Paying for everything has certainly become convenient thanks to the introduction of different payment methods such as digital payments, e-wallets, credit cards, debit cards, and more.

This convenience has also made businesses evolve and start accepting these modes of payment.

Merchant service providers are responsible for curating the entire payment process.

These high-value services ensure that you, as a business, are ready to accept payments from every source.

What are Merchant Services? What are Merchant Service Providers? How do they work? More importantly, should you invest in becoming a Merchant Service Provider?

Well, these are some questions that we are going to answer by the end of this blog. If you are intrigued about Merchant Service Providers, then your search ends here! Without further ado, let’s begin by understanding what these services are about.

Merchant Service Providers: An Overview

As the name suggests, these service providers cater to businesses and merchants who are active in the fintech market and looking for secure payment solutions.

These services enable businesses and merchants to accept payments using different payment methods.

Since businesses are no longer limited to offline transactions, they need a complete infrastructure to manage, accept, and initiate transactions.

Merchant Service Providers are the key players that provide the infrastructure required.

These serve as an intermediary between the merchant and different payment authorities, including banks, card networks, and payment processors.

The idea is quite simple: an MSP helps a business streamline its payment acceptance and settlement abilities by handling all the processes for it.

Merchant Service Provider offers a series of payment-enabling services for businesses that include-

- Digital Payments

- Transaction Tracking Integration

- Point-of-Sale Services

- CRM

- Outstanding Invoice Tracking

By helping businesses maintain a completely sorted process of accepting and processing payments, Merchant Service Providers bring a high value to the table.

However, if you do not know how these services function, you might miss out on something crucial.

How Do Merchant Services Work? Complete Flow Explained!

The main role of a Merchant Service Provider, as you might have understood by now, is to ensure that every transaction carried out at a business is processed quickly and securely.

While it seems easy on paper, it is a highly complex process as it involves several different parties and requires proper synchronization between them all.

To give you some perspective, here is a list of all the involved participants in the MSP ecosystem –

- Customer

- Merchant Service Provider

- Acquiring Bank

- Card Network

- Issuing Bank

- Merchant

With all these entities involved, a complete chain of events is triggered when a payment is initiated by the customer.

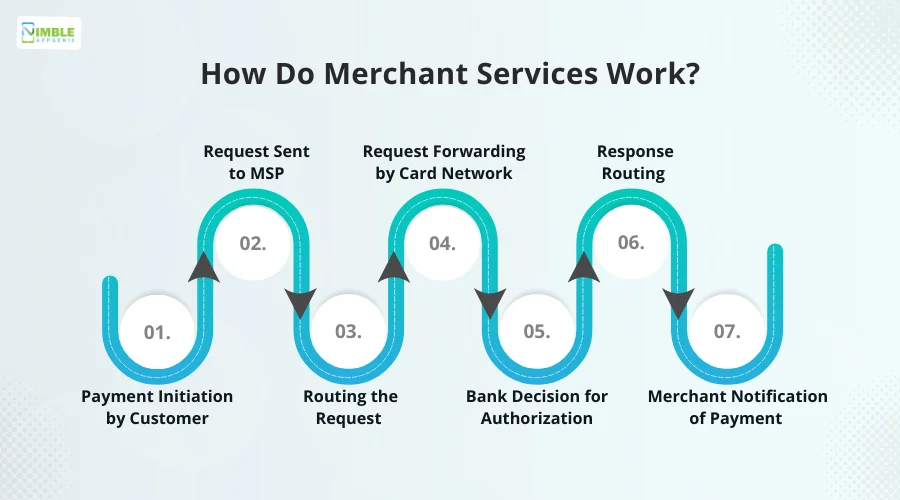

Here is how it all goes –

Step 1 – Payment Initiation by Customer

The Customer chooses a payment method and initiates a payment using their payment details. They can either tap their cards on a POS for physical purchases or enter their card details in the case of an online transaction.

Step 2 – Request Sent to MSP

The Merchant Service Provider involved in the transaction is notified of the payment initiated by the customer. This request is amplified by the MSP and sent to the acquiring bank or the payment processor that is being used.

Step 3 – Routing the Request

Once the MSP has received the request, it reroutes it to the respective card network to which the card corresponds. Different card networks, such as AMEX, MasterCard, Visa, etc., are used to process the payment.

Step 4 – Request Forwarding by Card Network

After the card network is pinged for a payment request, it forwards the same to the bank that has issued the card, also known as the issuer bank, to the customer. This way, the authorisation process is initiated.

Step 5 – Bank Decision for Authorization

When the bank receives the request from the card network, it instantly starts the process and checks if the customer’s account has enough funds for the transaction to go through. Based on the same, the transaction is declined or approved.

Step 6 – Response Routing

The response from the bank is then routed to the acquiring bank, which is directly connected to the MSP. The routing process is done instantly so that the MSP is in the loop for the entire transaction cycle.

Step 7 – Merchant Notification of Payment

The MSP notifies the merchant that the payment has been approved or declined. The merchant receives a confirmation message or an approval code from the bank.

The money is debited from the customer’s account and directly deposited into the merchant’s account. This process happens in real-time; however, in some setups, the banks might take 1-2 business days to settle the payments.

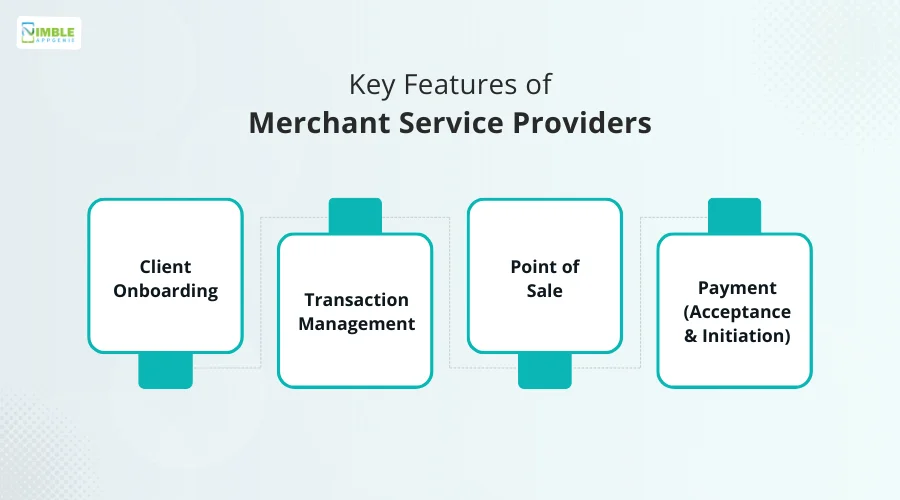

Key Features of Merchant Service Providers

The role of Merchant Service Providers lies in bridging the gaps between involved parties, from banks to card networks to banks.

To better understand the way it facilitates a transaction for merchants and businesses, let us take a look at MSP’s features that make the difference!

1. Client Onboarding

Merchant Service Providers offer a dedicated option to get your clients onboard, allowing them to use their closed-loop payment system & open-loop payment system options easily.

2. Transaction Management

As you might have understood by looking at the workflow and ecosystem, the MSP is a key player in managing the transactions that take place between merchants and customers.

3. Point of Sale

When planning to integrate a payment gateway online, you can simply ask a Merchant Service Provider to offer you a highly efficient solution that can guide you through.

4. Payment (Acceptance & Initiation)

An MSP plays a crucial role in both the initiation and acceptance of payments and refunds, as it enables a business to take care of all the transactions.

With these features and endless capabilities when it comes to processing and facilitating merchant payments, MSPs are cementing a crucial part of the entire payments landscape for businesses.

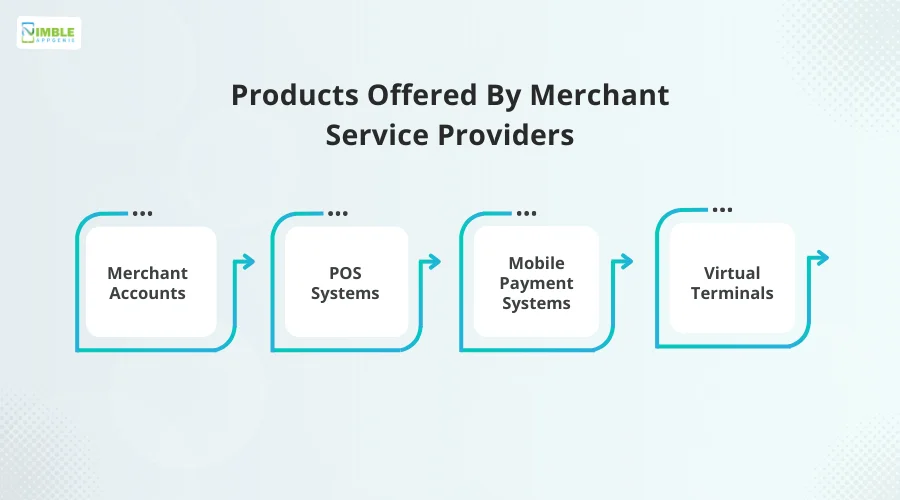

Products Offered By Merchant Service Providers

All the features that you have read about can be explored through different services and products that Merchant Service Providers offer.

These products are game-changers in terms of convenient transactions for both businesses and customers.

► Merchant Accounts

These are different from your regular accounts and have higher transaction limits and are more business-friendly.

► POS Systems

These are used in offline stores where people can simply use their cards and smartphones for a contactless payment system.

► Mobile Payment Systems

With the growing use of mobile payment apps like Google Pay, Apple Pay & Samsung Pay, you need a system that allows you to accept payments from the same, and MSPs do just the same.

► Virtual Terminals

These online portals enable merchants and customers to enter their card details and charge for services without needing a physical card reader.

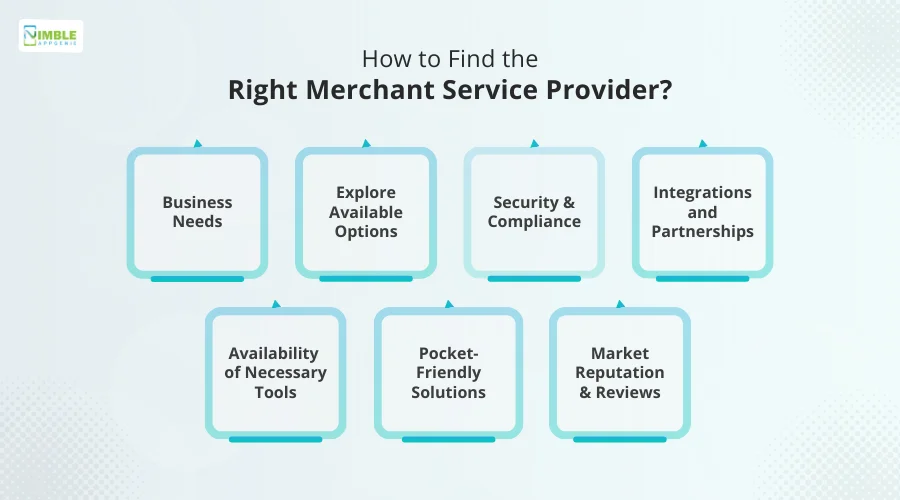

How to Find the Right Merchant Service Provider?

Now that you are aware of everything that the Merchant Service Provider offers to you, you need to identify what exactly a user is looking for.

You see, unlike other services, Merchant Services are highly scrutinized as they deal with financial transactions and are the core of any business.

This also means that businesses and merchants who are looking to find the right merchant services have several concerns.

Understandably so, if you are looking for a service provider, you must know the right questions to ask and the correct factors to account for.

Similarly, if you plan to become a Merchant Service Provider yourself, you should have insights into what people look for.

Here are the factors that one should consider to find the right Merchant Service Provider –

-

Business Needs

One of the key factors is understanding the exact requirements related to payment processing and the security of the transactions.

Every business caters to a different market, different audience, and different sections of society.

Hence, you need to identify the needs of your business and ensure that the service you choose can offer the exact services your business needs.

-

Explore Available Options

With the rise in online payments and multiple payment methods, there has been a significant increase in the availability of Merchant Service Providers.

Since it is a lucrative business, the competition in the market is massive.

However, this allows you to choose better. Evaluate all the available options in terms of their pricing, efficiency of service, offering, and market reputation.

-

Security & Compliance

When depending on someone for your financial matters, ensure that the service you choose meets industry standards.

Digital payment compliance measures that Merchant Service Providers take should be on your priority list.

Before hiring an MSP, you should identify if it is compliant with financial regulations, like PCI DSS compliance and others.

-

Integrations & Partnerships

It is crucial to understand that it is not easy to integrate MSPs into your service unless you have a strong development team and flexible services.

You need to ensure that it is easy to integrate the merchant services into the business tools that you are using.

-

Availability of Necessary Tools

Before adopting the MSP for your business, you should consider checking the availability of the necessary tools, such as reporting, analytics, customer support, feedback options, etc.

These tools make a customer’s payment experience super smooth.

-

Pocket-Friendly Solutions

While you cannot put a price on convenience, you have to be vigilant in selecting the right Merchant Service Providers that fit your budget.

Finding the right MSP that offers you the lowest transaction cost, minimum monthly fees, and no hidden charges can be difficult, but you should always stay ahead in your research and pocket-friendly solutions.

-

Market Reputation & Reviews

Last but not least, you should look for reviews and referrals for the Merchant Service Provider that you are planning to hire.

You should look for the digital payment market reputation and how much. If you have someone you know who is working in a similar industry and is using an MSP.

There’s no harm in asking them for referrals for MSPs.

How Can Nimble AppGenie Help You with Merchant Services?

Now that you have insights on how people choose a Merchant Service Provider, you can easily make your decision.

These factors are crucial for people, which speaks volumes about what you should do as a business and what you should do if you plan to become a Merchant Service Provider.

Nimble AppGenie is a prominent name in fintech solutions. We specialize in e-wallet app development services and create payment solutions that allow you to build a payment acceptance platform or dedicated e-wallets. Our offerings help your business stay ahead of the latest payment trends.

Not to mention, Nimble AppGenie can also help you develop a dedicated payment system that allows you to become a Merchant Service Provider.

The modern-day payments market is oozing with potential and offers lucrative opportunities to grow and earn.

Reach out to our experts today to discuss your ideas and make the first move!

Conclusion

Merchant Service Providers are key players in the overall business economy. Every business that accepts payments from multiple methods uses merchant services for managing and enabling seamless transactions.

It can be difficult to choose the right option if you do not know anything about how these services work.

Merchant services work as an intermediary between customers and businesses, helping digital payments go through instantly. Hopefully, this blog gives you all the possible insights on MSPs and how they work.

If you need any assistance in building your payment gateway or integrating methods for your business, connect with us now! Thanks for reading, good luck.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.