Digital money is taking over the world and with it, digital wallets have become one of the biggest trends.

Today, eWallet applications have almost completely replaced physical wallets, taking care of everything from money transfer, and in-store or even online payment to ticket management, card management, and much more.

This is what attracts the curiosity of endless investors as well as users from across the world.

Speaking of which, one must understand the highly regulated nature of mobile wallets due to them handling important fintech data (lots of it).

It’s important to know of the digital payment regulations at a greater level.

And that’s why, we shall be going through every bit of digital wallet app regulations and rules that you need to know.

With that being said, let’s get right into it:

Statistics: Growing Trend of Mobile Payment

Let’s start with digital wallet statistics.

Statistical data shows us how big and how fast the market is growing. Here are a few key ones:

- Digital and mobile wallets accounted for roughly half of global e-commerce payment transactions in 2021, and this share is set to increase to over 53 percent in 2025.

- The mobile payment transaction volume reached a staggering $1.7 trillion in 2021, showcasing a significant year-over-year increase.

- Over two billion people worldwide actively use mobile payments as of 2021 Business of Apps. This vast user base signifies a clear shift towards a more mobile-centric payment approach.

- Grand View Research estimates the mobile payment market size to reach a staggering $587.52 billion by 2030, boasting a compound annual growth rate (CAGR) of 36.2%. This phenomenal growth projection underscores the immense potential of mobile payments in the years to come.

Why Are Regulations Important?

In the era of digital transformation, mobile payments are not just a convenience; they have become a staple in our financial transactions.

As of 2023, over 2 billion people worldwide use mobile payment apps for everything from buying coffee to managing large financial transactions, highlighting the integral role these apps play in our daily lives.

Now, if you want to develop a digital wallet, you might have this question.

Worry not, there are various reasons why regulations for digital payments are so important. In this section, we shall be discussing a few important ones.

![Why_Are_Regulations_Important[1]](https://www.nimbleappgenie.com/blogs/wp-content/uploads/2024/04/Why_Are_Regulations_Important1.webp)

1. Securing Digital Transactions

ewallet security is paramount in the world of mobile payments.

eWallet regulations ensure that the digital wallets we develop adhere to the highest security standards, protecting users from potential breaches.

With cyberattacks becoming more sophisticated, regulations mandate the use of advanced security measures like end-to-end encryption and multi-factor authentication.

Thus, making sure users’ financial data and transactions are safeguarded against unauthorized access.

2. Upholding Consumer Confidence

The backbone of any digital wallet app is the trust users place in it.

Fintech regulatory frameworks are designed to protect consumer rights, ensuring transparency and accountability in every transaction.

For instance, in the event of unauthorized transactions, regulations provide a clear path for recourse, including timely reporting mechanisms and reimbursement protocols.

This not only protects users but also enhances their confidence in using digital wallet apps, fostering a loyal user base.

3. Encouraging Responsible Innovation

For anyone who wants to create their own wallet, regulations challenge us to innovate within a framework that ensures safety and compliance.

This might seem restrictive at first, but it catalyzes creativity, pushing us to develop solutions that are not only cutting-edge but also secure and user-friendly.

For example, the push towards open banking under regulations like PSD2 in Europe has opened new avenues for app developers to create more integrated and holistic financial solutions.

4. Combatting Financial Fraud

In an age where digital transactions are ubiquitous, the risk of financial fraud is ever-present.

Regulations play a critical role in mitigating these risks by enforcing strict compliance measures like Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

These measures ensure that digital wallets are not misused for illicit activities, thereby protecting the financial ecosystem and maintaining the integrity of digital transactions.

5. Stimulating Market Growth

The assurance that comes with regulated digital wallet apps can significantly boost user adoption rates.

A recent survey showed that 73% of consumers are more likely to use digital financial services that are transparent and compliant with regulatory standards.

This demonstrates how regulations not only protect but also promote growth by building a trustworthy environment for users to engage with digital financial services.

Now that we understand the importance of digital wallet regulatory compliance, it’s time to look at the major frameworks themselves. We’ll do that in the next section of the blog.

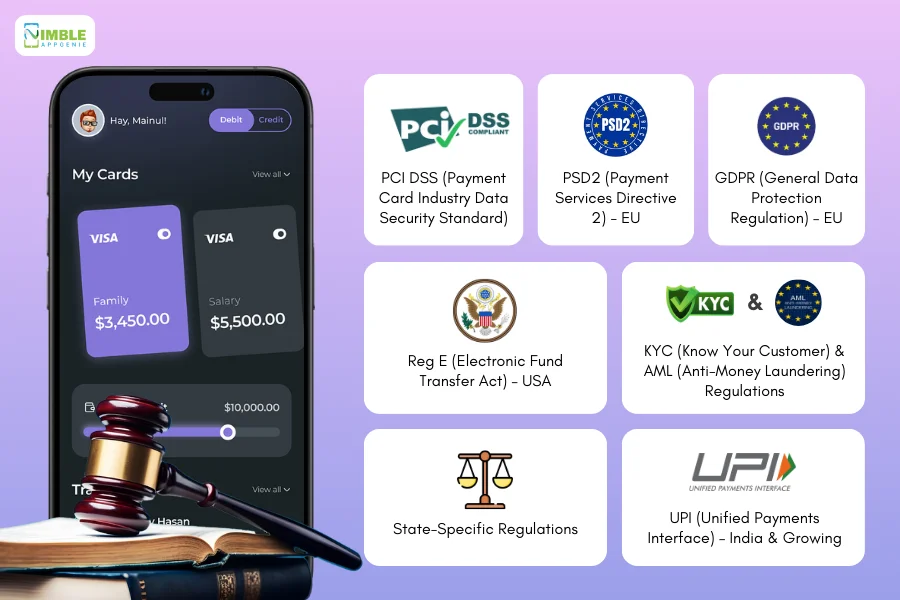

Key Mobile Payment Regulations

As digital wallet solutions continue to reshape the financial landscape, understanding key mobile payment regulations is crucial for both developers and users.

These regulations are designed to ensure a secure, reliable, and fair digital payment ecosystem.

Here, we delve into some of the pivotal regulations that govern mobile payments, highlighting their significance in the development and deployment of digital wallet apps.

-

PCI DSS (Payment Card Industry Data Security Standard)

Let’s start with PCI DSS.

It is a global standard that outlines security measures for handling cardholder data.

For digital wallet apps that store, process, or transmit credit card information, adherence to PCI DSS is mandatory.

This includes requirements for encryption, access control, and vulnerability management, ensuring that users’ payment information is protected at all times.

-

PSD2 (Payment Services Directive 2) – EU

PSD2 is yet another important EU mobile payment regulation.

Specifically for the European market, there is a directive that regulates payment services and payment service providers.

It introduces stringent security requirements, including Strong Customer Authentication (SCA), and promotes the development of open banking.

This allows third-party developers to create financial services that work seamlessly with banks’ systems, thereby fostering innovation and competition.

Also Read: Open Banking APIs

-

GDPR (General Data Protection Regulation) – EU

GDPR (General Data Protection Regulation) are tricky ones.

While not exclusively a mobile payment regulation, GDPR has significant implications for digital wallet apps in terms of how they collect, store, and use personal data.

It emphasizes user consent, data minimization, and the right to data portability, ensuring that users’ privacy is protected in all digital transactions.

-

Reg E (Electronic Fund Transfer Act) – USA

In the United States, Regulation E outlines rules for electronic payments, including provisions for error resolution and consumer liabilities in case of unauthorized transfers.

For digital wallet providers, this means implementing systems that allow users to report issues promptly and ensuring that their rights are protected during electronic fund transfers.

This is what makes it one of the most important regulations in mobile payment.

-

KYC (Know Your Customer) and AML (Anti-Money Laundering) Regulations

Globally, KYC and AML regulations are critical for preventing fraud and financial crimes.

Digital wallet apps are required to verify the identity of their users and monitor transactions for suspicious activity.

Compliance with these digital payment regulations not only safeguards the financial system but also builds trust with users by ensuring the legitimacy of transactions.

-

State-Specific Regulations

Now, when we are speaking of not just eWallet, but building any fintech app, one must understand that there are a lot of state-specific online payment regulations.

In many countries, including the United States, individual states may have their own regulations governing mobile payments.

For instance, the New York Department of Financial Services has specific cybersecurity requirements for financial services companies.

Digital wallet developers must be aware of and comply with these local regulations, in addition to federal standards.

| State | Regulation/Compliance | Brief Description |

| California | California Consumer Privacy Act (CCPA) | Gives consumers more control over the personal information businesses collect about them. |

| New York | NYDFS Cybersecurity Regulation | Requires financial services institutions to establish and maintain a cybersecurity program. |

| Massachusetts | Standards for the Protection of Personal Information | Establishes minimum standards for safeguarding personal information contained in both paper and electronic records. |

| Illinois | Biometric Information Privacy Act (BIPA) | Regulates the collection, use, safeguarding, handling, storage, retention, and destruction of biometric identifiers and information. |

| Texas | Texas Business and Commerce Code Chapter 521 | The Act requires businesses to implement and maintain reasonable procedures to protect sensitive personal information. |

| Nevada | Nevada Revised Statutes Chapter 603A | The Act includes provisions on the protection of personal information and the requirements for data breaches. |

| Florida | Florida Information Protection Act of 2014 (FIPA) | Expands the requirements on businesses to protect personal information and to provide notice to individuals when there is a data breach. |

-

UPI (Unified Payments Interface) – India & Growing

UPI app development is growing in popularity throughout the world.

For markets like India, the UPI framework provides a real-time payment system that facilitates inter-bank transactions through mobile apps.

Digital wallets integrating UPI must adhere to the standards and protocols set by the National Payments Corporation of India (NPCI), ensuring seamless and secure transactions.

Also read: BRICS Payment System

In navigating the landscape of mobile payment regulations, digital wallet app service providers must stay informed and proactive.

Ensuring compliance not only involves understanding these key regulations but also continuously adapting to new standards and legal requirements as the digital payment ecosystem evolves.

For users, the adherence of a digital wallet app to these regulations is a hallmark of trustworthiness and reliability, making it an essential factor in choosing a digital payment service.

Speaking of which, it’s time to look at some challenges that businesses might face in implementing

Digital Payment Regulation & Compliance Challenges

Navigating the mobile payment regulatory landscape presents a unique set of challenges for digital wallet app service providers as well as businesses who are planning to enter the market.

These challenges are not just about compliance; they also involve adapting to a rapidly changing technological environment, meeting user expectations, and ensuring the highest standards of security and privacy.

Let’s explore some of these key challenges in detail:

1. Rapid Technological Advancements

The pace at which mobile payment technology evolves often outstrips the speed at which regulations can be updated, creating a gap between innovation and legislation.

For digital wallet apps, this means constantly balancing between adopting the latest technologies, like blockchain or NFC mobile payments, and ensuring these innovations remain within regulatory boundaries.

2. Global Regulatory Fragmentation

With no universal standards for mobile payment regulations, companies face the daunting task of navigating a patchwork of international, national, and local regulations.

This fragmentation can significantly increase the complexity of developing and scaling digital wallet solutions across different markets, requiring a tailored approach to compliance in each jurisdiction.

3. User Experience vs. Security

Digital wallet regulations often mandate stringent security measures, like Strong Customer Authentication (SCA), which can sometimes be at odds with the seamless user experience digital wallet users have come to expect.

Striking the right balance between robust security protocols and a frictionless user experience is a continuous challenge for app developers.

4. Data Privacy Concerns

In an era where data is a valuable commodity, digital wallet apps must handle user data with the utmost care, complying with regulations like GDPR in the EU.

Ensuring user privacy while providing personalized and efficient services is a delicate balancing act, compounded by the risk of data breaches and cyberattacks.

5. Compliance Costs

Cost to develop an e-wallet app on its own is huge.

In addition to this, meeting regulatory requirements can be costly, especially for startups and smaller companies.

The costs associated with compliance, such as implementing secure payment infrastructure, conducting regular audits, and obtaining necessary certifications, can be significant.

These costs can impact innovation budgets and the overall affordability of digital wallet services.

6. Emerging Financial Risks

The digital payment ecosystem is susceptible to new and evolving financial risks, including fraud, money laundering, and cyber threats.

Staying ahead of these risks while ensuring compliance with AML and KYC regulations requires continuous vigilance, sophisticated risk management strategies, and often substantial investment in security technologies.

7. Interoperability Issues

As the digital payments ecosystem becomes more complex, ensuring interoperability among different payment systems, banks, and regulatory frameworks becomes increasingly challenging.

This not only affects the user experience but also complicates compliance efforts, as digital wallets must be designed to function seamlessly across diverse financial infrastructures.

Who Should Care About Mobile Payment Regulations & Compliance?

The ecosystem of mobile payments is vast and interconnected, involving various stakeholders each playing a crucial role.

Understanding and adhering to mobile payment regulations and compliance is not just the responsibility of one entity but a collective effort that ensures the security, efficiency, and trustworthiness of digital transactions.

Here’s a look at who should be invested in mobile payment regulations and compliance:

-

App Developers and Tech Companies

For those at the forefront of creating digital wallet apps and payment solutions, compliance is not an option but a necessity.

These regulations ensure that their innovations are safe, secure, and user-friendly.

Fintech app development company must integrate regulatory requirements from the ground up, embedding security and privacy into the DNA of their applications.

-

Financial Institutions and Banks

As the traditional custodians of financial transactions, banks and financial institutions are pivotal in the mobile payment chain.

They must ensure that their mobile banking services and partnerships with fintech companies comply with financial regulations, safeguarding customer assets and maintaining the integrity of the financial system.

-

Payment Processors and Service Providers

These entities handle the actual processing of transactions and thus must ensure their operations meet regulatory standards for security, data protection, and fraud prevention.

Their compliance to digital payment regulations ensures that transactions are processed smoothly, securely, and transparently.

-

Merchants and Businesses

Businesses that accept mobile payments need to ensure their systems are compliant with regulations concerning transaction security and consumer protection.

This includes small local businesses, large corporations, and e-commerce platforms, all of whom rely on the trust and efficiency of mobile payments to serve their customers.

-

Cybersecurity Professionals

Those specializing in cybersecurity within the mobile payment space have a vested interest in understanding and advocating for regulations that ensure the highest levels of security.

They are often on the front lines of implementing compliance measures and defending against threats to the payment ecosystem.

Now, with this being said, let’s move on to the next section, going through some case studies and examples.

Case Studies and Examples: Impact of Money Payment Regulations on Apps

The market is filled with payment apps, which gives us a lot of examples to learn from.

So, in this section of the blog, we shall be going through some of the major digital payment-related regulatory miss-ups without mentioning specific names (due to copyright).

These are, as mentioned below:

► Enforcing Security Standards

In 2019, the Federal Trade Commission (FTC) penalized a major data breach involving a money transfer app.

The app failed to implement adequate security measures, leading to unauthorized access to user financial information.

The FTC levied a hefty fine and mandated stricter data security practices for the app.

Impact

This case highlights the FTC’s role in enforcing data security regulations. Non-compliance can result in significant financial penalties and reputational damage.

► Balancing Innovation with Consumer Protection

A newly launched mobile payment app in the US is focused on a frictionless user experience.

However, their streamlined onboarding process faced scrutiny for potentially lax KYC (Know Your Customer) procedures.

While aiming for ease of use, concerns arose regarding potential money laundering risks.

Impact

This case exemplifies the need to balance user experience with consumer protection. Regulations like the Bank Secrecy Act (BSA) and the USA Patriot Act establish KYC requirements to combat financial crime. Finding a balance between these considerations is crucial for app developers.

► Regulations Fostering Trust

Following a string of data breaches impacting mobile payment apps, the Consumer Financial Protection Bureau (CFPB) issued guidelines emphasizing consumer disclosures and error resolution procedures.

These guidelines aim to empower users with greater transparency and control over their mobile payment transactions.

Impact

The CFPB’s actions demonstrate how regulations can foster trust in the mobile payment ecosystem. By ensuring clear communication and dispute resolution mechanisms, regulations can encourage user adoption and create a more secure environment for mobile transactions.

Nimble AppGenie, Your Partner in Seamless Fintech Development

Nimble AppGenie is a leading e-wallet app development company.

We stand at the forefront of fintech innovation, expertly navigating the complex landscape of digital wallet development.

Our commitment is to deliver cutting-edge, compliant digital wallet solutions that not only meet but exceed industry standards.

With a keen focus on security and regulatory adherence, we turn visionary fintech concepts into reality. Partner with Nimble AppGenie and embark on a journey towards creating a digital wallet app that’s secure, innovative, and ready to lead the market.

Together, we’ll redefine the future of digital transactions.

Conclusion

As the digital wallet landscape continues to flourish, navigating the complexities of regulatory compliance is paramount for developers and fintech companies.

The surge in mobile payment adoption underscores the need for secure, reliable, and compliant digital wallet solutions.

Mobile payment regulations like PCI DSS, PSD2, and GDPR are not just legal requirements but foundational pillars that ensure the security, transparency, and trustworthiness of digital transactions.

By embracing these regulatory frameworks, digital wallet providers can unlock new avenues for innovation, enhance the user experience, and build a loyal user base.

The future of fintech lies in balancing cutting-edge technology with stringent compliance standards and ensuring a secure and inclusive digital finance ecosystem for all.

FAQs

Mobile payment regulations are a set of laws, guidelines, and standards designed to ensure the security, efficiency, and integrity of mobile payment transactions. These regulations cover various aspects, including consumer protection, data security, anti-fraud measures, and compliance with financial laws.

Regulations ensure the safety and security of mobile payment transactions, protecting both consumers and providers from fraud, data breaches, and other cyber threats. They also foster consumer confidence in using digital wallets, which is crucial for the growth of mobile payments.

Compliance is a shared responsibility among all stakeholders in the mobile payment ecosystem, including app developers, financial institutions, payment processors, merchants, and regulatory bodies. Each plays a crucial role in ensuring that mobile payment services adhere to established regulations and standards.

Regulations impact app developers by setting the standards for security, privacy, and functionality that must be integrated into the app’s design and operation. Compliance ensures that apps provide a safe environment for users to conduct transactions.

Key regulations include PCI DSS for data security, PSD2 in the EU for payment services, GDPR for data protection, and local laws like Reg E in the USA for electronic fund transfers. Compliance with these and other regulations ensures the lawful and secure operation of mobile payment systems.

While ensuring security and compliance, regulations also create a stable environment that encourages innovation. By setting clear guidelines, regulators can drive the development of new technologies and services within a safe and secure framework.

Challenges include keeping up with rapid technological changes, navigating the complex landscape of global regulations, balancing security with user experience, managing the costs of compliance, and mitigating new financial risks.

Yes, consumers can play a significant role by staying informed about their rights and the regulations protecting them. Engaged and informed consumers can drive demand for more secure, transparent, and compliant mobile payment solutions.

While the fundamental principles of security and consumer protection apply universally, specific regulations may address the technical and operational aspects unique to each type of mobile payment technology.

Look for apps that are transparent about their compliance with major regulations, such as PCI DSS for security standards and local financial regulations. Reputable apps often provide detailed information about their security measures, privacy policies, and consumer protection practices.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.