In a Nutshell:

- Klarna app makes money from merchant fees, Klarna cards, customer interest, late fees, and shopping applications.

- The major components of Klarna are pay later, pay in installments, financing plans, and the Klarna card.

- Klarna now offers banking services, savings accounts, debit cards, and AI-powered financial features, which strengthen its ecosystem and improve profitability.

- Klarna app development focuses on secure payments, KYC, fraud prevention, AI-based credit checks, and smooth merchant integration.

- Nimble AppGenie provides custom BNPL app solutions to deliver a user-friendly BNPL app, inspired by the Klarna business model that aligns with your particular project needs.

Klarna has become one of the most popular BNPL apps in the world. With more than 114 million users globally, it enables people to pay later, split bills, or shop without immediate payment.

Every day, Klarna handles more than 2 million transactions that help stores manage their money while enjoying what they love.

While it simplifies what the app does and why it is popular among users, have you ever thought about how Klarna makes money? If yes, then do not worry, as you are definitely not alone.

With the rise of BNPL solutions in the market, every startup aiming for success wants to know the secret behind Klarna’s business and revenue model. If you are also looking to replicate the success that this BNPL app has achieved, then this is just the post you need.

In this blog, we will discuss everything about the Klarna app and will try to find the answer to one of the most important questions: how does Klarna make money?

Without further ado, let’s get started!

What is the Klarna App?

Klarna is a BNPL app, or buy now pay later app, that started in Sweden in 2005. Today, it is used by more than 180 million people in 45 countries (now 26) and works with 500,000+ stores.

It easily tracks deliveries of your online orders, saves products you like in a wish list, and gets alerts about price drops. It is one of the best buy now, pay later apps so far. Additionally, the app allows you to shop online and pay in different ways.

- Pay Now which means to pay the full amount right away.

- Pay Later means you get the product and pay within 30 days.

- Pay in 3 or 4 parts means splitting your bill into smaller payments over weeks or months.

- The financing option means longer monthly plans with interest.

Facts About Klarna

- Headquarters: Stockholm, Sweden

- Founded: 2005

- Users: 114 million+ active users

- Merchants: 850,000+

- Valuation: Once around $45.6 billion in 2021, but dropped to about $6.7 billion in 2022 after market changes. As of late 2025, the valuation had recovered significantly, touching $14 billion.

- NYSE Listing: Ticker KLAR, listed in September 2025

- AI First Approach: Klarna has evolved significantly as it is now using AI assistants to expedite the process while saving millions of dollars that a workforce would cost.

The facts clearly indicate the turnaround that Klarna has been able to pull off, considering its valuation went down from $50 billion to $6.7 billion. At the current pace they have achieved, Klarna not only makes money but is also profitable.

Market Statistics About the Klarna Buy Now Pay Later App

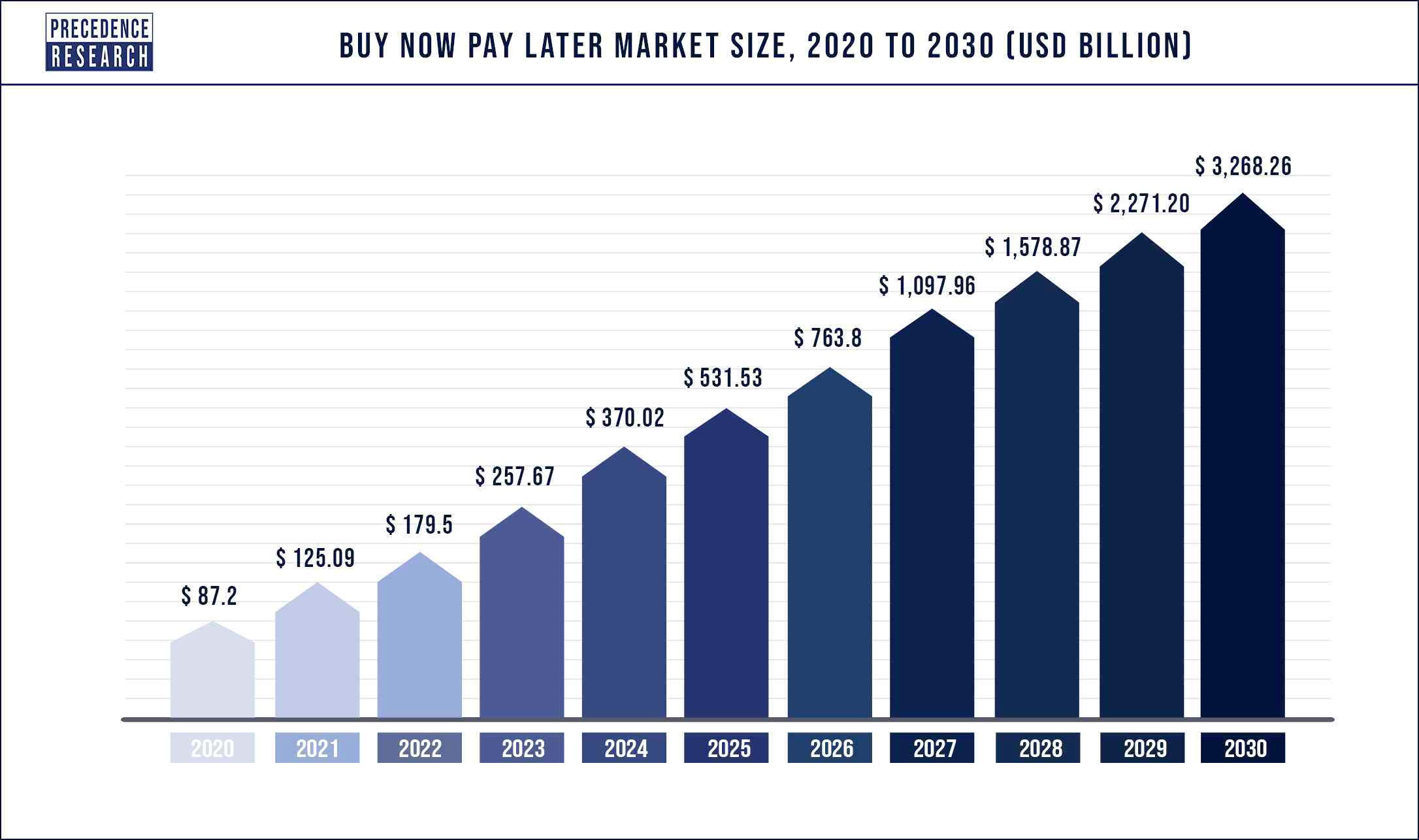

Now that you know about the Klarna app, it is vital to be well-versed in Klarna BNPL statistics and facts in the section below.

The BNPL market is growing rapidly due to rising eCommerce usage and demand for flexible, interest-free payments.

According to a report, the Buy Now Pay Later market is expected to expand from USD 87.2 billion in 2020 to over USD 3.26 trillion by 2030, driven by fintech innovation, younger consumers, and increased merchant adoption.

Klarna had more than 114 million active users across the globe in 2025. The best part is that millennials and Gen Z are the majority of users.

It partners with around 850,000 merchants globally, with the UK alone accounting for about 60,000. In 2024, the UK user base rose to 11 million, with merchant adoption nearly doubling year-over-year.

Klarna processes roughly 2.5 million transactions daily. If we look at the revenue earned, in 2023, Klarna’s revenue was approximately $2.26 billion. In the first half of 2024, it was around $1.24 billion, which is 27%. However, it is projected that by 2025, the revenue will increase by 26%.

Klarna leads BNPL globally with about 45% market share in 2024. BNPL accounted for about 6% of US e-commerce orders and 5% globally in 2024. Klarna is a widely used BNPL app. The statistics clearly indicate that Klarna has significant demand in the market.

While the numbers seem highly promising and special, how Klarna makes money is still an unanswered question for many. Keep on reading if you are looking for the same.

What are the Components of Klarna?

Klarna’s shop now pays later and has different parts that help people shop more easily and pay in ways that suit them.

Each part makes buying easy, gives customers more time to pay, and helps stores get their money safely. Below are the major components that the best apps like Klarna offer.

► Pay Later

With this option, customers can buy something immediately, but do not have to pay right away. Instead, customers get a 30-day relief to make the payment.

However, if the payment is not made within the due time, Klarna charges interest on the number of days of delay in payment. This is really helpful for people who do not want to spend money at once.

► Pay in Installments

Klarna allows customers to split the total amount into 3 or 4 smaller payments. These payments are made every two weeks or every month, depending on the plan.

For example, if you buy something worth $200, you can pay $50 each time until it is complete. The best part is that these installments usually do not include any extra fees if paid on time.

► Financing Plans

For bigger purchases, Klarna offers long-term financing. It means customers can spread the payments over many months. In some cases, interest may apply. But it still gives customers more flexibility to buy expensive products without paying all at once.

► Klarna Card

Klarna also provides a physical or virtual card that works like a regular debit or credit card, but with Klarna’s BNPL features.

Customers can use it in physical stores or online shops, even if those stores are not direct Klarna partners. This extends Klarna’s service to more places and makes it more useful in daily life.

Klarna Business Model: How Does the App Work?

Once you know the components of Klarna, it is clear that its payment mode has different versions. Klarna allows people to pay later, split payments into smaller parts, and use longer financing.

Klarna’s business model is based on helping people shop more, while making it safe and profitable for stores. Let’s now understand the business model of Klarna.

♦ How Klarna Works?

Klarna works as a link between customers and stores. It is vital to know that customers have to do KYC in fintech apps like Klarna. When customers buy something online or in a store and choose Klarna, they pay the store right away.

The customer then pays Klarna later. They can either pay the full amount after 30 days or split it into smaller payments. If the customer does not pay on time, Klarna may charge a late fee.

One of the key questions that often emerges is how Klarna makes money without charging interest. The answer to that question is simple: late charges and the merchant fees paid by retailers are the core income sources of Klarna, but more on that later!

♦ What Klarna Offers? (Value for Customers)

Klarna gives customers different ways to pay. They can buy now and pay later, pay in a few small instalments, or use longer financing options. The last one is just for the expensive products only.

The Klarna app helps customers track their orders, save their favorite products, and get notifications when prices drop. It also offers a card that brings BNPL integration to stores that do not directly partner with the service. This makes it convenient for shopping anywhere.

♦ Value For Stores

Stores also benefit from Klarna because it is the only one that gives customers a BNPL option. They get their money instantly, so they do not have to wait for customers to pay.

When stores provide the Klarna payment mode, it attracts more and more people to shop. Stores can also showcase their products inside the Klarna app, which helps them reach millions of customers.

♦ Key Resources

Klarna depends on its technology to manage payments, check for fraud, and run the app. It also uses data to understand customer behaviour and reduce risk.

It is vital to know that partnerships with banks, card networks, and online stores are essential. Lastly, Klarna’s trust and reputation are key, since people and stores need to feel safe using it.

♦ Key Activities

Klarna does many things every day to keep its business running. It manages payments, checks credit, detects payment fraud, and supports customers.

It also updates the app, works with new stores, runs marketing campaigns, and follows financial rules in different countries. To stay updated, Klarna follows the latest BNPL trends like providing flexible instalment options and using AI to make smart credit decisions.

♦ Partnerships

Klarna works with banks, card networks like Visa, and online platforms like Shopify. It also partners with giant stores like eBay, Nike, Walmart, and IKEA. These partnerships help Klarna reach more users and earn trust.

How Does Klarna Make Money? Key Revenue Streams

After knowing how it works, how does Klarna make money?

Well, Klarna generates revenue in many different ways. The main ways are interest charges, late payment fees, fees from merchants, and payments made using Klarna cards in stores. Let’s understand the Klarna revenue model below.

➤ Merchant Fees

Klarna makes most of its money through fees paid by merchants, or the stores that sell products. When a customer buys something using Klarna’s BNPL option, the merchant pays Klarna a fee. It is usually between 3% to 6% of the sale price.

This is higher than regular credit card fees, which are typically between 1.5% to 3%. So why do stores agree to pay these higher fees? The reason is very simple. Klarna helps them sell more. Stores see a major increase in how much people spend. This is also the reason why Klarna can make money without charging interest to the users.

It is sometimes by 20% to 30% or more; they get more customers completing their purchases, with up to 44% higher conversion rates. For many online stores, the extra sales and customers make the higher fees worth it.

➤ Customer Interest and Late Fees

You might be wondering how Klarna makes money besides merchant fees. Well, Klarna makes money from some of its services that involve payments over time.

For instance, while the pay in 4 plan, which splits payments into four parts, does not charge interest, Klarna does make money from longer payment plans. These plans allow customers to pay over six months to three years, but they come with interest charges.

If the customer misses a payment deadline, Klarna also charges a late fee, which adds to its revenue. Additionally, for those who choose longer financing options, Klarna charges interest on those payments, which can add up over time.

➤ The Klarna Card

In 2022, Klarna surprised many by launching a physical payment card. Even though online shopping is booming, about 80% of shopping still happens in regular stores. The Klarna card brings Klarna’s pay-later feature to these physical stores.

The card works like a normal credit card but follows Klarna’s BNPL model. Customers can split their payments into four parts through the Klarna app. This has created new ways for Klarna to earn money.

- Interchange fees

- Subscription fees

- Foreign exchange fees

- ATM withdrawal fees

The most important part of the Klarna card is that it allows customers to use BNPL anywhere that accepts credit cards. It is not only limited to online stores, but offline stores also allow this payment mode.

➤ Shopping App

Klarna’s next revenue model is a shopping app. It has turned its payment service into a full shopping application with more than 18 million active users every month. It is very similar to how other companies grew beyond their original services to provide more value.

The Klarna app makes money in many different ways. For instance, merchants pay for premium placement to get more visibility, and stores pay for targeted ads to reach the right customers.

Besides, Klarna earns commission from stores when users buy items through the app. This model works best because the more users join the app, the more merchants want to be part of it. More merchants mean more products and better prices.

➤ Banking Services

Klarna has expanded into banking to provide more financial services to its customers. Using its technology and large customer base, Klarna has developed a banking platform in Europe that includes savings accounts with good interest rates.

Additionally, debit cards that are connected to your account, and affordable international money transfers.

How does Klarna make money from its banking service? Well, it serves as a premium service for extra features and fees from debit card transactions. It also means extra revenue for the users.

Who Are Klarna’s Competitors?

Once Klarna became popular, many other BNPL companies started providing similar services. But most of these companies still have some limitations. Let’s check out the competitor apps.

| Major Features | Klarna | Afterpay | Affirm | Zip | Sezzle |

| Active Users | 114M+ (Q1 2025) | ~20M | ~18M | ~4M | ~12M |

| Partner Stores | 724,000+ | ~144,000 | ~266,000 | ~97,000 | ~90,000 |

| Main Offerings | Pay in 4, Pay in 30, Longer-term financing, Klarna Card, Cashback, Balance tools | Pay in 4 (interest-free) | Pay in 4, Loans up to 36 months | Pay in 4, Credit-building option “Sezzle Up.” | Flexible installments (weekly, bi-weekly, monthly) |

| Countries Available | 26 | Australia, U.S., UK, Canada, EU | U.S., expanding in Canada & Australia | U.S. & Canada | Australia, U.S., UK, NZ, EU |

| Banking Features | Yes – Card, Cashback, Balance tools | No | No | Limited – Credit-building only | Limited – Wallet + Installments |

| App & Customer Tools | Full-featured app for payments, tracking, and offers | Basic app for tracking payments | App supports payment scheduling and loans | App supports payments and credit-building | App supports tracking and payment reminders |

What Sets Klarna’s Business Model as a Differentiator?

As you can see, Klarna is already a leader in this BNPL space. Not just because it started early, but because the company grew smartly. It uses smart technologies while keeping its operation slow.

Overall, Klarna provides a mix of BNPL + digital banking + AI financial tools. While most competitors’ apps, like Affirm, as we mentioned above, are limited to a few countries, Klarna has expanded to 26 countries. With this massive reach, Klarna not only makes money but also creates a global impact.

Additionally, its large network and partnerships with major brands like eBay, Walmart, Nike, IKEA, and Sephora have helped Klarna build trust among its competitors. Its strong reputation and reliable service make it a preferred choice for many shoppers worldwide.

How Nimble AppGenie Can Help You Develop An App Like Klarna?

If you are planning to develop an app like Klarna, then Nimble AppGenie is a one-stop solution.

Founded in 2017, we have been serving many clients and helping them build custom and user-friendly fintech apps. Our expert team can guide you through the whole process, from planning the features to developing the instant payment system.

We will make sure your financial application works seamlessly and supports BNPL services. Our professional developers excel in crafting any type of mobile apps from BNPL to fintech apps, using the latest technology and also integrating the required fintech APIs.

With Nimble AppGenie, you can build an app like Klarna that can take your business to new heights and help you become the next industry leader in the BNPL space.

Conclusion

Klarna has set the perfect example in the BNPL market by providing flexible payment options and a user-friendly app. Its success comes from combining technology, customer convenience, and building partnerships with top brands.

Therefore, if you are impressed with the Klarna business model and want to create a similar BNPL solution, working with a BNPL app development company would be fruitful. With the right mobile app development team, your business can provide seamless BNPL services and reach customers globally.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.