While there was a time when people had to carry hefty wallets and cash to make a big purchase, today all of it can be done with a card or a smartphone. And it has only become possible with the introduction of electronic payments.

Electronic payments, referred to as digital payments, have affected how people spend their money. From everyday expenses to bigger investments, every type of transaction today is being carried out in one way or another.

All these electronic transactions are powered by a series of technologies and services that are referred to as Electronic Payment Services.

If you are thinking about starting your own business, it is essential to carry out electronic payment solutions that give convenience for your users and simplify transaction management for you.

But wait a second, do you know what electronic payment services are? If not, you have reached the right place! In this post. We are going to discuss everything about electronic payments, how they work, what their types are, the benefits, and the challenges.

But before we jump into the details, let’s understand what these services are all about! Without further ado, let’s begin!

What is an Electronic Payment Service?

An electronic payment service refers to a digital mechanism that takes care of all the incoming and outgoing transactions that take place between two parties electronically.

It allows a user to make payments or receive them using their smartphones, computers, or tablets. It is paperless and eliminates the use of any cash or cheques.

With a variety of payment methods, it offers great flexibility to its users.

A customer can make a payment using a credit card, debit card, online transfer, e-wallet, or other methods, without needing to engage in traditional exchange.

What makes electronic payments successful is their low rate of transaction failure and high security.

These transactions are not only encrypted but are traceable to their roots, helping in maintaining transparency.

Types of Electronic Payment Services

- Card Payments (Credit/Debit)

- E-Wallets

- Online Banking

- Electronic Funds Transfer

- Contactless Payments

- Peer-to-Peer Payments

- Cryptocurrencies

With so many options available, electronic payments are here to stay as more and more users have started using them.

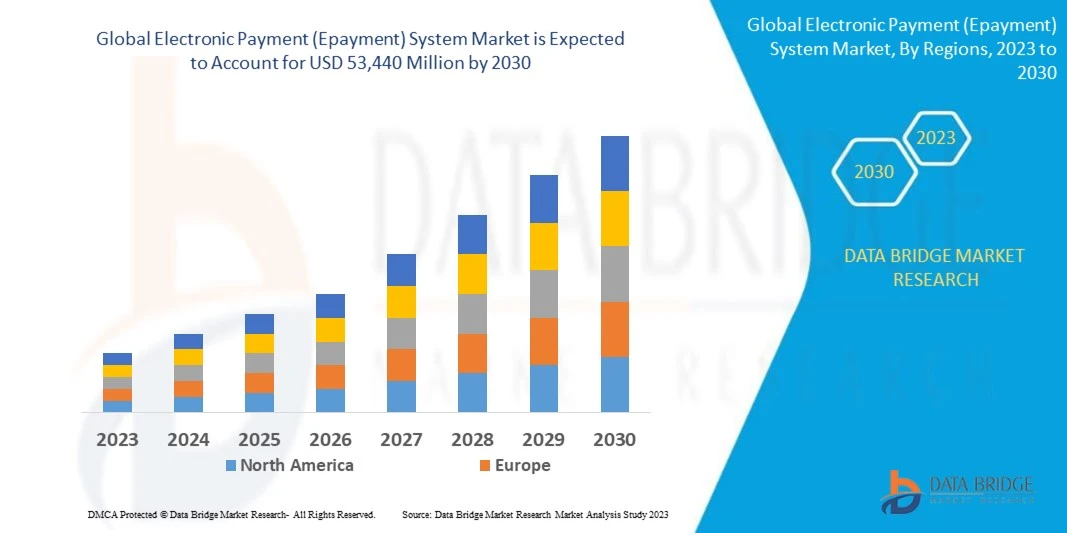

An Overview of the Electronic Payment Services Market

Electronic payment services are the backbone of the digital payments that every business relies on today.

These services refer to methods and technologies that are required to enable electronic payments for any business.

This means that these services have become an integral part of every business, making it a good opportunity.

If we talk about digital payments, the market was valued at $111.2 billion back in 2023 and is estimated to touch $193.7 billion by 2028, growing at a CAGR of 11.8%. All these digital payments are enabled by an electronic payment service.

If the numbers are not motivating yet, you may be interested to know that by 2030, the number of users is expected to touch a whopping 8.34 billion, showing you the adoption rate along with the popularity of electronic payments in general.

The fintech market is rewarding, as having electronic payment services or being a part of the electronic payments realm in any way can be a great decision for growth and revenue.

Electronic Payment Services: How Do They Work?

Knowing the impact of these services, you may be wondering how they work. Well, you are not alone, as several people still wonder how an exchange of funds can be done without any manual intervention.

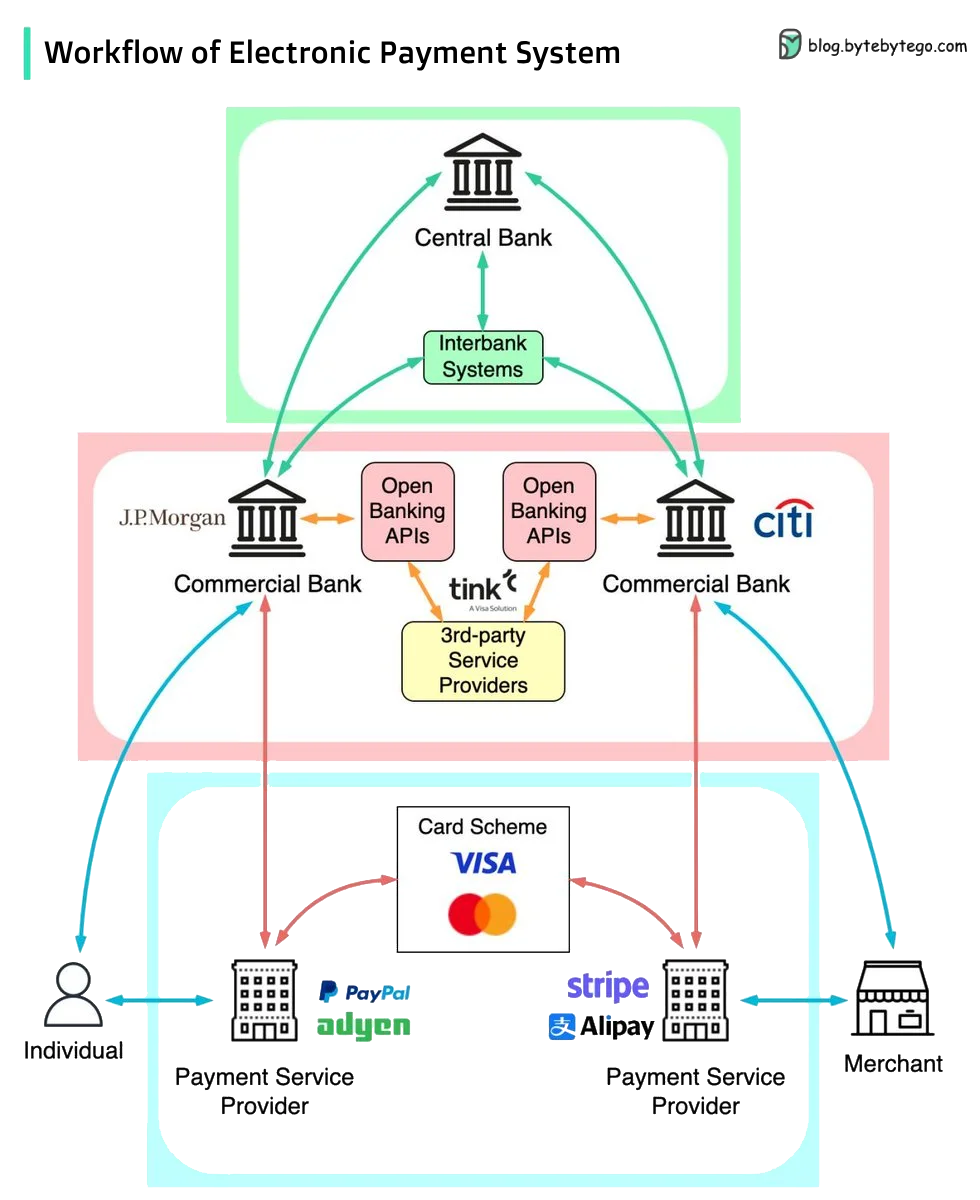

An Electronic Payment System is set up to deploy these services properly. This system comprises different processes that are interconnected in such a way that, when combined, enable the electronic transfer of funds.

Here is a series of processes that are being used to power electronic payment systems –

1. Transaction Initialization

The transaction is initiated by the customer or the payer who wants to transfer funds. This initialization depends on the mode of payment.

For instance, if a payer wants to pay via credit card, swiping or tapping it on the POS will start the transaction, whereas if the transaction is being made online.

The customer will have to enter their payment details to start the transaction.

2. Request Authorization

After the transaction is initiated, the electronic payment system will need authorization to check if the transaction details or the card being used is correct or not.

To ensure the authenticity of the transaction, the system may ask you for a PIN, a biometric authentication, or any other way to validate the transaction.

3. Details Transmission

When the authorization is received, the EPS transmits the request along with the collected payment information to the payment processor. The role of intermediary is now switched from your POS to the payment processor, as it facilitates the exchange of funds between the payer’s and payee’s accounts.

4. Data Routing

Payment processors now route the transaction data to the banks that are involved in the transaction. The information about the exchange is first sent to the payer’s bank so that the funds can be deducted from there.

Later, the payee’s account is credited with the amount. With this routing measure, the transaction becomes more secure as both banks are notified of the instant payment transfer.

5. Fund Settlement

Based on the transaction data routed, the funds are settled in both accounts, i.e., transferred from the payer’s account to the payee’s account.

The settlement can take place in real-time if done through an instant payment method, or it can take two business days, depending on the merchant service provider that the business is using.

6. Transfer Confirmation

When the settlement is completed, both parties are notified with the confirmation. The confirmation can be in the form of a text message, a receipt, or an email from the respective banks.

All these confirmations are done as part of the transaction confirmation so that both parties can stay on the same page.

7. Record Maintenance

The best aspect of electronic payments is that they maintain a record of every transaction. These records can be accessed by the account holder, simplifying reconciliation, auditing, and dispute resolution.

These methods help in maintaining transactions so that they can be revisited if and when necessary.

The entire electronic payment system works within these 7 steps, irrespective of what mode of payment is used.

All transactions, whether from Closed-Loop payments, Open-Loop payments, or other payment methods, must follow these steps for better accountability.

Pros & Cons of Using Electronic Payment Services

Just like any other technology, electronic payments have their pros and cons depending on who is using them.

Let’s take a closer look at these advantages and disadvantages to understand the electronic payment service better.

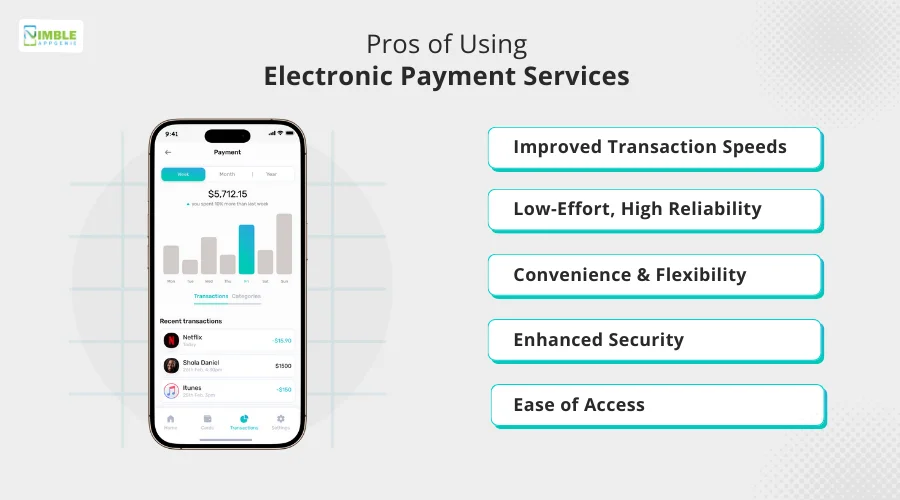

Pros of Using Electronic Payment Services

Here’s why electronic payment services are gaining widespread popularity.

-

Improved Transaction Speeds

Electronic payments are quick to complete as they use a direct-to-bank approach. Transactions are completed faster, saving time and resources.

-

Low-Effort, High Reliability

You need no individual to maintain a record of the transactions, as a customer can pay electronically for your services, keeping the transaction low effort and highly reliable.

-

Convenience & Flexibility

The convenience of walking into a store, choosing what you want, and instantly paying through an electronic payment terminal is unmatched, as it reduces the queues.

Not to mention, a customer does not have to carry cash or even a physical wallet as they can use e-wallets to pay for it via smartphone.

-

Enhanced Security

These transactions are traceable, hence becoming more and more secure. Not to mention, there are encryption and other security measures deployed to ensure that the funds are safely transferred from one account to another.

-

Ease of Access

The accessibility of electronic payments allows a user to pay through their account, irrespective of where or when they are making payments.

These methods allow users to make payments even after banking hours, making it more convenient for both businesses and individuals.

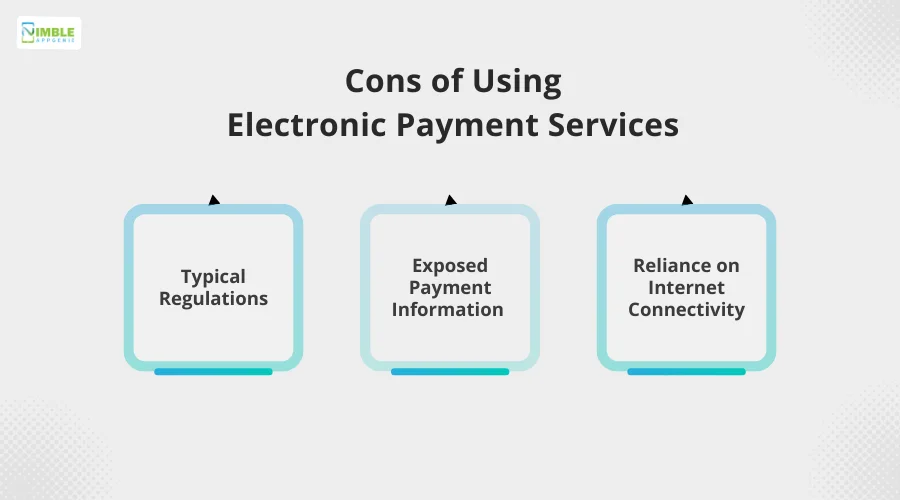

Cons of Using Electronic Payment Services

Let’s explore the potential downsides of using electronic payment services.

-

Typical Regulations

When using electronic payments, you have to adhere to several financial regulations and compliance, which often becomes a headache.

This usually happens when you have not chosen an experienced development team to integrate the EPS.

The ideal way to overcome this issue is by reaching out to a fintech app development company that is equipped to handle all the compliance issues while building the solution for you.

-

Exposed Payment Information

When using digital payments, one of the key concerns of users is that their payment information is exposed on the server. While the electronic payment infrastructure is always made heavy on security, the data can be intercepted during the transaction.

Hence, when building or integrating an EPS, you should pay extra attention to security measures and ensure that a reliable transaction processing system is used to manage the information properly.

-

Reliance on Internet Connectivity

Electronic payments rely on internet connectivity. This means if you are in a remote location and want to use digital payments in the absence of the internet, you may face an issue.

Several payment processors have insisted on creating an offline module that settles the amount when it gets connected to the internet. Which can be a good resolution to this challenge.

With all these pros and cons listed in front of you, you might have gained clarity on whether your business can enjoy these services.

Ideally, none of the cons seems a deal breaker, as the convenience that electronic payments offer overshadows all of them.

Upcoming Trends in Electronic Payment Services

Electronic payments in themselves seem like a thing from the future, as paying through your smartphone is nothing short of a miracle. In tier-3 countries, where people still struggle to access a smartphone.

But the evolution of technology is not stopping soon, as several new trends have already started appearing.

Here are some of the promising trends in electronic payments that you might see in the upcoming years –

Trend #1 – Use of Embedded Finance

With the rise in use of e-commerce and quick commerce applications, online payments have grown significantly.

To make it more convenient, businesses have started integrating embedded finance options that allow a user to pay for their purchases instantly from the app, without having to switch between apps.

Trend #2 – Use of Crypto & Other Digital Currencies

While these digital currencies have not become mainstream yet, they are going to become a regular mode of payment shortly.

With the implementation of blockchain in fintech and payments, the possibilities of using digital currencies have grown as more and more people have started investing in them.

Trend #3 – Open Banking Integration

Open banking APIs are all set to revolutionize the instant payment market as they allow direct transactions across platforms and regions. With the help of open banking, fintechs need not depend on a bank to offer payment services.

These APIs help in transferring banking data to third parties, making the transactions secure and smooth.

Other than these popular financial trends, the use of AI in financial services is a prominent trend that can be observed in a few years from now.

These trends make the entire payments system much more fascinating and convenient.

Nimble AppGenie: Enabling Electronic Payments like a PRO!

Knowing all the details about EPS, you may wonder how to make the most of it. Well, for any online business.

It is necessary to integrate a payment gateway like Square to access a merchant account that allows electronic transactions.

As easy as it sounds, it can be difficult to enable electronic payments on your own if you do not have experts to help you with the process.

At Nimble AppGenie, we have the best developers who will help you identify your requirements and recommend the best payment gateways.

Not only that, they can help you integrate customized gateways that are built to meet your requirements.

Reach out to our experts and ask for payment gateway integration, and start your journey to success with electronic payment services.

Conclusion

Digital payments or electronic payments have become a necessity these days, considering consumers are always looking for the easiest way to exchange funds and pay their bills.

Electronic Payment Systems enable a business to accept different digital payment methods, including cards, mobile wallets, e-wallets, and digital wallets.

Integrate these services into your business and become future-ready instantly! Hope this post helps you with all the insights related to Electronic Payment Services and how they work.

Thanks for reading, good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.