E-Wallet applications have become household items.

Used by a large chunk of the population across the world, eWallet applications are responsible for trillions of dollars in transactions each year.

While they are known for their convenience and ease of use, this begs the question of whether they are safe. Well, eWallet security is a big concern, especially for the service provider.

If you are one of the eWallet app companies that want to secure their solution or just want to learn more about the topic, this blog is for you.

Here, we shall be discussing everything you need to know about eWallet app security, common threats, best practices, trends, and more.

So with that being said, let’s get right into it:

The Ever-Growing Threat of Cyber Fraud: A Global Security Crisis

Fintech statistics show us an ever-growing market, with trillions in market value and billions of users across the globe.

But what they also show us is the growing threat of cyber fraud. Let’s dive into it:

- Globally, cybercrime costs businesses an estimated $6 trillion annually.

- Financial institutions are the most targeted industry for cyberattacks, accounting for 20% of all attacks.

- E-Wallet apps are a prime target for cybercriminals, with losses exceeding $1 billion in 2022 alone.

- Phishing remains the most common type of cyberattack, accounting for over 80% of all reported incidents.

- The average cost of a data breach in 2023 was $4.35 million.

The losses from these cyberattacks are huge. But even if that’s not a justification for why digital wallet Security is important, let us give you some more reasons in the section below.

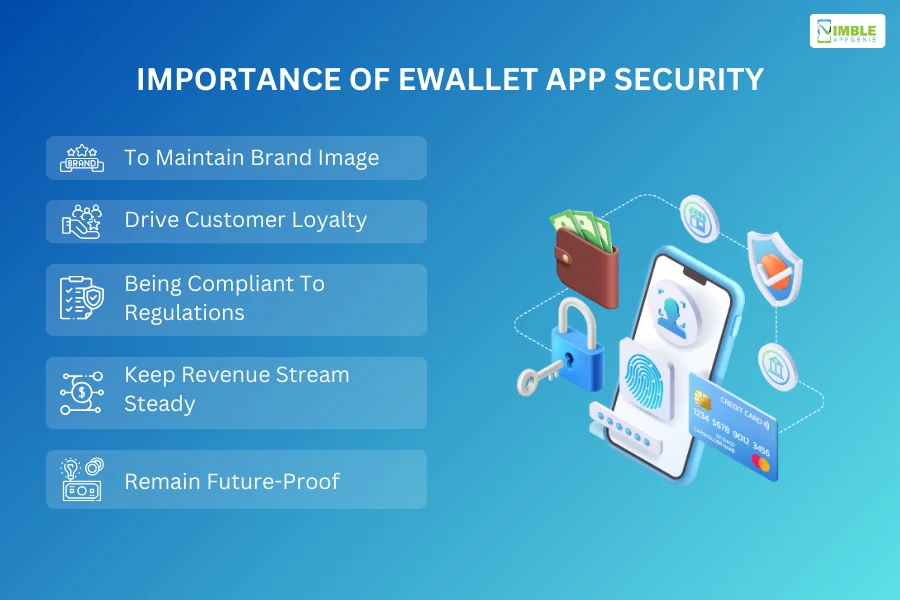

Why is Digital Wallet Security Important?

There are lots and lots of businesses that want to create an eWallet app.

But not everyone wants to invest in digital wallet security. That’s where the real trouble starts. “But eWallet security isn’t all that important, is it?”

Hate to break it to you, but if you’re not investing in Digital Wallet app security, there’s a sword hanging over your head.

Poor security is one of the reasons why most digital wallet app startups fail in the market.

Let’s see why it’s so important to protect your mobile wallet as a fintech company:

1. To Maintain Brand Image

If a company wants to market an eWallet app and create a sustainable brand image, then eWallet app security is a topic of importance.

Any marketing company or even a company CEO would love to tell you about the importance of the brand image and branding itself. When we are talking about fintech apps like eWallets, the majority of brand image depends on the level of app security they offer.

The reason is that a company that’s losing money (customers’ money) to fraud and cyber threats isn’t something a customer would like to be associated with.

This is why, to maintain the brand image, digital wallet Security is super important.

2. Drive Customer Loyalty

To make an app successful is to gain people’s trust and drive loyalty.

One of the best ways to boost customers’ confidence in the eWallet application and the business itself is by offering impregnable eWallet security.

When the user base knows their money and high-value information is safe, they can use the app worry-free.

Ask yourself, have you ever worried about fraud when using top apps like PayPal? Exactly.

3. Being Compliant With Regulations

Fintech and the financial world alike are subject to an endless number of regulations, and so. One common theme that most of the regulations have in common is to deliver an e-wallet with security to the end user.

This is a must for user and data privacy standards. So, if an eWallet app needs to compete in the market or exist in the market at all, doing this is very important.

4. Keep Revenue Streams Steady

eWallet monetization strategies will let you generate millions if done right.

But if you want to keep the stream steady and not lose money to fraud, it’s important to maintain a foolproof platform. The reason is that a secure app will attract more customers and investors while deflecting all fraud attempts that snatch millions at a time.

After all, financial institutions like eWallet companies are the first target of fraudsters.

5. Stay Future-Proof

If you have been exploring fintech app development scenarios, you must have heard the word “future-proof” a lot.

Being future-proof means having a platform that is ready for the market of tomorrow. To achieve this status, it’s important to make your eWallet secure.

So, these are the top reasons why it’s important to make your digital wallet secure. With that out of the way, let’s look at some common threats to eWallet app security.

Common eWallet Security Threats & Weak Points

To create a secure eWallet application, one must know of the threats that are lurking.

So, shining a light on that, we shall be going through some of the common eWallet app challenges and security threats in this section of the blog.

So let’s get right into it:

Threat 1: Phishing Attacks

One of the most common types of security threats is phishing attacks.

For those who don’t know about phishing, the attackers try to obtain sensitive information by pretending to be a trustworthy entity.

Here’s how it works in the eWallet security world: deceptive messages, emails, or calls are sent to the customer, directing them to a fake counterfeit website that may look like their bank’s.

Here, once they enter their login credentials or personal information, attackers will use it to their advantage.

Due to the general lack of awareness and financial literacy among generations, it is one of the most harmful cyber-attacks. Companies across the world have launched their own financial literacy apps to tackle this problem.

Threat 2: Social Engineering

This is a rather “non-technical” cyber threat.

Social engineering is when an attacker manipulates the user to gain their confidential information. This involves psychological games and tricks, and they are quite effective

There have been instances where people have impersonated someone and exploited the information of the eWallet company’s employees.

Threat 3: Communication Failure in APIs

To make an application work, a lot of Fintech APIs are used.

APIs or application programming interfaces establish communication between different components, and it also involves the transfer of financial information.

More often than not, different components come from different companies, which makes them less compatible with each other and leads to communication failure. This can lead to data leaks and other unwanted parties sucking in the data.

This is the reason why, making API security is the most important e-wallet security measure.

Threat 4: Man-in-the-Middle (MITM) Attacks

Man-in-the-middle or MitM attacks are yet another common form of cyberattacks that pose a big threat to eWallet app security.

Here’s how it takes place: the hacker will intercept communication between the devices and eWallet platforms. During these attack sessions, they will steal any important data they can get their hands on, including login credentials and payment information.

Threat 5: Malware and Viruses

If you have been using a PC or any kind of computer, there is a high chance that you have already heard of malware and viruses.

These are malicious software and programs that can damage even the most secure eWallets. Malware and viruses are often disguised under the name of popular apps that users may want to download from third-party sites. For instance, app store or play store alternatives.

But when they are installed, they attach themselves to smartphones, and they are hard to uninstall. Here, they will capture the user’s financial data as well as the user’s keystrokes.

Threat 6: Account Takeover (ATO)

The name says it all. Account takeover more popular known as ATO, is when an attacker gains access to a user’s account and locks them out of it.

Various methods can be used to gain unauthorized access, including social engineering. Speaking of which, once the user is inside the account, they will exploit the funds and transfer them to their account. They also steal their personal information.

Threat 7: QR code scams

In all popular eWallet applications like Google Play, Apple Pay, and Samsung Pay, we have something called QR code triggered payments.

This has become a common way to trigger payments in recent years. This has become one of the biggest threats to Digital Wallet security.

The reason is that hackers can create fake QR codes that, when scanned, can redirect users to phishing websites or download malware onto their devices.

Threat 8: Unpatched vulnerabilities

Creating an eWallet app is no easy task. More often than not, many bugs and errors are overlooked, leaving vulnerabilities.

These vulnerabilities are often targeted by hackers and used to damage the platform while trying to gain access to user accounts.

With the rise of eWallet applications, protecting sensitive information from cyber threats is crucial. One of the major security risks to be mindful of is malware which can secretly occupy your system. Incorporating solutions offering real-time malware detection makes it easier to keep such threats at bay.

This is a big issue that can be solved with regular app maintenance and support services.

Threat 9: Weak authentication mechanisms

E-Wallet apps should use strong authentication mechanisms, such as multi-factor authentication (MFA), to protect user accounts.

However, it should also be understood that weak authentication methods, like single passwords, are easily compromised by hackers. And that’s what happens when there is a compromise in the secure digital wallet.

Threat 10: Third-Party Risk

In every app development process, of third-party components are involved.

Similarly, eWallet apps often rely on third-party services, such as payment processors and data storage providers.

If these third-party providers are not secure, user data could be compromised.

Now that we are done with the common threats to eWallet security, it’s time to see how you can identify the same. Take a look at the audit process in the section below.

Digital Wallet Security Audit Process

The first step to making your digital wallet secure is to identify the vulnerabilities.

To do this, we need to conduct an audit to check eWallet security. In this section of the blog, we shall be discussing exactly that.

So let’s get right into it:

1. Scope and Planning

The first step in conducting an app security audit is defining the scope. What do you want to audit? Is it the data storage or authentication process?

Once you have a scope, it’s time to select an audit method. For instance, it can be penetration or beta testing, vulnerability scanning, and so on.

Also for this, the team needs to set up a timeline and budget.

2. Information Gathering

With the scope set and plan ahead, it’s time to start gathering information.

The team will gain access to information about the eWallet app, including architecture diagrams, source code (if applicable), system documentation, and security policies.

Plus, they shall also analyze the eWallet app design and implementation to identify potential vulnerabilities.

3. Vulnerability Assessment and Penetration Testing

It’s time to start using automated testing tools for vulnerability assessment.

One of the most important things that happens in this step is manual penetration testing. This is done to identify zero-day vulnerabilities and exploit potential attack vectors.

After testing, the impact as well as the severity of the identified vulnerabilities are assessed.

4. Security Code Review

Following the testing, it is time to review the eWallet app’s source code to identify coding errors and security weaknesses.

Following this, the team will check the use of secure coding practices and cryptographic algorithms. This is done to ensure compliance with industry best practices for secure coding.

5. Reporting and Remediation

With all that said and done, it’s time to create a report.

The audit team will prepare a comprehensive audit report documenting identified vulnerabilities, their severity, impact, and remediation recommendations.

Following this, it’s time to make the necessary changes to ensure the vulnerabilities are fixed. Here, banking app developers must focus on vulnerabilities based on their risk level and develop a remediation plan.

Finally, it’s time to carry out remediation measures to address identified vulnerabilities.

This is how you identify gaps in Digital Wallet security measures. Based on the audit report, it’s time to introduce eWallet app security features. Let’s just look at that in the next section of the blog.

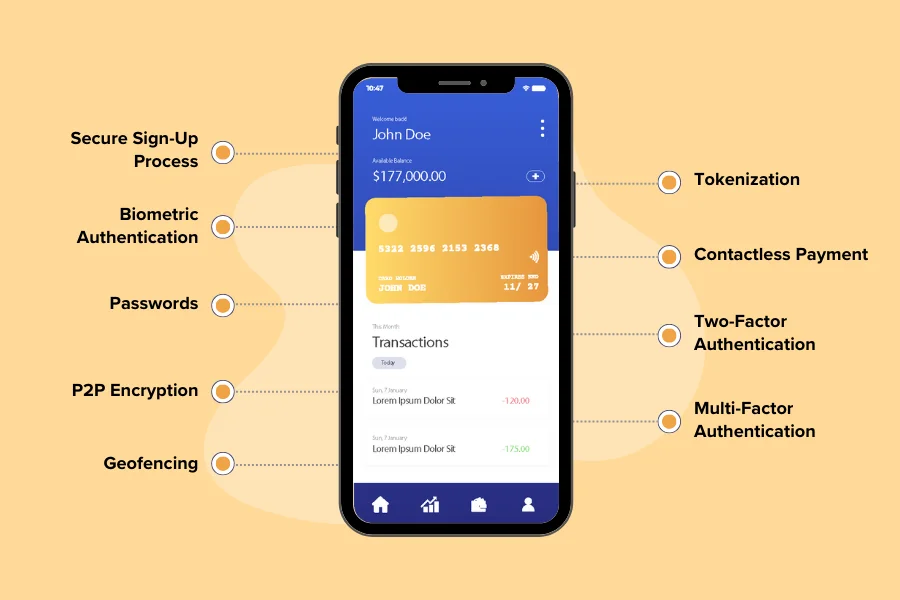

Top Security Features of a Digital Wallet

One of the top tips to improve eWallet security is to introduce features that complement app security at all levels.

eWallet app features play an important role in ensuring impregnable security. Take a look at some of the top wallet app features that help ensure total security.

These are, as mentioned below:

Feature 1: Secure Login and Sign-Up Process

If you want to know how to protect your digital wallet app, the first thing that you need to learn is secure onboarding.

The client side is the most vulnerable part of an eWallet platform. If the user is not verified, they can be a huge security threat.

This is the reason why to secure your digital wallet app, the platform must have a secure login and signup process.

Feature 2: Biometric Authentication

Throughout this blog, we have read how important authentication is in mobile wallet security. Well, one of the best authentication features is: biometric authentication.

This functionality has been in mobile phones for years [now. For instance, a fingerprint scanner on Android devices for unlocking and the popular FaceID for facial scans on recent iPhone models.

Biometrics are unique to every human and pretty difficult to bypass… that’s what makes it a top eWallet app security feature.

Feature 3: Passwords

A password is the most basic mode of protection, which must be used by every personalized website or app.

Adding a rejection feature that activates when the password is too short or easy to guess will make your app more secure and safe.

Biometric security can be added if the smartphone has a fingerprint sensor. This is a key part of a secure wallet app.

Feature 4: P2P Encryption

P2P Encryption is a robust security tool that helps in protecting the debit or credit card transaction process.

As soon as you swipe a card on the PoI (Point of Interaction) terminal, it will start encrypting your debit or credit card data until the final transaction is completed.

This is a useful fraud prevention tool to carry out if you are trying to ensure eWallet security with robustness.

Feature 5: Geofencing

Geofencing integration in the eWallet application ensures that the app can know the location of the user.

Here’s how it helps you secure your digital wallet securely: whenever there is an unauthorized transaction, it will not be approved as it won’t match the location of the user’s current location.

This is often used in eWallet apps like Google Pay. If you are planning to level up the eWallet app, make sure to improve this feature.

Feature 6: Tokenization

With the help of this technology, seamless eWallet security has become a reality.

Tokenization disconnects the buyer’s sensitive data from the end receiver through the use of mapped tokens, which the receiver uses to process the buyer’s credit card payment.

As soon as the user enters the card details to make payments, the card details are encrypted and turned into tokens that look similar to a random number.

Feature 7: Contactless Payment

Contactless payment is one of the eWallet app trends that has been changing the market. This is seen in the top NFC payment apps and how they have become so popular.

Well, apart from the convenience value and its aesthetic appeal, contactless payment technology is also great for promoting digital wallet security. Communication via NFC technology is much faster and more secure since all the data is encrypted.

Furthermore, when being used via a phone, it is next to impossible to commit physical fraud which is often the case with credit cards and debit cards.

Feature 8: Two-Factor Authentication

What better than one layer of app security? That’s right, two layers.

This brings us to one of the top tips for improving digital wallet security, i.e. introducing a two-factor authentication feature.

What this does is, in addition to the usual authentication layer, another one is added which can be activated via OTP or biometric.

Since it is already hard enough to bypass one layer, getting through two is next to impossible physically.

Feature 9: MFA – Multi-Factor Authentication

Well, if you want to take the authentication process to the next level when enhancing your digital wallet security, consider MFA.

It stands for multi-factor authentication. Here, the user is required to pass two or more layers of authentication to verify their identity and make a transaction possible.

Whether you want to create an app like Cash or the usual eWallet, this is a top feature that you should consider.

With that out of the way, let’s look at some of the top technologies used to secure an eWallet application.

Top Technologies For eWallet Security

If you have an idea for the eWallet app that you want to bring to reality or want to update the current legacy system to improve the eWallet app security, here’s a tip to follow.

App tech stack plays an important role in the functioning and working of the app. Take a look at some top technologies to add to your tech stack to make sure there are no vulnerabilities.

So, with that being said, let’s get started:

1. Blockchain is an Important Technology for eWallet Security

The use of blockchain development expands far beyond cryptocurrencies. Digital wallets integrated with blockchain technology are extremely safe, secure, and immutable when compared to other solutions.

This technology is preferred mostly by financial organizations and government agencies due to the high level of security associated with blockchain.

Blockchain is also very enticing to these large organizations due to the extra features that blockchain technology offers, such as decentralization and being able to offer tokens

2. NFC Technology Useful for eWallet Security

NFC, or Near Field Communications, allows users to transfer funds without sharing their contact details. This technology deals with easy data exchange between closely located devices.

NFC mobile payment allows users to make payments directly with their smartphone – instead of payment cards. Some of the successful examples of NFC are Samsung Pay and Apple Pay.

In addition to this, NFC also allows the transfer of funds by simply touching one smartphone to another smartphone. It is one of the most trusted e-wallet tech.

3. Bluetooth and Beacon Technology Useful for e-wallet Security

Are eWallets safe?

Well, when filled with mobile payment applications and security like Bluetooth, yes, they are.

This allows you to identify nearby devices that you can make a payment to. This is a very fast and secure technology to use for transferring funds digitally.

You can transfer funds to other users who are close to you or who are in the prescribed transfer range. The best part is that this technology doesn’t even ramp up the development cost of an ewallet app too much.

4. QR Code is Currently Trusted by eWallet Security Technology

QR Codes are generally used for making payments or transferring funds to other members of the public.

It is also used to make payments with contacts that are not already saved in the user’s phone. To make a payment, users just have to scan the QR code of the receiver.

This technology is one of the smoothest and most simplified ways of making payments.

With all that said and done, let’s look at some of the best practices to secure your digital wallet in the next section of the blog.

Best Practices to Secure Your Digital Wallet

Now that you know how to protect your mobile wallet, it’s time to look at some best practices to follow.

Inspired by what top digital wallet apps are doing, here are some things to do when securing your application.

These are, as mentioned below:

-

Implement Strong Password Management

One of the most important parts of eWallet app security as a whole is the authentication process.

To keep it secure and take it to the next level, what you can do as a service provider is implement strong password management.

-

Keep Your Digital Wallet App Updated

Developing a mobile app isn’t enough, it’s also important to invest in maintenance and updates.

To do this, you can partner with a mobile app development company or assemble your own in-house team of developers.

However, the former is highly recommended over the latter due to the cost involved. In any case, this is one of the Best Practices to Secure Your Digital Wallet to follow.

-

Use Hardware Wallets

Implementing hardware wallets as a security best practice for eWallet apps involves utilizing specialized physical devices to store and manage cryptographic keys securely.

These keys are crucial for authorizing transactions and accessing digital assets within the eWallet.

Moreover, the hardware wallet is a separate, dedicated device that is specifically designed to provide a highly secure environment for key management. This can take app security to the next level.

-

Create a Proper Backup for Your Digital Wallet

One of the best practices to follow is to create a proper backup for a digital wallet.

Now, depending on your platform, it can be a native backup or cloud-based. However, it is highly advised that you keep a backup on the cloud or avoid wallet app security threats.

After all, the user’s device is more vulnerable to threats.

-

Monitor the Activity

A considerable number of security threats to eWallet applications are internal. Based on this trend, one of the things that people finally started doing is using constant monitoring.

The monitoring team and software will securely identify discrepancies and avoid some of the big threats way before they happen.

It is also a good way to identify common security threats as well.

Factors to Consider for eWallet Security

Now that we’re done with digital wallet security features and best practices, it’s time to look at some of the top factors to consider when implementing these things.

These are, as mentioned below:

Factor 1: Wearable Device Integration

The popularity of wearable app development has been growing among eWallet app companies as they want to offer their end-users supreme convenience.

Based on IoT technology, wearable device integration does offer benefits as well as lucrative features. But on the flip side, it can also leave an open door for fraudsters.

So, it’s one of the things that you have to keep in mind when enhancing your eWallet security.

Factor 2: Fintech Security Compliance

In the fintech world, there are regulations like PCI compliance and GDPR compliance, which have to be followed.

The consequences of not following fintech regulations and compliance can be dire for a company. And since most of them have to do with eWallet app security, it is something to look out for.

Factor 3: Open Banking APIs

Open banking APIs are the golden grail of the eWallet world. It is next to impossible to build an online digital wallet without these components.

But, as good as they are, they are often the weak point in app security, making them a point of interest for companies.

Moving on, let’s look at some of the top eWallet app security future trends.

Future Trends for E-Wallet Security

If you want to create an eWallet app that’s successful among people and offers unmatched security, it’s important to consider future trends and adapt accordingly.

Therefore, the future trends that will help enhance eWallet security are, as mentioned below:

| Trends | Description | Potential benefits |

| Quantum Computing | When these computers are here, eWallet companies will be able to leverage quantum algorithms to enhance data encryption, potentially revolutionizing security. | Unbreakable data encryption and stronger fraud detection. |

| New Regulations | As time progressed, new regulations were introduced, standardized security protocols, and stronger consumer protection. | Increased trust and adoption of e-wallets. |

| AI-Driven Security Tools | Trending machine learning and AI technologies help create algorithms that will identify anomalies and prevent fraud in real-time. | Faster threat identification and proactive risk mitigation. |

| Decentralized Wallets | An application of blockchain, Defi can enhance user control and security against hacking and data breaches. | Greater autonomy and transparency in financial management. |

| User Education | It will become a common idea to empower users with knowledge about secure e-wallet practices and recognizing scams. | Reduced risk of human error and phishing attacks, increased trust in technology. |

Partner with a Solution Expert to Enhance Security

Do you have an eWallet app that you want to secure or an idea that you want to convert into an impregnable digital wallet?

Nimble AppGenie is a renowned eWallet app development company that is here to help you.

With hands-on experience working on over 350+ projects, including top digital wallets like SatPay and Pay By Check.

For our monumental work in the fintech industry, we are recognized by platforms like Clutch, GoodFirms, and DesignRush.

If you want to collaborate with the very best in the market, hire mobile app developers today, and let’s get down to it.

Conclusion

In the modern era, mobile device applications have changed the scenario of cash transfers. From electricity invoice charges to money transfers to blockchain and cryptocurrency, things are being paid for with the aid of mobile eWallet app packages.

In the current environment, developing a mobile app wallet app is a splendid concept for a start-up or enterprise. The only concern is eWallet security and to address this issue, you need a safer and more reliable approach to eWallet app.

With a great concept or prototype that brings value to users, you can help change the world environment, reducing or removing the need for cash-in-hand transactions whilst making people’s lives more convenient. eWallets have enhanced the economic and financial sectors of many countries.

Paytm, Google Pay, and PayPal are some examples of how eWallet apps are ruling the market. There is still space in these industries for more innovation. It could be you who is responsible for making these innovations happen!

FAQs

To secure your eWallet app, you can utilize strong, unique passwords, enable multi-factor authentication, keep your device and app updated, and be cautious of phishing attempts.

e-Wallet applications used technologies like:

- Encryption

- Secure login credentials

- Multi-factor authentication

- Transaction Monitoring

The protection of private keys is critical for e-wallet security. You see, using secure key management practices, such as hardware wallets, helps prevent unauthorized access and financial losses.

When used with proper security measures, eWallets are generally safe. However, users must stay vigilant against cyber threats, employ recommended security practices, and choose reputable e-wallet providers to ensure the safety of their digital assets.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.