): $250 million led by DST Global.

- Series D (2020): $500 million led by TCV.

- Series E (2021): $800 million led by SoftBank and Tiger Global.

► Robinhood

Robinhood disrupted the brokerage industry by offering commission-free trading, making investing more accessible to a broader audience.

It has grown rapidly, especially among younger investors, and has expanded its services to include cryptocurrency trading and cash management accounts.

The app’s easy-to-use interface and innovative features have made it a favorite among millennials.

Funding Rounds:

- Seed Round (2013): $3 million from Index Ventures.

- Series A (2014): $13 million led by Index Ventures.

- Series B (2015): $50 million led by New Enterprise Associates.

- Series C (2017): $110 million led by DST Global.

- Series D (2018): $363 million led by DST Global.

- Series E (2020): $600 million led by Sequoia Capital.

- Series G (2021): $3.4 billion from various investors including Ribbit Capital.

► Stripe

Stripe provides an online payment processing platform that has become a favorite among developers for its simplicity and robust API.

Stripe’s technology is used by millions of businesses worldwide, from startups to Fortune 500 companies, to handle their online transactions.

Funding Rounds:

- Seed Round (2010): $2 million from PayPal co-founders.

- Series A (2011):: $18 million led by Sequoia Capital.

- Series B (2012): $20 million led by General Catalyst.

- Series C (2014): $70 million led by Thrive Capital.

- Series D (2016): $150 million led by CapitalG.

- Series E (2018): $245 million led by Tiger Global Management.

- Series F (2019): $250 million led by Andreessen Horowitz.

- Series G (2021): $600 million led by Sequoia Capital.

► Plaid

Plaid connects financial accounts to various applications, enabling users to manage their finances seamlessly.

It is an essential infrastructure layer in the fintech ecosystem, used by apps like Venmo, Robinhood, and Coinbase to connect users’ bank accounts.

Funding Rounds:

- Seed Round (2013): $2.9 million led by Spark Capital.

- Series A (2014):: $12.5 million led by New Enterprise Associates.

- Series B (2016): $44 million led by Goldman Sachs.

- Series C (2018): $250 million led by Kleiner Perkins.

- Series D (2020): $425 million led by Altimeter Capital.

► Square

Square, founded by Jack Dorsey, offers payment and financial services for small businesses, making financial transactions more accessible.

Square has introduced a variety of innovative products, including the Square Reader, which allows small businesses to accept credit card payments via mobile devices.

Funding Rounds:

- Seed Round (2009): $10 million led by Khosla Ventures.

- Series A (2010):: $27.5 million led by Sequoia Capital.

- Series B (2011):: $100 million led by Kleiner Perkins.

- Series C (2012):: $200 million led by Starbucks.

- Series D (2014):: $150 million led by Goldman Sachs.

Nimble AppGenie: Your Fintech App Solution Partner

Navigating the complexities of fintech app and securing funding can be challenging.

Nimble AppGenie, a leading fintech app development company that offers the expertise and innovation needed to bring your vision to life.

With a proven track record in developing successful fintech solutions, we provide end-to-end services from concept to launch.

Our team of experts ensures your app stands out, attracts investors, and meets market demands.

Partner with us to make your fintech app a success.

Conclusion

In the dynamic world of fintech, securing the right funding can propel your app to new heights. By understanding your funding needs, exploring various funding options, and learning from successful examples, you can position your fintech app for success. Start your journey today and transform your fintech vision into a thriving reality.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.