Thinking about creating a financial app that offers users early access to their wages, just like EarnIn app?

An app like EarnIn can provide a much-needed service to those who live paycheck to paycheck, making it a popular choice in the fintech world.

In this blog, we’ll break down how to develop an app like EarnIn and factors to give you a clear understanding of what it takes to bring your idea to life.

What is EarnIn App?

EarnIn is a popular financial app that allows users to access a portion of their earned wages before their official payday.

The concept is simple yet powerful—users can withdraw money they’ve already earned without having to wait for their payday, offering a financial lifeline to those in need of immediate funds.

Unlike traditional payday loan apps, which often come with high interest rates and fees, EarnIn doesn’t charge interest.

Instead, users are encouraged to leave a tip for the service, making it a more user-friendly and flexible option.

EarnIn has revolutionized the way people manage their finances, providing a solution for those who need quick access to cash without the burden of debt.

The app has gained significant traction among users looking for financial flexibility, especially in an era where unexpected expenses are increasingly common.

The simplicity and convenience of EarnIn make it an attractive model for anyone considering developing a similar app.

Why Develop an App Like EarnIn?

Why create a fintech app?

Well, creating an app like EarnIn is not just about replicating its features; it’s about tapping into a growing market of users who need financial flexibility.

Here are three compelling reasons why developing an app like EarnIn can be a lucrative venture:

► Growing Demand for Financial Flexibility

In today’s gig economy, many workers don’t have the luxury of waiting until payday to access their earnings.

According to fintech statistics, nearly 69% of Americans would have difficulty meeting their financial obligations if their paychecks were delayed by a week.

The growing demand for immediate access to earned wages is a driving force behind the popularity of apps like EarnIn.

By developing a similar app, you can meet this need and attract a large user base seeking financial relief.

► High User Engagement and Retention

Financial apps that offer tangible benefits, such as early access to wages, tend to see high user engagement and retention rates.

Once users experience the convenience of accessing their earned money when they need it, they are likely to continue using the app regularly.

According to Statista, the number of mobile payment app users in the U.S. is expected to reach 125 million by 2025.

By offering a unique value proposition like EarnIn, your app can become a go-to solution for financial management, ensuring long-term user loyalty.

Also Read: User Retention in Fintech Apps

► Potential for Monetization

While EarnIn operates on a voluntary tipping model, there are multiple monetization strategies that can be employed in a similar app.

For instance, you could offer premium features, charge a small withdrawal fee, or partner with financial institutions for referral commissions.

The fintech market is expected to reach $310 billion by 2022, according to KPMG.

Developing an app like EarnIn not only positions you to capture a slice of this lucrative market but also provides numerous revenue streams to explore.

Average Cost to Develop an App Like EarnIn

Now that we’ve explored the reasons behind the popularity of apps like EarnIn, let’s dive into the numbers.

On average, you can expect the development cost to range from $20,000 to $1,50,000.

The cost to develop an app like EarnIn can vary significantly depending on several factors such as complexity, features, and the development team’s location.

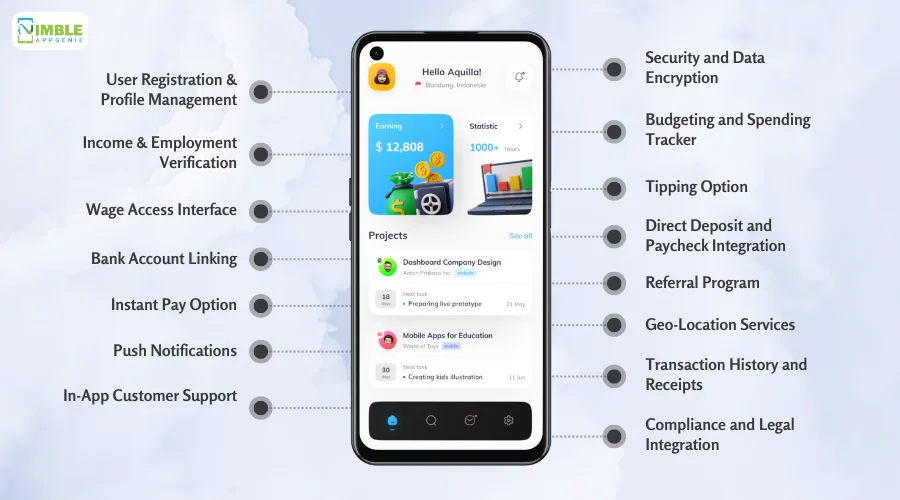

Essential Features to Include in EarnIn App

If you’re planning to develop an app like EarnIn, it’s crucial to include fintech app features that not only replicate its functionality but also offer a seamless user experience.

Here’s a detailed look at the 15 essential features your EarnIn-like app should have:

1. User Registration and Profile Management

The foundation of any app starts with user registration.

Your app should allow users to sign up easily via email, phone number, or social media account.

Once registered, users should be able to create and manage their profiles, including personal details, employment information, and bank account linkages for wage deposits.

2. Income and Employment Verification

To ensure that users have a legitimate income stream, the app must include an income and employment verification feature.

This can be done by integrating with payroll systems or through manual document uploads. This feature ensures that only eligible users can access their earned wages.

3. Wage Access Interface

This is a core feature of the app.

Users should be able to view their earned wages and withdraw a portion of them at any time. The interface should clearly display the available balance, withdrawal limits, and transaction history.

4. Bank Account Linking

Users need to link their bank accounts to the app to enable wage deposits and withdrawals.

This feature should support integration with various banks, providing users with a smooth and secure way to connect their accounts.

5. Instant Pay Option

Offering an instant payment option is crucial for an app like EarnIn.

Users should be able to withdraw their earned wages instantly, with the funds being transferred to their linked bank accounts within minutes.

6. Push Notifications

Keep users informed with push notifications about their available balance, successful transactions, and upcoming paydays.

This feature enhances user engagement and helps them stay on top of their finances.

7. In-App Customer Support

A robust in-app customer support feature is essential.

Users should be able to reach out to customer support via chat, email, or phone for any issues or queries they might have.

A comprehensive FAQ section should also be available within the app.

8. Security and Data Encryption

Given the sensitive nature of financial transactions, your app must have top-notch security features.

Implement SSL encryption, two-factor authentication, and biometric login options to protect user data and transactions.

9. Budgeting and Spending Tracker

Adding a budgeting and spending tracker feature can help users manage their finances better.

This tool allows users to set budgets, track their spending, and get insights into their financial habits, encouraging responsible financial behavior.

10. Tipping Option

EarnIn operates on a tipping model, allowing users to voluntarily tip for the service instead of charging a fixed fee.

Including a tipping option in your app can create a flexible revenue stream and make the app more user-friendly.

11. Direct Deposit and Paycheck Integration

For seamless transactions, your app should integrate with direct deposit and paycheck systems.

The feature allows users to have a portion of their paycheck deposited directly into the app, making it easier to access their earnings.

12. Referral Program

The referral program feature can help increase user acquisition.

Users should be able to invite friends to join the app, and in return, both the referrer and the referred can receive bonuses or rewards.

13. Geo-Location Services

Integrating geo-location services allows the app to track the user’s location, which can be useful for certain employment verification processes or to offer location-based services.

14. Transaction History and Receipts

Providing a detailed transaction history, along with digital receipts, helps users keep track of their financial activities.

This feature should include filtering options for easy navigation and retrieval of past transactions.

15. Compliance and Legal Integration

Your app must comply with financial regulations and legal requirements in the regions it operates.

This includes integrating features that ensure compliance with labor laws, wage garnishment rules, and other financial regulations.

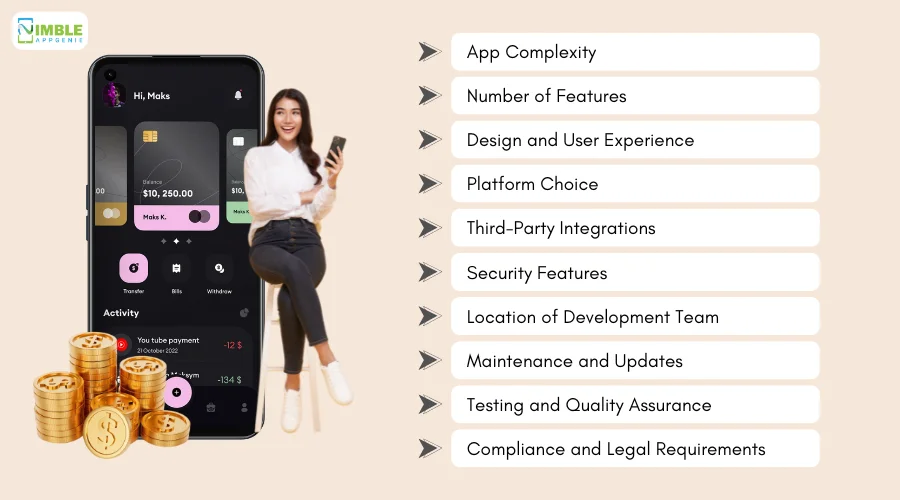

Factors That Affect EarnIn App Development Cost

When planning to develop an app like EarnIn, understanding the various factors that impact the overall app development cost is crucial.

These factors can significantly influence the EarnIn app development cost, and being aware of them allows you to better manage your budget and expectations.

Below, we’ll explore the 10 key factors in detail, each with a specific focus on how they contribute to the total EarnIn-like app development cost.

1. App Complexity

The complexity of your app is the primary driver of EarnIn development costs.

A simple app with basic features such as user registration, income verification, and wage access will cost less to develop.

However, as you add more advanced features like AI-driven customer support, predictive analytics, or real-time financial monitoring, the complexity increases, leading to higher development costs.

| Complexity Level | Estimated Cost |

| Simple | $50,000 – $80,000 |

| Moderately Complex | $80,000 – $120,000 |

| Highly Complex | $120,000 – $150,000 |

2. Number of Features

The number of features you decide to include in your EarnIn-like app directly affects the cost to develop an app like EarnIn.

Essential features such as wage access, bank account linking, and notifications are must-haves.

However, adding advanced features like budgeting tools, spending analytics, and custom financial advice can increase the overall cost to build EarnIn app.

3. Design and User Experience

Fintech app design and user experience are critical for success.

A well-designed app with intuitive navigation, visually appealing interfaces, and seamless user flow enhances user satisfaction and retention.

However, high-quality design work, including custom animations, micro-interactions, and responsive design, comes at a higher cost.

4. Platform Choice

Choosing the right platform is another significant factor in the EarnIn app development cost.

However, if you want to reach a broader audience, cross-platform development is the way to go, although it will require more resources.

5. Third-Party Integrations

Third-party integrations are essential for an app like EarnIn, which relies on functionalities like instant payment, payroll integration, and banking services.

Every third-party service you integrate, such as payment gateways or financial APIs, adds to the cost of building an app like EarnIn.

6. Security Features

Given the financial nature of an EarnIn-like app, security is non-negotiable.

Implementing strong security measures such as SSL encryption, two-factor authentication, and secure payment processing is crucial.

7. Location of Development Team

It’s time to hire app developers.

The location of your development team can greatly influence the cost of building an app like EarnIn.

Hiring a team in regions like North America or Western Europe tends to be more expensive, while outsourcing to regions like Eastern Europe, Asia, or Latin America can significantly reduce costs.

Here’s a general overview of cost to hire app developers.

8. Maintenance and Updates

Ongoing fintech app maintenance and support services are necessary to keep your app running smoothly and to introduce new features over time.

This includes fixing bugs, optimizing performance, and ensuring compatibility with new operating systems.

9. Testing and Quality Assurance

Fintech app testing and quality assurance (QA) are critical to ensuring that your app functions and provides a seamless user experience.

This involves various types of testing, including functional, performance, and security testing, all of which are essential to minimize post-launch issues.

10. Compliance and Legal Requirements

Financial compliance with legal and regulatory requirements is especially important for financial apps.

This includes ensuring that your app meets all relevant financial regulations, data protection laws, and consumer rights legislation in the region where it operates. Each of these factors plays a crucial role in determining the cost to build an app like EarnIn.

By understanding the impact of each factor, you can better plan your budget and ensure that your app meets both your financial and functional requirements.

Whether you are focusing on high-level security, advanced features, or cross-platform availability, each decision will influence the final development cost.

How Long Does It Take to Make an App Like EarnIn?

When considering the development of an app like EarnIn, time is just as crucial as cost.

The development timeline for a fintech app can vary based on the complexity of the features, the size of the development team, and the efficiency of the development process.

On average, it can take anywhere from 3 to 6 months to develop a fully functional app like EarnIn.

Here’s a breakdown of the estimated timeline:

| Development Phase | Estimated Timeframe |

| Planning and Research | 1-2 weeks |

| UI/UX Design | 3-4 weeks |

| Backend Development | 8-10 weeks |

| Frontend Development | 6-8 weeks |

| Third-Party Integrations | 3-4 weeks |

| Testing and Quality Assurance | 3-6 weeks |

| Deployment and Launch | 2-4 weeks |

| Post-Launch Maintenance | Ongoing |

In summary, the app development process for an app like EarnIn is comprehensive, requiring meticulous planning and execution.

While it may take up to a year to bring the app to life, the result is a fully functional and competitive product in the market.

Ways to Monetize App Like EarnIn

When developing an app like EarnIn, it’s essential to think about how the app will generate revenue.

While EarnIn uses a voluntary tipping model, there are several other monetization strategies you can implement.

Here’s a breakdown of the different ways to monetize your fintech app and the potential revenue they can generate:

♦ Tipping Model

The tipping model is what EarnIn uses, allowing users to voluntarily tip for the service instead of charging mandatory fees. This model builds goodwill and encourages users to contribute based on their experience with the app.

♦ Premium Memberships

Offering a premium membership can provide users with additional benefits, such as lower withdrawal fees, faster transaction processing, or access to advanced financial tools.

♦ Low Withdrawal Fees

Instead of relying solely on tips, you could implement a small, fixed withdrawal fee for every transaction. This model ensures consistent revenue without burdening users with high costs.

♦ Referral Programs

Implement a referral program that rewards both the referrer and the new user with a cash bonus or reduced fees. This not only drives user growth but also increases app usage.

♦ Data Monetization

With users’ consent, you can anonymize and aggregate user data to sell insights to financial institutions or research companies. This must be done with strict adherence to privacy laws to maintain user trust.

♦ Partnerships and Affiliations

Partner with financial institutions, credit card companies, or loan providers to offer users additional services. You can earn referral commissions for each successful sign-up or transaction.

♦ In-App Advertisements

Although not common in financial apps, you could include non-intrusive, targeted ads from financial service providers. Ads should be relevant and not disrupt the user experience.

♦ Loan Services

You could offer small loans directly within the app, with interest or service fees attached. The feature could help users cover expenses between paychecks, providing them with an alternative to payday loans.

♦ Financial Tools Subscription

Offer access to advanced financial tools like budgeting software, credit score monitoring, or financial planning resources as a subscription service.

♦ Crowdfunding Platform

Incorporate a feature that allows users to contribute to or raise funds for personal causes, with the app taking a small percentage of the raised amount as a service fee.

Each of these monetization strategies offers unique opportunities to generate revenue, and when combined, they can provide a diversified income stream that enhances the profitability of your EarnIn app.

Nimble AppGenie – Your App Solution Partner

When it comes to developing a high-quality, feature-rich app like EarnIn, you need a partner who understands the nuances of fintech and mobile app development.

Nimble AppGenie is a leading Fintech App Development Company with a proven track record of delivering innovative financial solutions that cater to modern user needs.

At Nimble AppGenie, we specialize in creating custom apps that not only meet your specific requirements but also exceed your expectations. Our team of expert developers, designers, and project managers will work closely with you to ensure that your app is built to the highest standards with seamless functionality and an exceptional user experience.

Conclusion

Building an app like EarnIn is a significant investment, both in terms of time and resources. However, with the growing demand for financial flexibility and the potential for high user engagement, it’s an investment that can yield substantial returns.

From understanding the development cycle involved to exploring various monetization strategies, this blog has provided a comprehensive guide to what it takes to develop an EarnIn-like app.

FAQs

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.