Making payments has become super easy thanks to the latest advancements in technology. While there was a time when people had to carry physical cash and change to pay for things, today it is possible to pay someone with just a tap of your smartphone.

This has been made possible by implementing various payment methods and systems. One such system is closed-loop payments.

Closed-loop payment systems today are a part of several industries, especially when we talk about daily expenses at coffee shops, retail stores, hotels, etc.

The ease of payment and security it provides to businesses is unmatched. By implementing a closed-loop payment system, any business can simplify the way they collect payments and interact with their customers better.

So how do you implement a closed-loop payment system? What are its benefits? What is the technology that makes it simple and secure at the same time?

Well, all your questions will be answered by the end of this post as this one is all about closed-loop payment systems!

So without further ado, let’s start by defining what exactly is a closed-loop payment system.

What is a Closed-Loop Payment System?

A closed-loop payment system refers to a financial arrangement that works in a particular ecosystem, allowing the customer to pay for a certain service directly.

Unlike open-loop payment systems that work across multiple entities, closed-loop systems offer higher efficiency by allowing a user to use a dedicated pool of funds only in their confined ecosystem of services.

The best example of a closed-loop payment system can be found at game zones where people add funds to their game zone cards and pay for different games directly from them.

All the funds present in the cards can only be used in the game zone, creating a seamless experience for cardholders.

Another cool example of a fully functional closed-loop payment system can be seen at Starbucks. The availability of a dedicated digital wallet where consumers can add funds and directly use those funds at any Starbucks creates an optimized payment experience for all users.

You may be wondering how it is a good payment arrangement if it is limited to a single ecosystem. Well, it creates an opportunity for businesses to develop a loyal customer base.

The entire system matches the robustness of a financial framework. It offers comparable features like instant payment transfer, a personal account to deposit funds, etc. that are quite comparable to mobile banking app features.

Not to mention, customers get instant cashback, loyalty points, and other offers for using a closed-loop payment system dedicated to a service provider, making it a win-win for both users and the company.

Global Trends in Closed-Loop Payment Systems

You may be wondering if there are challenges, why does someone get a custom closed-loop payment system built for their business? Well, that is because the usability that it brings along narrates a completely different story.

If you take a look at the global trends in closed-loop payment systems, you will be shocked to know how beneficial the system has been for many growing businesses.

- Gift cards remained the most popular when it comes to user’s wishlists for gifting in the 2024 holiday season, with 53% of shoppers requesting them.

- The Starbucks Rewards royalty program reached a record 34.3 million active users in the first quarter of 2024.

- More than 100 million people in the US are engaged with some sort of closed-loop payment system, Zelle P2P being at the center of it.

All the above stats clearly state that if a closed-loop payment system is implemented properly with the correct approach, it can help you not only generate revenue but can give you a loyal customer base.

At the end of the day, it all comes back to how you implement and what type of closed-loop payment solution you develop to help your business.

How Closed-Loop Payment Systems Work?

To understand how a closed-loop payment system works, you must first understand what it is made of.

There are several components that when combined form a payment arrangement that can be used to implement a closed-loop payment system.

A closed-loop payment system is made up of the following components –

- User-Facing Application: A digital platform that offers users the ability to add funds, check offers, and balances, and pay for the services they opt for.

- Point of Sale Platform: The point of sale is a payment terminal for retailers/business owners to accept payments easily and process them.

- Backend System: The system also requires a backend system that can be used to check all the transactions and keep track of incoming and outgoing payments.

- Payment Methods: For any closed-loop payment system, it is necessary to have at least one or two payment methods. In some cases, it is a digital wallet and in some, it is a physical card.

- Financial Infrastructure: Last but certainly not least, every closed-loop payment system requires a financial institution or a payment processor to enable the transactions. This infrastructure is what facilitates the transfer of funds.

Now, knowing the components involved in the system, you might have an idea about what closed-loop payments are all about.

Now, let’s take a look at all the steps involved in the entire process.

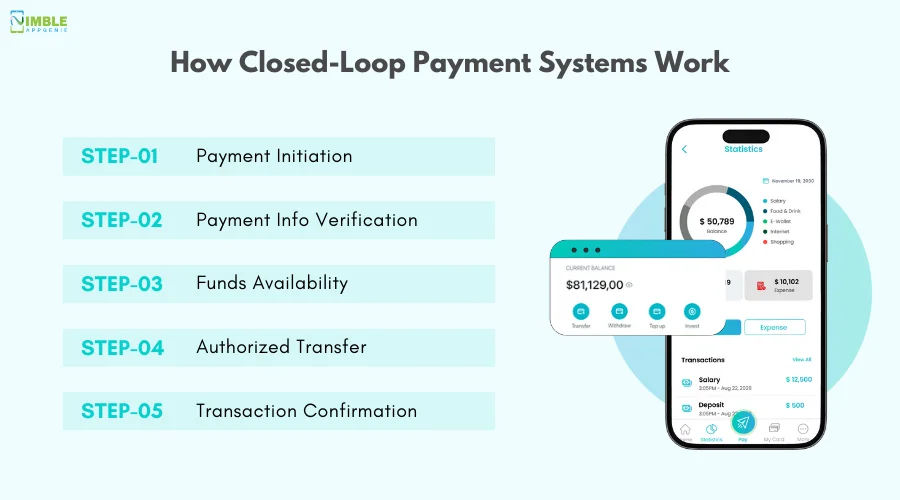

Step 1: Payment Initiation

In this step, the customer initiates a payment transaction through a secure transaction processing system to pay for the service using the payment method of their choice. They can use their e-wallet or physical card.

Step 2: Payment Info Verification

Once the customer initiates the payment process, the request is shared via the payment terminal used at the Point of Sale. This terminal checks the payment information of the customer. This information includes the name of the customer, account number, verification code, etc.

Step 3: Funds Availability

If all the information is verified, the backend system proceeds to check the balance of the customer to verify that the requested funds are available to finish the transaction.

Step 4: Authorized Transfer

Once both the payment information and fund status are verified, the transaction is authorized and the transfer is completed.

Step 5: Transaction Confirmation

A receipt of the transaction is generated and shared with the customer to let them know that their payment has been completed.

All these steps happen in a matter of seconds, making the entire transaction feel seamless.

The best part about these transactions is that in a closed-loop payment system, all of these are highly secure and since the ecosystem for it is limited, it is free of any sort of fraudulent activity.

Examples of Closed-Loop Payment Systems

As mentioned earlier, any transaction in which the payer and the payee are both a part of the same ecosystem can be considered an example of a closed-loop payment system.

There are many closed-loop payment systems that we come across almost every day.

Some of those include-

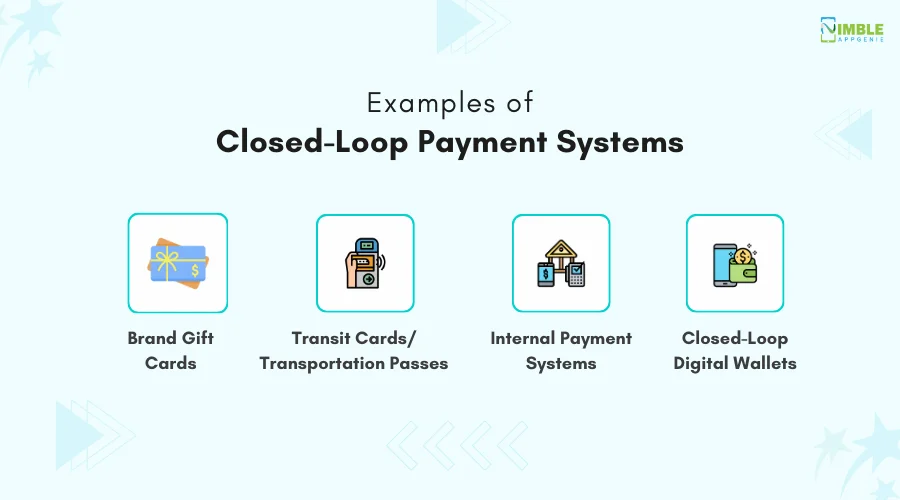

♦ Brand Gift Cards

If you are a brand that offers different types of products or services, you can create a gift card of your own that people can buy and use later as a payment option for your services.

The gift card works only for your products/services, making it a completely closed-loop payment system.

♦ Transit Cards/Transportation Passes

You might have seen several cities have implemented transit cards for their public transportation system. Well, those fall under the category of closed-loop transactions as the funds added to the transit cards can only be used at public transit and not anywhere else.

♦ Internal Payment Systems

In many coffee outlets, clubs, and game zones, you can find their ways of payment. This means you have to get a custom payment method (either a membership card or a registration) which is further funded to make payments.

The best example is a game zone card which can be used to spend on different games inside the play area only.

♦ Closed-Loop Digital Wallets

These are a type of e-wallets that can be used to make payments only internally. For instance, Starbucks’ reward wallet is a dedicated example of a closed-loop digital wallet, which only works at a Starbucks outlet and nowhere else!

All of these are examples of implemented closed-loop payment systems. Other than these, you can also find these systems in hospitality, cinema & entertainment, as well as healthcare sectors.

Benefits of Closed-Loop Payment Systems

The benefits of closed-loop payment systems are not hidden at all! Increased efficiency, security, and ease of use are just the tip of the iceberg.

Several benefits make closed-loop payment systems the go-to arrangement for payments when it comes to businesses and retailers.

These benefits include-

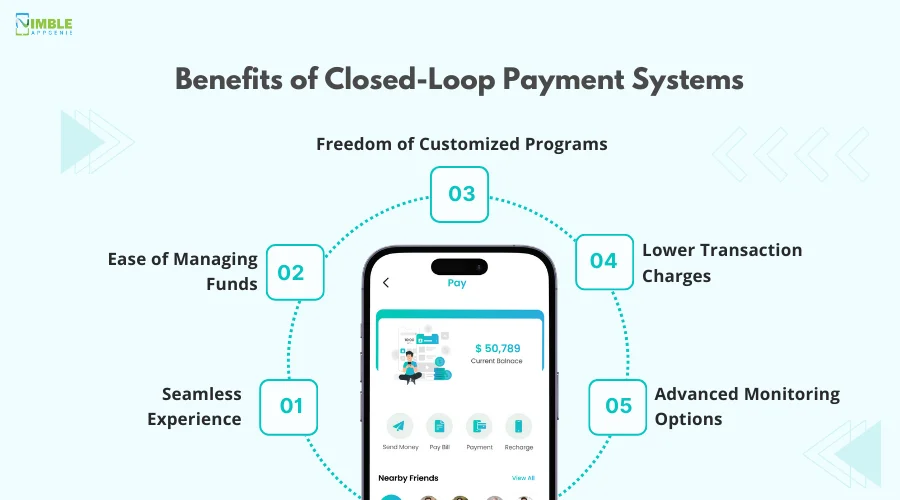

1] Seamless Experience

With a closed-loop payment system, the experience of a user becomes super-smooth as it only takes a tap to finish the transaction.

The card/e-wallet dedicated to the business is instantly recognized by the payment infrastructure available there.

2] Ease of Managing Funds

Managing your expenses and funds becomes easier when you are using a closed-loop payment system. This is because the particular mode of payment is only being used for a particular transaction. Hence, tracking those transactions and managing the funds is super simple.

3] Freedom of Customized Programs

For businesses, closed-loop payments offer a lot of freedom to introduce new reward points, cashback programs, and whatnot. Benefits like loyalty points, instant discounts, etc. are easy to implement when the payment mode is internal or closed-loop.

4] Lower Transaction Charges

For every card transaction that a user makes, businesses have to bear a charge. However, with your self-implemented payment system, you can reduce those charges to a huge extent.

A properly executed closed-loop transaction not only makes the process seamless but also makes it profitable by reducing transaction charges.

5] Advanced Monitoring Options

Tracking and monitoring the transactions also gets easier when it comes to a closed-loop payment system. That is because, unlike other payment options that accept payments from different avenues, a closed-loop payment is focused on a certain type of transaction.

Monitoring those payments is easier. Also, the entire system is set up by the business only, hence they have access to all insights on how much a consumer spends, what are the patterns of transactions, etc.

The benefits can be explored further by implementing a closed-loop payment system for your business. Implementing a closed-loop payment system can help you develop better customer relationships. Hence, it is a great investment from your business point of view.

Technology Behind Closed-Loop Payment Systems

With all the benefits listed above, it is valid to be curious about the technologies that power a closed-loop payment system. The seamless integration of APIs and robust software makes it a complete package for the user.

Let’s look at some of the advanced technologies behind closed-loop payment systems.

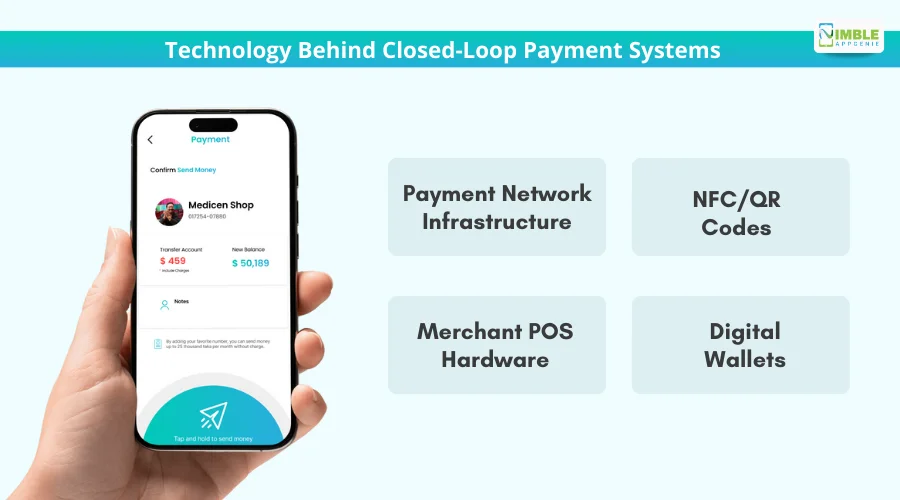

► Payment Network Infrastructure

For any transaction to go through, you need a proper payment network. These are internally developed shared network protocols that enable the transaction. The entire infrastructure includes a securely set up server, encryption protocols, authentication mechanisms, etc.

► NFC/QR Codes

To make these transactions through contactless payment, Near Field Communication(NFC) payments and Quick Response(QR) Codes are implemented. These allow a user to simply tap their cards or smartphones or scan a code using their phones to make payments instantly. NFC still requires you to tap the payment terminal, however, an e-wallet QR code payment can work even from a distance!

► Merchant POS Hardware

The point-of-sale terminal is a combination of a custom-built gateway along with a hardware solution to collect payments. It serves as the physical interface to the entire system.

► Digital Wallets

These offer another way of making payments for the customers. Digital wallets are properly built by developers and have a lot of technology involved.

For instance, it needs a proper database to store information, a dedicated code should be written to make it work, etc.

The contribution of technology is unparalleled when it comes to making things easier. Closed-loop payment systems are another example of how technology simplifies things.

All the above technologies when combined form a unique financial framework that helps a business get a bit closer to its customers while boosting their sales and revenue.

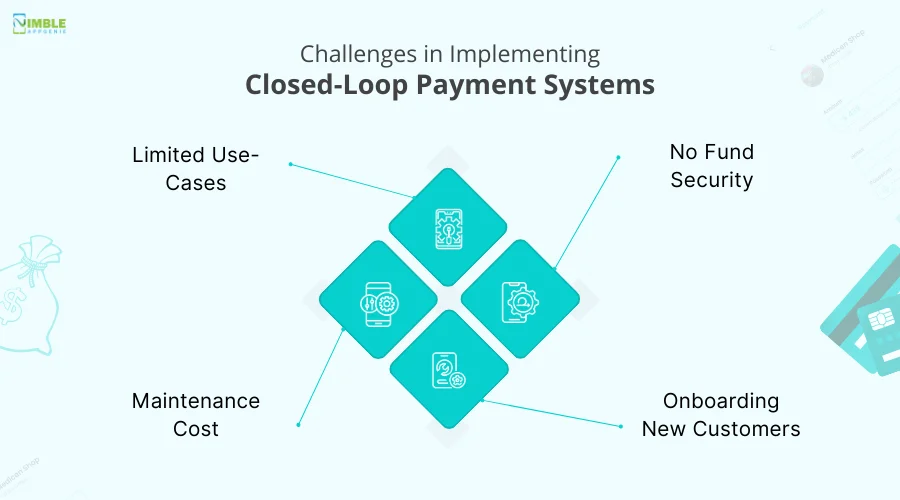

Challenges in Implementing Closed-Loop Payment Systems

While the concept seems like a great fit for every business/brand, there are still only a few of them that use a closed-loop payment system.

And that is because of the implementation challenges that come along with those benefits. To implement a closed-loop payment system, there are several things that you need to consider.

Let’s take a look at some of the challenges that you might encounter in implementing a closed-loop payment system:

#1. Limited Use-Cases

For any closed system, the biggest challenge is to make it a priority for the user. That is because the use cases of these payment systems are very limited. The payment option is limited to only a certain network, hence it often becomes difficult for a user to rely on.

#2. No Fund Security

One of the key challenges that closed-loop payment system users face is the risk of obsolescence. That is because, unlike an open-loop payment system that allows you to use the mode of payment at different outlets, closed-loop payments only work for a specific business.

If you have added funds and the business decides to shut the system down, all your funds become useless.

#3. Maintenance Cost

As far as businesses are concerned, the cost of implementing a closed-loop payment system often comes across as an additional cost.

Not to mention. When you set up an entire payment method, you have to ensure that the servers work properly, the system is intact, and functioning smoothly. It is often difficult to afford as the cost to build an eWallet alone is significantly high..

#4. Onboarding New Customers

In today’s day and age where instant payment systems have already simplified the entire process, it can become difficult for businesses to onboard new users to use the closed-loop payment system. Converting a client into a loyalty member needs several perks to be offered, which is a tough nut to crack.

Other than these challenges, the fact that a closed-loop payment system requires a team to be managed is something that stops several businesses from implementing the same.

Not to forget meeting the digital payment regulations for a closed-loop payment system can be difficult.

However, these challenges can be mitigated if you have a team of professionals who can develop a closed-loop payment system for your business at a minimal cost.

How Nimble AppGenie Can Help Develop Closed-Loop Payment Solutions?

With all the benefits and challenges mentioned above, you might have clarity on whether a closed-loop payment system is helpful for your business or not. If you plan to develop a closed-loop solution, you can start by developing an e-wallet corresponding to your business.

At Nimble AppGenie, we have expertise in e-wallet app development services that not only help you simplify the transaction process but also add value to your business.

Our experienced developers can understand the use case for your business to help you get a customized solution that serves your purpose without costing you extra for unnecessary features that you may not use. Reach out today to book your consultation!

Conclusion

Closed-loop payments offer a unique set of benefits for businesses. These payment systems allow merchants to collect payments from their customers in a closed environment, which means that the entire ecosystem is set up exclusively for the business.

This allows a business to create new discounts, loyalty programs and offers to entice new customers.

With all the benefits and challenges right in front of you, we hope you make the correct decision while choosing a payment system for your business. As far as getting the best closed-loop payment solution is concerned, Nimble AppGenie has always got your back!

Thank you for reading, good luck!

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.