Digital wallets have become an integral part of every business. Thanks to the digitisation of stores and financial institutions, people today prefer paying someone or receiving their funds digitally, rather than physically waiting for cash.

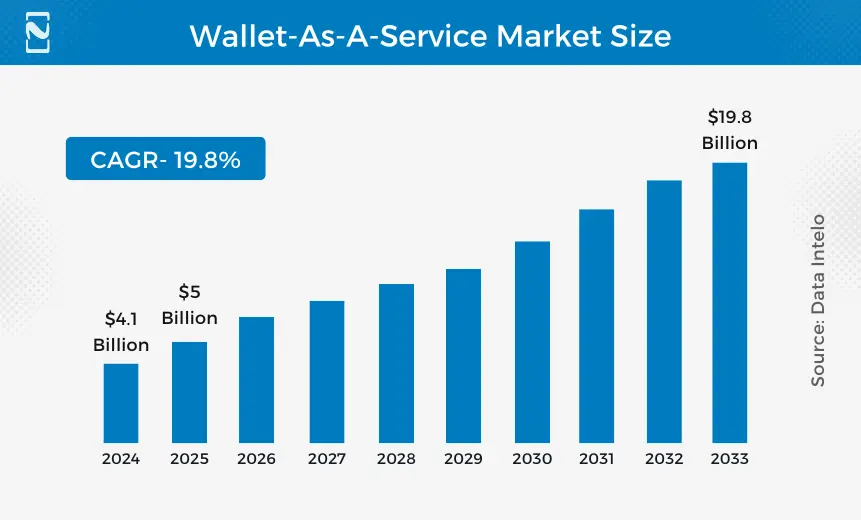

The market for wallet-as-a-service is growing rapidly with the rise of modular solutions. The current market, as of 2025, was valued at approximately $5 billion, estimated to touch $19.8 billion by 2033 with a CAGR of 19.8%

This also means that businesses planning to go digital must build an e-wallet of their own. However, that is not feasible for small and medium businesses. And that is where wallet-as-a-service comes into play.

With the rise of embedded financial services, every digital business, even the one that has nothing to do with finance, can integrate financial services like e-wallets, BNPL solutions, etc., directly into its platform.

Sounds interesting, right? Well, this is just the tip of the iceberg! Keep on reading, as in this post, we are going to learn everything about wallet-as-a-service, or WaaS.

Without further ado, let’s start by understanding what the concept of wallet-as-a-service is.

What is a Wallet-as-a-Service? WaaS Explained!

In the simplest terms, Wallet-as-a-Service (WaaS) is a modern financial model that enables businesses to offer electronic wallets to their customers without the need to build and maintain their own wallet infrastructure.

This model is facilitated through a cloud-based platform provided by a third party.

This manages the complex elements of digital wallet operations such as security, compliance, and technology updates.

Imagine having the capability to provide your users with a secure and efficient means to carry out transactions, store value, or even manage loyalty points, all under your brand name but without the headache of starting from scratch.

That’s WaaS in a nutshell – it’s like renting a shop in a bustling market instead of building one from the ground up.

With Wallet-as-a-Service, companies can embed financial services into their offerings. Thus, providing added value to their customers and creating new revenue streams.

This approach is particularly appealing in an age where convenience and speed are paramount, and customers expect seamless integration of services.

What are the Benefits of Wallet-as-a-Service for Businesses?

The idea of Wallet-as-a-Service has opened up a multitude of advantages for businesses looking to integrate digital payment solutions.

Benefits like low cart abandonment, higher conversion rates, and more loyal customers are just the beginning, as WaaS offers a lot of flexibility for businesses.

Check them out below:

1] Cost Reduction

Building a financial service from scratch requires substantial capital investment in development, infrastructure, and security measures.

All in all, the cost to build a fintech app is high.

WaaS, on the other hand, operates on a subscription-based model, which dramatically lowers entry and operational costs.

By utilizing a WaaS provider, businesses can save on the expenses associated with hiring specialized staff, purchasing hardware, and obtaining the necessary certifications.

2] Reduced Time to Market

Developing a wallet solution in-house can be a lengthy process, potentially taking years to launch.

WaaS providers offer ready-to-use platforms that can be quickly integrated, enabling businesses to go to market in a fraction of the time.

This rapid deployment is crucial in today’s fast-moving digital economy.

Here, being first can often mean the difference between leading the market and playing catch-up.

3] Scalability

The ability to scale services in response to customer demand is critical.

WaaS platforms are designed to handle a wide range of transaction volumes, from small startups to large enterprises, without any service disruption.

What this means is that businesses can start small and grow their financial services at their own pace, without the need for significant upfront investment in scalable infrastructure.

4] Global Expansion

WaaS providers often support multiple currencies and languages. This can facilitate businesses in their international expansion efforts.

This global reach capability can open new markets and customer segments without the complexity and regulatory challenges associated with international financial transactions.

5] Security and Compliance

WaaS providers are responsible for maintaining high levels of security.

This includes compliance with industry standards such as PCI DSS.

They employ advanced security technologies like biometric authentication, end-to-end encryption, and continuous fraud monitoring systems.

All of this is to safeguard users’ funds and data.

6] Enhanced Customer Experience

With WaaS, businesses can offer a seamless and intuitive user experience that’s consistent across all platforms.

This ease of use can result in higher customer satisfaction and loyalty.

Plus, it also helps with a reduction in customer support calls related to transaction issues.

7] Access to Advanced Technologies

WaaS providers continuously innovate and incorporate advanced technologies such as artificial intelligence, machine learning, and blockchain into their platforms.

Businesses that partner with WaaS providers benefit from these innovations without the need to invest in R&D or risk falling behind technologically.

8] Focus on Core Business

Fintech outsourcing lets the business focus on its core functions.

Utilizing WaaS allows businesses to concentrate on their core products and services, rather than diverting resources to the development and maintenance of a financial infrastructure.

This can lead to better products, services, and overall business performance.

9] Data Insights

WaaS platforms often come with robust analytics and reporting tools.

Thus, providing businesses with valuable insights into customer behavior and transaction patterns.

These insights can inform strategic decisions.

The reason is that these help businesses to better meet the needs of their customers.

10] Ecosystem Integration

A WaaS solution can integrate with other services and APIs, creating a comprehensive ecosystem for the business and its customers.

For instance, integrating loyalty programs, rewards, and offers with the wallet service can enhance the value proposition and increase user engagement.

These benefits underscore why WaaS is becoming the go-to strategy for businesses aiming to provide digital wallet services.

If you were able to relate to the benefits and identified some that you want to align with, then implementing a wallet-as-a-service is definitely something that you need. In the next section, let us take a look at how exactly WaaS is implemented and how you can make the most of it.

How Does Wallet as a Service Work?

To make the most out of your solution and use WaaS to its full potential, you need to understand how it works and how it is implemented into your existing solution.

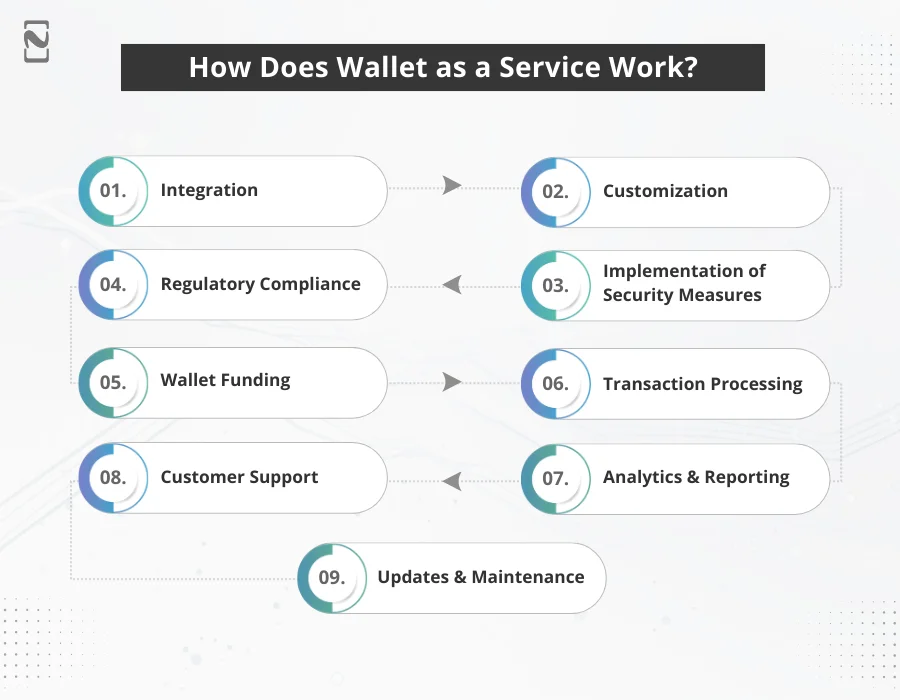

There is a series of steps that are involved in the working of wallet-as-a-service. Let’s take a look at those steps below!

Step 1: Integration

The first step for any business adopting WaaS is to integrate the WaaS provider’s API or SDK into its existing systems.

This is a crucial phase where technical compatibility and functionality are established.

This involves setting up communication protocols that will allow the business applications to interact seamlessly with the WaaS platform.

Step 2: Customization

Once the integration is complete, businesses can proceed to customize the look and feel of the wallet to align with their brand identity.

Wallet-as-a-Service platforms are typically designed with flexibility in mind, allowing for a high degree of personalization.

This might include tweaking the user interface, setting up the wallet’s features, and localizing the content for different markets.

Step 3: Implementation of Security Measures

The WaaS provider implements robust security measures.

This includes data encryption, two-factor authentication, and regular security audits.

These measures are designed to protect against unauthorized access and financial fraud, providing peace of mind for both the business and its end-users.

Step 4: Regulatory Compliance

In tandem with the security implementation, WaaS providers ensure that the wallet complies with the relevant financial regulations and standards.

This can vary from region to region.

The fintech compliance is ongoing, with the WaaS provider keeping abreast of and adapting to any changes in the regulatory landscape.

Step 5: Wallet Funding

The business’s customers can now begin funding their wallets.

This can be done through various methods such as credit/debit card payments, bank transfers, or even cash deposits at designated points.

The digital wallet as a service platform manages the complexities involved in processing these transactions.

Step 6: Transaction Processing

Once funded, customers can use the wallet to make payments, transfer money, and perform other financial transactions.

The WaaS platform handles transaction processing, ensuring that transactions are completed quickly and securely.

Step 7: Analytics and Reporting

The WaaS platform provides businesses with detailed analytics and reporting tools.

These tools allow businesses to monitor transaction volumes, user behavior, and other key metrics, which can be used to inform business decisions and improve the service.

Step 8: Customer Support

WaaS providers typically offer customer support services as part of their packages.

This can range from technical support for the business to user support for the end customer, dealing with any issues that arise in the use of the wallet.

Step 9: Updates and Maintenance

The WaaS provider is responsible for the ongoing maintenance and updates of the wallet platform.

This includes adding new features, updating security measures, and ensuring the platform remains operational and efficient.

After all these steps are completed, you have an optimized wallet as a service solution, ready to be used by your users.

Keep in mind that this implementation brings along several features for both your users and your business. What are these features? Let’s find out in the next section!

Key Features of Wallet-as-a-Service

When businesses evaluate a Wallet-as-a-Service (WaaS) provider, several key features stand out as essential for a robust, secure, and user-friendly digital wallet.

Below, we delve into the critical features that define a top-tier WaaS offering.

1. Multi-Currency Support

A standout feature for any WaaS is the ability to support multiple currencies.

This not only includes the major world currencies but also the flexibility to incorporate various digital currencies, including cryptocurrencies.

The feature allows businesses to cater to a global audience, removing barriers to entry in different markets and making transactions seamless for users traveling or engaging in cross-border activities.

2. Real-Time Analytics

Access to real-time analytics is indispensable for businesses to make informed decisions.

A WaaS platform should provide comprehensive dashboards that offer insights into transaction volumes, user engagement, and growth metrics.

These analytics can help businesses tailor their marketing strategies, anticipate market trends, and provide personalized services to their users.

3. Fraud Detection and Security

Given the financial nature of digital wallets, security cannot be overstated.

WaaS must have a robust fraud detection system in place that utilizes machine learning algorithms to identify and prevent fraudulent transactions.

The system should work in real-time, flagging suspicious activities and providing tools to mitigate potential risks.

4. Compliance Management

As financial services are highly regulated, compliance management is a key feature of WaaS.

The platform should ensure adherence to the various legal frameworks and standards, such as Know Your Customer (KYC), Anti-Money Laundering (AML) directives, and the Payment Card Industry Data Security Standard (PCI DSS).

A WaaS provider must stay current with regulatory changes and adjust the platform accordingly.

5. Customizable UI/UX

Customization of wallet design options is critical for businesses to provide a consistent brand experience.

The WaaS should offer a highly customizable user interface that can be modified to reflect the company’s branding and UX philosophy.

This includes everything from color schemes and logo placement to the overall layout and user journey within the app.

6. Seamless Integration

The ability for WaaS to integrate with existing business systems and third-party applications is a must.

This includes APIs for e-commerce platforms, CRM systems, and other financial services.

Seamless integration ensures a unified experience for the user and simplifies the operational aspects for the business.

7. Multi-Factor Authentication

To enhance security, a WaaS should provide multi-factor authentication (MFA) options.

This includes not only traditional methods like SMS verification but also biometric authentication, such as fingerprint scanning and facial recognition.

Multi-Factor Authentication adds a layer of security by ensuring that user accounts are protected against unauthorized access.

8. Support Loyalty Programs and Rewards

The digital wallet should support the integration of loyalty programs and rewards, enabling businesses to incentivize repeat customers and increase engagement.

Users should be able to earn and redeem points or access exclusive deals through their wallets, enhancing the overall value proposition.

9. Easy Onboarding

The onboarding process for new users should be streamlined and intuitive.

A good WaaS platform will guide users through the setup process quickly and efficiently, with minimal friction.

This could include simplifying the KYC process to make it as painless as possible for users to get started.

10. Customer Support Infrastructure

Finally, a robust customer support infrastructure is vital.

Users need access to help when they encounter issues with their wallets.

WaaS should provide businesses with tools to offer this support, whether through in-app messaging, chatbots, or a dedicated customer service line.

These features collectively form the backbone of a comprehensive Wallet-as-a-Service platform.

Next, we’ll explore the landscape of current WaaS providers and what sets them apart in this competitive market.

How to Choose the Right Wallet-as-a-Service?

Selecting the right Wallet-as-a-Service (WaaS) provider is a critical decision for any business.

It’s not just about picking a service; it’s about choosing a partner that will support your strategic goals and grow with you.

Here’s a structured approach to help businesses make an informed decision.

► Define Your Requirements

Before you start comparing providers, it’s important to understand your own needs. Consider the following:

- Transaction Volume: Estimate the number of transactions you expect to process.

- Market Reach: Determine if you need a provider with a global or regional focus.

- Currencies: Decide which currencies you need to support, including any cryptocurrencies.

- Compliance Needs: Understand the regulatory requirements of the markets you operate in.

- Technological Capabilities: Assess the level of technology integration required for your service.

► Assess Security and Compliance

Given the sensitive nature of financial services, prioritize providers with robust security protocols and a strong track record of compliance.

- Security Standards: Look for providers that adhere to top industry security standards like PCI DSS.

- Regulatory Track Record: Check if the provider has a history of regulatory issues.

- Data Privacy: Ensure their data privacy policies align with your business standards and the jurisdictions you operate in.

► Evaluate Technical Compatibility

The WaaS provider you choose should seamlessly integrate with your existing systems tech stack.

- API and SDK Quality: Test the ease of integration of their APIs and SDKs.

- Customization: Make sure the level of customization offered matches your branding requirements.

- Scalability: Ensure the provider’s platform can scale with your business growth.

► Consider the Customer Experience

Your customers’ interaction with the WaaS platform directly affects their perception of your brand.

- User Interface: Choose a provider with a user-friendly and intuitive interface.

- Support Services: Look at the provider’s customer support services and determine if they meet your standards.

- Onboarding Process: A streamlined onboarding process for your users is essential for adoption.

► Look at the Cost Structure

Examine the pricing models of various WaaS providers and how they align with your business model.

- Subscription Fees: Assess the monthly or annual costs and what they include.

- Transaction Fees: Understand the fees per transaction and how they might scale.

- Additional Costs: Consider any setup fees, customization costs, or other potential charges.

► Read Reviews and Get References

Research what other businesses say about the providers you’re considering.

- Customer Reviews: Look for reviews from businesses similar to yours.

- Case Studies: Request case studies or references from the provider to better understand their track record.

► Test the Service

If possible, engage in a trial period to see how well the service integrates with your operations and meets your expectations.

- Pilot Program: Run a pilot program to get firsthand experience of the provider’s service.

- Support Response: Evaluate the responsiveness and effectiveness of the provider’s support team during the trial.

Wallet-as-a-Service vs Custom eWallet Development

WaaS platforms offer a ready-made infrastructure that businesses can leverage to provide digital wallet services to their customers.

But how does it compare to developing a custom wallet? Well, let’s compare Waas vs eWallet solution development.

| Aspect | WaaS | Custom eWallet Development |

| Initial Cost | Lower | Higher |

| Time to Market | Faster | Slower |

| Customization | Limited | Extensive |

| Branding | Standards with some customization | Fully branded |

| Security & Compliance | Handled by the provider | Must be handled in-house or outsourced |

| Scalability | Highly scalable | Scalable, depending on the initial build |

| Maintenance | Provider Responsibility | Business Responsibilities |

| Control Over Data | Shared with the provider | Exclusive to the business |

| Market Differentiation | Limited differentiation | High differentiation |

| Ongoing Costs | Subscription and transaction fees | Varies based on maintenance costs |

Advantages

- Quick Deployment: WaaS can be integrated and launched relatively quickly.

- Reduced Costs: This eliminates the need for substantial initial investment and ongoing maintenance costs.

- Expertise and Support: WaaS providers bring specialized knowledge, especially in security and compliance matters.

Considerations

- Less Customization: While WaaS offers customization, it may not match the level available with a custom solution.

- Dependence on Provider: The business’s service is reliant on the WaaS provider’s stability and performance.

- Standardization: The solution may have standardized features that are also used by competitors.

Nimble AppGenie is Here to Help You

Nimble AppGenie, with our rich experience as an eWallet app development company, stands ready to guide you through this decision-making process.

Our expertise spans both custom eWallet solutions and the integration of Wallet-as-a-Service platforms.

We will help you assess your needs, weigh the pros and cons, and ultimately choose a path that aligns with your business objectives.

Whether you are looking for a unique, branded solution or a quick-to-market WaaS integration, our team is equipped to deliver excellence.

We will ensure that your eWallet solution, regardless of the chosen approach, is secure, compliant, user-friendly, and positions you for growth in the digital payment arena.

Conclusion

In a world where digital transformation is not just an advantage but a necessity, Wallet-as-a-Service emerges as a key facilitator for businesses eager to streamline their financial transactions.

The idea to integrate a wallet as a service can be easily implemented when you have enough understanding of the embedded wallet solutions.

Businesses from across the globe, be it a financial institution or any other business, can utilise wallet-as-a-service and make the most of it without having to spend a lot.

The whole experience depends on what kind of service provider you choose or delegate the task to. Make your decision wisely, and the rest will automatically fall into place. With that said, we have reached the end of this post.

Thanks for reading, good luck!

FAQs

Wallet-as-a-Service (WaaS) is a cloud-based platform that allows businesses to offer digital wallet functionalities without building their own system.

WaaS providers typically employ rigorous security protocols, including encryption, fraud detection, and compliance with global standards.

Yes, WaaS solutions are designed to scale easily, accommodating growing transaction volumes and user bases.

WaaS providers offer APIs and SDKs for integration with various business systems and applications.

While WaaS solutions provide customization options for branding and functionality, they may not be as extensive as custom-built solutions.

WaaS typically offers quicker deployment, lower upfront costs, and reduced need for in-house expertise in maintenance and security.

Consider your specific needs, required features, budget, target market, and the provider’s track record, security, and compliance standards.

Yes, businesses can start with a WaaS and transition to a custom solution as they scale and require more tailored features.

WaaS providers generally handle compliance with financial regulations, which can significantly ease the burden on businesses.

A good WaaS solution enhances the customer experience by providing a secure, fast, and smooth transaction process.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.