Digital wallets have caught up with apps that people use every day. From daily payments to online transactions, digital wallet apps make it all happen without a user having to carry their wallet.

Offline transactions in cash have seen a massive decline, thanks to the rise in the use of digital payment methods such as cards, e-wallets, and mobile wallets.

While these methods have simplified the payment experience for the users, the availability of multiple apps creates confusion in the mind of a user on which apps to use and which not.

In this blog, we will be taking you through the list of top digital wallet apps. Keep in mind that all these wallets have been used by our experts, based on which we have curated this list.

Top 10 Digital Wallet Apps: Pros, Cons & Standout Features!

With the recent boom in eWallet app development, the market is flooded with digital wallet apps.

The idea of making every transaction digital makes sense as it promotes convenience. But there may be an issue in choosing the right partner to delegate your online transactions.

Here is a complete list of the best digital wallets that you can try and use –

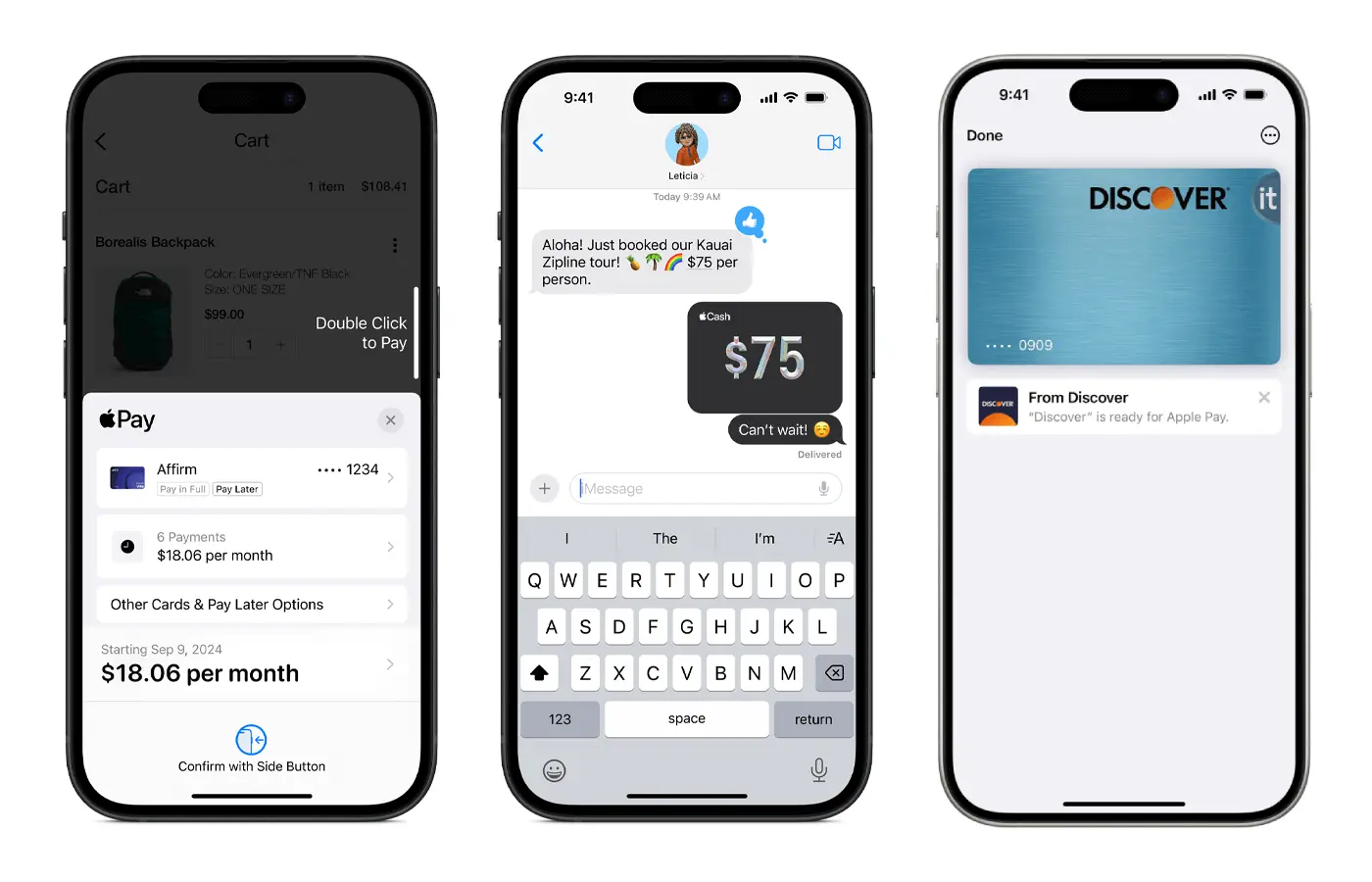

► Apple Pay

One of the most popular names when it comes to tech, smartphones, and apps is the tech giant Apple.

With its continuous innovation that covers a spectrum of industries, it has taken over the digital wallet space as well with Apple Pay.

The e-wallet built by Apple has all the necessary features and has the potential to replace a physical wallet, as you can not only use digital cash, but can also save all your card information in the wallet to pay for it through tap & pay.

Stand Out Features:

- Exclusive Apple Card

- Add Credit/Debit Cards

- Apple Pay Later Integration

Pros:

- Convenient to use, tap the smartphone on the POS to pay.

- Reliable Security Measures (encryption, tokenization, face ID/touch ID)

- Integrated wallet management to keep track of booked tickets, cards & more.

Cons:

- Only works for Apple devices, cannot be used on any other operating system.

- Offline payments require Tap & Pay, which is not always available at every store.

- Acceptance of Apple Pay is still an issue in tier 2,3 cities, which could pose an issue.

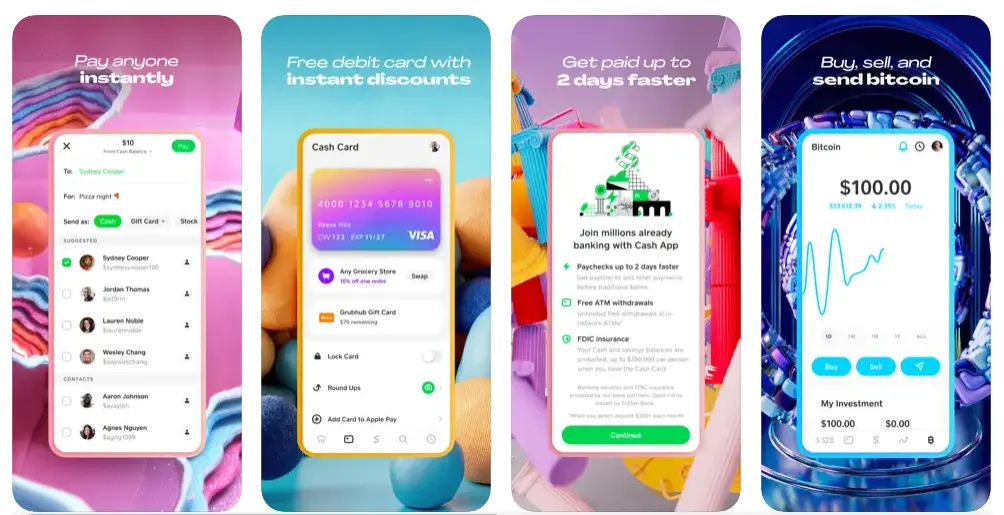

► Cash App

Another popular name when it comes to digital wallets, Cash App, has made its way to the top players in the market in no time!

With the idea of peer-to-peer payments executed properly, it has become an unavoidable payment method.

It takes the entire concept of digital payments to another level as it not only offers a wallet, but also has integrated ways to interact with your bank accounts.

Not only that, the application offers a Cash Card that allows you to use the money both offline and online.

Stand Out Features:

- Multi-Layer Authentication.

- Cryptocurrency Sending & Receiving.

- Customer Accounts

Pros:

- Ease of money transfer makes peer-to-peer transactions easy.

- Stocks & cryptocurrency options are available for direct investments.

- Dedicated Cash Card so you can use your Cash App balance offline.

Cons:

- Added processing fees implied on instant money transfers.

- Limited service areas: Cash App is not available outside the USA & UK.

- Debit card details required to add funds cannot be used through banking details.

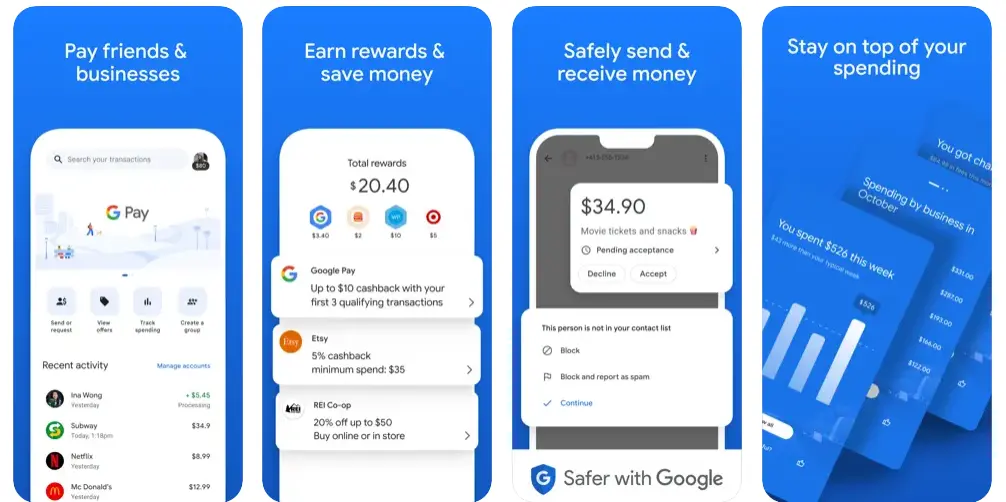

► Google Pay

Google Pay is a responsive digital wallet that simplifies making payments for all types of users.

While Apple Pay is limited to Apple Devices, Google Pay offers its services to both ends of the spectrum.

Both iOS and Android users can use the application to make payments, save cards, and use them for both in-store and online transactions.

Google Pay is a widely used payment method as Android devices are affordable and easily accessible even in the most remote locations.

Stand Out Features:

- Compliance with GDPR

- Mobile Recharge

- Bill Payment Options

Pros:

- Ease of integration with Google services on your device for integrated payments.

- No additional transaction processing fees for regular transactions. (cards excluded).

- User-friendly and easy to set up, while offering insights on financial literacy for users.

Cons:

- Google Pay is highly prone to digital fraud as new users are not cautious enough.

- Lacks international transfers and limits transactions to a certain amount in supported regions.

- Participating banks that enable direct transactions is limited.

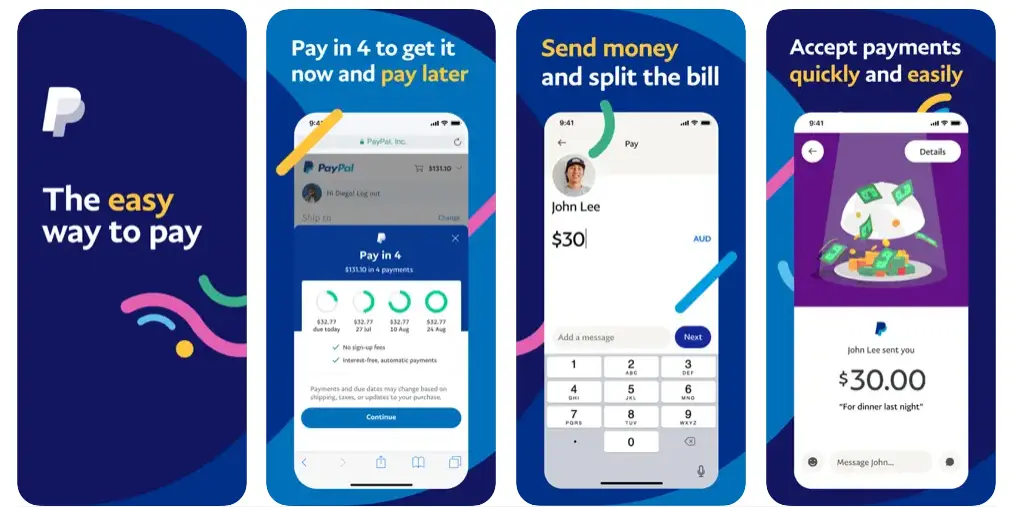

► PayPal

One of the most renowned digital payment methods, PayPal offers an accepted digital wallet that is used for international transactions.

With the help of PayPal, people can manage their financial information using their email and passwords.

This also enables different use-cases for the app as it can be used for financial transactions, shopping, e-commerce, sending and receiving funds, and more.

The application offers an easy way to manage online transactions.

Stand Out Features:

- Enhanced Direct Deposit

- Subscription Management

- Buy Now, Pay Later Ability

Pros:

- It is widely accepted by online retailers, merchants, and users.

- No separate merchant account is needed for business transactions.

- Offers buyer protection, helping users get their money back in case of a failed transaction.

Cons:

- Implied charges on credit and debit card transactions.

- Unreliable resolutions, as there’s no third-party arbitration.

- High chargeback fees for business transactions.

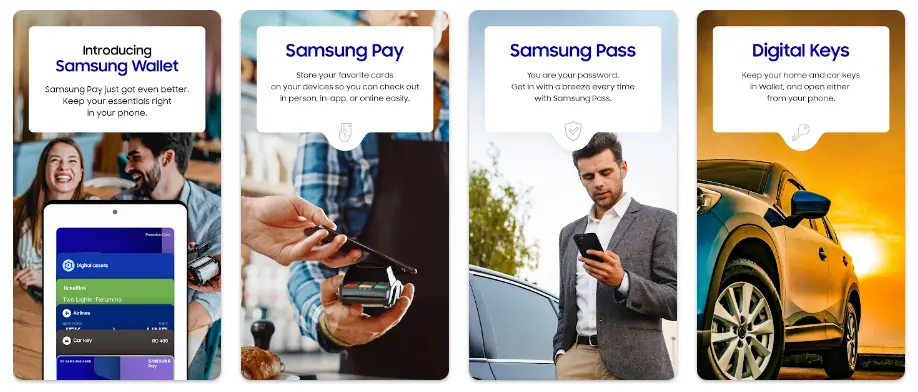

► Samsung Wallet

Samsung Pay is crafted to fulfill the day-to-day needs of Samsung users. This is what makes it a tough contender in the Google Pay vs Apple Pay vs Samsung Pay debate.

Being one of the best eWallet mobile apps, it has everything from payments to sending money to friends and family.

One thing that makes it stand out is that it integrates all the digital wallet apps on the phone into one.

Stand Out Features:

- Biometric authentication protection

- Virtual credit/debit cards

- UWB technology

Pros:

- It offers both an e-wallet and a digital wallet for extended payments.

- Keep all your cards and payment information in a dedicated vault.

- Added features to track a transaction & added rewards for Samsung users.

Cons:

- It only works with Samsung devices, which limits the user base.

- Online purchases are not supported with a Samsung Pay Wallet.

- Each transaction requires multiple reassurances, which adds to the steps and time taken to complete the transaction.

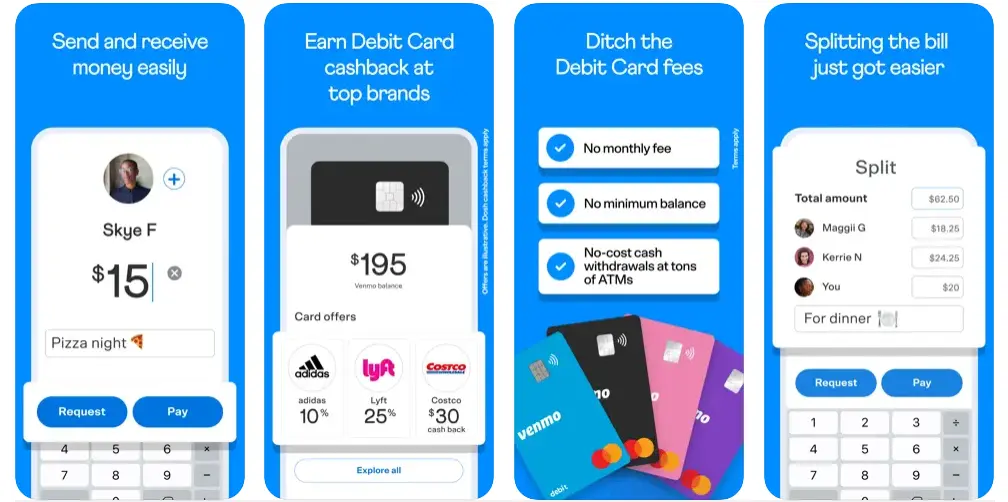

► Venmo

Venmo allows users to send/receive money and adds a social aspect to the app. For instance, users can split the bill at dinner or split necessities with their partner or roommate, or even send a gift to a friend.

While doing all of this, users can earn cash back and many amazing deals. Another great offering is cash advances.

Venmo is one of the best cash advance apps on the market, with high limits and easy repayment. Much like other apps like Revolut & Cash, this platform enables crypto-trading.

Stand Out Features:

- Debit/Credit Card Processing.

- Online – eCommerce payment.

- Split the bill

Pros:

- Social features to share payment descriptions and check transactions with contacts.

- Offers a detailed transaction history to make each expense traceable.

- Sophisticated, user-friendly features that allow easy onboarding of users.

Cons:

- Risk to user privacy, as social features often make it difficult to maintain discretion.

- Venmo transactions done for any service or goods are counted as taxable income for businesses.

- Credit Card transactions are charged a processing fee.

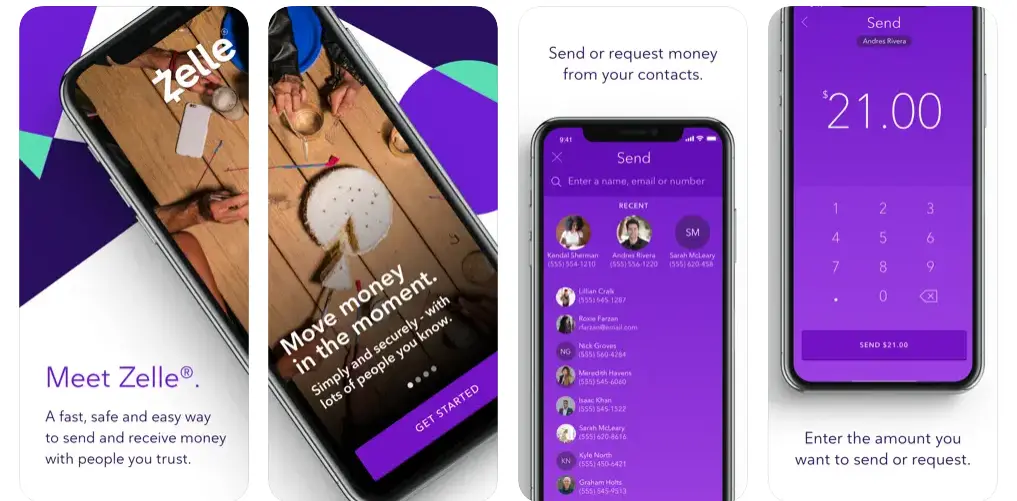

► Zelle

Zelle Pay is a market-leading solution known for its simple interface and robust eWallet app security.

If you are in the United States of America, this is one of the best mobile banking apps.

As the platform collaborates with over 2,000 banking apps across the market, it opens doors to endless opportunities and convenience for the user.

The best part is, it is free to use. Zelle is a game-changer for digital payments as it has one of the largest networks of banks that allows seamless transactions.

Stand Out Features:

- Mobile banking functionality

- Super-fast payments

- Unmatched eWallet app security

Pros:

- No charges for instant bank-to-bank transfers.

- Settles the transaction in a matter of minutes.

- Offers direct bank transfers without any third-party involvement.

Cons:

- High risk of fraud since security is compromised due to glitches.

- Users often experience technical issues while sending/receiving funds.

- Zelle only supports US-based banks; hence, it is highly restricted for overseas users.

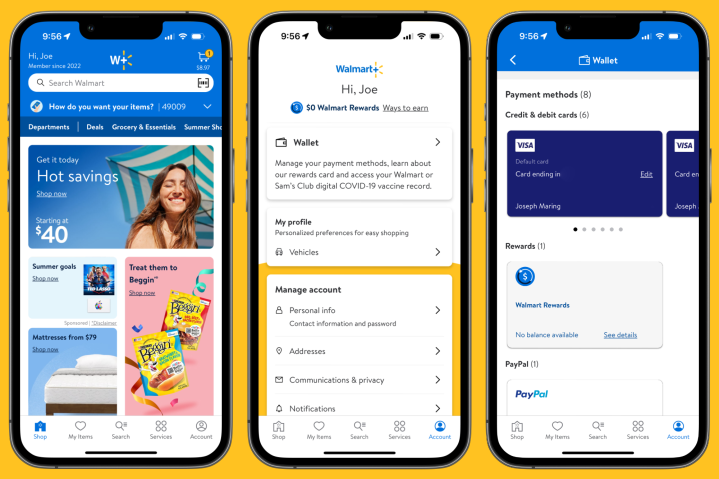

► Walmart Pay

Another interesting approach towards building a digital wallet is Walmart Pay. Not only does it allow simplified online payments, but it also expedites the checkout process at any of the Walmart stores.

A user can simply link their preferred card to the wallet and use it for easy payments.

However, it is also a perfect example of a closed-loop payment system, as all the Walmart Pay wallets are limited to functioning at a Walmart.

This often comes across as an issue; however, it is highly helpful for regular Walmart users.

Stand Out Features:

- Unified experience

- Available on both iOS & Android

- Scan & Go for Walmart+ Users

Pros:

- Allows users to make payments in the Walmart app, in-person transactions, and more.

- The closed-loop nature of the wallet reduces the risk of fraud.

- Maintain a digital record of receipts for future reference.

Cons:

- Limited acceptance since it is a closed-loop wallet, which restricts its use at other retailers.

- Walmart Pay does not support NFC, reducing the convenience of tap and pay/

- Comparatively smaller user base and troubleshooting forums.

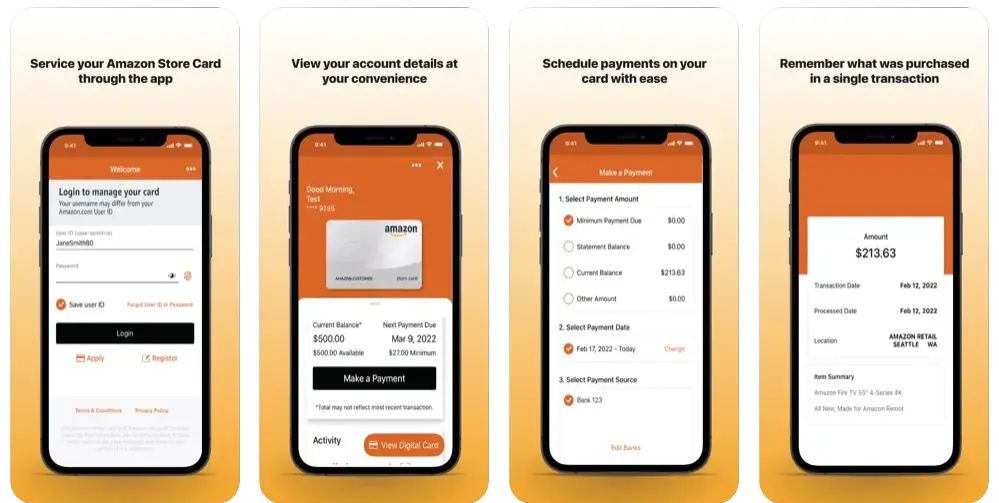

► Amazon Pay

Amazon Pay is one of the best digital wallet apps on the market today. This is not a stand-alone solution like other apps, like PayPal.

Rather, it is an integrated solution that you can find within Amazon’s eCommerce app.

Amazon Pay solves some of the largest eWallet app challenges by offering seamless integration with P2P Payments, as well as high-level security.

Its availability on all platforms is what makes it one of the best digital wallet apps for iOS and Android.

Stand Out Features:

- Diverse payment options

- Rewards and cashback

- Send and receive money

Pros:

- Allows easy checkout for Amazon users.

- The app uses Amazon’s secure infrastructure to offer secure transactions.

- Offers easy money transfers between accounts.

Cons:

- Not all merchants accept Amazon Pay, especially for offline payments.

- High transaction fees are another issue in using Amazon Pay, especially for cross-border transactions.

- Amazon has a reserved policy that often ends up delaying the transaction settlement for merchants and users.

► Dwolla

Dwolla offers a digital wallet that supports ACH transactions. People from around the US use it regularly.

The application allows users to manage their funds while maintaining an e-wallet that can be used to make payments.

With ACH payments, it opens a new realm of transactions that do not require you to use your cash, credit card, debit card, or check.

It offers instant settlement with low transaction fees, making it more convenient for businesses and individuals.

The app is popular among startups looking for an affordable payment solution.

Stand Out Features:

- Allows ACH transfers with a digital wallet.

- Offers account-to-account transfers.

- Integrated tools for payment workflow management.

Pros:

- Low transaction fees make transactions convenient for users.

- Instant settlements for payments, skipping the long processing of transactions.

- Easy to integrate with other platforms, enabling businesses to make the most of it.

Cons:

- Limited availability of the app restricts it to the USA only.

- While it can be integrated with other apps, it cannot process credit card payments.

- International users cannot use the application due to availability restrictions.

Each of these wallets has its pros and cons and can be helpful for a dedicated set of audiences with a dedicated set of features. Needless to say, the pros and cons of each make it clearer to make the choice. Simply opt for a digital wallet app as per your use case and transactional requirements.

All the wallets are tried and tested, so you need not worry about that! Simply go to the app store and start using the app today!

Conclusion

With all these options, you can make your transactions more secure and convenient. But the only downside here is that it all depends on technology and the internet.

The penetration of smartphones and the reach of digital wallets have grown rapidly. This makes it an ideal market for business growth.

You can plan for the development of your digital wallet app and maximize its potential in no time. If you plan to do so, Nimble AppGenie is the best choice for you!

Hope this list helps you make the right decision. Thanks for reading, good luck!

FAQs

When choosing the best wallet app to use, here are some factors to consider:

- Security

- Compatibility

- Ease of Use

- Fees

- Available Features

Look for apps with a good reputation, positive user reviews, and robust customer support.

While almost every pick on this list of digital wallet apps has millions of users, the most popular eWallets in the US include Apple Pay, Google Pay, and PayPal.

Verify if the app uses encryption, offers two-factor authentication, and complies with industry standards as well as regulatory compliance like GDPR compliance.

Mobile wallets are likely to evolve with enhanced features like biometric authentication, integration with emerging technologies, and increased acceptance, making them a central part of daily transactions.

While minimal, the risks include unauthorized access, data breaches, and potential fraud. For that reason, you should safeguard personal information, enable security features, and stay informed about the app’s security protocols to minimize these risks.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.