In a nutshell:

- Companies looking to build cost-effective fintech solutions by accessing global talent go for Fintech development outsourcing.

- Outsourced projects prioritize leveraging the latest fintech technology stack for scalable app development.

- Top fintech development companies ensure to address fintech compliance and security outsourcing risks, quality control problems, and communication gaps by following best practices and clear processes.

- Understand offshore vs in-house fintech development with the factors affecting fintech development outsourcing cost to optimize your timelines and budget.

- Businesses attain custom fintech development tailored to their exceptional requirements with proper planning and management.

- Partner with a certified fintech software development company like Nimble AppGenie that offers an agile fintech development team with the experience of delivering top-quality results.

Are you confused about outsourcing fintech development?

In the current competitive world, fintech is creating a new history.

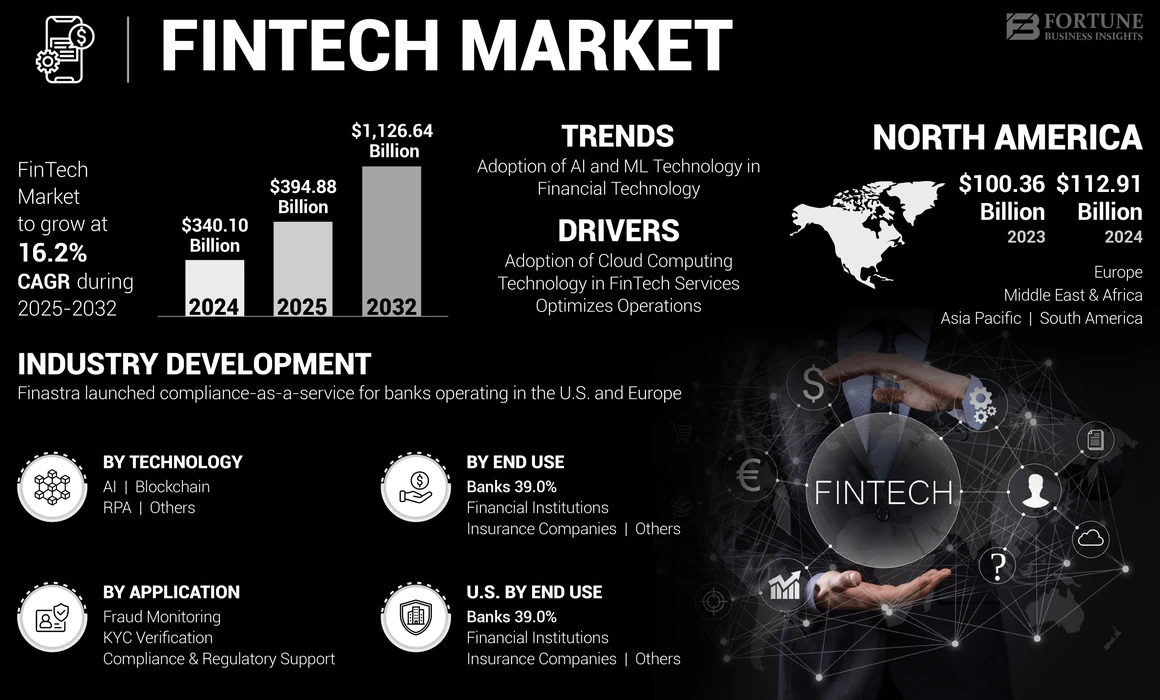

Do you know that the fintech global market is valued at USD 394.88 billion in 2025, which is expected to reach USD 1,126.06 billion by 2032?

The numbers are highly motivating for any business planning to enter the market. However, many of them make the mistake of thinking that fintech development can be easily pursued.

You need a dedicated team of experts who work on your fintech app and make it their priority to deliver high-quality solutions. But not every business is able to find, manage, and afford a full-fledged development team.

And understandably, attempting fintech development with limited resources is nothing less than wasting time and money. Hence, the only logical solution is to outsource fintech development.

Now, what is fintech development outsourcing? How does it work? What are the benefits of outsourcing fintech development, and most importantly, how to find the right fintech development outsourcing company? These are some of the burning questions that might hit you when planning to go for outsourcing.

If you are looking for answers to these, then worry no more, as you have reached the right place. In this post, let us discuss everything you need to know about fintech development outsourcing.

Without further ado. Let’s start by breaking down the concept.

What is Fintech Development Outsourcing – A Complete Understanding

When you partner with external experts or a certified fintech software development company to create secure fintech solutions, it is fintech development outsourcing.

So forth, businesses get access to an agile fintech development team and the ultra-modern fintech technology stack, allowing rapid delivery and flexibility.

Companies should evaluate offshore vs in-house fintech development options and confront possible fintech compliance and security outsourcing challenges to ensure reliable and successful custom fintech app development.

When it comes to outsourcing, it is all about the practice of hiring an external provider to do the services, as well as creating the products that are handled by the organization’s internal employees.

Fintech development outsourcing assists companies in collaborating with experienced software development teams to take new fintech innovations to the market.

It helps banks develop an app or software and get to market faster by leveraging the essential resources and expertise of external fintech developers.

Fintech development outsourcing helps businesses to have a pool of global experts. You can select the experts based on project requirements and the timeline that you have in mind.

Since you are practically hiring an entire team to do the job for you, you do not have to worry about focusing on the development process.

All you have to do is stay in the loop with your point of contact and keep sharing your requirements and suggestions.

Why Outsource Fintech Development?

By outsourcing fintech development, companies can easily access skilled teams and specialized expertise, resulting in rapid project delivery and mitigated operational costs.

Based on project requirements, it offers flexibility to scale resources and let businesses be attentive towards core operations.

Outsourcing fintech development is not just any other decision that you can take. It takes a lot of research, time, and money.

Which gives rise to another question, i.e., is it actually worth investing in fintech development?

♦ Access to Specialized Expertise

Fintech development outsourcing gives you a pool of experts to select the best team based on your project.

Through outsourcing, you will be able to connect with the experts and skilled people who will help you to lead the industry.

In the case of outsourcing, you will be able to connect with the experts belonging to other locations and may test their skills immediately.

Thus, it is one of the best ways to develop your dream project.

♦ Cost-Effectiveness

Different companies outsource specific tasks to reduce costs. That’s the specialty of adopting outsourcing.

You see, when you hire all the necessary resources for fintech app development, you need developers, analysts, testers, along with appropriate computers and other infrastructure.

All of it can cost you a lot of money just to set up. The recurring costs, such as your salaries and subscriptions, come later.

However, outsourcing software development for fintech can be useful in saving on the total cost. Here, you need not hire employees who are skilled in development.

Additionally, you need not spend on the training process of the developers, which minimizes office expenses.

♦ Faster Time to Market

Do you want to launch your fintech app faster to stay competitive? Fintech development outsourcing can help you minimize your time to market.

In today’s fast-paced world, you need to be at the right place at the right time, or else.

By partnering with an outsourcing team, you give a launch date to the developers who will be responsible for delivering your dream app on time.

Here, you don’t need to spend time recruiting and training the developers. Starting with experts is a choice.

♦ Offers Scalability

If you prefer to adopt emerging fintech trends while developing your dream project, then outsourcing them is a great choice.

Outsourcing can be an important tool for scaling fintech businesses through providing access to specialized talent, cost savings, and scalability.

You can start immediately with outsourcing fintech development by skipping the slow version of the in-house development procedure.

♦ Helps You Focus on Core Business

Through outsourcing, you can focus on core businesses and may make strategies for your target business immediately.

With the help of back-office outsourcing, you can free up fintech organizations from unnecessary chores.

This will assist you in concentrating on optimizing the most crucial activities in the business. It is important to focus on the business’s core activities, and outsourc ing fintech development can be helpful here.

Other than these clear benefits, the sheer fact that it can save you time and effort should be enough to give you insights into how beneficial choosing fintech development outsourcing can be. However, these benefits can only be found when you have chosen the team with diligence.

Factors to Consider Before Choosing Fintech Development Outsourcing

Before companies go for outsourcing fintech development, they should thoroughly evaluate the provider’s track record, expertise, and caliber to deliver outstanding solutions within budget and on time.

Other essential factors include understanding the technology stack they chose, their approach to compliance and security, the team’s scalability, and communication processes.

Assessing such aspects ensures a seamless partnership and successful project results.

Before you decide to outsource your fintech development requirements, it is important to find the right partner.

The benefits shared above might have given you enough grounds to try fintech development outsourcing. However, keep in mind that you should not hurry the process.

There are several important factors that you need to clear before you outsource the job. For everything you do, there must be some research, some prior conditions that must be met.

Here are certain factors to be fintech development outsourcing that impact the outsourcing of fintech development.

1. Ability to Complete the Project by the Deadline

You need to meet the deadlines of the project and launch the app as planned. Thus, you should check the project deadline and then make the decisions related to Fintech development outsourcing.

You need to analyze the FinTech development outsourcing at the vendor and stick to the promised timeliness and quality. One of the ways to do this is to pre-compile all the queries beforehand.

2. Resources and Technology

You must ask the vendor for the respective tools and technologies that they are going to use within the project.

You should analyze the type of technologies and resources that can be used for creating the app and bringing the idea to life.

Answering questions like this about the type of resource that the vendor will use is essential for achieving the desired app aim.

3. Minimal Supervision

When you connect with a team of developers to proceed with fintech development outsourcing, it’s vital to take care of every little aspect from scratch.

You should select the vendor to whom the supervision is required at a minimum level.

Considering this factor, you will be left with more time to focus on the core business functionalities.

This also means more time to spend on building marketing strategies and business plans for when you have launched the application.

4. Evaluate Vendor’s Past Projects

You must check the vendor’s past projects and previous assignments based on their past networks and clients.

This will help you find out more about the vendor and the respective services that they are offering to you.

You can connect with the clients for whom they have worked before signing up for the respective project.

5. Interruption Less Communication

Another major and crucial factor here is to consider communication. You should check how you are going to communicate with the respective vendor and how quickly the process will be here.

The channel of communication should be free of any barriers that might produce misunderstanding with the project.

6. Risk Management

You should know how capable the vendor is of addressing the frequent risks that might arise from unforeseen circumstances.

Under a risk management plan, it is important to analyze regular performance assessments, contract compliance, and other factors.

An effective outsourcing partner should define the services and standards for evaluating each aspect of the project by ensuring that everything works as per the plan.

Apart from the stated factors, other determinants needed to be considered include service-level agreement, top-quality talent, and the firm’s industry expertise for outsourcing the project.

Well, as you got the details about the factors, now it’s time to know the steps to outsource fintech development projects.

Let’s learn it all in the given section.

How to Outsource Fintech Development?

You need to follow a well-structured approach to successfully outsource fintech development.

Companies should meticulously select a reliable partner with relevant expertise and then clearly define their project scope, timelines, and deliverables.

Effective management and communication of the outsourced team is important for seamless collaboration.

Following the best practices for fintech development outsourcing ensures efficiency, timely delivery, and quality of fintech software projects.

After you have identified all the factors and understand the fintech development outsourcing company that you have decided to go with, it is time to start your outsourcing journey.

Your job doesn’t end after you have found the development partner or shortlisted companies to go forward with. In fact, you are an active part of the fintech development outsourcing process.

A lot of companies believe outsourcing to be simply about delegating the task. Well, they are wrong, as outsourcing is more of a partnership.

Here are the steps that go when you want to opt for fintech development outsourcing.

Step 1: Define Your Project Requirements

The first step in outsourcing fintech development is defining the complete project requirements.

Here you should be able to define the details related to the type of app, different features you want to include, and a complete detail of the project.

Here, you can include the type of budget you want to include, along with the launch date of your project in the competitive market.

Step 2: Choose the Right Outsourcing Partner

Well, defining the details will be suitable when you can select the right team of developers. It is important to hire mobile app developers who can aid you with the procedure.

The right outsourcing partner should depend on different parameters such as your budget, the user-friendly behavior of the developers, the location and skills of the developers, and several other things.

Step 3: Assess Skills and Expertise

It’s important to assess the skills and expertise of the developers to create a fintech project.

You should evaluate the skills that will be helpful to successfully determine if the team is sufficient for undertaking the project or not.

Additionally, you can check the value of the expertise of the outsource partners, and ensure that they have a deep knowledge of the frameworks, programming languages, and tools of the project.

Step 4: Set Clear Expectations and Milestones

The project’s aim and objectives should be clear when considering financial technology outsourcing.

Vague expectations will result in a vague project that doesn’t allow you to achieve the desired goal of the project.

You should set metrics as the benchmarks that are connected to the specific goals. Certain goals are less directly linked to numbers and dates.

Thus, setting milestones will be helpful to attain the project’s aim on time.

Step 5: Ensure Legal and Security Compliance

Now it’s time to ensure that legal and security compliance is within the project, effectively. You need to know the regulations and rules of the industry and build the app accordingly.

Evaluating security compliance is essential for establishing a network. It’s important to conduct regular privacy and security audits to identify potential weaknesses and check compliance.

Step 6: Collaborate and Monitor Progress

Now, it’s time to have a continuous check on the project and its progress. You need to set up communication conventions through fostering the collaboration value in the competitive market.

With the aid of online collaboration tools, you can allow for real-time, instantaneous messaging and integrate the chat functions and other effective tools.

In addition to online tools, incorporating SMS communications can ensure important updates are received instantly, especially in situations where team members may not have consistent access to internet-based platforms.

You can go ahead with custom fintech solutions outsourcing with the right guidance.

Well, while selecting the right outsourcing partner, you must know the types of challenges that may disrupt this procedure.

Key Challenges in Fintech Development Outsourcing and Solutions

When you outsource fintech development, you encounter several challenges, like handling communication across different time zones, security and regulatory compliance, and maintaining consistent quality.

Choosing the right partner, leveraging effective project management tools, and creating clear processes can help address these blockages.

Challenge #1: Security and Regulatory Compliance

Solution: Collaborate with an experienced provider that performs regular audits, integrates compliance needs, and follows industry security standards throughout the development lifecycle.

Challenge #2: Quality Control and Delivery Consistency

Use agile workflows, define clear deliverables, review code regularly, and track progress through structured project management processes.

Challenge #3: Integration with Existing Systems

Clearly document system dependencies, plan integrations early, and work with an experienced team to handle complex fintech integrations.

Challenge #4: Lack of Long-Term Control

Maintain shared repositories, do proper documentation, and create long-term models to retain project continuation.

Best Practices for Successful Fintech Outsourcing

For successful fintech outsourcing, you should clearly plan, communicate transparently, and robustly collaborate. In the early phase, define project objectives, choose the right development company, and maintain constant supervision for smooth execution. Proper documentation, frequent reviews, and aligned workflows decrease risks and boost efficiency, leading to reliable fintech solutions.

The challenges make it typical to implement fintech development outsourcing successfully.

Things can become even more difficult if you are not familiar with ways to manage the challenges mentioned above.

Ideally, you should not find yourself surrounded by challenges, as your approach should be defined and must follow a set of best practices when dealing with fintech development outsourcing to ensure that the execution is flawless and yields the best results.

Here are some specific fintech outsourcing best practices:

1] Clear the Project Scope

If your project scope is not clear or transparent, it can impact the complete journey of fintech development. While outsourcing the project, it’s essential to analyze what you want from it.

A clear project goal will help you lead the respective industry with ease. Additionally, with a defined goal, you can set up milestones to achieve it within a certain time.

2] Security and Compliance

Outsourcing fintech development can lead to a risk of data security and compliance practices, which may further impact your brand connections with the target audience.

Thus, it’s essential to ask the vendor to keep the agreement secure and not disclose any internal project activities to outsiders.

3] Check the Expertise of the Developers

While outsourcing your fintech development, you should analyze the expertise of the developers and the type of resources or steps they will take to make your project completion process simple and smooth.

Identifying the expertise will be useful in predicting the result of outsourcing the fintech development process.

4] Consider Market Reputation

Without evaluating the current market parameters and competitors’ strategies, you cannot succeed in the industry. Hence, it’s essential to look for a diversified market channel and different types of options to select the best.

So, it’s important to analyze the market reputation of the outsourcing partner before you sign any agreement.

5] Define the Budget

Outsourcing partners can add certain charges after completion of the project. Thus, you should clearly state your budget and the maximum push limits for investments.

A well-defined budget project will result in reaching the target audience and earning their trust in the brand.

These are some of the practices that you should adopt to continue with the fintech development outsourcing. Keep in mind that all of these practices can take you one step closer to successful fintech development outsourcing.

Till now, we have discussed the concept of fintech outsourcing development, why to proceed with the same, factors impacting selection, and the steps needed to undertake, along with challenges and practices.

One thing that you still need to learn about fintech development outsourcing is the cost associated with it. It is self-explanatory that building a fintech platform will require money.

However, what people often get confused about is whether they have to pay for the development team only or for the development service that they will get.

Let us help you clear the confusion in the next section, where we have discussed some interesting figures and factors about the cost of fintech development outsourcing.

Cost of Fintech Development Outsourcing

What is the fintech development outsourcing cost?

Well, it depends on various factors that we discussed above, such as complexity, the engagement model you choose, and the project scope.

More hidden factors that contribute to the cost are required expertise, team structure, and development duration.

You should choose an apt model and clearly define requirements upfront to effectively manage expenses while keeping up development quality.

Fixed-Price Model

Best for: Projects with clear requirements and timelines.

Offers: Limited flexibility (If modifications are required during development)

The cost is decided in advance, which makes budgeting predictable.

| Project Type | Estimated Cost Range |

| Basic fintech MVP | $20,000 – $40,000 |

| Medium-complexity app | $40,000 – $80,000 |

| Feature-rich fintech solution | $80,000 – $150,000+ |

| Best suited for | Clearly defined scope and timelines |

Hourly Rate Model

Best for: Businesses whose requirements change over time.

Offers: Complete flexibility

The cost fluctuates depending on scope adjustments and development duration. Businesses pay based on the number of working hours.

| Role | Hourly Cost Range |

| Fintech developer | $25 – $60 / hour |

| Senior developer/architect | $50 – $90 / hour |

| QA & testing | $20 – $45 / hour |

| Best suited for | Flexible scope and evolving requirements |

Dedicated Team Model

Best for: Complex or long-term fintech solutions demanding continuous development and close collaboration.

Offers: Better control, lasting value, and scalability.

Businesses hire a dedicated team that exclusively works on your project. The initial investment can be higher.

| Team Size | Monthly Cost Range |

| Small team (2–3 members) | $6,000 – $12,000 |

| Mid-size team (4–6 members) | $12,000 – $25,000 |

| Large team (7+ members) | $25,000 – $45,000+ |

| Best suited for | Long-term or scalable fintech platforms |

Tools & Technology Stack for Fintech Outsourcing

It’s crucial to choose the right tools and technologies to make your fintech outsourcing projects attain success.

Remember to go for a scalable and modern stack that can lead to flawless integration, smooth development, and lasting performance of fintech applications.

Check out the fintech tech stack you should choose for secure fintech app development.

| Category | Tools & Technologies |

| Frontend Development | React, Angular, Vue.js, Next.js |

| Backend Development | Node.js, Java, Python, .NET |

| Mobile App Development | Flutter, React Native, Swift, Kotlin |

| Database & Storage | PostgreSQL, MySQL, MongoDB, Redis |

| APIs & Integrations | REST APIs, GraphQL, Open Banking APIs |

| Cloud & Infrastructure | AWS, Microsoft Azure, Google Cloud |

| DevOps & CI/CD | Docker, Kubernetes, Jenkins, GitHub Actions |

| Security & Compliance | OAuth 2.0, JWT, SSL/TLS, Encryption |

| Testing & QA | Selenium, JUnit, Postman |

| Project Management & Collaboration | Jira, Trello, Slack, Confluence |

How to Choose the Right Fintech Development Partner?

A critical step that requires your attention is the selection of the right fintech development partner. For that, businesses should evaluate the technical proficiency and industry experience of possible providers.

Work with certified fintech software developers to make sure your projects are created using industry-compliant practices.

Consider the pointers before you collaborate with a fintech development partner.

- Evaluate the fintech experience and technical expertise

- Go for certified software developers

- Review case studies, portfolios, and client feedback

- Verify the candidate’s understanding of data security needs and regulatory standards.

- Assess post-launch maintenance, support, and long-term collaboration capabilities.

- Partner with the top fintech development company to ensure collaboration, reliability, and consistent project delivery.

Why Choose Nimble AppGenie for Fintech Development Outsourcing?

Lose or win relies on the outsourcing partner you choose.

Nimble AppGenie is best for your fintech project that offers end-to-end solutions for custom fintech development from experienced and certified fintech software developers.

By following fintech outsourcing best practices, the team creates compliant solutions tailored to your unique business needs.

You can check our proven track record of successful fintech platforms, post-launch maintenance, and ongoing support.

Partner with Nimble AppGenie to minimize risks and accelerate innovation, getting access to top-tier talent and advanced tools.

Real-World Case Study: Successful Fintech Outsourcing

Client Overview: A leading financial services company wanted to launch a mobile platform for managing personal finance and investment portfolios.

The client sought expertise in custom fintech development to ensure regulatory compliance, high performance, and a seamless user experience.

Challenges:

- Tight deadlines for market launch.

- Complex integrations with third-party services and banking APIs.

- Ensure data security and compliance with financial regulations.

Solution by Nimble AppGenie:

The fintech app development company managed end-to-end development, followed fintech outsourcing best practices, performed rigorous QA, implemented a modern fintech technology stack, and maintained constant collaboration with the client.

Results:

- Delivered a user-friendly fintech platform within the agreed timeline

- Simplified integration with multiple banking APIs

- Attained high user adoption and positive client feedback

Conclusion

Opting for a strategic approach, fintech development outsourcing helps businesses reduce costs, access specialized teams, and speed up the delivery of top-quality financial solutions.

You can accomplish your project successfully and ensure scalable growth by understanding the challenges, fintech outsourcing best practices, and choosing the right partner.

Collaborate with experienced fintech developers for custom development to focus on innovation while keeping up with reliability, efficiency, and compliance.

FAQs

Let’s consider the following list of steps to undertake for outsourcing fintech development.

- Clarify the Requirements: It is essential to define the project scope, goals, and objectives with the vendor before proceeding with the same.

- Select the Outsourcing Partner: You need to consider the location and expertise of the outsourcing partner and then select the best for your project.

- Assess Skills and Expertise: With an open discussion, you can evaluate the skills and expertise of the team and can proceed with the project successfully.

- Set Clear Expectations and Milestones: Now, you should set clear expectations and milestones for achieving the deadline of the project.

- Ensure Legal and Security Compliance: You need to know the legal challenges along with security compliance to proceed with the outsourcing fintech development.

- Collaborate and Monitor Progress: It’s important to collaborate and monitor the progress of your outsourcing partner to successfully lead the industry and track every activity.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.