PayPal manages more than 41 million transactions per day and has over 430 million users globally. That’s why adding PayPal API integration into your application or website makes the best business sense. It is the most secure and safe payment gateway.

If you are developing an app or running an e-commerce store, you should integrate the PayPal API. But let’s be honest. Payment integration can be complex if you do not know where to begin. That’s good news? It does not have to be.

With the right steps, adding PayPal APIs can be really quick and easy. This blog will guide you through everything, from PayPal APIs integration steps, benefits, and use cases of PayPal APIs.

So, let’s begin!

What is PayPal API Integration?

PayPal API integration is a process that connects an application, website, or platform with PayPal’s payment processing system. It helps in multiple financial transactions. Also, it enables businesses to mechanize operations like billing, payments, invoicing, and so on.

PayPal is an instant payment system that provides an instant payment feature that enables users to make immediate transfers to their bank accounts.

Users must have a debit card or bank account linked to recurring payments with PayPal their bank account for a better funding source. PayPal API integration offers a smooth payment experience, automated workflow, and increased security.

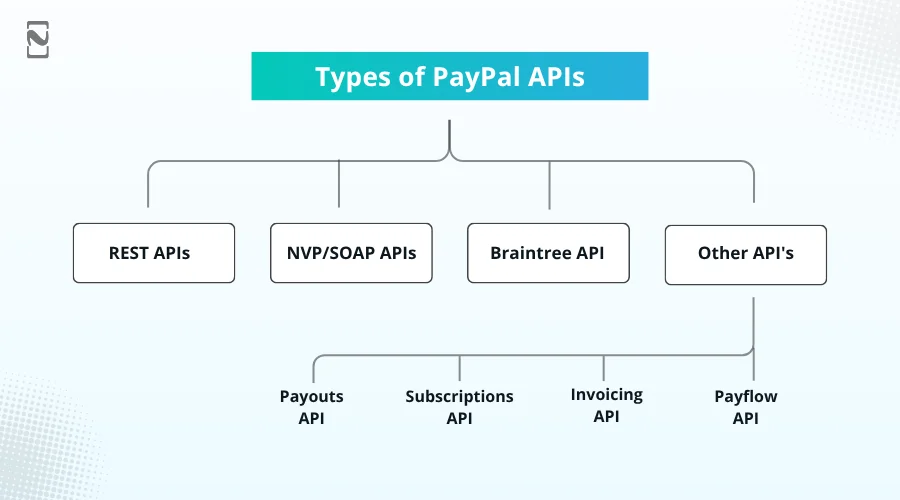

Types of PayPal APIs

Now that you know what PayPal API integration is, let’s understand its types. PayPal provides multiple APIs for developers so that they can integrate many functionalities into their apps. So, let’s check out each of them.

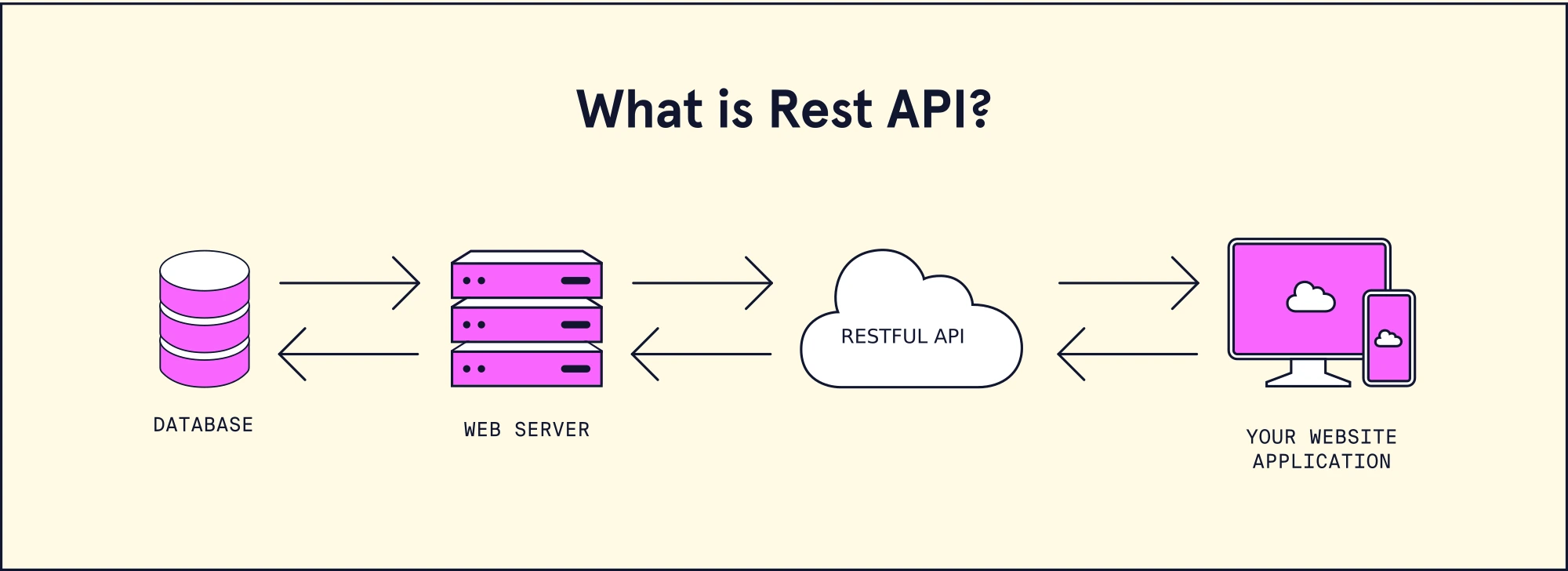

1] REST APIs

One of the most common types of APIs is REST APIs. It works best with websites, applications, and apps. REST APIs use simple web-based commands to perform actions.

For example, accept payments, handle orders, process refunds, and create and operate subscriptions. These are very flexible and support fintech security for easy transactions globally. If you are developing a new website or an app, PayPal REST APIs are the best choice.

2] NVP/SOAP APIs

NVP/SOAP APIs are the older PayPal APIs. NVP is a name-value pair, while SOAP is a simple object access protocol. They were primarily used before REST APIs came.

NVP APIs only use the simple text-based commands for sending and receiving data. However, SOAP APIs use XML-based messaging and are usually found in large company systems.

One thing about them is that they still work, and they are more complicated. Also, NVP/SOAP API is not suggested for new projects unless you are maintaining an older system.

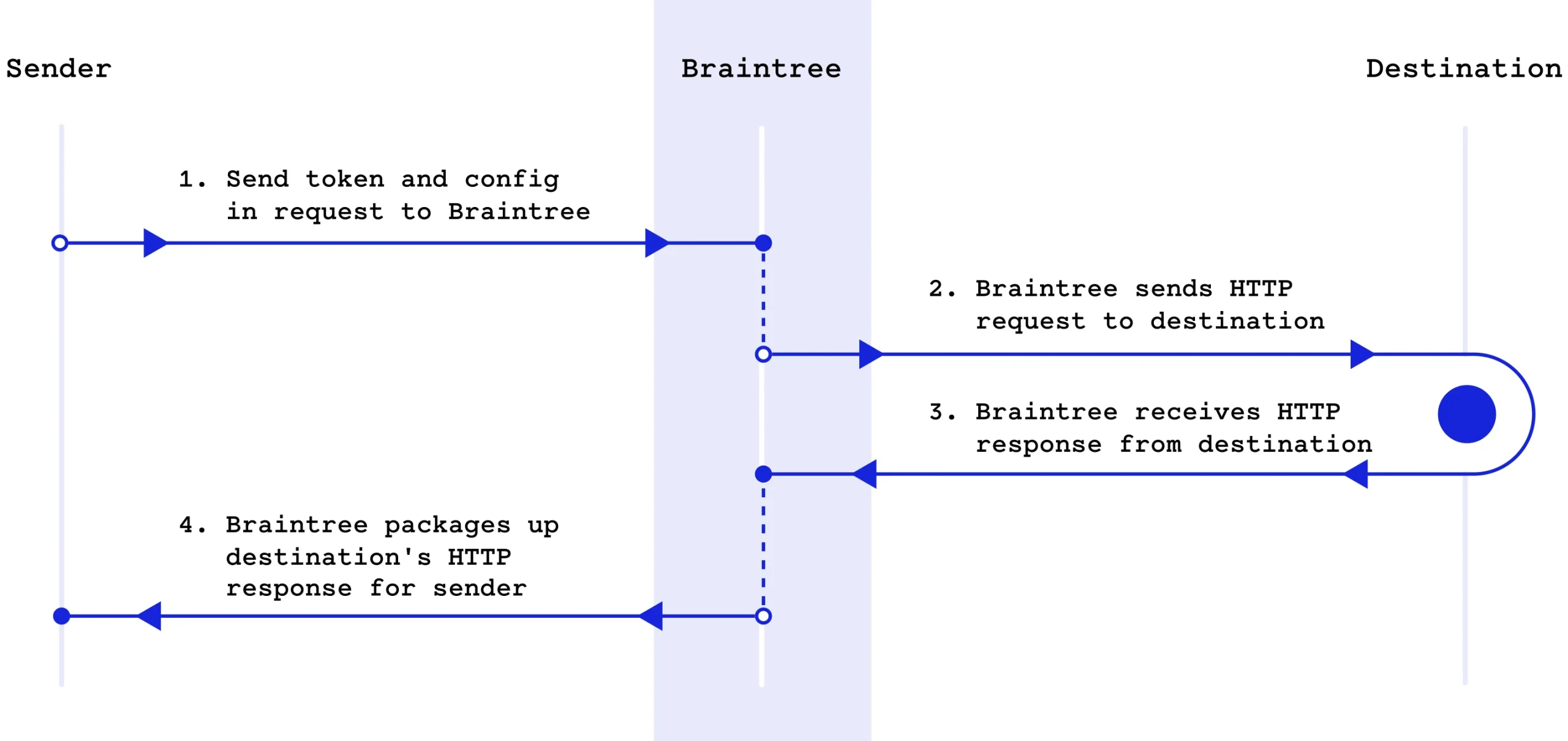

3] Braintree API

Braintree is owned by PayPal and provides a collection of APIs for advanced payment functions. Braintree APIs in fintech apps are widely integrated. Many companies want immense control over the transaction experience when using it.

With the help of Braintree API integration, you can accept credit or debit cards, Apple Pay, and so on. Also, you can store user transaction data safely, handle recurring billing, and handle overseas payments. It is the best option for developers who require a full-featured payment system.

4] Other API’s

PayPal provides various particular APIs for common business requirements. Let’s check out:

-

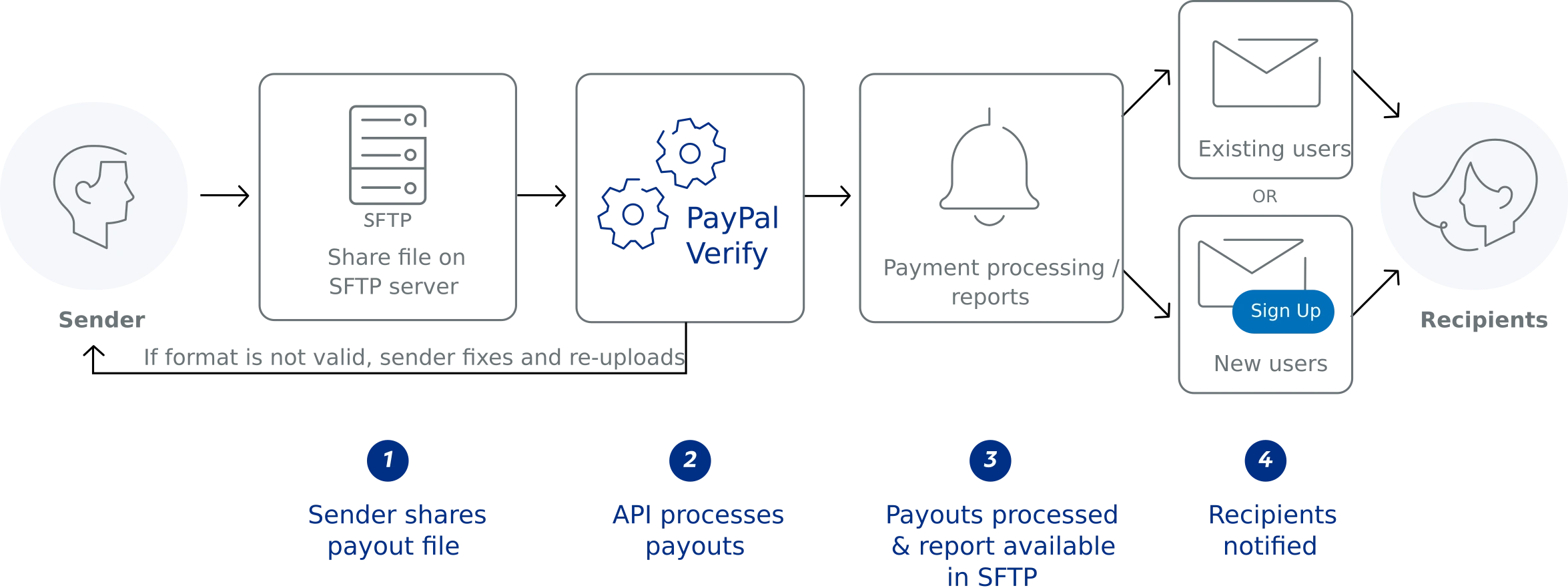

Payouts API

PayPal Payouts API is used to send money to various people at one time. It is the best API for freelance, gig workers, or rewards programs.

-

Subscriptions API

Subscriptions API PayPal enables developers to set up periodic payments for services or products like monthly memberships.

-

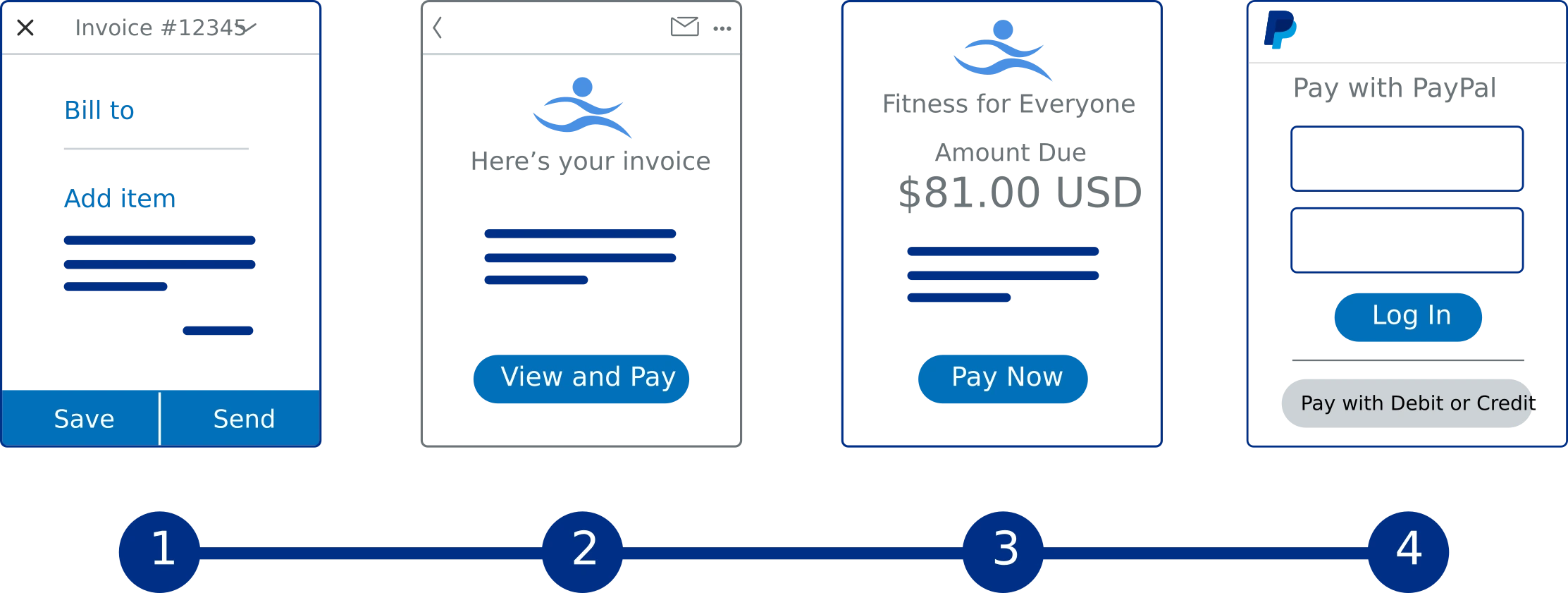

Invoicing API

PayPal Invoicing API assists you in creating, sending, and handling invoices online. It is useful for freelancers or businesses that make bills for clients.

-

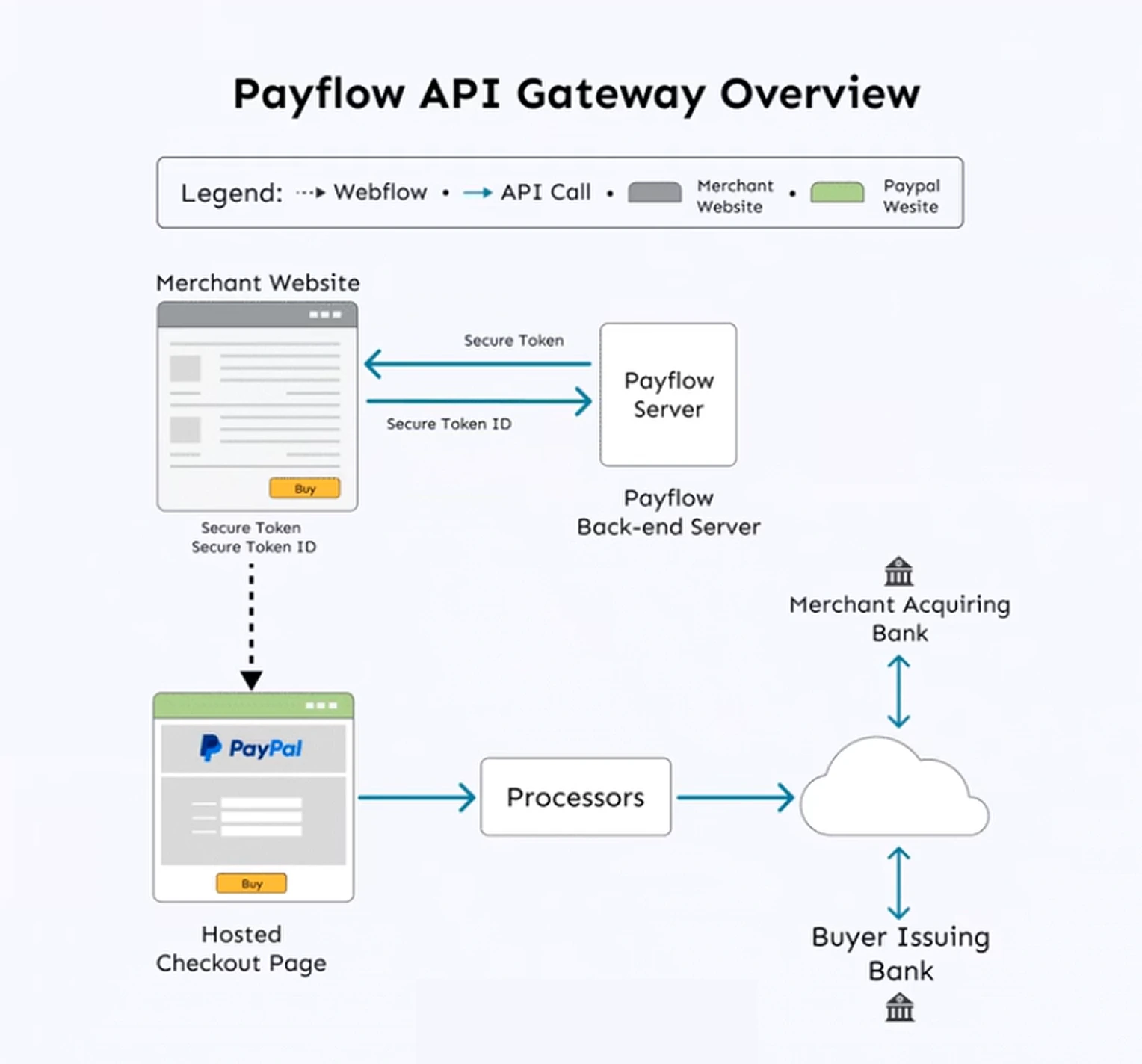

Payflow API

Payflow API is for businesses that want to utilize their own payment gateway while still accepting PayPal payments. This Payflow API integration provides more control but needs more setup.

Benefits of PayPal API Integration

If you are running an online business or planning to create a money transfer app, it is vital to integrate the PayPal API to make things easier and better for customers. Let’s check out some crucial benefits of PayPal API integration.

♦ Secure Transactions

Security is the main issue when it comes to online transactions. With PayPal, all your problems related to payment go away. When you use PayPal APIs, all the important payment information, like credit card numbers or bank account data. It is managed securely by PayPal, not you.

This means your business does not store or process the transaction details directly, which helps maintain PCI Compliance and lowers the risk of a data breach. PayPal uses advanced encryption and fraud detection tools to protect every payment.

♦ Global Reach

PayPal has a massive user base of around 434 million monthly active users. It is used in more than 200+ countries and supports 25+ currencies. It is a huge benefit if you want to sell your services to people globally.

When you integrate PayPal APIs in an app, you can easily accept payments from overseas customers. You do not need to set up different systems or worry about currency conversion. PayPal manages it all automatically.

It assists you in taking your business to greater heights, to a global audience reach.

♦ Multiple Payment Options

Not everyone wants to use the same payment method. Some prefer using debit cards, credit cards, while others prefer using a PayPal balance. Paying in instalments is also the choice of many customers.

PayPal provides users the ability to select how they want to pay. If you integrate PayPal APIs into your application or website, keeping in mind the fintech regulations, you can accept credit/debit cards, PayPal account payments, BNPL, and bank transfers.

♦ Easy Refunds & Subscriptions

As you might have noticed that customers often want refunds or need to cancel their subscription. PayPal makes this process simple with its APIs. You can issue refunds directly from your system without manually logging in to your PayPal account.

If you are providing subscription-based services, the API also enables you to automatically handle variable recurring payments, upgrades, or cancellations. This saves a lot of time and minimises human mistakes. It also gives your customers a seamless experience.

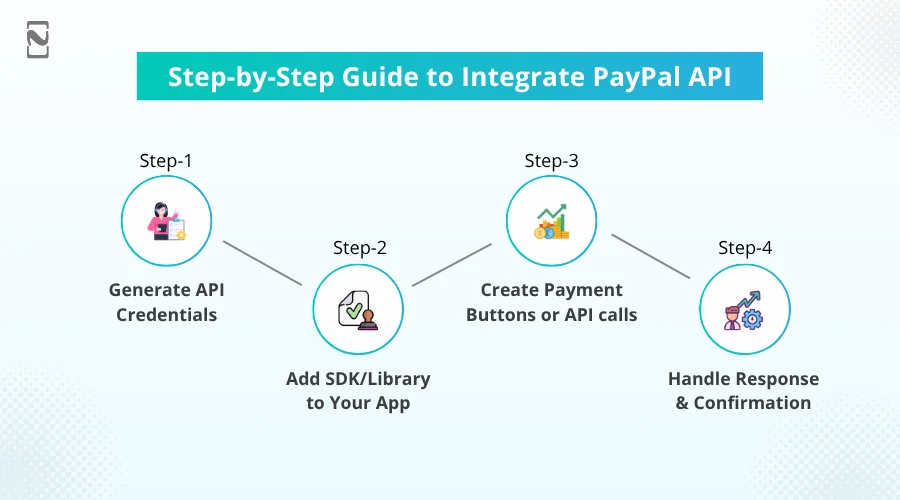

Step-by-Step Guide to Integrate PayPal API

How to integrate PayPal API in your application? This is the question most businesses ask. If you have technical or coding knowledge, you can easily integrate the API, but if not, you can hire developers for the same.

Here are the simple PayPal API integration steps that you must check out.

Step 1: Generate API Credentials

To begin integrating PayPal into your application, you need to create a PayPal developer account. You can go to developer.paypal.com and sign in or make an account there. Once you are successfully logged in, you can create a new app under the My apps and credentials sections.

PayPal will then generate a Client ID and Secret Key for your application. These are your API credentials. You have to use them to connect your application with PayPal’s servers. Just ensure that to keep the passwords or credentials safe.

Besides, PayPal gives you access to both the ‘Sandbox’ for testing and the ‘Live’ for real payments environments. You should always begin with a Sandbox to test everything before going live.

Step 2: Add SDK/Library to Your App

Now you need to add PayPal’s SDK or library to your application. PayPal facilitates official SDKs for multiple platforms. For instance, web, iOS, or Android. You can select the right SDK on the basis of the technology you are using.

This SDK assists your application in connecting and communicating with PayPal without writing all the low-level code yourself. For instance, if you are developing a web application, you can use the JavaScript SDK.

For mobile applications, there are separate SDKs for Android and iOS. Once you add this, the SDK will assist you in developing payment flows, handling users, and managing communication with PayPal’s servers.

Step 3: Create Payment Buttons or API calls

Once you set up the SDK, you can begin creating payment options for your application. You just have two main choices: use PayPal’s pre-built buttons or make your own custom payment flow by using APIs.

Pre-built options are very simple to integrate and provide basic functions like pay now or checkout with PayPal. However, if you want customised logic or full control, you can use PayPal APIs to make orders, set payment amounts, or define return URLs for successful payment or failure.

Whether you choose APIs or buttons, the main objective is to enable users to complete secure PayPal transactions within the app.

Step 4: Handle Response & Confirmation

Once a user makes a payment, PayPal will send a response back to your application. It covers details like transaction status, payment ID, and so on. Your application must read this response and confirm if the payment was successful.

For security, it is vital to verify the payment on your server by using PayPal’s APIs. After you confirm the payment, you can update the order status, deliver the product or service, and update the customer.

Just make sure to manage both success and failure cases properly for successful API security. It will allow users to know what is actually happening with their payment.

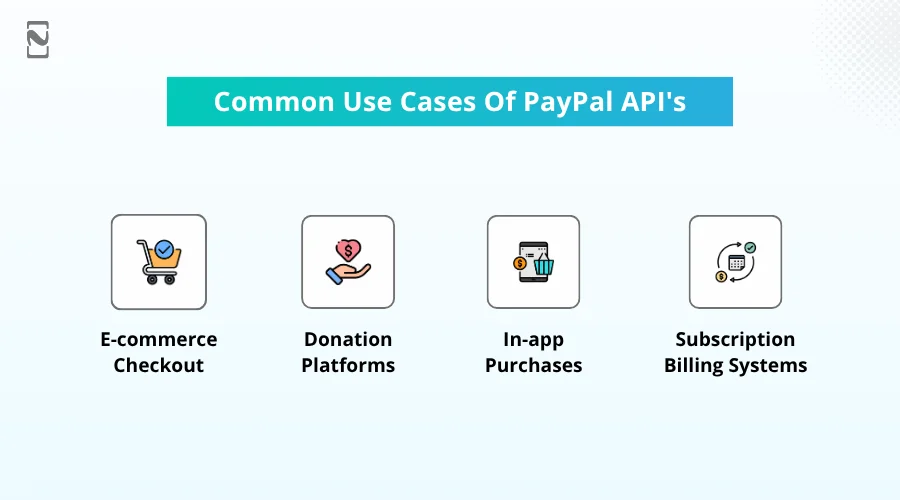

Common Use Cases Of PayPal API’s

PayPal’s APIs enable developers to connect their websites and applications to PayPal’s services. It makes it easier for users to make payments, subscribe to services, and donate money.

So, let’s have some of the common use cases where PayPal APIs are used.

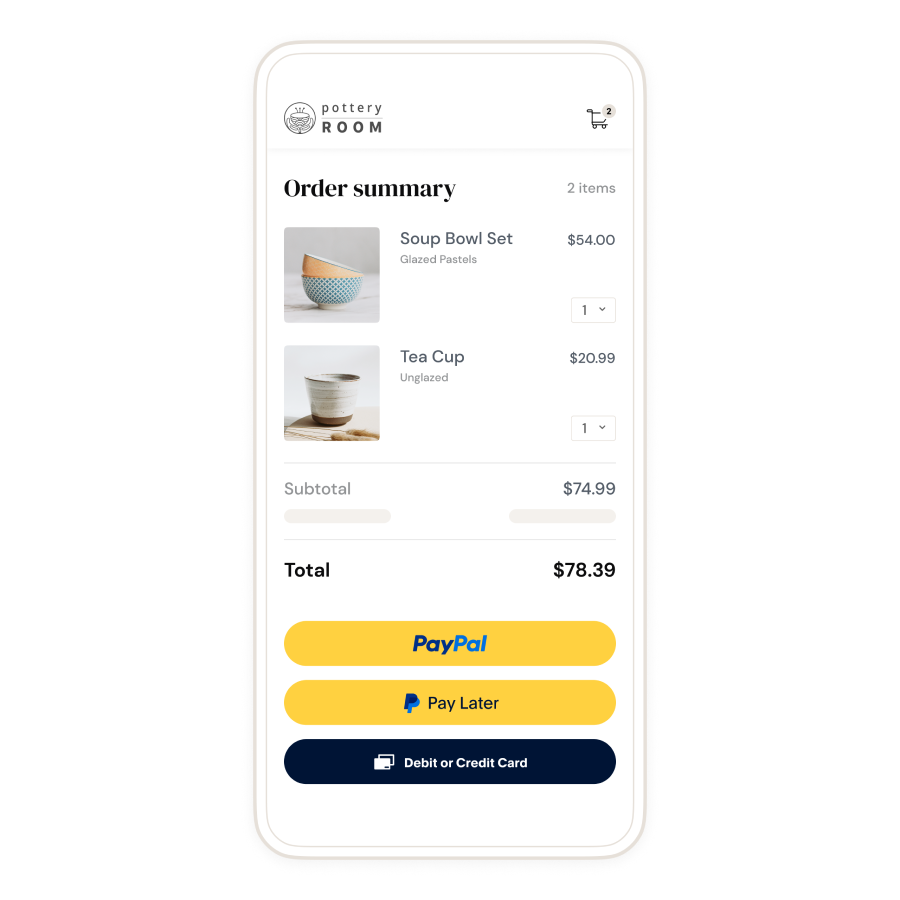

► E-commerce Checkout

Many online or e-commerce stores use PayPal’s APIs for accepting payments. When a customer purchases something online, they want a secure and fast method of payment.

PayPal for eCommerce apps enables customers to pay by using their PayPal account, credit/debit card, or even local payment methods. This way, online stores do not have to handle all the complexities of payment processing.

Additionally, integrating PayPal helps businesses comply with regulatory requirements like KYC in fintech apps. Since PayPal already verifies user identities, ecommerce apps benefit from an added layer of trust and compliance.

How it works:

Developers use the PayPal checkout API to integrate a ‘Pay with PayPal’ button on a website or an app. When users click on this button, they can log in to their PayPal account and finish their payment. It just manages all the payment details with all security and minimizes the fraud.

► Donation Platforms

NGOs and fundraisers mostly use PayPal APIs to accept donations online. PayPal makes it simple for people to contribute money in just a simple steps and allows them to make recurring donations.

It encourages more donations with smooth experiences, and supports one-time or recurring donations.

How it works:

Developers use the PayPal donate buttons or REST APIs to set up a donation form on a website. Donors or supporters can choose an amount and pay directly with PayPal or a card. APIs can track donors or supporters and send confirmation emails.

► In-App Purchases

Nowadays, there are many applications like games, shopping apps, e-learning platforms, music streaming platforms, etc., that need a payment gateway integration method to charge users directly from their application.

This is possible by PayPal API integration. You can integrate this API into mobile apps or web apps to enable users to make in-app purchases easily. It provides a smooth user experience and secure and fast payments.

How it works:

PayPal’s SDKs for mobile applications, which are available for Android or iOS, are used by developers. This can enable users to buy virtual goods, unlock many premium features, or even pay for services without opening a separate browser.

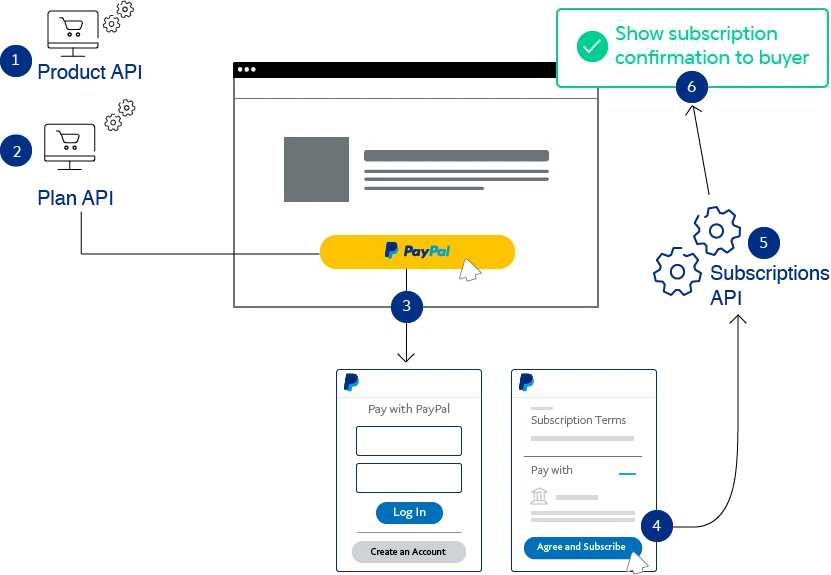

► Subscription Billing Systems

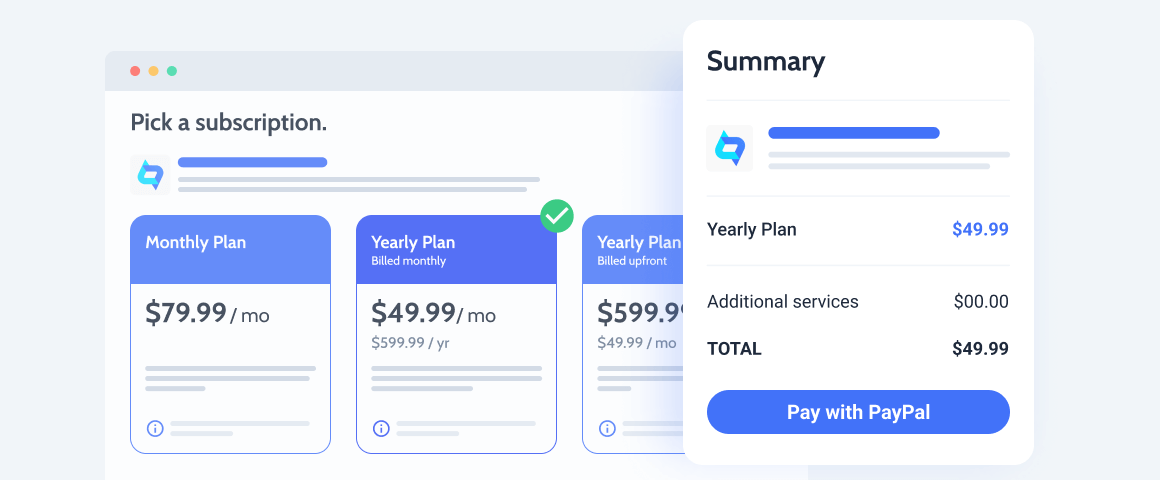

As you may have seen in the Netflix and Hulu apps, users have to pay for monthly subscriptions. They provide an Autopay feature within the app to automate billing. So, if a business provides subscription-based services, PayPal’s APIs assist in automating billing.

It means customers can charge automatically every month or year on their preferred plan. The PayPal API development process makes it easy to manage subscriptions and automate recurring payments with PayPal.

How it works:

With PayPal’s subscription API, you can make different plans with pricing, billing cycles, and free trials. Subscribers can take the premium version with just a few clicks, and PauPal handles all future payments.

How Nimble AppGenie Helps You Integrate PayPal API into Your Platform?

Nimble AppGenie is a leading fintech app development company that assists businesses in integrating PayPal APIs into their mobile app or website. PayPal payment gateway setup is done by our expert developers, so users can safely pay or get money online. We manage all the technical stages from account set up to testing.

Additionally, we ensure your platform runs smoothly and transactions are secure. No matter what you need, Nimble AppGenie customizes the PayPal features to fit your project requirements.

With our assistance, you save time, avoid errors, and give your users a trusted way to pay. If you’re exploring fintech app ideas, Nimble AppGenie is your go-to partner for reliable and secure PayPal API integration.

Conclusion

We hope this blog helps you get insightful information on PayPal APIs integration into your app. With the right setup, integrating PayPal can be a seamless process to enable secure transactions for users.

No matter if you want to develop a small e-commerce app or a huge platform like Amazon, PayPal’s API can boost your payment system. Just remember to test it thoroughly in the Sandbox before going live. If you follow the above simple steps, your app will grow and run in no time.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.