Waiting for payday and suddenly hit with an unexpected expense? It always seems to happen at the worst time. Sure, using a credit card or getting a payday loan might seem like a quick solution. But they usually come with high interest rates and hidden fees.

We live in a world where people are used to getting things instantly, rides, food, clothes, and yes, money. That’s why cash advance apps are becoming so popular.

Just like how technology has changed shopping and travel, it is now changing how people borrow money. And apps like Klover are proving just how powerful this shift can be.

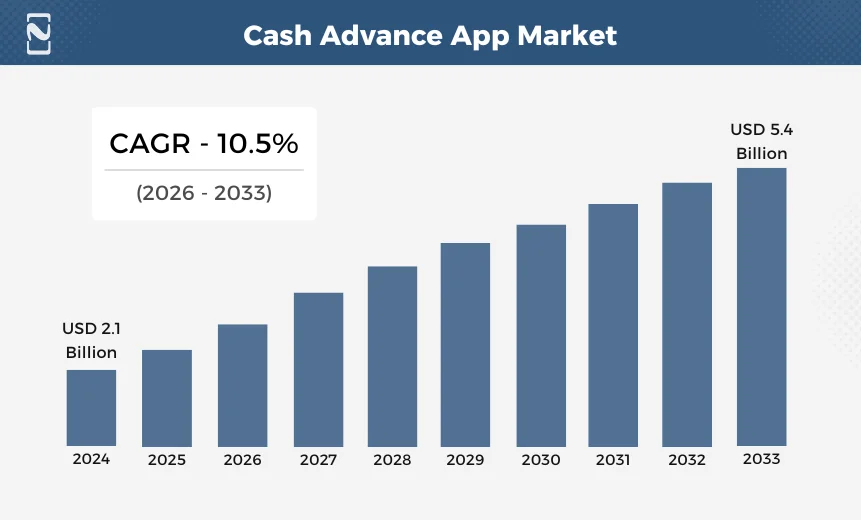

In fact, the global market size of the loan lending industry is forecasted to hit $5.4 billion by 2033. This shows that the demand for cash advance apps will grow in the coming years. If you are planning to develop an app like Klover, this guide will be a helpful insight for you.

In this blog, we will discuss the steps to develop an app like Klover, its must-have features, costs, and how you can monetize your cash advance app.

What is a Klover App?

Klover is an instant cash advance app that allows users to get a small part of their paycheck early before payday. So, if a user needs cash for groceries, gas, or bills, Klover can help them out without charging high fees like payday loans.

They can connect their bank and job information, and based on their earnings, Klover gives them an advance, usually up to $250 or more. Then, when their paycheck comes in, the Klover cash advance app automatically pays itself back.

Klover is one of the best loan lending apps that has other tools to help users budget, track spending, and boost their credit. And the best part? There are no interest or credit checks, though they may ask for optional tips or fees for faster service.

| App | Availability | Downloads | Rating |

| Klover | iOS & Android | 1M + | 4.7/5 |

Market Overview of Instant Cash Advance Apps

The market for cash advance apps is growing faster than expected. Here are some market stats to help you understand how much demand there has been so far.

The cash advance app market size was worth $2.1 billion in 2024. The market is expected to grow steadily and could reach around $5.4 billion by 2033, growing by about 10.5% each year starting from 2026.

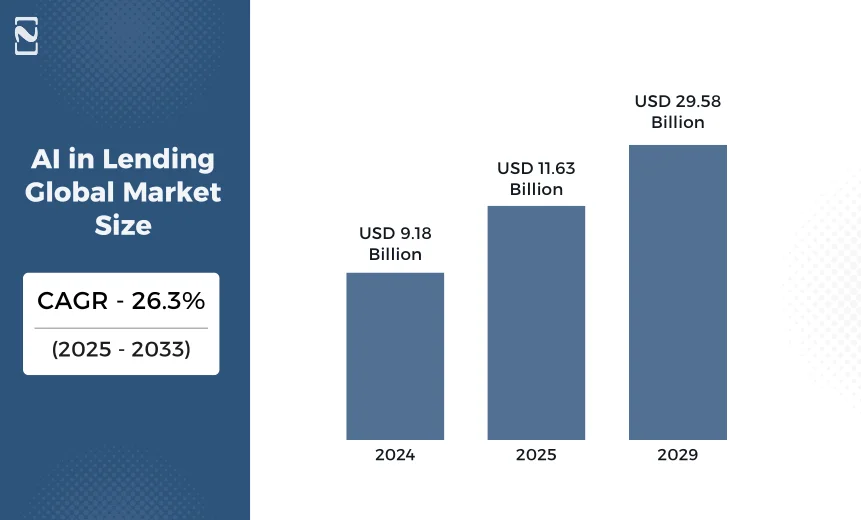

According to the Klover app, it had 2 million active users by mid-2025. AI in loan lending is growing very quickly. In 2024, the market was worth about $9.18 billion, and it’s expected to reach $11.63 billion by 2025. That’s a growth rate of around 26.3% per year.

How Does the Klover App Work?

Knowing the workflow of a cash advance app like Klover is essential for a better understanding before you create a P2P lending app.

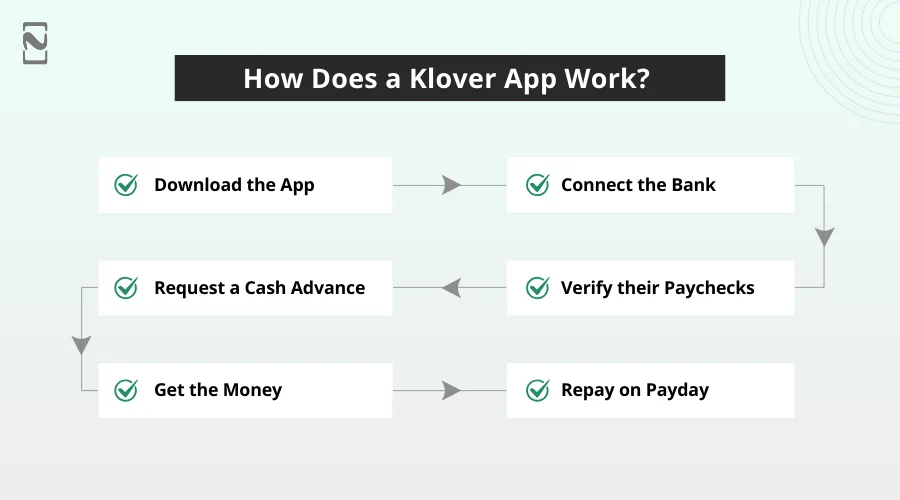

We have explained the step-by-step working mechanism of a Klover app :

► Download the App

First, users can download the Klover cash advance app from the app stores and then create an account by using basic details like name, ID, password, or even bank account details.

► Connect to the Bank

Next, users can link their bank accounts so Klover can see their income and spending. This helps them know when they get paid and how much they make.

► Verify their Paychecks

Klover covers their pay schedule and past deposits to confirm that they have a steady job or income.

► Request a Cash Advance

Once the user’s account is set up, they can request a cash advance. It is usually up to $250 or more, depending on their income.

► Get the Money

The money is sent to the user’s bank, sometimes instantly or within 1-2 days. They can choose faster delivery for a small fee or wait for free.

► Repay on Payday

When the user’s next paycheck hits their account, Klover automatically takes back the advance amount, so they do not have to worry about it.

Steps to Develop an App Like Klover

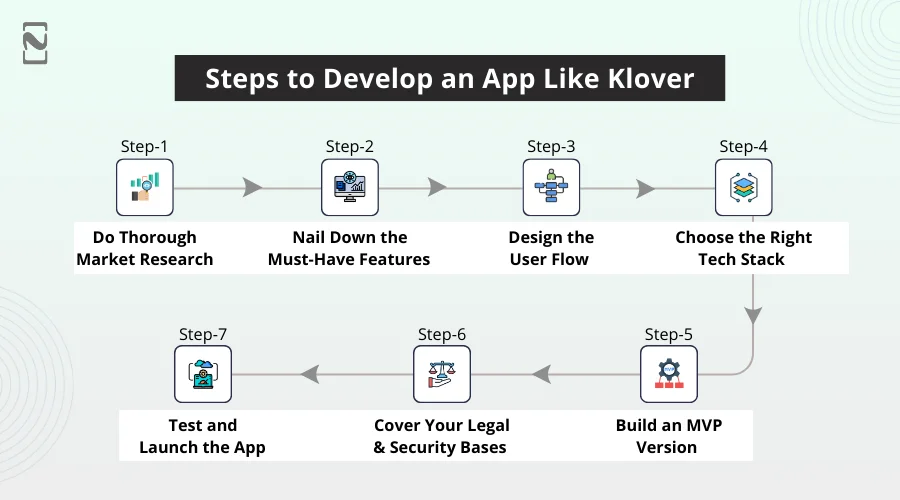

Once you know what features you would want to integrate into your cash advance app, now is the time to start developing an app like Klover.

Here, we will discuss the process to create an app like Klover :

♦ Do Thorough Market Research

Before you start developing an app like Klover, get super clear on why your app needs to exist. Apps like Klover work because they solve a real pain, like people running short on cash before payday.

Also, check out the latest lending app trends to get updates. Now talk to potential users. Ask them how they handle that gap today. What’s frustrating? What’s risky? You are not just copying Klover, you are solving a problem in your own way.

♦ Nail Down the Must-Have Features

Once you know the problem, decide what your app needs to do. Add core features like connecting to users’ bank accounts, giving cash advances, and automating repayments. Maybe you will add budgeting tools or rewards later. But don’t start there.

Just focus on a few things and do them really well. It keeps your cash advance app simple, your costs lower, and your target audience happier.

♦ Design the User Flow

Now sketch out what happens from the moment someone downloads the app to when they get their first cash advance. How did they sign up? What permissions do they give? What steps are involved?

The fewer taps and screens, the better. Just make sure to keep the design visually appealing and intuitive. A smooth experience builds trust, especially when money is involved.

♦ Choose the Right Tech Stack

Choosing the right loan lending app tech stack is really important as it directly impacts development time, cost, and long-term performance. So, choose a tech stack that fits your team and goals.

You can go for cross-platform technologies like Flutter or React Native to save time. For the backend, you will need something secure and scalable. Just make sure that when you build an app like Klover, your app should encrypt data and handle payment safely.

♦ Build an MVP Version

Developing an MVP is an essential step to building an app like Klover, as all the information you’ve gathered will feed into your MVP’s features, tech stack, etc.

The goal here is to launch a small, working version of your Klover money app that real users can interact with. It doesn’t have to be perfect. It just needs to function. Focus on getting the core features right.

Once it’s live, observe how users interact with it. What confuses them? Where do they drop off? Real feedback from real users is far more valuable than assumptions. This is where you learn what to improve before scaling further.

♦ Cover Your Legal and Security Bases

Security and compliance for digital lending app development are non-negotiable. You must implement strong data encryption, KYC for user verification, and follow all financial regulations.

If you fail to meet legal and security standards can lead to major issues. Always consult legal experts to stay compliant and protect both your users and your business.

♦ Test and Launch the App

Once everything is done, do not forget to do mobile app testing. Thoroughly perform different testing methods to find bugs, security issues, and performance issues.

Testing helps you catch errors early and ensures your digital lensing app runs smoothly and safely for real users. Once testing is done, you can successfully launch your app on the desired platforms.

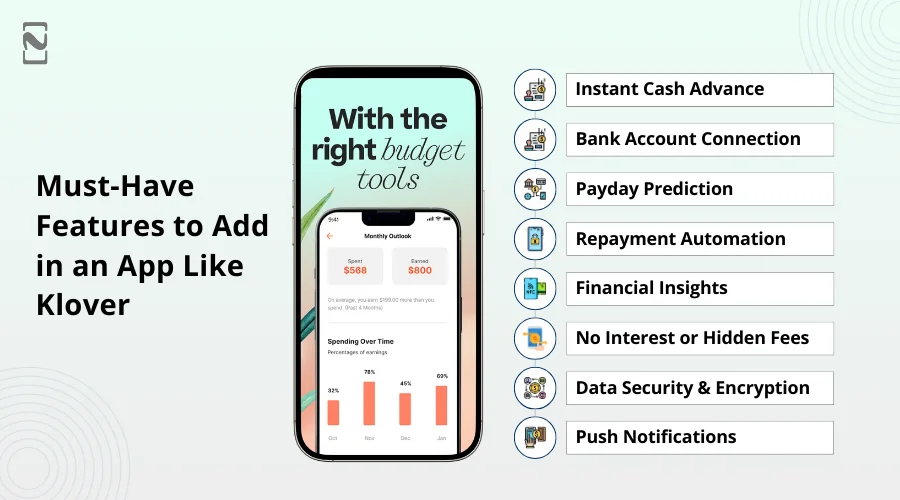

Must-Have Features to Add in an App Like Klover

Features are so essential for your app’s success. It can make or break the app. So, while choosing the features for your cash advance app, like Klover, be careful about that. It is vital to select must-have features and then advanced features if required.

Here are some of the must-have loan lending app features of Klover-like apps that you must check out :

➤ Instant Cash Advance

You should allow users to quickly request a small amount of cash before payday. The money should be sent to their bank account instantly or within minutes without charging high fees.

➤ Bank Account Connection

Cash advance apps should allow users to safely connect their bank accounts to the app. This helps track their income and spending, so the app knows when to offer a cash advance.

➤ Payday Prediction

An app like Klover can use a user’s banking history to automatically detect and predict when the user gets paid. This helps in offering cash advances at the right time without asking too many questions.

➤ Repayment Automation

When you develop an app like Klover, integrate a repayment automation feature into it. Automatically deduct the advance amount from the user’s bank account on payday. This keeps things simple and avoids confusion or missed payments for the user.

➤ Financial Insights

Your app must show users a simple breakdown of their income, bills, and spending. Also, help them understand where their money goes so they can make better financial decisions.

➤ No Interest or Hidden Fees

Just make sure there are no high-interest rates or hidden fees. Users should feel safe knowing exactly what they are paying for the cash advance service.

➤ Data Security and Encryption

When you create an app like Klover, protect user data with a strong security feature. Just allow users to know that their bank information, personal details, and transaction history are encrypted and safe from hackers.

➤ Push Notifications

Users can easily get helpful alerts for the upcoming repayments, available advances, or important account updates, so users do not miss anything important.

How Much Does it Cost to Develop an App Like Klover?

The cost to create an app like Klover can range from $20,000 to $150,000 and more. This is not a fixed cost because your project requirements play a major role in cost fluctuation.

The cost to develop a loan lending app like Klover can vary based on what you need. What features are you looking to include in the app you want to build? For example, the cost of developing an eWallet app won’t be the same as building an entertainment app.

We just want you to understand that the price depends on the project’s requirements and the client’s preferences. So, it is vital to first do proper planning and set a budget before investing a hefty amount in a project.

Now, let’s understand the Klover app development cost from the table below :

| Klover App Complexity | Cost Estimation |

| Simple | $20,000 – $50,000 |

| Medium | $50,000 – $100,000 |

| Complex | $100,000 – $150,000+ |

If you want, you can take a consultation from a fintech app development company to get a full quotation on cash advance app development.

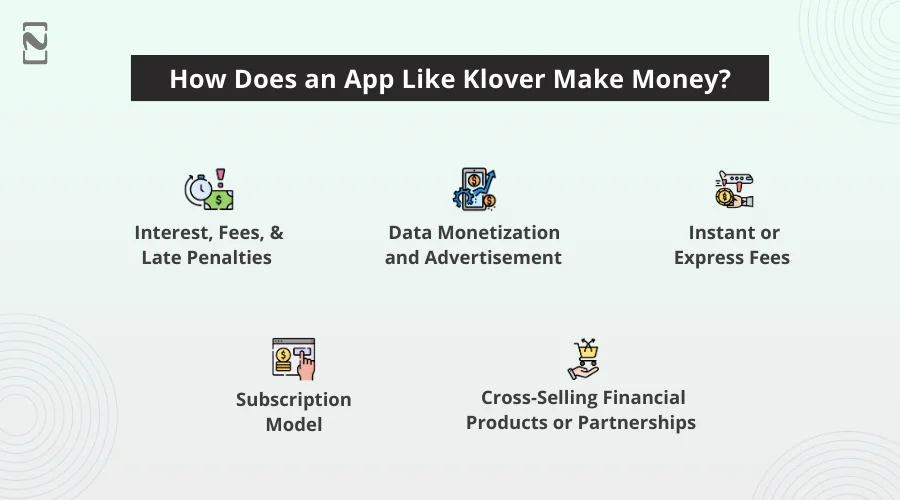

How Does an App Like Klover Make Money?

Klover-like money lending apps make money from different revenue streams that we are going to discuss below.

You can also implement these monetization models in your cash advance application, like Klover :

• Interest, Fees, and Late Penalties

This is one of the most obvious ways. When someone borrows money, the app charges interest, origination fees, and sometimes late-payment fees or penalty fees only if the repayments are delayed. This is how a loan lending app like Klover makes money.

• Data Monetization and Advertisement

When users interact with the cash advance app, they leave data. A cash advance app like Klover can use this data to show targeted ads, provide many offers from partners, or sell insights.

Klover loan app makes money by leveraging insights from its users’ data for its partners. It shows relevant ads, builds audiences from that data, and partners with advertisers.

• Instant or Express Fees

Users might be given a free or slower funding option, but if they want the money faster or instantly, the app can charge an extra fee. Also, there may be service fees or fees for certain conveniences. Klover provides standard traders but charges express or instant fees.

• Subscription Model

Here, the app provides a free basic version but charges for upgraded features like better financial tools, lower fees for faster access, or improved budgeting or credit monitoring.

Also, gamification in loan lending apps helps support subscription models by motivating users to stay active and build good financial habits. As they engage more, they can unlock rewards or premium features, which makes the paid plans more appealing and worth it.

• Cross-Selling Financial Products and Partnerships

Once a user is on the app, the app can offer them additional financial products, insurance, credit cards, savings or investment options, or partner services. Also, partnering with third parties or running affiliate programs is another way to earn income.

How Nimble AppGenie Can Help You Develop an App Like Klover?

Nimble AppGenie helps fintech founders turn big ideas into real, working applications. If you’re looking to build an app like Klover, we offer the technical expertise and industry experience to get you there faster and smarter.

Our expert mobile app development team handles everything from user-friendly design and secure backend development to deployment. Plus, we work closely with you to avoid common development issues that delay launches or hurt the user experience.

Being a trusted lending software development company, our goal is to build a loan app that’s not just functional, but one that users trust, enjoy, and return to. So, what are you waiting for? Contact us today for an outstanding cash advance app solution.

Conclusion

Loan lending apps are becoming a go-to option for people who need quick access to money. If you are thinking of building an app like Klover, it is a good idea to start, but it is vital to get it right.

However, there are plenty of common mistakes to avoid while developing a loan lending app. For example, poor design, lack of security, or unclear lending terms can become a hurdle in your app’s success.

So, focus only on making the app really simple, transparent, and helpful to users. Just do this, and you will not only develop an application, but something people will trust.

FAQs

To make an app like Klover, follow the steps below :

- Do market research

- Nail down the features

- Design the UI/UX

- Choose the tech stack

- Build an MVP version

- Test and launch the app

You can earn money from your cash advance application in the following ways :

- Subscription model

- Data monetization

- In-app advertising

- Cross-selling financial products

- Interest and late penalties

Here are some best cash advance apps :

- Brigit

- MoneyLion

- Klover

- Dave

- Earnin

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.