Modernizing fintech legacy systems is crucial for companies to stay competitive, secure, and efficient.

As technology rapidly evolves, legacy systems can become a barrier to innovation and growth. This blog explores the strategies, benefits, and challenges of fintech legacy system modernization.

Offering insights into how fintech companies can successfully transition to modern, scalable, and secure platforms.

Therefore, let’s get right into it:

Understanding Modernization in Fintech

Modernization in fintech is a crucial process that involves updating and transforming outdated legacy systems to meet current technological standards and customer expectations.

Fintech legacy system modernization is essential.

It maintains competitive advantage, enhancing security, and improving operational efficiency.

Modernizing legacy systems in fintech involves integrating new technologies like cloud computing, artificial intelligence, and blockchain.

This transformation enables you to provide faster, more reliable, and secure services to their customers.

Modernization isn’t a synonym for developing a fintech software ground up.

Rather, , fintech legacy modernization strategies often involve API integration for legacy systems, allowing seamless communication between old and new systems.

This approach helps in preserving valuable data and functionalities while enhancing the system’s capabilities. Upgrading legacy systems for fintech companies not only improves performance but also opens doors for innovation and new business models.

By adopting fintech legacy application modernization solutions, businesses can ensure they remain agile and responsive to market changes.

This process is not just about technology upgrade but also about aligning with the evolving regulatory landscape and customer expectations. Therefore, investing in fintech legacy software transformation is a strategic move that promises long-term benefits and sustainability for fintech enterprises.

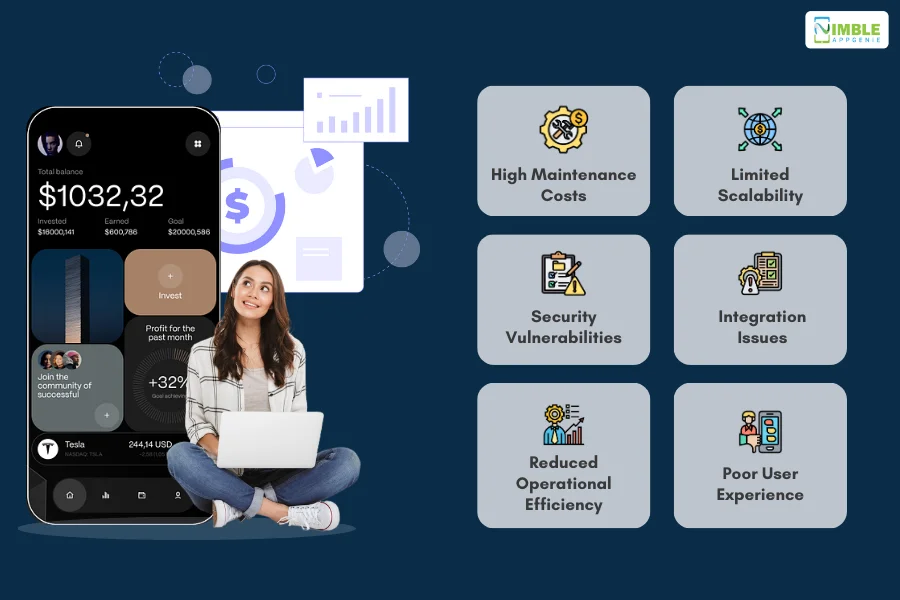

Challenges of Legacy Systems in Fintech

So, what are the challenges that are faced by fintech legacy systems?

Well, whether we talk about or other fintech platforms, ones that aren’t upto the market trends often face many issues.

Let’s look at a few of them below:

1. High Maintenance Costs

Legacy systems in fintech often incur high maintenance costs.

Supporting and maintaining outdated technology requires specialized skills that are becoming increasingly scarce.

These costs can divert resources away from innovation and growth.

Fintech legacy system modernization can help reduce these expenses by streamlining operations and utilizing more efficient technologies.

2. Limited Scalability

One of the most significant issues with legacy systems is their limited scalability.

These systems are typically rigid and cannot easily adapt to increased customer demands or support new services. This inflexibility can result in performance bottlenecks, reducing a company’s ability to compete effectively in a fast-evolving market.

Fintech legacy modernization strategies aim to overcome these limitations by adopting scalable solutions.

3. Security Vulnerabilities

In fintech world, cybersecurity is paramount.

Older systems are often not equipped to handle modern cybersecurity threats, making them more susceptible to data breaches and attacks.

Moreover, protecting sensitive financial data is critical, this poses a significant risk.

Fintech legacy application modernization includes implementing advanced security measures to protect against these threats and ensure compliance with regulatory standards.

4. Integration Issues

Integrating new technologies with outdated systems can be challenging.

Legacy systems often lack the flexibility to integrate seamlessly with modern applications and fintech APIs, leading to inefficiencies and potential data inconsistencies.

This makes it difficult to adopt new technologies that could improve services and operational efficiency.

API integration for legacy systems is a key component of modernization, enabling smoother transitions and better functionality.

5. Reduced Operational Efficiency

Legacy systems can lead to reduced operational efficiency due to outdated processes and technologies.

This can result in slower transaction times, increased error rates, and lower overall productivity.

Fintech legacy software transformation aims to enhance operational efficiency by automating processes, improving data management, and utilizing modern tools and platforms.

6. Poor User Experience

Outdated interfaces and slow system responses can negatively impact user experience.

Customers expect fast, reliable, and intuitive services, which legacy systems often fail to deliver.

Modernizing legacy systems in fintech involves updating user interfaces and improving system performance to meet contemporary user expectations.

By addressing these challenges through fintech legacy system modernization, businesses can improve performance, security, and customer satisfaction, positioning themselves for long-term success in the competitive fintech landscape.

The Cost of Inertia: Why Modernize?

So, why should you modernize your fintech solution.

Whether you are talking about fintech apps or software, it’s crucial to modernize if you want to win the market.

Speaking of which let’s get right inotit:

-

Competitive Advantage

Fintech market statistics shows the booming market. And if you want to win in this market, you need competitive advantage.

Fintech legacy system modernization provides a significant competitive advantage.

Modern systems are more flexible, scalable, and capable of supporting new technologies, enabling companies to innovate rapidly and respond to market changes effectively.

By upgrading, fintech firms can offer new and improved services that meet evolving customer expectations.

-

Improved Security

Modernizing legacy systems enhances security by incorporating the latest cybersecurity measures and compliance standards.

Older systems are more vulnerable to cyber threats.

However, with fintech legacy application modernization, businesses can protect sensitive financial data, ensuring robust security and compliance with regulations.

-

Cost Efficiency

Though the initial investment for fintech legacy software modernization can be substantial, it often results in long-term cost savings.

Modern systems are more efficient, reducing the need for expensive maintenance and support.

This shift allows businesses to allocate resources more strategically, focusing on growth and innovation rather than upkeep.

-

Enhanced User Experience

Customers expect seamless, fast, and intuitive services.

Modernizing legacy systems in fintech helps improve the user experience by providing modern interfaces, faster transaction times, and more reliable services.

This leads to higher customer satisfaction and loyalty.

-

Operational Efficiency

Upgrading legacy systems for fintech companies enhances operational efficiency.

Modern systems streamline processes, reduce error rates, and automate routine tasks, leading to faster and more accurate operations.

This efficiency not only improves productivity but also enhances overall business performance.

-

Integration With New Technologies

Legacy systems often struggle with integrating new technologies.

Fintech legacy application modernization strategies include integrating APIs and modern platforms, enabling seamless connectivity with innovative technologies like artificial intelligence, blockchain, and cloud computing.

This integration is essential for staying competitive in the fast-paced fintech industry.

-

Future-Proofing

Modernizing legacy systems in fintech ensures that the infrastructure is future-proof.

As technology evolves, having a modern system in place allows for easier adoption of new advancements, ensuring the business can continue to grow and adapt without significant overhauls.

Steps to Begin Modernization

Embarking on the journey of fintech legacy system modernization involves a series of well-defined steps.

These steps ensure a structured approach to transitioning from outdated systems to modern, efficient, and secure technologies.

♦ Assess Current Systems

Before diving into modernization, it’s crucial to understand the existing legacy systems.

This involves a thorough assessment of the current infrastructure, identifying the strengths, weaknesses, and limitations of the current setup.

Steps:

- Inventory Audit: Document all legacy systems, their functions, and dependencies. This comprehensive inventory helps in understanding the scope of modernization.

- Performance Analysis: Evaluate the performance, security, and maintenance needs of these systems. Identify bottlenecks, security vulnerabilities, and areas needing improvement.

- Gap Analysis: Identify the gaps between current capabilities and future requirements. This helps in setting realistic goals and expectations for the modernization project.

♦ Define Modernization Goals

Setting clear goals for modernization is essential for guiding the project.

These goals should align with the overall business strategy and address specific challenges identified during the assessment phase.

Steps:

- Strategic Objectives: Define what you aim to achieve with modernization, such as improved security, scalability, and customer experience. These objectives should be specific, measurable, achievable, relevant, and time-bound (SMART).

- Key Performance Indicators (KPIs): Establish KPIs to measure the success of the modernization efforts. These could include metrics like system uptime, transaction speed, user satisfaction, and cost savings.

- Roadmap Development: Create a detailed roadmap that outlines the phases and timelines for the modernization process. This roadmap should include milestones, deliverables, and deadlines to ensure the project stays on track.

♦ Choose the Right Modernization Approach

There are several approaches to modernizing legacy systems.

Selecting the right one depends on the specific needs of your business and the state of your current systems.

Steps:

- Rehosting: Also known as “lift-and-shift,” this approach involves moving existing applications to new infrastructure without significant changes. It’s quick and cost-effective but offers limited benefits.

- Refactoring: Modify the existing code to improve performance and maintainability. This approach requires more effort but can significantly enhance the system’s capabilities.

- Rebuilding: Develop new applications from scratch using modern technologies. This approach is time-consuming and costly but provides the most flexibility and future-proofing.

- Replacing: Replace legacy applications with off-the-shelf solutions that meet current needs. This can be a cost-effective and quick solution but may require customization to fit specific business requirements.

♦ Develop a Modernization Strategy

A comprehensive strategy ensures that all aspects of the modernization process are covered.

This includes planning for technology, resources, and potential risks.

Steps:

- Resource Allocation: Determine the budget, timeline, and personnel needed for the project. Ensure you have the right mix of skills and experience on the team.

- Technology Selection: Choose the appropriate technologies and tools for modernization, such as cloud services, AI, and API integrations. Evaluate these technologies based on their scalability, security, and compatibility with existing systems.

- Risk Management: Identify potential risks and develop mitigation plans to address them. This includes technical risks, such as data loss or integration issues, and operational risks, such as disruptions to business processes.

♦ Implement and Monitor

With a clear strategy in place, the next step is implementation.

This involves executing the modernization plan while continuously monitoring progress and making adjustments as needed.

Steps:

- Pilot Projects: Start with small, manageable projects to test the modernization approach and gather feedback. This allows you to refine processes and address any issues before scaling up.

- Full-Scale Implementation: Gradually scale up the implementation based on lessons learned from pilot projects. Ensure continuous communication and collaboration among all stakeholders.

- Continuous Monitoring: Regularly monitor progress against KPIs and adjust the strategy as necessary to ensure success. Use performance metrics and user feedback to guide ongoing improvements.

♦ Maintain and Optimize

Post-implementation, it’s essential to maintain and optimize the new system to ensure it continues to meet business needs and adapts to future changes.

Steps:

- Ongoing Maintenance: Implement a maintenance plan to keep the system running smoothly. This includes regular updates, security patches, and performance monitoring.

- User Training: Provide training and support to users to ensure they can effectively use the new system. This can help maximize the benefits of modernization.

- Continuous Improvement: Regularly review the system’s performance and make improvements as needed. Stay updated with technological advancements and incorporate new features that add value.

By following these structured steps, businesses can navigate the complexities of fintech legacy system modernization and achieve their modernization goals efficiently and effectively.

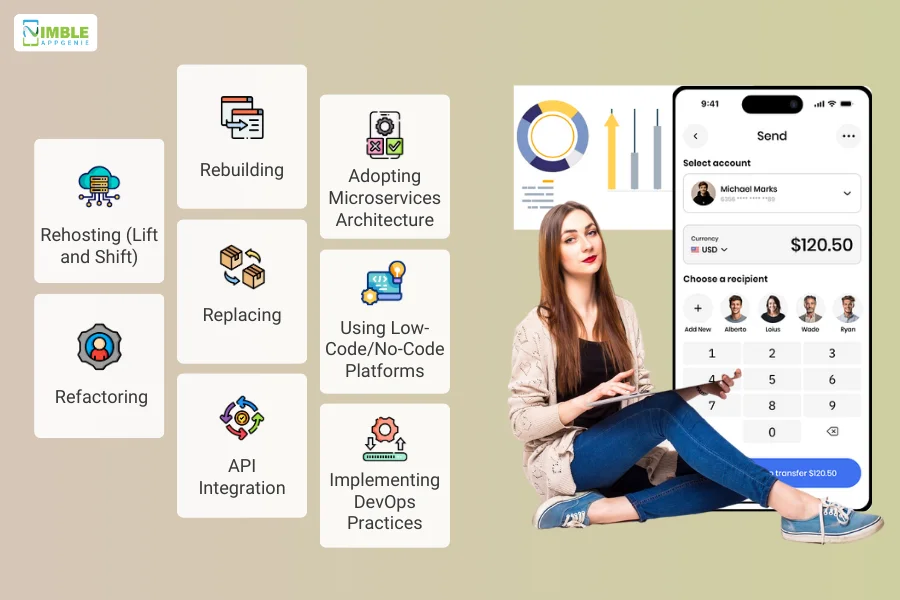

Fintech Legacy System Modernization Strategies

Modernizing legacy systems in fintech is a complex but essential process to ensure competitiveness, security, and efficiency.

Here are some effective strategies for fintech legacy system modernization:

♦ Rehosting (Lift and Shift)

Rehosting involves moving applications from on-premises servers to a cloud environment without significant changes to the code. This approach is quick and cost-effective, providing immediate benefits like reduced hardware costs and improved scalability.

Steps:

- Assessment: Evaluate which applications are suitable for rehosting.

- Migration: Use tools to migrate applications to the cloud.

- Optimization: Optimize the infrastructure for performance and cost-efficiency post-migration.

♦ Refactoring

Refactoring involves modifying the existing codebase to improve its structure, performance, and maintainability. This strategy allows companies to leverage modern technologies while retaining core functionalities.

Steps:

- Code Analysis: Analyze the existing codebase to identify areas for improvement.

- Redesign: Redesign components to enhance performance and maintainability.

- Testing: Thoroughly test the refactored code to ensure functionality remains intact.

♦ Rebuilding

Rebuilding entails creating new applications from scratch using modern technologies. This approach is best for systems that are too outdated to be efficiently modernized through rehosting or refactoring.

Steps:

- Requirement Gathering: Define the new system requirements based on current business needs.

- Development: Develop the new application using modern development practices.

- Deployment: Deploy the new application, ensuring a smooth transition from the legacy system.

♦ Replacing

Replacing involves substituting legacy applications with off-the-shelf solutions that offer similar or enhanced functionalities. This can be a quick way to modernize, though it may require customization to fit specific business needs.

Steps:

- Solution Identification: Identify suitable off-the-shelf solutions.

- Customization: Customize the solution to meet specific business requirements.

- Implementation: Implement and integrate the new solution into the existing ecosystem.

♦ API Integration

Integrating APIs into legacy systems enables them to communicate with modern applications and services. This strategy extends the functionality of legacy systems without extensive redevelopment.

Steps:

- Identify Integration Points: Determine where APIs can add value.

- Develop APIs: Develop or adopt APIs to facilitate integration.

- Testing and Deployment: Test the integrations to ensure seamless functionality and deploy them.

♦ Adopting Microservices Architecture

Breaking down legacy applications into smaller, independent microservices can improve scalability, flexibility, and maintainability. This strategy allows for incremental modernization and easier management.

Steps:

- Decompose Monolith: Identify components of the legacy system that can be separated into microservices.

- Develop Microservices: Develop and deploy each microservice independently.

- Orchestrate Services: Use orchestration tools to manage interactions between microservices.

♦ Using Low-Code/No-Code Platforms

Leveraging low-code or no-code platforms can speed up the development of new functionalities and integrations, reducing dependency on extensive coding and enabling faster delivery.

Steps:

- Platform Selection: Choose an appropriate low-code/no-code platform.

- Development: Use the platform to develop new functionalities and integrations.

- Integration: Integrate the newly developed components with existing systems.

♦ Implementing DevOps Practices

Adopting DevOps practices can streamline the development, deployment, and maintenance processes, ensuring continuous integration and delivery.

Steps:

- DevOps Tooling: Implement tools for continuous integration and continuous deployment (CI/CD).

- Automation: Automate testing, deployment, and monitoring processes.

- Collaboration: Foster a collaborative environment between development and operations teams.

Cost of Fintech Solution Modernization

The cost of fintech legacy system modernization can vary widely depending on several factors, including the complexity of the existing system, the extent of the modernization required, the technology stack chosen, and the geographic location of the development team.

Here’s a detailed look at the factors affecting the cost and some typical cost ranges.

| Cost Component | Estimated Cost Range |

| Assessment and Planning | $10,000 – $50,000 |

| Rehosting (Lift and Shift) | $50,000 – $150,000 |

| Refactoring | $100,000 – $300,000 |

| Rebuilding | $200,000 – $500,000 |

| API Integration | $20,000 – $100,000 |

| Microservices Implementation | $50,000 – $200,000 |

| DevOps Practices Implementation | $50,000 – $150,000 |

| Ongoing Maintenance | $10,000 – $100,000/year |

1] Project Complexity

The more complex the legacy system, the higher the cost of modernization.

Complex systems require more time for assessment, planning, and execution. They may also need more extensive integration and testing efforts.

- Number of applications and databases involved

- Degree of customization required

- Integration with other systems and services

2] Scope of Modernization

The scope of the modernization project significantly impacts the cost.

Projects that involve complete rebuilding or extensive refactoring are more expensive than simple rehosting or minor updates.

- Rehosting vs. Refactoring vs. Rebuilding

- Addition of new features and functionalities

- Compliance and security enhancements

3] Technology Stack

The choice of technology stack can affect both the development time and the cost.

Modern technologies may have higher initial costs but can offer better scalability and lower maintenance costs in the long run.

- Cloud services and providers

- Development frameworks and tools

- Licensing costs for proprietary technologies

4] Development Team Location

The geographic location of the development team influences the cost due to varying labor rates. Hiring developers from regions with lower labor costs can reduce the overall project cost.

- Onshore vs. Offshore development teams

- Hourly rates in different regions

- Quality and expertise of the development team

Example Cost Scenarios

Small-Scale Modernization:

- Rehosting of a few applications to the cloud: $50,000

- Minor refactoring for performance improvements: $100,000

- Total: $150,000

Large-Scale Modernization:

- Complete rebuild of the core banking system: $400,000

- Implementation of microservices architecture: $150,000

- Integration with third-party APIs: $80,000

- Total: $630,000

Example: Fintech Legacy System Modernization Case Study

Modernizing legacy systems is a critical task for fintech companies aiming to stay competitive and meet the evolving demands of their customers.

One prominent example of successful fintech legacy system modernization is the case of BBVA (Banco Bilbao Vizcaya Argentaria), a multinational Spanish banking group.

BBVA undertook a comprehensive modernization effort to transform its legacy banking systems into a more agile and customer-centric platform.

► The Challenge

BBVA faced several challenges common to legacy systems:

- Outdated Infrastructure: The existing IT infrastructure was outdated, making it difficult to support new digital banking services.

- High Maintenance Costs: Maintaining the legacy systems was costly and resource-intensive.

- Limited Scalability: The systems lacked the scalability required to handle increasing customer demands and new digital services.

- Security Vulnerabilities: The outdated systems posed significant security risks in the face of modern cybersecurity threats.

- Slow Innovation: The rigidity of the legacy systems hindered BBVA’s ability to innovate and quickly roll out new features and services.

► The Modernization Strategy

BBVA implemented a multi-faceted strategy to modernize its legacy systems. This strategy included several key components:

1. Adopting Cloud Computing

BBVA transitioned a significant portion of its IT infrastructure to the cloud. This move aimed to enhance scalability, reduce maintenance costs, and improve overall system performance.

Steps Taken:

- Migrated core banking applications to cloud platforms.

- Leveraged cloud-native services to enhance agility and responsiveness.

- Implemented robust cloud security measures to protect sensitive financial data.

2. Implementing API Integration

To ensure seamless communication between legacy systems and modern applications, BBVA invested in extensive API integration. This enabled the bank to offer new digital services without overhauling the entire system.

Steps Taken:

- Developed a comprehensive API strategy to facilitate integration with fintech startups and third-party services.

- Created APIs for core banking functionalities to enable easy access and integration.

- Ensured secure and reliable API management to maintain data integrity and security.

3. Utilizing Agile and DevOps Practices

BBVA adopted Agile and DevOps methodologies to streamline the development, testing, and deployment processes. This approach allowed for more frequent updates and faster delivery of new features.

Steps Taken:

- Established cross-functional teams to foster collaboration and innovation.

- Implemented continuous integration and continuous deployment (CI/CD) pipelines to automate testing and deployment.

- Focused on iterative development cycles to quickly respond to changing customer needs.

4. Investing in Data Analytics and AI

BBVA integrated advanced data analytics and artificial intelligence (AI) into its operations. This modernization step aimed to enhance customer insights, improve decision-making, and offer personalized banking experiences.

Steps Taken:

- Developed AI-driven models for risk assessment, fraud detection, and customer service.

- Implemented advanced analytics tools to analyze customer behavior and trends.

- Leveraged machine learning algorithms to provide personalized product recommendations.

► The Results

BBVA’s comprehensive modernization efforts yielded significant benefits:

- Enhanced Customer Experience: The modernization enabled BBVA to offer faster, more reliable, and personalized banking services, significantly improving customer satisfaction.

- Reduced Costs: By transitioning to the cloud and implementing automation, BBVA reduced maintenance and operational costs.

- Improved Security: The integration of modern security protocols and continuous monitoring strengthened the overall security posture of the bank.

- Increased Agility: Agile and DevOps practices allowed BBVA to rapidly develop and deploy new features, staying ahead of competitors.

- Scalability: The new cloud-based infrastructure provided the scalability needed to support growing customer demands and new services.

BBVA’s successful modernization of its legacy systems demonstrates the transformative potential of a well-planned and executed fintech legacy modernization strategy.

By adopting cloud computing, API integration, Agile and DevOps practices, and advanced analytics, BBVA not only overcame the challenges posed by its legacy systems but also positioned itself as a leader in digital banking innovation.

This case study serves as a valuable example for other fintech companies looking to modernize their legacy systems and achieve similar success.

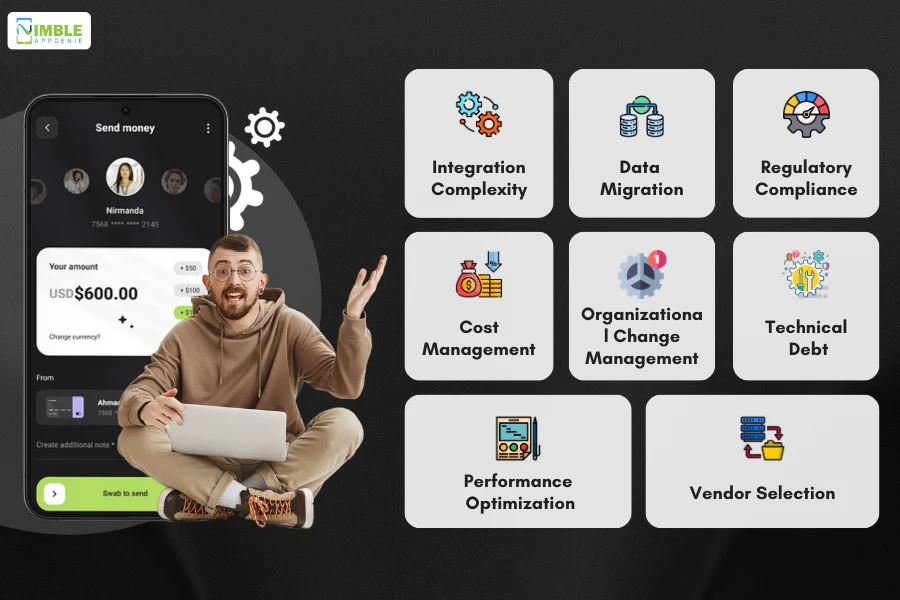

Challenges and Considerations

Modernizing legacy systems in the fintech industry comes with a set of unique challenges and considerations.

Understanding these challenges and planning accordingly can help ensure a smoother transition and successful modernization.

1. Integration Complexity

Challenge: Integrating modern technologies with legacy systems is often complex and requires significant effort. Legacy systems may lack the flexibility needed to seamlessly connect with new applications and services.

Considerations:

- API Integration: Utilize robust APIs to facilitate communication between old and new systems.

- Middleware Solutions: Implement middleware to act as a bridge between disparate systems, ensuring seamless data flow and compatibility.

- Data Consistency: Ensure data consistency and integrity during integration to prevent data loss or corruption.

2. Data Migration

Challenge: Migrating data from legacy systems to new platforms can be fraught with risks, including data loss, corruption, and downtime.

Considerations:

- Data Mapping: Conduct thorough data mapping to understand the structure and dependencies of data in legacy systems.

- Phased Migration: Implement a phased migration approach to minimize risks and ensure a smooth transition.

- Backup and Recovery: Establish robust backup and recovery processes to safeguard data during migration.

3. Regulatory Compliance

Challenge: Fintech companies must comply with stringent regulatory requirements.

Modernizing legacy systems can complicate compliance efforts, especially when handling sensitive financial data.

Considerations:

- Regulatory Alignment: Ensure that the new systems align with current regulatory standards and can be updated to comply with future regulations.

- Audit Trails: Maintain comprehensive audit trails to document compliance efforts and facilitate regulatory audits.

- Data Security: Implement advanced security measures to protect sensitive data and comply with data protection regulations.

4. Cost Management

Challenge: The cost of fintech legacy system modernization can be substantial, and managing these costs is crucial for project success.

Considerations:

- Budget Planning: Develop a detailed budget that accounts for all aspects of the modernization project, including hidden costs.

- Cost-Benefit Analysis: Conduct a cost-benefit analysis to justify the investment and demonstrate the potential return on investment (ROI).

- Funding Strategies: Explore various funding strategies, such as phased implementation or leveraging third-party financing options.

5. Organizational Change Management

Challenge: Modernization projects can lead to significant changes within an organization, affecting processes, workflows, and employee roles.

Considerations:

- Stakeholder Engagement: Engage stakeholders early in the process to ensure their buy-in and support.

- Training Programs: Implement comprehensive training programs to help employees adapt to new systems and processes.

- Change Management Plan: Develop a change management plan to address potential resistance and ensure a smooth transition.

6. Technical Debt

Challenge: Accumulating technical debt during the modernization process can lead to long-term maintenance issues and increased costs.

Considerations:

- Code Quality: Focus on writing clean, maintainable code to minimize technical debt.

- Refactoring: Regularly refactor the codebase to improve its structure and reduce complexity.

- Automated Testing: Implement automated testing to identify and address issues early in the development cycle.

7. Performance Optimization

Challenge: Ensuring that the modernized system performs optimally and meets user expectations is critical.

Considerations:

- Performance Testing: Conduct extensive performance testing to identify and address bottlenecks.

- Scalability: Design the system for scalability to handle increased workloads and user demands.

- Continuous Monitoring: Implement continuous monitoring to track system performance and proactively address issues.

8. Vendor Selection

Challenge: Choosing the right vendors for technology, tools, and services is crucial for the success of the modernization project.

Considerations:

- Vendor Evaluation: Conduct thorough evaluations of potential vendors based on their experience, reliability, and alignment with project goals.

- Service Level Agreements (SLAs): Establish clear SLAs to ensure vendors meet performance and support expectations.

- Long-Term Partnerships: Consider the long-term implications of vendor relationships and choose partners who can support future growth and innovation.

By addressing these challenges and considerations, fintech companies can navigate the complexities of legacy system modernization and achieve successful outcomes that enhance performance, security, and competitiveness in the market.

Nimble AppGenie, Your Partner in Fintech Innovation

Looking to transform your outdated systems?

Nimble AppGenie is a leading fintech app development company specializing in legacy system modernization.

Our expert team leverages cutting-edge technologies to revamp your infrastructure, ensuring improved performance, security, and scalability.

We provide tailored solutions that align with your business goals, helping you stay ahead in the fintech industry.

Partner with us to unlock the full potential of your fintech operations and deliver unparalleled customer experiences.

Contact Nimble AppGenie today to start your modernization journey.

Conclusion

Modernizing fintech legacy systems is a strategic necessity that offers numerous benefits, including enhanced security, improved performance, and cost efficiency. By adopting a structured approach to modernization, fintech companies can overcome the challenges posed by outdated systems and position themselves for future growth and innovation. With the right strategies and tools, the transition can be smooth, ensuring long-term success in a competitive market.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.