As the world is becoming tech-focused for routine chores, cashless, AI-driven financial services are gaining higher traction. Doubtlessly, digital payments have become a must-have that nearly everyone is choosing.

| According to global tech strategists, digital wallet adoption is expected to rise by approximately 35% worldwide over the next five years, up from 4.4 billion as of 2025. |

So why integrate AI in digital payments?

Here’s the catch.

The legacy rule-based payment systems you currently use are unable to keep pace with surging transaction volumes and are finding growing fraud techniques to be more sophisticated.

Why? Such older systems are weak at the adaptability needed to instantly detect anomalies, analyze real-time behavioral data, or personalize user experiences.

Here, AI in fintech can bail us out. How?

Artificial intelligence in fintech can diminish fraud losses while notably decreasing false transaction declines, directly safeguarding revenue and fostering customer trust.

If you are a fintech leader, payment platform owner, product head, banking & wallet stakeholder evaluating AI adoption, or developers & solution architect exploring AI in digital payments, this blog will lend a hand.

We will learn how AI empowers digital payments, market opportunities of AI-powered payment automation, architecture, use cases, real-world examples, and unveil the ROI of AI in digital payments.

Understanding AI in Digital Payments

Artificial intelligence in digital payments signifies the use of data-driven systems to scrutinize, learn, and make real-time decisions across payment flows.

Role of AI in Payment Ecosystem

AI performs as an intelligent layer in the payments ecosystem, which boosts speed, fintech security, and personalization across the whole transaction lifecycle.

Let’s understand digital payments personalization with AI. Before that, we will differentiate between three commonly used terms below.

1. Artificial Intelligence (AI)

Acknowledged as a border concept, AI simulates human decision-making, like recommending personalized offers or pinpointing suspicious transactions.

2. Machine Learning (ML)

A subset of AI, ML enables systems to learn from real-time and historical data to elevate accuracy over time, mostly used for fraud detection, customer segmentation, and risk scoring.

3. Deep Learning

An advanced form of machine learning in payments, deep learning leverages the strength of neural networks to process complicated data patterns, like behavioral analysis for continuous authentication or facial recognition for KYC in fintech apps.

So, AI-driven payments indicate real-time intelligence, where modern digital wallets gain the power to evaluate thousands of signals within only milliseconds.

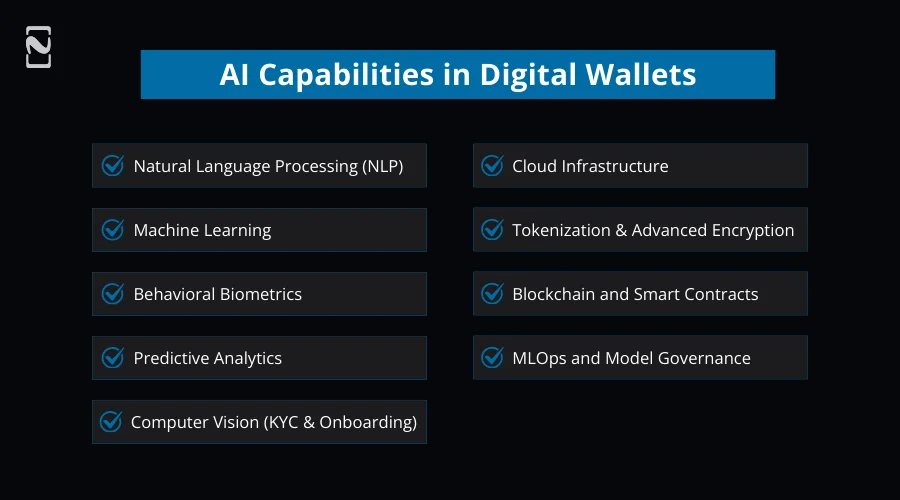

AI Capabilities in Digital Wallets

1. Natural Language Processing (NLP)

AI-powered virtual assistants and chatbots handle dispute handling, voice payments, and customer support, diminishing operational costs while increasing response times.

2. Machine Learning

AI identifies fraud patterns, mitigates false declines, assesses transaction risk, and optimizes approval rates via adaptive learning models.

3. Behavioral Biometrics

The technology constantly validates users based on their behavioral traits, like touch pressure, typing speed, and navigation patterns, adding a secure authentication layer.

4. Predictive Analytics

AI offers predictive analytics for digital wallets by scanning historical and behavioral data to anticipate spending habits, churn, lifetime value, and transaction trends, encouraging proactive business decisions.

5. Computer Vision (KYC & Onboarding)

AI enables identity verification via document scanning, liveness detection, and facial recognition, pacing onboarding while adhering to regulatory compliance.

6. Cloud Infrastructure

With elastic compute, you can keep traffic seamless and audits clear. Choosing cloud services, you can support policy controls and regional data residency.

You can witness smooth scaling of infrastructure during holiday spikes without hindering compliance.

7. Tokenization and Advanced Encryption

Tokens replace PANs and PII. Hardware security and key rotation restrict the blast radius if anything unusual happens. Security by design makes AI in banking and payments audit-ready.

8. Blockchain and Smart Contracts

Shared ledgers eradicate blind spots existing between parties for settlement and reconciliation. Smart contracts automate dispute logic and release conditions,

| AI-powered reconciliation mitigates the time you spend on back-office payment matching by about 80%. |

Transparency strengthens trust while removing manual reconciliation cycles.

9. MLOps and Model Governance

Models stay unbiased with proper versioning, drift alerts, and monitoring. Feature stores and streamlined retraining prevent precision decay.

Governance aligns AI in payment gateways with regulator expectations and policy.

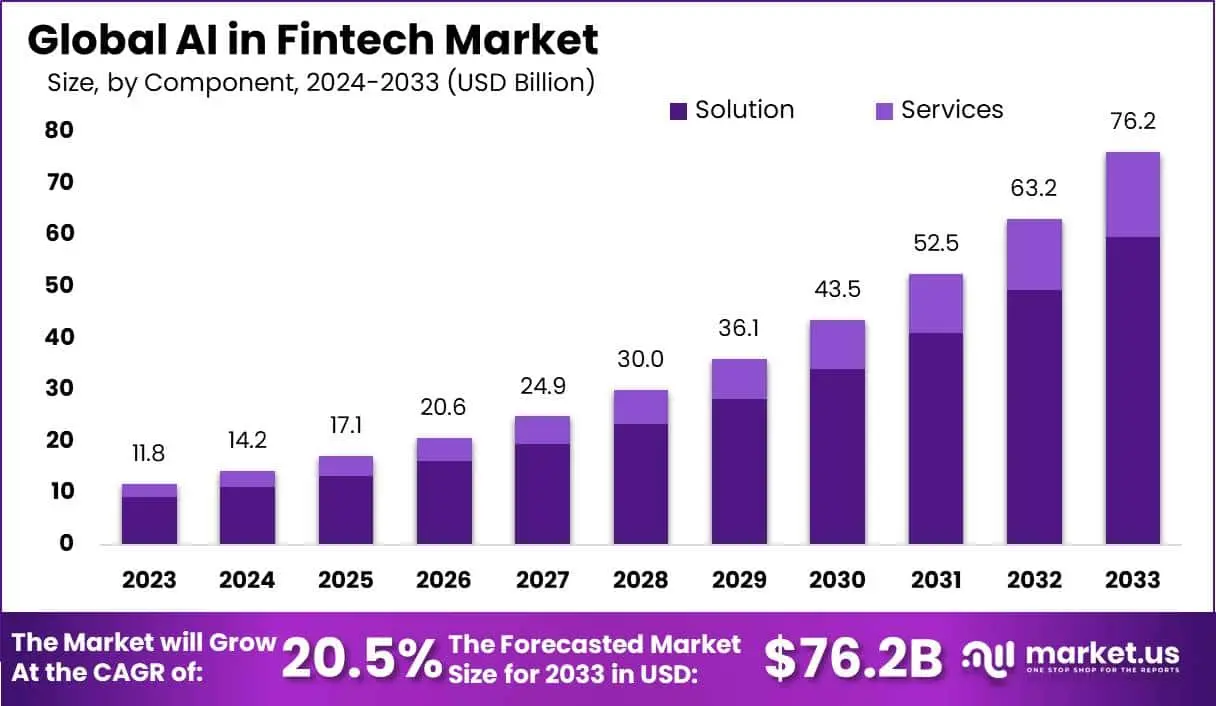

Why AI in Digital Payments Matters: Market Opportunities

With the rapid shift of users to cashless financial services, the fintech industry is going to reap the benefits of the lucrative market opportunities in history.

Market Stats & Projections for AI in Fintech

- AI in the fintech market is all set to expand, expected to grow from around $20.6 billion in 2026 and hit approximately $76.2 billion by 2033, showcasing a CAGR of about 20.5%.

- North America is dominating, holding a huge chunk of the 45-50% market because of fintech innovation, with Asia-Pacific regions as runners-up holding 30-35%.

- An increasing number of firms are surging their investment in AI in financial services. Per the records, nearly 75% of global banks are ready to invest $100 million or more in AI technologies.

- Almost 90% of fintech companies have already integrated AI or machine learning into their payment stacks in distinct forms.

- Financial institutions harnessing AI for fraud detection have disclosed a 20% surge in fraud detection rates compared to legacy, rule-based systems.

Pro Tip: Consider AI integration as a robust foundation for digitized financial operations to reduce risk, increase customer engagement, and drive revenue.

Digital Wallet Adoption Drivers

1. Augmenting user demands for secure, frictionless experiences, and

2. Enterprise demand for secure and data-driven payment systems.

Quick Recap: How AI in Digital Payments Helps

- AI escalates authorization rates and boosts conversions, leading to revenue acceleration.

- Intelligent personalization and smooth experiences deepen customer loyalty.

- Improved fraud prevention and compliance automation results in operational resilience.

- Bracing platforms for dynamic standards like generative AI-driven transaction automation and instant payments make your firm competitive and future-ready.

Real-World Examples: How Leading Digital Wallets Use AI

The giant digital wallet providers leverage artificial intelligence to enhance user experience, improve security, and handle risk at scale.

| PYMNTS survey reported that around 72% of financial leaders leverage AI technology in numerous areas, including risk management, fraud detection, and automation. |

Let’s have a walkthrough of real-world examples on how leading digital wallets use AI.

1. Apple Pay – Biometric Security & Authentication

Apple Pay utilizes AI-powered biometric authentication via Face ID and Touch ID to secure transactions.

Machine learning models scan biometric data locally on the device to authenticate user identity before validating payments.

This approach:

- Boost security,

- Maintain an effortless checkout experience, and

- Reduce the risk of unauthorized transactions.

2. Google Pay – Predictive Insights & Smart Personalization

Google Pay harnesses AI to analyze transaction history and spending patterns to provide predictive insights, like reminders, expense categorization, and personalized offers.

| Approximately 61% of customers want companies to predict their payment requirements via AI before they ask. |

Such AI-driven insights assist users in better managing finances while escalating engagement and frequency of wallet usage.

3. Stripe – Intelligent Risk Scoring Models

Stripe utilizes AI-based risk scoring to determine the probability of fraudulent transactions across its global payment network. Machine learning models smoothly assess patterns across a huge volume of transactions, permitting Stripe to dynamically fine-tune risk thresholds and boost authorization rates with no compromise on security.

4. PayPal – AI-Driven Fraud Detection

PayPal employs advanced machine learning models to detect possible fraudulent activity and monitor transactions in real-time.

AI analyzes device information, transaction context, and behavioral signals to detect threats early, safeguard merchants and consumers at scale, and mitigate false positives.

Key Takeaways for Digital Wallet Providers

1. AI empowers security without adding friction

2. Real-time risk scoring boosts transaction success rates

3. Predictive insights drive user engagement

4. Scalable AI systems are crucial for higher volumes

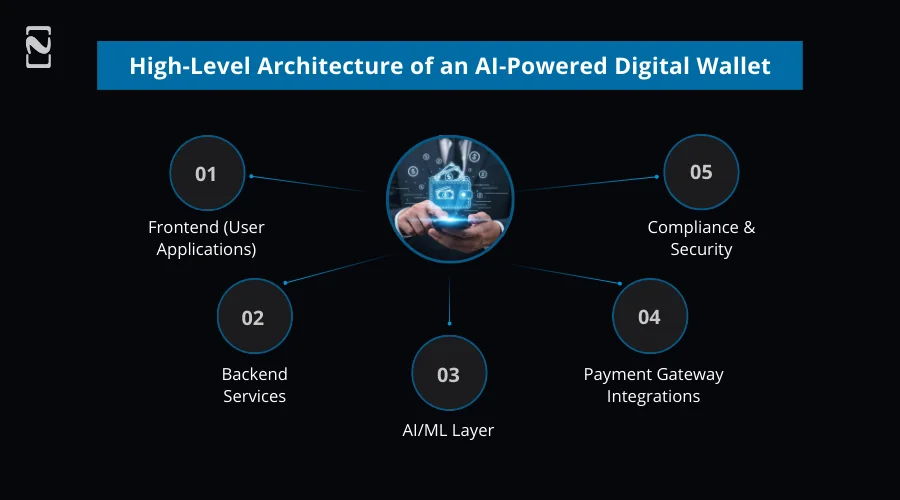

AI-Driven Digital Wallet Architecture

Rather than a standalone application, an AI-powered digital wallet is a layered, intelligence-backed system built to securely process transactions, make smart decisions, and scale flawlessly under increased volumes.

At a high level, the architecture integrates backend services, user interfaces, payment networks, components, and compliance regulations into a unified, data-backed ecosystem.

► High-Level Architecture of an AI-Powered Digital Wallet

Let’s discuss the core layers of an AI-enabled digital wallet:

Layer 1: Frontend (User Applications)

The frontend layer of the digital wallet architecture includes web and mobile apps where users transact and manage their wallets.

This layer performs as a chief data source for AI systems that catch behavioral signals, like device context, interaction speed, and navigation patterns, and focuses on usability and performance.

Layer 2: Backend Services

This layer handles the key wallet functionality, including transaction orchestration, user management, API integrations, and balance handling.

Created using microservices, it boosts scalability and maintains low-latency communication between systems.

Altogether, it acts like the control hub connecting frontend requests to payment networks and AI decision engines.

Layer 3: AI/ML Layer

The intelligent engine of the digital wallet is the AI/ML layer, which processes historical and real-time data to strengthen personalization, predictive analytics, transaction scoring, and fraud detection.

In this layer, the models consistently learn from new data, permitting the wallet to seamlessly adapt to surfacing fraud patterns and evolving user behavior.

Layer 4: Payment Gateway Integrations

This digital wallet architecture layer connects the wallet to card networks, third-party payment processors, banks, and UPI systems.

AI improves such integrations by diminishing transaction failures, optimizing routing decisions, and allowing swift authorization via intelligent risk assessment.

Layer 5: Compliance & Security

Despite treating security and regulatory compliance as isolated components, they are embedded in the architecture.

This layer implements PCI-DSS standards, identity verification, regulatory reporting, data encryption, and audit logging, while AI backs anomaly detection and real-time risk monitoring.

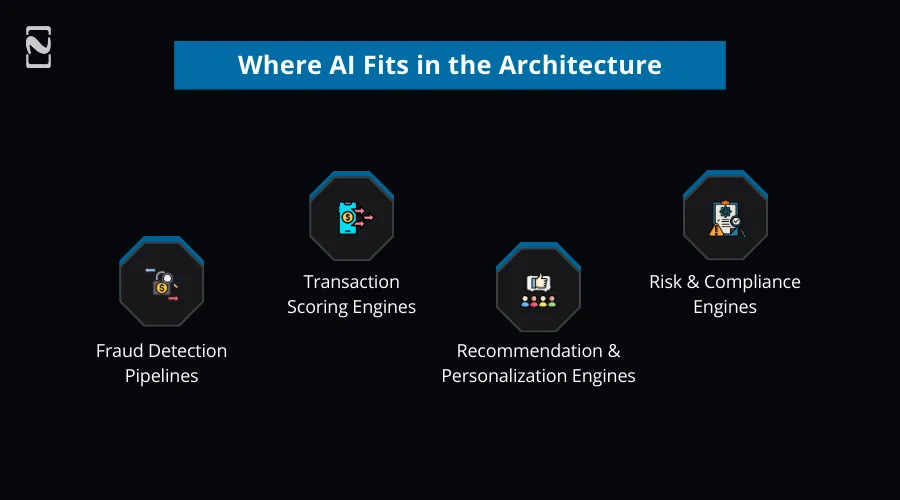

► Where AI Fits in the Architecture

As we talked, AI, when deeply integrated across the architecture, real-time intelligence activates at crucial decision edges:

1. Fraud Detection Pipelines

Machine learning pipelines constantly monitor transaction streams to analyze abnormal patterns and surging fraud tactics.

By adapting dynamically, these pipelines improve precision while diminishing false positives.

2. Transaction Scoring Engines

AI models study several signals, like location, user behavior, device fingerprints, and transaction amount, to evaluate risk scores in milliseconds.

These risk scores determine whether a transaction is challenged, approved, or declined, directly affecting fraud detection and conversion rates.

3. Recommendation & Personalization Engines

AI analyzes engagement data and spending habits to deliver personalized offers, insights, and rewards. This ability metamorphoses digital wallets into intelligent fraud assistants, boosting lifetime value and user engagement.

| AI-powered personalization in digital payment apps can boost customer retention rates by up to 15%. |

4. Risk & Compliance Engines

AI streamlines compliance monitoring by locating suspicious activities, promising regulatory adherence, and creating audit-ready reports.

Explainable AI models are increasingly chosen to meet transparency and regulatory needs.

Quick Overview: How Embedding AI in Fintech App Architecture Helps

- Reduce fraud losses and operational costs

- Scale performance under peak loads

- Rapid and safer transactions

- Increased approval rates and customer trust.

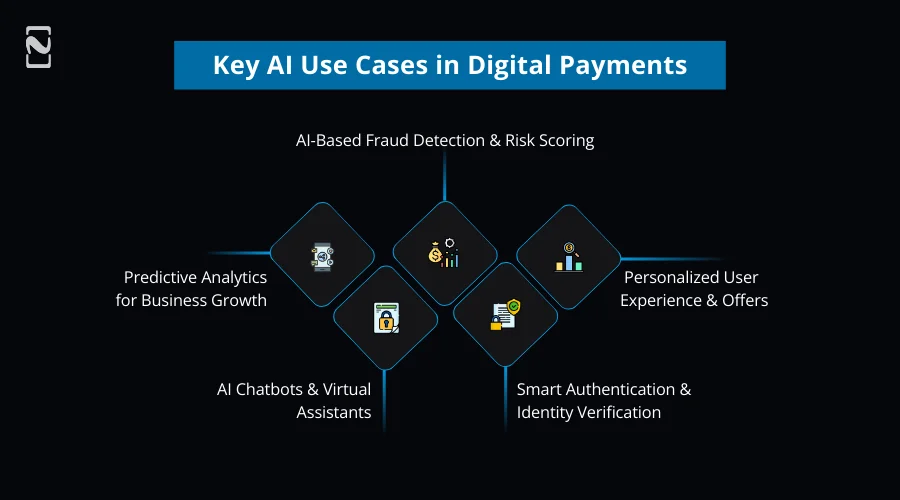

Key AI Use Cases in Digital Payments

AI use cases in digital wallets focus on improving security, automating processes, and offering personalized financial insights to enhance the user experience.

1. AI-Based Fraud Detection & Risk Scoring

Fraud prevention is the most imperative application of AI in digital payments.

AI models constantly learn from transaction behavior, leading to more accurate and faster decision-making.

- Real-Time Transaction Monitoring

- Anomaly Detection

- Adaptive Fraud Models

2. Personalized User Experience & Offers

Digital payments personalization with AI drives higher retention, engagement, and transaction frequency.

- AI-Driven Rewards & Cashback

- Spending Pattern Analysis

- Dynamic UI Personalization

3. Smart Authentication & Identity Verification

AI improves security without adding friction by triggering intelligent, multi-layered authentication mechanisms.

| 44% of consumers prefer using voice-activated AI assistants for bill payments. |

- Face & Voice Recognition

- Behavioral Biometrics

- Continuous Authentication

4. AI Chatbots & Virtual Assistants

AI-powered conversational interfaces boost service quality while diminishing operational costs.

| About 77% of customers prioritize using AI-powered chatbots to manage simple transfer requests and payment queries. |

- Dispute Resolution

- Customer Support Automation

- Voice-Based Payments

- Dispute Resolution

5. Predictive Analytics for Business Growth

Predictive intelligence allows wallet providers to shift from reactive decisions to a proactive strategy.

- User Lifetime Value (LTV) Modeling

- Churn Prediction

- Transaction Forecasting

How Businesses Can Adopt AI in Banking and Payments?

Adopting AI in payments sounds easy as plug-and-play, but it is actually not.

Here, we will know about the process by which businesses can smoothly adopt AI in banking and payments.

1] Know Business Requirements and Pain Points

Every company is struggling in one or another way in its payments stack. Some face high fraud losses, while the rest have compliance and infinite manual review headaches.

You should highlight such issues first to ensure the AI is applied to the required track.

2] Contact AI Experts Early

Well, even if you are tech-savvy, you find the integration process more technical, and wrong regulations can appear to be expensive later.

Partner with experienced AI teams offering AI consulting services to get clarity about architecture, compliance, and measurable outcomes.

3] Start with Basic and Then Scale

Yes, AI integration is important, but not at the cost of disrupting existing systems.

Choose to pilot AI in one room, like transaction routing or fraud detection, and then expand.

Thus, you can move ahead with confidence.

4] Opt for Skilled AI professionals

Even if you choose the best AI model, it will fail if you don’t know how to manage it.

Hire AI developers with years of experience to ensure your digital wallets improve over time.

5] Integrate with Current Systems

Integrate AI into an app or your core platform meticulously to gain the security and performance benefits that customers expect.

6] Evaluate, Monitor, Optimize

Consistently measure performance and provide feedback loops to ensure AI delivers value while staying sharp.

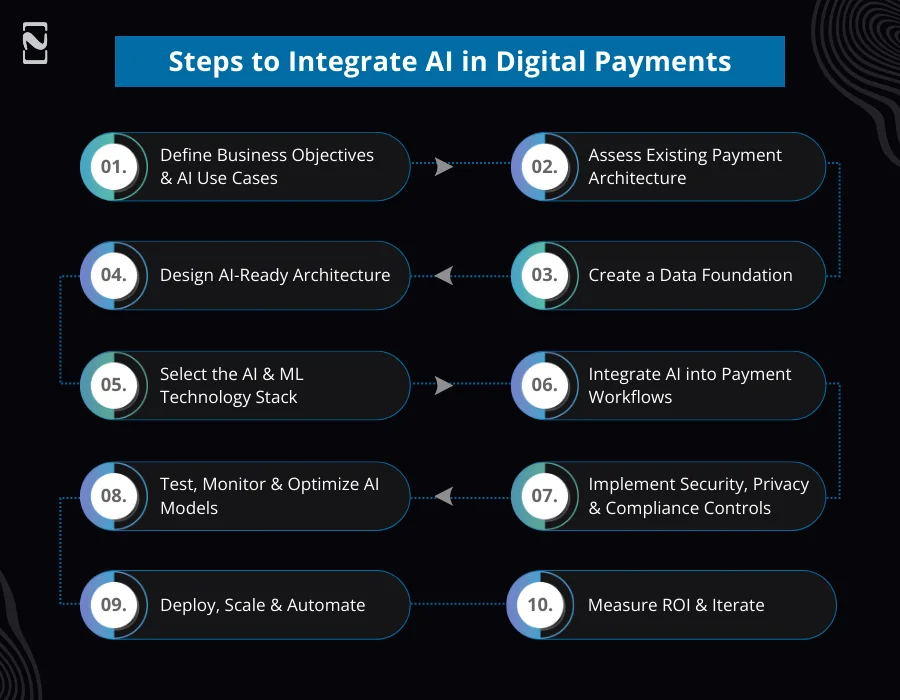

Steps to Integrate AI in Digital Payments

Below we will discuss a proven approach for AI integration in payments that leading fintech platforms follow.

Step 1: Define Business Objectives & AI Use Cases

First, identify what problems you want AI to solve; don’t introduce AI instantly.

- Improved approval rates

- Fraud reduction

- Compliance automation

- Personalized user experience

Outcome: Transparent KPIs aligned with risk, customer experience, and revenue.

Step 2: Assess Existing Payment Architecture

Determine AI readiness by evaluating the existing payment infrastructure.

- API maturity

- Real-time data availability

- Monolithic vs microservices setup

- Legacy system dependencies

Output: Gap analysis for AI integration.

Step 3: Create a Data Foundation

AI in payments is data-backed, demanding accessible and clean datasets.

- Historical Fraud Data

- Transaction data

- Device and contextual signals

- User behavior data

Outcome: AI-ready, compliant, and centralized data pipelines.

Step 4: Design AI-Ready Architecture

Don’t embed AI as an add-on, but as a core intelligence layer.

- AI/ML services integrated with backend APIs

- Secure data flow across layers

- Real-time inference engines

- Event-driven architecture for transactions

Outcome: Low-latency, scalable AI-powered payment architecture.

Step 5: Select the AI & ML Technology Stack

Opt for technologies based on scalability, compliance, and performance.

- MLOps tools for lifecycle management

- ML frameworks (TensorFlow, PyTorch)

- Databases and data warehouses

- Automating platforms (Kafka, Kinesis)

Outcome: Enterprise-grade AI stack optimized for payments.

Step 6: Integrate AI into Payment Workflows

Next, you should embed AI at crucial decision points.

- Fraud detection during payment processing

- Transaction risk scoring before authorization

- Personalization post-transaction

- Authentication during login and checkout

Outcome: Frictionless, real-time, and AI-driven decision-making

Step 7: Implement Security, Privacy & Compliance Controls

AI integrations should meet applicable regulatory standards.

- GDPR data privacy safeguards

- Explainable AI for auditability

- PCI-DSS compliance

- Secure model access and encryption

Outcome: Trust-compliant and regulatory-ready AI payments systems.

Step 8: Test, Monitor & Optimize AI Models

Continuous validation helps attain accuracy and reliability.

- Model performance testing

- Fraud Outcome Analysis

- Bias and drift detection

- Latency monitoring

Outcome: Stable AI models with increased revenue and ROI.

Step 9: Deploy, Scale & Automate

In this step, you should move ahead seamlessly, from pilot to production.

- CI/CD pipelines for AI models

- Continuous retraining workflows

- Global rollout readiness

- Auto-scaling infrastructure

Outcome: Scalable AI-powered payment platform

Step 10: Measure ROI & Iterate

Now it’s time to track how AI influences your business against the KPIs.

- Approval rate improvement

- Operational cost savings

- Fraud Loss Reduction

- Customer retention growth

Outcome: Consistent optimization suiting business growth.

What is the Cost of Integrating AI in Payments?

The cost of integrating AI into payment systems is based on complexity, scope, and scale of implementation.

You should ensure your AI investment is evaluated in terms of lasting ROI, not only the upfront development cost.

Cost of Integrating AI in Digital Payments

| AI Integration Level | Scope / Features | Estimated Cost | Business Impact |

| Basic Integration | Rule-based enhancements, basic ML models, and a limited scope | $15,000 – $30,000 | Minor fraud reduction and small automation gains |

| Mid-Level Integration | Real-time fraud detection, behavioral analytics, and compliance-ready setup | $30,000 – $70,000 | Improved approval rates, moderate fraud reduction, and enhanced compliance |

| Advanced AI Platform | Full AI stack: predictive analytics, personalization, global scalability, and chatbots | $70,000 – $150,000+ | Significant fraud reduction, higher transaction volume, lower operational costs, and higher customer retention |

Note: The costs we listed are estimated ranges and may vary depending on the complexity of AI use cases, compliance needs, security requirements, transaction volumes, and the choice between third-party AI solutions or in-house development.

AI in Payments: Navigating Regulatory and Compliance Needs

With the growing AI adoption in payments, regulatory compliance becomes a core success factor.

Payment platforms you build should ensure AI systems operate smoothly within rigid financial, consumer protection, and data privacy frameworks.

Key Regulatory Considerations

- PCI-DSS: Ensure protected management of cardholder data across AI-driven transaction flows

- PSD2 & Open Banking AI Integration: Robust Customer Authentication (SCA) and secure API access

- GDPR & Data Privacy Laws: Lawful data processing, data minimization, and consent management.

- Local Financial Regulations: Region-specific licensing, audit, and reporting requirements.

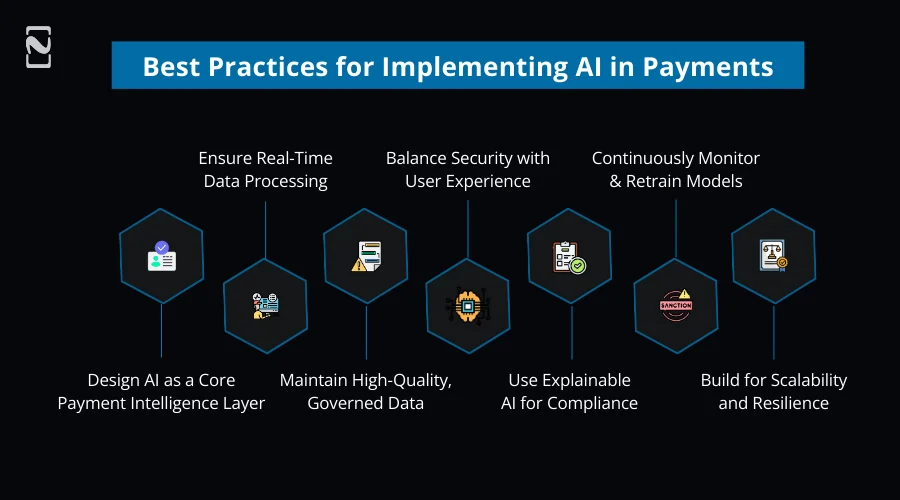

Best Practices for Implementing AI in Payments

Before you implement AI in digital payments, you should know how to meticulously choose the appropriate model, robust architecture, execution discipline, and governance.

Here, we will talk about the best practices you should follow to ensure you attain the required scalability, compliance, and measurable ROI while implementing AI in payment systems.

1. Design AI as a Core Payment Intelligence Layer

You should ensure embedding AI directly into transaction flows for real-time decisioning and risk scoring, despite adding it as an afterthought.

2. Ensure Real-Time Data Processing

Since payments require milliseconds-level decisions, you need streaming data pipelines for fraud detection and approvals.

3. Maintaining High-Quality, Governed Data

AI precision demands clean, well-governed, and unbiased datasets with consistent monitoring and validation. So be sure you maintain the quality of your data.

4. Balance Security with User Experience

You should adopt behavioral biometrics and adaptive authentication to maintain robust security with a smooth checkout process.

5. Use Explainable AI for Compliance

Regulators need transparency and clarity. Here, you should make sure AI decisions are auditable, traceable, and explainable.

6. Continuously Monitor and Retrain Models

Fraud patterns are dynamic, so you should emphasize ongoing model retraining and performance tracking.

7. Build for Scalability and Resilience

Go for cloud-native and microservices-based architectures as you build AI systems that can reliably manage peak transaction volumes.

Note: Ensure that you follow these practices to directly affect fraud reduction, regulatory compliance, revenue growth, and approval rates, as these are the top priorities of every digital payment platform.

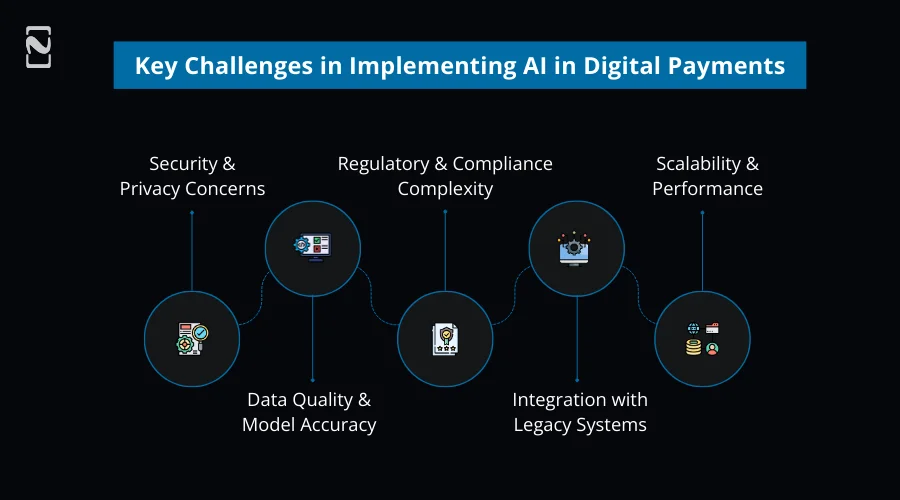

Key Challenges in Implementing AI in Digital Payments Adoption and Implementation

Doubtlessly, AI comes up with benefits in digital wallet platforms, but while implementing it, you can expect complicated technical, regulatory, and operational challenges.

You need to address these challenges to create compliant payment systems.

Challenge #1. Security & Privacy Concerns

Solution: Opt for privacy-by-design architecture, end-to-end encryption, and hardened AI models with adversarial protection.

Challenge #2: Data Quality & Model Accuracy

Solution: Financial institutions should implement centralized data governance and persistent model retraining through automated MLOps pipelines.

Challenge #3: Regulatory & Compliance Complexity

Solution: You can embed compliance frameworks like PCI-DSS, PSD2, GDPR, and Local financial regulations, and explainable AI models in your wallet architecture.

Challenge #4: Integration with Legacy Systems

Solution: Leverage API abstraction layers and microservices to modernize integration without disturbing existing systems.

Challenge #5: Scalability & Performance

Solution: Fintech firms should deploy lightweight AI models on auto-scaling infrastructure with event-driven processing.

Tip: Address these challenges to prevent regulatory penalties, increased fraud and revenue loss, limited scalability and innovation, and poor user experience and churn.

Future Trends in AI & Digital Payments

With the power of AI, digital payments have evolved into intelligent, autonomous financial ecosystems that extend beyond transactions.

With the maturing of mobile wallets, you can expect the upcoming innovative phase defined by invisibility, trust, speed, and personalization.

Let’s go through the future trends of AI in mobile apps, and you can expect.

1. Invisible & Context-Aware Payments

Now, payments will take place in the background with varied contexts triggering them, like usage patterns, device signals, and location, eradicating the need to follow detailed checkout steps.

2. Autonomous AI Payment Agents

AI systems will freely handle recurring payments, bill optimization, spending decisions, and subscriptions based on user preferences and behavior, diminishing manual intervention.

3. Hyper-Personalized Financial Experiences

AI will provide individualized, real-time offers, financial insights, and dynamic pricing based on lifecycle stage and every user’s spending habits.

4. Real-Time, Self-Learning Fraud Prevention

Fraud detection systems will be self-adapting models that instantly respond to new attack patterns with no manual rule updates.

5. Advanced Behavioral Biometrics

Considering behavioral signals, continuous authentication will take the place of one-time verification methods, boosting security while providing seamless user experience.

6. AI-Driven Open Banking Ecosystems

AI will perform data orchestration from several banks and financial services to foster smarter payment routing, embedded financial use cases, and personalized financial products.

7. Explainable & Regulation-Aware AI

With tighter regulations, AI systems will be empowered with in-built transparency, compliance intelligence, and auditability to meet applicable global regulatory standards.

8. Voice-First & Conversational Payments

Conversational AI and voice assistants will promote hands-free payments, customer support, and account management within mobile wallets.

9. AI-Powered Embedded Finance

Driven by AI-powered decisioning and risk management, payments will flawlessly integrate with non-financial platforms, like healthcare, retail, and mobility.

10. Cross-Border & Multi-Currency Intelligence

AI will locate cross-border fraud patterns, optimize foreign exchange, and smooth international payments in real-time.

Business Impact: ROI of AI in Digital Payments

When you implement AI strategically, it delivers powerful returns. How?

Let’s get deeper to know!

1. Fraud Loss Reduction & Risk Optimization

Compared to traditional rule-based systems, real-time AI fraud detection in digital payments recognizes suspicious activity rapidly and more precisely, notably diminishing financial losses and chargebacks.

ROI Impact: Improved margin safety and lower fraud-related costs.

2. Revenue Growth Through Increased Approval Rates

By distinguishing between fraudulent and legitimate transactions, AI-driven transaction scoring mitigates false declines, directly increasing authorization rates and leading to more successful payments with no higher risk.

ROI Impact: Increased recovered revenue and transaction volume.

3. Improved Customer Retention & Lifetime Value

By delivering tailored offers, rewards, and insights, AI-powered personalization boosts user engagement, which promotes repeat usage and lasting loyalty.

ROI Impact: Increased customer lifetime value (LTV) and higher retention rates.

4. Compliance Cost Reduction

Automated reporting and explainable AI streamline regulatory compliance, diminishing costly audits and penalty risks.

ROI Impact: Reduced regulatory risk and compliance expenses.

5. Faster Time-to-Market & Scalability

Without the need for ongoing manual reconfiguration, AI-enabled platforms quickly adapt to new regulations, market demands, and fraud patterns.

ROI Impact: Lower development costs and rapid innovation cycles.

6. Data-Driven Strategic Decision-Making

Predictive analytics enable smart investment and product decisions, offering insights into user behavior, transaction trends, and growth opportunities.

ROI Impact: Improved resource allocation and forecasting.

7. Operational Cost Efficiency

AI-powered automation, like dispute resolution, compliance monitoring, and chatbots, mitigates operational overhead and manual intervention.

ROI Impact: Lower support and compliance costs.

A Quick Overview of Bottom-Line Impact for Businesses

- Lower operational and compliance costs

- Higher transaction success rates

- Increased customer loyalty

- Reduced fraud and chargebacks

How Nimble AppGenie Helps Build AI-Powered Digital Wallets?

You should choose a bespoke fintech app development company that fuses robust engineering practices, regulatory proficiency, and AI governance, ensuring innovation while fostering trust.

Businesses are increasingly adopting intelligent payment solutions, and here, Nimble AppGenie is widely recognized for delivering strong AI-powered digital wallets that meet the real market needs.

The team of AI experts helps fintech companies implement AI in digital payments, improving their legacy systems or embedding AI in their digital wallets architecture to reap the rewards of the latest technology.

Nimble AppGenie’s Offerings

- AI-enhanced eWallet platforms,

- Predictive analytics for personalized user experiences,

- Machine learning-based fraud prevention, and more.

What Sets Nimble AppGenie Apart

- End-to-End Wallet Development

- AI-First Payment Architecture

- Scalable & Secure Infrastructure

- Regulatory-Ready Design

- Business-Driven AI Strategy

So forth, the AI developers offer custom AI app development services to help enterprises transform their older payment operations into intelligence-driven procedures and unlock business value.

Real-time Case Study:

Client: Name kept Confidential (Fintech Digital Wallet Provider)

Challenges Faced:

- High false declines are affecting user trust and revenue.

- Needed a scalable, compliant payment infrastructure.

- Rising fraud attempts during high-volume transactions

- Manual risk assessment and customer support workflows

Solutions We Offered:

- AI-based real-time fraud detection & transaction risk scoring

- Predictive analytics for user behavior and churn prevention

- PCI-DSS compliant, cloud-native digital wallet architecture

- Behavioral biometrics for smart, continuous authentication

- AI-powered chatbot for support and dispute resolution

Outcomes:

- 45% drop in fraud-related losses

- 40% reduction in manual support tickets

- 30% progress in transaction approval rates

- 25% boost in active user retention

Future Plans:

- Advanced AI-driven personalization and rewards engine

- Cross-border payment intelligence using AI

- Voice-enabled payments and conversational AI expansion

- Continuous model optimization for evolving fraud patterns

Consult with Nimble AppGenie’s fintech experts today!

Conclusion

AI in digital payments is not only about processing transactions; it’s about redefining how businesses gain customer trust and stay competitive.

Leaders should make decisions on whether to adopt AI for eWallet security, go for fintech legacy system modernization, or implement AI in payments.

Today, an increasing number of fintech startups fail without digital wallet AI features. So, enterprise digital wallet solutions powered by AI are essential to transform payments.

Contact Nimble AppGenie and build the future of digital payments with AI.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.