Have you noticed the changing trends in E-wallet?

If not! Here, you can find the e-Wallet app and their usage, along with the reasons behind using them in Malaysia.

The journey from cash payment to e-wallet has changed the way of payment. A shift has been observed from paying cash in exchange for commodities to downloading e-wallet apps. With the knowledge regarding e-Wallet app trends, you can figure out which one is perfect for your financial management practices.

So, here we are discussing the e wallet trend in Malaysia, with details on stats and key e-wallet payment apps used by Malaysians.

E-wallets And Their Usage in Malaysia

E-wallets can be defined as the digital versions of managing money transactions in an electronic way. These apps are developed to enable the user to make transactions online and also by being physically present in stores.

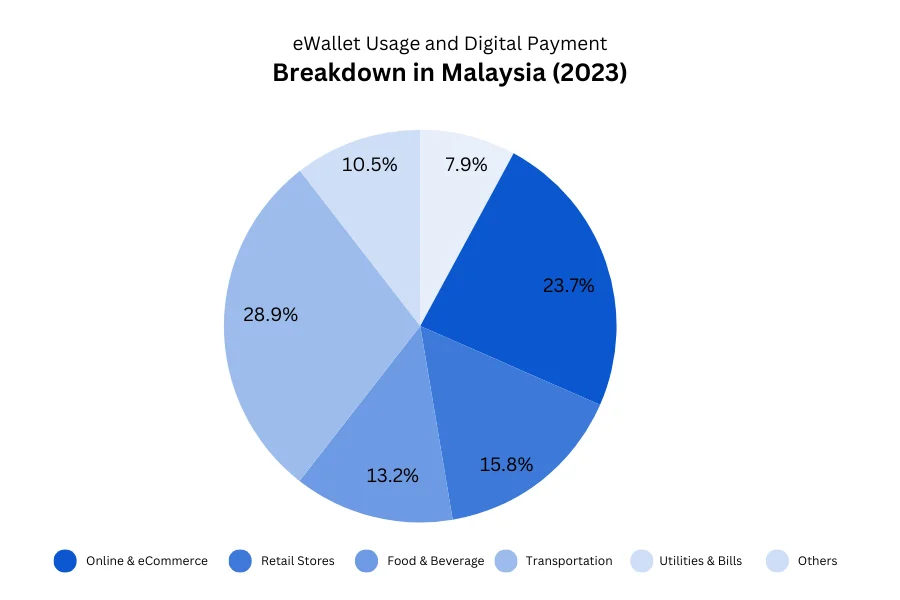

The stated figure reveals the usage of eWallet apps and digital payment systems in Malaysia. As of 2024, 88% of Malaysians use e-wallets, a significant increase from 63% in 2023. While specific category usage data for 2024 is limited, previous trends indicate diverse applications of e-wallets across various sectors.

The digital eWallet app facilitates customers in managing money transactions, monitoring cash flow, and handling finances effectively. The innovative practices used in developing e-wallet payment apps have contributed to their widespread adoption. These apps give security and user-friendly interfaces, improving the management of bank accounts.

According to a survey in 2024, over half of Malaysians now use non-cash payment methods, with e-wallet adoption rising 14% compared to the previous year. The use of e-wallets among various demographics in Malaysia has influenced shopping patterns in the country.

With the increasing rate of smartphone penetration and widespread availability of mobile devices, users are shifting towards e-wallet apps. Supported by government initiatives, merchants are increasingly adopting e-wallets to accept payments in Malaysia. This trend aims to ease efficient cash transactions and promote a cashless society.

Current Trends of eWallets in Malaysia

Current trends of e wallets in Malaysia are continuously increasing. The number of mobile wallet users in Malaysia has increased to more than 15 million. Further, it is forecasted to reach more than 25 million by 2026.

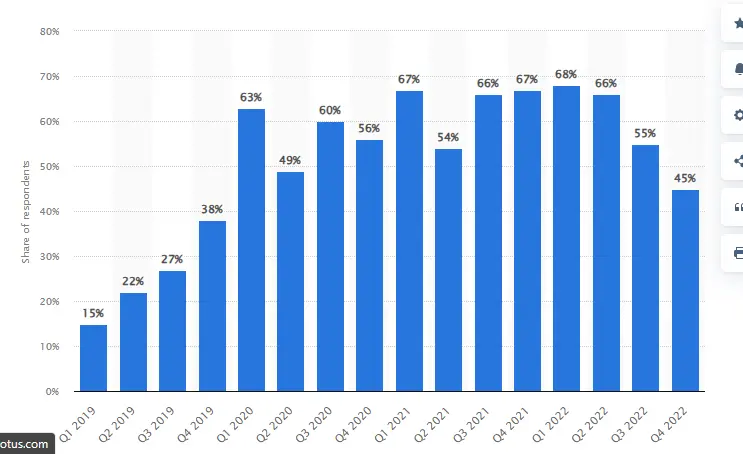

Pre-pandemic rate of use of e-wallets in Malaysia is less than post-pandemic use. The pandemic has made to attain contactless payment attributes, with a target to increase e-wallet users.

The above graph shows the change from pre-pandemic to post-pandemic. It has made the users to identify and download e-wallet apps. It can be observed that 66% of Malaysians have performed payment through e-wallet in the 4th quarter of the year 2021. The share increased to 68% in the second quarter of 2022.

The above graph shows the change from pre-pandemic to post-pandemic. It has made the users to identify and download e-wallet apps. It can be observed that 66% of Malaysians have performed payment through e-wallet in the 4th quarter of the year 2021. The share increased to 68% in the second quarter of 2022.

The number of users of e-wallet apps has constantly been increasing in Malaysia. The estimated number of users of e-wallet apps was approximately 15.7 million. It can be stated that about 48% out of 32.6 million country’s population have started using e-wallet apps.

Based on the pre-pandemic scenario, e-wallet users were working adults only. While at the time of pandemic and post-pandemic, the impact of the e-wallet trend on demographics in Malaysia shifted to youth and older age people. This represents the awareness among the people of using e wallets in Malaysia.

Fintech business in Malaysia is also increasing with the current trend of using e-Wallet apps. In 2024, the Malaysian Fintech market was USD 46.63 billion and is expected to grow to USD 96.09 billion. The e-Wallet app statistics can provide you with detailed insights regarding the usage of e-Wallets in the world and in Malaysia.

Fintech business models in Malaysia are becoming a central part of the country’s financial sector. In 2022, the banking and financial services sector observed a great demand in the private equity and wealth. This is leading to continued high growth in fintech industry, growing the need for increased investor relations, and to business development.

Why Use e Wallet Apps in Malaysia?

The major reason behind using e-wallet apps can be looked forward, to examine the increased demand for e-wallet payment app

1. Convenience

Every individual needs an app that can manage their transactions and can help them in improving their finances. A fast-Hassel free payment app can do this at your convenience. It also eliminates the need to carry physical cash and multiple cards. With the ease of just a few taps on smartphones, the users can avail payments anytime and anywhere.

2. Rewards

Several e-wallet apps offer cash-back rewards, loyalty, and discounts. These programs also encourage the user to make use of these platforms for making transactions. Some of the e-wallet apps provide free recharge and also offer discount coupons on their next purchases. Such rewards can be redeemed to have discounts and points on every transaction.

3. e-Wallet Security

The e-Wallet apps also offer security by prioritizing encryption, biometric authentication, and tokenization to protect the user’s financial information. e-Wallet security provides feasibility to the customers by reducing the risk of carrying physical cash and cards with enriching security features to their users. They get access to manage all the finances, wherever the person goes.

4. Faster than traditional payment

Counting cash while making payments can be a hassle, but with e-Wallet apps, a person can quickly complete the transaction process in one click. It has also reduced the long queues at the counters for filling up bills and for online purchases resulting in increased contactless payments. E-Wallet payment app empowers the users to make more financially sound decisions.

5. Contactless payment

The e-wallet app is a boon in pandemic times, as it offers contactless transactions. It does allow the users to make payments without being in direct contact with the merchandiser. During a pandemic, e-wallet apps have become an important feature, as they are helpful in reducing the risk of spreading virus through surfaces.

Leading e-Wallet Payment Apps in Malaysia and Their Impacts

In Malaysia, the trend for e-wallet payment apps has increased the cash flow. To study the trends of e-wallet apps in Malaysia, it is also important to know the best e-wallet apps in Malaysia. Here you can have a list of the trendy e-wallet apps with their impacts on customer behavior.

1. GrabPay

GrabPay is one of the innovative terms being used for the collective umbrella. It is a term being utilized for all payment services including performing payments through credit and debit cards. Here, one can find a safe and rewarding payment way for doing payments. The app offers services related to paying bills, rides, online shopping, and much more.

GrabPay offers 1% GrabRewards points for every dollar spent using the app. You can enjoy free Grabrewards for free rides, food, and also while making payments to GrabPay merchants. They also provide convenient payments to grab your favorite services. Along with this, the app offers different types of payment options while you are shopping around and paying bills.

GrabPay offers 1% GrabRewards points for every dollar spent using the app. You can enjoy free Grabrewards for free rides, food, and also while making payments to GrabPay merchants. They also provide convenient payments to grab your favorite services. Along with this, the app offers different types of payment options while you are shopping around and paying bills.

2. Instapay eWallet

With Instapay eWallet, you will get an e-wallet plus pre-paid MasterCard, which is specially designed for the purpose of improving payroll management at businesses. Along with this, the app has been designed to streamline the payroll processing with the organizations. The app is currently available only in Malaysia and is useful for employing low-skilled workers and addressing the financial challenges faced during payroll.

Instapay app has the vision to build the capacity of the employer organizations to manage their payroll for financially inclusive protocol. The app does contain very minimal transaction costs with the availability of real-time 24/7 fund transfers. Here the users can receive and send money easily even on holidays and on weekends.

Instapay app has the vision to build the capacity of the employer organizations to manage their payroll for financially inclusive protocol. The app does contain very minimal transaction costs with the availability of real-time 24/7 fund transfers. Here the users can receive and send money easily even on holidays and on weekends.

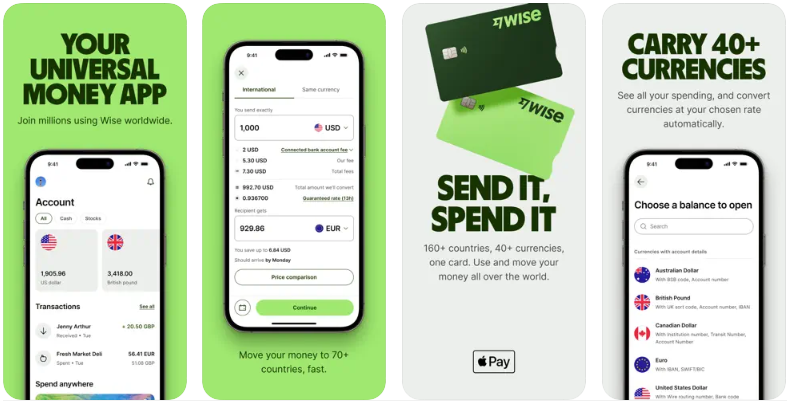

3. Wise (ex TransferWise)

Wise, termed as TransferWise, is a financial technology company providing international money transfers with excellent currency exchange services. The eWallet app in Malaysia is being designed with the aim of making cross-border payments more affordable, convenient, and transparent for businesses and individuals.

Apps like TransferWise also charges low and upfront fees, which are clearly displayed to the users while making a transaction. Wise offers real-time exchange rates; they are also being regulated by different financial authorities in multiple countries. Also, the platform offered by Wise is user-friendly and allows users to deal in multiple currencies. Here, you can enable fast international money transfers with several transactions completed within hours.

Apps like TransferWise also charges low and upfront fees, which are clearly displayed to the users while making a transaction. Wise offers real-time exchange rates; they are also being regulated by different financial authorities in multiple countries. Also, the platform offered by Wise is user-friendly and allows users to deal in multiple currencies. Here, you can enable fast international money transfers with several transactions completed within hours.

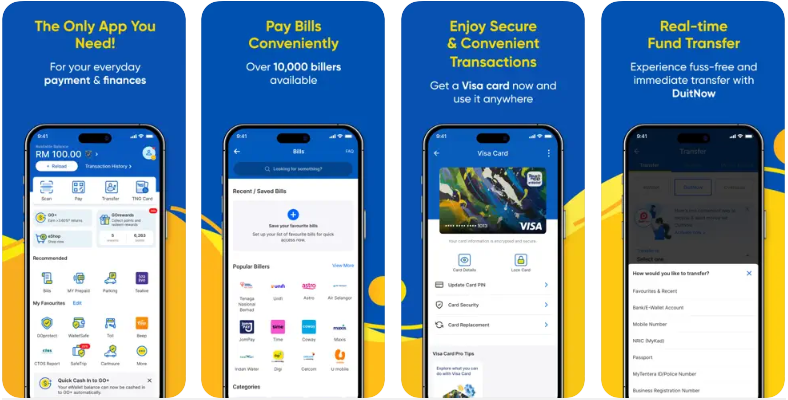

4. Touch ‘n Go eWallet

Touch ‘n Go is based in Malaysia, and provides electronic payment options to the customers. The app allows a contactless smart e-wallet app that helps the users to pay for the tolls on public transportation areas and highways and also the purchases at selected retail outlets. Users can also facilitate and reload their Touch ‘n Go eWallet with the funds.

Touch ‘n Go app allows the user to make cashless transactions using a smartphone. Along with this, users are permitted to link their bank accounts and credit/debit cards and can top-up their eWallet balance through online banking, over-the-counter reload points, and Touch ‘n Go self-service kiosks. The e-wallet app has also partnered with different transportation operators in Malaysia to link different payment solutions to the services.

Touch ‘n Go app allows the user to make cashless transactions using a smartphone. Along with this, users are permitted to link their bank accounts and credit/debit cards and can top-up their eWallet balance through online banking, over-the-counter reload points, and Touch ‘n Go self-service kiosks. The e-wallet app has also partnered with different transportation operators in Malaysia to link different payment solutions to the services.

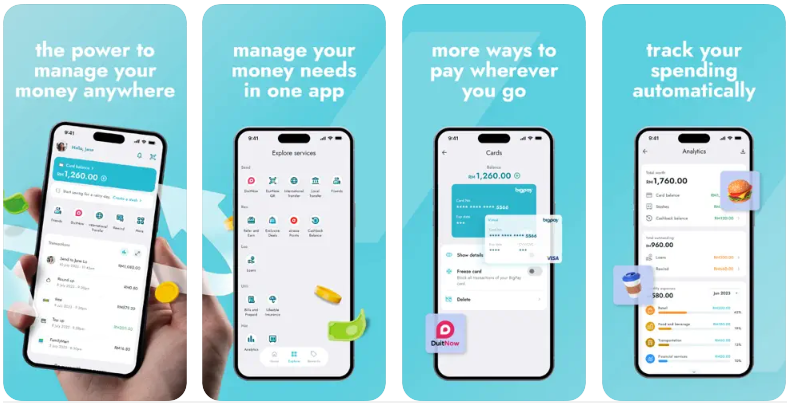

5. BigPay – financial services

BigPay offers customers control over their money. It is an app that comes with a card, one can use anywhere in the world. Through this app, the user can see all their money on one screen. This app is also useful to track and categorize all the expenses on one screen. The app also allows local and international bank transfers from the eWallet app.

BigPay is one of the travelers’ best friends, avoiding the money changes. The app is also effective for all your payment as the app can be successfully used anywhere in the world. Here you can also send money to all your friends by splitting the bill in a few steps. Also, the app offers the best exchange rates, helpful for tracking all your expenses.

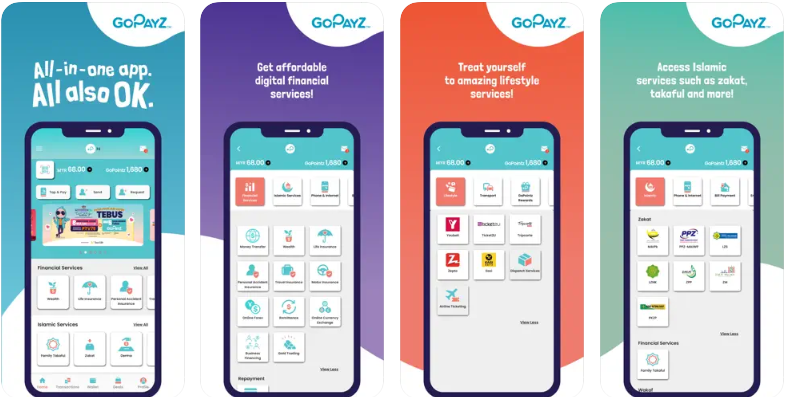

6. GoPayz

GoPayz offers a vast range of financial services in Malaysia that also comprises investments, remittances, and insurance. The eWallet app is being developed to help customers with QR payments, ordering GoPayz prepaid cards, and also to get virtual cards. Here, the customer can send payments locally and internationally.

GoPayz also provides a wide range of options to order foreign currency via cash to be delivered to your doorstep. International services are available comprising of options to make overseas remittances to the banks. With GoPayz, you can avail of investments, get general insurance, and can also pay your bills as well as other utilities.

Conquer eWallet Market in Malaysia with Expert Developers

Till now, you have an idea about different trends and the current reasons behind using eWallet apps in Malaysia.

Identifying and analyzing different sets of apps are important in order to know the current trends of e-wallet apps in Malaysia. Nimble AppGenie is an e-Wallet app development company that can help you understand your requirements for developing an e-wallet app and can design it for you.

You can hire mobile app developers to understand your key demands related to e-Wallet app. and can develop your e-Wallet app to lead not only in Malaysia but also at an international scale.

Conclusion

From the above discussion, it can be stated that Malaysia is becoming one of the biggest countries to deal in e-wallet app transactions in the current era. With the trends in e-wallet development, Malaysian e-wallet apps are the most preferred money transaction online payment mediums.

With the ease of convenience, speed, security, and contactless payment benefits, the use of e-Wallets has become a trend in Malaysia. An individual can download the app based on the feasibility and user target payment demand.

Contact us to learn more about designing e-Wallet apps.

FAQ

E-Wallet usage in Malaysia has surged, with over 15 million users pre-pandemic, projected to exceed 25 million by 2026. Post-pandemic, there’s a notable shift towards contactless payments, particularly among youths and older demographics.

In Malaysia, e-Wallets are popular for parking, transportation, toll payments, and shopping. Increased smartphone penetration and government support encourage their adoption among consumers and merchants alike.

The primary drivers are convenience, rewards like cashback and discounts, security features such as encryption and biometric authentication, faster transactions, and contactless payments, especially beneficial during the pandemic.

Major players include GrabPay, Instapay eWallet, Wise (formerly TransferWise), Touch ‘n Go eWallet, BigPay, and GoPayz. These apps offer diverse services from rewards to international money transfers, influencing consumer behavior positively.

Malaysia is witnessing a significant surge in e-Wallet transactions, driven by factors like convenience, speed, security, and contactless payments. Users can choose from a variety of apps based on their preferences and payment requirements.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments

Comments are closed.