Budgeting and personal finance have become significant issues that many people need to address.

Thankfully, we are surrounded by several amazing budgeting apps that take care of all this and much more.

In this listicle, we will go through the 18 best budgeting apps and everything related to them.

So with that being said, let’s get right into it:

List of the Best Budgeting Apps

There are a lot of budgeting solutions coming in all shapes and sizes.

For instance, budgeting apps for kids, budgeting apps for retirees, budgeting apps for couples, and whatnot.

Choosing the right and best budgeting app for you can be quite confusing.

Or if you are someone who wants to start a fintech business with a budgeting app product, this blog also serves as a good inspiration to become the next best.

In any case, we have got you covered.

| Apps | Total downloads | Platform | Rating (Play Store) |

| Wallet | 10 million | iOS – Android | 4.5 |

| Albert | 5 million+ | iOS – Android | 4.5 |

| YNAB | 1 million+ | iOS – Android | 4.7 |

| AndroMoney | 1 million+ | iOS – Android | 4.6 |

| EveryDollar | 1 million+ | iOS – Android | 4.4 |

| Toshl Finance | 1 million+ | iOS – Android | 4.2 |

| Spendee | 1 million+ | iOS – Android | 4.5 |

| Goodbudget | 1 million+ | iOS – Android | 3.7 |

| Fudget | 100k + | iOS – Android | 4.0 |

| PocketGuard | 100k + | iOS – Android | 4.0 |

| Honeydue | 100k + | iOS – Android | 4.2 |

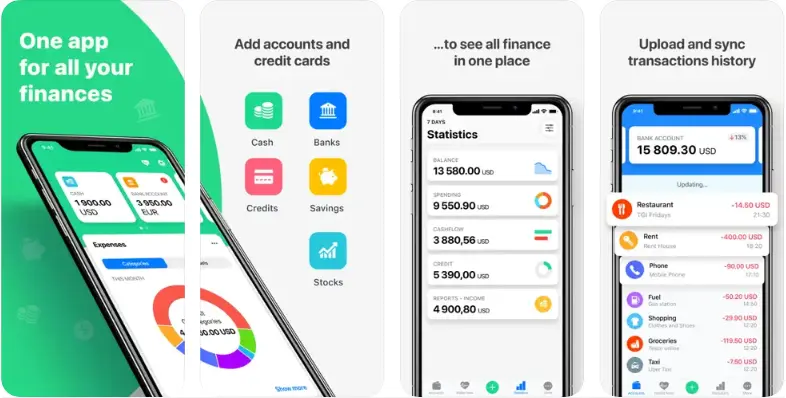

1. Wallet

Not to be confused with digital wallets, but what better name could you give a budgeting app than “Wallet”?

And let us tell you, this app offers performance as good as its name.

This is one of the best budget apps for college students, the elderly, as well as young ones.

It makes everything so easy that you will feel like it has AL integrated into it.

It makes everything so easy that you will feel like it has AL integrated into it.

The wallet will track all of your transactions straight from your bank account, as well as all of the other details. And the best part is, all of this is shown in an easy-to-see graph format.

In addition to reports, it also gives you suggestions as to what you should do to improve your savings. It also tracks bills and lets you know about due payments. It has several good features that you will love.

Features

- Wealth management features, including investment and retirement planning.

- Net worth calculator to monitor assets and liabilities in real time.

- Cash flow analysis to track income and spending.

- Portfolio performance tracking against market benchmarks.

- retirement planners to ensure financial security in later years.

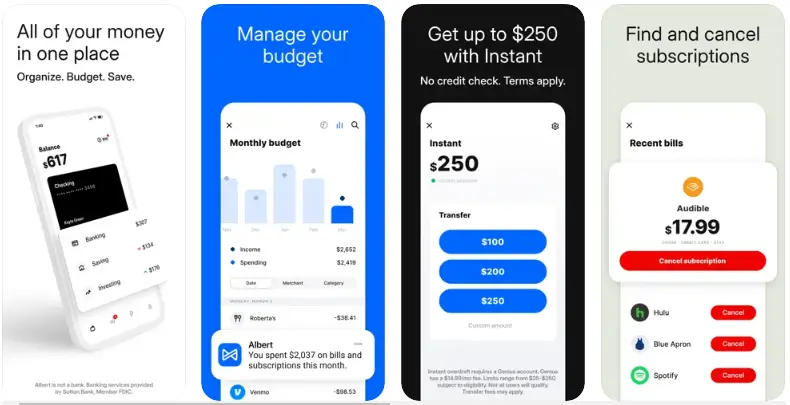

2. Albert

What do we have here? Well, we have Albert

This is a budgeting platform that combines budgeting support with automated savings and professional financial advice.

The app uses smart technology to analyze your spending habits and make real-time recommendations for saving money.

The app uses smart technology to analyze your spending habits and make real-time recommendations for saving money.

The platform also offers a feature where users can text human experts for personalized financial advice, making it a hybrid between traditional budgeting apps and financial advisory services.

Features

- Automated savings feature to help effortlessly set aside money.

- Text access to human financial experts for personalized advice.

- Real-time alerts and recommendations to optimize spending.

- Customizable budget categories to fit personal financial needs.

- Integration of banking, savings, and investment in one platform.

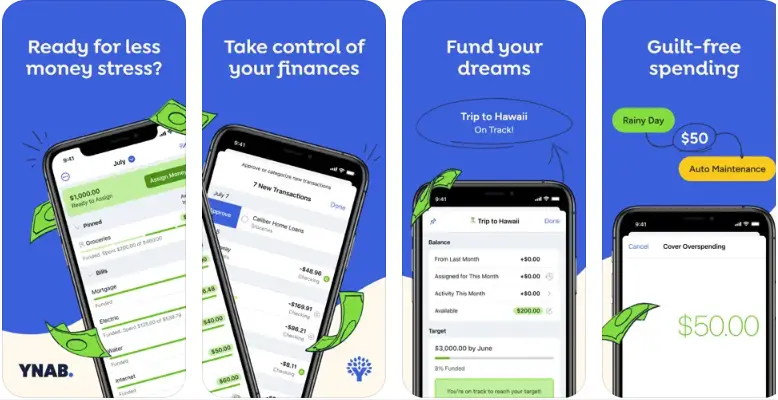

3. YNAB (You Need A Budget)

YNAB stands for “You need a budget”. And as the name suggests, you do need this app. This is easily one of the best personal expense tracker apps.

What it does is it uses a zero-based budgeting system where at the end of the day, your total income, when subtracted from the expenditure, should be equal to zero.

For those of you who are thinking this app makes you spend all of your money every month, hold your horses. What it means is, it keeps track of everything from savings, debt payments, to shopping.

For those of you who are thinking this app makes you spend all of your money every month, hold your horses. What it means is, it keeps track of everything from savings, debt payments, to shopping.

At the end of each month, you get laid out an easy-to-read insight of all that has happened in the previous 30 days.

Features

- An envelope budgeting system where money is divided into categories for spending.

- Sync across multiple devices to keep all family members on the same page.

- Expense tracking to monitor and categorize every expense.

- Income vs spending reports to visualize financial flow.

- Debt tracking to manage and plan the reduction of debts.

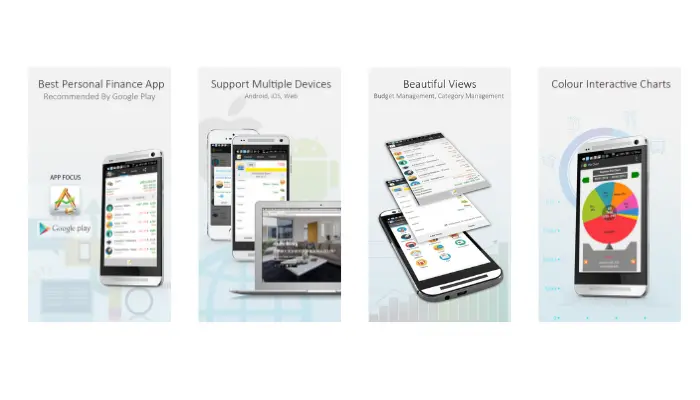

4. AndroMoney

AndroMoney, as the name suggests, is a budgeting application for Android. While it is also available on iOS, it has carried forward its simple and intuitive interface.

With its amazing features and well-put-together design, it is safe to say that it is a good example of what mobile app development can result in with an amazing budgeting app idea.

This not only helps you track your expenses, but it is also a good tool to maximize your savings. Most importantly, it is fast and very simple to use.

One of the best free budget apps, it is for those who don’t want everything automatic and enjoy doing the accounting stuff manually. Some of the top features of this application are, as mentioned below:

Features

- Multiple account support and cross-account transactions.

- Detailed charts and reports for comprehensive financial analysis.

- Cloud synchronization for use across multiple devices.

- Budget and expense management to keep finances on track.

- Customizable categories for personalized budgeting.

5. EveryDollar

Have you ever heard of EveryDollar?

It is a user-friendly budgeting app designed to help users implement the zero-based budgeting method popularized by personal finance expert Dave Ramsey.

What makes it among the top budgeting apps in 2024 is that it lets users allocate every dollar of their income toward expenses, savings, and debts, which facilitates meticulous financial management and control.

What makes it among the top budgeting apps in 2024 is that it lets users allocate every dollar of their income toward expenses, savings, and debts, which facilitates meticulous financial management and control.

It’s especially useful for individuals who want a straightforward approach to managing their money with clear, direct budgeting principles.

Features

- Zero-based budgeting system ensures that every dollar is accounted for in the budget.

- Automatic transaction syncing with connected bank accounts to keep your budget up to date.

- Customizable budget templates to suit various financial goals and lifestyles.

- Debt tracking and payoff tools to help users plan how to reduce debt efficiently.

- Integration with Ramsey+ for access to premium financial education resources.

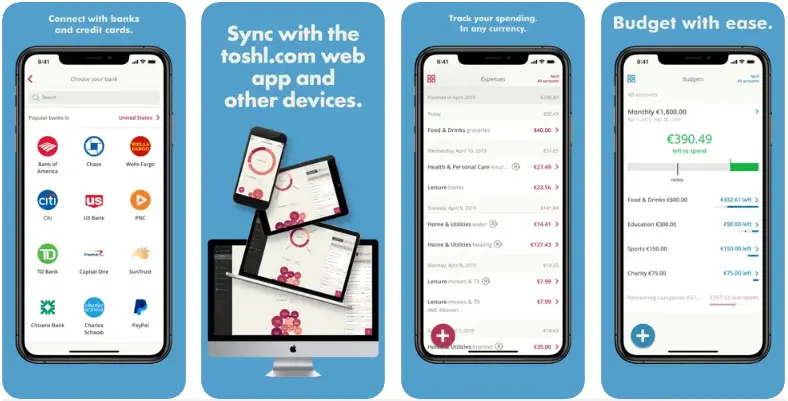

6. Toshl Finance

Toshl Finance stands as one of the top personal budget apps in the market.

The platform distinguishes itself with a whimsical interface and robust budgeting tools that make managing finances engaging and comprehensive.

It supports an extensive range of currencies and offers deep customization options, making it ideal for travelers or anyone dealing with multiple currencies.

It supports an extensive range of currencies and offers deep customization options, making it ideal for travelers or anyone dealing with multiple currencies.

The app includes fun graphics and intuitive navigation to simplify the often daunting task of budgeting.

Features

- Supports over 200 currencies and various cryptocurrencies, making it perfect for international users.

- Automatic bank syncing allows for real-time updates to your financial status.

- Detailed spending trends and forecasts to help plan future spending.

- Customizable tags for transactions to enhance tracking and sorting of expenses.

- Budget reminders to ensure timely payments and savings contributions.

7. Spendee

Named quite appropriately, Spendee is a visually appealing budgeting app that offers users an excellent overview of their finances with its bright, user-friendly interface.

It provides automatic transaction categorization and the ability to connect multiple bank accounts for a consolidated view of your financial health.

This personal budgeting app is particularly effective for those who wish to track their cash expenses alongside their digital transactions.

This personal budgeting app is particularly effective for those who wish to track their cash expenses alongside their digital transactions.

Thus, it goes hand in hand with most eWallet apps.

It also supports shared wallets, which is ideal for families and couples who want to manage their finances together.

Features

- Multi-bank connectivity for a comprehensive financial overview.

- Automatic transaction categorization to simplify expense tracking.

- Shared wallets for managing family or couple finances.

- Budget goals help users save for specific objectives.

- Detailed financial insights and reports.

8. Goodbudget

If you want to plan for a financially independent future, Goodbudget is something you should try.

One of the best free budgeting apps lets users divide their income into different categories. As you go on spending, the app will be tracking & analyzing it all to give you an insight.

Goodbudget will also help you reach your financial goal, sharing your spending in different categories.

Goodbudget will also help you reach your financial goal, sharing your spending in different categories.

Not to mention, GoodBudget’s success has inspired and attracted a lot of people from across the world.

One downside, though, is that despite being cross-platform, the data doesn’t synchronize across accounts.

Moreover, it follows a freemium model that comes with the $8/month subscription fee if you decide to buy the premium plan.

Features

- An envelope budgeting system where money is divided into categories for spending.

- Sync across multiple devices to keep all family members on the same page.

- Expense tracking to monitor and categorize every expense.

- Income vs spending reports to visualize financial flow.

- Debt tracking to manage and plan the reduction of debts.

Read Also:- How to Create an App Like GoodBudget?

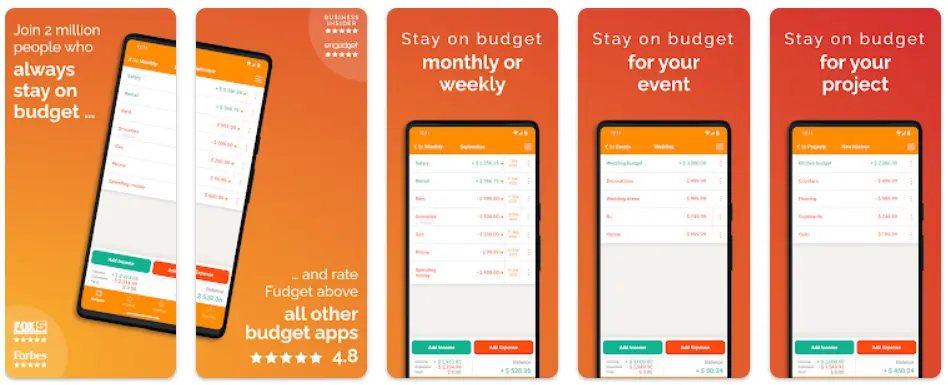

9. Fudget

This is a different one.

In this list of some of the best budgeting apps, Fudget makes a place for itself with its more manual approach.

So there isn’t any automatic syncing; you have to do everything with your own hands. It may not sort out the expenses by itself, but it does offer a simple and aesthetic interface.

This one is more like a spreadsheet, but not exactly. Nevertheless, it is one of the best budget apps. So, with this being said, let’s look at the features that this app brings:

Features

- Simple list interface for easy budget management.

- No categories or complications, which simplifies budget creation and management.

- One-tap adding and editing for speedy transaction entries.

- Star marking for important expenses.

- Budget sharing with friends and family.

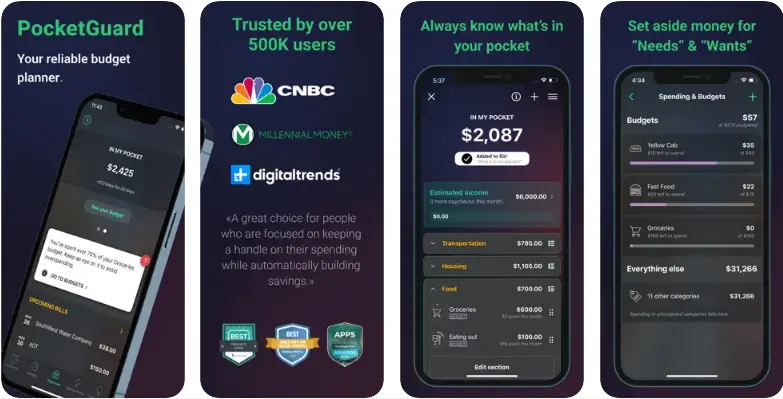

10. PocketGuard

PocketGuard is one of the most sophisticated apps on the list. It takes quite a modern, high-tech approach to budgeting.

As a product of AI solution development, it monitors your spending habits, your bank accounts, and so on.

You can sync your account with PocketGuard if you allow the platform to have real-time access. It also comes with amazing features like a subscription manager, a debt manager, and detailed analytics.

This is the best budget app, free to use… that also offers a premium version. Moving on, let’s look at the amazing features this application offers:

Features

- Simple list interface for easy budget management.

- No categories or complications, which simplifies budget creation and management.

- One-tap adding and editing for speedy transaction entries.

- Star marking for important expenses.

- Budget sharing with friends and family.

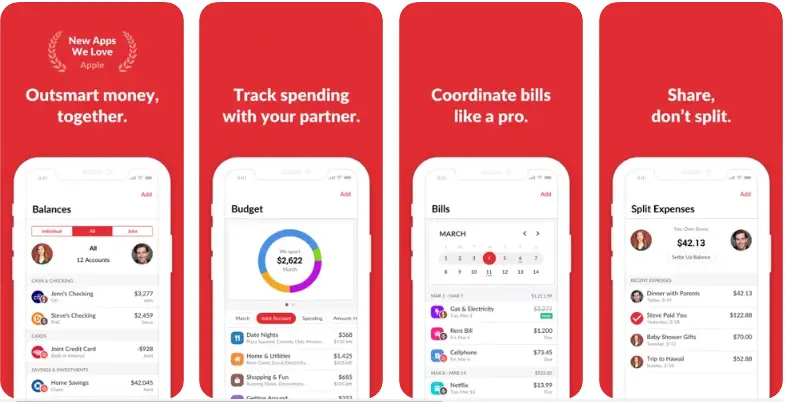

11. Honeydue

If you are looking for the Best Budget App For Couples, this is it. Honeydue is a budgeting application specifically designed for sweethearts.

What makes this stand out from the rest is that both the accounts and their details can be seen from one app. It also allows you to split expenses at your convenience.

However, sometimes complete transparency even among couples can become what we call these days “Toxic”. Therefore, both of partners can choose what they want to share with their spouses.

However, sometimes complete transparency even among couples can become what we call these days “Toxic”. Therefore, both of partners can choose what they want to share with their spouses.

Apart from all of this, it comes with an amazing feature for couples as well as good tools that you may expect from it.

Features

- Joint financial overview for couples to manage shared finances.

- Bill reminder to notify both partners of upcoming payments.

- Chat feature to discuss finances directly in the app.

- Customizable categories and budgets tailored to the couple’s needs.

- Monthly spending limits to keep financial goals on track.

Do You Have a Unique Idea? Develop a Budgeting App of Your Own!

Do you have a unique fintech app idea?

With the rise of the fintech market, there are a lot of businesses that want to create their own budgeting app and enter this vast market.

If you want to create a fintech app, here’s why you should do it:

► Tailored Solutions

Fintech statistics show the growing demand for these solutions.

With tailored solutions, you can capture this market. Here’s how: Every individual has a unique financial situation and goals.

A custom app can be perfectly tailored to fit your specific requirements, whether it’s managing irregular income streams, handling multi-currency transactions, or integrating personal investments and savings goals in one place.

► Innovative Approach

With your own app, you have the freedom to innovate beyond traditional budgeting methods.

This might include incorporating cutting-edge technologies like AI to offer predictive budgeting, or creating more interactive and gamified experiences to make managing finances fun and engaging.

This is a lesson for a fintech startup that wants to take the market by storm.

► Potential Revenue Stream

It is no secret, you can make money with fintech apps, of money!

If your app solves a problem effectively, it could serve as a potential revenue stream.

Once you’ve built and tested your app, you could offer it to other users with similar needs, turning your personal solution into a profitable business.

Nimble AppGenie, Your Fintech Solution Partner

Nimble AppGenie is a distinguished fintech app development company with over 7 years of expertise, renowned for crafting top-tier apps like SatBorsa, Cut Wallet, and Satpay,

We have completed over 350 projects for more than 250 clients globally.

Our commitment to excellence has been recognized by industry leaders such as GoodFirms, DesignRush, and Clutch.co, establishing us as a leader in the fintech development space.

Whether you’re initiating a new app or enhancing an existing one, Nimble AppGenie is equipped to deliver transformative digital finance solutions.

Let us help you propel your business to new heights.

Conclusion

As the financial landscape continues to evolve, choosing the right budgeting app can make a significant difference in managing your finances effectively.

From apps designed for couples like Zeta and Honeydue to comprehensive platforms like Personal Capital and Mint, there is a tool to suit every need.

Whether you’re looking for simplicity with Fudget or detailed financial insights with Clarity Money, these apps are crafted to help you achieve financial clarity and control.

FAQs

A budgeting app is a software application designed to help individuals manage their finances more effectively. It allows users to track their income, expenses, and savings, often providing tools for setting financial goals, monitoring spending habits, and planning for future financial needs.

Budgeting apps help by providing tools to track and categorize expenses, set budget limits, and view financial summaries. They can help pinpoint areas where you might be overspending and offer insights into managing money more efficiently, which is crucial for achieving financial stability and goals.

Many budgeting apps provide features to track investments and savings. They can help set savings goals, monitor progress, and sometimes integrate with investment accounts to give a comprehensive view of financial health.

Yes, many effective budgeting apps offer free versions that include basic budgeting tools and expense tracking. Premium versions often add enhanced features like automatic transaction syncing, financial advice, and advanced analytics.

Some budgeting apps support multiple currencies, which is beneficial for users who travel frequently or have financial obligations in more than one country. These apps can provide currency conversion and track expenses across different countries.

Budgeting apps offer more convenience and accuracy compared to traditional methods like spreadsheets or paper. They automate much of the process, provide real-time financial insights, and can sync directly with your bank accounts to track every transaction accurately.

For specific financial planning needs, look for apps that offer customizable features or consider premium versions that cater to detailed financial strategies and advice. Some apps also connect you with financial advisors for personalized planning.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.