Fintech as an industry has grown rapidly over the past decade, thanks to its widespread application in different industries, and multiple ways to generate revenue/ The rise of fintech as a business model has certainly given rise to different business models that people did not know existed.

However, with so many ways to benefit from fintech comes the confusion of choosing the right model. People planning to penetrate the fintech realm often find themselves in a dilemma of deciding which fintech business model to choose.

If you, too, are one such entrepreneur looking for a way to capitalize on the growing fintech economy but do not know what approach to choose, then this is the post for you!

In this one, we are going to discuss all the factors related to fintech business models, what they mean, what their components are, and most importantly, how to choose the right fintech business model.

So without further ado, let’s begin!

What is meant by the “FinTech Business Model”?

A fintech business model is a business approach that leverages financial technology to generate revenue. It can be said that a business model is primarily based on a fintech product.

It can be an app, website, payment gateway integration, or any sort of financial service being deployed with the use of technology. The idea is to disrupt traditional financial sectors, including banking, insurance, and investment management, by leveraging cutting-edge technologies.

At its core, a fintech business model is characterized by its use of software and mobile apps to create and deliver financial services that are more accessible, efficient, and user-friendly than those of traditional financial institutions.

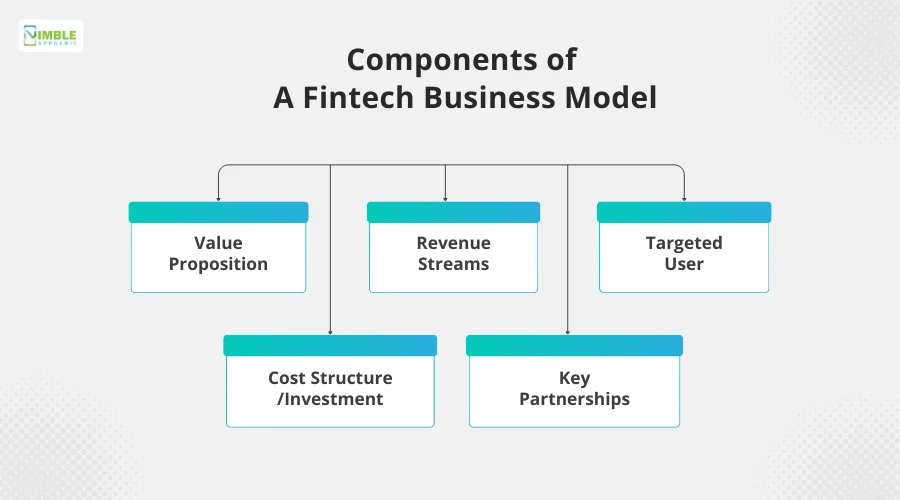

Components of a Fintech Business Model

A fintech business model, just like any other business, has specific components that must be understood before execution. The only difference here is that in fintech, you combine your financial endeavors with technology to exponentially increase its reach.

Here are the key components of a fintech business model that you must define –

♦ Value Proposition

Before starting a fintech business, you must define the unique benefits and value that your product or service will bring to the table. Identify how you plan to leverage fintech in your business and why users will be attracted to your business.

♦ Revenue Streams

Another crucial thing to consider is the revenue streams that your business will open for you. Identify every opportunity to generate revenue. Fintechs offer multiple ways to earn money, as there are several monetization strategies for increasing revenue.

♦ Targeted User

When selecting a fintech business model, incorporating tools that simplify customer interactions is essential. The QR Code generator can help by offering easy access to services like onboarding, payments, or document verification—improving convenience and streamlining the user journey.

♦ Cost Structure/Investment

Identify the key investments that will be required to execute your fintech business model efficiently. For instance, to execute a fintech business, you need to hire a development team, get the required resources, and do other things.

♦ Key Partnerships

For any fintech business model to be executed successfully, you need to ensure that you make the right choices in choosing the partners. You have to collaborate with banks, payment processors, merchant service providers, and other important entities.

Top Fintech Business Models & Examples

Now that you are aware of the components, let’s take a look at the different models that you can execute. There are several fintech businesses that you can choose to enter the market with.

Here are some of the key business models in fintech that you can go for –

#1. Alternative Credit Scoring System

So, what’s a credit scoring system?

A credit score is an important concept that helps financial institutions determine how risky it is to lend someone their services.

As such, people with lower credit scores have to pay higher fees and interest rates, whereas people with higher credit scores have to pay less and get loans much more easily.

Building a credit score isn’t all that easy, and many people suffer because of it.

The global alternative credit scoring market is expected to reach USD 7.8 billion by 2027, growing at a CAGR of 24.4%.

With an alternative credit scoring business model, users can check a lender’s creditworthiness using relatable, current, and easily available data. This is done by tracking their digital footprint.

Traditional credit scoring often excludes underbanked populations. Alternative data like social media activity, phone call patterns, and utility payments can lead to a 20% increase in loan approvals for these groups

That’s why this is a top fintech financial model that a lot of companies across the market use.

Plus, this is also highly beneficial. Not to mention, it’s one of the leading ideas for fintech solutions you can find today.

Some of the popular examples of Alternative score apps are:

- Nova Credit

- Canopy

- Cortera

Who is it for?

Startups and financial institutions aim to expand financial inclusion by providing credit to underserved markets, such as individuals without traditional credit histories.

Why Choose This Business Model?

Alternative credit scoring models leverage non-traditional data (like utility payments, social media activity, and mobile phone usage) to assess creditworthiness, enabling lenders to reach a broader customer base.

Pros:

- Expand access to credit for underserved segments.

- Reduces reliance on traditional credit scoring methods.

- This can lead to lower default rates through enhanced risk assessment.

Cons:

- Privacy concerns over the use of personal data.

- Regulatory challenges in certain jurisdictions.

- Potential for biased outcomes if not properly managed.

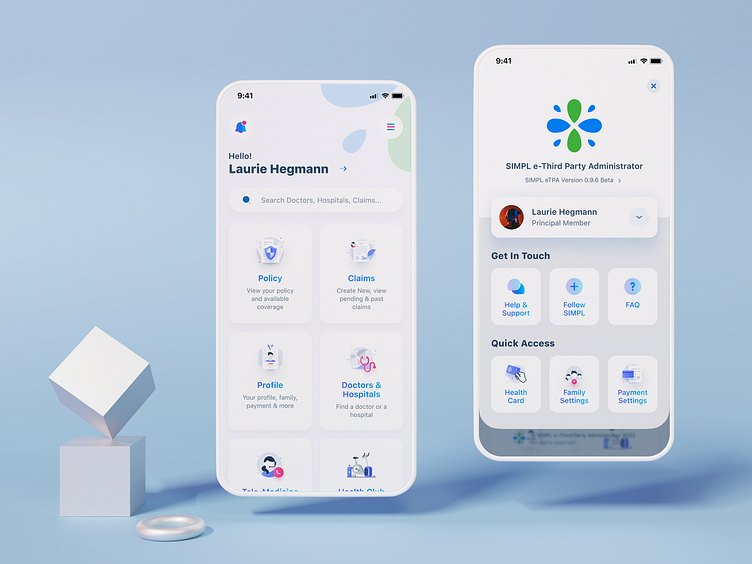

#2. Smart Insurance Underwriting

The market for insurTech solutions is huge.

There are just so many insurance companies that want to launch an insurance app. We just have a fintech business model for the insurtech platform.

“Smart insurance underwriting”

It is revolutionizing the way insurance companies assess risk and price policies. Leverages technology, data, and analytics to create a more efficient, accurate, and customer-centric process. Here are some key aspects of smart insurance underwriting:

- Telematics data

- Public Records

- Alternative data

The global InsurTech market is expected to reach USD 341.36 billion by 2026, growing at a CAGR of 16.3%. 73% of consumers are willing to share data for personalized insurance experiences.

Wearables and telematics data can personalize insurance premiums based on driving habits or health metrics.

Some of the popular examples of Smart Insurance apps are:

- Smart Life Insurance

- GEICO

- Liberty Mutual

Who is it for?

Insurance companies want to innovate and improve risk assessment through AI, machine learning, and big data analytics.

Why Choose This Business Model?

With this business model of financial technology, you can enable more accurate risk assessment, personalized insurance policies, and dynamic pricing based on real-time data, leading to higher efficiency and customer satisfaction.

Pros:

- Enhanced risk assessment accuracy.

- Personalized and flexible insurance offerings.

- Improved customer experience and satisfaction.

Cons:

- High initial technology investment.

- Data privacy and security concerns.

- Potential regulatory hurdles.

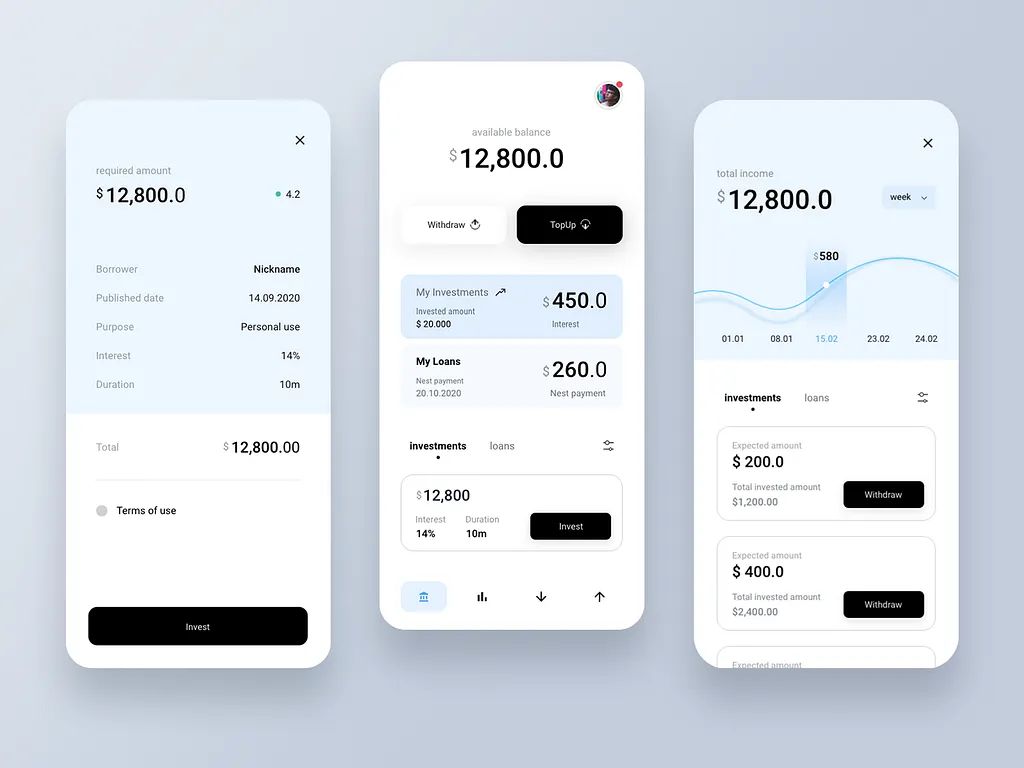

#3. Peer-to-Peer Lending

Here we have the popular P2P or Peer-to-Peer Lending.

The global P2P lending market is projected to reach USD 468.9 billion by 2025, at a CAGR of 25.5%. This makes it one of the most popular business models in the finance industry. After all, with the low cost to develop lending platforms, it has become people’s favorite business model.

For those who don’t know, P2P platforms offer loans to borrowers with thin credit files or those seeking lower interest rates compared to traditional banks. This often comes to life with the help of a loan lending app development.

The platform is adorned with various amazing features, from flexible repayments to instant soft loans. With the platform’s benefits, the market is filled with amazing loan lending apps.

The growth all over the world is amazing.

Today, China dominates the P2P lending market with a 70% share, followed by the US and the UK (PwC).

This could be the perfect business model for fintech startups looking to establish a place for themselves in the market.

It’s the right time to add your business name to the top loan lending apps.

Some of the popular examples of Peer-to-Peer lending apps are:

- Lending Club

- Funding Circle

- Prosper

Who is it for?

Entrepreneurs want to create a P2P platforms that connect borrowers directly with investors, bypassing traditional financial intermediaries.

Why Choose This Business Model?

The fintech business model offers an alternative financing solution for borrowers while providing investors with higher returns than traditional savings accounts.

Pros:

- Access to credit for those who might not qualify through traditional banks.

- Potentially higher returns for investors.

- More competitive interest rates for borrowers.

Cons:

- Credit risk for investors.

- Regulatory challenges and compliance.

- Dependency on the platform’s ability to match borrowers with investors.

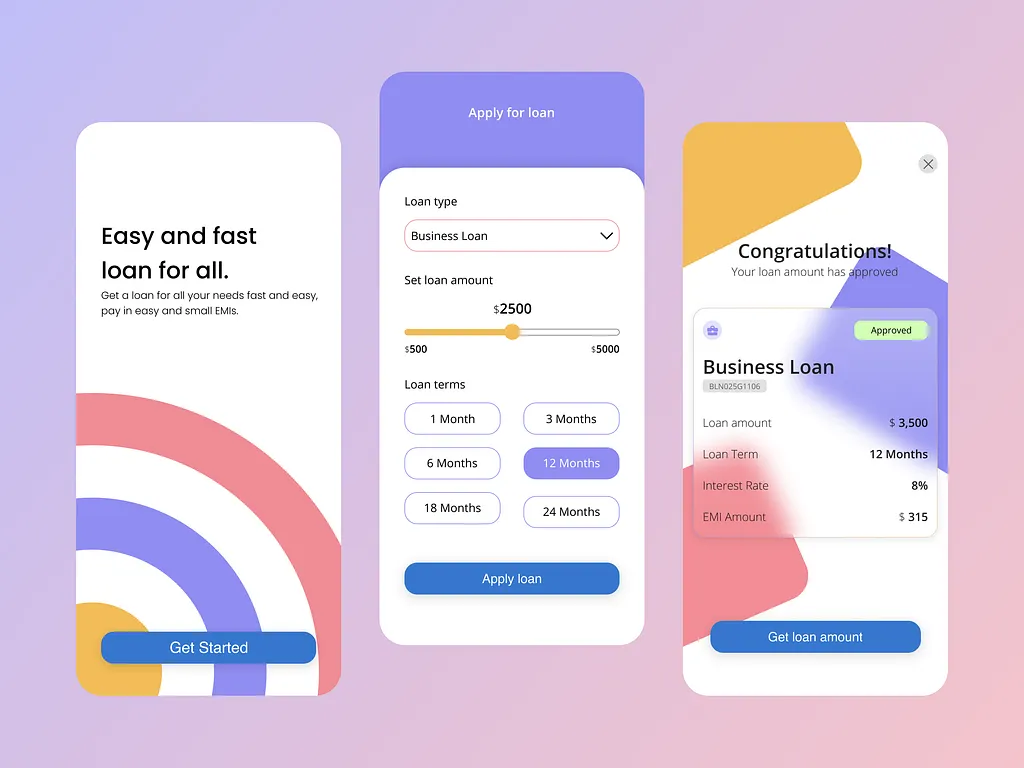

#4. Small Ticket Loans

Another application for loan lending is small-ticket loans.

With an innovative fintech business model, Microfinance platforms and BNPL solutions provide quick and affordable loans to underserved populations, promoting financial inclusion.

Nevertheless, as easy & readily available as it is, getting a loan isn’t all that simple. It requires several bank visits and tons of paperwork, and even then, your application might not be approved as it is not profitable for the bank.

It is common for banks to say no to “small-ticket” loans due to low margins and the relatively high cost of setting up and recovering those loans.

Nevertheless, where banks don’t help, fintech companies save the day. In this model, you can offer them soft loans.

A widespread example of this model is Buy Now Pay Later apps like Afterpay. Another one is cash advance apps.

These loans can be availed through mobile applications and don’t require a day-long process.

Moreover, there is a 0% interest rate, and the client has to pay the amount within a month or so. As far as revenue generation is concerned, it can be done through late fees and partnership commissions.

Not to mention, there’s huge demand: 2.1 billion adults globally lack access to formal financial services, creating a massive need for small loans.

Who is it for?

Fintech startups’ lessons are focused on providing short-term, low-value loans to individuals or small businesses quickly and with minimal paperwork.

Why Choose This Business Model?

Meets the demand for immediate, short-term financing needs, especially in markets with a significant unbanked population.

Pros:

- Quick and convenient access to funds.

- Serves an underserved segment of the market.

- Potential for high volume and scalability.

Cons:

- High interest rates and fees can lead to debt traps for consumers.

- Regulatory scrutiny and the potential for increased regulation.

- Risk of high default rates.

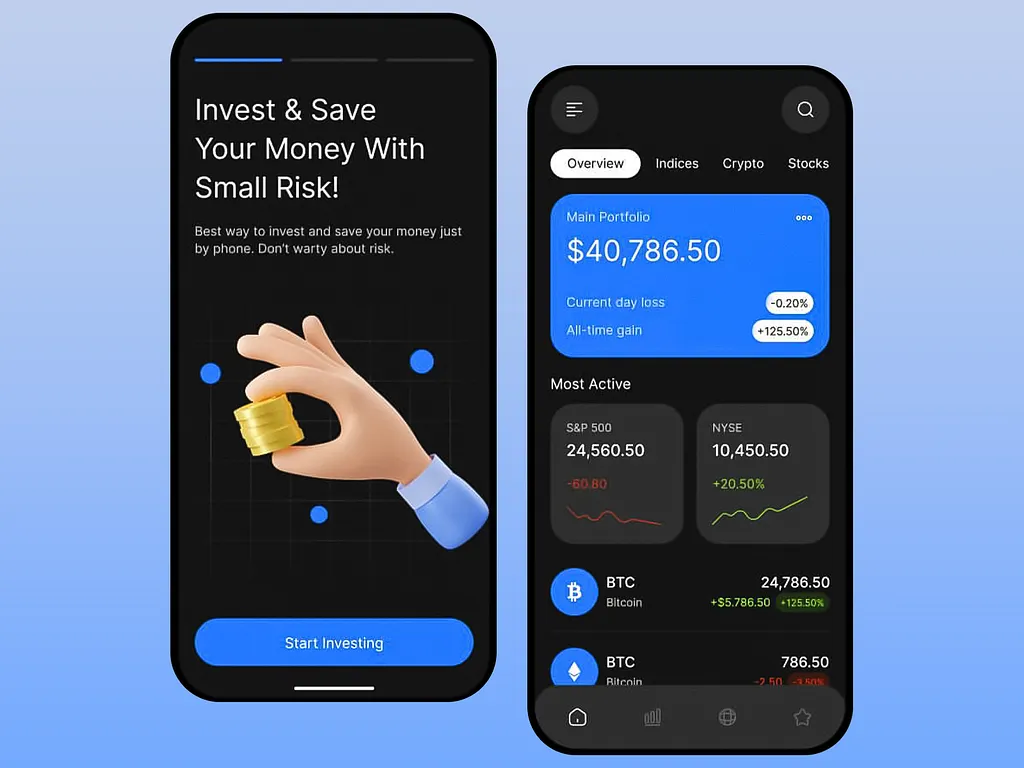

#5. Investment Management Platforms

Investment has been growing popular among the common populace in recent years.

Studies show that as much as 56% of the U.S. population invests in stocks, and many of these are active traders. Robo-advisors manage over USD 1 trillion in assets globally, and their assets are expected to reach USD 12.2 trillion by 2027

This gives us a clear picture of the investment landscape in the USA.

While there are a lot of people who are involved in the market, the majority suffer from investment mismanagement. This doesn’t only mean a lot of loft opportunities but also huge losses at times.

And this is a problem you can solve.

Hire developers and go for capital management solution development. Traders will be able to manage their investment operations regardless of their location through their mobile phones.

Apart from traditional wealth management, you can also integrate it with Blockchain technology.

13% of Americans have invested in cryptocurrency trading apps. We offer them a unique platform to track their investments.

This Fintech business model has high potential, and there are already companies that have generated billions in the market.

Some of the popular examples of such investment management apps are –

- Betterment

- eToro

- Robinhood

Who is it for?

Startups and financial institutions aim to provide individuals and SMEs with digital tools for investment management, financial planning, and advisory services.

Why Choose This Business Model?

Democratizes access to asset management services, traditionally available only to high-net-worth individuals, by using technology to lower costs and minimize investment thresholds.

Pros:

- Broadens access to investment management services.

- Lower fees compared to traditional asset management.

- Customized investment strategies using AI and algorithms.

Cons:

- Market volatility and investment risks.

- Requires continuous technological innovation to stay competitive.

- Regulatory and compliance requirements.

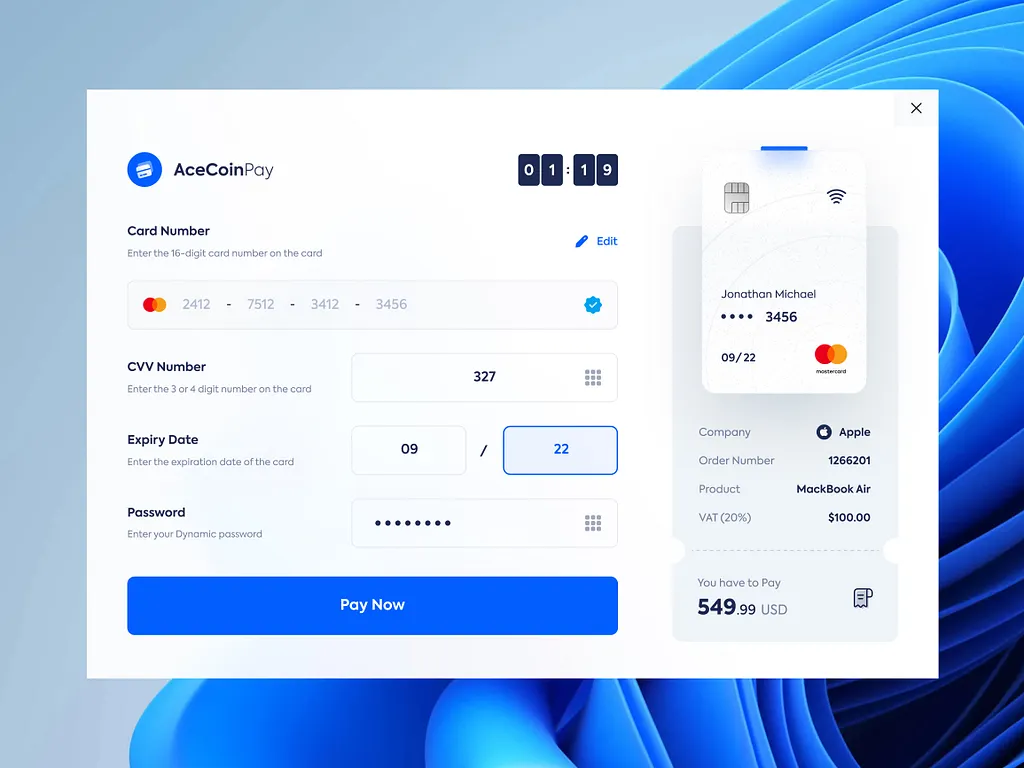

#6. Digital Payment Gateways

With global mobile payment technology transaction volumes expected to reach USD 45.7 trillion by 2026, it’s right for this fintech app business model to mature.

Digital payment gateways, as the name suggests, enable users to send money and other users or vendors to accept it. This can be triggered via eWallet apps, credit cards, debit cards, etc.

Due to recent adoption, digital payment statistics show that digital payment gateways are expanding rapidly in Africa and Asia, providing financial access to unbanked populations.

We are moving towards cashless societies. Countries like Sweden and China are leading the shift towards cashless economies, driven by convenient and secure digital payments.

There are various ways this can be done, including one of the prominent fintech business models. Covering both the needs of the users and accommodating merchant payment providers.

Moreover, you can see that digital payment gateways come in many forms and sizes. Various people have created money transfer platforms based on the same.

Some examples of popular digital payment gateways are, as mentioned below:

- Paypal

- Stripe

- Clover

Who is it for?

Entrepreneurs aim to facilitate online transactions for e-commerce businesses, offering secure and efficient payment processing services.

Why Choose This Business Model?

The payment solution business model supports the growing demand for e-commerce by enabling seamless and secure online transactions, enhancing the user experience.

Pros:

- Facilitates the growth of e-commerce and online services.

- Offers secure and efficient transaction processing.

- Integrates various payment methods to cater to diverse customer preferences.

Cons:

- High competition from established players.

- Security risks associated with online transactions.

- Compliance with international payment standards and regulations.

#7. Digital Wallets, Mobile Wallets, eWallets

Over 3.5 billion people globally use mobile wallets, and their number is expected to reach 4.8 billion by 2025

We are living in the 21st century, and you no longer need a wallet. Not physically, at least. Due to the advancement in fintech, you only need a mobile phone.

While there is no need to define digital payment apps, these store payment cards, loyalty programs, and IDs simplify everyday transactions.

You see, many people carry bulky wallets filled with cash, cards, and other important documents with them, as there is no other option.

But with this app, you can replace a physical wallet with a digital one.

As the name suggests, eWallet applications are installed on our phones and allow us to do anything finance-related.

You can transfer money, pay for shopping instantly, recharge your phone, transfer funds through the bank, check your bank balance, pay bills, open a new account, and so on.

eWallet app development can give you solutions that meet your business needs and ideas. And with this app, you can lead the market.

Many examples of successful eWallet applications have helped their parent companies dominate the market while generating record-breaking revenue.

Some of the popular examples of Digital Wallet apps are:

- Cash App

- Apple Pay

- Samsung Pay

Who is it for?

Companies are looking to offer a convenient and secure digital alternative to traditional wallets, enabling users to store payment information and make transactions electronically.

Why Choose This Business Model?

This is a popular business model in the finance industry, and it caters to the increasing consumer preference for digital payments, driven by convenience, speed, and added functionalities like rewards and budget tracking.

Pros:

- Enhanced convenience and user experience.

- Reduced need for physical wallets and cash.

- Opportunities for integration with loyalty programs and financial services.

Cons:

- Security vulnerabilities and fraud risks.

- Requires widespread merchant adoption to be effective.

- Regulatory compliance and data privacy concerns.

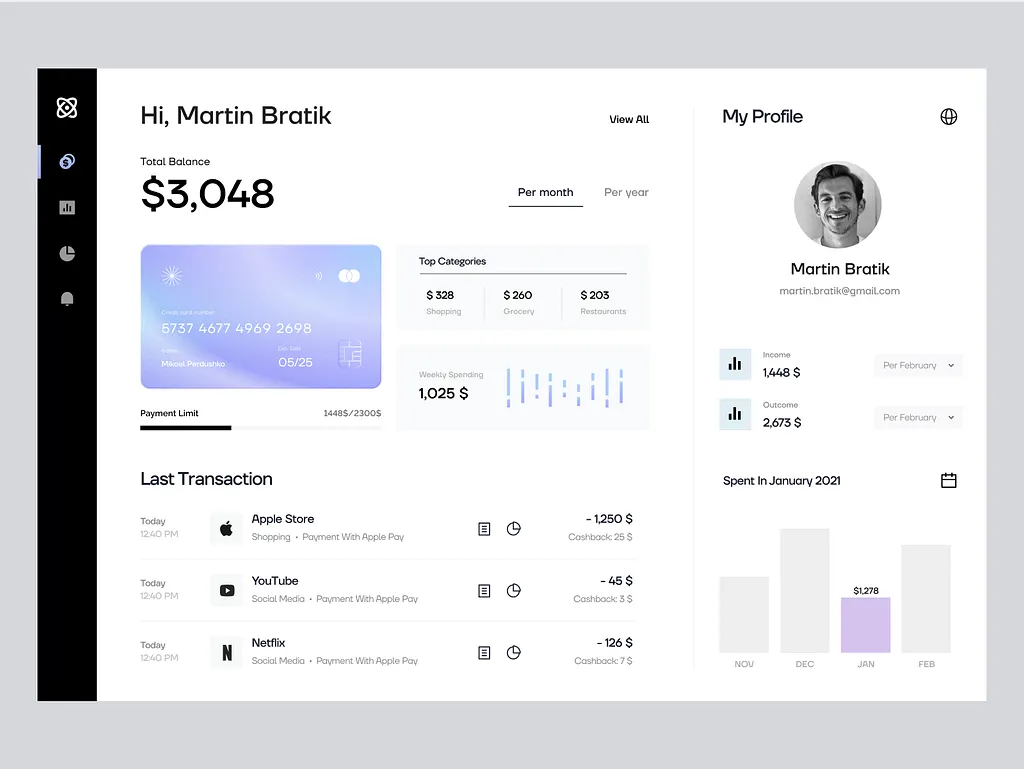

#8. Digital Banking Solutions (Neobanks)

NeoBank App Development has become one of the top fintech business models.

Today, over 80 million people in Europe will use neobanks by 2025. As traditional banks struggle to compete with neobanks’ lower fees, user-friendly apps, and innovative features, they are partnering with FinTech companies to offer digital banking solutions.

Popular mobile banking apps like Bank of America. But they all focus on one task, digitalization, and automation.

You see, only half a decade ago, you had to visit a bank branch for virtually every task. However, with the introduction of mobile banking app development, that became history.

Today, more than 64% of Americans use at least one digital banking product. Over 80 million people are expected to use mobile banking.

This clearly shows the concept’s popularity and its future potential. This is one of the best business models on the list and is worth your consideration.

Now, all you need to do is apply this business model to your platform. Or create a mobile banking solution of your own from the ground up.

Some of the popular examples of Digital Banking (Neobank) apps are:

- Chime

- Fampay

- Moneylion

Who is it for?

Startups and traditional banks aim to offer banking services entirely online, including account management, transfers, loans, and more.

Why Choose This Business Model?

The digital banking business model meets the demand for convenient, 24/7 banking services, appealing to tech-savvy consumers and those seeking alternatives to traditional banking.

Pros:

- The convenience of accessing banking services anytime, anywhere.

- Lower operational costs compared to traditional banks.

- Quick and innovative financial product deployment.

Cons:

- The lack of physical branches may deter some customers.

- Security and privacy concerns with online banking.

- Regulatory hurdles and ensuring compliance with financial regulations.

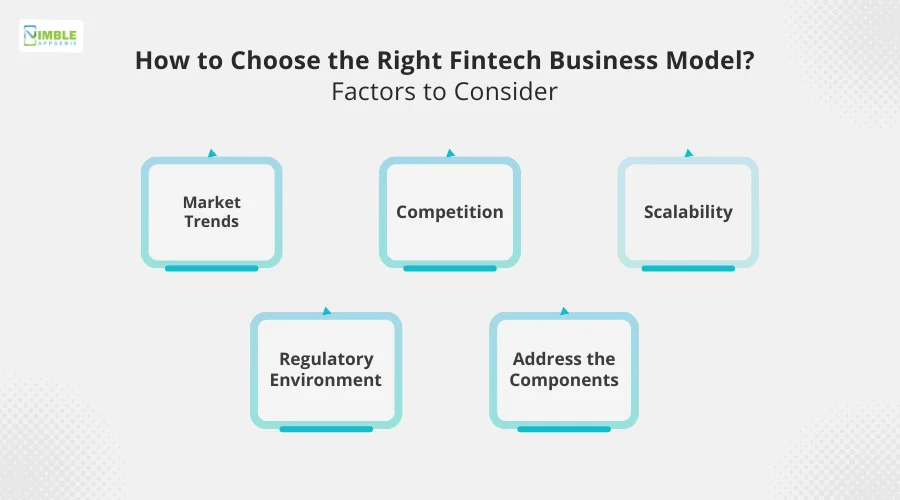

How to Choose the Right Fintech Business Model? Factors to Consider

Now here comes the most crucial question: how to choose the right fintech business model to enter the market? Well, there are several factors that you need to consider before making the decision. Let’s take a look at these factors and identify why they are crucial.

Factors that affect the selection of the right fintech business model –

Market Trends

- Stay informed about emerging fintech trends and technologies.

- Adapt to changing market dynamics

Competition

- Conduct a competitive analysis

- Identify direct and indirect competitors and their strategies

Scalability

- Plan for growth in terms of customer base, geography, and product offerings

- Ensure the model is adaptable

Regulatory Environment

- Understand the competitive landscape & required compliances to be followed.

- Choose the one that is less regulated & more flexible.

Address the Components

- Ensure your execution addresses all the components of your app.

- Simplify fintech business model adoption by addressing the factors.

From Idea to Launch: Nimble AppGenie Builds Your Digital Product

Have you found your venture’s perfect fintech business model, or are you still confused? In any case, we are here to help you.

Nimble AppGenie is a renowned fintech app development company with years of experience in the market, working on 350+ projects, and delivering 95% client satisfaction.

We have been recognized by top platforms like Clutch.com, GoodFirms, and DesignRush for our contribution to the fintech industry. It’s time to turn this idea into reality, backed by a robust fintech business model.

Conclusion

Fintech, or financial technology, is one of the largest and most profitable industries in the world. Various Fintech companies have developed their own Fintech apps, following specific Fintech business models to generate billions of dollars in the market.

Now, if this has inspired you to start your own business with one of the fintech business models and the cost to create a market-leading fintech application, you should consult a stellar app development company that will take you to the next level.

FAQs

A fintech business model is the strategic framework financial technology companies use to deliver innovative financial services, streamline operations, and generate revenue by leveraging advanced technologies. This includes the use of software and mobile apps to offer services that are more accessible and user-friendly than traditional financial institutions.

Business models in the fintech industry are crucial because they ensure regulatory compliance, foster innovation and differentiation, build customer trust and loyalty, enable market adaptability, and define clear revenue streams. These elements are vital for staying relevant and competitive in the rapidly evolving financial market.

Fintech business models outline the core structure and strategy for delivering value and operating in the financial market, focusing on the type of service or product offered. In contrast, monetization models describe specific methods to generate revenue from these services or products, focusing on financial value extraction.

A fintech business plan outlines the strategic approach a fintech startup or company will take to address a specific problem within the financial industry using technology. Key components of a fintech business plan include:

- Executive Summary

- Market Analysis

- Company Description

- Organization and Management

- Services and Products Offered

- Marketing Plan

- Operational Plan

- Financial Plan

Prominent fintech business models include Alternative Credit Scoring Systems, Smart Insurance Underwriting, Peer-to-Peer Lending, Small Ticket Loans, Investment Management Platforms, Digital Payment Gateways, Digital Wallets (eWallets), and Digital Banking Solutions. Each model caters to different market needs and leverages technology to enhance financial services.

Choosing the right fintech business model involves considering factors such as the target customer segment, value proposition, revenue model, technology stack, regulatory compliance, partnerships, cost structure, market trends, competition, and scalability. Understanding these dimensions helps in selecting a model that aligns with market needs and business objectives.

The fintech industry is known for its innovative and disruptive business models that have significantly transformed traditional financial services. Some of the most interesting fintech business models include:

- Blockchain and Cryptocurrency Platforms

- Neobanks and Challenger Banks

- InsurTech

- RegTech

- Robo-Advisors

- Buy Now, Pay Later (BNPL)

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.