The buy now, pay later (BNPL) industry is rapidly transforming the global financial landscape.

With its flexible payment options, BNPL has gained immense popularity among consumers, retailers, and fintech startups.

This blog delves into various aspects of the BNPL market, including its economic impact, adoption across different regions and industries, user demographics, and leading market players.

We will explore the latest BNPL statistics, discuss the benefits and challenges of BNPL services, and highlight why fintech startups should consider entering this booming market.

Without further ado, let’s start digging into the BNPL statistics and forecasts that might motivate you to enter the rising and lucrative market of BNPL services.

BNPL Market Statistics & Revenue Forecasts (2026 & Beyond)

Buy Now Pay Later has attracted several new investors and entrepreneurs, giving a much-needed push to the market’s overall growth.

The trends for BNPL have certainly changed for good, as today the fintech market is not only rewarding but also promising for the future.

Here is the data that backs the opportunity and value that buy now, pay later offers:

Global Market Size

The global BNPL payment market is projected to reach US$560.1 billion in 2025, growing by 13.7% annually.

It is expected to continue this upward trajectory, with a CAGR of 10.2% during 2025-2030, reaching approximately US$911.8 billion by the end of 2030.

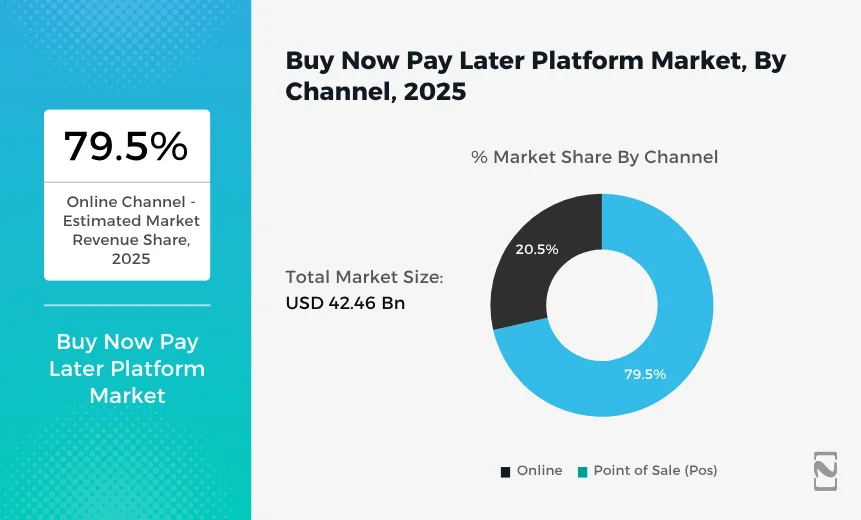

Overall Market Value (BNPL Platforms)

The buy now, pay later platform market is estimated to be valued at US$42.46 billion in 2025 and is expected to reach US$175.87 billion by 2032, growing at a compound annual growth rate (CAGR) of 22.5% from 2025 to 2032.

Regional Growth

- Asia Pacific: The BNPL market in Asia Pacific is expected to grow by 14.5% annually to reach US$211.7 billion in 2025. It’s projected to expand to approximately US$358.6 billion by 2030, with a CAGR of 11.1% during 2025-2030.

- Europe: The BNPL payment market in Europe is expected to grow by 12.4% annually to reach US$191.3 billion in 2025. It’s forecast to reach approximately US$293.7 billion by 2030, with a CAGR of 9.0% during 2025-2030.

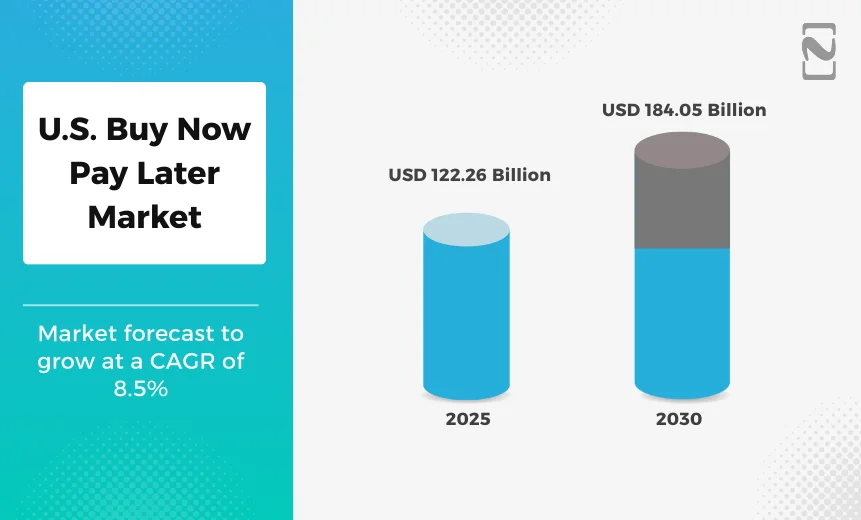

- United States: The BNPL payment market in the United States is expected to grow by 12.2% annually to reach $122.26 billion in 2025. It’s projected to expand to approximately $184.05 billion by 2030, with a CAGR of 8.5% during 2025-2030.

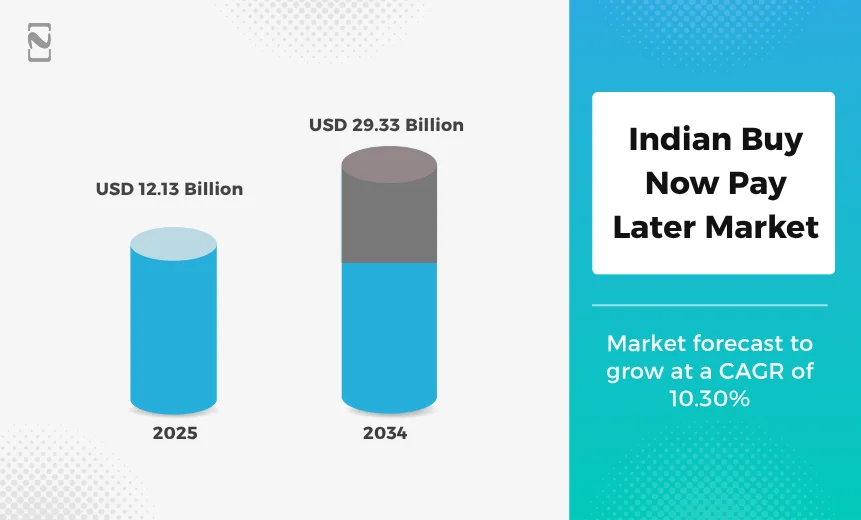

- India: The India Buy Now Pay Later Services Market is projected to grow from USD 12.13 billion in 2025 to USD 29.33 billion by 2034, exhibiting a CAGR of 10.30% during the forecast period (2025 – 2034).

All in all, it can be said that the BNPL sector is evolving in both global and regional markets. Investing time and effort into building your BNPL application can certainly prove beneficial in the long run, given the rising demand in different parts of the world.

Not to mention, there are several other regional markets that BNPL is yet to tap.

Buy Now Pay Later Detailed Market Analysis (2026-27)

If the above numbers are not enough to help you understand the trajectory of growth for BNPL services, let us dissect them and identify all the factors that make BNPL an exponentially growing market.

1. Key Drivers of Growth:

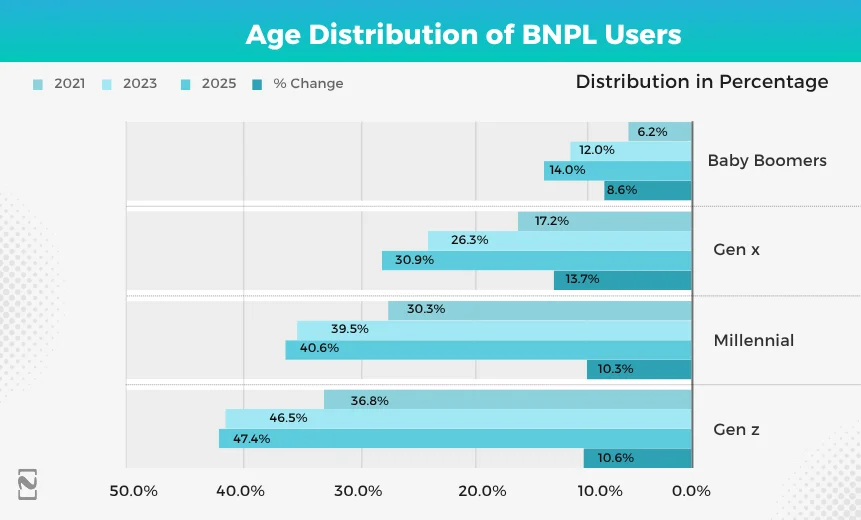

- Evolving Consumer Preferences: Consumers, especially Gen Z and Millennials, increasingly prefer flexible payment solutions that offer interest-free installments and transparency, avoiding traditional credit card debt.

- E-commerce Growth: The continued surge in e-commerce sales globally, and particularly in regions like the Asia Pacific and India, is a primary driver, as BNPL seamlessly integrates into online checkout processes.

- Digitalization & Smartphone Penetration: Rapid digitalization and increasing internet and smartphone penetration, especially in emerging markets, support the widespread adoption of BNPL services.

- Financial Inclusion: BNPL expands credit access for a wider customer base, enabling individuals with limited or subprime credit histories to obtain financing, especially in emerging markets where traditional credit options are scarce.

- Increased Average Order Value (AOV) and Conversion Rates: Merchants offering BNPL often experience higher conversion rates and increased average transaction values, as consumers are more comfortable making larger purchases.

2. Diversification and Expansion into New Sectors:

- Beyond Retail: BNPL is increasingly expanding beyond traditional retail (apparel, electronics, home decor) and into non-traditional sectors.

- Healthcare: Financing medical treatments, dental care, and elective procedures.

- Education: Offering installment plans for tuition fees, courses, and skill development programs.

- Travel: Enabling consumers to pay for flights and vacation packages in installments.

- Home Improvement: Supporting renovations, furniture, and appliances with BNPL-backed financing.

- Offline Adoption: Small and medium-sized enterprises (SMEs) are driving offline BNPL adoption, offering point-of-sale (POS) installment options.

- Cross-border e-commerce: More consumers are increasingly utilizing BNPL for international purchases, which helps them manage the higher costs associated with cross-border transactions.

- B2B BNPL: The next big frontier for BNPL is business financing, with SMEs using it to finance inventory, equipment, and services.

3. Competitive Landscape:

-

- Dominant Players: Klarna, Afterpay, PayPal, and Affirm continue to be major players in the global BNPL market.

- Traditional Banks Entering the Arena: Traditional banks like JPMorgan Chase and American Express are integrating BNPL features into their offerings, intensifying competition and driving innovation.

- Regional Players: Region-specific players like Tamara (Middle East), MercadoPago (Latin America), and Kredivo (Southeast Asia) are focusing on localized offerings.

-

- Consolidation and Mergers: As regulatory scrutiny increases, smaller BNPL providers may consolidate with larger players to achieve scale and compliance. (Source)

4. Technological Advancements:

- AI-driven Credit Assessments: Leading BNPL providers are investing in AI for advanced credit scoring and fraud detection, optimizing risk while enhancing the user experience.

- Personalization: AI and machine learning personalize BNPL offers and repayment options according to individual consumer behavior and credit patterns.

- Integration with Digital Wallets and Banking: BNPL services are increasingly integrating with neobanks and digital wallets (e.g., Apple Pay, PayPal) to offer comprehensive financial services.

- Open Banking Solutions: Open banking has accelerated BNPL’s growth by enabling providers to access real-time financial data, optimize credit risk management, and deliver a seamless payment experience.

5. Regulatory Landscape:

- Increased Scrutiny: Governments globally are implementing stricter regulations to protect consumers from debt risks, transparency issues, and predatory lending practices.

- New Regulations:

-

- Australia: From June 10, 2025, the classification of BNPL products will change to ‘low-cost credit contracts’ under the National Consumer Credit Protection Act 2009 (Cth) and the National Credit Code. Providers will require an Australian Credit License (ACL) and comply with modified responsible lending obligations.)

- Europe (EU): The updated Consumer Credit Directive (CCD II) requires BNPL providers to conduct creditworthiness assessments and follow stricter lending standards.

- United States: The Consumer Financial Protection Bureau (CFPB) is assessing risks tied to consumer debt and exploring tighter BNPL regulations.

- Compliance as a Priority: Compliance with diverse regulatory frameworks will be critical for sustaining growth, with larger players with robust frameworks being more likely to thrive.

6. Consumer Demographics and Behavior:

- Younger Demographics: Gen Z and Millennials are the primary drivers of BNPL adoption, with 63% of Millennials and 56% of Gen Z having used BNPL services as of 2025 in the UK. They are likelier to use BNPL for experiences, personal travel, and exercise equipment.

- Motivations for Usage: The chief reason for using BNPL is managing cash flow (36%), followed by making larger purchases more affordable (28%).

- Online Shopping Affinity: BNPL users are significantly more likely to enjoy online shopping, research products online, and place online orders weekly.

- Demand for Flexibility: A significant percentage of consumers (72% in the U.S.) plan to use BNPL in the coming year, especially for furniture, home decor, appliances, and personal travel.

7. Challenges and Risks:

- Regulatory Compliance: Navigating diverse and evolving regulatory frameworks across different regions is a significant challenge for BNPL providers.

- Rising Default Rates: The rapid growth of BNPL, often with minimal credit checks, has led to concerns about rising default rates, which could impact profitability and require more robust risk management.

- Consumer Debt Accumulation: There are ongoing concerns about consumers overextending themselves and accumulating unsustainable debt through multiple BNPL arrangements.

- Operational Complexity: Managing revolving credit, customer accounts, and sophisticated treasury instruments for a rapidly expanding user base can be operationally complex.

- Fraud and Data Security: The volume of sensitive financial data on BNPL platforms makes them attractive targets for cyberattacks and fraud, requiring robust security measures.

The above factors give us clear insights into all the aspects of the BNPL Statistics. Knowing what drives growth and what might become a challenge in the future helps you in streamlining the app development process, as in the end, it is your app that has to balance all these factors for you.

Top Players in the BNPL Market

Several top BNPL companies dominate the market, including popular apps like Klarna, Affirm, Afterpay, Sezzle, and Zip.

Each of these companies brings unique strengths and innovations to the BNPL market, driving competition and growth in the industry.

Let’s take a look at the stats related to these key players in the market to get a glimpse of how they have made their fortune and how they compare to each other.

► Klarna

Klarna has established itself as a leading player in the BNPL market, especially in its home country of Sweden.

It is expected that by 2025, nearly 724,000 of merchants will have Klarna on their websites with a buy now, pay later (BNPL) option, and almost 11% of websites in Sweden offering any form of payment technology.

While the United States has the highest number of merchants offering Klarna, its relative use in Europe, particularly in Sweden and neighboring countries, is significantly higher.

In contrast, U.S. and UK merchants prefer card networks like Visa, MasterCard, or American Express more regularly.

Read Also – How to Build an App Like Klarna?

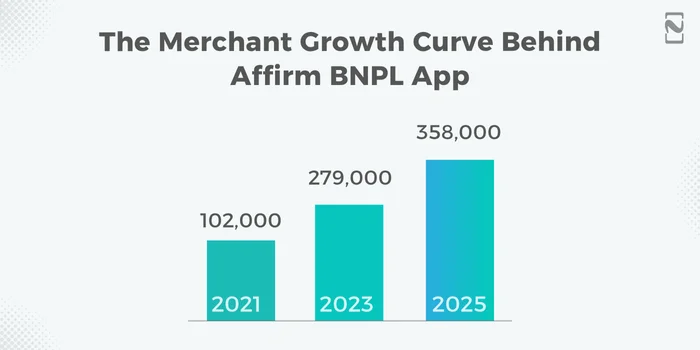

► Affirm

Affirm is most frequently offered as a BNPL option within the United States and Canada.

As of February 2025, more than 560 Canadian merchants had Affirm on their websites, representing slightly over 8% of all domains in the country with a buy now, pay later (BNPL) option.

This indicates that North American merchants, especially those in the U.S. and Canada, predominantly use Affirm compared to other regions.

Read Also- How to Create an App Like Affirm?

► Afterpay

Afterpay, originating from Australia, is heavily used in Oceania.

By February 2025, nearly 5,000 New Zealand merchants featured Afterpay on their websites, equating to over 50% of all domains in the country with a buy now, pay later (BNPL) option.

Although the U.S. had the highest number of merchants offering Afterpay until 2023, its market share in Australia and New Zealand remains significantly higher.

So many people want to build an app like Afterpay.

► Sezzle

Sezzle has a significant market share in India, with more than 27% of the market by 2024.

However, the highest number of merchants offering Sezzle is found in the United States and Canada.

By February 2024, over 2,500 Canadian merchants were using Sezzle, representing nearly 40% of all domains in the country, with a buy now, pay later (BNPL) option. This is what pay-later statistics show us.

► Zip

Zip as a platform is having a serious impact on the buy now, pay later market. Australia had the highest number of merchants offering Zip at 2024, though its market share is also notable in the Philippines.

More than 390 New Zealand merchants use Zip, accounting for around 4% of all domains in the country with a buy now, pay later (BNPL) option.

These BNPL app statistics highlight the significant presence and market penetration of these top BNPL companies globally. The BNPL industry continues to evolve, with leading firms like Klarna, Affirm, Afterpay, Pay in 4, Sezzle, and Zip playing crucial roles in shaping the pay-later market.

Future Trends for BNPL in 2026 and Beyond

While the list of top players from the market shows what has worked for them so far, it is also important that you keep up with all the upcoming fintech trends.

The evolving nature of BNPL is what has made it highly lucrative, and eventually, you will also have to evolve with it.

- Deep Integration: Further integration into various digital platforms, including e-commerce, digital banking, and even physical retail points.

- Omnichannel Expansion: Streamlined online and in-store payment solutions are becoming a key differentiator for retailers.

- Enhanced Risk Management: Continuous investment in AI and data analytics to optimize credit assessment and fraud detection, particularly as high-value transactions become more common.

- Responsible Lending: A stronger emphasis on responsible lending practices and consumer protection due to increased regulatory oversight.

- Diversification of Offerings: Providers will continue to diversify beyond traditional retail into new sectors, tailoring solutions for specific industries.

- Partnerships: Strategic partnerships between BNPL providers, merchants, and traditional financial institutions will be crucial for expansion and innovation.

BNPL Statistics in 2026 is dynamic and highly competitive, offering significant opportunities for growth while navigating increasing regulatory demands and the need for robust risk management.

Nimble AppGenie: Your Gateway to Emerging BNPL Statistics

With all these trends and the ever-changing nature of the market, entering the market is quite difficult without a solid fintech app development partner.

Nimble AppGenie is a leading BNPL app development company that specializes in developing cutting-edge Buy Now, Pay Later (BNPL) solutions tailored to meet the needs of today’s dynamic market.

With the BNPL industry experiencing explosive growth, valued at $532.9 billion globally and projected to continue its upward trajectory, there has never been a better time to invest in BNPL (Buy Now, Pay Later) technology.

Our team of experts leverages advanced technologies to create seamless, user-friendly BNPL platforms that enhance customer experiences and drive sales for businesses.

Whether you’re a startup looking to enter the market or an established business aiming to expand your payment options, Nimble AppGenie provides comprehensive development services, from consultation to deployment and ongoing support.

Hire dedicated developers today to start your journey towards innovative payment solutions.

Conclusion

The BNPL industry is reshaping the financial landscape, offering consumers flexibility and enhancing retail growth worldwide.

With a significant user base, expanding market size, and increasing adoption across various sectors and regions, BNPL services present immense opportunities for fintech startups and established businesses alike.

However, with growth comes the need for responsible usage and robust regulatory frameworks to protect consumers. As the industry continues to evolve, staying informed about BNPL statistics will be crucial for businesses aiming to capitalize on the benefits of BNPL.

By embracing these insights, companies can drive innovation, improve customer satisfaction, and achieve sustainable growth.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.