The impact of Venmo in pop culture is massive.

So much so that people often use it as a synonym for paying, for instance, “Can I Venmo you for the pizza later?”.

It is this immense popularity of Venmo that motivates several companies and entrepreneurs to explore the instant payment and electronic fund transfer market.

But before investing in an idea similar to Venmo, the first question that comes to mind is How does it make money?

Think about it? How does a simple app that doesn’t charge a user for day-to-day transactions and offers the convenience of making peer-to-peer payments at zero charges generate revenue?

Well, that is exactly what we are going to decipher in this post. Through this one, let’s take a closer look at Venmo’s business model and understand how Venmo makes money.

Without further ado, let’s get started!

What is Venmo? An Overview

Venmo is one of the most popular names when it comes to modern-day digital payment methods.

With millions of users on board, Venmo is the leading app for electronically transferring funds from one user to another.

It is primarily based in the U.S. and works as a P2P mobile payment app that allows users to send and receive money among friends and family.

However, while it was introduced for the convenience of sharing funds, today it also supports consumer payments, allowing users to pay for goods and services at both online and offline stores.

The usability of Venmo doesn’t stop there, as it also brings along several features that add to its value.

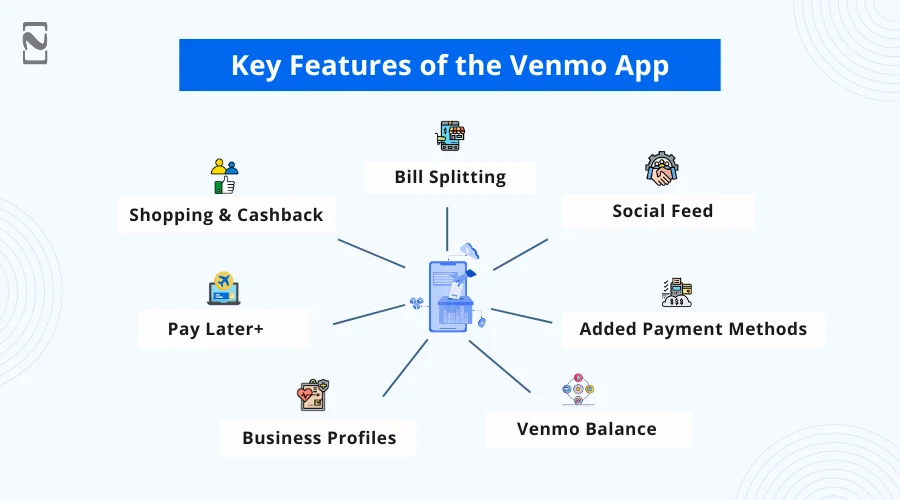

These features include:

Bill Splitting

Allows the user to pay the bill and split it among the users involved in the transaction. It also has a reminder feature, which makes the settlement easier for both payer and payee.

Social Feed

This is an interesting feature that allows users to share their expenses, experiences, and more on a social feed that can be seen by their Venmo contacts, making the app interactive and improving user retention in payments app for better engagement.

Added Payment Methods

Unlike a closed-loop wallet, which functions with certain limitations, Venmo opens doors to multiple payment methods, including direct transfers from Debit Cards, Credit Cards, and bank accounts.

Venmo Balance

Venmo Balance is the internal wallet that it uses to keep the funds that you receive through Venmo. One can easily use this balance instantly through Venmo or with a Venmo Debit Card.

Business Profiles

Though it started as a P2P application, the number of users and the growing use of Venmo made it open its doors to small and large businesses, allowing them to sign up for business profiles that can be used to collect payments.

Pay Later+

Recently, the application has launched its own Pay Later solution, entering the lucrative BNPL market. It certainly brings a lot of convenience as a user now has options to make payments and break them down into installments as they see fit.

Shopping & Cashback

The application also offers various shopping options on the platform, while allowing its users to enjoy cashback with these transactions.

With all these features, Venmo dominates the market in the US with 97 million users as of 2025.

As far as the revenue is concerned, Venmo has already touched the $1.62 billion mark, with a total payment volume of over $342 billion.

What’s interesting is that among the overall transaction volume, 63% belong to P2P payments while 37% are for business-related expenses, clearly indicating the social aspect of Venmo.

How Venmo Works? 3 Phases

The way this app works is quite simple, which is also the reason why it has users from all generations.

Venmo offers a user-friendly interface, which makes it easy for all to access and explore the multiple features it offers.

The proposition of Venmo has always been slightly different from your traditional payment apps.

It functions more as a social network of known friends who can send and receive funds from one another, from the convenience of their smartphones.

Some might even say that it is a great way of borrowing money from your friends, as it also has a request feature built in.

This is also the reason why it has a text field in the transaction section where a user can mention the purpose of the expenditure.

Venmo allows the use of emoticons to make the mobile payment technology more fun and interactive.

If you are not in the USA and are unaware of how exactly it is used, do not worry, as we have shared the entire workflow as per the phases.

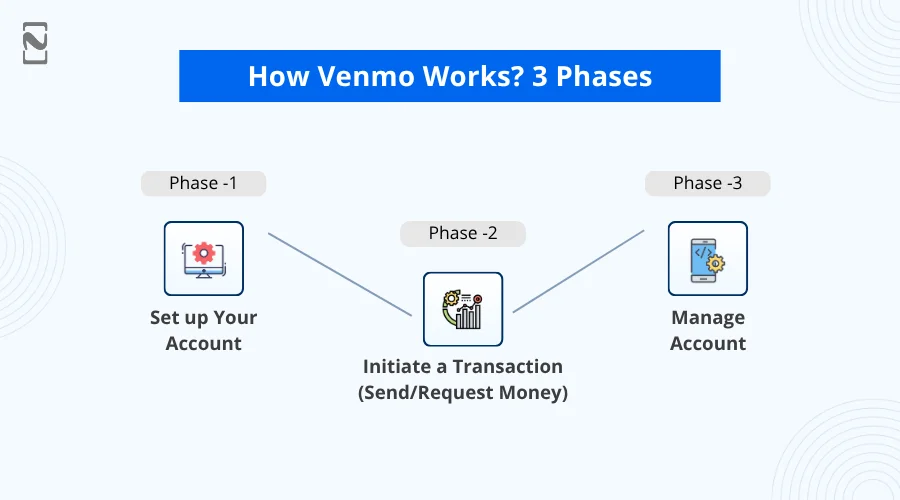

Venmo functions in 3 phases :

Phase 1 – Set up Your Account

The first phase is to download the app and set up your profile. The best way to set it up is to follow the instructions that pop up on your screen. Add the details as required to verify your profile.

This is also the phase where you add your bank account details to make payments and set up your Venmo Wallet. You also have the option to add your debit/credit cards for direct payments.

Phase 2 – Initiate a Transaction (Send/Request Money)

After phase 1, it is time to start transacting using Venmo. You can find the user you want to interact with using their contact details, including their Venmo username, phone number, email address, or by using a unique QR code.

When you have found the user, you have the option to either send them funds or request them for the same. Simply select the recipient, add your note, and then pay or request as per your need.

Phase 3 – Manage Account

Additionally, Venmo offers multiple options to manage your account. You have your social feed where you can interact with your friends and check their payments. The option for private payments is also available.

If you use Venmo a lot, you also have the option to have a Venmo Debit Card, which makes the funds in your Venmo Wallet directly available for use.

You can also transfer funds from Venmo to your bank account; however, it may take 1-3 days for a free transaction. If it’s urgent, you do have the option to use instant transfers; however, they might charge you a fee.

Venmo is one of the most elaborate and fun electronic payment apps that attracts users with its never-ending features and convenience.

You can keep exploring the app daily, and it might still surprise you with new features that it keeps adding.

Ways Venmo Makes Money

With a great user experience and comfort, Venmo makes it super easy for the user to make peer-to-peer payments.

But the question remains, what’s in it for Venmo?

Considering the majority of the features are available for free, how exactly does an app like Venmo make money? Well, there are several digital wallet monetization strategies that it uses.

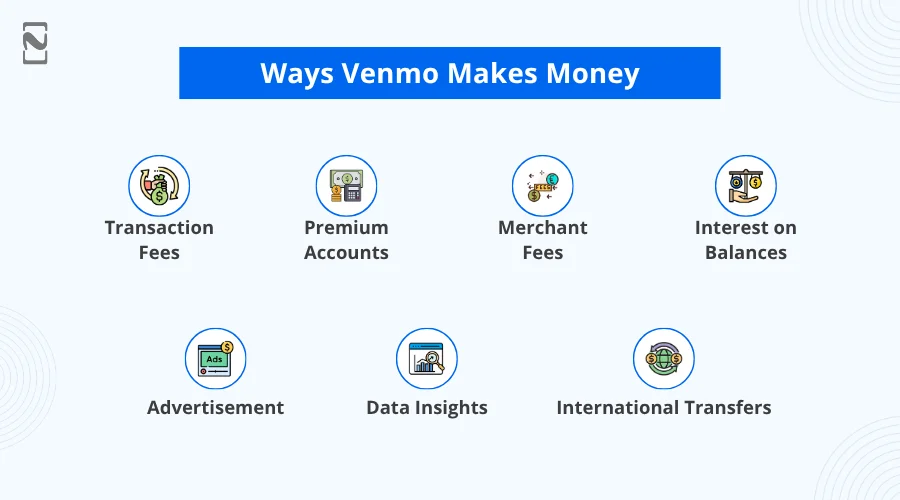

These include:

1. Transaction Fees

While basic P2P transactions are usually free, the app could charge a small fee for instant transfers to bank accounts or for using credit cards instead of bank transfers or debit cards.

2. Premium Accounts

Offering premium account features for a monthly or yearly subscription can be a way to monetize. Premium features might include higher transaction limits, advanced security features, or exclusive offers and discounts.

3. Merchant Fees

Partner with businesses and online merchants to allow users to pay through the app at their establishments or websites. The app can charge merchants a small percentage of each transaction as a fee.

4. Interest on Balances

If users maintain a balance within the app, the company could invest these funds and earn interest, a portion of which could be revenue.

5. Advertisement

Displaying unobtrusive ads within the app can be a source of revenue. These could be targeted based on user spending habits and preferences.

6. Data Insights

Aggregate and anonymize transaction data to provide valuable insights to third parties like market researchers, retail businesses, or financial analysts, while ensuring user privacy and compliance with regulations.

7. International Transfers

Charge a fee for international money transfers, which often require currency exchange and entail higher processing costs.

With millions of users coming in regularly, the opportunities to generate revenue are endless for Venmo.

These methods allow you to generate revenue and recoup the cost to develop an app like Venmo, which is a significant amount considering such apps are highly feature-rich.

Traffic on your platform is nothing less than a gold mine for any app, as they have the option to introduce new features that can help them monetize their app.

And with the growing use of AI in digital payments, it is only a matter of time before more and more similar apps appear in the market.

Should You Invest in an App Like Venmo?

Knowing all the ways Venmo generates revenue, you may wonder whether it is a good decision to invest in an app like Venmo.

Well, absolutely!

With multiple income streams and a solid market clientele, it makes sense to invest in the lucrative fintech market, particularly in payments and digital fund transfer platforms.

The market is certainly open for more and more similar applications.

Sure, there are several challenges that one might have to face when replicating the success of Venmo.

However, with the clear growth of the market and the availability of professional mobile app developers for hire, there’s nothing that cannot be achieved.

In case you are wondering who can help you enter the market with a Venmo-like app, then keep on reading, as the next section might answer your question!

Monetize Your App Like Venmo with Nimble AppGenie

Investing in an app only makes sense if it can help you earn your investment back with some expected profits.

To achieve your desired results, you need a solid team of fintech app developers, analysts, and quality testers who can simplify the app development process for you.

And where can you find all of it? Nimble AppGenie is the answer!

With years of experience and highly qualified experts, it is the best digital wallet app development company you can find to help you replicate the success of Venmo.

In fact, with due diligence and quality research, you can easily plan to surpass your competitors.

Reach out today and start your journey towards excellence!

Conclusion

Be it Venmo or any other electronic payment app in the market, if the approach is right, one can easily generate revenue.

Venmo is definitely a great example and motivation for budding businesses and entrepreneurs in the same field.

Though it often appears that Venmo has no direct way to generate revenue, it is the cleverly implemented monetization strategies and a well-crafted platform that make the difference.

In case you are planning a venture in the same field, make sure you have the best resources backing your journey.

With that said, we have reached the end of this post. Hope this clears your confusion related to how Venmo makes money and gives you clarity on how you can also replicate similar results.

Thanks for reading, Good luck!

FAQs

To start your journey with Venmo, simply follow the given steps:

- Download the app on your phone and create your account.

- Enter your details and set up your bank account and Venmo Wallet.

- Find friends and contacts you want to send/receive money.

- Initiate a transaction by selecting the user, adding your note, and choosing the send/request option.

- You can receive funds similarly and manage your account while enjoying multiple different features.

Venmo, as an app, offers several features that you can use. While most are free, it also includes premium features that come with transaction fees. Additionally, Venmo generates revenue through instant transfers, merchant transaction fees, and other monetization strategies that enhance the user experience while generating profits.

If you have no experience with fintech, banking, or e-wallet apps, it can be challenging to create an app like Venmo. Hiring a professional team like Nimble AppGenie can help you design, develop, and deploy a secure, scalable mobile payment app efficiently.

Venmo can include certain fees that may not always be transparent. For example, credit card transactions carry a 3% charge, which is relatively high. By addressing such issues and improving fee transparency, you can develop an app that offers a better experience than Venmo.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.