Banks are not what they used to be. It has gone through a drastic shift. You might not notice it right away, but the way things work behind the scenes is nothing like it was a decade ago. A lot of what used to take days now happens in minutes or less.

You can open an account without going to a bank, send money in seconds, and get loan approval from a simple mobile app.

What’s making all this possible? Technology! This shift is a major part of something bigger, which is retail banking’s digital transformation.

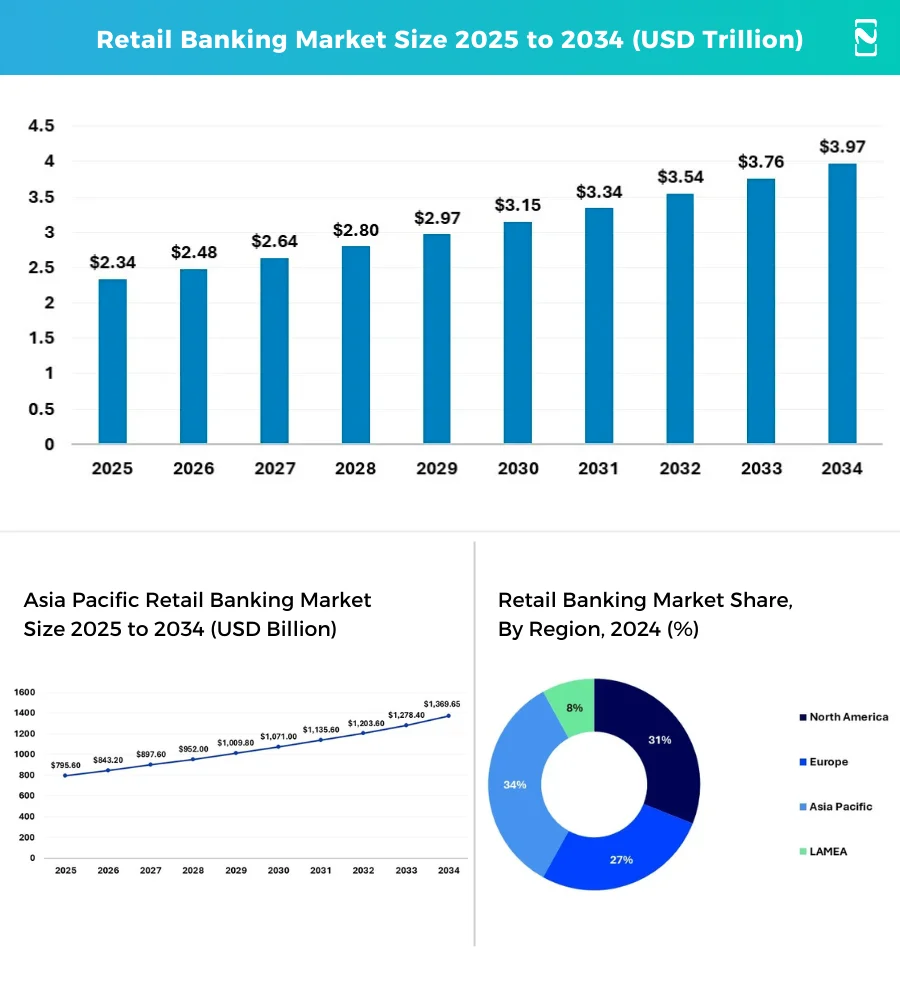

The numbers say a lot. In 2023, the worldwide mobile banking market was valued at around $1.16 billion, and it is projected to reach $4.26 billion by 2032. Retail banking revenue could hit $3.97 billion by 2034. So no, this is not a short-term trend. It is a long-term transformation.

But what does retail banking digital transformation really look like in real life? And how are banks using it to improve both their systems and the customer experience? We’ll talk about all of that in this blog.

So, let’s begin!

What is Digital Transformation in Retail Banking?

Retail banking digital transformation is all about using technology to make banking better for both customers and banks.

That means updating old systems, automating tasks, and improving how banks connect with people.

From mobile apps and online banking to chatbots and digital systems, everything is designed to make banking easier and more convenient.

The goal is to create a smooth, fast, and personalized experience that fits the way people live and bank today. At its core, it’s about meeting customer expectations in a digital world.

Market Overview of the Mobile Banking Industry

The mobile banking transformation has changed the whole banking system. If we look at the mobile banking statistics, the market size is forecasted to reach $4.26 billion by 2032, with a CAGR of 15.60%.

This growth is driven by the rising number of mobile phone users and the increasing demand for on-the-go banking services. In addition, the retail banking alone market size is estimated to rise to $3,373 billion by 2033.

However, in terms of revenue, the retail banking market was valued at $2.34 billion in 2025, and it will grow to $3.97 billion by 2034. Also, the AI in banking is projected to have a revenue of $379 billion by 2034.

This shows that the demand for digital retail banking is going to rise in the coming years, and if you are planning for retail banking app development, now is the perfect time to invest in it.

Benefits of Digital Transformation in Retail Banking

Digital retail banking transformation is not just a trend. It is an immense implementation of digital software in all financial institutions.

It boosts the transaction process, reduces costs, and helps banks do banking more smartly.

Let’s have a look at the core benefits of retail banking digital transformation.

-

Boost Customer Experience

Digital banking has made everyone’s life so much easier. Now customers do not have to wait in long lines. They can check balances, transfer money, or pay mobile bills directly from their mobile phone. It is super convenient and time-efficient for customers.

Additionally, retail banking feels more personal with mobile banking app features like chat support. It is not just about technology, but it also gives customers a better way to manage their finances.

-

Better Operational Efficiency

Digital banking not only helps customers, but also the banks too. Banks have a lot of daily work that takes hours to complete. For example, filling out forms, checking details, and so on. With core banking software and retail banking automation, these tasks can be done in minutes.

It minimizes mistakes and lessens stress for staff. It also helps banks serve more customers in less time. By doing things faster, banks can now focus on more customers and less paperwork.

-

Better Understanding of Customer Needs

As banks go digital, they can learn more about customers’ needs. Whenever customers use the banking app or make a payment, that data helps the bank understand habits and preferences.

This means banks can provide more useful services to customers. For example, showing tips to save money, offering the best loan at the right time.

Of course, none of this works without trust. That’s why mobile banking app security is a top priority that keeps customer data safe and still gives a personalized experience.

-

More Room to Grow and Improve

Retail banking apps give banks a chance to grow and improve. When everything is online, it is really easy to test new ideas, launch better services, and respond to customers fast.

Now, banks can improve things in a few hours without waiting for months to make changes. It helps banks to stay updated, fix issues faster, and improve the overall customer experience.

Major Factors Driving the Digital Shift in Retail Banking

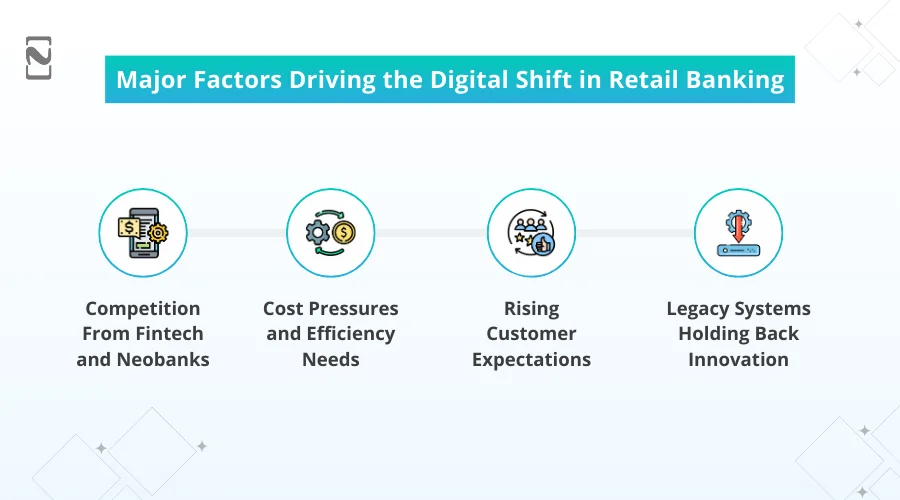

Retail banking digital transformation is not just about using new technology. It is a change in mindset that focuses on putting the customer first.

Here’s why banks are choosing to invest in going digital.

1. Competition from Fintech and Neobanks

Today, banks face huge competition from fintechs and neobanks. These digital-first players provide seamless and often cheaper services, and they do not have any branches or complex paperwork.

That’s super appealing to Gen Z users. To stay in the game, banks now need to create a mobile banking app that’s just seamless and secure. It is not just about going digital. It is about the faster service you provide to customers.

2. Cost Pressures and Efficiency Needs

As you already know, running a physical bank and dealing with paperwork costs a huge amount of money.

If tech is moving fast, the cost of digital transformation in banking will only increase. Experts say banks could end up spending most of their revenue just to operate.

That’s why going digital by using AI in retail banking or a cloud system is the best option. It helps banks cut down costs while improving services. Digital banking can help in saving money and free up resources for innovation.

3. Rising Customer Expectations

Customers are used to seamless technology like online shopping. They want the same things from banks, like faster service, smart suggestions, and 24/7 support. Most customers will choose banks only if their app is good.

That’s why many of the best mobile banking apps are developed around user experience and personalization. Banks that do not meet these customer expectations are at risk of losing the trust and money of Gen Z customers.

4. Legacy Systems Holding Back Innovation

You might have seen that many banks still use outdated systems that are really complex to update or connect with new technology. It shows them down when trying to offer modern features like mobile payments or instant transfers.

So, the solution is to update these old systems by switching to new platforms called retail banking digital transformation. Banks can become more flexible and launch services faster.

Challenges and Solutions for Retail Banking Modernization

It is really not easy to update a bank’s infrastructure. A carefully planned method is essential. At the start, you will require stakeholders.

To guarantee your investment, it is vital to develop a compelling business case that’s well structured.

Your business case should cover various considerations.

-

Cyber Security Threats

As banks go digital, keeping customer data and money safe is really important. They must find a balance between using new technology and keeping strong security.

To do this, banks are using smart apps that can spot fraud by using AI. They are also using multi-factor authentication, which adds extra steps when logging in, making it harder for hackers to break in.

With the rise of open banking APIs, which allow third-party apps to securely access banking data, there’s an even greater need to protect customer data. These APIs create new opportunities for retail banking innovation, but also require banks to strengthen their cybersecurity.

-

Data Privacy Regulations

Banks must follow strict rules to protect customer information, even when it is online. To keep data safe, they need to use tools like encryption, regular security checks, and limit who can see sensitive information.

They also have to follow KYC and rules for AML software to stop fraud, identity theft, and money crimes. To stay within the law, banks should use smart systems that can check identities and monitor transactions for anything suspicious.

-

Outdated Legacy Systems

Many banks still use old computer systems that are really expensive to run. They are often still being paid off. This makes it hard for banks to spend money on new technology.

Updating core banking systems is not just about getting new software. Banks also need to change the way they work with customers.

For example, improving banking app design is an important part of making services easier and more enjoyable to use. To do this, they must get support from key decision-makers by showing how upgrades will help the business.

Major Trends Shaping the Future of Retail Banking

The digital banking industry is growing fast due to new technology and changing customer needs. Experts expect strong yearly growth in the digital banking market from 2025 to 2031.

Here are some of the major mobile banking app trends that are shaping the future of the banking industry.

► Full Automation in Banking Operations

Banks are now automating their entire process using technologies like Robotic Process Automation and AI.

This means that many tasks that were previously done manually, like checking documents and approving loans, are now handled automatically by smart systems.

This is one of the best retail banking technology trends that not only speeds things up but also saves huge money.

So overall, digital transformation in fintech is becoming more efficient, and customers get faster services.

► Personalized Banking Experiences

Banks are no longer providing the same thing to everyone. Instead, they are using data and technology to understand each customer’s needs and provide services that are personalized.

For example, you might get spending alerts or money-saving tips based on your habits.

You will see loan or investment offers that make sense for you. In fact, 74% of customers now expect this type of personalized service, and most banks are focusing on making this a reality.

► Smart Fraud Detection and Prevention

Fraud and cyberattacks are increasing in the banking world. So banks are using AI-powered systems to detect and stop suspicious activity in real-time. These systems can monitor transactions as they happen.

It also quickly flags anything unusual and blocks fraud before it even happens. With over half of banks reporting cyberattacks in 2024, this kind of smart protection is more important than ever.

How Nimble AppGenie Can Help You Develop a Retail Banking App?

Do you want to develop a digital banking app? Nimble AppGenie is a one-stop solution that provides top-notch banking software development services since 2017.

We develop online banking solutions, from trading to mobile banking systems and banking CRM solutions.

Our skilled team integrates customized banking features like AI-driven financial suggestions, real-time fraud alerts, and rapid P2P payments. Our solutions help improve customer satisfaction and make banking easier.

At Nimble AppGenie, we take security seriously and use strong measures to protect your online banking solutions. If you partner with us, you can confidently enjoy the benefits of retail banking digital transformation.

Final Thoughts

Growing competition from banks and increasing customer expectations, merged with the ongoing requirement to reduce costs and fulfill strict rules, are the major factors for digital banking transformation.

However, it is vital to connect them with the latest fintech trends like full automation, personalized services, and fraud detection. That said, true retail banking digital transformation goes beyond adopting new technology.

So, are you ready to revolutionize your bank for the modern era? If yes, then connect with Nimble AppGenie now!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.