The evolution of fintech has been nothing short of magic. While there was a time when there were only a few fintech apps providing niche services, today you can easily find a plethora of options to access and manage your finances.

One such evolved fintech solution is a fintech super app. You may be aware of the concept of a super app. If not, here’s a quick definition:

Super apps are applications that have multiple services integrated into them in the form of a mini app, API, or a feature.

Now, while super apps are highly popular among their users, they are also popular among businesses as they allow them an opportunity to expand their operations into different but related fields.

It has been really interesting to see the rise of super apps. If you have not experienced the same, do not worry, as in this blog, we are going to take you through the entire concept and discuss everything you need to know about fintech super apps.

Without further ado, let’s get started!

An Overview of Fintech Super Apps

As mentioned earlier, a fintech super app is an integrated application that combines multiple fintech features along with lifestyle features in a single platform.

Fintech services, such as your banking, lending, payments, account management, etc., fall into the same category but often need a dedicated app on the mobile device.

Simplifying the hassle of switching from one app to another, even for related services, fintech super apps make it easy for a user to enjoy these services from the convenience of a single platform.

Let’s talk about the market response and growth of super apps. The current market for super apps is valued at $127.1 billion, out of which 42.5% is dominated by financial services, giving you a clear picture of how the demand for these services is growing.

Fintech super applications have definitely paved the way for themselves in the market, as more and more existing players are now moving towards becoming a super app.

The rise of embedded financial services and the exponential growth in the use of online lifestyle services have made fintech solutions a necessity for every platform.

While earlier these tasks were done with a payment gateway integration, the scope of financial services has grown.

This is why businesses today are focusing on building fintech super apps that incorporate other services. That makes sense.

How Does a Fintech Super App Work: Components & User Journey

With that overview, you might have understood how crucial it is for a financial service to move towards a super app. However, it is not that easy.

You must understand the mechanics of how it all works.

You are already aware that the key difference between a super app and a traditional app lies in the scope of services and functionality that they offer.

While a traditional app can only help you complete a single action, super apps offer a complete ecosystem of related services, making it easier for the user.

But how does it actually work? What makes it all possible? Well, several components come together to make it possible.

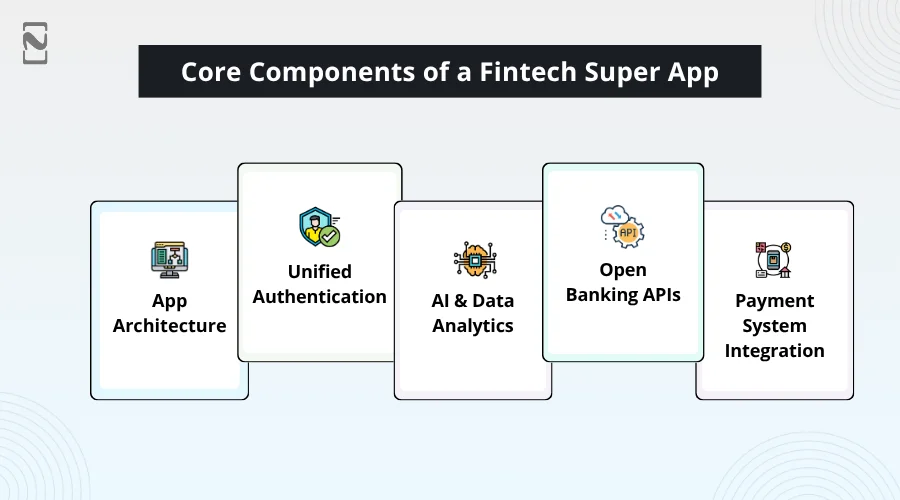

Core Components of a Fintech Super App

Let’s take a look at them to understand them better.

-

App Architecture

For any application to be successful, the fintech app architecture must be defined properly.

When we talk about a fintech super app, the architecture has to be modular enough to allow proper integration with different components that will be helpful in bringing multiple services together.

-

Unified Authentication

When you use different fintech apps to get different operations done, you need to pass an authentication to access the service.

However, when you have all the services in a single app, you need a unified authentication mechanism that simplifies access for you.

-

AI & Data Analytics

With so many services under a single hood, a fintech super app might not be the best experience for a user who prefers direct access to their preferred functionalities.

That is why AI and data analytics are used to ensure that every user can get a personalized experience.

This is the component that allows you to find your most commonly used functionalities and recommendations on the homepage.

-

Open Banking APIs

Adding banking services to your fintech service can certainly become a tedious task.

This is why app developers prefer using open banking APIs that simply get integrated with the platform and make it possible for the app to add banking and financial services to the super app without having to go through a lot of hassle.

-

Payment System Integration

While open banking allows the platform to add core banking solutions, you need payment system integration for all the transactions to go through.

This system involves a proper payment gateway and serves as the central system that completes all the transactions. From your restaurant bill to cab fare, a single gateway for all the services.

All these components, when combined, can help you get your hands on a fintech super app that gets the job done. If you are someone who already works with a financial service, you might have understood what we are talking about.

Read Also: Payment Gateway Integration Guide!

Fintech Super App User Journey

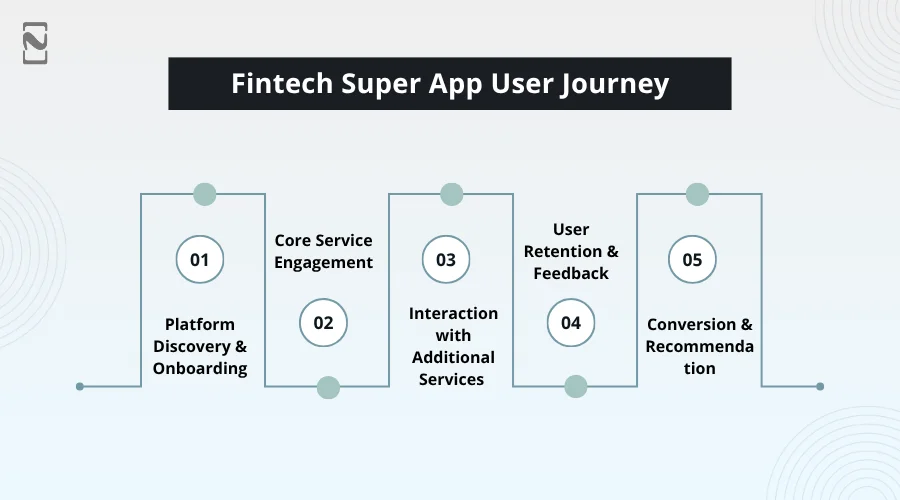

However, if you are still confused about the functioning of a fintech super app, let us take you through the entire customer journey of a super app, which will further help you get insights into how a fintech super app works.

-

Step 1: Platform Discovery and Onboarding

The first step is when a user discovers your service. This is when they create an account on your platform. Generally, users come from their need for a feature, or they discover the application through a marketing campaign.

-

Step 2: Core Service Engagement

The first interaction of a user is with the core service, in this case, financial/banking services. This is the time when your app needs to be flawless, as it is your core service. Make sure that you introduce your expanded services, too.

-

Step 3: Interaction with Additional Services

When the user engages with the application, they tend to discover your additional services, whether it is cab booking, restaurant bill payments, or any other finch service that is not exactly your core solution.

-

Step 4: User Retention & Feedback

With different services on your platform, you can easily retain the user and cross-sell different products, be it a membership or a BNPL credit line, making the user stick to your application. Make sure you keep track of user feedback so that you can keep upgrading your app.

-

Step 5: Conversion & Recommendation

Now that you have got your user right where you wanted, you will find that users have started recommending your app to their friends and colleagues.

These recommendations are highly valuable for you, considering that they will drive more and more users to you!

Through this entire customer journey, you might have gained a solid clarity on how a fintech super app works.

This journey and the set of components are also enough to give you a peek into the cost of developing a fintech app.

The development process for super apps remains the same; however, when building a fintech super app, you can actually enhance the overall solution, and you can integrate some practices. What are these practices? Find out in the next section.

Best Practices to Develop a Fintech Super App

When developing a super app, be it a fintech solution or from any other industry, you need to understand that there are several factors that can make or break your app.

To ensure that your application is always attracting new users and makes the most of the userbase, make sure that you follow the given best practices.

1] Make Your UX Intuitive & Predictive

When designing the user experience of your fintech super app, make sure that it is easy to navigate, even for a first-time user.

Financial services from a smartphone already seem a typical feat to achieve.

If you can simplify the process for your average user, the application will be more user-friendly, making it a preferred choice for the user.

2] Focus on Embedded Security

When several services are integrated into a single application, one of the primary concerns of the users is security.

You see, a fintech app must be secure; however, no one cares if their restaurant booking app uses a password or not.

Hence, you need to use embedded security, enabling internal methods like biometric authentication, screenlock pin, etc., to give assurance to your user.

3] Using Advanced AI for Personalization

Personalizing the application can help you attract a new user easily. Fintech super apps do offer some features and services; however, not every user is on the app for all the functionalities.

Hence, with an AI-based fintech application, you can allow the user to focus on the service that they use the most.

Offering a dynamic dashboard that changes with every use, integrating an AI assistant to help, and personalized product suggestions are good ways to use AI for personalization in a fintech super app.

4] Add Microservices for Better Retention

In the process of developing a super app that does it all, do not forget the importance of microservices.

For instance, if you have integrated a payment solution, you can also add a bill splitter or a budgeting microservice, as it will make a user spend more time on the application and use it more often.

The role of microservices is vital for improved user retention in fintech applications.

5] Keep Updating Your Expanded Services

Staying within the boundaries of being a fintech super app never means that you cannot expand or introduce new services.

You can easily introduce new features and expanded services for various niches while being a fintech super app.

We can offer a dedicated e-commerce platform where your users can shop and pay through their bank right within the app.

You can also introduce a BNPL solution as an added service for ease of e-commerce shopping. Once you have mastered all these practices, developing a successful fintech super app becomes easy.

However, these practices can only work in your favor if you have developed the application properly. Without a robust application, none of the practices will be able to help you out.

Who Can Help Me Develop a Solid Fintech Super App?

If you are wondering where to get started or how you can develop a fintech super app for your business, then worry no more, as Nimble AppGenie is here to help!

With years of dominance in the fintech market, we have completed hundreds of projects and delivered high-quality solutions to our clients.

The key to developing a robust fintech super app lies in the understanding of the concept and the requirements of the user.

All you have to do is reach out, and you will instantly get a reply. At Nimble AppGenie, we focus on delivering results quickly, making our turnaround time the fastest in the industry.

This efficiency reduces your app’s time to market!

Connect today and take the first step towards your fintech super app!

Conclusion

Fintech and banking are two fields that have undergone a complete digital transformation. With the use of AI in finance and ML in banking, the sector has already seen advanced solutions.

All these advancements should be utilized to create a dedicated hub of various services that leveraged to develop a super app.

Use of embedded finance and open banking is of the essence for the rise of the fintech super-application.

Another crucial player in the entire process is your app development firm. Hence, make sure you have the right partner for fintech app development services.

With that said, we have reached the end of this post. Hope all the information gives you a peek into fintech super apps.

Thanks for reading, good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.