If you run a business and want to accept payments online or through an app, Square is one of the easiest and most reliable options. From selling products to booking appointments, Square payment gateway integration enables you to collect money from your customers hassle-free.

More than 4 million users use Square globally, and over $230 billion was made in payments in 2023 alone. Many businesses trust and depend on Square to manage their transactions.

If you are thinking of integrating Square’s payment gateway into your app or website, this blog will provide an in-depth insight.

We will take you through the types of APIs Square offers, the best use cases, and how to integrate the Square payment gateway into your app.

So, let’s begin!

What is Square Payment Gateway?

Square’s payment gateway helps businesses accept payments from customers. It works for both online and in-person payments. From mobile apps, websites, to physical stores, the Square payment gateway integration can be used to make payments.

Users can take card payments, use digital wallets and even send invoices. It makes transactions very easy and secure. It manages the money transfer from customers’ cards to merchants’ accounts. Users can also get amazing features to handle orders, products, and customer details.

It is a good option for small businesses and service providers. Square also provides users with a dashboard to track all their sales and payments in one place.

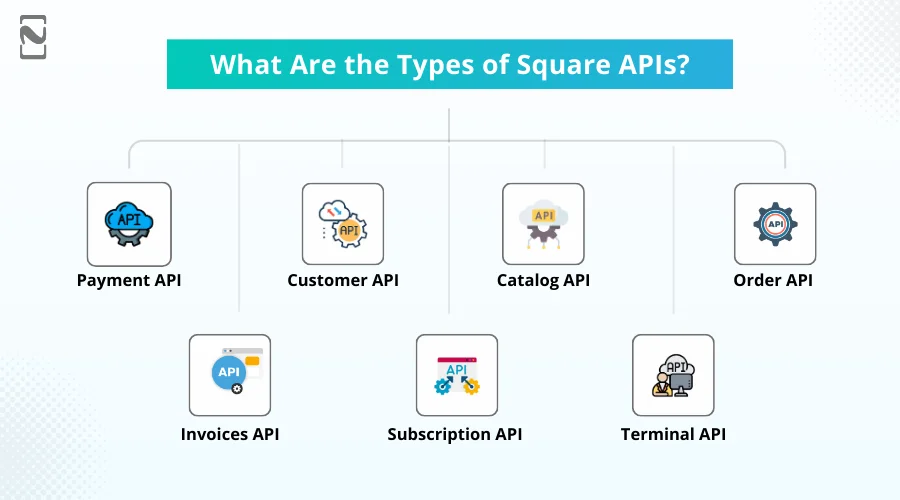

What are the Types of Square APIs?

Square provides various APIs to help businesses accept payments, manage customers, and handle products, etc. These APIs can be used in websites, mobile apps, or even physical stores.

Let’s take a look at the 7 types of Square APIs.

1. Payment API

The Payment API is one of the best API’s of the Square system. It helps businesses to quickly and safely accept payment from customers.

No matter if you run an online store, mobile app, or in-person business, this API enables you to take card payments and digital wallets.

It is specifically built to manage secure transactions, refunds, and track payment history. If you want to get paid online or through the app, this is the main API you will require.

2. Customer API

If you integrate a customer API in your app, you can collect and store customer information like names, phone numbers, and email addresses.

It also assists businesses in tracking their regular buyers and providing them with better service. It can also be used for customer notes and marketing messages.

3. Catalog API

The catalog API stores all your business items like products, services, prices, catalogs, and variations. Stop updating everything manually because the catalog API enables you to add or change product details in one place and updates every system. This is perfect for online stores and offline shops to keep everything in sync.

4. Order API

The Order API is used to create and handle customer orders. It works well for businesses that sell products or services and want to track items in each sale.

For example, if you run a restaurant or a shopping store, this assists in managing what the customer has purchased, how much it costs, and whether it covers taxes or discounts. It also connects with the Catalog API to get the product details.

5. Invoices API

The Invoice API enables you to create and send online invoices to customers. They receive an email or a link where they can pay you online. It is the best API development solution for service providers like repair businesses, consultants, etc, who bill clients after completing work.

6. Subscription API

If your business runs on monthly or yearly billing, like a gym, streaming service, or software, you can use a Subscription API. It allows you to set up recurring payments, manage plans, and handle cancellations or modifications. You can automate everything so customers are billed without reminders.

7. Terminal API

The Terminal API is used for in-person payments through Square’s card reader software. If you run a store or a cafe, the Square payment gateway integration enables your custom software to connect with Square’s physical devices to take secure card payments on the spot.

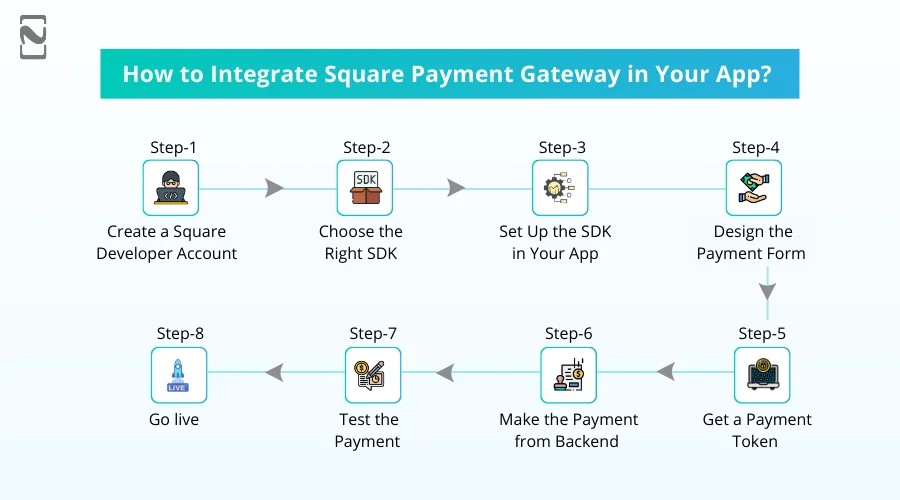

How to Integrate Square Payment Gateway in Your App?

If you are building a mobile or website and want to accept payments from your users, Square payment gateway integration is a good option. It is secure and works well for small businesses, online stores, or service-based apps.

Let’s have a look at the steps to integrate the Square payment gateway in your app.

Step 1: Create a Square Developer Account

First of all, you should go to the Square developer website and register for a free developer account. Once you are easily registered, log in and create a new application from the dashboard. This mobile app will provide you with access to your application ID and access token, which you will need to connect your app to Square.

Step 2: Choosing the Right SDK

Square provides multiple SDKs or software tools based on the type of mobile application you are developing. For example, for mobile apps, you can use the Square in-app payment SDK, which is available for iOS and Android.

For websites, you can use the Square web payments SDK or a payment form. Always choose the one that fits your application type. These tools will assist you in developing the payment screen and managing transactions.

Step 3: Set Up the SDK in Your App

After picking the right SDK, you are required to download it into your app. Here is how you can do it. For Android apps, you can add the SDK to your app’s build. Gradle file using the code from Square’s docs.

For iOS apps, you can use Swift Package Manager or CocoaPods to install the SDK. Lastly, for web apps, you can add the Square script link in your HTML file and follow their JavaScript setup.

Step 4: Design the Payment Form

At this stage, you need to design a simple yet visually appealing payment form in your application. This form usually asks for the card number, expiry date, and CVV. Also, you can either design your own form or use the pre-built form provided by Square’s SDK. The form manages things like input validation and security.

Step 5: Get a Payment Token

When a user enters their credit card details and clicks pay, the SDK will turn that data into a more secure token known as a nonce.

This token is used instead of the actual card data to keep everything safe. You should send this token to your backend server to finish the payment.

This process also helps improve API security because the actual card data is never shared directly over the network. Only the token is sent, which makes it much safer.

Step 6: Make the Payment from the Backend

On your server, you should use the Square payment gateway integration API to process the payment. You will send the token along with the amount, currency, and a few other details.

You will need to use your access token from the Square dashboard on the backend to authenticate your mobile application.

Step 7: Test the Payment

Now, before your app goes live, it is vital to use Square’s sandbox mode to test everything. The sandbox allows you to use fake cards to check if the payment flow is working.

Just make sure that you test the app for successful payments, failed payments, and error messages. This will help you to make sure your users do not face any issues.

Step 8: Go live

Once everything works well in the sandbox, you can switch to the production model. Always update your application ID and access token with the live ones from your Square dashboard. Your application is now ready to accept the real payment by using Square.

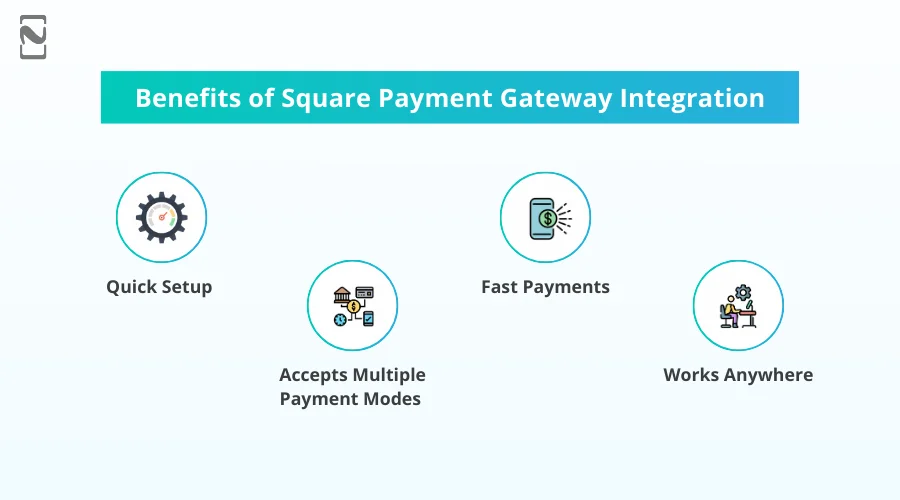

Benefits of Square Payment Gateway Integration

If you are thinking of integrating the Square payment gateway in your e-commerce application, it is vital to carefully go through the benefits.

So, let’s check out the main benefits of using Square in the app.

♦ Quick Setup

Square’s payment gateway is easy and quick to set up. You don’t need to be a computer expert; just create an account and start accepting payments. The app provides a step-by-step tutorial to guide you.

♦ Accepts Multiple Payment Modes

When you integrate Square into your app, your customers can pay the way they prefer. It accepts credit cards, debit cards, Apple Pay, Google Pay, and even BNPL.

This means more people can buy from you. Plus, with built-in fintech security, all transactions are safe and protected. This gives your customers peace of mind while making payments.

♦ Fast Payments

Square sends money to your bank account faster. Usually, it takes only 1 or 2 days. This will assist you in managing your money better and keeping your business running smoothly.

♦ Works Anywhere

You can use Square in your shop, online, or even while traveling. Square provides card readers for mobile use. If you sell products at events or markets, you can still take card payments.

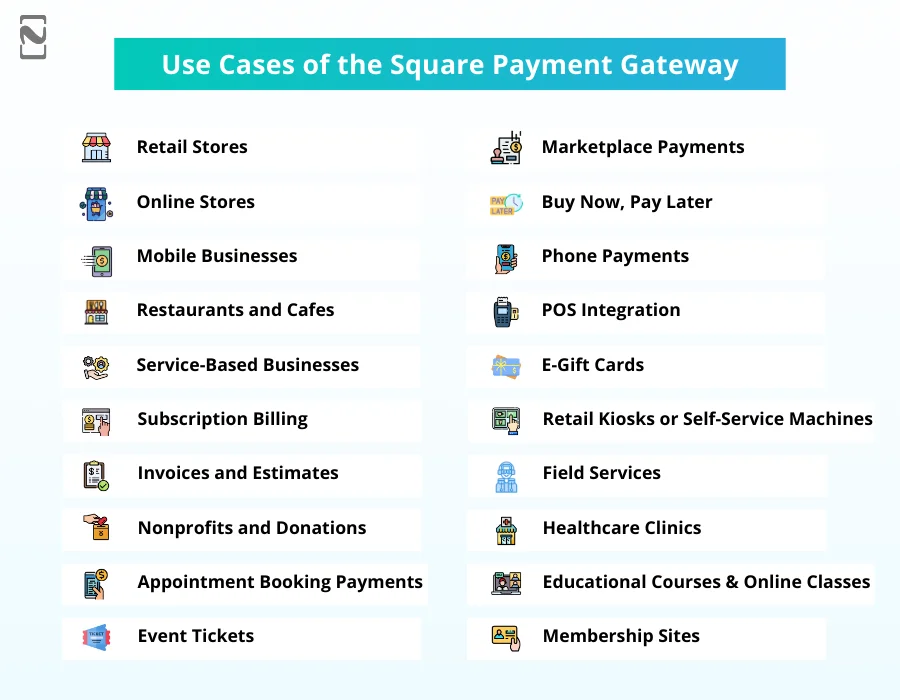

What are Some Use Cases of Square Payment Gateway?

Square payment gateway is used by many types of businesses to easily get payments. From selling products in a store to running an online shop, Square assists you in accepting payments through many instant payment systems. It works for both small and large businesses.

Check out the list of use cases for the Square payment gateway.

How Nimble AppGenie Can Assist You in Integrating the Square Payment Gateway?

Nimble AppGenie is a prominent fintech app development company that can help you integrate the Square payment gateway into your app or website.

Our expert team knows how Square works and can connect it with your system so that users can easily pay using cards, wallets, or other Square options. We will manage all the setup, from creating a Square account to linking it with your app.

Also, we ensure the payment system works well on both Android and iOS. If any issues arise, our experts provide support and fix them instantly. If you want to accept payments using Square, it can save you time and make the whole setup stress-free.

Final Thoughts

The above blog mentioned how to integrate the Square payment gateway into your website or app and how it makes sense. Square’s payment gateway integration brings many advantages, from quick setup to accepting payments anywhere.

However, there are some challenges you might face while integrating Square with your app. A proper setup can easily solve issues and handle transaction hurdles. So, if you are planning to create a money transfer app with payment features, Square is a good option to begin with.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.