The introduction of technology in finance has opened up new opportunities in the market for everyone.

Earlier, the finance industry was tough to crack as everything required financial expertise and, more importantly, a degree in the same domain.

However, with the rise of fintech, people who are not from the fraternity can enter the market with their digital solution that simplifies financial transactions.

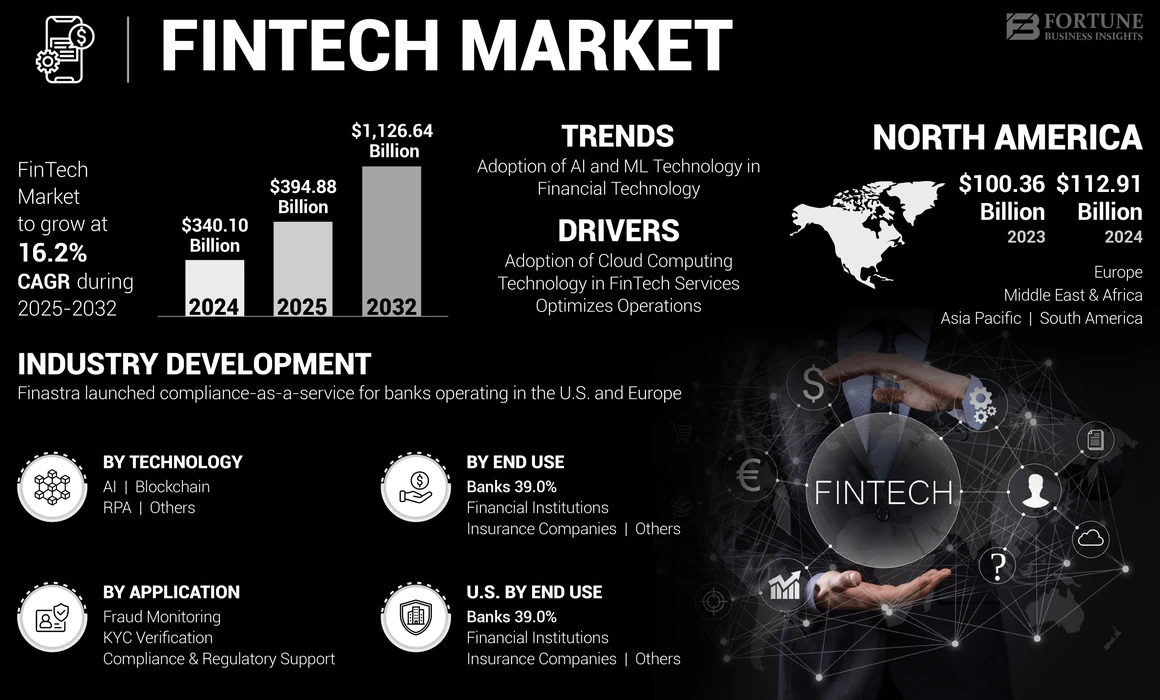

The market has proven to be highly lucrative over the years as more and more people have started their fintech businesses, and it is also visible in the numbers.

The global fintech market, for instance, was valued at $340 billion in 2024. What’s even more fascinating is that it is expected to grow at a CAGR of 16.2%, taking the projections for 2032 to a whopping $1,126.64 billion.

This is one of the many stats that motivate young entrepreneurs and existing legacy business owners to turn their attention towards fintech.

However, as enticing as it sounds, it is not easy to start a fintech business.

There are a lot of things that you need to worry about while planning your own fintech company, and in this post, we are going to cover them all! So without further ado, let’s get started!

Understanding the Concept of a Fintech Company/Business

At its core, a fintech company, or financial technology company, leverages technology to enhance or automate financial services/processes.

This fusion of finance and technology has paved the way for more efficient, accessible, and often more affordable financial solutions for both businesses and consumers alike.

Fintech businesses can range from mobile banking and insurance to investment apps and peer-to-peer lending platforms.

The essence of these companies lies in their innovation to solve traditional financial challenges.

The idea is to make financial services more accessible from the convenience of a smartphone or a computer. And to do so, you, as a business, will need to address a particular service/issue that people may be interested in and try to simplify it.

A key focus is on improving the user experience of fintech apps and democratizing access to financial services.

This has not only opened up new avenues for consumer convenience but has also sparked a surge in financial startups looking to carve out their niche in this burgeoning industry.

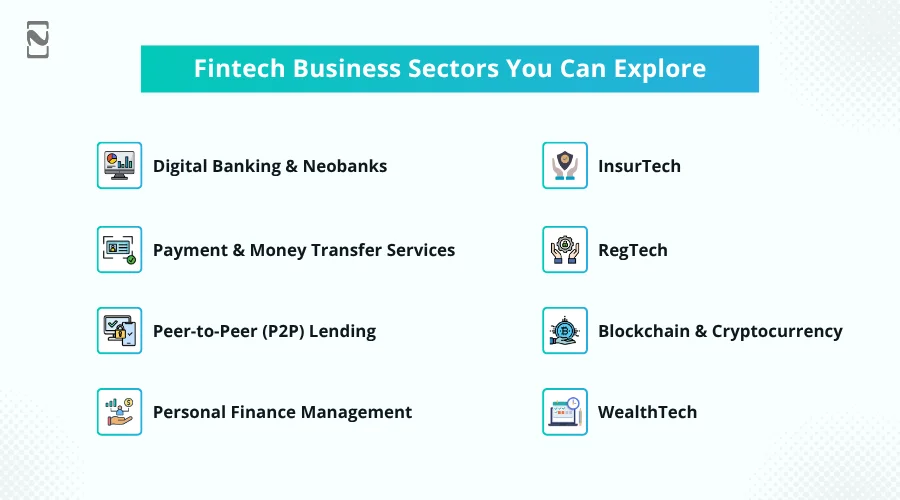

Fintech Business Sectors You Can Explore

Before we start with the steps involved in starting a fintech business from scratch, let us first understand what fintech is and take a look at the sectors you can explore.

Unlike any other industry where you can start just by identifying the limited operations, fintech requires you to decide on your niche.

From payments to money management and from integration to third-party services, there are different types of fintech sectors you can choose from.

Here’s a list of fintech businesses you can explore –

-

Digital Banking and Neobanks

This time, it’s with digital banking solutions and Neobank platforms. These fintech businesses aim to redefine traditional banking by offering online-only financial services that eliminate the need for physical branches.

They focus on user-friendly interfaces, lower fees, and often provide features like budgeting tools and real-time notifications.

-

Payment and Money Transfer Services

One of the most common ideas for a fintech company is to start an eWallet. And it is also one of the best.

This category includes companies that facilitate easier, faster, and more secure payments or money transfers, both domestically and internationally.

They often target inefficiencies in traditional banking systems, such as high transaction fees and slow processing times.

-

Peer-to-Peer (P2P) Lending

P2P lending platforms connect individuals who want to lend money with those who need to borrow, bypassing traditional financial institutions.

This can lead to more favorable terms for both parties and opens up lending to a wider audience. Another popular and growing variation in lending is BNPL.

-

Personal Finance Management

Personal finance management is an up-and-coming niche in fintech. These fintech startups offer tools and apps that help individuals manage their finances, budgets, and investments.

For instance, this includes budgeting & expense management apps, as well as financial literacy platforms. They often include features like expense tracking, financial goal setting, and personalized financial advice.

-

InsurTech

Launching an insurance app is a good fintech business plan. Standing at the crossroads of insurance and technology, InsurTech companies aim to disrupt the traditional insurance industry.

We do this by offering innovative insurance models, personalized policies, and streamlined claims processing through technology.

-

RegTech

Regulation Technology (RegTech) focuses on leveraging technology to streamline compliance and regulatory processes within the financial industry.

This is particularly crucial given the complex and ever-evolving regulatory landscape that fintech companies navigate. With the growing importance of digital payment regulations and rules, this is a good idea.

-

Blockchain and Cryptocurrency

Blockchain development is growing super popular. This segment includes companies that use blockchain technology to offer services like cryptocurrency exchanges, digital wallets, and decentralized finance (DeFi) platforms.

They focus on providing secure, transparent, and efficient alternatives to traditional financial systems.

-

WealthTech

This is a rather new form of fintech platform. WealthTech startups focus on making investment and wealth management accessible to a broader audience.

They offer services like robo-advisors, online brokerage platforms, and automated investment tools.

Other than these, you also have embedded finance and other emerging fintech trends that you can explore.

With all of these options and more available, one thing is clear: fintech is never going to see a saturation point in terms of businesses, as the market is certainly vastly different and growing.

Knowing about the industry might have gotten you all excited about starting a fintech business of your own.

However, there’s still one of the most crucial questions left unanswered: how to start a fintech company? Well, keep on reading, as in the next section, we have mentioned all the necessary steps you will need to build a successful fintech business.

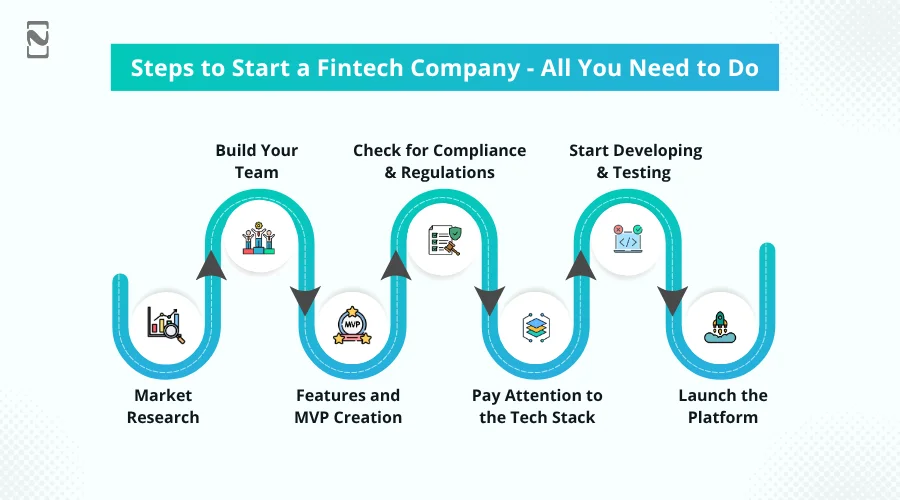

Steps to Start a Fintech Company – All You Need to Do

Irrespective of what niche you plan to enter in fintech, you need to follow a series of steps to get started.

These steps not only help you understand the way this market works but also gradually prepare you to function as a full-fledged fintech company.

Some of the currently functioning high-value fintech companies have reached their spot after using a similar approach.

Hence, if you plan to start a fintech company of your own, make sure you take a closer look at the following steps.

Step 1 – Market Research

The first step is to research the market after you have chosen the sector you want to enter. Learn everything about the industry and accordingly plan your business.

The research includes data points, including current market stats, current players in the industry, previous players who have failed and why they failed, and what makes the current market leaders better than others in the field.

Study them to address all gaps that you can address and become a part of the market.

Step 2 – Build Your Team

After you have understood your niche and the objective of what you want to do in the vast fintech market, you now need a team that can help you achieve your vision.

The idea is simple: you need like-minded people working with you to start a fintech business from scratch. Find a development team that can help you complete the product, and then enlist the services of fintech marketing agencies and experts to give your business a boost in terms of establishing its identity.

All in all, it can not be a 1 man job to start a fintech company, unless you outsource your work to professionals.

Step 3 – Features and MVP Creation

With the objectives to be achieved and the team that can help you achieve the same, it is now time you focus on building your fintech solution.

Choose the features you want to integrate, and based on those features, allow the team to build a minimum viable product. This will give you insights into what your product will look like.

This MVP will help you take a peek into how your vision will appear after execution, so that you can identify if it is meeting your expectations or not.

Step 4 – Check for Compliance & Regulations

If you find the MVP fine, you should now look for other compliance regulations requirements to be sure that the solution you have built is compliant with the regulations and follows all the guidelines that are required to be met by a financial institution/service provider.

Since fintech is a field that requires direct involvement of a user’s financial and personal information, it can get really difficult to be compliant with organizations responsible for compliance and regulations, so you can function smoothly.

Step 5 – Pay Attention to the Tech Stack

Once you have finalized the foundation of your application, it is time to go all in. Start by selecting the right technologies that will make your work easy and your customers’ work convenient.

Let the experts of our development team suggest to you the correct set of frontend and backend technologies that can be used to bring your vision to reality.

In case you are worried about their features and functionalities that can be easily executed in your work.

Simply discuss with your technology partners to ensure that the tech stack you choose is scalable, easy to maintain, and upgrade.

Step 6 – Start Developing & Testing

This is the step where you start focusing on developing the final product. Irrespective of a website, app, software, or anything else that you are building, the development process is the key.

This is the step where every feature that you have chosen, every functionality that you thought of, is built from the ground up.

Your fintech platform takes shape and is ready to be tested. You can check all the functionalities manually and identify if there are any issues.

Testing and quality analysis is a crucial part of the development process; hence, you should pay attention to the process.

Step 7 – Launch the Platform

By now, you have identified the gaps, got a team to support your business, found the technology that would help you find the best solution, and allowed your development team to build the solution.

The only thing left now is to be sure of the entire software and launch it for people. Ask your development specialists to deploy the final build and accordingly finish the product building process.

All these steps help you lay the foundation of your fintech business. Not only will you be able to initiate your fintech journey, but you will also have completed the majority of the important launch operations, as after all the steps you have.

- An idea of what needs to be done.

- A team that can help you do what is required.

- A fintech product that is ready to go public.

Now all you have to do is focus on your operation and keep upgrading the user’s experience to make everything more and more effective. With everything available to you, you now need to enter the corporate realm and start pushing out your services to other users. It can be difficult in the beginning, but you can make the most if you stay persistent.

Cost of Starting a Fintech Company

Starting a fintech company can be an exhilarating venture, but it’s important to have a clear understanding of the potential costs involved.

The total expense can range significantly depending on the complexity of your product, regulatory requirements, and the market you’re entering.

To ballpark it, the cost to launch a fintech startup could fall anywhere between $50,000 to $500,000.

Here, the cost to develop a fintech app would be anywhere between $25,000 and $150,000+.

Below is a breakdown of how these costs might be distributed across various needs and stages of development:

| Expense Category | Approximate Cost Range | Description |

| Market Research & Analysis | $2,000 – $10,000 | Understanding market dynamics, customer needs, and competitor landscape through surveys, focus groups, and industry reports. |

| Legal & Compliance | $5,000 – $50,000 | Costs of incorporating, consulting on regulatory compliance, drafting policies and agreements, and any necessary licenses. |

| Technology & Infrastructure | $10,000 – $200,000 | Development of MVPs, including software development costs, purchase hardware, and subscribe to cloud services. This can vary widely based on the complexity of your fintech solution. |

| Product Design & UX | $5,000 – $40,000 | Crafting a user-friendly design and interface, from initial wireframes to the polished final product design. |

| Security Measures | $10,000 – $70,000 | Investments in cybersecurity features like encryption, secure data storage, compliance audits, and penetration testing to safeguard user data and transactions. |

| Marketing & Branding | $5,000 – $50,000 | Initial efforts to build brand identity, develop a website, create content, and run marketing campaigns to attract users. |

| Personnel & Operations | $10,000 – $100,000 | Salaries and fees for your team, costs for office space (if opting for a physical location), and other operational expenses. This includes any initial hires necessary to get your startup off the ground. |

| Licenses & Subscriptions | $1,000 – $20,000 | Ongoing costs for essential software licenses, API access, and subscriptions to tools required for development, project management, and team collaboration. |

| Contingency & Miscellaneous | $2,000 – $20,000 | A buffer for unforeseen expenses, which can cover anything from unexpected technical challenges to administrative hurdles. |

Now that we are done with this, it’s finally time to make some money.

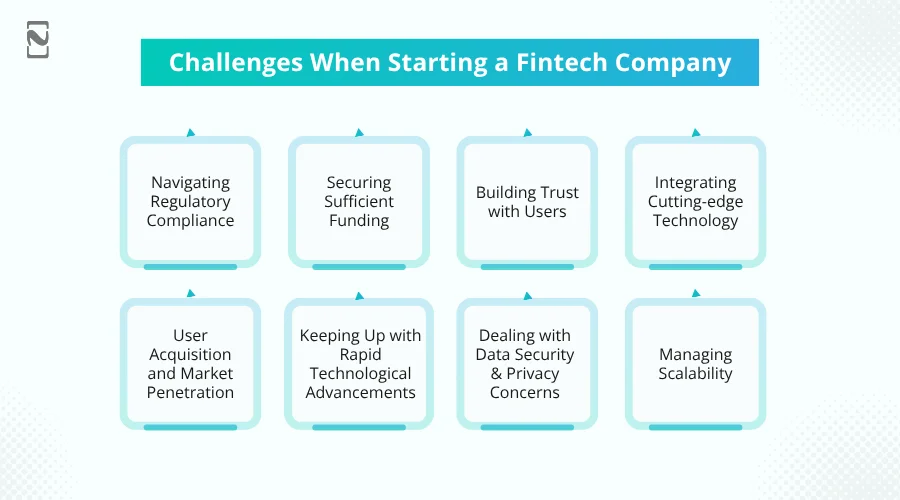

Challenges When Starting a Fintech Company

Starting a fintech company is undeniably exciting, but like any great adventure, it comes with its share of challenges.

So, here are some important lessons for fintech startups:

1. Navigating Regulatory Compliance

The financial industry is heavily regulated, and keeping up with these regulations can be daunting. Compliance is not just a hurdle; it’s a constantly moving target.

-

Solution

The key here is to get cozy with the regulations that affect your niche. Don’t shy away from consulting with legal experts specializing in fintech. They can help you build a compliance-first approach, ensuring that your product is built on a solid legal foundation.

2. Securing Sufficient Funding

Fintech startups often require significant upfront investment, not just for development but also for regulatory compliance, security, and user acquisition.

-

Solution

Craft a compelling pitch that clearly outlines the value and potential of your fintech idea. Explore various funding avenues, from venture capital and angel investors to crowdfunding and strategic partnerships. It’s also wise to start learning and focusing on your MVP (Minimum Viable Product) to prove your concept before seeking larger investments.

3. Building Trust with Users

In the world of fintech, trust is everything. Convincing users to trust your platform with their financial information is no small feat.

-

Solution

Transparency is your best friend. Be clear about how you use and protect user data. Implement and showcase robust security measures. User education is also key; it helps your users understand the benefits and safety features of your platform through clear communication and responsive customer support.

4. Integrating Cutting-edge Technology

The fintech industry thrives on innovation, but integrating new technologies while ensuring reliability and security can be tricky.

-

Solution

Stay on top of tech trends, but be judicious in your choices. Focus on technologies that genuinely enhance the user experience and operational efficiency. Don’t forget thorough testing and quality assurance processes to ensure that new tech integrations don’t compromise the stability or security of your platform.

5. User Acquisition and Market Penetration

The fintech space is crowded, and standing out to attract users can be challenging, especially when competing with established players.

-

Solution

Focus on your unique value proposition and niche. Use targeted marketing strategies to reach your specific audience. Content marketing, strategic partnerships, and leveraging social proof (like testimonials and case studies) can be powerful tools to attract and retain users.

6. Keeping Up with Rapid Technological Advancements

The pace of technological change is blistering, especially in fintech. Keeping your product up-to-date without constant disruption can be a balancing act.

-

Solution

Foster a culture of continuous learning and agility within your team. Stay engaged with the fintech community to stay abreast of new developments. Consider adopting a modular architecture for your product, making it easier to update or replace components without overhauling your entire platform.

7. Dealing with Data Security and Privacy Concerns

Data breaches can be catastrophic in the fintech world, eroding user trust and potentially leading to significant legal and financial repercussions.

-

Solution

Invest in state-of-the-art security infrastructure. Regularly update your system and conduct penetration testing to identify vulnerabilities. Educate your users about securing their data and implement strict privacy policies that respect and protect user information.

8. Managing Scalability

As your user base grows, scaling your operations and infrastructure to handle increased demand without sacrificing performance or security can be challenging.

-

Solution

Plan for scalability from the start. Cloud-based solutions can offer flexibility and scalability, allowing you to adjust resources according to demand. Regularly review your infrastructure’s performance and make proactive adjustments to accommodate growth.

Navigating these challenges requires a blend of strategic planning, technological savvy, and a relentless focus on user needs. By addressing these hurdles head-on with thoughtful solutions, you’ll be well on your way to building a successful fintech business that stands the test of time.

Things to Keep in Mind While Starting Your Own Fintech Business

There are several different things that you need to take care of when you choose to start a fintech business of your own.

It is not like any other business where you are just involved in a simple exchange of goods and services; it is more than that, as fintech in itself has several overlapping services and sensitive information involvement, which makes the entire process more intricate to manage.

To ensure that you are on the right track while starting your own fintech business –

-

Make Sure You Stick to Your Niche

When you start building a fintech application, you should keep in mind that you should stick to your niche. Different fintech niches overlap during execution; however, you should not deviate from the vision and stick to your niche only.

-

Always Have Multiple Revenue Streams

Pay attention to the fintech monetization strategies that you can implement to make the most out of your application. You see, if you are depending on single revenue streams

-

Focus on User Feedback

After you have launched the application, you can start gathering your user feedback to understand what they like and dislike about your app. Focusing on things that your current users convey to you is important to make their experience better.

-

Check for Scalability

When starting a fintech business, you should consider the scalability of your niche as well as the opportunities that you will be able to capitalize on. This not only helps your business grow but also makes it sustainable in the long run.

It is crucial to take care of what you spend and how much you spend in your initial days, as it can be difficult to manage things when you have less number of users and more resources deployed on the project.

One of the biggest mistakes that budding fintech companies make is that they make the wrong choice when it comes to finding the right guidance.

If you have made up your mind to start a fintech business of your own, you must start by finding the right assistance for building the solution.

Enter the Profitable Market of Fintech With Professional Assistance!

The fintech market is booming right now, and as lucrative as it appears, it can be difficult to crack without proper assistance.

Hence, you need some industry experts on your side to help you enter the profitable market of financial technology.

While you can learn about the business principles and how fintech services work, you will need professional assistance with the execution of fintech app development.

You see, building an application is not a cakewalk. It takes years of experience and a highly motivated group of professionals to bring your vision to life. Hence, you should only invest in hiring the best people for your fintech company.

However, finding affordable developers and technical professionals is difficult, especially when you are looking to hire them full-time.

Outsourcing your ideas to a fintech app development company like Nimble AppGenie makes the most sense. Connect with our experts today and start your fintech company without compromising your vision!

Conclusion

The financial technology (fintech) industry is experiencing explosive growth, with a projected market size of $32.17 trillion by 2028.

This surge is fueled by ever-growing demand for convenient and accessible digital financial solutions.

Traditional financial institutions, often slow to adapt, leave gaps in the market that fintech startups are perfectly positioned to fill.

These nimble innovators can cater to niche markets, offering tailored services that resonate with specific demographics or address unmet needs.

From mobile payments and robo-advisors to blockchain-powered solutions and personalized lending platforms, fintech companies are revolutionizing the way we manage our money.

This dynamic landscape presents a wealth of opportunities for entrepreneurs with fresh ideas and a passion for disrupting the status quo.

If you have a vision for transforming the financial world, the booming fintech market might just be the perfect launchpad for your innovative startup.

FAQs

Starting a fintech company can cost anywhere from $50,000 to $500,000, depending on various factors such as the complexity of your fintech solution, regulatory requirements, initial staffing needs, and the technology stack. Planning for initial development costs and ongoing operational expenses is crucial.

Starting a fintech company involves navigating a complex landscape that includes regulatory compliance, technological innovation, and intense market competition. While it’s an exciting venture, it requires thorough planning, a deep understanding of the financial sector, and a commitment to overcoming challenges such as securing funding and building a trustworthy product.

Create a fintech company and start with market research to identify unmet needs or areas for improvement in financial services. Define your value proposition and ensure your idea complies with regulatory standards. Develop a robust business plan, secure the necessary funding, assemble a skilled team, and focus on building a user-centric product. Pay close attention to security, scalability, and ongoing innovation.

Yes, fintech companies can be highly profitable. They typically employ various revenue models such as transaction fees, subscription services, advisory fees, and earning interest on deposits. Success in monetization requires a clear understanding of your target market and a value proposition that meets user needs effectively.

Fintech startups must navigate a complex regulatory landscape that can include financial services regulations, data protection laws, and anti-money laundering (AML) directives. The specific regulations depend on the services offered and the regions in which the company operates. It’s crucial to engage with legal experts in fintech to ensure compliance from the outset.

Fintech startups commonly leverage technologies like blockchain to secure transactions, artificial intelligence and machine learning for personalized financial services, and big data analytics for informed decision-making. The choice of technology should align with the company’s specific services and value proposition.

Cybersecurity is paramount for fintech companies due to the sensitive nature of the financial data they handle. Implementing robust security measures like encryption, secure data storage, and regular security audits is essential to protect user data and maintain trust.

Fintech startups can expand internationally, but they must consider the regulatory environment, market needs, and cultural differences in each new market. International expansion requires careful planning and may involve adapting the business model to comply with local regulations and meet unique customer needs.

To stay competitive, fintech startups should focus on innovation, user experience, and customer service. Staying abreast of emerging technologies and industry trends, and being agile enough to pivot in response to market feedback, can also help maintain a competitive edge.

Partnerships can be a growth catalyst for fintech companies. Collaborating with traditional banks, other fintech firms, and non-financial companies can expand service offerings, extend market reach, and enhance the overall value proposition to customers.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.