Have you noticed how banking is no longer about visiting branches or waiting in queues? Today, people expect to manage their money from their mobile phones. Mobile banking has become really huge.

Around 2.17 billion people used mobile banking services globally in 2025, and usage continued to rise fast. According to SQ Magazine, 72% of people in the US use mobile banking applications, and in many countries, more than three-quarters of bank customers rely on mobile apps.

This shift is not just a trend; it is a transformation in how people think about money. People expect banking to be instant, clear, and secure. That’s where apps like CBQ Mobile come in. It delivers all of this smoothly and helps users manage accounts, pay bills, and more in one place.

So, if you are a startup, fintech founder, or business leader, you might be asking: “What does it take to develop an app like CBQ Mobile?” The answer is not just about copying the UI and features.

It is about understanding why users trust and use apps like this, what tech stack and planning it requires, and how to build something scalable that people stick with. Thus, in this blog, we will discuss the process to build a mobile banking app like CBQ Mobile.

So, let’s begin!

Understanding CBQ Mobile App: What Makes It Successful

There is one fact that startups often miss: CBQ Mobile did not win because it had more features. It won because it made banking really easy and faster for users. Most applications attempt to impress users with flashy interfaces, numerous options, or animations.

CBQ Mobile does the opposite. It removes friction. It asks: “How quickly can a user complete what they came here to do?” This mind changes everything.

Why does CBQ Mobile work for users?

- It provides fewer steps for every task.

- The security of a mobile banking app is top-notch, but it does not constantly remind users of it.

- Security works quietly in the background, which builds trust instead of frustration.

- CBQ Mobile feels controlled and reassuring, even during complicated transactions.

- Users feel confident every time they open it.

CBQ Mobile is not just trying to do everything. It is trying to do the essential things exceptionally well.

Market Overview of the Mobile Banking Industry

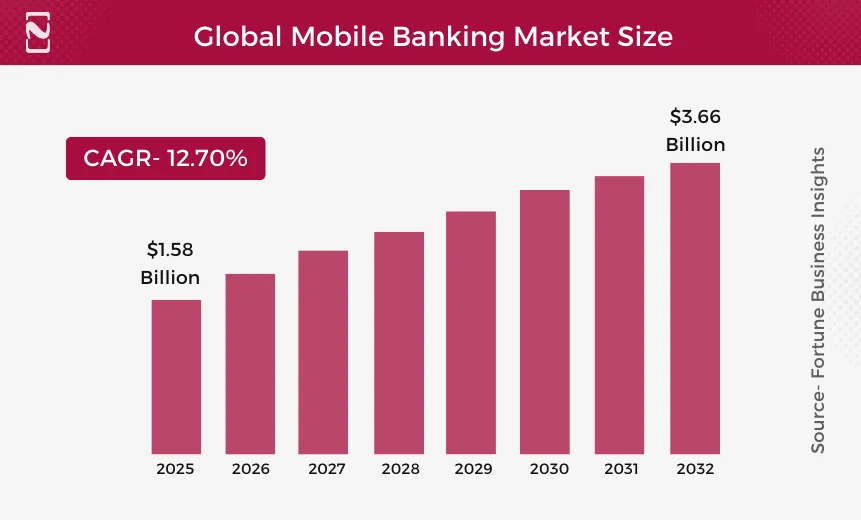

Mobile banking isn’t just a trend anymore; it has become the main source of handling money. The worldwide market size of the mobile banking industry is forecasted to reach $3.66 billion by 2032. Let’s have a deeper look at the mobile banking statistics.

- North America will dominate a big part of the market. It is forecasted to hold almost 43% of mobile banking users by 2035.

- Android will lead the way by 2035, and about 65% of mobile banking users will be on Android devices.

- Europe is set to grow quickly over the next decade, thanks to better rules for banks and strong digital systems.

The main reasons more people want custom mobile banking apps are the availability of mobile phones. Digital services are becoming very popular worldwide, and banks are going digital. So, now is the perfect time to develop an app like CBQ Mobile and become the next industry leader.

Key Features Needed to Build an App Like CBQ Mobile

Developing a mobile banking app like CBQ Mobile is not just about copying screens or adding flashy features. The mobile banking app features you choose, and when you launch them, can make or break your app. To help you plan, we can group features into three categories: must-have, retention-driving, and nice-to-have.

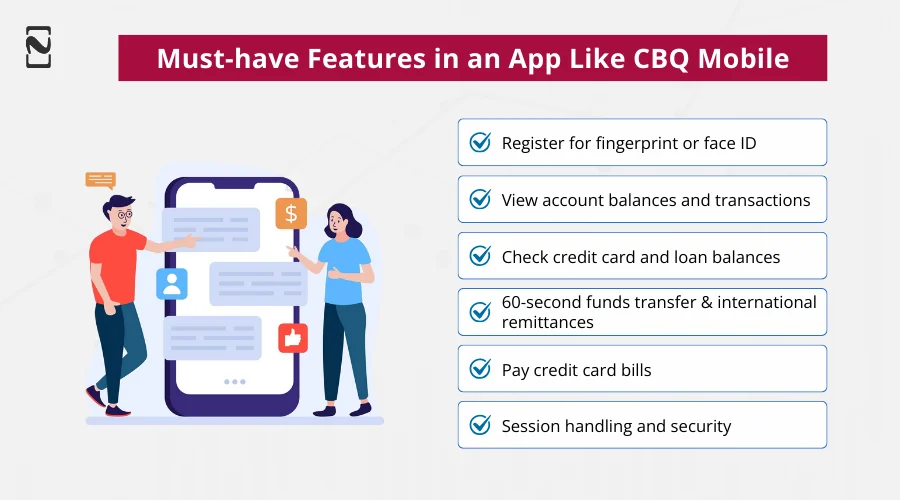

1. Must-have Features

These are the features your app cannot launch without. Users would not trust your app if these are not done right:

- Register for fingerprint or face ID: You can allow users to log in securely with fingerprint or face recognition, so they do not have to type passwords every time.

- View account balances and transactions: Your app should show users their current balance and recent transactions instantly. This keeps them informed at all times.

- Check credit card and loan balances: You can make it easy for users to see their outstanding amounts and manage their finances without confusion.

- 60-second funds transfer and international remittances: Your app-like CBQ Mobile should allow users to send money quickly within Qatar or abroad.

- Pay credit card bills: You can enable users to pay their credit card bills directly from the app.

- Session handling and security: Your app should prevent sudden logouts during important transactions.

| Tip: These features focus on security, reliability, and core banking functionality, not flashy visuals. |

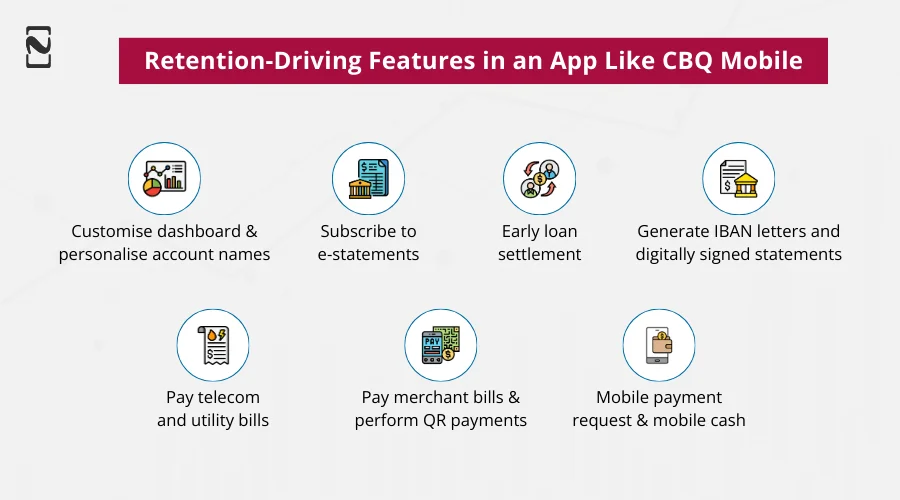

2. Retention-Driving Features (Why Users Keep Coming Back)

These are the features that make users open your CBQ Mobile-like app regularly:

- Customise dashboard & personalise account names: You can allow users to organise their dashboard and name their accounts or cards for easier navigation.

- Subscribe to e-statements: You can offer paperless statements that users can access anytime for easy record-keeping.

- Early loan settlement: Your app can allow users to pay off loans early to save interest or better manage finances.

- Generate IBAN letters and digitally signed statements: You can make official documents available instantly in the app.

- Pay telecom and utility bills: Your app should allow users to pay Ooredoo, Vodafone, Kahramaa, and Qatar Cool bills easily.

- Pay merchant bills and perform QR payments: You can enable users to pay schools, clubs, insurance, and other merchants using QR codes.

- Mobile payment request and mobile cash: Your app can allow users to request payments from other customers or send cash to any mobile number in Qatar for ATM withdrawal without a card.

| Tip: These features focus on daily convenience, trust, and engagement. |

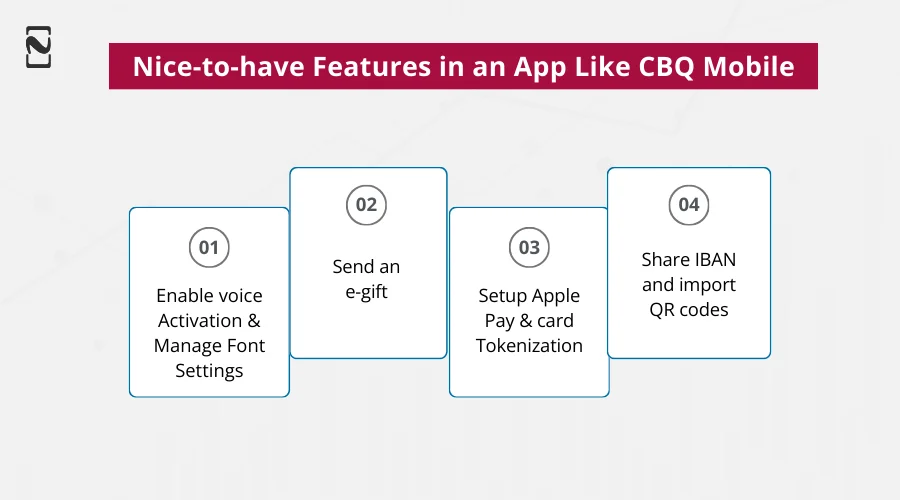

3. Nice-to-have Features (Can Be Delayed at Launch)

These features enhance user experience, but you can add them after your banking app is stable:

- Enable voice activation and manage font settings: You can allow users to interact with the app using voice commands and adjust fonts for comfort.

- Send an e-gift: Your app can allow users to surprise friends and family on special occasions with digital gifts.

- Setup Apple Pay & card tokenization: You can enable users to pay with Tap n Pay securely using their devices.

- Share IBAN and import QR codes: You can make it easy for users to send money to family, friends, or new beneficiaries.

| Tip: These features delight users and improve retention, but can be added after the core app is stable. |

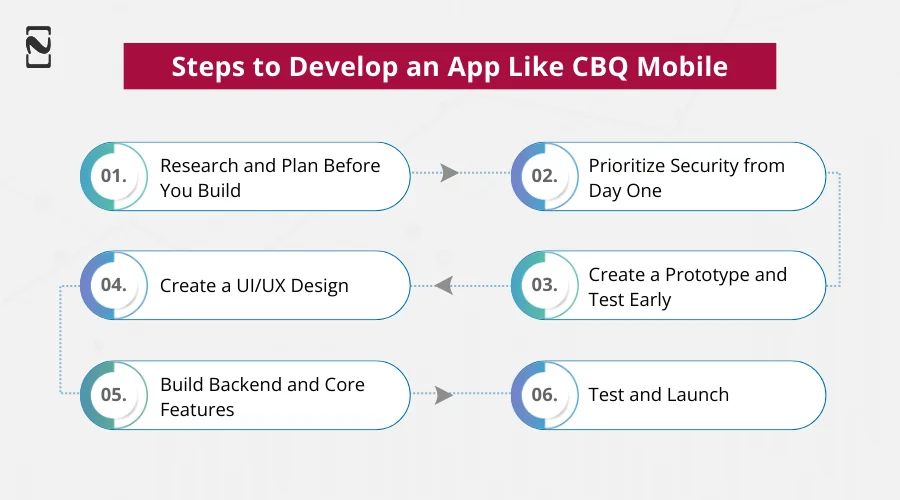

Steps to Develop an App Like CBQ Mobile

Creating a mobile banking app like CBQ Mobile is pretty similar to making any other app. But you need to pay extra attention to security. Below, we have shared easy steps to help you develop an app like CBQ Mobile. Take a look!

Step 1: Research and Plan Before You Build

First of all, you should take time to understand your target audience and the market. You can ask questions like who will use your CBQ Mobile-like app? What problems is your app trying to solve? What features do competitors provide? What are your target audience’s pain points?

Knowing this will help you focus on what really matters, rather than adding every possible feature at once. A clear plan and proper mobile app market research prevent wasted time and ensure your app solves real banking needs for your target audience.

Step 2: Prioritize Security from Day One

Security is not just a feature. It is the foundation of your mobile banking app like CBQ Mobile. You should plan secure logins, encrypted data, and fraud protection before adding fancy screens.

Additionally, if users do not feel safe, they will not trust your app, no matter how good it looks. So, it is vital to consider mobile app security as the backbone of every function, from logging in to transferring funds, so your app stays trustworthy from the first use.

Step 3: Create a Prototype and Test Early

Instead of creating a mobile banking application like CBQ Mobile at once, you should start with a simple prototype that shows the main flows. Mobile app prototyping helps you test whether users understand your app, spot confusing steps, and refine the experience early.

Besides, you can collect feedback from real users or your team to test your MVP. Early testing avoids costly mistakes later and ensures the final app is easy to use and intuitive, especially for complex banking actions.

Step 4: Create a UI/UX Design

Your CBQ mobile banking app design should guide users, not confuse them. It is vital to focus on simple flows, clear buttons, and easy-to-read screens. Also, it is advisable to avoid overloading dashboards or adding unnecessary animations.

A visually appealing, intuitive design makes users feel confident performing banking tasks like transfers or bill payments. For best results, you can use feedback from your prototype to adjust layouts and flows. A design that feels natural will keep users coming back.

Step 5: Build Backend and Core Features

To develop an app like CBQ Mobile, you should start coding the core functions like account overview, transfers, bill payments, and security features. Just make sure your backend can handle multiple users, real-time updates, and potential errors without crashing.

Additionally, it is suggested to avoid rushing to add extra or nice-to-have features because stability comes first. You can add them later. A strong backend ensures the app is reliable, fast, and scalable, which is what users care about more than visual bells and whistles.

Step 6: Test and Launch

Once you create a mobile banking app like CBQ Mobile, it is time for testing. Major testing methods can be used for identifying bugs, errors, and other issues. Now that your CBQ Mobile-like app is successfully tested, you can launch the app. After launch, your work is not done.

You can pay attention to real user behavior and feedback to spot bugs, improve flows, and add features gradually. Also, you can focus on stability first, then boost the app with advanced or retention-driving features. Just remember that successful banking apps grow based on users, not assumptions.

Cost to Develop an App Like CBQ Mobile

Building an app like CBQ Mobile is not cheap, but it’s also not just about making pretty screens. The real cost to develop a mobile banking app comes from making the app secure, reliable, and compliant with banking rules.

The MVP cost to develop an app like CBQ Mobile can be around $25,000- $100,000. But for a fully-featured app like CBQ Mobile, the cost can range from $150,000 to $250,000 or more, depending on the complexity of features and compliance requirements.

| App complexity | Cost breakdown |

| Simple MVP version | $25,000-$70,000 |

| Intermediate app | $1,00,000-$150,000 |

| Complex app | $150,000-$250,000+ |

The smart approach for startups is to start with the essential features, get the app stable and secure, and then gradually add advanced features. This way, you control costs, reduce risks, and build a strong foundation for your core banking solutions.

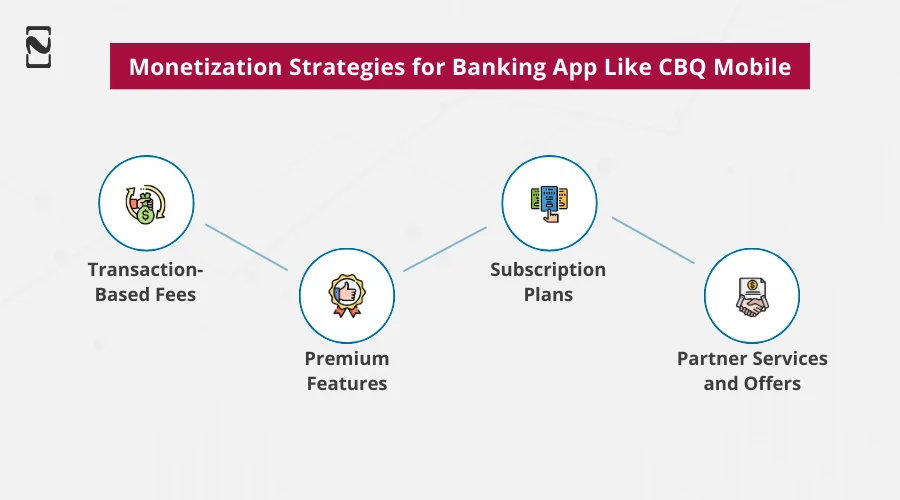

Monetization Strategies for Banking App like CBQ Mobile

How do banking apps make money? Well, most apps do not make money from basic features. They earn by offering optional services or premium tools that users find valuable. Let’s have a look at the common revenue stream of CBQ Mobile-like apps.

-

Transaction-Based Fees

CBQ Mobile apps often charge small fees for optional services, like international transfers, instant payments, or cash withdrawals. Users accept these fees if they are clear and fair. This is one of the most common ways banking apps earn revenue without annoying regular users.

-

Premium Features

Some users want more convenience. Online banking apps can offer premium features like higher transfer limits, advanced spending reports, or faster customer support. Users pay only if they need these extras, so the app stays useful for everyone while creating an extra income stream.

-

Subscription Plans

You can also offer monthly or yearly subscriptions. Users get benefits such as free transfers, priority support, or extra features. This app monetization model gives predictable revenue for the business and better value for users who want more than the basic services.

-

Partner Services and Offers

Mobile banking apps like CBQ Mobile can collaborate with merchants, insurance providers, or loan companies. When users buy these services inside the app, the bank earns a commission. These offers should be helpful and relevant, not pushy, so users feel supported, not sold to.

Challenges of Developing an App like CBQ Mobile & Possible Solutions

After knowing the monetization strategies, it is vital to know what challenges you might face while creating your mobile banking app. Below are the potential challenges and their solutions to develop an app like CBQ Mobile.

► Strong Security Without Complicating User Experience

Mobile banking apps handle sensitive money and personal information, so security is a must. The challenge is to protect users without making the app hard to use. Too many steps or repeated logins can frustrate users and reduce app adoption.

Solution:

Mobile app developers can use secure login methods like biometrics or OTPs, encrypt all data, and monitor transactions for fraud. This is all without interrupting normal app use. Make security invisible to the user but strong behind the scenes.

► Building a Fast and Reliable App

Users expect instant access to balances, transfers, and payments. Slow mobile apps or crashes make people leave. Even a few seconds of delay during peak hours can create negative impressions and reduce trust.

Solution:

You should optimize the backend, use cloud servers, and run performance tests to ensure smooth, quick operations even during heavy traffic. Also, continuous monitoring and updates help keep the app stable and reliable.

► Offering a Simple but Complete User Experience

CBQ Mobile does a lot of things, like accounts, cards, payments, and transfers. But users should not feel confused. Overloading menus or burying important features can make even a powerful app feel complicated.

Solution:

You should focus on easy navigation, highlight the most used features, and test with real users to make sure the app feels simple and intuitive. A clean and visually appealing design with clear workflows encourages users to engage more often and trust the app.

How Can Nimble AppGenie Help to Build an App Like CBQ Mobile?

The Fintech market is very specific, and building a successful mobile banking app is not easy. However, reaching your goals becomes much simpler when you have a trusted mobile banking app development services provider and stick to a clear plan from start to finish.

At Nimble AppGenie, we assist businesses in designing and building mobile financial products that work smoothly and securely. With our support, you can create a mobile banking app like CBQ Mobile that makes remote banking more convenient.

We focus on the right features, stability, and user experience, so your app can stand out in the fintech market. Besides, we also integrate AI in banking apps to make your app smarter, faster, and more personalized.

For example, AI can help with fraud detection, predictive spending insights, and automated customer support, giving your users a seamless experience.

So, are you ready to boost your business banking experience? Nimble AppGenie is your one-stop destination for all your mobile banking solutions.

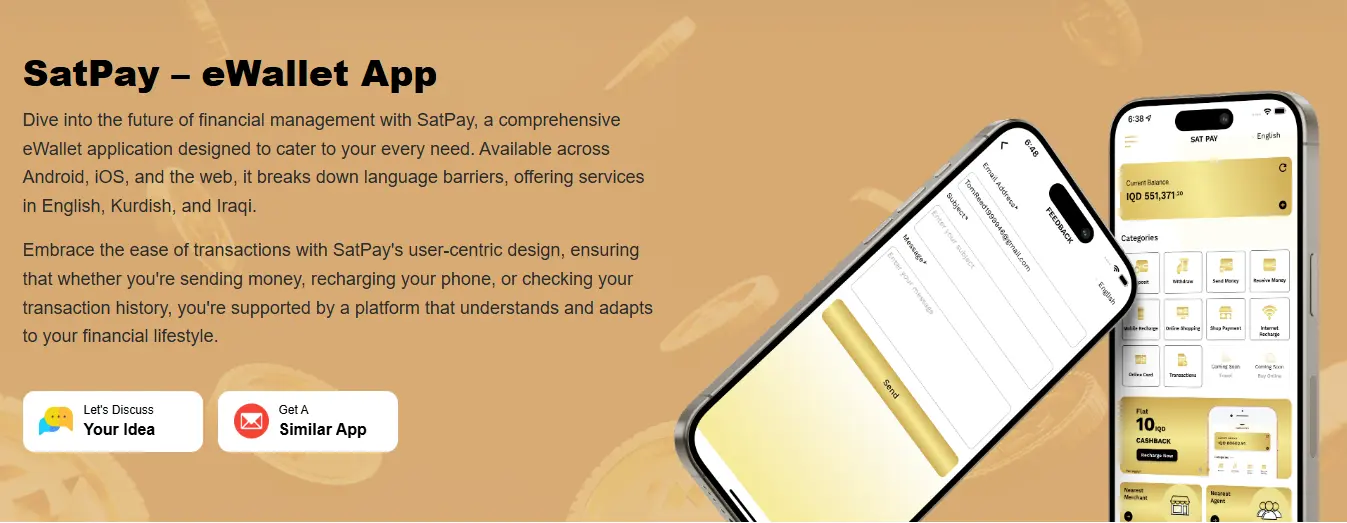

SatPay: Ewallet Application Case Study

Client Type: Ewallet and mobile payment app named SatPay

Challenge: Users faced slow money transfers, low adoption of peer-to-peer payments, and limited engagement with bill payment and merchant services. Our goal was to make SatPay faster, more engaging, and easier to use.

Solutions Implemented:

- Developed real-time fund transfers with instant transaction notifications

- Added easy bill payment options for utilities, telecom, and merchants

- Integrated an in-app rewards and cashback system to encourage regular use

- Built simplified QR code payments for quick merchant interactions

Business Results:

- 50% increase in active users within 3 months

- 60% higher peer-to-peer transaction volume

- 40% faster payment processing

- Improved user retention and repeat app engagement

Key Takeaway: By developing SatPay, we made mobile payments faster, more convenient, and more rewarding. Real-time transfers, rewards, and easy bill payments helped increase adoption, engagement, and loyalty. This makes SatPay a competitive and trusted e-wallet in the market.

Final Thoughts

Developing a mobile banking application like CBQ Mobile is a long-term commitment. Success does not come from launching fast or adding every possible feature, but from making sure the app works smoothly, stays secure, and earns user confidence over time.

Besides, it is vital to understand the mistakes to avoid while developing a banking app, which helps reduce risk and protect both users and the brand. When the foundation is strong, improvements and new features become easier to add without discussion.

So, if you have a banking mobile app idea and want to turn it into reality, book a free consultation with us.

FAQs

To build an app like CBQ Mobile, you have to follow the steps below:

- Conduct market research and target audience

- Plan out the core features

- Make a prototype and test in advance

- Design the UI and UX interface

- Build an MVP Version of the app

- Test and launch the application

- Maintain and update the app

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.