Do you want to develop a crypto platform?

In recent times words like “Crypto” and “Blockchain” are being thrown around a lot. From billion dollar companies to ambitious startups, everyone is looking to enter this lucrative field.

And they aren’t wrong! This is one of the world’s largest industries with billion dollar potential.

Lucrative, right? Well, that’s what has brought you here.

Investing in developing a crypto platform is a good business idea for so many reasons. Revenue, recognition, future proofing, and what not.

But the big question is, how do you do it?

Well, that’s what we are here for. In this guide to crypto platform development, you’ll learn all you need to know about it.

Starting from understanding the basics to full-fledged development process breakdown, we’ll cover it.

Therefore, with this being said, let’s get right into it:

Understanding Crypto Platform

First things first, what’s a crypto platform?

A crypto platform is your gateway to the world of digital assets.

It’s a digital infrastructure that allows you to buy, sell, trade, and manage cryptocurrencies seamlessly.

Whether you’re looking to develop a crypto platform for exchanges, wallets, or trading, understanding the basics is crucial. Crypto platforms are built on blockchain technology, which ensures transparency, security, and decentralization.

This technology forms the backbone of your platform, providing the trust and reliability your users need.

The growing demand for cryptocurrencies makes it essential to create a robust platform that caters to diverse needs, from simple transactions to complex trading operations.

By choosing to create a cryptocurrency platform, you’re not just joining a trend—you’re stepping into the future of finance.

The flexibility of crypto platforms allows you to tailor them to various use cases, whether it’s for personal investments, business transactions, or trading.

As the digital asset market expands, your platform will be a vital tool for users looking to navigate this exciting new world.

♦ Blockchain Technology – Ether Of Crypto

Blockchain technology is the heart of any crypto platform.

Without it, the transparency, security, and decentralization that define cryptocurrencies wouldn’t exist.

So, if you want to build a crypto platform, understanding blockchain is crucial.

A blockchain is essentially a digital ledger that’s distributed across a network of computers.

Every transaction made on the platform is recorded on this ledger in a way that’s transparent and immutable.

This means that once a transaction is recorded, it cannot be altered or deleted, providing a high level of security and trust.

When you decide to develop a blockchain-based crypto platform, you’re choosing a foundation that’s not just secure but also highly scalable.

Blockchain development allows your platform to handle a large number of transactions simultaneously without compromising on performance. This is vital as your user base grows.

By integrating blockchain into your platform, you’re ensuring that your users have a secure, transparent, and efficient experience. This is why it’s called the ether of crypto—it’s the very substance that powers your platform.

Types of Cryptocurrencies

When you create a cryptocurrency platform, understanding the various types of cryptocurrencies is essential.

Each type offers unique features and use cases that can significantly impact how your platform operates and serves its users.

► Bitcoin (BTC)

Bitcoin is the original cryptocurrency and remains the most well-known. It’s often referred to as digital gold due to its value and limited supply. Keeping an eye on the Bitcoin price today is crucial for both investors and enthusiasts, as it can influence market sentiment and trading decisions.

Many users are drawn to Bitcoin for its stability and wide acceptance across platforms.

► Altcoins

Altcoins are any cryptocurrencies other than Bitcoin.

These include popular names like Ethereum (ETH), Ripple (XRP), and Litecoin (LTC). Each altcoin serves different purposes.

For example, Ethereum is known for its smart contract functionality, while Ripple is favored for fast and low-cost cross-border payments.

► Stablecoins

Stablecoins are a type of cryptocurrency pegged to a stable asset, like the US Dollar or gold.

They’re designed to reduce the volatility typically associated with cryptocurrencies. Examples include Tether (USDT) and USD Coin (USDC).

Integrating stablecoins into your platform can attract users looking for stability in their digital transactions.

► Tokens

Tokens are a form of cryptocurrency that represents assets or utilities on a specific platform, typically within the Ethereum blockchain.

They can represent anything from digital art in the form of NFTs (Non-Fungible Tokens) to voting rights in a decentralized organization.

► Privacy Coins

Privacy coins like Monero (XMR) and Zcash (ZEC) focus on providing enhanced privacy features.

They offer users the ability to make transactions that are untraceable, appealing to those who value anonymity.

When you build your own cryptocurrency platform, offering support for various types of cryptocurrencies can help you cater to a broader audience. Each type serves different user needs, from high-security transactions to more speculative investments.

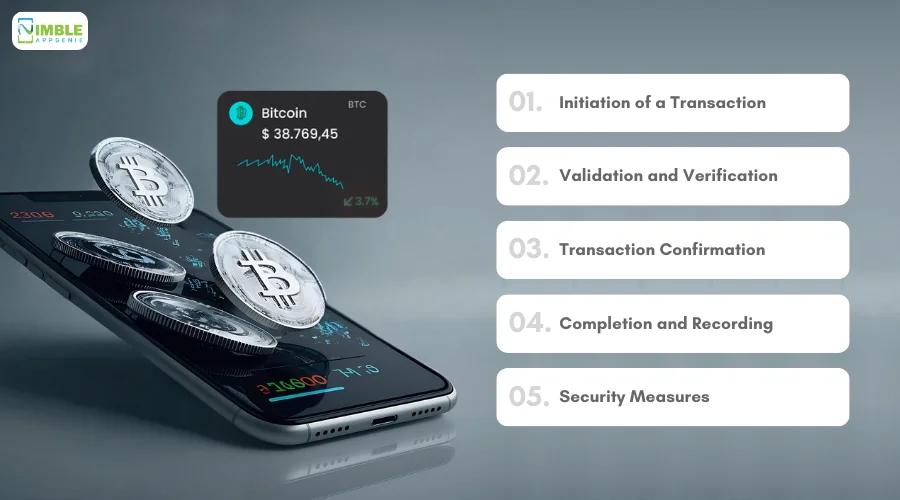

How Crypto Transactions Work?

Understanding how crypto transactions work is fundamental when you develop a decentralized crypto platform.

Crypto transactions differ significantly from traditional financial transactions, primarily because they rely on blockchain technology to ensure security, transparency, and decentralization.

1. Initiation of a Transaction

A crypto transaction begins when a user decides to send cryptocurrency to another user.

This is done by entering the recipient’s wallet address and specifying the amount to be sent. The transaction is then broadcast to the entire network.

2. Validation and Verification

Once the transaction is initiated, it enters a process known as validation. In a decentralized network, this process is carried out by miners or validators, depending on the blockchain protocol.

These participants verify the legitimacy of the transaction by ensuring that the sender has sufficient funds and that the transaction follows the rules of the blockchain.

3. Transaction Confirmation

After validation, the transaction is bundled into a block and added to the blockchain. Each block contains a record of multiple transactions, and once added, it cannot be altered.

This immutability is a key feature of blockchain technology and ensures that transactions are secure and trustworthy.

4. Completion and Recording

Once the block is added to the blockchain, the transaction is confirmed. The recipient’s wallet is credited with the cryptocurrency, and the sender’s wallet is debited.

This process is typically fast, especially on platforms that have integrated efficient blockchain networks.

5. Security Measures

Crypto transactions are secured through cryptographic techniques, ensuring that only the owner of a private key can authorize a transaction.

This makes unauthorized transactions virtually impossible, adding an extra layer of security to your platform.

By understanding and implementing these processes, you can create a secure crypto wallet platform that your users can trust. The smooth handling of transactions is crucial for the success of your crypto platform, as it directly impacts user experience.

Why Develop A Crypto Platform in 2024?

It’s time to ask the big question, why develop a crypto platform?

The year 2024 presents a unique and promising opportunity for those looking to develop a crypto platform.

The global cryptocurrency market continues to grow at an unprecedented rate, and more businesses and individuals are turning to digital assets as a viable alternative to traditional finance.

Here’s why investing in a crypto platform now makes more sense than ever.

1] Market Growth and Adoption

Cryptocurrencies have seen exponential growth in adoption, with over 300 million crypto users worldwide.

This number is expected to rise, driven by increased awareness and the growing acceptance of digital assets by major financial institutions.

By 2024, the market is anticipated to exceed $2 trillion, offering immense potential for new platforms to capture a share of this expanding market.

2] Advancements in Blockchain Technology

The technology underpinning crypto platforms, blockchain, is rapidly evolving.

Innovations such as layer 2 scaling solutions and interoperability are making blockchain networks faster, more secure, and more user-friendly.

These advancements reduce development costs and improve the performance of crypto platforms, making 2024 an ideal time to create a cryptocurrency platform that leverages these innovations.

3] Regulatory Clarity

As the cryptocurrency market matures, so does the regulatory environment.

Governments around the world are providing clearer guidelines for the operation of crypto platforms, reducing the risks associated with regulatory compliance.

This clarity makes it easier for businesses to launch and operate crypto platforms without fear of sudden legal challenges.

4] Diversified Use Cases

Cryptocurrencies are no longer just about trading and investment.

They are increasingly being used for various applications, including remittances, micropayments, decentralized finance (DeFi), and more.

This diversification of use cases presents a wide range of opportunities for entrepreneurs to develop a blockchain-based crypto platform that caters to specific needs in the market.

5] Competitive Advantage

The earlier you enter the market, the better positioned you’ll be to capture a loyal user base.

As more companies recognize the potential of cryptocurrencies, the competition will become fiercer.

By starting your development in 2024, you’ll be ahead of late adopters, establishing your platform as a trusted and reliable option in the market.

6] Technological Maturity

The tools and frameworks for building crypto platforms have matured significantly.

Developers now have access to a variety of robust platforms and libraries that make it easier to build a secure crypto platform.

This maturity reduces the time and resources needed to bring a platform to market.

By choosing to build your own cryptocurrency platform in 2024, you’re capitalizing on a market that’s ripe with potential. The combination of growing user adoption, technological advancements, and regulatory support creates an ideal environment for new crypto platforms to thrive.

Types of Crypto Platforms

When you set out to launch a crypto spending app, it’s essential to understand the various types of platforms available.

Each type serves different purposes and caters to different user needs.

In this section, we’ll explore the most common types of crypto platforms, including their unique features and potential applications.

♦ Cryptocurrency Exchanges

Cryptocurrency exchanges are the most popular type of crypto platform. They allow users to buy, sell, and trade cryptocurrencies. These platforms come in two primary forms:

- Centralized Exchanges (CEX):

Centralized exchanges are managed by a central authority or company. They provide a user-friendly interface, high liquidity, and a wide range of trading pairs. Examples include Binance and Coinbase. Centralized exchanges are often preferred by beginners due to their ease of use, but they require users to trust the platform with their funds, which can be a security concern. - Decentralized Exchanges (DEX):

Decentralized exchanges operate without a central authority. They facilitate peer-to-peer trading of cryptocurrencies directly between users. DEXs, like Uniswap and PancakeSwap, are gaining popularity due to their enhanced security and privacy, as users maintain control of their funds at all times. However, they may offer less liquidity and a steeper learning curve compared to centralized exchanges.

When you create a cryptocurrency exchange platform, you must decide whether to focus on a centralized or decentralized model, depending on your target audience and their preferences.

♦ Crypto Wallets

Crypto wallets are essential tools for anyone involved in cryptocurrencies. They allow users to store, send, and receive digital assets securely. And before you go on to develop a crypto wallet, here are the different types. There are different types of wallets, each offering varying levels of security and convenience:

- Hot Wallets:

Hot wallets are connected to the internet and are typically used for everyday transactions. They offer convenience and accessibility, making them popular among active traders. However, because they are online, they are more vulnerable to hacks. - Cold Wallets:

Cold wallets are offline storage solutions, such as hardware wallets or paper wallets. They provide a higher level of security by keeping private keys offline, making them ideal for long-term storage of cryptocurrencies. - Multi-Currency Wallets:

Multi-currency wallets support multiple cryptocurrencies within a single interface. This feature is increasingly popular as users diversify their crypto holdings. When you create a crypto wallet platform, offering multi-currency support can attract a broader audience.

♦ Crypto-to-Fiat Software

Crypto-to-fiat software bridges the gap between cryptocurrencies and traditional fiat currencies. It allows users to convert their crypto assets into fiat money, such as USD or EUR, and vice versa. This type of software is essential for platforms that want to offer seamless integration with traditional financial systems.

- Key Features:

- Real-time conversion: Instant conversion rates for accurate transactions.

- Integration with payment gateways: Supports payments in both crypto and fiat.

- Regulatory compliance: Ensures all transactions adhere to local and international financial regulations.

Developing crypto-to-fiat software is crucial for businesses that want to provide a full-service financial platform, enabling users to transact in both digital and traditional currencies.

♦ Crypto Payment Gateways

Crypto payment gateways allow merchants to accept cryptocurrency payments for goods and services. These platforms act as intermediaries, converting crypto payments into fiat currency or other digital assets.

- Integration with E-commerce Platforms

Crypto payment gateways can be integrated with popular e-commerce platforms like Shopify or WooCommerce, allowing businesses to expand their payment options. - Security Features

Payment gateways must include robust security features to protect both merchants and customers from fraud.

When you build a crypto payment gateway, it’s essential to focus on ease of integration and security to attract businesses looking to adopt cryptocurrency as a payment method.

♦ DeFi Platforms

Decentralized Finance (DeFi) platforms offer a range of financial services without the need for traditional intermediaries like banks. These platforms operate on blockchain technology and offer services such as lending, borrowing, and yield farming.

- Lending and Borrowing

Users can lend their cryptocurrencies to others in exchange for interest, or borrow against their crypto assets. This is done through smart contracts, ensuring that the terms of the loan are met automatically. - Yield Farming

Yield farming involves users staking or lending their crypto assets to earn rewards. It’s a way for users to generate passive income through their digital assets.

DeFi platform development is highly innovative and represents the future of financial services. When you develop a blockchain platform for crypto, including DeFi features can set your platform apart from traditional financial services.

♦ Crypto Lending Platforms

Crypto lending platforms allow users to borrow and lend cryptocurrencies without the need for traditional financial institutions. They are the blockchain-based cousins of loan lending apps. These platforms often use smart contracts to automate the lending process.

- Peer-to-Peer Lending

Users can lend their cryptocurrencies directly to other users, earning interest on their loans. This decentralized approach reduces costs and increases efficiency. - Collateralized Loans

Borrowers can secure loans by offering their crypto assets as collateral. This reduces the risk for lenders and allows for lower interest rates.

Creating a decentralized crypto platform that includes lending features can attract users looking for alternative ways to earn or borrow money using their crypto assets.

♦ Crypto Trading Platforms

Crypto trading platforms provide users with tools to trade cryptocurrencies. These platforms range from simple trading interfaces to complex systems that offer advanced trading features.

- Automated Trading Bots

Trading platforms can include automated bots that execute trades based on pre-set criteria. This is ideal for users who want to take advantage of market opportunities without constantly monitoring prices. - Advanced Analytics

Offering tools like charting, indicators, and market analysis can help users make informed trading decisions.

When you develop a secure crypto trading platform, ensuring the security of user funds and providing advanced tools can help differentiate your platform from competitors.

Core Feature of A Crypto-Platform

Features can break a platform or make a platform.

When you set out to create a cryptocurrency platform, it’s essential to integrate core features that will not only attract users but also provide them with a secure, efficient, and user-friendly experience.

These features are the foundation of your platform’s success and will determine how well it performs in a competitive market.

1. Multi-Currency Support

Your platform should support multiple cryptocurrencies.

This allows users to manage various digital assets within a single interface, making it convenient and versatile.

Whether it’s Bitcoin, Ethereum, or lesser-known altcoins, providing a wide range of options can attract a diverse user base.

2. User Authentication and Security

Security is paramount in the world of cryptocurrencies.

Implementing strong user authentication measures, such as two-factor authentication (2FA) and biometric authentication, can protect user accounts from unauthorized access.

Plus, encryption of sensitive data and secure key management practices are essential to maintain trust and security on your platform.

3. Real-Time Data and Analytics

Providing users with real-time data on cryptocurrency prices, trading volumes, and market trends is crucial.

This feature allows users to make informed decisions and enhances their overall trading experience.

Advanced analytics tools, such as charting and technical indicators, can further empower users to engage more deeply with the market.

4. Seamless User Experience (UX)

A smooth and intuitive user experience is vital.

Your platform should offer easy navigation, quick access to key features, and a clean interface.

Whether a user is a seasoned trader or a newcomer, they should be able to operate your platform effortlessly. A great UX can significantly boost user retention and satisfaction.

5. Wallet Integration

Integrating secure wallets into your platform is essential.

Users should be able to store, send, and receive cryptocurrencies directly from your platform without the need to use external wallets. This can be done via wallet APIs.

Support for both hot and cold wallets can cater to different user preferences, offering flexibility and security.

6. Smart Contract Capabilities

If you’re developing a blockchain-based platform, integrating smart contracts is a must.

Smart contracts automate transactions and other processes on the blockchain, reducing the need for intermediaries and ensuring that transactions are executed exactly as intended.

7. Regulatory Compliance

Adhering to regulatory requirements is crucial, especially as governments worldwide are increasingly scrutinizing the cryptocurrency industry.

Features like KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance are necessary to operate legally and build trust with your users. Staying compliant can protect your platform from legal challenges and fines.

8. Customer Support and Helpdesk

Providing robust customer support can set your platform apart.

Offering 24/7 support via chat, email, or phone ensures that users can get help whenever they need it.

Moreover, creating a comprehensive FAQ section and user guides can reduce the burden on support staff and improve user satisfaction.

9. Transaction Speed and Scalability

Your platform should be able to handle a high volume of transactions quickly and efficiently. Scalability is key as your user base grows.

Implementing solutions like layer 2 scaling or integrating with high-throughput blockchains can ensure that your platform remains responsive and reliable.

10. Integration with Payment Gateways

For platforms dealing with fiat currencies, integrating with reliable payment gateways is crucial.

This allows users to easily convert their cryptocurrencies to fiat or vice versa.

Secure and smooth transactions between crypto and fiat currencies can enhance the overall user experience.

These core features are the building blocks of a successful crypto platform. By focusing on security, user experience, and compliance, you can develop a secure crypto platform that stands out in the market and meets the needs of its users.

Crypto Platform Development Process

Developing a crypto platform is a multi-step process that requires careful planning, technical expertise, and attention to detail.

Each phase of the development process plays a crucial role in ensuring that your platform is secure, user-friendly, and equipped to handle the needs of your users.

Here’s a detailed breakdown of the process:

Step 1: Define the Project Scope

The first step in developing your crypto platform is to clearly define its scope.

This involves understanding what you want the platform to achieve and identifying the target audience.

Are you aiming to build a crypto exchange, a wallet, or perhaps a payment gateway?

Each type of platform has unique requirements and caters to different user needs.

- Platform Type: Decide on the specific type of crypto platform you want to develop (e.g., trading platform, wallet, payment gateway).

- Target Audience: Identify who your users will be (e.g., retail investors, institutional traders, businesses).

- Feature List: Outline the key features your platform will offer (e.g., multi-currency support, security measures, user interface).

Defining the project scope provides a clear direction and helps in setting realistic goals and timelines for the development process.

Step 2: Choose the Right Blockchain

The blockchain you choose forms the foundation of your platform.

Different blockchains offer different benefits, such as transaction speed, security, and scalability.

Popular choices include Ethereum for its smart contract capabilities, Binance Smart Chain for its low fees, and Solana for its high throughput.

- Blockchain Selection: Choose a blockchain that aligns with your platform’s goals (e.g., Ethereum, Binance Smart Chain, Solana).

- Transaction Speed: Consider how quickly transactions need to be processed on your platform.

- Security: Ensure the blockchain you choose has a strong security track record.

- Scalability: Select a blockchain that can handle your anticipated transaction volume and user base.

The right blockchain will not only support the core functions of your platform but also ensure that it can scale as your user base grows.

Step 3: Design the Platform Architecture

Designing the architecture is a critical step that involves laying out how different components of your platform will interact.

This includes the server infrastructure, database management, APIs, and user interfaces. A well-designed architecture ensures that your platform is reliable, scalable, and easy to maintain.

- Modular Design: Break down the platform into modules (e.g., user management, transaction processing, wallet integration) for easier updates and scaling.

- Database Setup: Choose the appropriate database (e.g., SQL for structured data, NoSQL for large-scale unstructured data).

- API Development: Develop APIs for communication between the frontend and backend, ensuring secure and efficient data transfer.

- Server Infrastructure: Set up a robust server environment, possibly using cloud services like AWS, Azure, or Google Cloud for flexibility and scalability.

A well-thought-out architecture will lay the groundwork for a platform that can handle both current needs and future expansions.

Step 4: Frontend and Backend Development

The development phase is where your platform begins to take shape.

The frontend involves creating a user-friendly interface that allows users to interact with the platform easily, while the backend handles the server-side logic, database management, and APIs.

- Frontend Development: Focus on creating a responsive, intuitive user interface (UI) that works well across different devices (e.g., desktop, mobile).

- Backend Development: Develop the server, database, and API logic that will power the platform’s core functions (e.g., transactions, data storage, user authentication).

- Security Integration: Implement security features such as encryption, two-factor authentication (2FA), and secure key management to protect user data.

Both frontend and backend development need to be closely coordinated to ensure a seamless user experience and secure, efficient operations.

Step 5: Integrate Core Features

The core features of your platform are what make it functional and attractive to users.

These features may include multi-currency support, wallet integration, real-time data analytics, and more.

Ensuring that these features are well-integrated and user-friendly is key to the platform’s success.

The integration of these features should be smooth and intuitive, providing users with a seamless experience that meets their needs.

Step 6: Testing and Quality Assurance

Before launching your platform, rigorous testing is essential to identify and fix any issues.

This includes functional testing to ensure all features work as intended, security testing to protect against potential threats, and performance testing to assess how the platform handles high traffic and large transaction volumes.

- Functional Testing: Test all features and functionalities to ensure they work correctly and as expected.

- Security Testing: Conduct security audits and penetration testing to identify and address vulnerabilities.

- Performance Testing: Simulate high traffic scenarios to ensure the platform remains responsive and reliable.

- User Testing: Involve beta users to gather feedback on usability and identify any issues that might have been overlooked.

Thorough testing helps to ensure that your platform is robust, secure, and ready for launch.

Step 7: Ensure Regulatory Compliance

Cryptocurrency platforms must comply with various regulations, particularly around KYC (Know Your Customer) and AML (Anti-Money Laundering).

Ensuring compliance is critical to avoiding legal issues and building trust with users.

- KYC Compliance: Implement processes to verify user identities, such as requiring government-issued ID and proof of address.

- AML Compliance: Monitor transactions for suspicious activity and ensure adherence to AML regulations.

- Data Protection: Ensure that user data is handled securely and in compliance with regulations like GDPR or CCPA.

- Legal Consultation: Work with legal experts to ensure your platform meets all local and international regulations.

Compliance not only protects your platform from legal risks but also enhances its credibility with users and investors.

Step 8: Deployment

Once your platform is fully developed, tested, and compliant, it’s time to deploy it to a live environment.

This involves setting up the production servers, migrating any necessary data, and making the platform accessible to users.

- Server Setup: Deploy the platform on a secure and scalable server infrastructure, possibly using cloud services for flexibility.

- Data Migration: Ensure that any data from the development or testing phases is securely migrated to the live environment.

- Domain and SSL: Set up the domain name and SSL certificates to ensure the platform is accessible and secure.

- Final Checks: Perform a final round of testing to confirm that everything is working correctly in the live environment.

Successful deployment is crucial for ensuring that your platform is ready for public use without any major issues.

Step 9: Post-Launch Monitoring and Updates

After launch, maintenance and support services are necessary to maintain the platform’s performance, security, and user satisfaction.

This includes tracking user activity, applying security patches, and rolling out new features based on user feedback.

- Continuous Monitoring: Use monitoring tools to track platform performance, user activity, and security.

- User Feedback: Gather and analyze user feedback to identify areas for improvement and new feature opportunities.

- Regular Updates: Release updates to fix bugs, enhance features, and improve security.

- Scaling: Adjust server capacity and optimize the platform’s architecture to handle growing user numbers and transaction volumes.

Ongoing maintenance ensures that your platform remains competitive, secure, and responsive to the needs of its users.

This development process provides a structured approach to building a crypto platform that is robust, secure, and scalable. Each step builds on the previous one, ensuring that by the time your platform is live, it is fully prepared to meet the demands of the market and its users.

Cost of Developing A Crypto Platform

It’s time to ask the big question that you have been waiting for:

How much does it cost to develop a crypto platform?

The average cost of developing a crypto platform can range from $50,000 to $500,000 or more, depending on various factors such as platform complexity, features, security measures, and development team expertise.

Here’s a breakdown of the primary cost factors:

| Cost Factor | Description | Estimated Cost |

| Platform Type | The type of crypto platform (e.g., exchange, wallet, payment gateway) significantly impacts development costs. Complex platforms with multiple features are more expensive. | $10,000 – $200,000 |

| Blockchain Integration | Costs associated with integrating blockchain technology, including smart contract development and network setup. | $15,000 – $80,000 |

| Frontend/Backend Development | Costs for developing the user interface, backend services, APIs, and databases. | $20,000 – $150,000 |

| Security Features | Implementing advanced security measures like encryption, 2FA, and DDoS protection. | $5,000 – $50,000 |

| Compliance and Legal | Ensuring the platform meets regulatory requirements (KYC/AML) and data protection laws (GDPR/CCPA). | $5,000 – $20,000 |

| Testing and QA | Comprehensive testing, including functional, security, and performance testing, to ensure platform reliability and safety. | $5,000 – $30,000 |

| Ongoing Maintenance | Post-launch costs for platform monitoring, updates, scaling, and security patches. | $10,000 – $50,000 annually |

Blockchain development cost is a little difficult to calculate.

Therefore, it’s highlight recommended that you consult a development partner or more specifically a blockchain development company.

By carefully planning and prioritizing features, you can manage the development costs while ensuring your platform is secure, compliant, and capable of meeting user needs.

Possible Challenges You Might Face

Developing a crypto platform is not without its challenges. From technical hurdles to regulatory complexities, there are several potential obstacles you might encounter. Understanding these challenges in advance can help you prepare and mitigate risks effectively. Here’s a look at some of the most common challenges in crypto platform development:

♦ Regulatory Compliance

The regulatory landscape for cryptocurrencies is constantly evolving. Different countries have different laws regarding crypto trading, KYC/AML requirements, and data protection.

Impact: Non-compliance can lead to severe penalties, fines, or even the shutdown of your platform. Navigating these regulations requires ongoing legal consultation and the flexibility to adapt your platform to changing laws.

Mitigation:

- Work closely with legal experts specializing in cryptocurrency regulations.

- Implement robust KYC/AML processes from the start.

- Stay informed about global regulatory changes and be prepared to adapt quickly.

♦ Security Threats

Cybersecurity is a major concern in the cryptocurrency space. Platforms are prime targets for hacking attempts, phishing scams, and fraud.

Impact: A security breach can lead to significant financial losses, damage to your platform’s reputation, and loss of user trust.

Mitigation:

- Implement multi-layered security measures, including encryption, two-factor authentication (2FA), and regular security audits.

- Conduct penetration testing to identify and fix vulnerabilities.

- Educate your users on best security practices to reduce the risk of human error.

♦ Scalability Issues

As your platform grows, it may struggle to handle increased traffic and transaction volumes, leading to slow performance and downtime.

Impact: Poor scalability can result in user dissatisfaction, lost transactions, and reduced trust in your platform’s reliability.

Mitigation:

- Design your platform with scalability in mind from the outset.

- Use cloud-based infrastructure to easily scale resources as needed.

- Implement caching, load balancing, and other performance optimization techniques.

♦ User Experience and Adoption

Cryptocurrency platforms can be complex, and if the user experience (UX) isn’t intuitive, users may struggle to navigate the platform or avoid using it altogether.

Impact: A poor UX can lead to low user retention, negative reviews, and reduced adoption rates.

Mitigation:

- Focus on creating a user-friendly interface with clear navigation and easy-to-understand features.

- Conduct user testing during development to gather feedback and make necessary adjustments.

- Provide educational resources, tutorials, and support to help users get started with your platform.

♦ Liquidity Management

Ensuring sufficient liquidity on your platform, especially for cryptocurrency exchanges, is crucial for smooth trading operations.

Impact: Low liquidity can lead to higher volatility, larger spreads, and difficulties in executing trades, which can drive users away.

Mitigation:

- Partner with liquidity providers to ensure there’s always enough volume for trading.

- Consider implementing liquidity pools or market-making strategies to maintain liquidity.

- Regularly monitor and adjust liquidity levels based on user activity and market conditions.

♦ Competition and Market Saturation

The crypto market is becoming increasingly competitive, with numerous platforms offering similar services. Standing out in such a crowded market can be difficult.

Impact: Without a clear unique selling proposition (USP), attracting and retaining users can be challenging.

Mitigation:

- Clearly define your platform’s USP and ensure it addresses a specific need or gap in the market.

- Focus on niche markets or specialized services where competition is less intense.

- Invest in marketing and community-building efforts to create a loyal user base.

While developing a crypto platform offers significant opportunities, it’s essential to be aware of these potential challenges. By anticipating these issues and implementing strategies to address them, you can increase your platform’s chances of success and longevity in the competitive cryptocurrency market.

Future of Crypto Platforms: Trends & Predictions

The cryptocurrency landscape is evolving rapidly, and staying ahead of trends is crucial for anyone looking to develop a blockchain-based crypto platform.

As the market matures, several key trends and innovations are expected to shape the future of crypto platforms.

Understanding these trends will help you position your platform for success in the coming years.

-

Increased Adoption of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) platforms are gaining traction as they offer financial services without traditional intermediaries like banks.

DeFi enables users to lend, borrow, trade, and earn interest on cryptocurrencies in a decentralized manner.

Prediction:

The DeFi sector is expected to grow exponentially, with more users and businesses adopting DeFi solutions for everything from savings accounts to complex financial instruments. This will drive demand for decentralized crypto platforms that integrate DeFi functionalities.

What This Means for You:

Consider integrating DeFi features into your platform, such as lending protocols, decentralized exchanges (DEXs), or yield farming opportunities. This will attract users who are looking for more control over their financial activities and the potential for higher returns.

-

Enhanced Security Through Quantum-Resistant Cryptography

As quantum computing technology advances, there is growing concern that quantum computers could break the cryptographic algorithms that currently secure blockchain networks.

In response, the industry is exploring quantum-resistant cryptography.

Prediction:

By 2025, we could see the implementation of quantum-resistant algorithms on major blockchain networks, enhancing the security of crypto platforms against future threats.

What This Means for You:

Stay informed about developments in quantum-resistant cryptography and consider adopting these technologies to future-proof your platform. This will ensure that your platform remains secure and trustworthy in the long term.

-

Growth of NFT and Digital Asset Platforms

Non-Fungible Tokens (NFTs) and digital assets have exploded in popularity, with applications ranging from digital art and collectibles to virtual real estate and gaming items.

Prediction:

The NFT market will continue to grow, with more platforms enabling the creation, trading, and management of digital assets. This will lead to the rise of specialized platforms focused on NFTs and other digital assets.

What This Means for You:

If your platform supports or could benefit from digital asset trading, consider integrating NFT marketplaces or features that allow users to create and trade unique digital assets. This will open new revenue streams and attract a diverse user base.

-

Expansion of Regulatory Frameworks

As cryptocurrency adoption increases, governments and regulatory bodies worldwide are developing more comprehensive frameworks to govern the industry.

This includes stricter KYC/AML requirements, tax reporting obligations, and consumer protection measures.

Prediction:

By 2024, we can expect more countries to have clear regulations in place, which will bring stability to the market but also require platforms to be more compliant.

What This Means for You:

Ensure that your platform is designed with flexibility in mind to adapt to changing regulations. This might involve implementing modular compliance systems that can be updated as new laws are introduced. Being proactive in compliance can also be a selling point to users who prioritize security and legality.

-

Integration with Traditional Financial Systems

As cryptocurrencies gain acceptance, there’s a growing trend toward integrating them with traditional financial systems.

This includes everything from crypto credit cards to banking services that support cryptocurrency transactions.

Prediction:

In the near future, we’ll see more seamless integration between crypto platforms and traditional financial services, blurring the lines between fiat and digital currencies.

What This Means for You:

Consider developing crypto-to-fiat software that facilitates these integrations, enabling users to move easily between traditional and digital currencies. This can significantly expand your user base by attracting individuals and businesses who want the flexibility of using both types of currencies.

-

Emergence of Web 3.0 and the Metaverse

Web 3.0 and the metaverse represent the next evolution of the internet, emphasizing decentralization, user ownership, and immersive digital experiences.

Cryptocurrencies and blockchain technology are at the core of this transformation.

Prediction:

The metaverse will create new opportunities for crypto platforms, including decentralized economies, virtual goods, and blockchain-based identities. This will drive innovation in how crypto platforms operate and interact with users.

What This Means for You:

Stay ahead by exploring how your platform can integrate with the metaverse and Web 3.0 technologies. This could involve supporting virtual transactions, digital identities, or decentralized governance models, positioning your platform as a leader in the next generation of digital interaction.

The future of crypto platforms is bright, with numerous trends and innovations poised to shape the industry. By staying informed and adaptable, you can develop a secure crypto platform that not only meets current market demands but also positions itself for future growth. Embracing these trends will ensure that your platform remains competitive, innovative, and relevant in the rapidly evolving world of cryptocurrency.

Nimble AppGenie – Your Partner in Crypto Platform Development

At Nimble AppGenie, we specialize in delivering cutting-edge solutions as a leading cryptocurrency platform development company.

Our team of experts is dedicated to helping you build a secure, scalable, and user-friendly crypto platform tailored to your unique needs.

Whether you’re looking to develop a trading platform, a secure wallet, or a decentralized exchange, we bring extensive experience and the latest technologies to the table.

We understand the complexities of the cryptocurrency landscape and are committed to guiding you through every step of the development process.

From initial concept to post-launch support, we ensure your platform is not only compliant with global regulations but also optimized for performance and user satisfaction.

Partner with Nimble AppGenie, and let’s turn your vision into a successful cryptocurrency platform that stands out in a competitive market.

Conclusion

Developing a crypto platform in today’s fast-evolving digital landscape presents a unique opportunity to tap into the growing cryptocurrency market.

By understanding the intricacies of blockchain technology, embracing the latest trends, and anticipating potential challenges, you can create a platform that not only meets the current needs of users but also adapts to future developments.

Whether you’re building a crypto trading platform, a crypto-to-fiat software, or a decentralized exchange, careful planning, robust security measures, and a commitment to continuous improvement are key to success.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.