Have you ever faced issues with the regulations and compliance for your fintech app?

You’re lucky if you don’t, as more than 25% of fintech startups fail in their first year due to compliance and regulatory issues.

While fintech statistics show exponential growth with the introduction of modern tech solutions, compliance and regulations have always been a point of concern for businesses.

Now, you may be wondering how one can overcome this issue. Well, this is where regtech comes into the picture.

RegTech is a technology that is deployed to handle all the possible regulatory issues without any manual involvement.

Fascinating, right? If you are wondering how it all works and what the benefits of using RegTech are, this is the post for you!

In this discussion, let us explore RegTech in its entirety and understand its core principles. Without further ado, let’s get started!

What is RegTech? An Overview

RegTech, as mentioned above, is Regulatory Technology that helps financial institutions to streamline all the regulatory processes, including monitoring and reporting of compliance processes.

The technology is a game-changer for financial institutions as they can focus better on their services rather than getting stuck in fighting the regulatory issues that appear out of nowhere.

Fintech apps and solutions often receive a large amount of data, making it challenging to screen for every minor issue.

Hence, RegTech is the best solution for these applications as it works on big data and machine learning.

The implementation of RegTech allows an app to mitigate the potential risks that may arise.

Regulatory technology has become a mandatory requirement for applications, as it streamlines the process of monitoring regulations and compliance in fintech.

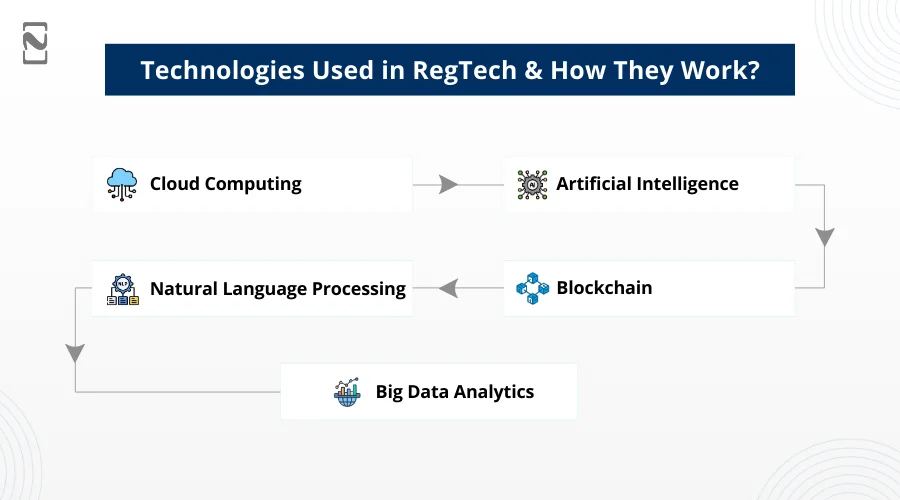

Technologies Used in RegTech & How They Work?

Now, you already know what RegTech does. It ensures that the fintech application with which it is being used complies with the regulatory requirements associated with it.

Often referred to as a subset of fintech, RegTech is one of the most important inclusions that an app needs, as the regulations have certainly become stricter over the years.

You may be wondering how exactly RegTech works. Well, it leverages technology to simplify the regulatory process and makes it more convenient for businesses to comply.

Keep in mind that RegTech has to overtake hundreds of human-led processes and automate them in turn to make the regulatory process a regular occurrence.

Hence, it needs access to advanced technologies. These technologies include –

Cloud Computing

Helps businesses leverage the Software as a Service model, allowing executives to run the bulk of data through a SaaS model so that regulatory gaps can be identified with a cost-effective infrastructure that is flexible enough to be accessed from anywhere.

Artificial Intelligence

AI in fintech is used for taking predictive measures and pattern recognition for potential risks that may appear on the regulatory front.

It learns from the patterns of your application to detect uninvited fraud and market abuse issues, helping you make better decisions.

Blockchain

One of the key problems that fintech apps face is maintaining the ledgers and proper audits.

The implementation of Blockchain in fintech platforms allows you to be at the forefront, as it creates a transparent ledger for easy audit and easy management of immutable records.

Natural Language Processing

For any system to work in compliance with regulations without the involvement of a human, it needs to understand the language in which they are stated.

Hence, for an app to recognize the policies and understand them, it needs NLP integration.

Big Data Analytics

One of the most crucial technologies for regtech to function, big data analytics allows the solution to go through a bulk of data to flag the risks properly.

The idea of finishing any fintech application is incomplete without incorporating RegTech into it, and to implement RegTech, you need professionals who can incorporate all these technologies into the system.

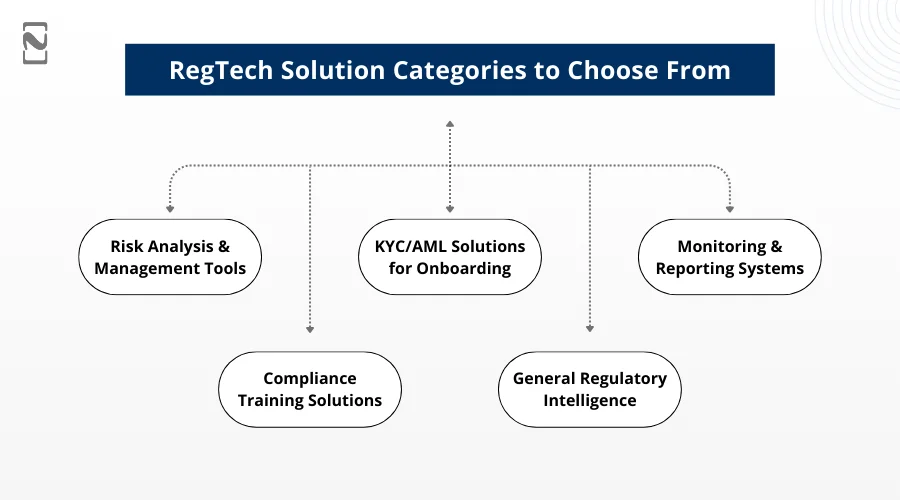

RegTech Solution Categories to Choose From

While these technologies may seem a bit too much to build on your own, keep in mind that there are types of RegTech solutions that use either or all of these technologies.

Hence, you should be aware of all the RegTech types that you can use and accordingly choose the solution.

Here are the types of RegTech solutions that you can choose from –

1. Risk Analysis & Management Tools

These are solutions that allow you to identify, assess, and manage different types of risks associated with your solution.

From compliance to operational risks, these tools are prepared to handle all types of issues and can help you mitigate the risk easily.

2. KYC/AML Solutions for Onboarding

When dealing with a fintech app, you need to ensure that your application is well-built and allows easy onboarding without compromising on security.

KYC/AML solutions are the best way to handle financial crime compliance and make the solution more secure.

The use of Anti-Money Laundering (AML) software and KYC in fintech is mandatory in many regions, making them must-have solutions.

3. Monitoring & Reporting Systems

Your RegTech system can also be built solely with the purpose of monitoring and reporting.

You can put in place a system that allows the system to timely report obligations and unresolved issues to the authorities.

These systems make it easier for a business to stay on top of all the possible regulations, from the oldest to the latest.

4. Compliance Training Solutions

RegTech can also offer training solutions that allow your application to be aware of all the necessary compliance practices.

This also means you can train the employees to stay and function as per the necessary compliance requirements.

Many businesses struggle to maintain a clean compliance system as the human resources involved in the process are not properly trained.

This issue is resolved easily with Compliance Training Solutions.

5. General Regulatory Intelligence

You can even go for a general regulatory intelligence solution that can help you do everything at your disposal.

It is primarily used to monitor and interpret emerging threats that can help you find the regulatory gaps of your business, app, or organization.

It also keeps an eye on emerging fintech trends and regulations, making it easier for you to comply with them when required.

With all these solutions designed for specific tasks, you can easily choose which one you want to invest in. It can surely be difficult to break down which one is the best for your application.

Moreover, many of the fintech brands still believe that they do not need to spend on RegTech as they have resources that can manage compliance manually.

If you, too, believe that it is just an additional expense, then think again, as several benefits come along with RegTech.

Benefits of RegTech: Why Opt for Regulation Technology?

Implementation of RegTech helps a business avoid unnecessary compliance issues that it might have to go through without using the regulation technology.

However, that is not the only benefit of using RegTech.

Here are some additional benefits of RegTech that you can experience by opting for the same –

♦ Extended Risk Management

With real-time tracking and preventive measures in place, RegTech allows businesses to actively manage issues and regulatory risks.

♦ Future-Proof Solutions

When a business chooses RegTech, it can easily stay focused on growing its business while the regulatory tech keeps it updated with the latest developments in compliance, making the process future-proof.

♦ Improved Customer Experience

With a risk-free application comes an improved experience for the user, as they are no longer worried about unlawful activities on your application.

♦ Added Efficiency & Accuracy

For every application that uses RegTech, efficiency increases as the processing of data is better, and the time taken to report the issues is significantly reduced with higher accuracy.

♦ Reduced Overall Cost

With automated processing and leveraging technology to get things done faster, the overall cost to the business is reduced as you no longer need to pay a dedicated human resource or a team of resources to manage compliance risks. Not to mention, with RegTech, you need not worry about penalties.

You see, while RegTech seems like an additional investment, the benefits make all the efforts completely worthwhile, as it not only makes the solution safe and automated but also helps you save some money on top of it.

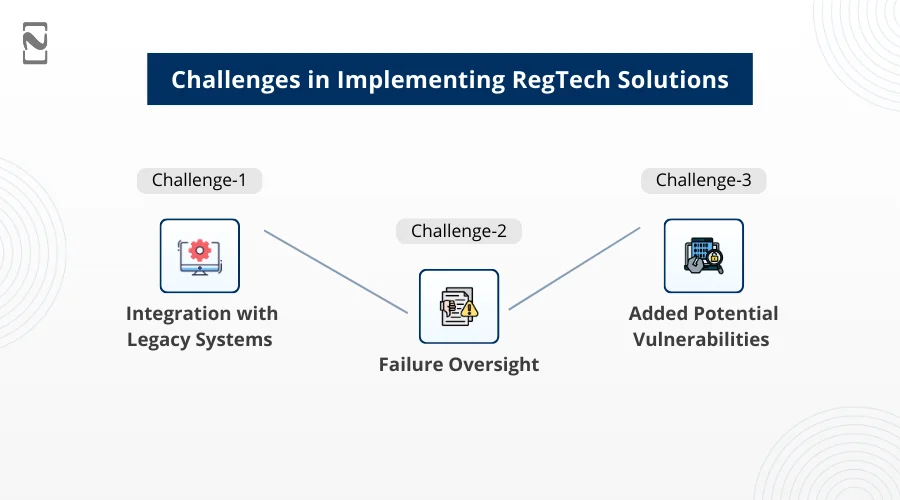

Challenges in Implementing RegTech Solutions

The benefits mentioned above might have got you all excited about implementing RegTech, and you sure should do the same, considering it offers a plethora of better solutions than any other approach.

However, if you are ready to opt for the same, you should be aware of the possible challenges that you might have to deal with in the long run.

These challenges include –

Challenge#1 – Integration with Legacy Systems

The first challenge with RegTech is that it often poses a problem when you plan to integrate the application with an existing legacy system.

Financial institutions that have been around for years now rely on their existing systems, which are not properly compatible with the latest technologies required to implement RegTech solutions.

Solution – Ideally, you might need to modernize your existing app solution and give it a revamp. It actually depends on how old your existing solution is and whether it is modular enough to be upgraded with the implementation of regulatory technology.

Challenge#2 – Failure Oversight

When you have implemented an automated RegTech solution, it reduces the number of resources you have manually deployed. This also means that if a failure occurs despite a RegTech solution, it will go unnoticed, causing issues.

Solution – To ensure there is no failed oversight in the first place, make sure you have a responsible resource managing the regtech solution regularly. The more you can check the solution, the better results regulatory technology can offer you.

Challenge#3 – Added Potential Vulnerabilities

Many fintech institutions are still sticking to traditional methods, as they do not want any additional vulnerabilities. With a digital solution, you invite various digital anomalies that make your data available to the notorious online fraudsters who might try to attack your solution.

Solution – It genuinely is a problem for many fintech companies; however, with the rise in fintech security measures, you can easily overcome it. The first thing to do here is to be transparent with the development company you hire, as they can help you safeguard your data easily.

Other than these, one of the common challenges that occurs in the application is the standardization of data. RegTech uses big data, which requires high-quality data to generate a process.

Knowing these challenges, you may be wondering whether you should rely on RegTech or not. Generally, these challenges only come into play when your regtech development company has not guided you properly. Hence, before implementation, you need to focus on finding the right partner to guide you through the process.

Want to know who can help? Read the next section carefully!

Develop a Robust RegTech Solution with Nimble AppGenie

The role of a RegTech development company is significant in building a solution that helps a business experience all the benefits of using regulatory tech without having to go through the challenges. It is solely dependent on the business to opt for any type of app, be it just for monitoring or for intelligence.

But where do you find one such development partner? Well, your search ends here as Nimble AppGenie is here to help you! With years of experience in RegTech and Fintech solutions, we understand the app development process quite well.

Simply reach out to our professional team, and they can surely help you develop the right solution without having to compromise on security or features. The best part is that all our services are pocket-friendly, making them the best choice for you.

So, let’s connect?

Conclusion

RegTech is one of the best things that fintech apps and sensitive businesses can opt for, as it allows them to stay secure while dealing with sensitive data.

Not only does regulatory technology simplify the implementation of compliance, but it also ensures that no irregular practices are carried out when maintaining high volumes of data.

Needless to say, RegTech is the ultimate solution to regulatory compliance and keeping financial crimes away from your app.

Hope all the information shared gives you insights into why you should use RegTech and what it is all about. With that said, we have reached the end of this post.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.