Key Takeaways:

- The demand for banking apps is rising continuously in the market.

- The banking app creation process is divided into 12 steps, starting with market research and thorough analysis of the opportunities.

- Other steps include choosing the development approach, finalizing the tech stack, app designing, functionality development, testing, and deployment.

- The average banking app development cost ranges between $25,000 to $250,000+, depending on different complexities and decisions.

- Convenience, Increased customer engagement, Improved customer satisfaction, Data-driven insights, Competitive advantage, and Brand loyalty are some of the many benefits of building a banking app.

“Mobile banking” solution or a banking app refers to digital solutions that allow users to access banking services such as funds transfer, account management, pay bills, deposit checks, and much more.

Every bank today must plan and create a banking app to maximize its reach and offer high convenience to its customers.

However, the process is not that simple. Since banking is generally aligned with traditional practices, it is quite fascinating for businesses and customers to interact with

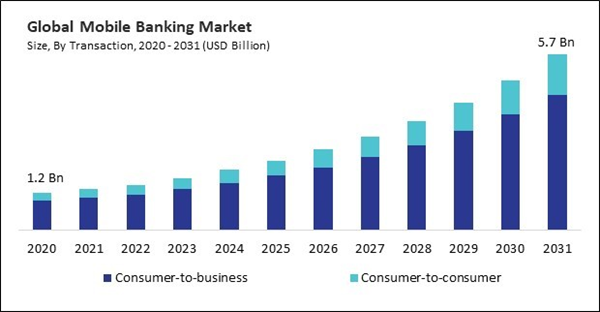

Speaking of market leaders, let’s look at some mobile banking statistics that will help us better understand the market as a whole.

Banking App Development Market Statistics

Did you know? According to a report by Statista, the number of mobile banking users worldwide is expected to reach 3.6 billion by the end of 2024, a significant increase from 2.7 billion in 2020.

Research and Markets.com’s latest report claimed that the Global Mobile Banking Market size is forecast to reach $5.7 billion by 2031, rising at a market growth of 16.5% CAGR.

- Global mobile banking users are expected to reach 4.87 billion by 2028.

- In the US alone, 60% of adults actively use mobile banking, which is an impressive mobile banking solution.

Banking apps simply address the gaps in traditional banking experiences, making them more viable and attractive for a modern user.

Understandably, there are different banking services available in the market. Unless it is a superapp, it can become extremely difficult to inculcate all of them into a single app. Hence, there are different types of mobile banking app solutions.

What are the Different Types of Banking Apps?

Banking apps can never be one size fits all solution as there are different types of banking services required.

If you are planning to enter the lucrative market of banking apps, but do not know about the different options you have, worry not, as we have listed them below.

Here are some of the most prominent types of banking apps that you can choose to develop for your business:

1. Traditional Banking Apps (or Dedicated Banking Apps)

The first on the list is a traditional banking app.

As the name suggests, these are offered by the traditional banks as an extension of their services. In other words, allows users to access their core banking services remotely via mobile phone.

They share some similarities with eWallet app development, but there are some big differences as well.

Chase Mobile, Bank of America Banking app, and Wells Fargo Mobile App are a few examples of traditional banking apps.

2. Neobanks/Challenger Banks

NeoBank App Development has become quite a popular part of mobile banking solutions in recent times.

The term “Neo” refers to new, as in there are digital-first banks that don’t have any physical branches. There is a high chance you have heard of these apps.

Some popular examples are apps like Chime, N26, and Revolut.

3. Specialized Banking Apps

Well, specialized banking apps are “specialized” to perform certain tasks. And these are quite common these days. Including apps like PayPal, Acorns, Robinhood, etc.

They are still called banking apps despite offering different services, as they are still directly connected to your bank account.

4. Niche Banking Apps

Every industry has its niche-specific apps. And the mobile banking app concept isn’t different either.

These are tailored to specific communities or industries, and these apps cater to specific niches. These include Bonsai, Mercury, and Moven.

5. Open Banking Apps

If you are familiar with Zelle’s Business model, you will understand the open banking app.

For those who are new to the concept, these platforms leverage open banking APIs. Let’s look at some of these apps: Mint, Plaid, and YNAB.

So, these are the different types of banking solutions, and it’s much clearer how to build a banking app.

Speaking of building, let’s take a look at the complete banking app development process in the next section.

How to Create a Banking App From Scratch

After going through the different types of banking apps, you may be wondering how to create one.

Well, the process to create a banking app is the same for all the different types; however, only the tech and functionalities vary.

There are multiple steps that you can follow to create a banking app from scratch. In case

So let’s get right into it, starting with:

Step 1: Market Research

The first step to making an online banking app is conducting thorough app market research.

While it might not seem as important as other steps on the list, it’s very crucial. After all, it’s with research that you gather data that is used as a base for every other decision.

So, what do you need to do in this step? Well, it looks something like:

- Competitor Analysis

- Trend Analysis

- User Research

And so on.

Not to mention, based on your banking app idea and the data you collected, you create a UVP or unique value proposition.

In layman’s terms, it refers to the exclusive thing you are offering that makes you stand out in the market.

Step 2: Choose a Business Model & Monetization

With a concept ready, it’s time to make some money. After all, that’s one of the main reasons to build an online banking application.

In any case, this is where you choose the business model, or what we call app monetization strategies.

Let’s look at a few of them below, starting with:

| Business Model | Description | Strengths | Weaknesses |

| 1. Freemium | Offer basic features for free and charge for premium features like budgeting tools, investment access, or higher transaction limits. | Low barrier to entry, attracts a broader user base, and recurring revenue from premium users. | Requires careful balancing of free vs. paid features, and potential user frustration with limited free features. |

| 2. Subscription Apps | Charge a monthly or annual fee for access to all features and functionalities of the app. | A predictable revenue stream encourages user engagement and retention. | A higher initial barrier to entry may limit the user base compared to a freemium model. |

| 3. Transaction-based fees | Charge a fee for specific transactions like international payments, bill payments, or ATM withdrawals. | Revenue is directly tied to user activity, suitable for users who perform frequent transactions. | Requires sufficient transaction volume to be profitable, and potential user dissatisfaction with additional fees. |

| 4. Marketplace model | Integrate with third-party financial services (loans, insurance, wealth management) and earn commissions on referred users and completed transactions. | Diversified revenue streams tap into the additional financial needs of users. | Requires strong partnerships with third-party providers and relies on user trust and engagement with integrated services. |

| 5. Advertising | Display targeted ads within the app based on user data and financial habits. | Can generate additional revenue without charging users directly. | Potential user privacy concerns and intrusive ads may negatively impact user experience. |

| 6. Data insights & partnerships | Aggregate and anonymize user data to sell insights to financial institutions or marketing companies. | An additional revenue stream without impacting user experience directly. | Raises ethical concerns regarding data privacy and requires robust data security and user consent management. |

Now that we are done with the monetization stuff, let’s move to the next step of learning how to create an online banking app.

Step 3: Deal With Legal & Regulations

Whenever you want to create a banking app of any form or niche, you need to deal with a lot of legal and regulatory compliance.

These are very important for very obvious reasons. Ignoring compliance is one of the top reasons why banking apps fail.

| Category | Regulation/Compliance | Impact on App Development |

| 1. Financial Regulations | KYC/AML/CFT | User verification & onboarding processes.

AML/CFT measures to prevent illegal activities. |

| Data Privacy (GDPR, CCPA, GLBA) | Data protection measures (consent, storage, breach notification). | |

| Electronic Funds Transfer Act (EFTA) | Secure transaction processing & dispute resolution. | |

| Payment Card Industry Data Security Standard (PCI DSS) | Cardholder data security measures. | |

| Open Banking APIs | Compliance with relevant standards for open banking integration. | |

| 2. Security & Compliance Standards | PCI SSC, NIST, ISO, CSA | Implement robust security measures for user data and financial information. |

| 3. Consumer Protection | CFPB, FCA, ASIC | Fair & transparent practices, avoid deceptive marketing, comply with consumer protection laws. |

Step 4: Finalize App Features & Functionality

Much like the eWallet app feature, functionality, and features in mobile banking applications are also super important.

So, let’s get started with the basic yet essential mobile banking app features and then move to more advanced ones.

| Essential Features: | ||

| User Panel | Bank Panel | Admin Panel |

| 1. Account Balances | 1. Real-Time Transaction Monitoring | 1. User Management (Advanced) |

| 2. Transaction History | 2. User Management | 2. Role-Based Access Control |

| 3. Funds Transfer (Internal/External) | 3. Fraud Detection & Prevention | 3. Security Management |

| 4. Bill Payments | 4. Report Generation | 4. App Version Management |

| 5. Mobile Top-Up | 5. Customer Support Management | 5. Push Notification Management |

| 6. Card Management | 6. Performance Analytics | 6. Content Management (if applicable) |

| 7. Investment Monitoring (if applicable) | 7. Regulatory Compliance Tools | 7. Marketing & Campaign Management |

| 8. Loan Management (if applicable) | 8. Branch Management (if applicable) | 8. Data Management & Analytics |

| 9. Profile Management | 9. Integrations with Third-Party Services | 9. System Monitoring & Maintenance |

| 10. Secure Messaging | 10. System Administration | 10. Regulatory Reporting |

While basic features are the bread and butter, you need advanced features to attract customers and keep them engaged, delivering value.

Here are some advanced mobile banking app features that you can consider:

- AI-powered Budgeting & Financial Insights

- Investment Management Tool

- Cardless ATM Withdrawals

- Voice-Activated Banking

- Biometric Authentication

- P2P Payments with QR Codes

- Gamification & Reward

- Open Banking Integration

- Blockchain-Based Transactions

- Virtual Assistants

Step 5: Choose Development Platform

One of the most crucial steps to creating a banking app is choosing a platform.

There are two main choices when going with mobile app development: Native and hybrid apps.

Hybrid, being as it is, gives you many options when it comes to technology. For instance, you can create an app with react native.

On the other hand, when it comes to native app development, you can either choose an iOS app or go with Android app development.

But understand this, while the hybrid platform has quite some flexibility and reach, it slows down in terms of performance; native apps offer robust performance and an amazing feature set.

Moving to the division in the native platform, both iOS and Android are great, catering to two entirely different types of audiences.

In any case, once you are done with this, we move to the next step, which is selecting a tech stack to build an online banking app.

Step 6: Finalize Tech Stack

The mobile app tech stack plays an important role in the features, look, and overall performance of the application.

One of the most important aspects of understanding how to develop a successful mobile banking app is understanding the importance of the tech stack and how to choose the right one.

Moving on, let’s look at a sample tech stack for mobile banking apps.

| Layer | Technology | Description |

| 1. Operating System | iOS (Apple) / Android (Google) | The mobile app will be developed for either iOS or Android platforms, or both. |

| 2. Development Environment | Xcode (iOS) / Android Studio (Android) | These are the official Integrated Development Environments (IDEs) for iOS and Android app development, respectively. |

| 3. Programming Languages | Swift / Kotlin | Swift is the primary language for iOS app development, while Kotlin is preferred for Android. |

| 4. User Interface (UI) | UIKit (iOS) / Android UI Framework | These frameworks provide components and tools for building the app’s user interface. |

| 5. Backend Development | Node.js / Python / Java | Backend technologies for handling server-side logic, data storage, and APIs. Node.js is often used for real-time features. |

| 6. API Development | RESTful API / GraphQL | Create APIs for communication between the mobile app and the server. RESTful APIs and GraphQL are common choices. |

| 7. Database | PostgreSQL / MySQL / MongoDB | Databases for storing user data, transactions, and other critical information. Choice depends on specific requirements. |

| 8. Authentication | OAuth 2.0 / OpenID Connect | Secure user authentication and authorization protocols. |

| 9. Security | SSL/TLS, Encryption, OWASP Top Ten | Implement security measures like data encryption, SSL/TLS for secure communication, and protection against common security threats. |

| 10. Push Notifications | Firebase Cloud Messaging (FCM) / Apple Push Notification Service (APNs) | Services for sending push notifications to users’ devices. |

| 11. Payment Integration | Stripe / Samsung Pay / Apple Pay / Google Pay | Integrate payment gateways for transactions and financial operations. |

| 12. Analytics | Google Analytics / Firebase Analytics | Tools for tracking user behavior and app performance. |

| 13. Version Control | Git | To manage and collaborate on the source code. |

| 14. Continuous Integration/Continuous Deployment (CI/CD) | Jenkins / Travis CI / CircleCI | Automate testing, building, and deployment processes. |

| 15. Cloud Hosting | AWS / Azure / Google Cloud | Host backend servers and databases on cloud platforms for scalability and reliability. |

| 16. Performance Monitoring | New Relic / AppDynamics | Monitor app performance in real-time and identify bottlenecks. |

| 17. App Store Deployment | Apple App Store / Google Play Store | Publish the app on the respective app stores for distribution. |

| 19. Code Repository | GitHub / GitLab / Bitbucket | Store and manage the source code. |

Step 7: MVP Development (Optional)

In app development, an MVP is a solution with just enough features to be usable by early customers who can then provide feedback for future app development.

The goal of an MVP is to get real-world feedback from users as early as possible in the development process so that the product can be iterated on and improved before investing a lot of time and money into features that may not be needed or desired.

You need to understand that MVP development is optional.

Companies only do it when they are either trying to generate funding for a mobile app or they need proof that the concept will work.

However, if it’s a well-established idea or has enough funding, you can directly skip to the next step.

Step 8: Design The App

Now that we are done with all the preparation, it’s time to start the actual development. The first thing would be UI/UX Design.

When it comes to mobile applications, especially ones dealing with inherently boring concepts like banking, they need to look “amazing”.

That’s why you need to invest time and money in banking app design if you want to develop a successful online banking app. And that’s what makes it one of the most important steps to create a mobile banking app.

In any case, once all of this is done, it’s time to move to the next step.

Step 9: App Development

It’s time to build a digital banking app, in a technical sense.

In layman’s terms, it is this step that all of the technical aspects are given the face of mobile applications.

In longer terms, app developers combine front-end design and interface with the back-end, combining all of it to build a mobile banking app.

As one might assume, it is the most time and resource-consuming step of the process. And once this is done, we move to the next step.

Step 10: Testing & QA

And now, we have come to the testing part of this step-by-step guide to create a banking app.

App Testing & QA play an important role in polishing the final product as well as client satisfaction. While testing is something that goes on for the entire development process, this is one final round.

Depending on the platform, there are different strategies and techniques. In other words, testing for iOS apps and Android apps can be a little different.

In any case, once all of this is done and chances are made, we move to deployment.

Step 11: Deployment

It’s finally time to deploy the app.

This is a non-technical step, and once the app is submitted, it takes 2 weeks for approval or rejection.

Well, speaking of rejection, Apple apps get rejected more frequently when compared to the Android ones, due to the platform’s strict guidelines.

However, once the app is approved, you can start with App Store optimization.

Step 12: Maintenance

While the initial development process is done, and you know how to make a mobile banking app, the work is not finished just yet.

To create a digital banking app that takes the market by storm and holds the position, you need to invest in mobile banking app maintenance.

Plus, this is also the right time to start the mobile app market.

So, this is how you create a mobile banking app. Now, let’s answer one of the most commonly asked questions: how much does it cost to develop a mobile banking app?

How Much Does It Cost to Develop a Banking App? Breakdown

The exact cost to create a mobile app is hard to predict. The average cost to develop a mobile banking app ranges from $25,000 to $250,000; you need to take into account different factors and different aspects of the development process.

While we have already discussed the factors in one of our cost guides here, you must be aware of what are the stages of development where the budget goes and exactly how much money is spent in each stage.

Check out the table below for more detailed information:

| Development Stage | Estimated Min. Cost ($) | Maximum Cost ($) |

| 1. Project Planning | $1,000 | $5,000 |

| 2. UI/UX Design | $1,000 | $15,000 |

| 3. Front-end Development | $3,000 | $30,000 |

| 4. Back-end Development | $3,000 | $30,000 |

| 5. Security & Compliance | $1,000 | $15,000 |

| 6. Testing | $1,000 | $15,000 |

| 7. Mobile App Deployment | $1,000 | $5,000 |

| 8. API Integration | $1,000 | $10,000 |

| 9. Maintenance & Updates | $1,000/year | $10,000/year |

| 10. Marketing & Promotion | $1,000 | $15,000 |

| 11. Contingency (10% of total) | Varies | Varies |

To obtain an accurate cost estimation, consult an expert mobile app development company.

The cost of banking app development indicates that all scales of banks can have a digital solution based on their requirements.

While some see the benefits of the ideation, some often wonder why they create a banking app. What does it bring to the table?

Several reasons and benefits make your decision to create a banking app a profitable one. Check them out in the next section!

Why Create a Banking App? Benefits

One of the reasons to build a mobile banking app is the plethora of benefits it offers. So, what are these benefits?

Well, let’s start with the benefits for users, then we shall see why businesses are so willing to invest in building digital banking apps.

For Users:

- Convenience and accessibility: Access your bank accounts and manage finances anytime, anywhere with a smartphone or tablet.

- Security: Securely view account balances, transaction history, and make payments with multi-factor authentication and encryption.

- Time-saving: Avoid queues and branch visits by paying bills, transferring funds, and depositing checks remotely.

- Personalization: Set up custom alerts, track spending patterns, and manage budgets with personalized financial tools.

- Real-time updates: Receive instant notifications for transactions, account changes, and important financial information.

- Mobile payments: Make contactless payments in stores, online, and on the go with mobile wallets and QR codes.

- Financial management tools: Track expenses, set savings goals, and manage investments with integrated financial tools.

- 24/7 customer support: Access customer support through the app anytime, anywhere, for assistance with banking needs.

For Businesses:

- Increased customer engagement: Offer convenient banking services and attract new customers through the app.

- Reduced operational costs: Lower branch traffic and operational expenses by encouraging mobile banking adoption.

- Improved customer satisfaction: Provide a seamless and personalized banking experience that keeps customers happy.

- Data-driven insights: Gain valuable customer data and analytics to improve products, services, and marketing strategies.

- Enhanced security: Implement advanced security measures to protect customer data and transactions within the app.

- Competitive advantage: Stand out from competitors by offering innovative and user-friendly mobile banking solutions.

- Scalability and reach: Expand your customer base and reach new markets without the need for physical branches.

- Brand loyalty: Build stronger brand loyalty by providing a convenient and personalized banking experience.

All these benefits make it a game-changer for several financial institutions. However, the execution of the development process is definitely crucial for the users.

And when implementing banking app development, several challenges may come in your way. Let’s take a look at them in the next section!

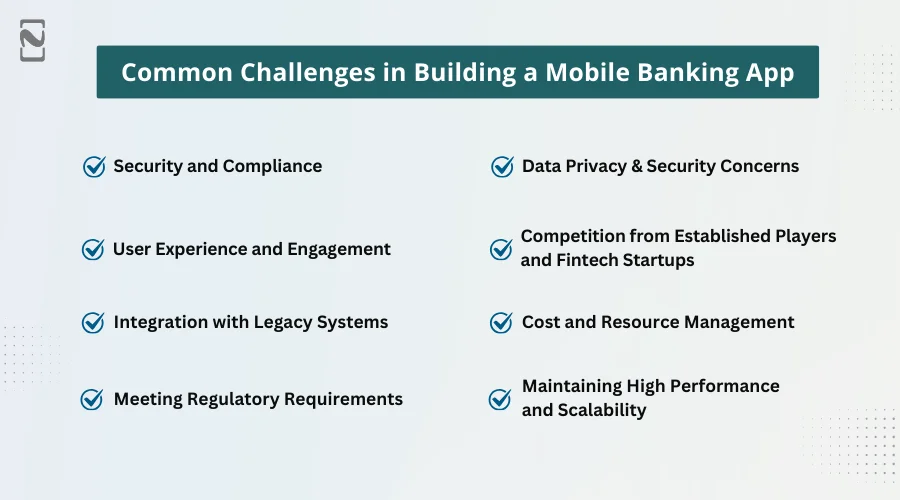

What are Some Common Challenges in Building a Mobile Banking App?

Going through all the steps of building the app, you might have understood that it is definitely not a cake walk to build a banking app, even if you are aware of all the steps.

That is because while the benefits are super motivating, there are some additional challenges in implementing the solution effectively.

Wondering what these challenges are? Checkout the following banking app development challenges that you might face:

Challenge 1: Security and Compliance

Implement multi-factor authentication, encryption, and regular penetration testing. Ensure compliance with financial regulations and data privacy laws like GDPR and CCPA.

Challenge 2: User Experience and Engagement

Conduct user research, prioritize core features, use clear and concise language, employ design thinking principles, and gather user feedback for continuous improvement.

Challenge 3: Integration with Legacy Systems

Utilize APIs for efficient integration, choose agile development methodologies, and involve stakeholders from both sides for smooth collaboration.

Challenge 4: Meeting Regulatory Requirements

Partner with legal and compliance experts, stay updated on regulatory changes, and build flexibility into the app to adapt to future requirements.

Challenge 5: Data Privacy and Security Concerns

Offer transparency about data collection and usage, implement strong data security measures, and obtain explicit user consent.

Challenge 6: Competition from Established Players and Fintech Startups

Identify a unique value proposition, focus on innovative features and user experience, and leverage user feedback to differentiate your app.

Challenge 7: Cost and Resource Management

Utilize cost-effective development tools and resources, prioritize essential features, and consider phased development with budget optimization.

Challenge 8: Maintaining High Performance and Scalability

Conduct proper load testing, choose a scalable cloud infrastructure, and optimize the app for efficient data processing.

While these challenges do seem insurmountable, a well-planned approach can help you create a banking app that performs well in the market. In fact, there are several players in the market who have already achieved decent performance.

Check out the next section, where we have shared some successful case studies of banking apps.

Successful Mobile Banking App Case Studies

The market is filled with successful banking apps.

And if you want to create a banking platform that captures the heart of the masses, you too need to learn from the best.

That’s why we shall be going through some of the best banking apps in different parts of the world, learning what makes them successful.

1. Revolut (Europe)

Let’s start with Revolut.

Ruling the European fintech market, the app brings true innovation to the world of banking.

Since its launch in 2015, Revolut has captivated over 20 million users across Europe by redefining the banking experience. Plus, it has inspired a lot of people to go for popular apps like Revolut.

Known for its feature-rich platform, you can access functions like instant currency exchanges, multi-currency debit cards, and a wide array of features, from budgeting tools to investment options.

So, what makes it stand out from the rest?

Well, Revolut stands out for its competitive rates and fee-free transactions.

If you’re aiming to create a mobile banking app that truly resonates with users, Revolut’s success story highlights the importance of diverse features and a strong focus on user experience.

2. N26 (Europe)

If you want to build a successful mobile banking app, you’d better learn from N26.

This mobile-first banking app, with its intuitive interface, has attracted over 8 million customers by making banking both simple and enjoyable.

Some of its key features include real-time transaction notifications and budgeting tools wrapped in a user-friendly package, offering a clear blueprint for those looking to innovate in the mobile banking space.

N26’s approach shows how a focus on design and user experience can transform the way people manage their finances.

That’s something businesses can learn a lot from.

3. Zelle (USA)

Launched by a consortium of US banks in 2017, Zelle has quickly become a household name for instant peer-to-peer payments.

Integrated within existing banking apps, it offers a seamless experience for users, contributing to its rapid growth.

Zelle stands as a testament to the power of collaboration and convenience in the digital payment space.

For people who want to make a digital banking app, Zelle’s success underscores the value of integrating with existing systems and focusing on simplicity and security to enhance user satisfaction.

4. Ally Bank (USA)

If you are a US citizen, there is a high chance you have heard of Ally Bank.

This is the app that brings online banking to new heights with its digital expertise and customer-centric features.

As an online-only bank, Ally offers everything from mobile check deposits to high-yield savings accounts, all accessible through a highly rated mobile app.

This focus on convenience, competitive rates, and a comprehensive suite of services makes Ally a model for how digital-first strategies can lead to high customer satisfaction and loyalty in the mobile banking industry.

5. Monzo (Europe)

Lastly, we have Monzo.

This digital banking application has made waves in the UK banking scene by emphasizing transparency, user experience, and innovative features like virtual cards and personalized budgeting tools.

For those looking to break into the mobile banking market, Monzo’s approach provides valuable insights into the importance of customer trust and engagement through innovative features and a transparent pricing model.

With over 6 million customers, its success lies in its commitment to making banking more accessible and user-friendly.

So, those were some successful examples that inspired people to build a mobile banking app like Monzo, as it’s successful in the market. One of the key factors that is common among all of these profitable banking apps is a balanced development team.

You must have a solid banking app development team backing your solution to make the most of this growing and lucrative market.

Nimble AppGenie, Your True Partner in Creating a Mobile Banking App

Do you want to develop a banking app?

As we discussed in the blog, creating an app from the ground up can be quite some work. But don’t worry because we have got you covered.

Nimble AppGenie is a renowned mobile banking app development company with years’ worth of experience in the market, working on 700+ projects, and delivering 95% client satisfaction.

Some of our top projects are, as mentioned below:

- Pay By Check: Pay by Check is a popular e-wallet mobile app in the United States of America. It allows users to transfer, pay, or even exchange currency.

- SatPay: An eWallet platform, it’s a Versatile eWallet Solution that allows users to request, receive, and send payments without hassle.

- CUT: An E-wallet Mobile App, CUT is available in China and Myanmar. It works well with both RMB and MMK currencies.

- SatBorsa: A Currency Exchange Fintech app, SatBorsa is one of the platforms that is available on both iOS and Android.

For our work and innovation across industries, we are recognized by prestigious platforms worldwide.

If you have an idea for a digital banking app, we know how to bring it to reality. Hire mobile app developers in 24 hours with us and supercharge your project.

Conclusion

To create a mobile banking app, you need a comprehensive understanding of the market, user needs, and regulatory requirements.

The key to success lies in offering a secure, user-friendly, and feature-rich platform that stands out in the competitive fintech landscape.

Businesses must navigate challenges such as ensuring robust security, providing an engaging user experience, integrating with legacy systems, and adhering to stringent regulatory standards.

Overcoming these hurdles is crucial for developing an app that meets the evolving needs of modern banking customers and leverages the latest technological advancements for a seamless banking experience.

FAQs

One of the biggest concerns people, as well as tech companies, have about banking solutions is whether they are safe.

Cybersecurity threats are indeed increasing at a never-before-seen rate. But at the same time, mobile banking and wallet app security are experiencing innovation like never before.

From the user’s perspective, apps that show they are safe and take measures to win their trust. And on the company’s side, it gives them a motive to invest in mobile banking app security.

So, the answer is YES, Mobile Banking apps are safe.

The requirements for a mobile banking app include security measures such as multi-factor authentication and encryption, real-time transaction monitoring, funds transfer capabilities, bill payment functionality, mobile top-up options, card management, investment monitoring (if applicable), profile management, secure messaging, and more. These features should cater to user needs while complying with legal and regulatory standards.

To create a mobile app specifically for Access Bank or any other bank, you would typically need to partner with the bank itself or have authorization from the bank to develop an app for their customers.

This involves collaboration with the bank’s IT and legal teams, adhering to their security and compliance standards, and using their APIs and systems to provide banking services through the app.

Creating an online banking platform involves similar steps to creating a mobile banking app, including conducting market research, choosing a business model, dealing with legal and regulatory requirements, hiring developers, selecting a development platform, and finalizing the tech stack.

The main difference is that online banking platforms are typically web-based and accessible through browsers, while mobile banking apps are specific to smartphones and tablets.

Some of the main challenges are:

- Security and Compliance

- User Experience and Engagement

- Meeting Regulatory Requirements

- Data Privacy and Security Concerns

- Cost and Resource Management

- Integration with Third-Party Services

The best online banking app can vary depending on individual preferences, needs, and geographic location. Some popular online banking apps include Ally Bank, Chime, Capital One 360, and others.

It’s essential to evaluate different options based on your specific requirements, such as account types, features, fees, and user experience, to determine which one is best for you.

Online banking typically refers to accessing banking services through a web browser on a computer or tablet, while a banking app is a dedicated mobile application designed for smartphones and tablets.

The key differences lie in the accessibility and functionality of the two platforms, with mobile banking apps often offering a more streamlined and touch-optimized experience for on-the-go banking.

The cost of developing a banking app can range from $25,000 to $150,000 or more, depending on various factors such as the complexity of features, the development platform (iOS, Android, or both), the tech stack, and the geographic location of the development team. It’s essential to budget for ongoing maintenance and updates as well.

The steps to create a mobile banking app:

- Market Research

- Choosing a business model

- Dealing with legal and regulatory requirements

- Hiring mobile app developers

- Selecting a development platform

- Finalizing the tech stack

- Designing the app

- Developing a prototype

- Building the app

- Testing and deploying it

Starting your own business for a mobile banking app involves identifying a unique value proposition, conducting market research, developing a business plan, securing the necessary funding, hiring a skilled development team, dealing with legal and regulatory requirements, and launching your app in the market. Success also depends on delivering a user-friendly and secure app with relevant features.

The future of mobile banking apps is likely to include trends such as super apps that offer a wide range of financial and non-financial services, hyper-personalization using AI, open banking expansion, increased use of biometric authentication, voice banking with virtual assistants, gamification elements, cardless transactions, enhanced financial wellness tools, continued focus on cybersecurity, and potential integration of blockchain technology for secure and transparent transactions.

To create the best banking app, you should consider factors such as:

- User-friendly design

- Robust security measures

- A wide range of useful features

- Compliance with regulatory standards

- Seamless integration with other financial services

Additionally, staying updated with the latest trends and technologies in the banking industry is crucial for success.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.