Planning to create an investment platform?

Investment, trading, and stocks have always been the buzzwords behind successful people in the past century. While this used to be something only the rich and privileged could do, that phase is behind us.

Fast forward to the 21st century, and with the help of technology, investing is easier than ever.

Investment platforms like Robinhood and WeBull are enabling millions around the buy and sell assets at their own pace, without any wolves waiting on Wall Street.

In the process, these platforms have generated BILLIONs in revenue.

Needless to say, this has attracted businesses, investors, and startups from across the world to develop their own investment platforms.

If you are one of these, we have all you need to know.

In this guide to investment platform development, we shall be going through statistics, basics, reasons to develop, development process, cost, and much more.

So let’s get started:

Statistics: The Growing Craze of Online Investment Platforms

Fintech statistics open our eyes to a market that is booming.

Investment platforms across the world are enjoying a multi-billion strong user base with even more in revenue.

Here’s a brief insight.

- The global online investment platform market is estimated to be worth around $9.5 billion currently and is projected to grow at a healthy clip of over 14% annually until 2031.

- Over half of all online investment platform revenue comes from mobile apps. This shows a clear preference for convenience and on-the-go investing.

- The number of people using stock trading apps shot up by nearly 50% between 2020 and 2021, reaching over 130 million users globally.

- Robinhood, a commission-free trading platform, was the leader in terms of users in 2021 with over 16 million active users.

Now with this out of the way, it’s time to look at the basics of investment platform development.

Understanding Investment Platforms

So, what is an investment platform?

As the name suggests, the term “investment platform” refers to a website or online portal that allows users to invest or trade freely. These platforms offer a convenient way to invest in a variety of assets, including:

- Stocks

- Bonds

- Mutual funds

- Exchange-traded funds (ETFs)

- Cryptocurrencies

These platforms have various features and functionality that enable the users to do what they want. We shall be discussing specifics later down the line.

From a technical POV, investment platforms are a mix of fintech and custom website development solutions. However, they aren’t without their mobile app counterpart. More often than not, an investment platform would exist in both app and web portal formats.

Investment platforms come in all shapes and sizes, giving us different types.

So, let’s look at the different types below:

Type of Investment Platform

Investment platforms come in various forms, each designed with specific features and functionalities to serve the diverse needs of investors.

Understanding the types of investment platforms can help potential users choose the one that best fits their investment strategy and goals.

Here’s an overview of the main types of investment platforms:

Type 1: Robo-Advisors

Robo-advisor platform development has been growing super popular among investors in recent years.

For those who are unfamiliar, robo-advisors represent a fusion of finance and technology, offering automated, algorithm-driven investment management services.

With minimal human intervention, these platforms provide personalized portfolio management based on the investor’s risk tolerance and investment goals.

Plus, Robo-advisors are known for their low fees and low account minimums.

Thus making them an attractive option for novice investors and those seeking a hands-off investment approach.

Type 2: Online Brokerage Platforms

Online brokerage platforms are the digital successors to traditional brokerages.

Thus, allowing investors to buy and sell securities like stocks, bonds, and mutual funds directly.

These platforms offer a range of tools and resources, including real-time market data, research reports, and analytical tools.

This way the platform caters to both beginner and experienced investors who prefer a more hands-on approach to managing their investments.

Type 3: Peer-to-Peer (P2P) Lending Platforms

P2P lending platform development is yet another super popular choice.

These lending platforms facilitate direct loans between individuals without the intermediation of traditional financial institutions.

Investors on these platforms can fund loans in whole or in part, earning interest as borrowers repay the loans.

P2P lending offers an alternative asset class for investors, often with the potential for higher returns compared to traditional fixed-income investments.

Type 4: Crowdfunding Platforms

Crowdfunding platform development has become a buzzword in the market, here’s why:

It allows investors to fund start-ups, small businesses, and other projects in exchange for equity, debt, rewards, or simply the satisfaction of supporting a cause they believe in.

Equity crowdfunding platforms, in particular, enable investors to buy a stake in early-stage companies, providing a unique opportunity to invest in potential high-growth companies.

Type 5: Social Trading Platforms

Social trading platform development is not a new concept.

It combines elements of traditional investing with social networking, enabling users to observe the trading behavior of their peers or experienced investors and replicate their strategies.

These platforms often feature community discussions, leaderboards, and the ability to automatically copy the trades of successful investors.

Thus, appealing to those who value a collaborative approach to investing.

Type 6: Specialty Platforms

Specialty investment platforms – as the name suggests – cater to niche markets or specific asset classes, such as real estate, commodities, or art.

These platforms offer specialized investment opportunities that might not be readily available on more general investment platforms.

Thus, appealing to investors looking to diversify their portfolios with alternative investments.

Type 7: Hybrid Platforms

Lastly, we have Hybrid platforms, not to be confused with hybrid app development.

As a hybrid, it offers a blend of automated and human advisory services, catering to investors who desire a more personalized investment experience.

These platforms might combine robo-advisory services with access to human financial advisors, providing a balanced approach for those seeking both technological efficiency and personalized advice.

So, these are the different types of investment platform development. Now, with this out of the way, it’s time to look at the workings of these investment platforms.

These are, as mentioned below:

How Does the Investment Platform Work?

If you want to learn how to create an investment platform, you must first understand how it works.

These are quite complex platforms with thousands of gear that move behind the screen to deliver desired responses to the end user.

Here’s how this works:

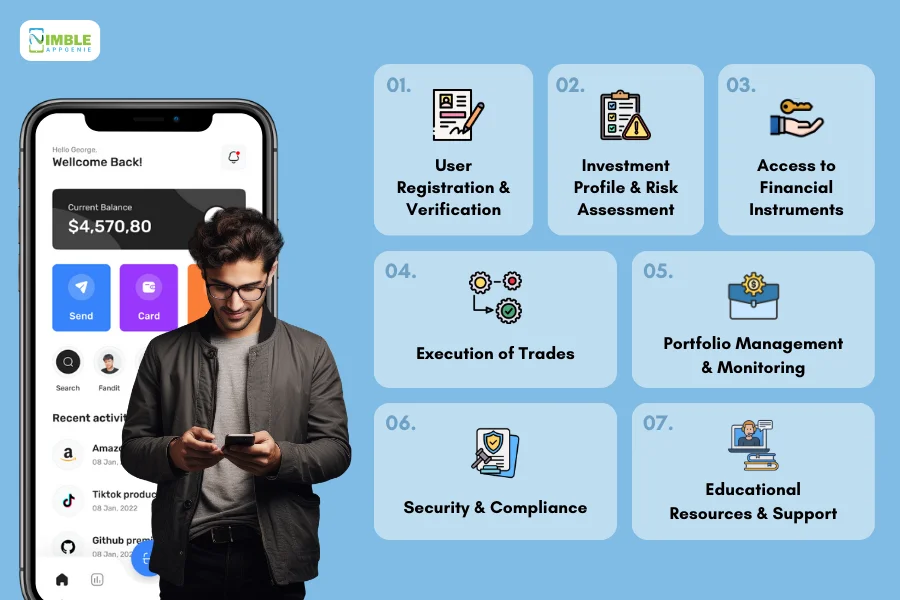

1. User Registration and Verification

The first step for any user is to create an account on the platform.

This process typically involves providing personal information and completing a verification process to comply with regulatory requirements.

This is known as ‘Know Your Customer’ (KYC) and is crucial for preventing fraud and ensuring the security of transactions.

2. Investment Profile and Risk Assessment

Once registered, users are often guided through a risk assessment questionnaire.

This step is vital for tailoring the investment experience to individual preferences, risk tolerance, and financial goals.

The platform uses this information to recommend suitable investment options or to allow users to make informed choices on their own.

3. Access to Financial Instruments

Investment platforms aggregate a wide range of financial instruments from various markets.

This consolidation provides users with the convenience of exploring and investing in diverse assets from a single interface.

Platforms often include tools for researching investments, such as historical performance data, analyst ratings, and news related to specific assets or market sectors.

4. Execution of Trades

The core functionality of an investment platform is to execute buy and sell orders on behalf of its users.

When an investor decides to invest in a particular asset, the platform processes this order through integrated trading systems that interface with stock exchanges and other marketplaces.

This process is made seamless and efficient through sophisticated backend technologies that ensure timely and accurate order execution.

5. Portfolio Management and Monitoring

Investment platforms offer users tools to manage and monitor their portfolios.

This includes real-time tracking of asset performance, portfolio rebalancing features, and automated alerts for significant market movements.

These tools empower investors to make informed decisions and adjust their investment strategies as needed.

6. Security and Compliance

The backbone of any reputable investment platform is its commitment to security and regulatory compliance.

Advanced encryption methods, secure data storage solutions, and regular audits are standard practices to protect user data and financial assets.

Moreover, compliance with financial regulations ensures the platform operates within legal boundaries and maintains trust with its user base.

7. Educational Resources and Support

To support users in their investment journey, platforms often provide educational resources, tutorials, and market insights.

This educational component is crucial for helping users understand market dynamics, investment strategies, and the risks involved.

Furthermore, customer support services are also a vital part of the platform, offering assistance and guidance to users as needed.

Now that we understand how investment software works, it’s time to explore reasons to go for investment platform development.

Why Develop an Investment Platform?

Investment platform development is a great idea with proven revenue.

But, should you create a fintech solution? While this is an amazing opportunity, many businesses have second thoughts.

Here’s why you should create your own investment platform, worry-free:

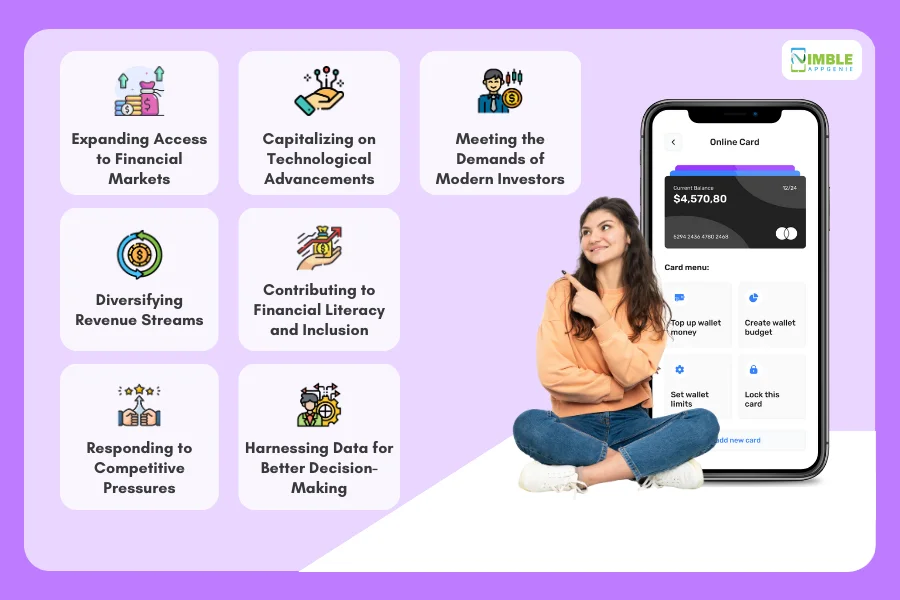

Expanding Access to Financial Markets

The fintech market, which encapsulates digital investment platforms, is booming, with its value anticipated to grow at a compound annual growth rate (CAGR) of around 20% from 2021 to 2025.

This growth is a clear indicator of the escalating demand for accessible financial services.

Investment platforms are at the forefront of this movement, breaking down traditional barriers to entry and making it possible for a broader demographic to engage with financial markets.

Capitalizing on Technological Advancements

Technological advancements, particularly in AI and blockchain, are revolutionizing the financial services industry.

With over $12 billion invested in AI within fintech in 2020 alone, these technologies are not just buzzwords but fundamental components that enhance the functionality, security, and efficiency of investment platforms.

They enable features like automated portfolio management and real-time fraud detection, setting new standards for personalized and secure investment experiences.

Also Read: How To Build An App Like WeBull?

Meeting the Demands of Modern Investors

The preferences of modern investors, especially millennials and Gen Z, lean heavily towards digital-first solutions.

Surveys indicate that a significant majority of these demographics prefer managing their financial activities online.

Moreover, the global increase in mobile app usage for financial services, which saw a 45% uptick from 2019 to 2020, underscores the importance of mobile-friendly investment platforms that cater to on-the-go investors.

Diversifying Revenue Streams

The potential for revenue generation in digital wealth management is substantial, with assets under management via digital platforms expected to reach $3.4 trillion by 2025.

This growth trajectory presents a lucrative opportunity for businesses to diversify their revenue streams by integrating investment platform services.

So, what want to make their first (or next) million?

Contributing to Financial Literacy and Inclusion

Digital platforms play a pivotal role in enhancing financial literacy and inclusion.

The dramatic increase in global financial account ownership saw over 1.2 billion new accounts being created since 2011.

Half of which were through mobile services, is a testament to the power of digital solutions in making financial services more accessible and understandable.

Responding to Competitive Pressures

In a market where 43% of non-financial services companies are exploring fintech offerings, developing an investment platform is not just an opportunity; it’s a strategic necessity.

This competitive pressure compels traditional financial institutions and new entrants alike to innovate continuously and offer value-added services to retain and attract clients.

Harnessing Data for Better Decision-Making

The reliance on big data for strategic decision-making in finance is more pronounced than ever.

With the market for big data in financial services is projected to grow significantly.

Investment platforms, with their ability to collect and analyze vast datasets, can provide invaluable insights for both platform operators and investors, leading to more informed and effective investment decisions.

Now that you have a reason to create an investment website, it’s time to learn from the best. These are, as mentioned below:

Top Investment Platforms to Learn From

It goes without saying, the market is filled with leading investment platforms.

Now, if you are planning on creating investment software of your own, it’s a good idea to learn from the very best.

Here, we shall be doing exactly the same:

► Charles Schwab

A giant in the brokerage world, Charles Schwab offers a user-friendly platform with extensive research tools and educational resources. They are popular for:

- Low fees: Known for their low commission and expense ratios on ETFs and mutual funds.

- Extensive research: Provides in-depth research reports, stock screeners, and fundamental analysis tools.

- Suitable for all investors: Offers a variety of investment options for beginners to experienced investors.

► Fidelity Investments

Another major brokerage firm, Fidelity, offers a wide range of investment products and a commission-free stock and ETF trading platform. They are popular for:

- Zero-commission trades: Offers commission-free stock and ETF trades, making it attractive to beginners and active traders.

- Fractional shares: Allows investors to buy fractional shares of stocks, making expensive stocks more accessible.

- Research resources: Provides a wealth of research reports, educational content, and investment tools.

► Vanguard

Renowned for its low-cost index funds and ETFs, Vanguard is a favorite among long-term investors. They are popular for:

- Low-cost funds: Offers a large selection of index funds and ETFs with exceptionally low expense ratios.

- Long-term focus: Encourages a buy-and-hold investment strategy through their low-cost index funds.

- Investor education: Provides a variety of educational resources to help investors make informed decisions.

► TD Ameritrade

A popular choice for active traders, TD Ameritrade offers a powerful trading platform with advanced tools and features. They are popular for:

- Advanced platform: Offers a robust trading platform with technical analysis tools, charting capabilities, and option trading features.

- Margin trading: Allows experienced investors to borrow money to amplify their returns (and risks).

- Educational resources: Provides educational content geared towards active traders.

► E*Trade

A user-friendly platform with a focus on mobile investing, E*Trade is a good option for beginners and casual investors. They are popular for:

- Mobile app: Offers a user-friendly mobile app for easy on-the-go investing.

- Easy to use platform: Designed with a simple and intuitive interface, making it attractive to beginners.

- Promotions and bonuses: Often offers promotions and bonuses to attract new investors.

► Interactive Brokers

A platform geared towards experienced investors, Interactive Brokers offers a wide range of investment products and global market access. They are popular for:

- Global investing: Provides access to a wide variety of investment products in international markets.

- Advanced order types: Offers a variety of advanced order types for sophisticated trading strategies.

- Lower commissions: Generally has lower commissions compared to other brokers, especially for high-volume trading.

► M1 Finance

A unique platform that allows investors to build and automate custom investment portfolios. They are popular for:

- Automated investing: Enables investors to create personalized investment pies and automate their contributions and rebalancing.

- Fractional shares: Allows buying fractional shares of stocks, making expensive stocks more accessible for all investors.

- Low account minimums: Requires a low minimum balance to get started, making it attractive to new investors.

► SoFi Invest

A mobile-first platform offering commission-free stock and ETF trading, SoFi Invest is a good option for millennials and mobile-savvy investors. They are popular for:

- Millennial focus: Caters to millennial investors with a user-friendly mobile app and emphasis on thematic investing.

- Commission-free trading: Offers commission-free stock and ETF trades, making it cost-effective for beginners.

- Cryptocurrency trading: Allows buying and selling a limited selection of cryptocurrencies.

► Betterment

A robo-advisor platform that provides automated investing services, Betterment is a good option for hands-off investors. They are popular for:

- Automated investing: Creates and manages diversified investment portfolios based on your risk tolerance and financial goals.

- Low fees: Charges a low annual management fee based on your account assets.

- Hands-off approach: A good option for those looking for automation in investing.

► Wealthfront

Another robo-advisor platform, Wealthfront, offers automated investing with a focus on tax efficiency. They are popular for:

- Tax-optimized investing: Uses tax-efficient investment strategies to minimize your tax burden.

- Financial planning tools: Provides access to financial planning tools and calculators.

- High minimum investment: Requires a higher minimum investment compared to other robo-advisors, catering to investors with more capital

Now that you know what a winning online investment platform development project looks like, it’s time to go for features.

Core Features (& Advanced Ones) For Investment Platform Development

To build a solid foundation for an investment platform, certain core features must be integrated to ensure functionality, user engagement, and security.

These foundational features include:

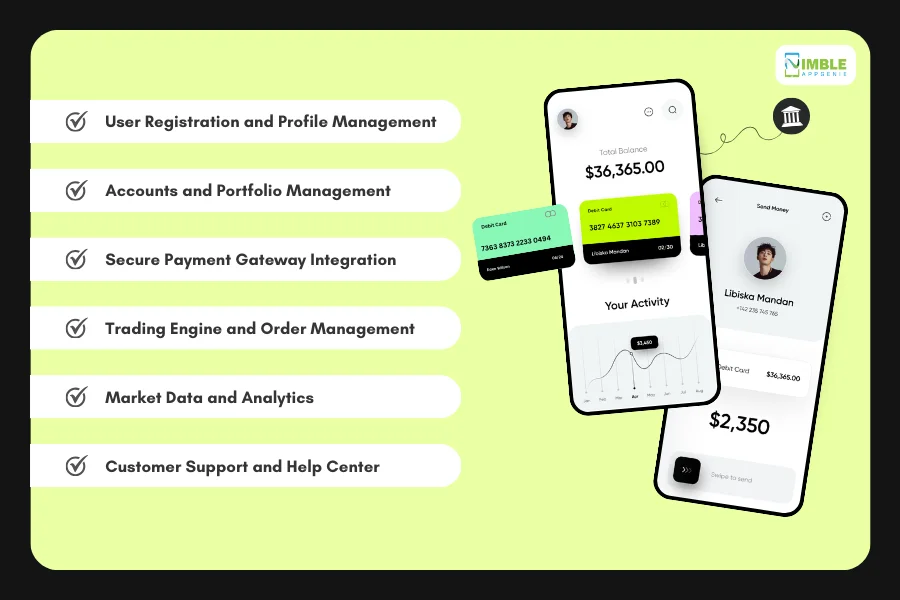

1. User Registration and Profile Management

A secure and intuitive registration process is the first step in user engagement. Incorporating KYC (Know Your Customer) compliance ensures security and trust right from the outset. Profile management allows users to customize and manage their investment preferences and personal information.

2. Accounts and Portfolio Management

Users should be able to easily view and manage their investment portfolios, including balances, transaction histories, and current holdings. Real-time updates and comprehensive portfolio analytics are essential for informed decision-making.

3. Secure Payment Gateway Integration

A secure, seamless payment system is crucial for user trust and satisfaction. It should support multiple payment methods, including bank transfers, credit/debit cards, and possibly digital wallets, ensuring convenience and security for all financial transactions.

4. Trading Engine and Order Management

The heart of an investment platform is its trading engine, which executes buy and sell orders efficiently. An effective order management system should support various order types (market, limit, stop loss, etc.) and provide real-time execution updates.

5. Market Data and Analytics

Access to real-time market data, including stock prices, forex rates, and other relevant financial information, is critical. Integrated analytics tools that offer insights into market trends, performance charts, and investment summaries help users make informed decisions.

6. Customer Support and Help Center

Robust customer support, including FAQs, live chat, and a ticketing system, ensures that users’ queries and issues are addressed promptly, enhancing the overall user experience.

Advanced Features for a Competitive Edge

To distinguish your platform in a crowded market, consider incorporating advanced features that cater to sophisticated investors and enhance user engagement:

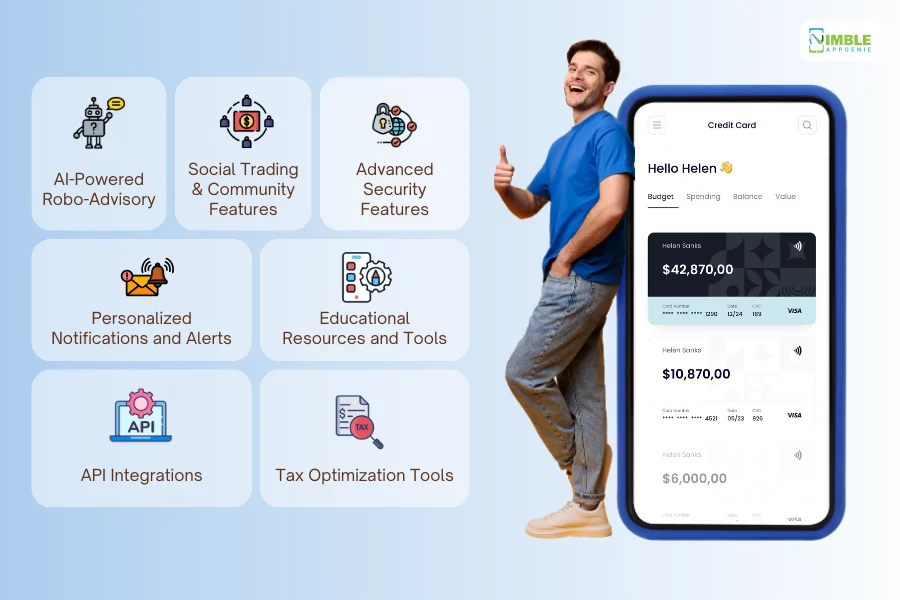

AI-Powered Robo-Advisory

Integrating AI-driven investment advice can cater to users seeking automated, personalized portfolio management. Robo-advisors can analyze individual financial goals, risk tolerance, and market conditions to recommend tailored investment strategies.

Social Trading and Community Features

Features such as copy trading, investment clubs, and community forums encourage user interaction and engagement. They allow investors to share strategies, follow successful traders, and leverage collective wisdom for investment decisions.

Advanced Security Features

Beyond basic encryption and secure login processes, implementing biometric authentication, multi-factor authentication, and blockchain technology can significantly enhance platform security and user trust.

Personalized Notifications and Alerts

Customizable notifications about market movements, portfolio performance, and other relevant events ensure that users stay informed and can react promptly to market opportunities or risks.

Educational Resources and Tools

Providing users with a comprehensive library of educational content, including tutorials, webinars, and articles, can help improve their financial literacy and investment skills, fostering long-term user engagement.

API Integrations

Allowing third-party integrations through fintech APIs can enable users to connect their accounts with other financial tools and services, offering a more integrated and seamless financial management experience.

Tax Optimization Tools

Features that help users track and manage their potential tax liabilities based on their investment activities can add significant value, making tax planning and reporting easier.

Now that we are done with all things investment app development-related, it’s finally time to look at the development process in the section below.

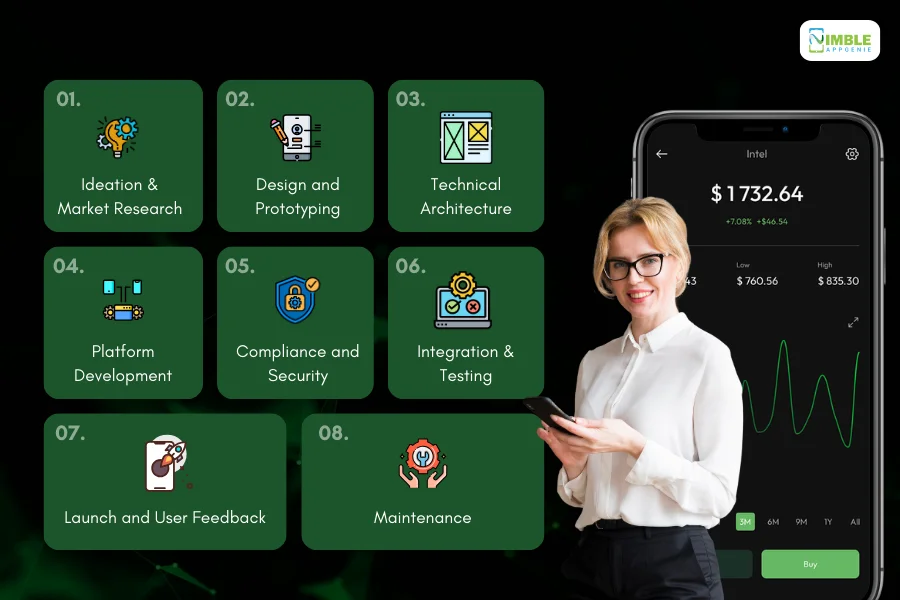

Investment Platform Development Process

It’s time to build an online investment platform.

Now, whether you are going for online website development or you want to create an investment app, the process is more or less similar.

Whether you are a solo-preneur or someone planning to hire dedicated developers, understanding how to create an investment platform and the steps involved will take you a long way. So, with that said, let’s get right into it:

Step 1: Ideation and Market Research

The development of an investment platform begins with a solid ideation phase, where you crystallize the concept of your platform and what unique value it will offer to users.

Here, it’s all about laying down the vision by identifying the target audience, understanding their needs, and pinpointing the gaps in the current market that your platform can fill.

Detailed market research is indispensable at this stage, involving competitor analysis to understand the features, pricing, and user experiences offered by existing platforms.

Moreover, a deep dive into regulatory requirements and compliance standards in your target markets ensures that your platform concept is viable and legally sound.

Step 2: Design and Prototyping

Design and user experience (UX) are at the heart of any digital platform, especially in the fintech space where user trust and ease of use are paramount.

This phase involves creating detailed wireframes and interactive prototypes of your platform, focusing on user-centric design principles.

The design process should prioritize clarity, simplicity, and ease of navigation, considering the complex nature of financial data and transactions.

Prototyping is an iterative process, with continuous testing and feedback loops to refine the user interface (UI) and UX until they align perfectly with user expectations and the platform’s objectives.

Also Read: Fintech Solution Design Guide

Step 3: Technical Architecture

Developing a robust technical fintech architecture is critical for ensuring the scalability, security, and performance of your investment platform.

This phase involves selecting the right technology stack, database structures, and backend services that can support the platform’s functionalities and user load.

Here’s a brief breakdown of the fintech tech stack for investment platform development:

| Layer | Technology/Tool |

| Frontend | React |

| Angular | |

| Vue.js | |

| Backend | Node.js |

| Spring Boot (Java) | |

| Django (Python) | |

| Database | PostgreSQL |

| MongoDB | |

| Redis | |

| Authentication | OAuth 2.0 |

| JSON Web Tokens (JWT) | |

| API Gateway | Kong |

| Amazon API Gateway | |

| Message Brokers | Apache Kafka |

| RabbitMQ | |

| Cloud Infrastructure | Amazon Web Services (AWS) |

| Google Cloud Platform | |

| Microsoft Azure | |

| DevOps Tools | Docker |

| Kubernetes | |

| Jenkins | |

| Security | OWASP ZAP |

| SSL/TLS | |

| Analytics | Elasticsearch |

| Kibana | |

| Prometheus & Grafana |

Step 4: Platform Development

The investment software development process is typically agile, allowing for flexibility and iterative improvements through sprints.

Key considerations during this phase include integrating secure payment gateways, developing the trading engine, and ensuring data encryption and cybersecurity measures are in place to protect user information and financial transactions.

While this might seem short & sweet, this is one of the longest and most resource-intensive steps of the process.

Step 5: Compliance and Security

In the fintech industry, adherence to regulatory requirements and ensuring top-notch security are non-negotiable.

Therefore, this stage involves working closely with legal experts to incorporate compliance frameworks into your platform, including KYC (Know Your Customer), AML (Anti-Money Laundering), and GDPR (General Data Protection Regulation) for European users.

Implementing advanced security features such as SSL encryption, two-factor authentication, and regular security audits are essential to safeguard the platform against data breaches and cyber threats.

Step 6: Testing and Quality Assurance

Thorough testing and quality assurance are crucial to ensure the platform functions flawlessly across all scenarios.

This phase involves a combination of automated and manual testing methodologies, including functional testing, performance testing, security testing, and user acceptance testing (UAT).

The aim is to identify and rectify any bugs, performance bottlenecks, or usability issues before the platform goes live.

Step 7: Launch and User Feedback

Launching the platform is a significant milestone, but the work doesn’t stop there.

Initial user feedback is invaluable for understanding how well the platform meets real-world user needs and expectations.

This feedback loop should be structured and ongoing, allowing you to make iterative improvements to the platform.

Step 8: Maintenance

Post-launch, the focus shifts to continuous maintenance and support services.

This involves adding new features, refining existing functionalities, and expanding to new markets or user segments based on user feedback and market trends.

Scalability is key, ensuring the platform can handle increased user loads and transaction volumes without compromising performance.

Cost to Build an Investment Platform

So, how much does it cost to build an investment platform?

The average cost to develop an investment platform ranges between $25,000 and $250,000+.

Currently, fintech platform development cost depends on a lot of different factors including complexity, development team, size, features, and so on.

In any case, here’s a breakdown of the same:

| Cost Category | Estimated Cost Range |

| 1. Market Research | $2,000 – $10,000 |

| 2. UI/UX Design | $5,000 – $20,000 |

| 3. Backend Development | $10,000 – $100,000 |

| 4. Frontend Development | $8,000 – $50,000 |

| 5. Security & Compliance | $5,000 – $25,000 |

| 6. Testing & Quality Assurance | $3,000 – $15,000 |

| 7. Cloud Hosting & Services | $500 – $5,000/month |

| 8. Third-party Services | $1,000 – $10,000 |

| 9. Marketing & Launch | $5,000 – $50,000 |

That’s how much you might have to pay to build your own investment platform. Now that we are done with this, it’s time to look at how we can make some of the money back.

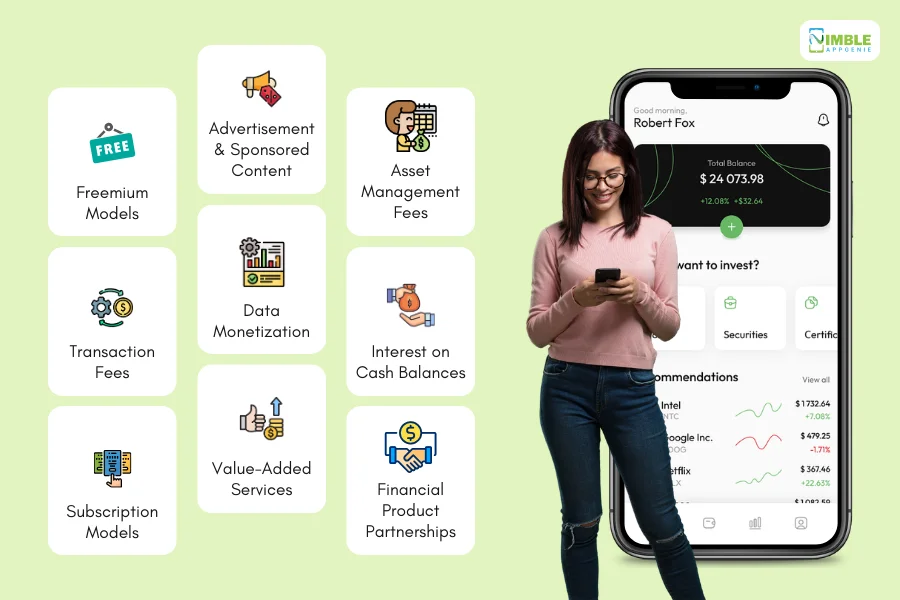

Monetization: How to Make Money With an Investment Platform

Investment platform development can leave a hole in your pocket, but monetization can fill that.

Monetizing an investment platform requires a strategic approach to revenue generation that aligns with your business model, enhances user experience, and maintains a competitive edge.

So, here’s how you can make money with your fintech solution:

Freemium Models

The freemium model offers basic services for free while charging for premium features.

This can attract a large user base initially, some of whom may convert to paid users as they seek more advanced features or exceed the usage limits of the free tier.

Transaction Fees

One of the most straightforward ways to generate revenue is by charging transaction fees.

This involves taking a small percentage or a fixed fee for each trade or transaction made on the platform.

The key is to balance the fee structure to ensure competitiveness while covering operational costs. It’s essential to be transparent about these fees to maintain trust with your users.

Subscription Models

Subscription models provide a steady revenue stream and can be tailored to different user segments.

You could offer basic access for free while charging for premium features such as advanced analytics, additional trading tools, or personalized investment advice.

Tiers can be based on the level of service, the number of transactions per month, or access to exclusive investment opportunities.

Advertisement and Sponsored Content

While not suitable for all platforms, targeted advertising and sponsored content from reputable financial institutions or fintech companies can be a significant revenue source.

This might include banner ads, sponsored research reports, or educational content.

The challenge is to integrate advertising seamlessly to avoid detracting from the user experience.

Data Monetization

With user consent, aggregated and anonymized trading data can be valuable to market researchers, financial institutions, and academic organizations.

Selling insights derived from user behavior and market trends can be a lucrative revenue stream, provided it’s done transparently and in compliance with data protection laws.

Value-Added Services

Offering value-added services such as tax optimization, estate planning, or access to financial advisors can cater to more sophisticated investors willing to pay for personalized advice.

These services can enhance the user experience and differentiate your platform from competitors.

Asset Management Fees

If your platform offers managed portfolios or robo-advisory services, you can charge an annual percentage fee based on the assets under management (AUM).

This fee compensates for the ongoing management and rebalancing of portfolios.

It’s a common model in the wealth management industry and is appreciated for its alignment of platform interests with client success.

Interest on Cash Balances

Holding user funds in accounts can generate significant revenue through interest, especially as your user base grows.

This involves investing user cash balances in safe, liquid assets like money market funds or Treasury bills.

The platform can earn a spread between the interest earned on these investments and the interest paid to users.

Financial Product Partnerships

Partnering with financial institutions, mutual funds, and insurance companies can open up additional revenue streams.

For example, you could earn referral fees or commissions for recommending certain financial products or integrating partner services into your platform.

It’s important to ensure that any partnerships or product recommendations are in the best interest of your users to maintain trust and credibility.

Nimble AppGenie, Your Partner in Investment Platform Development

Do you want to develop an investment platform?

Going for a fintech project can be a hectic task and without expert developers, it’s almost impossible. That’s where we come in.

Nimble AppGenie is a renowned fintech platform development company.

Recognized by top platforms like Clutch.co, TopDevelopers, GoodFirms, and DesignRush, we have helped more than 350 clients turn their ideas into reality.

Some of our top projects include:

- Pay By Check–a popular ewallet mobile app in the United States of America.

- SatPay–The eWallet platform is a Versatile eWallet Solution.

- CUT– E-wallet Mobile App, CUT is available in China and Myanmar.

- SatBorsa– a Currency Exchange Fintech app.

We if can do it for them, we can do it for you. Reach out to us today and we will assign a team of developers

Conclusion

The investment platform market is booming, fueled by a desire for accessible financial services. This guide has equipped you with the basics to navigate development, from concept to launch.

By understanding platform types, features, and successful examples, you can tailor your platform to a specific niche. Partnering with a skilled development team ensures a secure, user-friendly platform that empowers investors.

FAQs

An investment platform is a digital service that connects individual investors with financial markets, allowing them to buy, sell, and manage a wide range of investment products such as stocks, bonds, mutual funds, and ETFs. It provides tools for portfolio management, market research, and investment strategy execution.

Investment platforms work by offering users a user-friendly interface to access financial markets, execute trades, and manage their investment portfolios. They integrate various functionalities like user registration, market data provision, trading engines, and secure payment processing to facilitate seamless investment experiences.

The main types include robo-advisors, online brokerage platforms, P2P lending platforms, crowdfunding platforms, social trading platforms, specialty platforms for niche markets, and hybrid platforms that combine automated and human advisory services.

Core features include user registration and profile management, account and portfolio management, secure payment gateway integration, trading engine and order management, market data and analytics, and robust customer support.

Advanced features might include AI-powered robo-advisory, social trading and community features, advanced security measures like biometric authentication, personalized notifications and alerts, educational resources, API integrations, tax optimization tools, and virtual trading simulators.

The development process includes ideation and market research, design and prototyping, technical architecture and development, compliance and security measures, extensive testing and quality assurance, and finally, launch and continuous improvement phases.

Monetization strategies include transaction fees, subscription models, asset management fees, interest on cash balances, financial product partnerships, advertising and sponsored content, data monetization, value-added services, freemium models, and offering white-label solutions.

Investment platforms comply with financial regulations through rigorous KYC and AML processes, adhere to data protection laws, and implement advanced security features like SSL encryption, two-factor authentication, and regular security audits to protect user data and transactions.

Udai Singh is a senior content writer with over 6 years of experience in creating content for FinTech, eWallet, EdTech, and App Development. He is an expert in simplifying complex concepts and creating engaging content that resonates with the audience.

Table of Contents

No Comments

Comments are closed.