Finance is the lifeblood of society. Without proper access to a financial system, no individual can survive, and that is why it is one of the most important things that needs to be spread.

The best way to maximize anything’s reach today is by involving technology in it. This thought has given birth to a unique concept that today allows us to leverage technology to access financial information and services from the convenience of our smartphones, Fintech.

Fintech has certainly transformed the way people access their bank accounts, make payments, and manage their finances over the past decade. However, while the term is used popularly, not everyone is aware of what fintech is.

In this post, let us explore everything about fintech, starting from the very basic but most crucial question: What is Fintech?

Understanding Financial Technology: An Overview

As discussed earlier, the combination of technology and financial services has given the concept of financial technology, popularly known as fintech.

However, that is just the origin of the concept. If we talk about the definition, fintech can be defined as –

A term that describes the applications, software, hardware, and technologies that allow users to access their financial information and assets digitally, from anywhere in the world.

People often confuse fintech with being only about digital payments and banking. Well, it’s not. It is a complete world of apps and technologies that help you set financial goals, identify investment opportunities, manage your finances, apply for a mortgage, do your taxes digitally, and much more.

Fintech today is a key component of the entire societal system that we live in. From individuals to enterprises, fintech is being used by everyone, and that is certainly the reason why several financial institutions have made the move to go digital with the implementation of fintech solutions.

Fintech Market Overview: Statistics

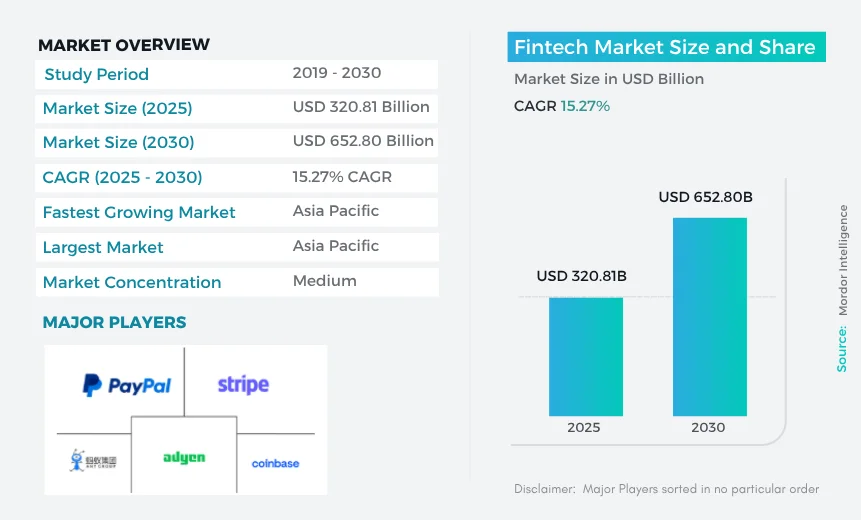

Fintech statistics show the sheer massive size of the market, and it is growing at an amazing rate. This is why businesses, startups, and investors from across the world want to enter the market.

Let’s see what it holds:

-

- As of 2025, the global fintech sector is valued at $320.80 billion, expected to reach $652.80 billion, boasting a 15.27% CAGR.

- The USA leads the list of countries with the highest number of Fintech unicorns, numbering 48, collectively holding a market share surpassing $187 billion, constituting over 1% of the worldwide financial industry.

- A study suggests potential disruption of up to $4.7 trillion in traditional financial services revenue by fintech. Notably, 60% of credit unions and 49% of U.S. banks recognize the importance of fintech partnerships.

- Digital payments have emerged as the dominant fintech product, claiming 25% of the market share. The Nasdaq lists 463 fintech-related stocks, reflecting the sector’s significance in the global market.

While these stats tell the complete story of how impactful fintech has been, it is crucial to understand how it is being implemented in society and what cases for which fintech is the perfect problem solver.

In the next section, let us take a look at how exactly fintech is used by individuals and businesses.

How is Fintech Used? Types of Fintech

There are different ways people today are applying fintech solutions in their daily lives.

If we talk about an individual, fintech has opened up a realm of possibilities, allowing a user to be more informed about their financial situation and plan ahead of time.

For instance, a user has access to budgeting apps that help in planning and managing their expenses. They can make payments digitally, helping them complete transactions from anywhere to anywhere. Not to mention, a user can also track their creditworthiness, helping them make the right decisions.

On the other hand, fintech enables an enterprise to have more control over the services it offers. Not only does fintech make it easier to deploy a service, but it also makes it easier to amplify, thanks to the digital reach that sees no borders.

For instance, an enterprise can experience the speedy deployment of services, streamline business processes, gain better reach for its customers, and fulfill market requirements faster. Financial services digital is a life-changing experience for businesses and enterprises as it allows them to be more open about expanding their boundaries and make a larger impact.

What makes all these uses possible is the different types of fintech that are available today. The diversity of solutions makes it possible for businesses and individuals to leverage the concept of financial technology. Check them out in the next section.

Types of Fintech Services that Make a Difference

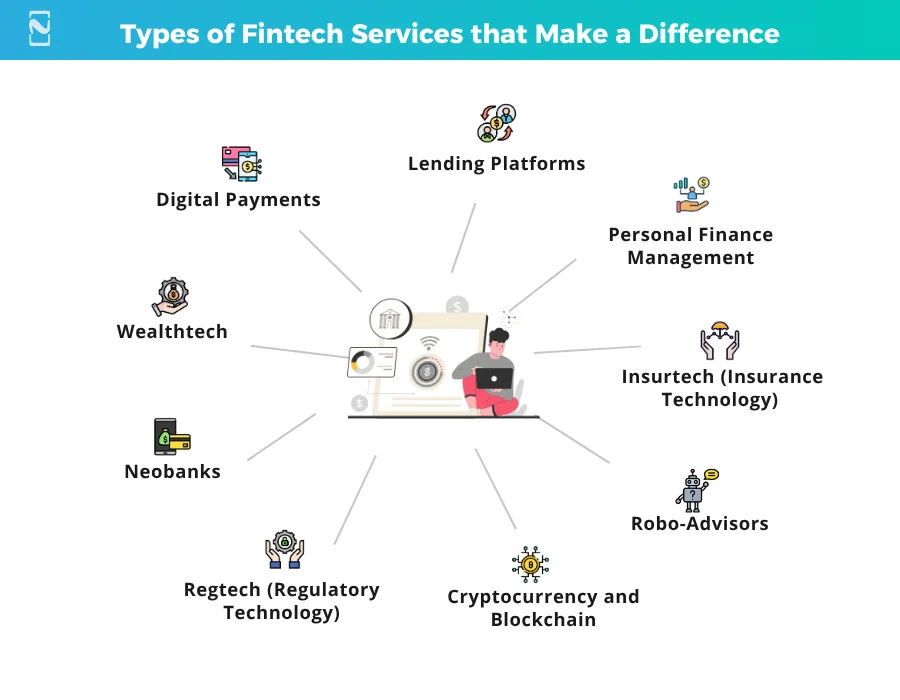

As you might have guessed, fintech is an umbrella term for everything related to financial services that use technology to simplify the overall process.

Since there are several different sectors in the market that have different types of financial requirements and services, fintechs have also branched out into different types.

These types are –

Type 1: Digital Payments

Digital payment services enable seamless transactions via mobile apps or online platforms.

They encompass mobile wallets, payment gateways, contactless payments, and virtual credit cards, facilitating instant money transfers and purchases.

Type 2: Lending Platforms

Lending platforms, including peer-to-peer (P2P) and online lending services, create P2P lending apps to connect borrowers directly with lenders, bypassing traditional financial intermediaries.

Type 3: Personal Finance Management

Personal finance management apps help users monitor and manage their finances by tracking expenses, budgeting, and offering financial insights.

Type 4: Insurtech (Insurance Technology)

Insurtech leverages technology to enhance and streamline the insurance industry, offering digital solutions for policy management, claims processing, and personalized insurance products.

Type 5: Robo-Advisors

Several businesses advise new startups to build a Robo-advisor platform as they use algorithms and artificial intelligence to provide automated investment advice and portfolio management at lower costs than traditional financial advisors.

Type 6: Cryptocurrency and Blockchain

Cryptocurrencies are digital or virtual currencies using cryptography for security, while blockchain is the underlying technology providing a decentralized ledger of all transactions.

Type 7: Regtech (Regulatory Technology)

Regtech uses technology to help financial institutions comply with regulatory requirements more efficiently and effectively, reducing the risk of non-compliance.

Type 8: Neobanks

Neobanks are digital-only banks without physical branches, offering a range of banking services through mobile apps and online platforms. Due to the capabilities of these digital banks, neobank app development has gained immense popularity in the past few years.

Type 9: Wealthtech

Wealthtech combines technology and wealth management to provide innovative investment and savings solutions, often through user-friendly apps and platforms.

These types are defined by the key service that a fintech company can offer to you, making it simpler for the user. As technology advances, more and more advanced fintech apps and services are surfacing on the market, allowing users to be more flexible and at ease.

How Technology is Integrated in Financial Services?

Looking at all the types of fintech, you may be wondering how exactly technology is integrated into financial services.

Well, there are different ways financial services can use available technology to gain a wider reach and build better solutions.

To do so, you need multiple catalysts that make it possible for a service provider to complete the loop.

These include –

-

Mobile Applications

In the fintech revolution that the world has observed, mobile apps have played a pivotal role. For every type of fintech available today is an app that can be easily installed and used by the user.

This means that the ability to check the bank account balance or make a payment online is all brought through an app, making it a key component in the expansion of mobile applications.

-

APIs

Application Programming Interfaces, popularly known as APIs, are the components that make it easier for fintechs to share data among each other to create a synchronous experience for the user.

The best example of this is your Open Banking API, which allows even non-financial institutions to access your data when you allow them to, in exchange for your service.

-

Websites & Solutions

Several fintech providers also offer similar functionality on their websites, allowing a user to use any device to log in and make the most of their fintech service. They can even offer additional features and keep upgrading their experience through web solutions.

Other than these, fintechs also offer hardware support, providing POS devices and other ways to collect payments for enterprises.

Blockchain development for startups is another way to help them enter the crypto market, which is a growing market of fintech. The idea is to make things technically sound and give the entire experience a structure that maintains its integrity.

The Technology Behind Fintech

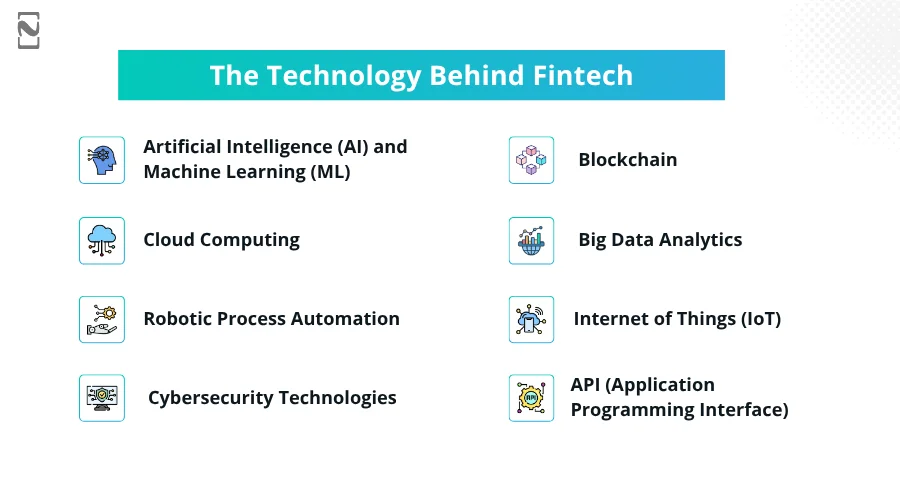

Knowing about the ways fintechs reach their users, you might have gotten a bit curious about the technologies that are being used by them. The fintech ecosystem is powered by a variety of advanced technologies that drive innovation and transform traditional financial services.

Often also known as Fintech Tech Stack.

Here are some of the key technologies behind fintech:

► Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML are at the forefront of fintech innovation. They are used to analyze vast amounts of data to provide personalized financial advice, detect fraudulent activities, and automate customer service through chatbots. AI in Fintech enhances decision-making and operational efficiency.

► Blockchain

Blockchain technology underpins many fintech solutions, particularly in the realm of cryptocurrencies and smart contracts. It provides a secure, transparent, and decentralized way to record transactions, reducing the need for intermediaries and increasing trust in financial systems.

► Cloud Computing

Cloud technology enables fintech companies to store and process data more efficiently and cost-effectively. It offers scalable solutions that can be quickly adapted to meet the changing needs of the market, facilitating faster development and deployment of new financial services.

► Big Data Analytics

Fintech companies leverage big data to gain insights into consumer behavior, market trends, and risk management. This data-driven approach helps in creating more targeted products and services, optimizing operations, and improving customer experiences.

► Robotic Process Automation (RPA)

RPA in Fintech is used to automate repetitive and mundane tasks. This includes processing transactions and updating records. This technology helps fintech companies streamline operations, reduce errors, and cut costs.

► Internet of Things (IoT)

IoT devices, like smartwatches and other wearables, are increasingly being integrated with fintech applications. These devices can provide real-time data and facilitate seamless transactions, enhancing user convenience and engagement.

► Cybersecurity Technologies

As fintech solutions handle sensitive financial information and electronic payment services, robust cybersecurity measures are crucial. Advanced encryption, biometric authentication, and multi-factor authentication are some of the technologies used to protect data and ensure secure transactions.

► API (Application Programming Interface)

APIs allow different software systems to communicate with each other, enabling fintech companies to integrate various services and provide a seamless user experience.

Fintech APIs are essential for open banking, where banks share their data with third-party providers to offer innovative financial products. These technologies are the backbone of the fintech ecosystem, driving innovation and enabling the creation of new, efficient, and user-friendly financial services.

By harnessing these advanced tools, fintech companies continue to push the boundaries of what’s possible in the financial industry. These technologies not only make the experience better but also expand the possibilities of what can be done and how quickly it can be done through fintech.

Benefits of Fintech: How Fintech is Improving People’s Lives?

The impact of fintech on businesses and common people is huge. From simplifying transactions to making a huge impact and banking the unbanked, fintech has made a user’s life significantly easier.

There are several benefits of fintech. Check them out below –

-

Enhanced Accessibility

Fintech platforms make financial services accessible to a broader audience, including the unbanked and underbanked populations. Mobile banking apps, digital wallet apps, and online lending platforms provide financial services to those who previously had limited or no access to traditional banking.

-

Convenience and Speed

Fintech solutions offer unparalleled convenience, allowing users to perform financial transactions anytime, anywhere. Services such as instant money transfers, mobile payments, and online loan applications save time and effort.

-

Cost Savings

By automating processes and reducing the need for physical infrastructure, fintech companies can offer lower fees and better interest rates compared to traditional banks. This translates to cost savings for consumers.

-

Financial Inclusion

Fintech promotes financial inclusion by offering microloans, digital payments, and insurance to underserved communities. This helps individuals and small businesses gain access to credit, insurance, and other essential financial services.

-

Improved Financial Management

Personal finance management apps help users track their spending, create budgets, and set financial goals. Several startups even create expense tracking apps as these tools provide valuable insights and tips, empowering users to make informed financial decisions.

-

Enhanced Security

Fintech companies use advanced technologies like encryption, biometric authentication, and AI to enhance the security of financial transactions. This reduces the risk of fraud and unauthorized access.

-

Customized Financial Products

Fintech enables the creation of personalized financial products tailored to individual needs and preferences. Algorithms and AI analyze user data to offer customized investment portfolios, insurance policies, and loan options.

-

Increased Transparency

Fintech regulations used on these platforms provide greater transparency in financial transactions and services. Users can easily track their transactions, understand fees, and receive real-time updates on their financial activities.

Other than these, the fact that the control is equally distributed between the service provider and the user makes it more and more simpler for a user to manage their finances.

How to Capitalize on the Lucrative Market of Fintech? We Can Help!

After going through all the things discussed above, you might have understood that fintech is a growing field that you can invest in. And you are right! Fintech offers a great opportunity for businesses and startups to enter the market.

With high growth potential and the evolution of traditional financial services puts you are in the best place to garner more and more users. The field even offers high scalability and gives you enough regulatory support to get started without any issues.

However, the issues that you might face is finding the right team of experts to build a fintech solution for you. If you are planning to enter the lucrative market of fintech, then Nimble AppGenie can be a great partner to align your interests. Not only do we help in building a technically sound solution, but our experienced developers also guide you in making better decisions.

Connect today to get started with a fintech app development solution of your own!

Conclusion

Fintech has revolutionized the financial industry by leveraging technology to create more accessible, efficient, and user-friendly financial services. From digital payments and lending platforms to robo-advisors and blockchain technology in fintech, the sector is reshaping how we manage our finances.

We hope this post answers the burning question: What is Fintech? And makes it clear that it is the future. It offers vast opportunities for innovation and growth, making it a promising sector for investment and development. With that said, we have reached the end of this post.

Hope you find it helpful in understanding what fintech is and how you can make the most of it. Thanks for reading, good luck!

FAQs

Fintech companies originate from the financial sector and integrate technology to enhance financial services. In contrast, techfin companies start as technology firms and later enter the financial sector, leveraging their technological infrastructure and user base to offer financial products.

Both played crucial roles in transforming the financial industry, but had different starting points.

Robo-advisors are automated platforms that provide investment management and financial advice using algorithms and AI. They create personalized investment portfolios based on user goals, risk tolerance, and financial situation. Robo-advisors offer low-cost, efficient, and accessible investment solutions, democratizing wealth management for a broader audience.

Fintech companies ensure security through advanced technologies such as encryption, biometric authentication, and multi-factor authentication. They have implemented robust cybersecurity measures to protect sensitive financial data and prevent fraud. Regular security audits, compliance with regulatory standards, and user education further enhance the security of fintech platforms.

Regulators play a crucial role in the fintech ecosystem by creating frameworks and guidelines that promote innovation while ensuring consumer protection and financial stability. They oversee compliance with financial regulations, address potential risks, and support the development of new technologies. Regulatory sandboxes and collaborations with fintech firms help balance innovation and regulation.

Yes, traditional financial institutions can benefit from fintech by partnering with fintech companies, adopting advanced technologies, and innovating their services. Collaboration can lead to hybrid financial products that combine traditional banking strengths with fintech innovations. This enhances the customer experience, operational efficiency, and competitive advantage in the evolving financial landscape.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.