Goodbudget has been on the market since 2009 and has been a helpful tool for many consumers. In this blog, you will read the Success Story of the Goodbudget App and everything about the Good Budget app.

If you like managing monthly budgeting, an app like Goodbudget helps you organize your expenses. The app offers free and paid services that allow you to budget for free and get better services. After all, a budgeting app can handle all our cash more effectively than us.

Moreover, budgeting needs discipline and accountability so that you spend on entertainment and other things wisely. Of course, there are many ways a budget can go wrong, but you must understand that it’s just a trial-and-error method until you find the right set.

Budgeting is a crucial task, especially when you are managing your entire financial plan by yourself. Several budgeting apps not only help you stay on track, but also help you meet your financial goals by staying organized.

However, several apps in the market offer unique services, perks, and advantages. However, if you are looking for new philosophies and tools, we recommend the Goodbudget app. It has a 4.4 Google Play Store rating and features like viewing your budget across multiple devices.

Let’s go

The Success Story of Goodbudget App

Budgeting has long been a challenge for common people. Big firms, companies, and millionaires can hire accountants, but how does an everyday person manage their finances?

Well, this was a question many people used to ask until it was answered by Goodbudget.

Brought to market as an experiment by Dayspring Technologies, a San Francisco-based web and mobile development firm, in 2009, Goodbudget soon became much more than that.

The product was designed to create “virtual envelopes,” but it offered much more. Features like checkbook reconciliation, accounts, and recurring transactions were later added to the platform.

This envelope-style budgeting platform is an example of a true personal finance manager app. The company truly listens to its customers as well.

A decade and three years later, this platform has become a way for students, workers, and others to save more and spend wisely.

Leading the market and improving everyday budgeting The Goodbudget Way, this platform stands firm on its philosophy and beliefs.

As a result, this platform generates millions in revenue and inspires people worldwide to save more using a money manager app, expense tracker app, or budget planner app approach.

The success story of the Goodbudget app is remarkable. But it isn’t over yet. The platform continues to grow and improve.

With this inspiring success story in mind, let’s explore more about the best home budget planning app and bill tracker app for Android and iOS.

What is The GoodBudget App? All You Need To Know

Well, you know the success story of the GoodBudget app; now it’s time to learn more about the platform.

GoodBudget is an envelope-based budgeting app that allows users to manage and build their budgets – in fact, it’s one of the best budgeting apps on the market.

The envelope method is a tried and true approach to money management that involves placing money in a collection of envelopes for different spending categories.

When you get paid, you can put the amount of money in each envelope. If you accidentally go over the budget, you will add more cash to the envelope. And yes, there is a psychological aspect to this method.

The major difference between GoodBudget and other apps is that you need help connecting your financial accounts and can import transactions directly. Instead, you’ll have to update your transactions from each account manually. Thus, it doubles as a financial literacy app too.

However, you can consider this approach if you have simple finances and have few financial accounts. So don’t go with this app if you have more accounts; it will take longer to update transactions manually.

It has a free version with 20 envelopes, but you can only get a budgeting history for one year and share one account with two devices. Plus, if you have premium access to the GoodBudget app, you’ll get unlimited access to envelopes and accounts on up to five devices. It can cost you around $7 per month and $60 yearly.

Overall, this is a fine fintech app. It is inspiring many other people to make their own on-demand apps.

Also, let’s answer some big questions about the platform:

Q. What are the Security Features of GoodBudget?

It uses 256-bit bank-grade encryption to protect your personal information, and the app doesn’t share your data with other parties. In addition, GoodBudget doesn’t connect to your financial account, so you don’t have to worry about thefts and identity leaks.

Q. GoodBudget App Review, Rating and Availability

GoodBudget app is available on Android and iOS and available on desktop browsers. It has a 4.7-star rating of more than 12,600 reviews on the Apple App Store and a 4.4-star rating of 19,080 reviews on the Google Play Store.

Why are Apps Like Goodbudget Popular?

Well, there are various reasons behind the popularity of GoodBudget app and the story of the GoodBudget app is definitely one of them.

Nevertheless, apart from this, there are some major benefits it offers and why people love it. Therefore, let’s look at some big reasons why everyone loves it:

1. Unique Approach to Budgeting

The story of the Goodbudget app also shows a glimpse into its unique approach to budgeting. And that is one of the reasons behind its popularity.

You see, there are a lot of top fintech apps in the market that help with budgeting, but there are only a few like this one. We shall discuss its work more in the blog’s next section.

2. Easy To Use

One big thing that makes an app successful is its features, front-end, and user interaction. And when it comes to GoodBudget, this platform is very easy to use.

It’s not an overly boring app, mind you, but a very elegant one. It has just the right features and design elements to help users reach their goals.

3. Effective, Very Effective

Well, well, this platform as a budgeting app is very effective. And that is probably an understatement.

The reason is that it owes its success story to its effectiveness which attracts users from across the web. These are some of the reasons behind the popularity of this platform. Now, it is time to look at how it works.

How Does GoodBudget Work?

GoodBudget introduced the envelope budget system tradition, which is a simple approach to budgeting. Its virtual budget program helps you stay on track with friends and family with the time-tested envelope budgeting method.

Here are some points that will help you understand how GoodBudget works:

- It divides expenses into different categories, which completely depend on the individual. For example, it can include self-care, bills, shopping, groceries, etc. This way, you can budget all your money and choose three or more categories you are likely to overspend on. You can add more categories when you get comfortable growing with the app.

- Choose the specific amount you want to spend in each category and set a spending limit for the month. The offline envelopes app will allow you to fill each envelope with whatever amount you plan to put in. You can withdraw half the amount and plan to put that amount in the envelope.

- After spending the money, the cash will decrease proportionately, allowing you to track the exact amount that you are spending. You’ll also have the option to add other envelopes, which you can use to track certain financial goals, whether it’s saving for a vacation or paying down debt.

- The app allows users to input their transactions themselves or import a summary of their bank’s recent transactions. The file will be available on your personal bank online portal.

- GoodBudget allows users to follow visual cues like green or red bars that show you that their budget is on track. If you are constantly stuck in the red, don’t worry. You can always go back and customize the envelopes at any time.

Pros and Cons of GoodBudget App

Even if you look at the platform from a user’s perspective, you’ll find many good goodbudget app reviews.

Every app has its pros and cons. It depends on which type of budgeter you are. It’s important to know the benefits and defects to determine whether GoodBudget is right for you.

Here is an overview of the pros and cons of GoodBudget:

| Pros | Cons |

| GoodBudget offers a free version | The free version is limited |

| Easy and simple envelope budgeting approach | You can connect financial accounts for more convenient expense tracking |

| Provide spending reports | Features are limited |

| Offers resources to help you | No investing tools |

| Allows users to customize their envelopes to fit their lifestyle easily | The envelope system is not appealing to every user |

| Offers both web and mobile versions | The app cannot directly sync with bank accounts and relies on manually entering transactions, which is time-consuming |

GoodBudget can add some features that make you an app that makes your budgeting process easier to manage. Here are some helpful tools that will make your budgeting process easier to manage:

- Resources: This app offers courses that you can take to learn how budgeting breaks the cycle of paycheck to paycheck and how to deal with other financial issues. GoodBudget has articles and podcasts filled with more information to help you.

- Reports: This feature allows you to view reports of your income and expenses that break down your spending by envelope to help you achieve your financial goals.

- Forum: This website has a forum where you can communicate with GoodBudget users who are happy to answer questions

- Budget sharing: Goodbudget allows you to sync all your budgets across several devices; if you sign up for the Plus version, you can create multiple accounts and share a budget with a partner.

GoodBudget Pricing

Revenue generation is a big part of the Success Story of GoodBudget App. So, how does this app make millions in the market?

Let’s see.

There are two versions of the GoodBudget app, one is free the other is a paid version. In the free version of GoodBudget, users can designate 10 envelopes that allow them to connect to one account with a maximum of two devices.

Take a look at below table:

| Free | Plus |

| $ 0 | $ 8 per month and $70 annually |

| 10 envelopes | Unlimited envelopes |

| 1 account | Unlimited accounts |

| 2 devices | 5 Devices |

| 1 year of history | 7 years of history |

| Community support | Email support |

Why Build an App Like GoodBudget?

So, why should you invest in this app development? Well, with the rising need for budgeting apps in the market, it is right to develop an app like GoodBudget, here’s why you should go for it:

- Growing Demand for Personal Finance Tools: Increasing financial awareness fuels the need for effective budgeting and expense-tracking applications.

- Unique Budgeting Approach: The envelope method offers a distinctive, intuitive way to manage finances, appealing to users seeking a tangible budgeting system.

- Market Differentiation: Innovating on GoodBudget’s features and methodology can help a new app stand out in the crowded fintech space.

- Opportunity for Financial Education: Integrating financial education within the app can enhance its value beyond mere budgeting.

- Cross-Platform Integration: Seamless syncing across multiple devices caters to the collaborative budgeting needs of families or partners.

- Revenue Generation Potential: A freemium model and additional monetization strategies offer various revenue streams.

- Niche Targeting and Customization: Tailoring the app to specific user groups like students and families can address unique budgeting challenges.

- Technological Advancements: Incorporating AI and machine learning can provide personalized advice and innovative budgeting features.

- Community Building: Social features can foster a supportive user community, enhancing engagement and loyalty.

- Positive Social Impact: Assisting users in achieving financial stability contributes to their overall well-being and offers a fulfilling mission for the app creators.

Features to Include in an App Like GoodBudget

Want to make an app that’s successful among people? Well, then you can’t ignore the importance of features. Here are some basic and advanced features to include in your GoodBudget Like App.

1. User Panel Features

- Comprehensive Dashboard: Provides a clear overview of income, expenses, and budget balances in one place.

- Seamless Transaction Management: Add, edit, and delete income and expense transactions with ease.

- Customizable Categories: Create, manage, and personalize spending categories to suit your needs.

- Effective Budgeting: Set and track budgets for different categories and periods to stay on top of your finances.

- Goal Setting: Define financial goals and monitor progress towards achieving them for increased motivation.

- Informative Reports: Generate detailed reports on income, expenses, and budgets over various timeframes for deeper insights.

- Personalized Insights: Gain valuable insights and recommendations based on your spending habits to make informed financial decisions.

- Optional Financial Tools: Include calculators, debt trackers, or investment tracking tools to provide additional functionality.

- Data Export: Allow users to export their financial data in various formats for personal record-keeping or external analysis.

2. Admin Panel Features

- User Management: Add, edit, and delete user accounts for efficient user control.

- Content Management: Manage educational content, articles, and financial tips to educate and engage users.

- App Settings: Configure app settings like branding, currency, and data security to personalize the user experience.

- Analytics Dashboard: View user engagement data and app usage statistics to gain valuable insights into user behavior.

3. Advanced Features

- Multi-currency Support: Manage finances in different currencies for global users or individuals with international transactions.

- Bill Reminders: Set up timely reminders for upcoming bills and dues to avoid late payments and penalties.

- Family Budgeting: Allow multiple users to collaborate on shared budgets and finances, promoting financial transparency and joint financial goals.

- Optional Bank Integration: Connect with your bank accounts for automatic transaction import, saving time and reducing manual data entry.

- Investment Tracking (optional): Track investment performance and holdings for a holistic view of your financial portfolio.

- Customizable Reports: Empower users to generate personalized reports based on specific criteria for tailored financial analysis.

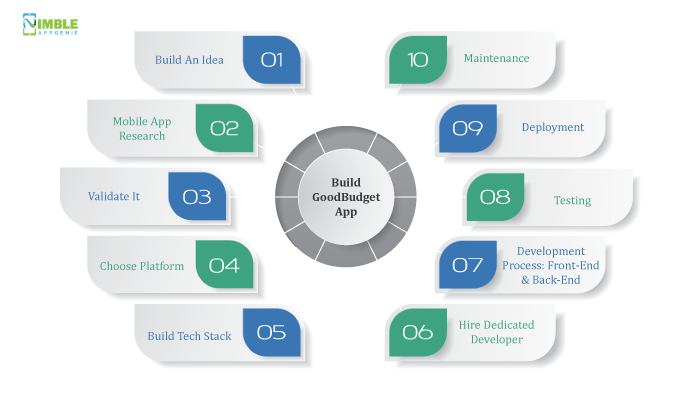

How To Build An App Like GoodBudget?

Step 1. Build An Idea

The first thing you need is a perfect fintech app idea.

Now, when it comes to fitness apps, there are of ideas, with space for innovation. But, this might prove to be the hardest part of the app development process.

In any case, once you have an idea, it’s time to move towards…

Step 2. Mobile App Research

If you want to build an app like GoodBudget that disrupts the market, you need to back it up with information, data, and insight. That’s why you need to invest time and money in mobile app market research.

Here’s what you need to do: analyze competitors, find your target audience, look for market openings, and so on. Once you have a good amount of information, we will hire developers.

Step 3. Hire Dedicated Developer

It’s time to find app developers for your project. Now, there are various ways you can do it, here are some of the top methods:

- Outsource your fintech development

- Assemble an in-house team

- Or strengthen the existing team via staff augmentation

In any case, once you have found a partner, we will

Step 4. Confirm the Idea

Before moving forward with the GoodBudget clone development project, it’s time to validate the idea.

One of the ways to do it is via MVP app development which also helps in generating funds for app development. However, this is an entirely optional step.

Step 5. Build Tech Stack

It’s time to build a mobile app tech stack.

So, what’s the tech stack? It refers to the technologies involved in mobile app development. In this case, to develop an app like GoodBudget. Here’s an example:

| Components | Technology Options | Pros | Cons |

| 1. Frontend | React Native, Flutter | Cross-platform development, flexible UI, large community | Requires more developmental effort for native look and feel |

| 2. Backend | Node.js, Python (Django/Flask) | Scalable and mature frameworks, large developer pool | Can be complex for beginners |

| 3. Database | PostgreSQL and MongoDB | Robust ACID compliant (PostgreSQL) and flexible schema (MongoDB) | Choosing the right one depends on specific needs |

| 4. Payment Gateway | Stripe, Braintree, Adyen | Secure and integrated payment processing solutions | Fees associated with transactions |

| 5. Fraud Detection | Sift, Riskified, Fraude Labs Pro | Reduce fraudulent transactions and ensure financial security | Requires ongoing monitoring and configuration |

| 6. Credit Scoring | Plaid, LexisNexis Risk Solutions | Assess the creditworthiness of borrowers and make informed lending decisions | may require additional compliance measures |

| 7. Notifications | Twilio and Pushwoosh | Send real-time updates to users and improve engagement | The cost associated with sending notifications |

| 8. Analytics | Google Analytics and Firebase Analytics | Track user behavior and measure app performance | Requires integration and data analysis expertise |

Step 6. Development Process: Front-end & Back-end

So, what happens in the development process? Well, it can be be divided into three parts, these are:

- Front-end development: Design and build the user interface, ensuring intuitiveness, user-friendliness, and responsiveness across different devices.

- Back-end development: Develop API endpoints for user authentication, data management, transaction processing, and budgeting functionalities.

- Integration: Integrate front-end and back-end components, ensuring seamless data flow and functionality.

This is the most resource-intensive step of the development process. After this, we will test the app.

Step 7. Testing

With development done, it’s time for fintech mobile app testing.

As the name suggests, here the budgeting app is tested for errors and defects. Once this is done, everything is fixed and the app is sent for deployment.

Step 8. Deployment

Finally, it’s time for deployment.

Here, we need to follow App Store guidelines and prepare the necessary documentation for publishing your app on the App Store (iOS) and Google Play Store (Android).

Also for this, we’ll deploy your back-end code to a reliable hosting platform to ensure secure and scalable operations.

Step 9. Maintenance

The work isn’t done yet, after the app is deployed, it requires mobile app maintenance services. Here’s how it goes.

- Bug fixes and updates: Address any bugs reported by users and release regular updates with new features, security patches, and performance improvements.

- Monitoring and analytics: Track app usage and user behavior to identify areas for improvement.

- User support: Give channels for users to report issues, ask questions, and receive timely assistance.

This is the mobile app development process. But this begs the question, how much does it cost to build an app like GoodBudget? Well, it highly depends on various factors. Therefore, you should contact a development firm to learn more.

How Can Nimble AppGenie Help You?

Enter the world of budgeting apps with your own platform like GoodBudget App.

With 700 projects under our name and recognition from top platforms like Clutch.co, DesignRush, and GoodFirms, we are one of the fintech app development company in the market.

Here are some of our top projects.

- Pay By Check – Ewallet Mobile App

- SatPay – E-wallet Platform

- CUT–E-Wallet Mobile App

- SatBorsa – A Currency Exchange Fintech App

If you want to be the next best in BNPL and give platforms like Apple After Pay and Klarna a run for their money, hire mobile app developers with us.

Conclusion

The success story of the GoodBudget app has inspired a lot of people, and if you too want to create an expenses tracking app, you are on the right path.

If you want to do just that, you need to contact a mobile app development company that will help you put life into the concept. After all, it’s not that hard to find app developers in 2023, is it?

FAQ

GoodBudget is an envelope-based budgeting app that allows users to manage their budgets using a virtual envelope method. It helps users allocate funds to different spending categories and manually track expenses, offering both free and premium versions.

GoodBudget has been available since 2009 and has evolved over the years, adding features like checkbook reconciliation, accounts, and recurring transactions to its platform.

Unlike many budgeting apps, GoodBudget does not connect directly to your financial accounts for importing transactions. Users manually update their transactions, which can be beneficial for those with simpler finances or those who prefer a more hands-on approach to budgeting.

GoodBudget offers features like envelope budgeting, spending reports, budget sharing across multiple devices, and resources such as courses, articles, and podcasts to help users manage their finances.

Yes, GoodBudget uses 256-bit bank-grade encryption to protect your personal information and does not share your data with third parties.

Pros include its simple envelope budgeting approach, availability of a free version, and comprehensive resources. Cons include the inability to connect to financial accounts directly and the manual entry of transactions, which may be time-consuming for users with complex finances.

GoodBudget offers a free version with limited features and a Plus version for $7 per month or $60 annually, providing unlimited envelopes, accounts, and up to five devices.

GoodBudget is ideal for individuals who prefer manual tracking of expenses, are disciplined in updating their budget, and like the envelope method of budgeting. It may not be suitable for those looking for automatic transaction imports or who have complex financial situations.

Apps like GoodBudget are popular due to their unique approach to budgeting, ease of use, and effectiveness in helping users manage their finances and achieve their financial goals.

Yes, GoodBudget can help users track specific financial goals, such as saving or paying off debts, by allowing them to create and manage envelopes dedicated to these goals.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.