In today’s fast-paced digital world, developing a seamless and efficient payment app is a top priority for many businesses and startups. INTERAC is a prime example of such an app, known for its secure and reliable payment processing.

But how much does it cost to develop an app like INTERAC?

On average, the cost to develop an app like INTERAC can range from $50,000 to $150,000.

The wide range depends on various factors such as app complexity, features, development team location, and more.

In this blog, we will dive deep into the specifics of what it takes to build an app like INTERAC, including the cost breakdown, essential features, and tips to minimize expenses while maintaining quality.

Stay with us as we explore the cost of developing an app like INTERAC, its key features, and much more to help you make informed decisions about your investment.

What is INTERAC?

INTERAC is a Canadian interbank network that facilitates electronic financial transactions, including instant fund transfers, direct payments, and online payments.

Established in 1984, INTERAC has become an integral part of Canada’s financial ecosystem, enabling secure and efficient transactions across various platforms.

Core Functions of INTERACT:

- INTERAC e-Transfer: This service allows users to send money directly from one bank account to another using email or mobile numbers. It’s widely used for person-to-person and business transactions due to its convenience and speed.

- INTERAC Debit: This feature enables users to make purchases directly from their bank accounts using a debit card at point-of-sale terminals. It’s accepted nationwide and offers a secure alternative to carrying cash.

- INTERAC Online: A service that allows users to pay for goods and services online directly from their bank accounts without using credit cards. This service emphasizes security by leveraging bank-grade authentication processes.

INTERAC’s ability to offer secure, fast, and convenient transactions has made it a trusted name in the Canadian financial landscape.

Its continuous innovation and commitment to security ensures that it remains a preferred choice for digital payments and transfers.

Top Features of INTERAC App

When you’re developing an app like INTERAC, incorporating robust fintech app features ensures a seamless and secure user experience.

Here’s a breakdown of the essential features you should include:

♦ INTERAC e-Transfer

The feature allows users to send and receive money directly from their bank accounts using an email address or mobile number. It’s quick and convenient, with transactions typically completed within minutes.

♦ Mobile Payments

Support mobile payment technology, allowing users to make secure payments using their smartphones. Enhance this feature with tokenization, replacing sensitive card information with a unique identifier to increase security.

♦ INTERAC Debit

Includes a feature that lets users make purchases directly from their bank accounts using a debit card at point-of-sale terminals. It is widely accepted across Canada and offers a secure alternative to carrying cash.

♦ INTERAC Online

Facilitate online payments directly from users’ bank accounts without needing a credit card. This feature leverages bank-grade authentication processes to ensure secure transactions that can build trust with your users.

♦ Enhanced Security

Implement multiple layers of security, such as encryption, real-time fraud detection, and EMV chip technology. These measures are crucial to protect user transactions from unauthorized access and fraudulent activity.

♦ Automated Clearing and Settlement

Facilitate the clearing and settlement of transactions in a reliable and timely manner. This ensures that funds are accurately transferred and recorded between financial institutions.

♦ Fraud Prevention

Employ advanced fraud detection systems that monitor transactions in real-time. This helps in flagging and investigating any suspicious activity, preventing fraudulent transactions and ensuring user trust.

♦ User-Friendly Interface

Focus on creating a user-friendly interface that makes it easy for users to navigate and perform transactions. A simple and intuitive design can significantly enhance the user experience and encourage app usage.

♦ Contactless Payments

Offer quick and secure contactless payments using debit cards or mobile devices. This is especially useful for small transactions and can significantly enhance user convenience.

♦ Interbank Network

Provide a robust interbank network that supports seamless transactions between different financial institutions. This ensures users can send and receive money across various banks efficiently.

By integrating these features, you can create a comprehensive, secure, and user-friendly financial solution that meets the diverse needs of your users.

Why Develop an App Like INTERAC?

Do you want to develop an app like INTERAC?

Well, one of the big questions that comes here, bigger than even that of INTERAC app development cost is “Should you develop such an app?”

Starting a fintech startup can be a daunting task.

However, there are more than enough reasons to do so. Let’s look at some of them below:

1. High Demand for Secure Payment Solutions

With the increasing prevalence of digital transactions, there is a growing demand for secure and reliable payment solutions.

INTERAC is trusted for its robust security measures, making it a model for developing similar apps.

Businesses can tap into this demand by offering a secure payment app that ensures customer trust and satisfaction.

2. Expanding the Digital Payment Market

The digital payment market is expanding rapidly, with significant growth projections for the coming years.

According to recent statistics, the global digital payments market is expected to reach $8.26 trillion by 2027.

Developing an app like INTERAC positions businesses to capitalize on this lucrative market, attracting a wide user base.

3. Enhanced User Convenience

INTERAC-like apps offer unparalleled convenience for users, enabling quick and easy transactions.

eWallet features such as instant fund transfers, low transaction fees, and user-friendly interfaces enhance the user experience.

Providing such convenience can drive user adoption and retention, ensuring a steady stream of revenue.

4. Competitive Advantage

Launching an app with features similar to INTERAC can give businesses a competitive edge in the market.

Such an app can differentiate a company from competitors by offering unique and advanced features.

Staying ahead in technology and security can help businesses attract and retain more customers.

5. Revenue Potential

Monetizing an app through various strategies can yield significant revenue.

These strategies include transaction fees, premium features, and partnerships with financial institutions.

By leveraging these monetization methods, businesses can achieve a high return on investment, making the development of an INTERAC-like app a profitable endeavor.

Average Cost to Develop an App Like INTERAC

Developing an app like INTERAC involves various factors that contribute to the overall cost. On average, the cost to develop an app like INTERAC ranges between $50,000 and $150,000.

This estimate can vary based on several key factors such as the complexity of features, the development team’s location, and the technology stack used.

| Development Phase | Estimated Cost Range |

| 1. Planning and Research | $5,000 – $10,000 |

| 2. UI/UX Design | $10,000 – $20,000 |

| 3. Frontend and Backend Development | $20,000 – $70,000 |

| 4. Quality Assurance and Testing | $5,000 – $15,000 |

| 5. Deployment and Maintenance | $10,000 – $35,000 |

The initial planning and research phase involves understanding the market, defining user requirements, and creating a roadmap for development.

The UI/UX design phase focuses on creating an intuitive and visually appealing interface. Frontend and backend development involves coding the app’s functionalities and integrating the necessary features.

Quality assurance ensures the app is free from bugs and runs smoothly. Finally, deployment and maintenance cover launching the app and ongoing support.

Each phase is crucial in determining the total cost to develop a fintech app, and careful planning can help manage the budget effectively.

Factors That Affect INTERAC Clone Development Cost

Developing an app like INTERAC involves multiple factors that significantly impact the overall mobile app development cost.

Understanding these factors can help in budgeting and planning for the project. Here are the major factors that affect the INTERAC clone development cost:

► App Complexity

The complexity of the app is a major cost determinant.

The features and functionalities you choose to include can drastically influence the INTERAC like app development cost.

Basic features like user authentication, simple fund transfers, and transaction history are less costly to develop.

In contrast, advanced features such as instant notifications, multi-currency support, AI-powered fraud detection, and integration with other financial services increase both INTERAC app development time and cost due to their complexity and the need for sophisticated technology.

| Feature Level | Description | Estimated Cost Range |

| Basic | User authentication, simple fund transfers, transaction history | $30,000 – $50,000 |

| Advanced | Instant notifications, multi-currency support, AI-powered fraud detection, integration with financial services, and advanced security measures | $70,000 – $100,000 |

► Development Team Location

It’s time to hire mobile app developers.

The geographical location of your development team greatly influences the cost of making an app like INTERAC.

Cost to hire app developers varies widely across different regions due to the cost of living and average salary standards.

For instance, hiring developers in North America or Europe tends to be more expensive compared to Asia.

However, regions with lower rates might come with potential challenges such as time zone differences and communication barriers, which can impact the overall efficiency of the development process.

| Location | Hourly Rate | Pros and Cons |

| North America | $100 – $200 | High-quality work, fluent communication, familiarity with latest technologies; higher costs. |

| Europe | $50 – $100 | Good balance of quality and cost; strong technical expertise; time zone differences. |

| Asia | $20 – $50 | Lower cost, large pool of skilled developers; potential communication barriers, varying quality standards. |

► Technology Stack

The choice of fintech technology stack also plays a critical role in determining the cost of INTERAC clone.

Basic technologies like HTML, CSS, JavaScript, and MySQL are cost-effective and suitable for simpler apps.

However, for better performance and scalability, modern technologies like React Native for cross-platform development, Node.js for backend, and MongoDB for database management are preferred.

These advanced technologies, while offering superior performance, require specialized expertise and thus come at a higher cost.

| Technology Stack | Description | Estimated Cost Range |

| Basic | HTML, CSS, JavaScript, MySQL | $40,000 – $60,000 |

| Advanced | React Native, Node.js, MongoDB | $60,000 – $90,000 |

► App Design

The design of your fintech app is crucial in attracting and retaining users.

A well-designed app with a custom user interface (UI) and user experience (UX) can significantly enhance user satisfaction and engagement.

Basic designs with standard elements are less costly but may not stand out in a competitive market.

In contrast, advanced designs that include custom UI/UX, high interactivity, and responsive elements optimized for various devices and screen sizes involve higher costs due to the increased time and skill required.

Speaking of which, here’s a breakdown of UI/UX design cost:

| Design Level | Description | Estimated Cost Range |

| Basic | Simple UI/UX, limited customization | $10,000 – $20,000 |

| Advanced | Custom UI/UX, high interactivity, responsive design | $20,000 – $40,000 |

► Development Timeframe

The time allocated for developing the app also affects the cost to build an app like INTERAC.

A shorter timeframe might require more developers to work simultaneously, which increases the cost.

Conversely, a longer timeframe might reduce immediate expenses but can delay the launch and potential revenue generation.

Balancing your fintech development time and the number of resources is key to managing costs effectively.

| Timeframe | Description | Estimated Cost Impact |

| Short | More developers working simultaneously | +20% – +40% |

| Standard | Balanced approach with optimal resources | Standard cost |

| Extended | Fewer developers, slower progress | -10% – -20% |

► Third-Party Integrations

Integrating third-party services like payment gateways, identity verification, and security protocols can add to the INTERAC clone development cost.

These integrations often require licensing fees and additional development time to ensure seamless functionality within the app.

The more integrations required, the higher the overall cost will be.

| Integration Type | Description | Estimated Cost Range |

| Basic | Simple payment gateway and basic API integrations | $5,000 – $15,000 |

| Advanced | Multiple payment gateways, advanced security protocols, and extensive API integrations | $20,000 – $40,000 |

► Maintenance and Updates

Post-launch maintenance services and regular updates are essential to keep the app functioning smoothly and securely.

These ongoing services involve fixing bugs, updating software to the latest versions, and adding new features based on user feedback.

App maintenance costs can vary depending on the complexity of the app and the frequency of updates required.

| Maintenance Level | Description | Estimated Cost Range (Annual) |

| Basic | Bug fixes, minor updates | $5,000 – $10,000 |

| Advanced | Regular updates, new features, comprehensive support | $15,000 – $30,000 |

► Security Measures

Implementing robust security measures is critical for a payment app like INTERAC.

Advanced security features such as encryption, two-factor authentication, and real-time fraud detection systems ensure user data protection but add to the cost to create INTERAC app.

The more sophisticated the security measures, the higher the development and maintenance costs.

| Security Level | Description | Estimated Cost Range |

| Basic | Standard encryption, basic authentication | $10,000 – $20,000 |

| Advanced | Enhanced encryption, two-factor authentication, real-time fraud detection | $30,000 – $50,000 |

► Marketing and Launch

Finally, the cost of mobile app marketing and launching the app should not be overlooked.

A well-planned marketing strategy is essential to attract users and create a strong market presence.

This includes costs for advertising, promotions, and possibly partnerships with other businesses to enhance visibility.

An effective launch can significantly impact the app’s success and user acquisition.

| Marketing Level | Description | Estimated Cost Range |

| Basic | Online advertising and social media promotions | $5,000 – $15,000 |

| Advanced | Comprehensive marketing campaign, partnerships, extensive advertising | $20,000 – $50,000 |

Each of these factors plays a significant role in determining the total cost to develop an app like INTERAC. Careful planning and prioritization can help manage the budget effectively while ensuring a high-quality product.

How Long Does It Take to Develop an INTERAC-Like App?

The time required to develop an app like INTERAC can vary significantly depending on several factors such as the app’s complexity, the development team’s expertise, and the availability of resources.

Generally, the development process can be broken down into several phases, each contributing to the total time required.

| Development Phase | Time Estimate (Weeks) |

| 1. Planning and Research | 2 – 4 |

| 2. UI/UX Design | 4 – 6 |

| 3. Frontend and Backend Development | 12 – 20 |

| 4. Quality Assurance and Testing | 4 – 6 |

| 5. Deployment and Launch | 2 – 4 |

| Total Time Estimate | 24 – 40 |

Overall, the development of an app like INTERAC can take anywhere from 24 to 40 weeks, depending on the specifics of the project.

This timeline can be shortened or extended based on the project’s requirements and resources available.

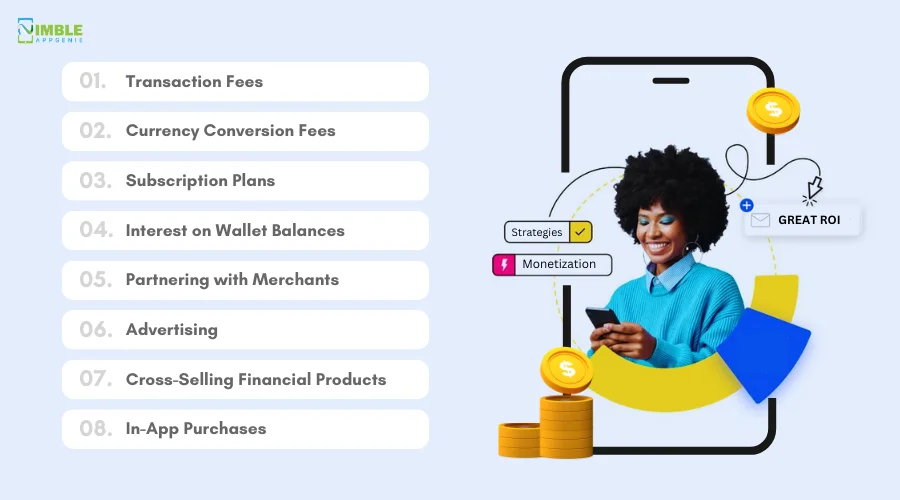

Monetization Strategies for Great ROI

Developing an app like INTERAC is just the first step; ensuring it generates a significant return on investment (ROI) is crucial for long-term success.

Here are some detailed monetization strategies for a financial app that can help you achieve a great ROI:

1] Transaction Fees

Charging a small fee for each transaction processed through the app is a direct and reliable revenue stream. This method is particularly effective for payment apps where a high volume of transactions occurs daily.

- Example: If your app processes 10,000 transactions per day and you charge $0.50 per transaction, this translates to $5,000 in daily revenue.

- User Impact: Ensure transaction fees are competitive and provide value to users, such as lower fees compared to traditional banking methods.

2] Premium Features

Offering advanced features or services as part of a premium subscription model can attract users willing to pay for enhanced functionalities.

- Examples of Premium Features:

- Advanced Security Options: Enhanced encryption and fraud detection.

- Priority Support: Faster customer service responses for premium users.

- Exclusive Financial Tools: Budgeting tools, detailed analytics, and investment advice.

- Subscription Tiers: Create different subscription levels (e.g., Basic, Pro, Enterprise) to cater to various user needs and budgets.

- Revenue Potential: Subscriptions provide a steady stream of revenue and can increase user loyalty.

3] Advertisements

Displaying relevant advertisements within the app can generate income based on ad impressions or clicks. This strategy works best when the ads are non-intrusive and add value to the user experience.

- Ad Types:

- Banner Ads: Placed at the top or bottom of the app interface.

- Interstitial Ads: Full-screen ads that appear at natural transition points, such as after completing a transaction.

- Native Ads: Integrated seamlessly into the app content, making it less intrusive.

- Partnerships: Collaborate with advertisers who offer financial products or services related to your app to ensure relevance and higher engagement rates.

4] Partnerships with Financial Institutions

Collaborating with banks and other financial institutions can open new revenue streams. These partnerships can provide mutual benefits, such as offering exclusive services to users and sharing revenue from new customer acquisitions.

- Example: A partnership with a bank could involve your app being the preferred payment method for the bank’s customers, with a share of the transaction fees going to your app.

- Additional Benefits: Enhanced credibility and trust among users, as well as access to a larger user base through the bank’s customer network.

5] Data Analytics Services

Offering anonymized user data and analytics to businesses for market research can be a lucrative monetization strategy. This approach must ensure compliance with data privacy regulations to maintain user trust.

- Types of Data: Transaction patterns, user demographics, spending behaviors.

- Potential Clients: Financial institutions, market researchers, and retail businesses interested in understanding consumer behavior.

- Revenue Model: Charge for access to detailed reports or offer subscription-based access to real-time analytics.

Each of these strategies can contribute to a robust revenue model for your INTERAC-like app. By diversifying your income sources and offering value to both users and partners, you can maximize ROI and ensure the long-term success of your app.

Nimble AppGenie – Your Partner in App Development

As a leading fintech app development company, Nimble AppGenie excels in creating innovative, secure, and user-friendly financial applications.

Our expert team leverages cutting-edge technology and industry best practices to deliver top-notch apps that enhance user experience and ensure seamless financial transactions.

Whether you’re looking to develop an app like INTERAC or any other digital wallet, our comprehensive services cover everything from conceptualization and design to development and maintenance.

Our global presence, with teams in Asia, Europe, and North America, ensures that we provide round-the-clock innovation and support.

We are committed to driving your fintech success and helping you achieve your business goals with a reliable and robust eWallet solution.

Conclusion

Developing an app like INTERAC offers significant opportunities in the rapidly growing digital payment landscape. By understanding the costs, essential features, and effective monetization strategies, you can create a robust, user-friendly, and profitable eWallet solution.

Partnering with an experienced app development company like Nimble AppGenie ensures that your project is handled with expertise and precision, paving the way for your success in the competitive fintech market.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.