Key Takeaways:-

- Fintech trends have evolved significantly over the past few years and are set to change completely in 2026.

- Use of AI agents and automation is the new standard that helps in handling end-to-end tasks like KYC, background checks, and others without any human intervention.

- Rising fintech trends in 2026 also include embedded finance ecosystems, which are an upgraded version of embedded finance, scaling the usage of financial services in a non-financial application.

- RegTech as a trend will evolve significantly in 2026, changing from simply focusing on maintaining regulations to a much more integrated technology embedded at the architectural design level for any financial service.

- Trends like Neobanking, Open Finance, Use of CBDCs, and more are some of the most prominent trends to watch out for in 2026.

- Nimble AppGenie can improve the quality of your fintech app or solution by helping you implement the latest trends.

Fintech has been one of the fastest-growing fields in the past decade.

Combining the latest technologies with the fundamentals of finance, people have made financial services super convenient for regular users.

What keeps the momentum going for Fintech is the adoption of new technologies and trends.

New advancements in technology help banks address the needs of users better while preventing fraud and scams.

In this post, let’s take a look at some of the emerging fintech trends that can help you stay ahead of the competition in 2026.

Let’s get started!

10+ Fintech Trends That Will Change Everything in 2026

The market for fintech services is a growing one, valued at $460.76bn in 2026 and estimated to reach the market value of $1,382bn by 2031.

The growth of fintech apps is directly proportional to their ability to adopt the latest market trends. However, there are different markets, and for different markets, the trends keep changing.

To help you stay ahead of the market and give you better insights, we have curated a list of the most popular fintech trends.

Without further ado, let’s discuss them and understand how they are going to help you grow your fintech business in the upcoming years!

► Trend 1: Use of Agentic AI and Automation

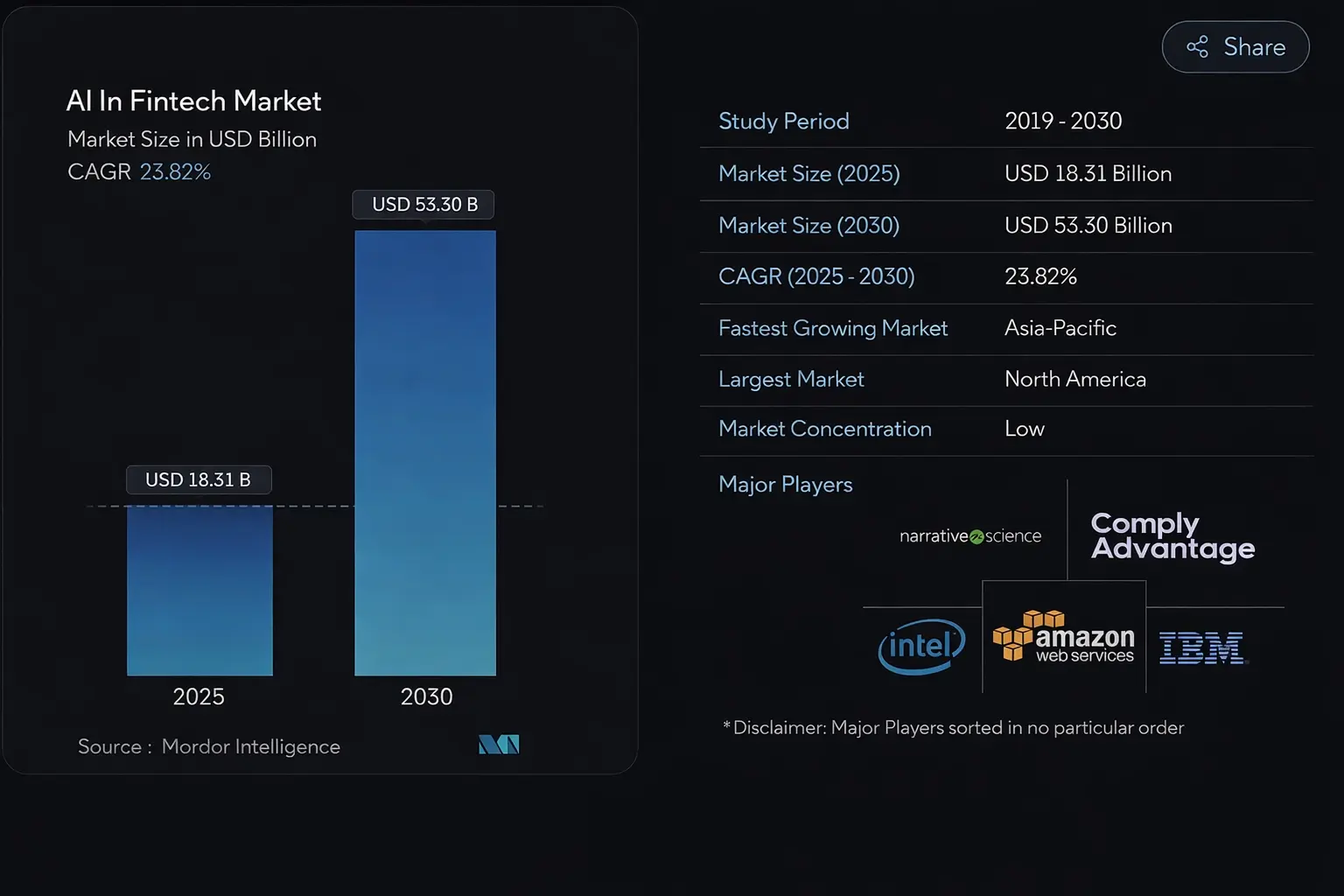

AI in fintech has already achieved several milestones. From simplifying workflows to yielding better insights, artificial intelligence has found numerous applications in the industry. However, 2026 is all about the use of Agentic AI and automation.

With the implementation of AI agents, you build intelligent systems that track the inputs and, based on their own understanding, make decisions to move the progress of a task from one stage to the next.

Agentic AI and automation can speed up the process and make real-time decisions. You might have heard about AI and automation earlier as well. But what changes in 2026? Well, the clear answer to that is the growth in AI infrastructure over the years.

In 2026, we have the technical maturity to implement AI agents that automate decision-making processes. However, it is always advised to start with low-risk automation, implementing AI in simplifying the KYC process, for instance.

AI agents today can easily simplify a user’s experience and help businesses make more impactful decisions automatically by analyzing the requests made by the users.

It is a cost-saving solution as it completely reshapes the back office management and the requirement for human resources. Tech giants like Apple, Google, and Microsoft are embracing AI, signaling its readiness for adoption in banking and financial services.

► Trend 2: Increasing Use of IoT in Fintech

The Internet of Things has been around for a while and has certainly made its way into Fintech.

With its application in smart point-of-sale hardware, ATM management, smart branch management solutions, and more, IoT is one of the most cutting-edge technologies that has enhanced Fintech usability.

The crucial thing that makes IoT a success in Fintech is the fact that it is not only limited to banking and payments but also extends to other areas of Fintech.

Such as InsurTech, which helps in improving customer support, data analysis, and real-time decision-making.

The fact that with the help of smart IoT devices and the IoT compatibility of modern smartphones, financial institutions can move towards a smarter functioning office/business, allowing technology to enhance their user experience. IoT in Fintech is truly a game-changing technology.

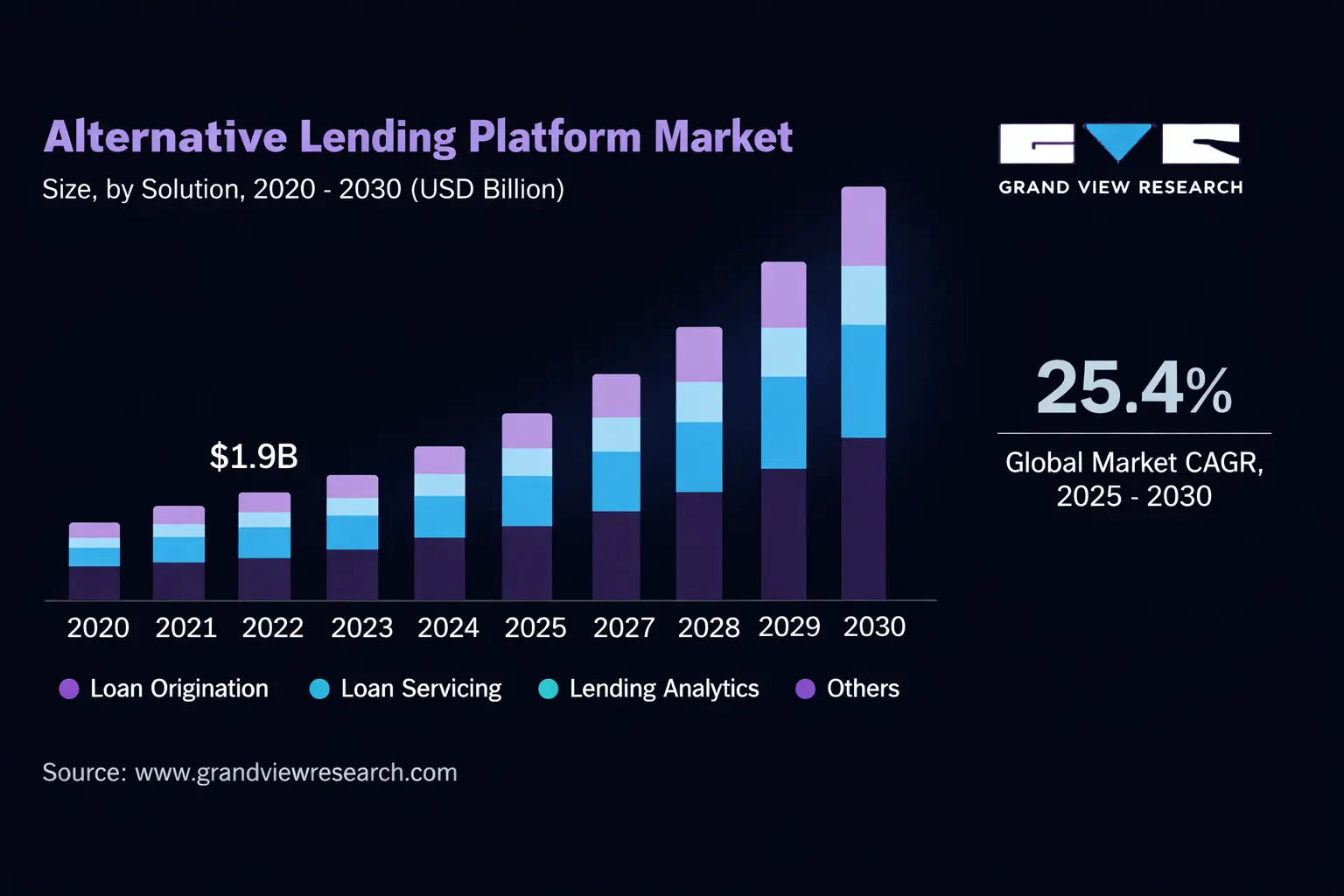

►Trend 3: Introduction to Alternative Lending

Also referred to as peer-to-peer lending and marketplace lending, this is one of the new trends that is going to be on the rise in the future.

Lending and borrowing have always been integral to traditional financial practices. Alternative lending will change the way these work as it offers a new digital way of allowing individuals to find people for lending/borrowing.

This means that you do not have to be a bank or associated with a financial institution to invest your money in a lending business. Alternative lending platforms are usually funded by institutional investors.

The global alternative lending platform market size was estimated at USD 3.82 billion in 2024 and is expected to grow at a CAGR of 25.4% from 2025 to 2030.

While it may seem a bit difficult to digest the fact that now individuals will be able to borrow money without involving any banking institution, as it seems unsecured, more regulations may become an issue.

However, you may be shocked to know that these have been highly successful.

P2P lending is slowly catching up and can be a hit in markets like the USA, UK, and Australia, where people are more educated about the benefits of investing their extra income in lending businesses.

► Trend 4: Evolution of Regulatory Technology (RegTech)

One of the key problems that Fintech applications face is complying with ever-changing regulatory requirements. In 2026, regulation and compliance are the primary concerns of businesses.

Taking care of all the regulatory requirements from the first step, regtech allows developers to integrate compliance in the design layer of the app. This allows the app to be more transparent and reliable when it comes to making decisions and managing risks.

With the help of RegTech, businesses can easily make their solution compliant with all the regulations, as this technology analyzes the functioning of the application and checks for fintech regulatory compliance.

Generally, RegTech is considered the solution to help businesses avoid unnecessary penalties. However, in 2026, RegTech is more of a tool for businesses to establish agility and earn trust in the market.

This offers advanced opportunities for people struggling with different issues related to maintaining their regulations properly.

►Trend 5: Decentralized Finance (DeFi)

Decentralized Finance has been the talk of the town for a while now. And in the upcoming years, it is going to be a great application of Fintech as it addresses a huge issue that traditional Fintech applications offer, i.e., unnecessary transaction fees.

DeFi solutions offer a more direct approach to finances as they plan to eliminate the complexities of traditional financial institutions. In the upcoming years, starting from 2026, more and more regulatory bodies are interested in creating transparency in the usage of DeFi.

For instance, it uses direct smart contracts on a programmable and permissionless blockchain to reduce intermediaries such as brokerage, exchanges, or any other institution.

It somewhat functions as peer-to-peer financial services on public blockchains, making it more and more accessible, transparent, and secure!

However, so far, there have been so many issues in implementing decentralized finance, such as a lack of conceptual understanding, issues in regulating DeFi, and other implementation errors.

All these trends are highly motivating for people planning to penetrate the market. The trends not only improve the services but also open new avenues for introducing solutions that do not exist today, such as the use of an alternative currency for everyday transactions.

The growth of Fintech is already enticing new businesses to enter the market, and with all these upcoming Fintech trends favoring growth, this year might just be the best one to step into the Fintech realm.

►Trend 6: Advancements in Security in Fintech

Cybersecurity has always been at the forefront of protecting the digital experiences of users, especially when it comes to managing financial transactions and user assets.

With the rise of technology, the rise of cybercrime has also seen a massive hike, and hence, security in Fintech is one of those trends that has made it more usable and secure.

Secure gateways, MFA (Multi-Factor Authentication), OTPs (One-Time Passwords), and other technology-driven security features actively enhance the safety of transactions.

One of the key issues in Fintech is that users have to share a lot of sensitive information, such as their personal information, account numbers, credit/debit card details, etc.

This creates significant security risks. If not shared securely, such data can cause serious problems for users.

However, modern technologies, such as biometric authentication and advanced cybersecurity measures, can effectively minimize these risks.

You can easily rely on the latest advancements in security and keep your users away from these issues.

► Trend 7: Rise of Hyper-Personalization in Neobanking

With the rise of digital banking and mobile banking applications, several financial institutions have taken the initiative of simply providing banking services online, without having any offline branches whatsoever.

These new-age banking solutions are called Neobanks. These only use smartphone apps and websites to offer their services.

Initially, Neobanks faced issues of reliability since people struggled to trust these services without physical branches.

However, with the benefits that these banks offer, they were able to overcome the resistance.

Features such as higher interest rates on savings accounts, lower transaction fees, real-time notifications, etc., made these applications highly usable for the user, creating a way for neobanking in Fintech.

This trend has made it easier for smaller companies and entrepreneurs to enter the financial market, as now there’s no need to invest in physical resources such as a dedicated bank branch, an ATM, and other aspects. Instead, all you need is a Fintech platform that is robust enough to handle the transactions.

While these trends make Fintech more and more robust, these are just the tip of the iceberg as there are so many more trends that will leave a massive impact on Fintech.

The past few years have been some of the most technologically advanced years for Fintech, and based on current financial trends, it is not stopping anytime soon.

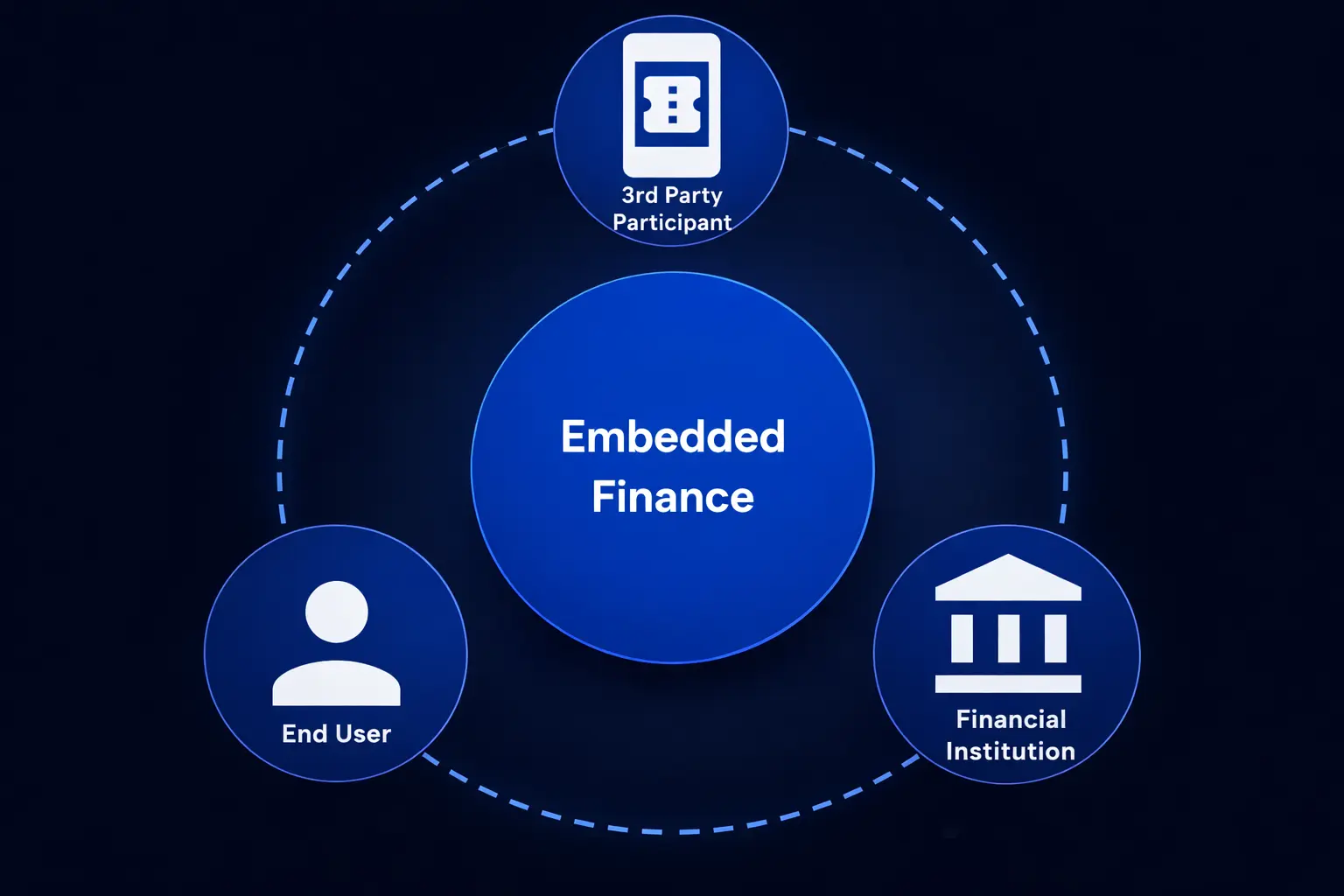

►Trend 8: Rise of Embedded Ecosystems in Fintech

Embedded finance is the smarter way to pay for things without having to go through traditional banking methods. It is like integrating, or as the term is often called, embedding financial features into a regular application.

In 2026, this goes a step further with embedded payment systems and services evolving into ecosystems that are not limited to dropping a payment API. With embedded fintech ecosystems, the scope of integrated services is endless.

BNPL solutions are the most common application of embedded finance that you can find appearing in your regular shopping apps.

A non-financial platform can leverage embedded financial ecosystem services to implement different solutions, including embedded lending, payroll, savings, insurance, etc., into solutions that are not traditionally financial platforms.

However, with the growth of these embedded ecosystems, the regulations and compliance will also become stricter. Hence, you need to ensure that you stay compliant and implement controls over the risk logic along with the flow of money and data generated by the users.

Embedded finance has definitely grown faster than any other trend in the market and is all set to touch new heights in the upcoming years.

►Trend 9: Use of Open Finance: The Next Step to Open Banking

Open banking allows a consumer to share their financial data with a third-party service provider.

While it offers a simplified account aggregation for users, Open Finance goes a step further and allows access to full-fledged systems that include different fintech services like mortgages, pensions, tax data, insurance, and more.

Well, these third-party applications are also Fintech solutions; however, they work more on personalization and simplification of a user’s experience.

For instance, financiers and lenders have started relying on Open Finance APIs to run credit checks and affordability scores for better decisions.

The market is already witnessing the use of open banking as several Fintech applications have appeared in the market that are not working with financial institutions but enable a user to use financial services, such as variable recurring payments.

Money management apps are another use case for open banking, as several applications can easily fetch your financial data to manage your funds.

►Trend 10: Rise of Sustainable Finance

Sustainable finance is going to be an added trend that will help drive sustainable development and changes in the way finances work.

More and more people are moving towards a sustainable way of living, and the same can be said for Fintech.

With every Fintech organization dedicated to working on sustainability, investors have started worrying about the impact of their investments on the environment.

This understanding of sustainability will help in the growth of more and more digital payment options.

Things like sustainable investments, Sustainability-Linked Loans, and investments in renewable energy. This gives Fintech a new direction as Fintech solutions that help a user contribute to a sustainable cause.

While this may seem like a trend not specifically useful for many businesses planning to make a Fintech transition.

This highlights the trajectory of Fintech applications and emphasizes the importance of planning for a sustainable Fintech solution that succeeds!

►Trend 11: Continued Growth of Buy Now, Pay Later (BNPL)

Buy Now Pay Later, as shared earlier, is continuously rising as one of the most common applications of Fintech.

With the rise in embedded financial services, BNPL services have become a great entity to invest in. In the upcoming years, it is going to be one of the core verticals that existing financial services will expand to.

It not only offers flexibility of use but also solves the complications of using existing payment options for online payments.

The market for Buy Now Pay Later was $16 billion in 2023 and is expected to reach $115 billion by 2032. The expected growth clearly states the growth potential of the market.

What makes BNPL a rising trend in Fintech is the increased use of online shopping and digital payments. BNPL is going to play a crucial role in making digital payments more and more convenient for the user, for easy transitioning.

Also Read: The Ultimate Guide to BNPL Integration for Businesses

►Trend 12: More Use of Central Bank Digital Currencies (CBDCs)

Another interesting Fintech trend is the use of CBDCs. These are digital currencies issued by a country’s central bank, making them legal for use nationwide.

This can be a game-changer for people who do not have direct access to financial services.

The use of these central bank digital currencies could open new opportunities for Fintech businesses.

Managing CBDCs allows users to interact better with these digital currencies, and many other use cases can give rise to new Fintech applications that will further boom.

One of the key features of Central Bank Digital Currencies is that they can help all walks of life.

Authorized Central Bank Digital Currencies can facilitate all types of transactions, from retail and wholesale to fiscal operations and cross-border payments.

Since these can offer more regulated digital payment options, it can be a great option to minimize money-related crimes.

►Trend 13: Implementation of Robotic Process Automation (RPA)

RPA is one of the trends that almost every Fintech institution is looking forward to. This is because, just like in traditional banking, several transactions are repetitive, and while there are resources available to perform these tasks, they are not always optimized or up to the mark. Hence, automating these processes with the help of a robotic process is the best option.

Robotic Process Automation can be used to facilitate faster processing, reduce errors, and increase the efficiency of repetitive tasks in Fintech.

A bank, insurance company, or any Fintech solution can use RPA to automatically address frequent queries of the users with the help of a chatbot.

RPA also finds its application in support and assistance for a Fintech application.

The implementation of robotic process automation has already started, as several Fintech applications have been using these chatbots to greet their customers online.

In the coming years, RPA can be trained for advanced operations as well. Processes such as identifying creditworthiness, collecting details for checking insurance premiums, and automating other basic steps of a Fintech service.

But how do you do that? Well, we might have just the solution you are looking for!

Nimble AppGenie: Your Partner in Fintech Innovation

It does not matter how trends support Fintech growth if you do not have a Fintech app development company by your side to implement these innovations in your solution.

At Nimble AppGenie, we have some of the finest experts in all the emerging technologies working to make your next Fintech solution.

With recognition from across the world, we have worked on hundreds of Fintech apps that are currently dominating the market in their respective domains.

If you, too, are looking for a Fintech solution that helps you make an impact in the market, then simply reach out to us, and we can help you out!

Not only do we offer development services, but we also help you maintain the quality of your Fintech services while assisting you in implementing newer technologies in existing solutions.

So what’s stopping you from making the move? Call us today and start your journey toward success!

Conclusion

Knowing about the trends can help you stay ahead of the competition. However, it is the implementation of these technologies that makes all the difference.

While these trends do seem to make your application future-ready, you need to understand what the requirements are for your particular business. Implementing these trends can help you in the long run, but it is also quite expensive.

Hope all these trends help you identify the potential in the market and how you can make the most of the technological advancements in Fintech.

FAQ’s

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.