Buy Now Pay Later is a payment and loan service that allows you to purchase goods instantly without having to pay immediately.

With the rise of online shopping and online payments, the demand for BNPL has significantly increased. This rise has turned BNPL into a flourishing market.

Today, financial service providers and experts are moving towards an interactive solution for the users.

Building a BNPL application has presented a great business opportunity that several fintech enthusiasts have taken into consideration.

However, one of the key concerns of all the interested parties is the cost of a BNPL application. Without identifying the investment, entrepreneurs and business owners are reluctant to invest, and rightly so.

If you are also planning to enter the lucrative market of Buy Now Pay Later apps and want to understand the cost of developing a BNPL app, let’s first explore the BNPL statistics to see how rapidly the market is growing.

In this blog, we will break down the entire cost structure of a BNPL app and help you understand the best practices to get the job done with minimal expenditure.

Without further ado, let’s begin!

How Much Does it Cost to Develop a BNPL App?

The cost to develop a BNPL app starts from $30,000 and can go to $250,000 or beyond, depending on your requirements and choices.

As you may be aware, Buy Now Pay Later is a financial service that allows you to buy goods and services instantly without having to pay in full. You can easily convert the expense into easy installments spread over a few months for convenience.

In order to build a similar system, you need solid developers, advanced tech, and an association with financial institutions, all of which come at a price.

However, with diverse solutions available in the market, the cost depends on several factors.

Let us take a look at these factors one by one and understand how they affect the cost of the Buy Now Pay Later app.

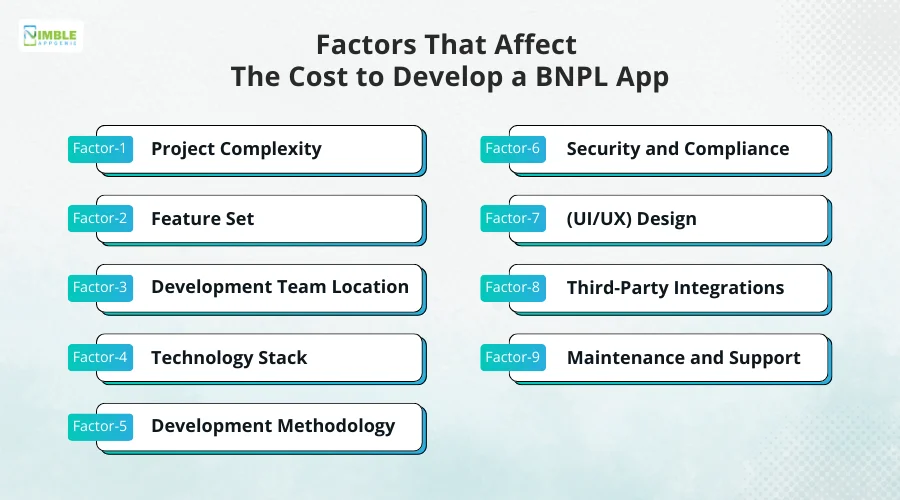

Factors That Affect the Cost to Develop a BNPL App

The cost can vary widely depending on multiple factors.

Here are the most critical ones:

Factor 1: Project Complexity

The complexity of the BNPL app is a significant factor influencing the cost.

More complex projects require extensive planning, a larger team, and longer times. Complexity can arise from the number of features, integrations, and the architecture of a Buy Now Pay Later app.

| Project Complexity | Estimated Cost |

| Simple | $25,000 – $50,000 |

| Moderately Complex | $50,000 – $150,000 |

| Highly Complex | $150,000 – $300,000+ |

Key Considerations:

- Feature Set: Advanced features like AI-driven credit scoring, fraud detection, and real-time analytics increase complexity.

- Integration: Integration with various payment gateways, banking systems, and third-party services adds to the complexity.

- Architecture: A scalable, high-availability architecture requires a more sophisticated design and implementation.

Factor 2: Feature Set

The features included in the Buy Now Pay Later app play a crucial role in determining the development cost.

Basic features like user registration, transaction history, and payment processing are standard. However, adding advanced features increases the cost significantly.

| Feature Set | Estimated Cost |

| Basic Features | $20,000 – $50,000 |

| Advanced Features | $50,000 – $200,000+ |

Factor 3: Development Team Location

The geographic location of the development team affects the cost to develop a BNPL app.

Labor rates vary greatly around the world, with developers in North America typically commanding higher rates than those in Eastern Europe, Asia, or Latin America.

Therefore, location can greatly affect the cost to hire developers.

Key Considerations:

- North America: Higher labor costs but potentially higher quality and easier communication due to proximity and language.

- Eastern Europe & Asia: Lower labor costs with a growing number of skilled developers, though there might be time zone and communication challenges.

- Latin America: A balance between cost and quality, with moderate labor costs and closer time zones for North American businesses.

| Region | Hourly Rate |

| North America | $100 – $200 |

| Eastern Europe | $30 – $75 |

| Asia | $20 – $50 |

| Latin America | $40 – $80 |

Factor 4: Technology Stack

The mobile app technology stack impacts the cost of creating a BNPL app.

Different technologies have varying costs associated with licensing, development, and maintenance. The technology stack should align with the project requirements and future scalability needs.

Key Considerations:

- Backend Technologies: Choices like Node.js, Python, Ruby on Rails, and Java.

- Frontend Technologies: React, Angular, Vue.js.

- Database: SQL (MySQL, PostgreSQL) vs. NoSQL (MongoDB, Cassandra).

- Cloud Services: AWS, Azure, Google Cloud.

| Technology Stack | Estimated Cost |

| Open-Source Technologies | Lower initial cost |

| Proprietary Technologies | Higher initial cost |

Factor 5: Development Methodology

The development method adopted can impact both the cost and the timeline of the BNPL app project. Agile methodologies, which involve iterative development and continuous feedback, can lead to higher initial costs but often result in a better-quality product.

| Development Methodology | Cost Structure |

| Waterfall | Fixed cost |

| Agile | Variable cost |

Factor 6: Security and Compliance

Ensuring that the Buy Now Pay Later app is secure and compliant with relevant regulations is crucial.

Security features and compliance with financial regulations can add to the cost of making a BNPL app, but they are essential for protecting user data and avoiding legal issues.

| Security and Compliance | Estimated Cost |

| Basic Security Measures | $10,000 – $30,000 |

| Advanced Security Measures | $50,000 – $150,000+ |

Factor 7: User Interface and User Experience (UI/UX) Design

A well-designed user interface and user experience are critical for the success of a Buy Now Pay Later app.

Investing in high-quality UI/UX design can enhance user satisfaction and increase adoption rates, but it also adds to the cost of building a BNPL app.

- Custom Design: Unique, tailored design for the app.

- Responsive Design: Ensuring the app works seamlessly across various devices and screen sizes.

- User Testing: Conducting user testing to refine the design based on feedback.

| UI/UX Design | Estimated Cost |

| Basic Design | $10,000 – $30,000 |

| Advanced Custom Design | $30,000 – $100,000+ |

Factor 8: Third-Party Integrations

Integrating APIs into the BNPL app can add significant value, but it also increases the development cost. These integrations might include payment gateways, CRM systems, analytics tools, and more.

- Payment Gateways: Integration with services like Stripe, PayPal, and other financial institutions.

- CRM Systems: Integration with customer relationship management systems for better user management.

- Analytics Tools: Integration with analytics and reporting tools for data-driven insights.

| Third-Party Integrations | Estimated Cost |

| Basic Integrations | $5,000 – $20,000 |

| Complex Integrations | $20,000 – $50,000+ |

Factor 9: Maintenance and Support

Another big factor is the cost of app maintenance and support. Ongoing maintenance and support are essential for ensuring the app remains functional, secure, and up-to-date. This includes bug fixes, updates, and general support, which adds to the overall cost.

| Maintenance and Support | Estimated Cost |

| Annual Maintenance | $10,000 – $50,000/year |

| Comprehensive Support | $50,000 – $100,000+/year |

By understanding and planning for these factors, businesses can better estimate the cost of creating a BNPL app and ensure a successful, cost-effective one.

The whole point of sharing these factors is to give you deeper insights into what decisions affect your business directly or indirectly affect the cost of the Buy Now Pay Later app.

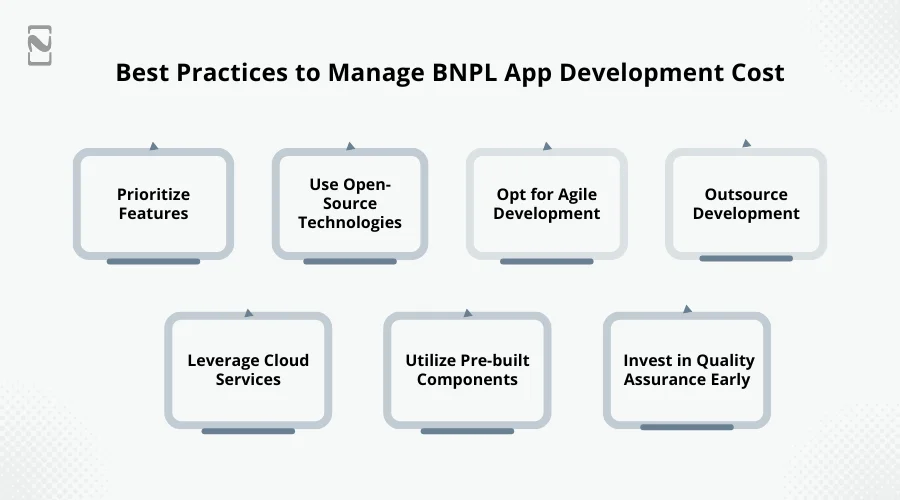

Best Practices to Manage BNPL App Development Cost

Knowing all these factors, you might have some clarity on where exactly your money is invested.

The cost of building an optimized BNPL app that is balanced with features and functionality can be reduced significantly when you make the correct choices and follow the best practices when planning to develop the app.

Here are some practices that you should follow while planning our BNPL app –

1. Prioritize Features

When building a BNPL application, identifying the right combination of features is crucial. You see, BNPL applications today come with a different set of features.

While only a few of them are being used regularly, others are integrated to give the user convenience, “in case” they want to use it.

The best way to do so is by categorizing features into 3 lists named – Must Have, Good to Have, & Last Priority.

Pick the features from each category and make sure you prioritize them as per the rolling out requirements, i.e., which ones are necessary in the initial phase and which ones can be rolled out later with an update. Plan accordingly to make the most of it.

2. Use Open-Source Technologies

Open source usually refers to technologies that are open to use for everyone, without having to pay a license fee. Ideally, open source technologies are considered to be free to use and require no proprietary license whatsoever.

Hence, when you decide on what technologies will power your app features, ask your developer to implement as many open-source technologies as they can.

This way, you will not only save money on the tech stack but will also eliminate the risk of any future hindrances due to technology payments.

Leveraging open-source technologies can significantly cut down on licensing fees and other costs associated with proprietary software.

3. Opt for Agile Development

Agile development methodologies can help manage and reduce costs by breaking the project into smaller, manageable parts and allowing for iterative development and continuous feedback.

When you implement Scrum or Kanban methodologies to manage tasks and sprints, not only does the process become streamlined, but it also helps you conduct regular sprint reviews and retrospectives to optimize processes.

Using Agile Development, you can easily enhance the flexibility and adaptability of the project and developers, ensuring that the project finishes on time.

4. Outsource Development

Building a BNPL application requires a dedicated pool of resources, which is not easy to get hold of as the cost significantly rises when you onboard a team of developers.

To ensure that you save money on development, you should outsource the task rather than building an in-house team.

When planning to develop a BNPL application, you should know that outsourcing mobile app development to regions with lower labor costs can result in significant savings.

However, ensure that quality is not compromised by selecting reputable outsourcing partners.

5. Leverage Cloud Services

Cloud services offer powerful development tools that make them easier to use and accessible without costing a lot.

Unlike traditional computers, which have limited resources (and even those are expensive), cloud services pool the computing power of different systems and servers hosted over the web.

Cloud services charge a subscription fee that is much less than the value of the cloud development services that you get to access.

Using cloud services for hosting, storage, and other infrastructure needs can reduce the cost associated with maintaining physical servers and IT infrastructure.

6. Utilize Pre-built Components

The cost of the BNPL app depends directly on the time of development. Hence, it may not be wrong to say that the less time your development process takes, the more you save.

The easiest way to save time is to go for pre-built components instead of building every feature from scratch. Pre-built components, SDKs, and APIs can help you add any functionality quickly and cost-effectively.

To do so, you must identify all the third-party applications you need to integrate and ensure that the components you choose are reliable enough to power your application.

While building from scratch is costly and takes a lot of effort, integrating pre-built components makes the entire process secure and reliable.

7. Invest in Quality Assurance Early

Early and continuous testing can prevent costly fixes later in development, ensuring that issues are identified and resolved promptly.

With the help of quality assurance services, you can easily stay on top of all the errors that you may find, resolving them instantly, ensuring that no extra hours are spent on rectifying mistakes that weren’t supposed to be there in the first place.

Needless to say, the whole concept of investing in quality assurance early, while it seems like an added cost in the beginning, can help you save big on the project in the future.

By applying these strategies, you can effectively minimize the development cost while still delivering a high-quality product that meets user needs and market demands.

You see, maintaining a balance between cost and quality is a matter of choices that you make and with these practices, tackling issues related to going out of your set budget.

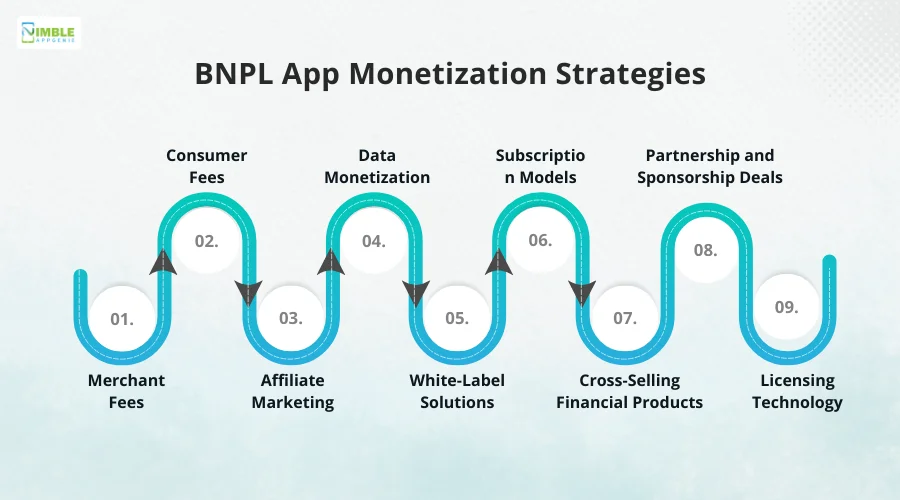

Buy Now Pay Later Apps Monetization Strategies

In case you are wondering whether all these efforts are worth it or not, then you are certainly not aware of how some famous BNPL apps are making money.

For a lot of people, BNPL seems like a highly capital-intensive business to begin with. However, they do not realize that it is also a great way to earn money.

Ask your development experts to implement monetization strategies for you to make the most of the BNPL app you are planning.

1] Merchant Fees

BNPL apps charge merchants a fee for offering their payment services. The fee is typically a percentage of each transaction facilitated through the app.

Merchants are often willing to pay these fees because Buy Now Pay Later options can increase sales, reduce cart abandonment, and attract new customers.

- Average Fee: 3% to 6% of each transaction

- High Potential: With high transaction volumes, merchant fees can generate substantial revenue. For example, a BNPL app facilitating $1 million in transactions per month at a 5% fee would earn $50,000 monthly.

2] Consumer Fees

Some Buy Now Pay Later apps charge consumers fees for using their service.

These fees can include late payment fees, monthly account fees, or interest on longer-term payment plans.

While many BNPL services market themselves as “interest-free,” they may still charge fees for specific features or conditions.

- Late Fees: $10 to $30 per late payment

- Interest Fees: 10% to 30% APR on extended payment plans

- High Potential: Consumer fees can be a significant revenue source, especially if the app has a large user base and a high rate of late payments or extended financing options.

3] Affiliate Marketing

BNPL apps can partner with retailers and brands to promote specific products or services.

In return, the Buy Now Pay Later app earns a commission on sales generated through these promotions. This strategy leverages the app’s user base to drive sales for partners.

- Commission Rate: 1% to 10% per sale

- Moderate to High Potential: Depending on the volume of promoted sales, affiliate marketing can provide a steady revenue stream.

4] Data Monetization

BNPL apps collect a vast amount of data on consumer spending habits, preferences, and creditworthiness.

This data can be anonymized and sold to third parties, such as marketers, financial institutions, and researchers, or used internally to enhance targeted marketing efforts.

- Data Sales: Variable, depending on the market and demand

- High Potential: With the increasing value of data, monetizing user data can be highly lucrative. However, it is crucial to adhere to privacy regulations and obtain user consent.

5] White-Label Solutions

BNPL companies can offer their technology as a white-label solution to other businesses.

This means other companies can integrate the BNPL service into their platforms under their own brand, while the Buy Now Pay Later provider earns a fee for providing the technology and support.

- Setup Fees: $10,000 to $50,000 per client

- Monthly Fees: $1,000 to $10,000 per client

- High Potential: This strategy can create a stable, recurring revenue stream, especially if the BNPL provider partners with multiple businesses.

6] Subscription Models

Some BNPL apps offer premium features or services through subscription models.

Consumers and merchants pay a monthly or annual fee to access these additional features, such as enhanced analytics, premium support, or exclusive deals.

- Subscription Fees: $10 to $100 per month

- Moderate to High Potential: Depending on the value and demand for premium features, subscriptions can provide a consistent revenue stream.

7] Cross-Selling Financial Products

BNPL apps can cross-sell other financial products, such as personal loans, credit cards, or insurance, to their user base.

Leveraging existing customer relationships and data, these offers can be highly targeted and relevant.

- Commission per Product Sold: Variable, often $100 to $1,000

- High Potential: Cross-selling can significantly boost revenue, particularly if the app successfully markets high-value financial products.

8] Partnership and Sponsorship Deals

BNPL apps can enter into partnerships and sponsorship deals with brands and retailers.

These agreements can include co-branded marketing campaigns, exclusive promotions, and special offers for Buy Now Pay Later app users.

- Partnership Deals: $10,000 to $100,000 per deal

- High Potential: Well-negotiated partnerships and sponsorships can generate substantial revenue and enhance the app’s brand recognition.

9] Licensing Technology

Buy Now Pay Later providers can license their technology to other financial institutions that are looking to incorporate solutions into their offerings.

- Licensing Fees: $50,000 to $500,000 per license

- High Potential: Licensing technology can lead to significant upfront revenue and long-term royalties, depending on the agreement.

Keep in mind that you should always plan your monetization before developing the app.

Integrating these strategies requires proper features and functionalities, so after you have decided on these things, you can easily monetize your BNPL application and make profits.

Nimble AppGenie: Your Partner in App Solutions

The ideal way to minimize your costs and maximize profits is to hire a partner who understands your objectives.

At Nimble AppGenie, we spend a lot of time understanding the requirements of our clients and then start with the entire process. The application we help you develop is purely based on your ideas and our expertise.

Our developers are highly skilled, and with our years of experience in building robust solutions from the ground up, we can surely be your best bet to develop a highly rewarding BNPL app development company.

Connect with our experts today and take the first step towards your BNPL journey! Call now.

Conclusion

Managing the cost of building a Buy Now Pay Later application is an art not every development expert knows about.

Hence, the first and foremost step towards optimizing your development cost is to ensure that you hire an expert who understands your vision.

There are several practices that you need to introduce in your approach to ensure that not only is your app optimized to the best, but also helps you generate revenue.

We hope this cost guide for Buy Now Pay Later apps helps you identify the key factors to take care of. With all these best practices mentioned, you can make the most out of your BNPL app. Thanks for reading, good luck!

FAQs

The cost to develop a Buy Now Pay Later app can range from $120,000 to $250,000, depending on factors such as project complexity, feature set, and team location.

The timeline for a BNPL app can vary from 6 months to over a year, depending on the scope and complexity of the project.

Key features include user authentication, transaction management, payment processing, credit scoring, fraud detection, and integration with various merchants and payment gateways.

You can minimize costs by prioritizing essential features, using open-source technologies, opting for agile development, outsourcing to cost-effective regions, and leveraging pre-built components.

Monetization strategies include merchant fees, consumer fees, affiliate marketing, data monetization, white-label solutions, subscription models, cross-selling financial products, partnership deals, and licensing technology.

Factors include project complexity, feature set, team location, technology stack, methodology, security and compliance requirements, UI/UX design, third-party integrations, and maintenance.

Yes, integrating with existing payment gateways like Stripe, PayPal, and others is possible and often recommended for a seamless user experience.

Security considerations include implementing strong encryption, complying with financial regulations, integrating fraud detection mechanisms, and ensuring secure API management.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.