Developing an app like OPay might seem like a huge task, but with the right planning and team, it’s absolutely achievable—and the potential returns make it well worth the effort.

OPay, a rising star in the fintech world, particularly in Nigeria, is a prime example of how mobile payments and wallets are transforming how we handle money.

So, how much does it cost to develop an app like OPay?

On average, the cost to develop an app like OPay can range from $50,000 to $250,000, depending on various factors like features, platform, and development team.

The more complex and feature-rich the app, the higher the price tag, naturally.

But, keep in mind that while the development cost is significant, the long-term benefits—especially in a booming fintech market—far outweigh the initial investment.

You’re not just building an app; you’re creating a fintech platform that could revolutionize the way your audience handles transactions.

Nigeria’s rapidly growing digital payment landscape offers the perfect setting for an app like OPay.

With the right features and strategic execution, your app could be the next big thing in the market, attracting millions of users who are ready to ditch traditional banking systems for a smoother, more efficient digital experience.

OPay – Revolutionizing Payments in Nigeria

OPay is not just another mobile wallet app—it’s a full-fledged financial ecosystem that’s making waves in Nigeria.

Launched in 2018, OPay has rapidly gained popularity due to its wide range of services that go beyond simple money transfers.

From paying bills and ordering food to hailing rides and managing savings, OPay is essentially a super app built to serve the financial needs of everyday Nigerians. It’s a one-stop shop for all things financial, targeting the unbanked and underbanked population, who make up a large portion of the country’s economy.

What sets OPay apart is its seamless integration of multiple services into one platform.

Users can send money, receive payments, invest in savings products, and even buy airtime—all within seconds.

The ease of use, coupled with its widespread accessibility, has contributed to OPay’s explosive growth.

With millions of active users, OPay has truly transformed how people in Nigeria approach daily financial tasks, offering convenience and speed that traditional banks struggle to match.

This fintech app isn’t just about transactions; it’s about empowerment—giving people more control over their finances.

That’s why developing an app like OPay, tailored to the Nigerian market, presents such a lucrative opportunity for fintech entrepreneurs.

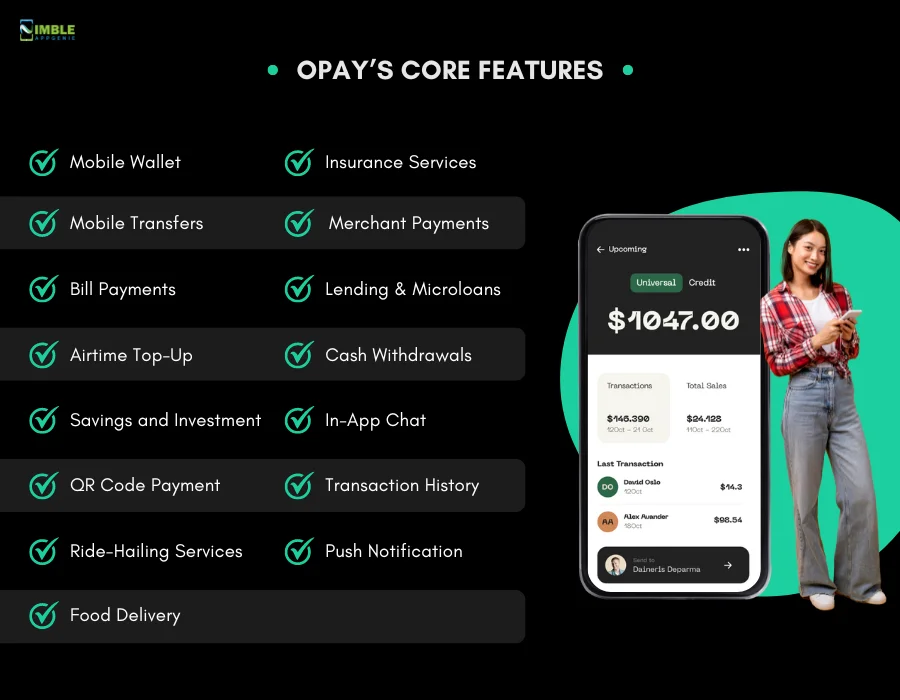

OPay’s Core Features

When it comes to developing an app like OPay, the feature set is where the magic happens.

OPay’s success can largely be attributed to its robust and diverse range of services, catering to the everyday financial needs of its users.

Below are the core fintech app features that are essential for building a successful OPay-like app:

- Mobile Wallet – Secure digital wallet for storing and transferring funds.

- Money Transfers – Instant transfers between users and to bank accounts.

- Bill Payments – Pay electricity, water, and other utility bills directly through the app.

- Airtime Top-Up – Users can easily purchase mobile airtime for any network.

- Savings and Investment – Users can earn interest by saving or investing their money within the app.

- QR Code Payments – Quick and easy payments using QR codes at participating merchants.

- Ride-Hailing Services – Integrated ride-hailing features for booking transportation.

- Food Delivery – Order food from local restaurants and get it delivered straight to your door.

- Insurance Services – Access to various micro-insurance products, offering coverage for health, life, and more.

- Merchant Payments – Facilitate payments to local businesses using a secure merchant system.

- Lending & Microloans – Provide small loans to users based on their transaction history and creditworthiness.

- Cash Withdrawals – Enable users to withdraw cash from partner agents, even without a traditional bank account.

- In-App Chat – A feature that allows users to communicate with each other for transaction confirmations and support.

- Transaction History – Detailed history of all user transactions for tracking and record-keeping.

- Push Notifications – Alert users about payments, offers, and important app updates.

These features give OPay its all-in-one appeal, allowing users to handle everything from bill payments to microloans in a single app.

When building your OPay-like app, including these core features will ensure a comprehensive experience that attracts a wide range of users.

Why Develop an App Like OPay?

The big question is how to, but why start a fintech business?

Building an app like OPay is not just about joining the fintech trend—it’s about tapping into a booming market with massive potential.

Here are three key reasons why developing a fintech app like OPay for the Nigerian market is a smart business move:

♦ Untapped Market Potential

In Nigeria, nearly 40% of the adult population is either unbanked or underbanked.

This creates a huge opportunity for digital financial services to fill the gap.

OPay has successfully capitalized on this by offering accessible financial solutions to a large number of users who lack access to traditional banking services.

Developing an app like OPay gives you the chance to reach millions of potential users who are hungry for easy, reliable financial tools.

♦ Booming Fintech Industry

Nigeria is becoming a fintech hub in Africa, with investment in fintech startups soaring. In 2021 alone, Nigerian fintech companies attracted $1.37 billion in funding, reflecting the massive investor interest in this space.

With such strong backing, the fintech sector in Nigeria is expected to grow rapidly, making it an ideal time to jump in and build an app like OPay that caters to this market’s growing demand.

♦ Rapid Digital Adoption

The rise of smartphone penetration and internet connectivity in Nigeria has paved the way for apps like OPay to thrive.

According to reports, over 50% of the Nigerian population is now online, and the numbers are only growing. This shift toward digital services is fueling the adoption of mobile wallets and fintech platforms, giving your app the potential to scale rapidly.

Moreover, with OPay’s success as a benchmark, developing a similar app could position you as a serious player in the digital finance market.

Developing an app like OPay is a smart investment, especially in an emerging market like Nigeria, where the fintech space is expanding rapidly and the demand for mobile financial solutions is on the rise.

Average Cost To Develop An App Like OPay

So, how much does it really cost to develop an app like OPay?

On average, the cost to develop an app like OPay can range from $50,000 to $250,000.

Prices can vary based on several factors, including the complexity of the features, the development team you choose, and the platform (iOS, Android, or both).

This is a broad estimate, and your specific cost will depend on the scale and intricacy of the app you want to build.

Here’s a simple breakdown of what the development cost of a fintech app might look like:

| Development Stage | Cost Estimate (USD) |

| Planning & Research | $5,000 – $10,000 |

| UI/UX Design | $10,000 – $25,000 |

| Frontend & Backend Development | $25,000 – $100,000 |

| API Integrations | $5,000 – $20,000 |

| Testing & QA | $5,000 – $15,000 |

| Deployment & Launch | $3,000 – $10,000 |

| Post-Launch Support & Maintenance | $2,000 – $10,000/month |

Why such a broad range?

The cost to build an app depends heavily on the number of features you want to integrate.

If you’re looking for a basic app with money transfers, bill payments, and mobile wallet functionality, you can aim for the lower end of the estimate.

However, adding advanced features like QR code payments, microloans, or merchant services can push the cost to the higher end of the range.

While the upfront costs may seem substantial, the potential return on investment (ROI) can make it all worthwhile. A well-designed app can capture the attention of millions of users, providing consistent revenue through various monetization methods.

Factors That Affect the Cost to Develop an App Like OPay

Developing an app like OPay involves a lot of moving parts, and each decision you make during the development process can have a significant impact on the overall cost.

Below are 10 key factors that directly influence the cost to develop an app like OPay.

For each factor, I’ll break down its potential cost impact and explain why it’s crucial to your app’s success.

Incorporating these factors into your budget will help ensure you’re fully prepared for the financial commitment of building such a fintech platform.

1. App Features & Functionality

If you want to develop a fintech app, one of the biggest cost affect factors is complexity.

The complexity and number of features will play the biggest role in determining the overall OPay app development cost.

A simple mobile wallet app with basic functionality like money transfers will be more affordable, but if you want to add advanced features like QR code payments, ride-hailing, or microloans, the cost will increase significantly.

| Feature Complexity | Cost Estimate (USD) |

| Basic (wallet, transfers) | $10,000 – $30,000 |

| Advance (QR payments, loans, ride-hailing) | $40,000 – $80,000 |

Developing an app like OPay means you’ll need to think carefully about which features are essential for your users and which can be added later in future updates.

The more advanced and integrated your features are, the higher the cost to make an app like OPay.

2. Platform Choice (iOS, Android, or Both)

The choice of platform also impacts the cost to build an app like OPay.

You can choose for iOS & Android, or both.

A single platform app will naturally cost less, but if you want to reach a broader audience in Nigeria—where Android devices are highly popular—you may need to invest in both platforms.

| Platform | Cost Estimate (USD) |

| Single Platform (iOS or Android) | $20,000 – $50,000 |

| Cross-Platform (iOS and Android) | $40,000 – $100,000 |

Cross-platform development ensures you capture the largest possible user base, but it also increases the cost to create an app like OPay.

However, this investment is often worth it in the long run, as it allows for broader market penetration, particularly in emerging markets like Nigeria.

3. UI/UX Design

Fintech app design plays a critical role in user satisfaction and retention.

A simple, user-friendly design will reduce costs, but if you want a more advanced, custom interface tailored to the Nigerian market, the cost to develop an app like OPay will increase.

Custom animation, intuitive navigation, and a localized user interface will make your app stand out but at a price.

Here’s a breakdown of UI/UX Design Cost:

| Design Complexity | Cost Estimate (USD) |

| Basic Design | $10,000 – $20,000 |

| Custom/Advanced Design | $20,000 – $40,000 |

Custom UI/UX design ensures your app is visually appealing and easy to use, which is key in gaining traction with your target audience.

4. Backend Infrastructure

Building a strong and scalable backend is essential for any fintech app like OPay.

Your backend is responsible for managing user data, processing transactions, and ensuring the app runs smoothly.

The basic backend will be cheaper, but if you need to handle high volumes of users and transactions (which is likely in Nigeria’s growing fintech space), the cost to build the infrastructure will rise.

| Backend Complexity | Cost Estimate (USD) |

| Basic Backend | $15,000 – $30,000 |

| Advanced and Scalable Backend | $30,000 – $60,000 |

For an app like OPay, having a secure and scalable backend is non-negotiable, as you’ll need to handle sensitive financial data.

The investment in a strong backend will ensure your app remains reliable as you grow.

5. API Integrations

OPay’s success is largely due to its integration with multiple third-party services, such as bill payments, ride-hailing, and food delivery.

Each API integration adds functionality but also contributes to the cost of building an app like OPay.

For instance, integrating payment gateways, external fintech APIs for ride-hailing, or even microloan services can drive costs higher.

| API Integration | Cost Estimate (USD) |

| Basic API Integration (e.g., payment gateway) | $5,000 – $15,000 |

| Multiple API Integrations (ride-hailing, utility payments) | $20,000 – $30,000 |

The more APIs you integrate, the more seamless and versatile your app will be, but this flexibility comes at an added cost.

6. Security Features

Given that you’re developing a fintech app like OPay, security must be a top priority.

Ensuring that users’ financial data is secure will require encryption, two-factor authentication (2FA), biometric logins, and other security protocols.

This is especially crucial in the Nigerian market, where trust in digital financial services is still being built.

| Security Features | Cost Estimate (USD) |

| Basic Security (Encryption, HTTPS) | $5,000 – $15,000 |

| Advanced Security (2FA, biometric login) | $15,000 – $25,000 |

The more robust your security, the more expensive it will be to develop, but this is one area where you shouldn’t cut corners.

7. Compliance with Regulations

When you’re handling financial transactions, you must comply with local and international fintech regulations.

In Nigeria, the cost to develop a payment app like OPay will involve adhering to guidelines set by the Central Bank of Nigeria (CBN) and other regulatory bodies.

Compliance can include legal fees, licenses, and additional development work to meet these regulations.

| Compliance Requirements | Cost Estimate (USD) |

| Basic Compliance (CBN Guidelines) | $5,000 – $10,000 |

| Complex Compliance (Multiple Countries) | $15,000 – $25,000 |

Ensuring your app is legally compliant will protect you from future issues and build trust with users.

8. Development Team Size & Location

The size and location of your development team can greatly affect the OPay like app development cost.

Hiring a small offshore team will be more cost-effective than a large, local team.

However, while offshore teams can offer lower rates, they may also require more management and longer timelines.

Here’s a breakdown of cost to hire app developers:

| Team Type | Cost Estimate (USD) |

| Small/Offshore Team | $30,000 – $60,000 |

| Large/Local Team | $80,000 – $150,000 |

It’s important to balance cost with quality when choosing your development team. A larger, more experienced team can deliver faster and more reliably but will come with a higher price tag.

9. Testing & Quality Assurance (QA)

Before launching your fintech app rigorous testing is essential to ensure it functions smoothly and securely.

Testing includes everything from functionality to security to user experience. The more extensive your testing process, the higher the cost.

| Testing Type | Cost Estimate (USD) |

| Basic Testing | $5,000 – $10,000 |

| Comprehensive Testing | $10,000 – $20,000 |

Testing will help identify bugs and performance issues, ensuring that your app runs without any hiccups, especially under heavy use.

10. Post-Launch Support & Maintenance

Once your app is live, it’s important to continue providing updates, fixing bugs, and adding new features. Post-launch fintech app maintenance & support is a continuous cost and should be factored into your overall budget.

Speaking of which, here’s a basic breakdown of cost to maintain an app:

| Maintenance Type | Cost Estimate (USD) |

| Basic Maintenance | $2,000 – $5,000/month |

| Advanced Maintenance | $5,000 – $10,000/month |

Ongoing maintenance ensures your app stays up-to-date with evolving technology and user demands, protecting your investment over time.

These factors provide a detailed insight into what influences the cost to develop an app like OPay. Whether you’re focusing on how to create an app like OPay or looking at the more technical aspects of development, understanding these elements will help you plan your budget effectively.

How Long Does it Take to Develop an App Like OPay?

Developing an app like OPay is no small feat.

The development timeline for fintech app depends on various factors like complexity, features, the size of the development team, and whether you’re building the app for one platform or both (iOS and Android).

On average, the time taken to build an app like OPay can range from 6 to 12 months, with each phase of development requiring specific attention.

Here’s a breakdown of the development stages and how much time each typically takes:

| Development Stage | Estimated Time |

| Planning & Research | 2 – 4 weeks |

| UI/UX Design | 4 – 8 weeks |

| Frontend & Backend Development | 12 – 20 weeks |

| API Integration | 4 – 6 weeks |

| Security & Compliance Setup | 3 – 5 weeks |

| Testing & Quality Assurance | 4 – 6 weeks |

| Deployment & Launch | 2 – 3 weeks |

| Post-Launch Support | Ongoing |

In total, the timeline to create an app like OPay can take anywhere from 6 months for a simple version to 12 months or more for a fully-featured, cross-platform app.

The exact timeline will depend on the complexity of your app and the resources you allocate to the project.

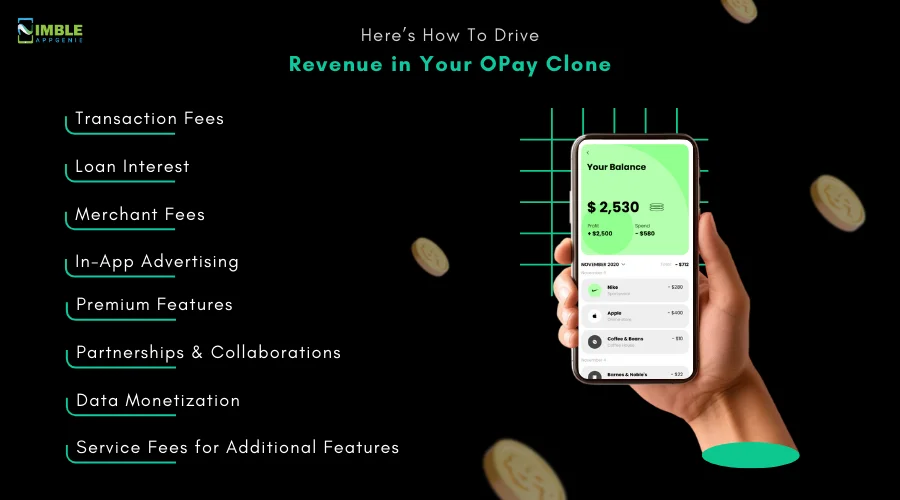

Here’s How to Drive Revenue with Your OPay Like App

Creating an app like OPay is just the first step; real success comes from how well you can monetize your fintech app.

There are several revenue streams you can explore to ensure your OPay like app generates a strong return on investment (ROI).

Below are some of the most effective monetization strategies along with their revenue potential.

► Transaction Fees

One of the most straightforward ways to generate revenue is by charging users a small fee for each transaction, whether it’s money transfers, bill payments, or merchant transactions.

Even a minimum fee of 1-2% can add up quickly, especially if you have a large user base.

- Revenue Potential: With millions of users performing daily transactions, this model can easily generate a steady and significant income.

► Loan Interest

If your app includes microloan services, you can charge interest on the loans provided to users.

This is a common feature in fintech apps like OPay, which offer small, short-term loans to users and charge interest based on repayment terms.

- Revenue Potential: Depending on the volume of loans issued, this could be a major source of income, particularly in markets where access to traditional banking is limited.

► Merchant Fees

OPay and similar apps often allow businesses to accept payments via the platform.

You can charge merchants a fee for each transaction processed through your app. This is an excellent way to tap into the business-to-business (B2B) side of fintech.

- Revenue Potential: Merchant fees are typically around 1-3% per transaction, and with enough participating businesses, this could form a substantial revenue stream.

► In-App Advertising

By partnering with third-party advertisers, you can display ads within your app and charge advertisers based on impressions, clicks, or actions.

Given the number of users that apps like OPay attract, advertisers will pay a premium to reach such a large audience.

- Revenue Potential: In-app advertising can provide a steady stream of income, especially if your app maintains high engagement rates.

► Premium Features

Offering additional features or services at a premium is another great way to monetize your app.

For example, you could offer enhanced savings products, advanced security features, or faster transaction speeds for users who are willing to pay for them.

- Revenue Potential: Premium subscriptions or one-time payments for advanced features can generate considerable income from users looking for added value.

► Partnerships and Collaborations

Collaborating with businesses in complementary sectors—such as e-commerce, ride-hailing, or food delivery—can also generate revenue.

These partnerships can take the form of referral programs or integrated services within the app, where both parties benefit financially.

- Revenue Potential: These partnerships can create multiple revenue streams as your app becomes an ecosystem of services.

► Data Monetization

While user privacy is critical, aggregated and anonymized data can be monetized by providing insights to businesses and financial institutions.

This data could relate to spending habits, geographic trends, or other consumer behaviors.

- Revenue Potential: Though this requires careful handling of privacy regulations, data-driven insights can provide significant revenue from companies looking for market research.

► Service Fees for Additional Features

Charging users a small fee for using premium services like expedited transfers, higher withdrawal limits, or financial advisory services can provide an additional revenue stream.

- Revenue Potential: This is particularly useful for users who want more than just the basic services offered in the app.

With a combination of these monetization strategies, your OPay like solution can generate significant revenue, offering not just a great user experience but also an attractive financial return for your business. The more diverse your revenue streams, the more resilient your business model becomes, ensuring a steady ROI over time.

Nimble AppGenie – Your Partner in Fintech Excellence

At Nimble AppGenie, we specialize in turning innovative ideas into reality, when it comes to building fintech apps like OPay.

With years of experience in the fintech industry, we understand the complexities involved in developing secure, scalable, and feature-rich payment platforms tailored to meet your business goals.

Whether you’re looking to build a mobile wallet, integrate multiple APIs, or create a full-fledged payment ecosystem, our team of expert developers and designers is here to help. We ensure that your app is not only built to perform but also optimized for success in a competitive market like Nigeria.

Ready to develop an app like OPay? Let Nimble AppGenie, a top fintech app development company, guide you from concept to launch.

Conclusion

Developing an app like OPay is a smart investment, especially in a growing fintech market like Nigeria. With a clear understanding of the development costs, essential features, and the factors that influence your budget, you’re well-equipped to create a successful mobile payment platform. From basic money transfers to advanced features like loan services and QR payments, your app can become a powerful tool for users seeking modern financial solutions.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.