Every individual today is familiar with the convenience that Apple Pay, PayPal, CashApp, etc. offer.

While every payment is being rapidly replaced with mobile payments, only a few are aware of the technology behind them.

Over the years, mobile payments have become an integral part of daily life. Which makes it all the more important to understand how things work.

Let’s not forget the number of businesses that this idea powers and the abundant opportunities that the field has unlocked for new businesses and entrepreneurs.

Mobile payments in itself is a complete industry that is worth trillions of dollars. Developing a mobile payment solution of your own is a lucrative business that one can start today.

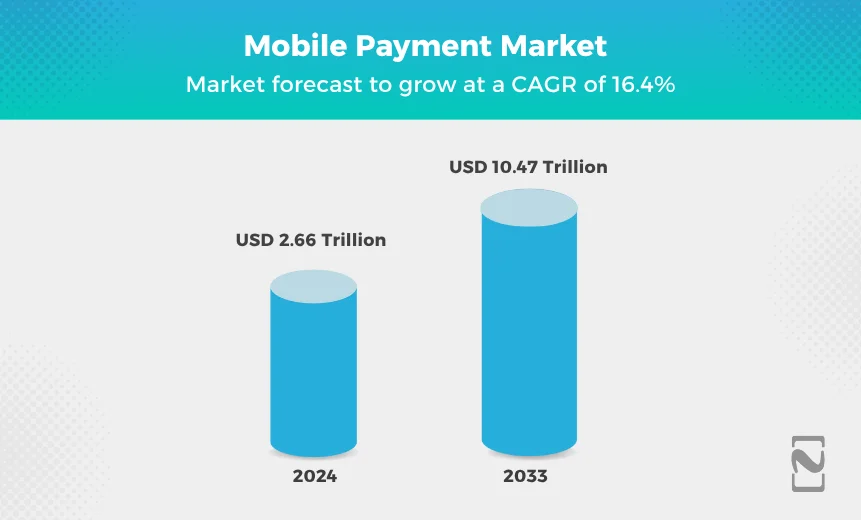

Going by the stats, the mobile payments industry was estimated to be worth $2.66 trillion in 2024, expected to touch a whopping $10.47 trillion by 2033, making it one of the most impactful industries in the world economy.

If you are planning to enter this market, you should be familiar with mobile payment technology and identify what it is all about, how it works, and who can make it work for you. If that is your objective, you have reached just the right post.

Without further ado, let’s get started by defining what mobile payment technology is.

Introduction to Mobile Payment Technology

Technologies that simplify making payments via a mobile device, be it a smartphone or a tablet, fall under the umbrella of mobile payment technology.

Technology is a key player in facilitating online money transfers from one account to another (generally from a user’s to a merchant’s).

The transaction is initiated via a smartphone, making it more and more convenient and accessible for the user.

Mobile payments are highly dependent on the technical infrastructure established to facilitate the transfers. Individual components of this architecture, from fintech mobile apps, browsers, to payment gateways, assist in completing these transactions.

Mobile payments technology works in multiple ways. You can use mobile payments both in physical stores and for online purchases remotely.

Technology makes it possible for a user to make proximity payments and distant transactions easily through a single interface. To understand the fintech technology behind it, check out the next section!

Understanding the Technologies Used in Mobile Payments

The idea of sending money to someone else’s bank account through a remote device still feels unreal. However, what’s more fascinating is the technology that makes it possible.

There are several mobile payment technologies that come together to complete a single transaction.

These technologies include –

- Near Field Communication NFC

- Payment Gateways

- QR Code/Readers

- Cloud-Based Payments

- Beacon Technology/ Bluetooth

The technology is growing faster and is becoming more and more mainstream. All of these technologies are combined and brought together through the interface of a mobile application.

One can reach out to any type of mobile payment app development company to integrate the necessary technologies and build a robust application.

The whole idea behind executing these technologies is to leverage them for faster and safer transactions.

How do these services work, you ask? Check out the next section to find out!

How Do Mobile Payment Technologies Facilitate a Transaction?

Knowing what technologies power mobile payments, you may be wondering how exactly these payments work.

Well, there are a series of steps involved in finishing a mobile payment transaction.

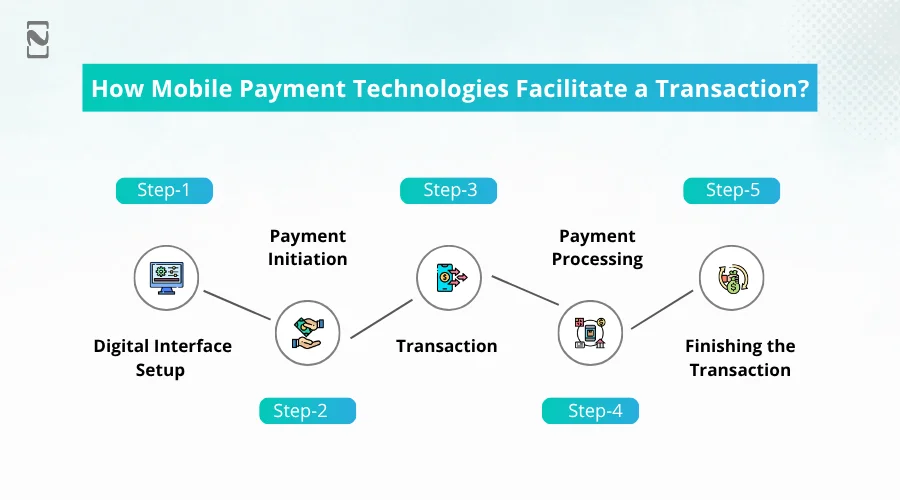

Here are the steps that we are talking about –

Step 1: Digital Interface Setup

A wallet or payment app is the digital tool you use to manage transactions, easily accessible on your smartphone anytime and anywhere.

Step 2: Payment Initiation

Through a digital interface, usually an e-wallet app, the user chooses the merchant/individual they want to pay and selects a payment method that can access and allow funds.

Step 3: Transaction

If a user plans to make a payment through a physical point of sale solution, they simply tap the POS device with their smartphones, which are NFC-compatible.

This is where Near Field Communication technology is commonly applied in mobile payments. If the payment transfer is done remotely, payment via digital QR code scanning can also be used.

Step 4: Payment Processing

After identifying the payment methods, it is time to process the transaction. The digital wallet, on realizing that the transaction has been initiated for a particular amount, encapsulates the information and sends it in tokens to the receiver’s POS system.

The bank identifies the tokenised information, checks for the availability of funds, and accordingly approves or denies the transaction.

Read Also:- How To Start A POS Business?

Step 5: Finishing the Transaction

Once the user’s bank approves the transaction, the merchant’s POS system receives a payment code that confirms the transaction was successful and that the payment has been received.

Tokenized payment information is encrypted to prevent interception. The POS invokes the payment processor to verify details with the bank.

With the help of these steps, mobile payment technologies are implemented and curated to ensure the convenience of users.

The process does seem a bit typical, as a lot of things have to work correctly in the background to support a single transaction. Understandably, mobile app technologies are expensive and complicated to execute.

But then the question arises, why do people choose to build a mobile payment app? Well, the benefits that it brings along supersede the cost and complexity.

Check out the benefits of using these modern-day mobile payment technologies for businesses in the next section!

Benefits of Adopting Mobile Payment Technologies

Mobile payment technology has already made its mark in every industry, which is also the reason why every business and every individual is more and more attracted to the adoption of mobile payment applications.

Since there are different users involved in the mobile payments process, the benefits differ for both users and businesses.

Let’s explore all these benefits and understand them.

Reasons Why Customers Love Using Mobile Payment Technologies

Here’s why mobile payments have become the go-to choice for modern consumers.

-

Convenience

Mobile payment solutions reduce the hassle of carrying cash, let alone keeping exact change to buy things/services. Simply use your mobile to pay.

-

Speed

Tapping a POS with an NFC-enabled smartphone is not only convenient, it’s quicker to do. You simply tap and go, making the entire process super fast, saving a lot of time for the user.

-

Security

Since you do not need to carry cash, buying and selling, and using services automatically become secure. More and more check parameters are deployed automatically to manage and trace digital transactions.

-

Ease of Inclusion

Mobile payments powered by e-wallets benefit unbanked users as well. This fosters an inclusive environment for everyone, regardless of their banking status.

Reasons Why Businesses Are Adopting Mobile Payment Technologies

Here’s why businesses across industries are embracing mobile payment systems.

-

Lower Execution Costs

While it requires a specific digital infrastructure for payments, it can lower your costs by eliminating the resources and expenses allocated for cash handling, as a payment system fully automates the process without compromising accuracy.

-

Simplified Reconciliation

It is crucial to have a set procedure for reconciliation, and with a mobile payment system, the entire process becomes simplified, saving you a lot of time and effort that usually goes into the reconciliation of bills.

-

Global Expansion

With a digital payment system, you can collect payments from customers across the globe. Multi-currency e-wallets allow instant conversion and payment settlement in the required currency, making it more convenient for both users and businesses, boosting their reach globally.

-

Customer Insights

When mobile payments are used, every transaction is recorded digitally, giving businesses insights about what a customer bought. This information, along with other parameters, makes it easier for businesses to craft customer-oriented strategies.

The whole idea of implementing a better payment system is to save time, meet customer expectations, and simplify the exchange of services and goods.

How to Implement Mobile Payment Technologies? Nimble AppGenie Can Help!

After recognizing the benefits of mobile payment technologies, you may be curious about how to begin implementing them. Well, hiring an e-wallet app development company is your best option, as combining payments with technology is not easy.

If you are planning to start a fintech business of your own and require assistance from the experts, then this is your perfect chance.

We at Nimble AppGenie have years of experience in offering the best payment solutions, with the best of mobile payment technology implemented at their core.

Our experts have always catered to the requirements of the customers, understanding their needs and crafting customized apps.

Reach out to us today and ask our experts to assist you with mobile payment technology integration for the best results. After all, who doesn’t like better results?

Conclusion

Mobile payment technology is improving day by day, and the earlier you adapt, the better it is for you. In case you are wondering, mobile payment technology is the key catalyst that has made it possible for people to use their smartphones as a way to pay for things.

Everything from your e-wallet to an online payment gateway uses mobile payment technology in one way or another, and to implement the same, you need to understand how it works and what it does.

Hopefully, this post has covered everything from what mobile payment technology is to how it can be implemented. If you have any doubts about mobile payment technology or fintech, feel free to browse through our other posts, as we cover everything.

Thanks for reading, Good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.