Creating an investment platform is one of the most profitable ideas one can have when planning to enter the market.

That is because the ease of access to smartphones and the internet makes investing and the market highly accessible to every type of investor.

From novice to advanced investors, every type of user is interested in finding the right investment platform, which in turn offers a massive opportunity.

Wondering what opportunity we are talking about?

Well, businesses in the market can certainly capitalize on the rising demand in the market for a sophisticated platform by building an investment app.

There are several players in the market that are already thriving in the field, which certainly states that launching an investment platform of your own can be a lucrative decision.

In this post, let us take a look at the investment platform development process from every angle and identify core steps to build an investment platform while discussing all the crucial aspects related to it, such as cost, monetization strategies, and why it is a good idea to create an investment platform in the first place.

Without further ado, let’s get started!

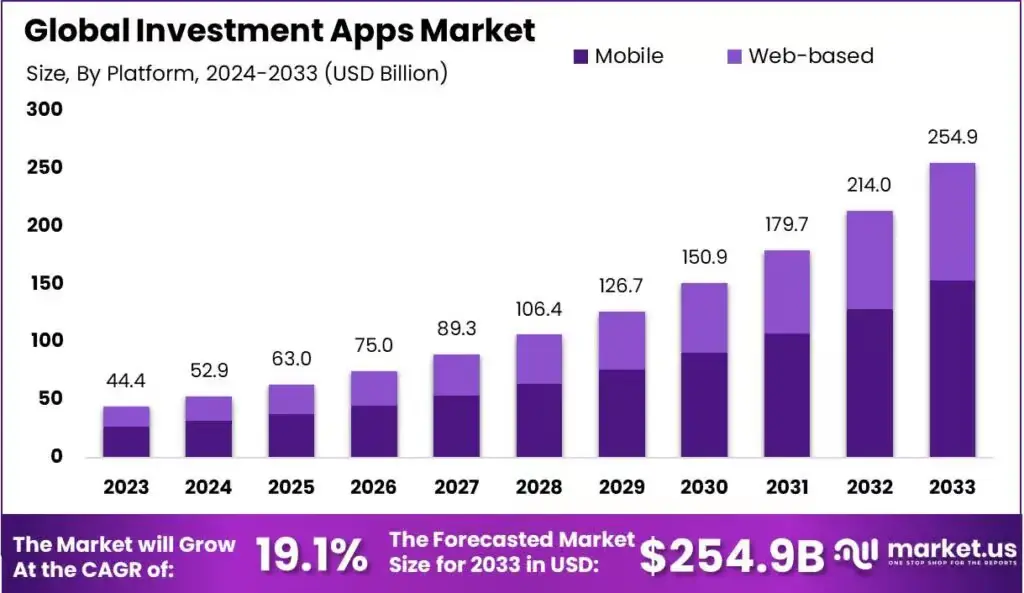

Insights into Investment Platform Business: Stats & Market Predictions

The fintech market for investment platforms and fintech applications is booming. The rise in the use of smartphones and increased reliance on online platforms has contributed to the growth of investment platforms as a whole.

If we talk specifically about online investment platforms, the growth has been nothing short of a joyride for the users. The industry for online investment platforms generated $2.08 billion in revenue in 2022 and is expected to reach $5.8 billion by 2030.

This means the market is set to grow at a CAGR of 13.9% between 2023-2030. Trading is one of the most viable integrations on an investment platform, which directly boosts the opportunities for investors.

The global market size for trading was valued at a solid $8.9 billion in 2021, expected to reach a whopping $18.4 billion by 2031, with a CAGR of 7.8%, which shows the stature of growth that comes along with the business.

People from across the globe, especially those who are connected with a fintech business in one way or another, are moving towards creating an investment platform of their own. Even for banks and financial institutions, offering trading and investment features has become a vital decision.

How Does an Investment Platform Work? Steps & Types

An investment platform is an online portal that can be accessed either through a website or a dedicated application, which allows users to check the current stock market status and invest accordingly.

An ideal investment platform offers different entities where users can invest their money. These entities include – Stocks, Bonds, Mutual funds, Cryptocurrencies, and more. However, some platforms focus on either of these entities individually.

If we talk about the way it works, every platform has a certain workflow and set of features that it offers.

The basic flow is as follows –

- A user registers on the platform by creating their profile. They will have to verify their email address/contact details to proceed. Generally, these platforms use KYC to verify user identities.

- Link your bank accounts or use different payment methods to fuel your investments and trades.

- Browse through the available investment options. Select the asset you wish to invest in and accordingly analyze the market trends.

- Once you are ready to invest, you can place your order for the quantity of stocks or any other desired entity.

- After the order is successfully placed, you can easily track it and its progress via portfolio management tools.

This is the flow that every investment platform follows. However, all of this can change depending on the type of investment platform you are using.

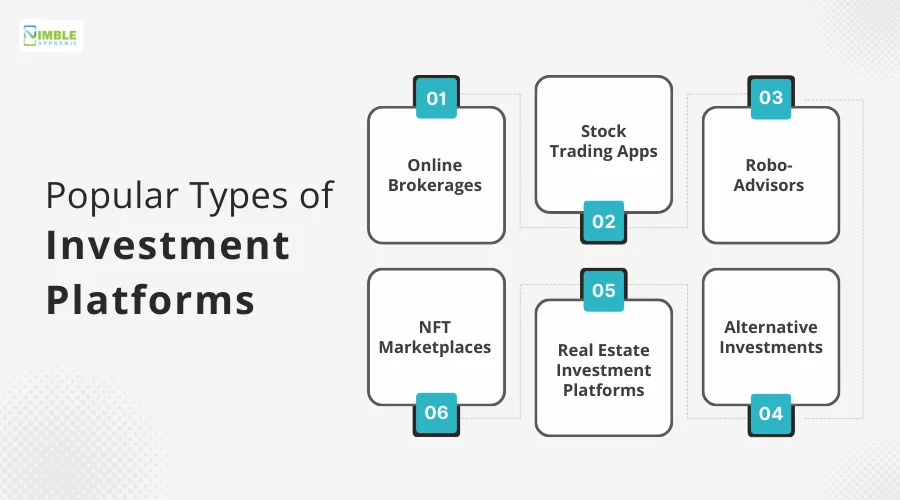

Popular Types of Investment Platforms

Here are some of the most popular types of investment platforms, categorized for clarity:

1. Online Brokerages

These platforms focus primarily on brokering your trades. These are reliable middlemen that can help you invest in stocks according to your profile and risk tolerance.

2. Stock Trading Apps

These are some of the most popular choices when it comes to investment platforms, as they allow a user to trade in stocks and other commodities directly. Insights about the trades are available to simplify the process for new users.

3. Robo-Advisors

These are automated investing accounts that use a dedicated algorithm to reduce human intervention and the margin of error.

With advanced robo-advisor platform solutions, they also become more cost-efficient and scalable for both businesses and investors.

4. NFT Marketplaces

With the help of these types of investment platforms, users can manage their digital assets like unique NFTs and more that they can later trade. These platforms are relatively new in the spectrum and are more appealing to people who are interested in investing in art and non-tangible assets.

5. Real Estate Investment Platforms

If you plan to invest in real estate, there are dedicated platforms that can help you do the same. Real estate investment platforms allow you to understand the market closely as it has some serious insights that can help in the long run.

To manage these insights effectively and handle investor communications, many firms leverage skilled virtual professionals. Platforms like Virtual Latinos provide real estate virtual assistants who support data management, reporting, and client coordination.

6. Alternative Investments

These platforms cover trading and investment options that are other than equities, bonds, and other traditional investing options. It generally offers access to hedge funds, private equity, and other private commodities.

Knowing the types, you can easily identify what type of investment platform you want to build.

Some apps often combine multiple platforms in one to target a wider audience. Keep in mind that you need dedicated experts to help you build the desired type of investment platform, as the process requires the necessary expertise.

Features of an Ideal Investment Platform

What helps the current collection of investment platforms stand apart from each other is the collection of features that they offer.

Features play a crucial role in the overall user experience. It makes the entire platform more valuable and attracts a lot of new users to it.

Some of the features that are available in every investment platform include –

| Investment Platform Features | |

| 1. Onboarding & Credentials | 11. Transaction Management |

| 2. User Profile | 12. Advanced Charting Tools |

| 3. Customer Support | 13. Educational Resources |

| 4. Portfolio Tracking and Reporting | 14. Mobile Compatibility |

| 5. Real-Time Market Data | 15. Order Execution and Management |

| 6. Secure Account Management | 16. Diverse Investment Options |

| 7. AI-Based Predictions | 17. User-Friendly Interface |

| 8. Payment Gateway | 18. Real-time Analytics |

| 9. ROI Calculator | 19. Feed & Notifications |

| 10. Investment Insights | 20. Financial Integrations |

All these features, along with integrated sets of data-fetched fintech APIs, build an investment app that is reliable and convenient for the user.

All of these features, when combined, can surely create an application that enables a user to invest and trade on the platform easily.

However, it is not an easy task to combine them all and build a platform.

Let’s take a closer look at the entire process of building a platform and what it takes to power a well-built investment platform.

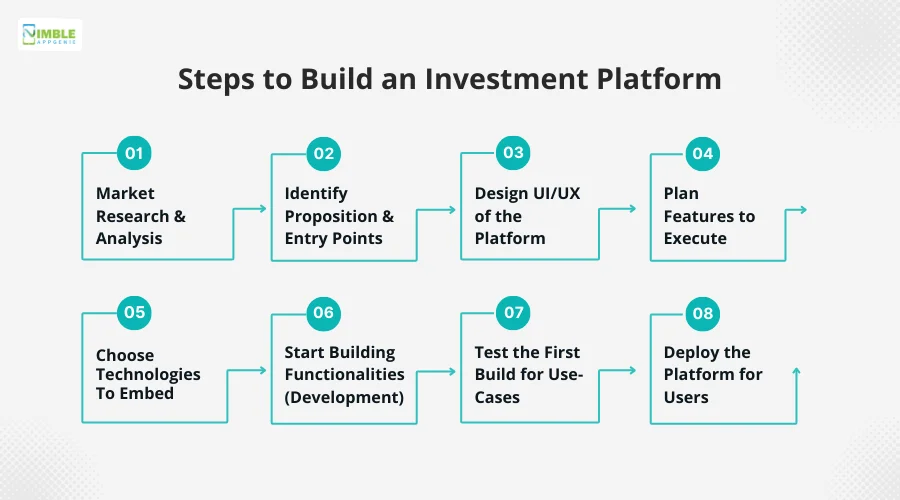

Steps to Create an Investment Platform

For investment platform development, you need to follow a series of steps.

Check them out below –

Step 1 – Market Research & Analysis

Before you start building an investment platform of your own, you must understand the dynamics of the market. What are the demands, and what makes a good investment platform? What does a user need? etc.

Step 2 – Identify Proposition & Entry Points

Once you have understood the market, identify the gaps in the currently available platforms in the market and find ways that help you build a better investment solution for the masses.

The deeper you research, the more insights you explore. This helps you understand your value proposition, giving you an entry point in the already cluttered market.

Step 3 – Design UI/UX of the Platform

With an understanding of the market and a unique value proposition, it is now time to focus on designing the basic user experience and interface for your investment platform.

To create an investment platform, you need to understand the target market. The majority of your users will likely be first-timers.

This means your app should offer ease of access to users who want to step into investing and trading but are not professionals.

Step 4 – Plan Features to Execute

After you have designed the flow of your application, you need to plan what functionalities you want to offer. These features are key factors that drive a user towards your app. Choose the features of your investment platform wisely, as they can certainly make or break your value proposition.

Step 5 – Choose Technologies To Embed

To power the features that you have chosen in the previous step, you need certain aligning technologies.

Choose a fintech tech stack that not only supports your vision but is also scalable in the long run. Usually, people make the mistake of choosing the latest technologies over reliable ones.

While the latest technologies can surely give your app an advantage of the latest features, it can often become difficult to manage them in the long run.

Step 6 – Start Building Functionalities (Development)

This is the step where the developers start building your application. All the functionalities are built from scratch to ensure that they meet your expectations.

The development process is the most time-consuming step of the entire investment app development process.

However, you should let the developers take their time as the more time they spend on the functionalities, the better they turn out to be!

Step 7 – Test the First Build for Use-Cases

When the developers are done building the functionalities, the very first build of the platform is generated and shared with the testing professionals.

These are highly qualified quality assurance experts who run the app in different environments and check for issues, bugs, and irregularities.

There are different test cases that they identify and test the application. This way, the application can be refined and made even smoother for the users.

Step 8 – Deploy the Platform to Users

This is the final step that allows the development team to bundle your platform and deploy it for the users.

While it may seem that releasing an application is as easy as uploading something to social media, it is not. It’s quite the opposite.

There are different platform guidelines, financial regulations & compliance, and other factors that you need to consider when deploying the final application and making it available to the masses.

As you might have understood, it is not easy to develop an investment platform if you do not have a clear understanding of what you want.

More importantly, you need professionals by your side to execute the entire development process.

All these steps are a necessity if you plan to create an investment platform of your own. These steps are best executed by professionals, and hence it is advised that you go for a service that has prior experience in developing a similar solution.

How Much Does it Cost to Create an Investment Platform?

All these steps are not cheap to complete. There are different types of costs to develop a fintech app involved in the entire process.

If you plan to develop a new investment platform of your own, it can cost you anywhere from $25,000 – $250,000, depending on various factors.

Here is a complete breakdown of the entire cost of creating a fintech app specifically for investments.

| Cost Category | Estimated Cost Range |

| 1. Market Research | $2,000 – $10,000 |

| 2. UI/UX Design | $5,000 – $20,000 |

| 3. Backend Development | $10,000 – $100,000 |

| 4. Frontend Development | $8,000 – $50,000 |

| 5. Security & Compliance | $5,000 – $25,000 |

| 6. Testing & Quality Assurance | $3,000 – $15,000 |

| 7. Cloud Hosting & Services | $500 – $5,000/month |

| 8. Third-Party Services | $1,000 – $10,000 |

| 9. Marketing & Launch | $5,000 – $50,000 |

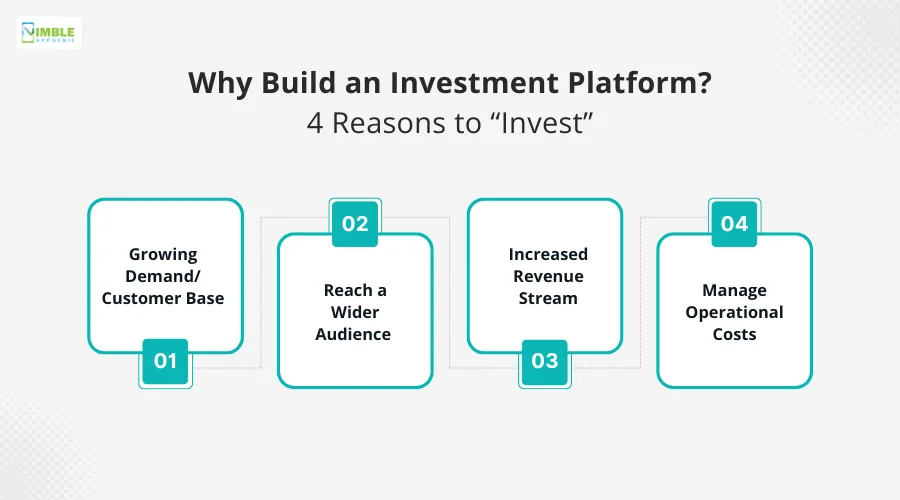

Why Create an Investment Platform? 4 Reasons to “Invest”

Looking at the complex process, cost of development, and level of expertise required to create an investment platform, you may be wondering how it will help.

Well, there are several reasons why building an online platform can prove to be vital for your business.

Here are some reasons why you should invest in a platform –

Reason #1 – Growing Demand/Customer Base

With the rise of social media and smartphones, people have become more aware of investing and the benefits that it offers.

With investment platforms becoming easily accessible, more and more users are inclined to invest, which simply means not only is the demand for investment platforms is growing, but you can also expect the customer base to grow exponentially in the upcoming years.

This presents an opportunity for people who are looking to enter a fruitful market.

Reason #2 – Reach a Wider Audience

If you are already in the finance sector and struggling to expand your business, it can be vital to build an online investment platform as it can easily help you reach a wider audience.

When you are working offline or have clients from a particular locality, your visibility is limited to other regions.

However, with an online presence and a solution for users that is accessible to all, you can surely convert more clients and reach more people.

Reason #3 – Increased Revenue Stream

It can be expensive to build an investment platform. However, it can surely earn back all your investment as it opens a new stream of revenue for your financial institution.

You can not only gain new clients but can also monetize the services that you offer on your platform.

This way, you have an added income, making it more interesting to pursue. You can easily make more money by investing a little in developing an investment platform of your own.

Reason #4 – Manage Operational Costs

The operating and resource costs of any financial institution are significantly higher than in any other business. That is because it takes a lot of staff, infrastructure, and manual interventions.

However, when you have an online platform, many manual processes, such as onboarding a client, collecting the details, processing their payments, etc., are automated, making them more efficient while maintaining high accuracy of operations and payments.

All these reasons, along with the sheer motivation that comes with having a lot of users on your side, help you identify the core reasons why people tend to create an investment platform of their own.

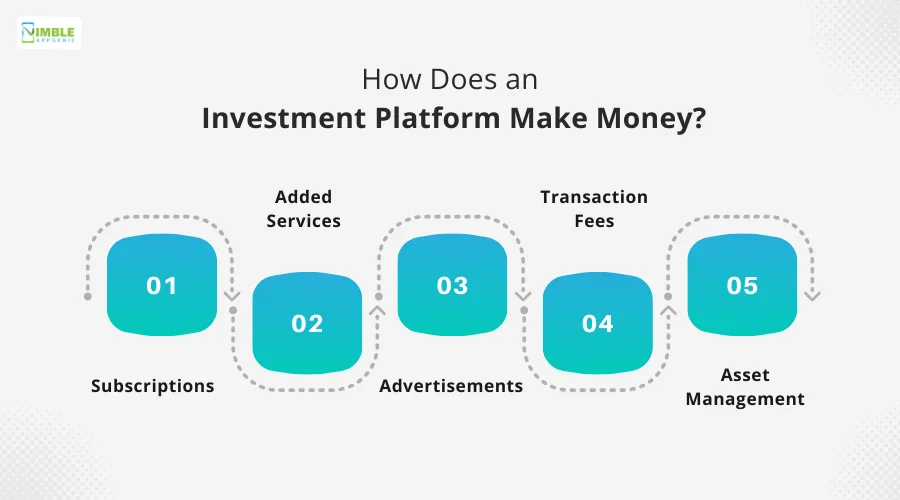

How Does an Investment Platform Make Money?

The majority of legacy investment bankers, firms, and advisors are moving towards an investment platform in search of better earnings and revenue.

Not only does an investment platform boost your reach to a wider user base, but it also contributes to your net revenue. But how?

Well, different fintech app monetization strategies can be integrated into an investment platform. These include –

1. Subscriptions

You can offer subscriptions for added perks to the users of your platform. These perks can include priority access to stock, better customer support, predictive analytics, and more.

2. Added Services

You can introduce several add-ons to your platform that help a user get more insights. They can help connect them with investing experts to guide them, financial consulting, and more, in exchange for a fee.

3. Advertisements

For any application that has a significant number of users, advertisements offer a great way to make money. You can even opt for affiliate advertising for better returns.

4. Transaction Fees

With an integrated payment gateway, you can simplify investing directly for the user, and to facilitate these transactions, you can charge a minimal fee. Based on the number of transactions you have, you can easily generate a substantial income.

5. Asset Management

Offering to manage the assets of your users can also help you generate revenue. It is a widely popular practice for investment platforms and is a great way to monetize them.

Other than these, value-added services, interest on cash balances, and internal product partnerships also play crucial roles in the overall monetization of the app.

Keep in mind that to make money with an investment platform, you need high volumes of users to be active on your platform. This means the quality of the tech and experts you use plays a crucial role.

Popular Investment Platforms & Their USPs

To help you understand how these work, here are some apps that are a testament to the idea of investment platforms –

► Charles Schwab

One of the most popular investment platforms, Charles Schwab, has been around for a while now and offers some significantly useful tools for investing and educating yourself to make better choices.

USPs of Charles Schwab:

- Low Fees: The app offers great investment options and charges a minimal fee on every transaction done through the app.

- Extensive Research: The platform offers a pool of educational resources that a user can use to learn more about investing, helping novice users.

- Suitable for all investors: Caters to all types of users from professionals to beginners.

► Fidelity Investments

Fidelity Investments is one of the few platforms that offers commission-free stock and ETF trades,s, making it easier for new investors to try investing without having to pay additional commissions.

- Zero-Commission Trades: The no-commission policy of the application is the biggest USP that makes it popular among users.

- Fractional Shares: The platform allows investors to go for fractions of a share, reducing their investment and at the same time making them a part of the trade. This lets all types of users invest even with a small amount.

- Research Resources: The app is also user-friendly as it offers several resources for those who want to learn more about the market and how investment platforms work.

► Vanguard

Renowned for its low-cost index funds and ETFs, Vanguard is a favorite among long-term investors. They are popular for:

- Low-Cost Funds: Offers a large selection of index funds and ETFs with exceptionally low expense ratios.

- Long-Term Focus: Encourages a buy-and-hold investment strategy through their low-cost index funds.

- Investor Education: Provides a variety of educational resources to help investors make informed decisions.

► TD Ameritrade

A popular choice for active traders, TD Ameritrade offers a powerful trading platform with advanced tools and features. They are popular for:

- Advanced Platform: Offers a robust trading platform with technical analysis tools, charting capabilities, and options trading features.

- Margin Trading: Allows experienced investors to borrow money to amplify their returns (and risks).

- Educational Resources: Provides educational content geared towards active traders.

► E*Trade

A user-friendly platform with a focus on mobile investing, E*Trade is a good option for beginners and casual investors. They are popular for:

- Mobile App: Offers a user-friendly mobile app for easy on-the-go investing.

- Easy to Use Platform: Designed with a simple and intuitive interface, making it attractive to beginners.

- Promotions and Bonuses: Often offers promotions and bonuses to attract new investors.

► Interactive Brokers

A platform geared towards experienced investors, Interactive Brokers offers a wide range of investment products and global market access. They are popular for:

- Global Investing: Provides access to a wide variety of investment products in international markets.

- Advanced Order Types: Offers a variety of advanced order types for sophisticated trading strategies.

- Lower Commissions: Generally have lower commissions compared to other brokers, especially for high-volume trading.

► M1 Finance

A unique platform that allows investors to build and automate custom investment portfolios. They are popular for:

- Automated Investing: Enables investors to create personalized investment portfolios and automate their contributions and rebalancing.

- Fractional Shares: Allows buying fractional shares of stocks, making expensive stocks more accessible for all investors.

- Low Account Minimums: Requires a low minimum balance to get started, making it attractive to new investors.

► SoFi Invest

A mobile-first platform offering commission-free stock and ETF trading, SoFi Invest is a good option for millennials and mobile-savvy investors. They are popular for:

- Millennial Focus: Caters to millennial investors with a user-friendly mobile app and an emphasis on thematic investing.

- Commission-Free Trading: Offers commission-free stock and ETF trades, making it cost-effective for beginners.

- Cryptocurrency Trading: Allows buying and selling a limited selection of cryptocurrencies.

► Betterment

A robo-advisor platform that provides automated investing services, Betterment is a good option for hands-off investors. They are popular for:

- Automated Investing: Creates and manages diversified investment portfolios based on your risk tolerance and financial goals.

- Low fees: Charges a low annual management fee based on your account assets.

- Hands-off approach: A good option for those looking for automation in investing.

► Wealthfront

Another robo-advisor platform, Wealthfront, offers automated investing with a focus on tax efficiency. They are popular for:

- Tax-Optimized Investing: Uses tax-efficient investment strategies to minimize your tax burden.

- Financial Planning Tools: Provides access to financial planning tools and calculators.

- High Minimum Investment: Requires a higher minimum investment compared to other robo-advisors, catering to investors with more capital

With almost every type of investment platform making profits and giving outstanding returns to the organization, people are highly interested in building an investment platform of their own.

There are hardly any issues that users of these platforms face, thanks to a robust platform designed by experts.

How Can Nimble AppGenie Help You Create an Investment Platform?

Reading here might have gotten you interested in building your own investment platform. If you plan to replicate the success of the aforementioned popular platforms then the first thing you need to do is find a fintech app development services that aligns with your idea, understands the intricacies of your vision, and helps you build a solid investment platform.

With decades of experience and highly qualified developers, Nimble AppGenie offers the finest development services that not only can customize things as per requirements but also take the initiative to guide you through the process.

You can easily connect with our developers and share your vision related to how you want your investment platform to be, and they will surely bring it to life. Connect today and let them take the matter into their own hands!

Conclusion

The idea of investment platform development as a business can certainly yield better profits in the long run.

The market is ripe and users are highly involved in managing their investments by themselves. This makes it just the right time to invest in an app of your own.

If we talk about the development cost of an investment platform, it certainly depends on your vision and the partner that you find for the job.

The features and the capabilities of an investment app is a territory that is yet to be explored and if all goes well, your investment platform has the potential to skyrocket.

However, it is crucial today that you make your move and hire an investment app development company that can help you bring your idea to life.

With that said, we have reached the end of this guide. Hope it gives you all the necessary information and helps you create an investment platform of your own.

Thanks for reading, good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.