The 21st century is dominated by smartphones and technology. This has changed how we used to do things, from shopping to getting directions to our finances.

Mobile Banking Apps have revolutionized the way we manage our money, offering us on-the-go access to accounts, payments, and financial tools. But with the constant change in user demand and new innovations hitting the market, the landscape of banking apps is evolving.

This not only fascinates the users but also businesses to explore new advancements and transform the way we take our finances. But, what are these advancements or shall we call them trends?

This sparks questions for which people seek answers.

Looks like, the same reason also brought you to this blog. We got you covered.

This blog post will delve into the latest mobile banking app trends shaping the banking app sector to stay ahead in this ever-changing landscape.

Without any delay, let’s get started.

Overview of Mobile Banking App

The idea of a mobile banking app is something we all can relate to. As we all juggle our finances with these apps.

So, it is no wonder that:

- Young adults are leading the charge in mobile banking adoption, with nearly three-quarters (74.1%) of those aged 15-24 using their phone as their primary way to manage their finances.

- This trend extends beyond just one generation; a whopping 97% of Millennials and an impressive 89% of all consumers rely on mobile banking apps.

- The preference for mobile is clear – six out of ten mobile users choose apps over websites for their banking needs.

- And nearly everyone, around 90%, uses their app to check account balances.

- Businesses that personalize their mobile banking apps can potentially increase revenue by 15%, making it a win-win for both banks and their customers.

With these brief mobile banking statistics, it is clear that mobile payment technology especially banking is taking center stage.

With each passing day, technological advancements are at the forefront of the digital revolution for banking apps, meaning the market still has potential and is likely to undergo further transformation.

Let’s look at those trends that will be responsible for the change.

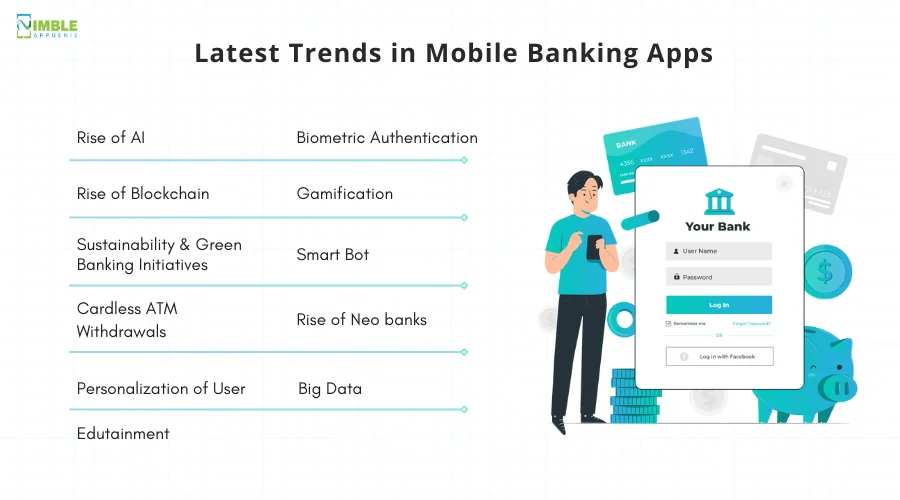

Latest Trends in Mobile Banking Apps

Trends are the essence of successful apps, and mobile banking apps are no exception.

These trends are basically what users expect and look forward to reaching them. And, also demonstrates the impact of Fintech on businesses.

So, if you are planning for development of a mobile banking app, here are some key mobile banking app trends you should be aware of:

1. Rise of AI

AI holds incredible potential!

With the increased AI role in Mobile Banking, it seems banking is on the verge of a new era, which is why AI in banking is a top-tier digital banking app trends.

As banking will leverage artificial intelligence to offer customized experiences tailored to personal preference. These apps will provide better financial recommendations in times of need such as based on risk tolerance, apps can tell user different investment opportunities as per their risk tolerance.

By doing so, they can ensure a better experience for their user.

2. Biometric Authentication

Do you know? Data breaches hit banks & financial institutions hard in 2023, ranking as the second most affected sectors.

This is why user looks forward to those banking apps that continue to evolve, ensuring better and greater safety for apps that hold a lot of valuable information for users.

For this, banks are deploying advanced security measures such as biometric authentication along with multi-factor authentication and encryption technologies to increase transaction and banking app security.

The rise of biometric authentication methods such as fingerprints and facial recognition adds an extra layer of security, making banking apps more secure from unauthorized access. This is why, it is the most looked upon trend of mobile banking.

3. Rise of Blockchain

For decades, the financial world relied on a centralized system for managing transactions.

However, as the pace of financial activity sped, the need for a more agile and efficient system became increasingly apparent. This is why when Blockchain technology launched; experts saw its potential to revolutionize mobile banking.

While this is still in its early stages, some banks have started to explore ways to integrate Blockchain into their apps. Apps like Revolut are a perfect example of this.

4. Gamification

Gamification is a mobile banking app trend in 2025 that captured investors & users’ attention.

Why?

Because, this encourages participation, and provides enjoyment in financial activities.

With the increased competition in the market, banks are coming up with new and innovative ideas to boost user engagement and promote healthy financial habits, by providing fun and engaging experiences.

This is only possible through gamification.

You see, traditional apps are often bland and monotonous so users don’t show much interest.

But, by integrating challenges and rewards, the app can be made fun and exciting, making users more engaged to your app and giving them reasons to use it.

One such example is apps like Chime which has partnered with Zogo to offer gamified financial education. Such advancements by Chime always attracted investors to make an app like Chime and imitate its success.

5. Sustainability and Green Banking Initiatives

Green banking is something that goes beyond your traditional banking services.

This is a digital banking future trend that is set to rise in the upcoming future.

The objective of green banking is to incorporate eco-friendly design principles and green banking initiatives into their digital strategies.

From paperless transactions to energy-efficient app design, banks take steps to minimize their environmental footprint.

For example, Green Banks prioritize providing loans and investments to projects that promote renewable energy, green infrastructure, and environment-friendly technologies.

6. Smart Bot

From AI-powered financial planning tools to secure digital payment solutions, smart BOTs are just one example of how fintech is transforming the banking industry.

It’s another banking industry trend that shows a promising future. The rise of smart bots, or Chatbots powered by artificial intelligence, is helping us in every way possible, including:

-

24/7 Customer Support

Do you know how costly it is to hire a support team & manage them? Despite that this is not necessary that they will be available all the time.

However, this problem is solved by SmartBots through which now banks can easily provide immediate assistance to their users in need, removing the need to wait on hold during off-hours and user frustration.

-

Personalized Financial Guidance

What else can AI-powered bots can offer? Well, they can analyze user data and offer personalized advice on budgeting, saving, investment & more.

-

Simplified Transactions

With just a few conversational prompts, users can learn a lot of information or perform basic banking tasks that include checking balances, transferring funds, or paying bills.

7. Cardless ATM Withdrawals

The popularity of mobile banking apps is slowly making us realize why we wanted them in the first place.

One such example is convenience such as cardless ATM withdrawals. People who misplace their cards or forget to carry them will surely find this feature really helpful.

As all you need is your smartphone that’s always glued to your hands. So, as long as it is in your hands, you can make a withdrawal anytime, even if you forget your debit card at home.

This actually helps those who don’t know how to use a card and also eliminates the need to insert and retrieve your card. Without any doubt, this is the latest trend in mobile banking that’s inspiring users.

8. Rise of Neo banks

The growing number in development of neo-banking apps does tell us that they are the latest digital banking app trends.

Neo banks, or digital-first challenger banks, aim to provide a banking experience with lower fees and more convenience. The reason we feel it has a strong future is because of agility and disruption.

They are not burdened by traditional banking practices and often adapt to new technologies and customer demands. With a generation of people that’s cost-conscious and tech-savvy, neo-banks seem to gain traction and disrupt the banking landscape.

9. Personalization of User

You did see this one coming, right?

Yes, personalization is a dominant trend in mobile banking apps and it’s here to stay.

Big institutions are using your data from different sources to analyze financial situations better. and analyzing that they offer you personalized financial guidance.

Such as, through a secure open banking API connection, your mobile banking app can deliver timely push notifications to update you about new deals, about any upcoming payments, or pending subscription payments.

Seeing this trend, it feels like mobile banking apps are becoming more intelligent companions that guide you toward financial wellness and improve your banking experience.

10. Big Data

Cookie-cutting approach is old and officially over, and this is truly a lesson for businesses. That, businesses should embrace Big Data to unlock the key the Personalization, a necessary advantage in today’s competitive landscape.

This is where businesses can empower mobile banking apps to analyze user behavior through big data and predict future trends.

Also, offer information most relevant to them such as upcoming bills, spending trends, or progress toward saving goals, etc. This way, the app can also suggest investment options that are aligned with risk tolerance, helping users to make better financial decisions.

11. Edutainment

Edutainment is a combination of Education and Entertainment and is a growing Mobile Banking App Trend.

Imagine an app that not only informs you about your finances but also guides you to make better financial choices. This is the future of mobile banking, a personalized financial assistant that provides you with knowledge while keeping things fun.

Wouldn’t that be amazing? The banking apps are no longer just about transactions, but now they are promoting financial literacy as well.

Apps like PayPal and American Express leading the way by streamlining investment with the help of bots and also teaching users about finances. Leveraging such an element for your app might increase the development cost of a banking app, but it will be worth the investment.

These are some exciting mobile banking app trends that can shape the future of mobile banking apps. But, as we can expect, even more innovative trends making our finances easier and efficient.

How Nimble AppGenie Can Help to Leverage Top Mobile Banking App Trends

Don’t just join the crowd. Harness the power of the latest mobile banking app trends to develop a disruptive banking app that stands out from the rest!

For that, Nimble AppGenie, is a top mobile banking app development company with a proven track record. We specialize in crafting innovative banking apps. Let’s turn your vision into a reality with cutting-edge trends that help people manage their finances easily.

Are you looking for development of a banking app? Hire mobile app developers and get started today!

Wrapping It Up!

The mobile banking landscape is undergoing a rapid transformation, driven by innovative trends like AI, biometrics, and open banking.

These trends are reshaping how we manage our finances, offering a more personalized, secure, and convenient banking experience.

This is an exciting time to be a mobile banking investor! With so many innovative features and functionalities emerging, investing in this market becomes more important to make great revenue.

So, embrace these trends and explore the possibilities that mobile banking apps that exceed expectations and make a mark of your name in the market.

FAQs

AI offers personalized financial experiences. By analyzing your financial data, the app can recommend budgeting strategies, suggest investment opportunities aligned with your risk tolerance, and even predict future spending patterns.

Biometrics like fingerprint or facial recognition add an extra layer of security compared to traditional passwords. This makes unauthorized access to your mobile banking app significantly more difficult.

Gamification uses game-like elements like points, badges, and leaderboards to make financial activities more engaging. This encourages users to participate in healthy financial habits like saving and budgeting.

Open banking APIs allow secure data sharing between financial institutions and third-party apps. This enables features like personalized financial guidance and the aggregation of your financial data from different accounts into a single view.

By analyzing vast amounts of user data, mobile banking apps can predict future trends, offer targeted financial products, and deliver more relevant information. This empowers you to make informed financial decisions.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.