Getting a mortgage has always been a headache. There’s a lot of paperwork, long waits, and confusing steps that leave both homebuyers and lenders feeling stuck.

But things are starting to shift now. More people want to handle their mortgage process online, and lenders are looking for better tools to keep up.

In fact, studies show that over 80% of homebuyers now prefer a fully digital mortgage experience, and the mortgage software market is expected to hit $56.11 billion by 2034.

That makes now a great time for businesses to explore the possibilities of mortgage software development. If you have a loan lending business, then developing a mortgage software can be helpful for you.

So in this blog, we’ll discuss the major steps to make mortgage software, what features really matter, and how the right setup can make life easier for everyone involved.

What is Mortgage Software?

Mortgage software helps users get a home loan without all the paperwork. Instead of filling out paperwork or going to the bank, users can simply apply for a loan, upload their documents, track their progress, and sign everything digitally.

It works just like some of the best loan lending apps you might have heard of, like Rocket Manger, MoneyPark, etc. This makes the whole loan process much easier and quicker. Users do not have to deal with the usual headaches of getting a mortgage.

Overview of the Mortgage Software Market

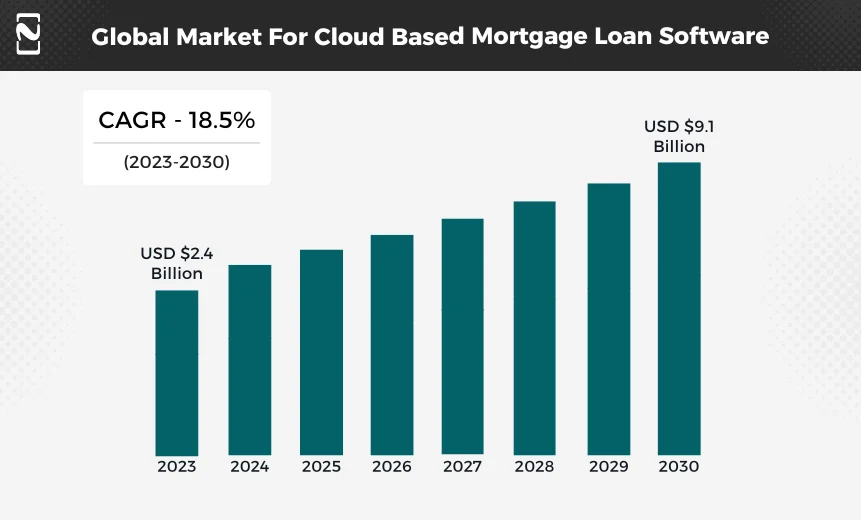

The global market for cloud-based mortgage loan software was worth $2.4 billion in 2023. It’s expected to grow quickly, by about 18.5% each year, and could reach $9.1 billion by 2030, according to Verified Market Research.

Lenders and brokers who use cloud-based software say they’re able to process loans up to 30% faster and cut their costs by around 40%. By 2034, North America is expected to make up about 31.5% of the global e-Mortgage market.

Fintech companies and online lenders now make up 33% more of the mortgage market than before. Nearly 6 out of 10 millennials and 7 out of 10 Gen Z applicants want to do the whole process through a mobile app.

By handling document notarization remotely, businesses could save up to $1 billion a year. Around 81% of people would rather e-sign documents than go into a branch.

This just shows how fast mortgage software is taking off, and it’s a great opportunity for businesses to jump in and start creating their own mortgage solutions.

Key Mortgage Technology Trends for 2026

The mortgage world is finally catching up with modern technology. It used to depend on old, clunky systems that did not work well together and were slower.

Now, things are changing fast. That’s why mortgage software development is such a big deal right now. We help companies build software that works.

We have listed down the major mortgage and loan lending app trends that are changing the game.

► Conversational Chatbots and IDAs

Chatbots are becoming a big trend in the mortgage world in 2026. They use AI in chatbots to communicate like humans and help solve queries of customers 24/7.

In 2023, chatbots helped businesses save up to 30% on support costs of around $137.6 million. But not all chatbots are really helpful.

People want real conversation, not just pre-set replies. They want someone who can solve their problems. That’s where advanced AI models like ChatGPT come in.

It simply acts more like a digital assistant that develops real connections. For example, BHHS Chicago launched Elle, a chatbot that remembers chats and helps users anytime.

So, if you are planning to develop mortgage software for banking institutions, integrating this technology into it can really help in making the mortgage services better.

► Big Data and Analytics

Lenders are now using big data to better understand their customers. For example, their background, spending habits, and payment management. It really helps them offer more personalized loan options.

Software like TrustEngine uses AI to automatically check a borrower’s profile when there is a credit score change or a new mortgage inquiry. NatWest Bank is also using real-time data to remain up-to-date.

Instead of just pushing products, they are now more focused on what their customers need. It is simply about using data to make smarter and more helpful decisions.

► Blockchain and NFTs

One of the best trends in the mortgage industry is blockchain and NFTs. Some lenders are now using blockchain and NFTs to manage mortgage information in a secure and more modern way.

With Blockchain and NFT technology, important data like who owns the loan or property is stored securely and cannot be copied or faked. This way, the data of buyers and lenders is protected from fraud.

Whether you want to develop mortgage software or an app, implementing this technology is a smart way to strengthen security and compliance for a digital lending app. This keeps sensitive data protected from fraudsters and gives users more confidence in the system.

► Document Management Software

Getting a mortgage requires lots of paperwork, from checking documents to approving loans. Also, it is a very time-consuming process. To reduce this process, document management software is really helpful.

It helps mortgage companies safely store, organize, and manage all those files in one place. They can also scan paper documents, sort them neatly, and find anything quickly with document management software.

A recent study by Data Breach at KeyBank in Ohio showed how important it is to have secure systems that include audit trails, data encryption, and activity tracking.

How to Develop Mortgage Software?

Mortgage software development requires careful planning and execution. So, if you are planning to create mortgage software, you need to thoroughly understand the whole industry.

Let’s have a look at the crucial process of creating mortgage software:

1. Understanding the Mortgage Industry

Before developing mortgage software, take enough time to understand how mortgages work. This means learning the end-to-end process from application to approval, everything. You can also talk to mortgage brokers, lenders, or loan officers.

Now read up on regulatory requirements, credit checks, underwriting, and compliance. If you do not understand the real-world process, you will develop something that looks good but fails to solve the right issues.

2. Identify the Core Issues You’re Solving

Once you have clearly understood the mortgage industry, it is time to identify the problem you are going to solve. What exactly are you developing this software to fix or improve? Is it to help lenders apply more easily? To speed up the lender’s internal process?

Do you want to create a P2P lending app or software? Or maybe to make compliance seamless. Just be specific. Mortgage management software can mean many things. Defining the problem or issue in advance helps you share the product in the right direction.

3. Define the Core Features You Need

The next stage in mortgage software development is defining the features. You should focus on what your software should do. Don’t try to build everything at once. You can start with the essentials.

Most mortgage platforms need functionalities like loan applications, borrower profiles, document uploads, etc. You can create a list of must-have features and a second list of nice-to-have features. This keeps the goal manageable and helps avoid function creep early on.

4. Design the UI/UX of Software

Once your feature list is clear, you can sketch out the user journey. What happens when a borrower logs in? Where do they go to apply? What does the lender see on their side? Just clearly map it out step by step. Then, transform that journey into a clean and visually appealing interface.

Mortgage software solutions often deal with sensitive and high-stress decisions. So it is vital that your software design feels easy and trustworthy. You can use some famous design tools like Figma or Sketch, but even a basic wireframe will be helpful.

5. Choose the Right Tech Stack

When you create mortgage software or loan lending apps, it is vital to wisely choose the loan lending app tech stack. For the front-end, the best technologies are React and Angular. These are the strong choices by developers.

For the back-end, you can leverage something scalable like Node.js or others. You will also require a secure database and possibly integrations for credit checks, identity verification, and e-signatures. You should prioritize security and compliance because financial data demands it.

6. Developing Mortgage Software

Now comes the main part of the development process. No matter if you want to develop a loan application or mortgage software, you should always begin with a working prototype. Don’t aim for perfection; just get the core flow working in your mortgage software development.

As each part is developed, you should thoroughly test the software. Testing can be done by either user testing or technical testing. It’s easy to overlook confusing forms or missing validations until real users point them out. This is where the real users’ feedback matters most.

7. Launch of Mortgage Software

Last but not least, the mortgage software launch. Once you are confident, you can launch the first version or MVP to a small user group. We just monitor its performance and not just technically, but in terms of user behaviour.

Are borrowers completing their applications? Are lenders able to process loans efficiently? You can use that feedback to iterate. Mortgage software isn’t a set it and forget it product. The regulations change, user expectations evolve, your software should too.

Key Features of Mortgage Software Development

If you are planning to develop mortgage software to streamline the whole loan lending process more easily, you need to integrate the must-have features into it.

Also, if you first only want to develop an app, then you should integrate the following loan lending app features:

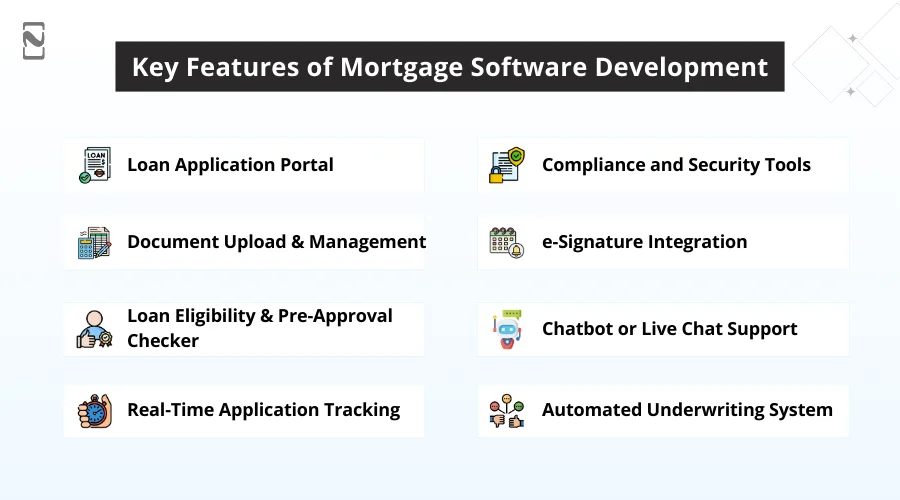

♦ Loan Application Portal

It will allow users to apply for a mortgage directly through the platform. The portal should collect basic details like income, property information, and loan amount. You should make it mobile-friendly and simply fill it out with auto-save, so users do not get stuck in between.

♦ Compliance and Security Tools

When you develop loan management software, you can integrate features like data encryption, audit trails, and access control to protect sensitive data and stay compliant with legal regulations. This is a must for developing user trust and avoiding security risks.

♦ Document Upload and Management

Borrowers should easily upload and manage all their documents, like ID proof, income verification, tax returns, bank statements, and so on, in one place. You can add simple features like drag-and-drop uploads, status tracking, and push notifications if something is missing.

♦ e-Signature Integration

Your mortgage software must allow lenders to sign forms digitally, without requiring you to print or visit a branch. E-Signatures speed up the process, reduce paperwork, and are legally valid when implemented through a reliable eSign API, using trusted providers like Signeasy or DocuSign.

♦ Loan Eligibility and Pre-Approval Checker

This feature of mortgage software helps users to see if they qualify for a loan before they apply. It can run a soft credit check and quickly calculate loan eligibility based on income, expenses, and credit score. It really saves everyone time.

♦ Chatbot or Live Chat Support

You can integrate an AI-powered chatbot to answer customer questions, guide them through the loan process, and give personalised suggestions. AI in loan lending is a growing trend. It helps users get instant support without waiting for a human agent. It also saves time for both the user and your support team.

♦ Real-Time Application Tracking

Once someone applies for a mortgage loan, they should easily track their application status, no matter if it is under review, approved, or waiting for more details. You can just integrate a simple timeline or step-by-step tracker to make this clear and stress-free.

♦ Automated Underwriting System

AUS reviews the loan application, checks all the data like credit reports and income, and gives a decision or recommendation. This helps speed up approvals and reduces manual errors for lenders.

How Much Does it Cost to Develop Mortgage Software?

The cost to develop mortgage software ranges from $20,000 to $200,000 or more. The cost is not always fixed because the requirements you provide will only be one of the major factor that plays a crucial role in affecting the cost.

Let’s say you want to build a simple mortgage software but only want the core features. Now, here the mortgage software development cost will be less.

Similarly, if you want a customized mortgage software with some advanced features and designs, then you will require a huge investment. This goes for the application part also.

However, the cost to develop a loan lending app can be less compared to software due to less complexity and fewer features. The more customization you want and the more features you want to integrate, the higher the cost will be.

Let’s understand this with the table below:

| Mortgage Software Complexity | Cost Estimation |

| Simple | $20,000 to $100,000 |

| Medium | $100,000 to $150,000 |

| Complex | $150,000 to $200,000 + |

Monetization Strategies for Mortgage Software

So, how do money lending apps make money, or software make money? Well, mortgage platforms monetize by providing subscription access and streamlining loan processes, and so on.

So, let’s check out the multiple ways to earn money from your mortgage software or app:

➤ SaaS Licensing for Lenders and Banks

Most mortgage software companies use a SaaS model. They charge lenders, banks, or credit unions a license fee to use their platform. This could be a flat monthly or annual subscription, often based on the number of users, branches, or loan volume.

For example, popular platforms like Encompass by ICE Mortgage Technology and Blend charge lenders for access to software that handles loan origination, compliance, and more. This licensing model is the backbone of their revenues.

➤ Loan Transaction or Volume-Based Pricing

Instead of flat fees, some platforms charge clients based on loan volume. This means lenders pay a fee per mortgage application or closed loan processed through the software.

This model aligns the software provider’s earnings with the success of the lender and is commonly used in both consumer-facing apps and B2B platforms. Additionally, some gamification in loan lending apps includes elements like achievement badges.

This helps to boost user engagement and retention. These features not only improve the borrower experience, but also drive more loan activity, indirectly increasing revenue for the platform through higher transaction volume.

➤ Third-Party Service Integrations

This is one of the most popular revenue models that many mortgage companies leverage. These platforms often integrate third-party services like credit reports, background checks, e-signature tools, etc.

When lenders use these services through their mortgage platform, the software company earns a commission or referral fee. It is a real and consistent monetization model that acts as a central hub for various mortgage-related services.

How Nimble AppGenie Helps You With Mortgage Software Development?

Mortgage software is really important for lenders to stay successful in 2026. If you hire a software development company like Nimble AppGenie, you can get high-quality loan lending software with all the important features to grow.

Our expert developers have expertise in creating flexible, secure, and easy-to-use mortgage software development solutions that fit your business requirements. We also provide consultation to help you improve your work process and get better results.

With Nimble AppGenie, you can improve how you manage customers and make the mortgage process easier and faster. So, what are you waiting for? Contact us right away and get a customized quote on mortgage software development!

Conclusion

In this blog, we have walked you through all the major aspects of building mortgage software. The mortgage world is going digital fast, and there is a real opportunity to build something similar that makes the process easier for everyone.

If you follow the above guide, you will be in a strong position to create high-quality mortgage software solutions that meet your target audience’s needs.

However, if you are seeking a reliable and trusted partner to help you with mortgage software development, you should hire a lending software development company like Nimble AppGenie.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.