Back in the day, we had to carry cash to make payments or to buy something.

However, with the advent of new eWallet applications like PayPal, these applications have replaced the traditional methods.

They make it easy, secure, and convenient to make transactions or send someone money with just one tap on the phone.

Over time, PayPal has grown tremendously and has become a user favorite. However, not every user has a good experience with the app, so people start looking for apps like PayPal.

As a business, this gives you a chance to provide a more effective and efficient app that you think can work magic in the market and prove to be the best alternative to PayPal with the help of an eWallet app development company.

To build your app like PayPal, you need to know what other apps like PayPal have in them and how they are ruling the market. In this blog, we will get to know the top players in the market.

7 Best PayPal Alternative Payment Methods

Based on whether you are looking for an app to help you with international transactions or personal payments.

We have curated a thorough list that can help you find a solid PayPal alternative payment method for your payments.

| Tool | Features | Fees | Security | Ease of Use |

| Payoneer | International Contractor Payments, Local accounts in different countries, Currency conversion, Small capital advances | Annual fee of $29.95 (if < $2000 received in 12 months), Currency conversion fees, Additional fees for specific services | 2-factor authentication, Integrated RSA Adaptive Authentication, Instant email notifications for transactions | Easy integration with business tools, Built-in invoice generator, Easy acceptance of international payments via debit/credit cards |

| Stripe | Card updates: Available in 46 countries, Programmer-friendly, extensively adopted | 2.9% + $0.30 per transaction, +0.5% on manually entered cards, 0.8% + $5 cap ACH direct debit fees | PCI DSS Compliance, Integrated Data Encryption, Radar Fraud Prevention | Pre-built responsive payment form, Easy to implement & integrate with Stripe API, Automated billing for subscriptions & recurring invoices |

| Venmo | ACH payment processing, No monthly or annual fees, Offers credit cards, Purchases, and crypto | Free for linked bank accounts or Venmo balance, 3% fee for credit card payments, 1.8% fee for buying & selling crypto assets | Purchase protection for buyers, Scam awareness guidance, Works directly with banks for failed/incomplete transactions resolution | Instant peer-to–peer payments for personal use, No-cancellation policy, Lacks business features like automation and reporting |

| Square | Plug into mobile for cash register, Connects to PayPal, Google Wallet, etc., online/offline payments, payroll tools & invoicing | 2.6% + 15 cents per in-person transaction, 1% (min $1) for ACH transfers, 3.3% + 30 cents per invoice transaction | Payment data encryption, Account transaction security, PCI compliant | No monthly fees or setup charges, Easy online signup, Direct phone support |

| Adyen | Easy and instant payment, Debit/credit card support, Rewards/coupons/gift cards, Plug and play payment packages | Interchange fee + variable markup for card transactions, 40 cents per ACH transaction, Additional fees (interchange, markup, scheme) | Advanced fraud prevention (ML-based risk scoring, real-time data analysis), Regular third-party security audits, Compliant with security measures | Pre-built e-commerce integrations, easily customizable for different businesses, optimized payment solutions with the Adyen Uplift program |

| Payline | Prevention of fraud, enhanced mobile payments, Transparent pricing, All-in-one solution | 0.2% + 10 cents per transaction, $25 chargeback fee, Variable monthly plan fee | Biometric data security (Face ID/Touch ID), Dedicated compensation for third-party fraud, Encryption, and other security measures | Centralized dashboard, Streamlines payment processing (POS integration, invoice dispatching), Easy to navigate user interface |

| Wise | Multicurrency Wallet (local details in 23 countries), Batch Payments via CSV, 0.5% Cashback on Wise Debit Cards, No recurring costs | No hidden costs, Variable fees for international transactions, Multicurrency card with 0 fees (replacement may cost) | Money transmitter license, Dedicated fraud prevention and security teams, Funds kept as high-quality liquid assets (not lent out) | Clear and intuitive user interface, entirely online and 24/7 availability, Multi-currency physical card for international withdrawals |

Without further ado, let’s get started!

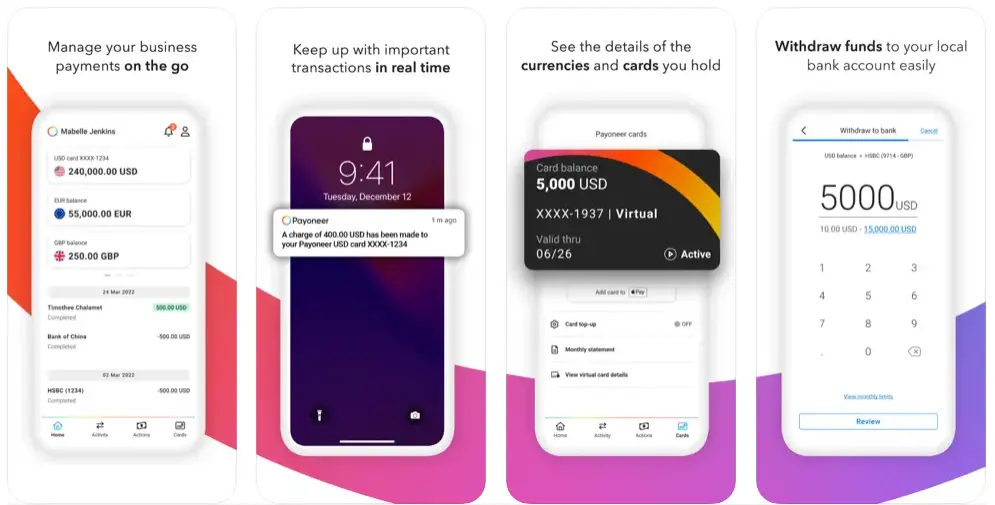

1. Payoneer

Are you looking for the best PayPal alternative payment method for your business? You should give Payoneer a try.

Payoneer provides business-oriented solutions to these companies and emphasizes international commerce. The platform also provides a debit card that you can use to make a purchase or even withdraw funds from it. It offers a variety of services to different industries with safe, flexible, and low-cost solutions, networks, and businesses anywhere in the world.

Transactions between Payoneer accounts are free. The platform has 100 million registered users, and the numbers are still growing, making it one of the PayPal alternatives for online payments.

Features of Payoneer:

- International Contractor Payment

- Please open a local account in different countries.

- You can convert the currency and then transfer.

- Small capital advances for businesses.

Fees:

- If your Payoneer account receives payments of less than $2000 in 12 months, you may be liable for an annual fee of $29.95.

- Currency conversion fees are applicable.

- Payoneer may charge additional fees for specific services, such as credit card transactions or ACH transfers.

Security:

- Payoneer offers 2-factor authentication to help you keep your account safe and secure.

- Integrated RSA Adaptive Authentication.

- Instant notifications via email for every transaction.

Ease of Use:

- Offers easy integration with business tools for ease of tracking transactions.

- Built-in invoice generator for international invoices.

- Easily helps you accept international payments via debit and credit cards.

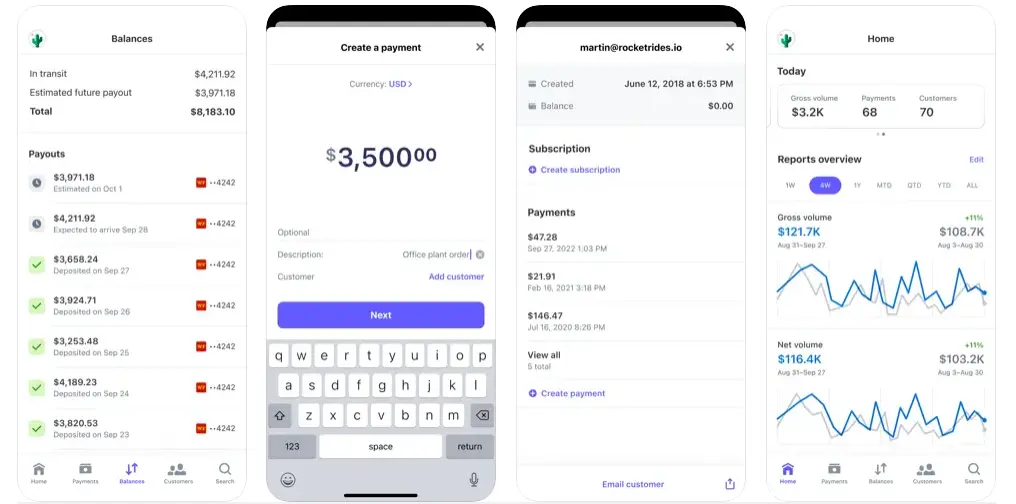

2. Stripe

Stripe is one of the fastest-growing similar apps to PayPal in the market. Initially, the app started as an assistance to startups to gather funds. But, soon it became one of the widespread payment services for online businesses.

They consider themselves to be a ‘developers first’ business. Because of this, they provide a clean, user-friendly API that is easy to integrate. Due to this, it is used in a lot of SAAS applications. Stripe API helps businesses to easily take or accept payments through different methods using Credit cards, debit cards, or any other mode.

Features of Stripe:

- Offer card updates.

- Available in 46 countries.

- Programmer-friendly.

- Extensively adopted.

Fees:

- Stripe charges 2.9% + $0.30 per transaction.

- An additional 0.5% on manually entered cards.

- 8% + $5 cap ACH direct debit fees

Security:

- Offers PCI DSS Compliance

- Integrated Data Encryption

- Radar Fraud Prevention

Ease of Use:

- Comes with a pre-built responsive payment form.

- Easy to implement & integrate with the Stripe API

- Automated billing process for subscription & recurring invoices.

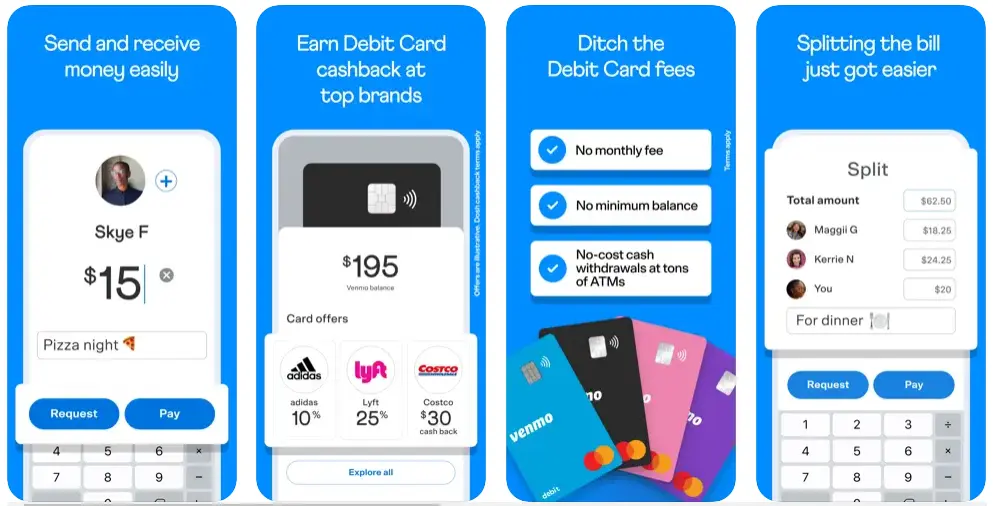

3. Venmo

While writing about the best alternatives to PayPal, we can’t forget about “Venmo”.

Venmo is backed by PayPal and is utilized widely by people to make payments, send money to someone, and much more. While Venmo may not be as big as PayPal, it has 83 million-plus customers using it already.

Making payments on Venmo is easy and user-friendly; all you have to do is enter the receiver’s phone number or scan the QR code and send them money within just a few taps on your smartphone. You can see your past transactions on the app, add notes or emojis to make payments, and do much more. For that, you have to use the app. Although PayPal is already famous and used by many, Venmo has become quite a famous P2P payment app that people enjoy using.

Features of Venmo:

- Offer ACH payment processing.

- No monthly or annual charges.

- Offers credit cards.

- You can make purchases and sell crypto.

Fees:

- All transactions from linked bank accounts or Venmo balances are free.

- A fee of 3% is charged on sending money via credit card.

- 8% is charged on the buying & selling of crypto assets.

Security:

- Offers purchase protection for buyers.

- Venmo offers scam awareness tips to help its users stay safe.

- Works directly with banks to give you a resolution for any failed/incomplete transactions.

Ease of Use:

- Offers instant peer-to–peer payments for personal payments.

- Venmo follows a no-cancellation policy for transactions, making them irreversible once done.

- Lacks business features such as automation and reporting.

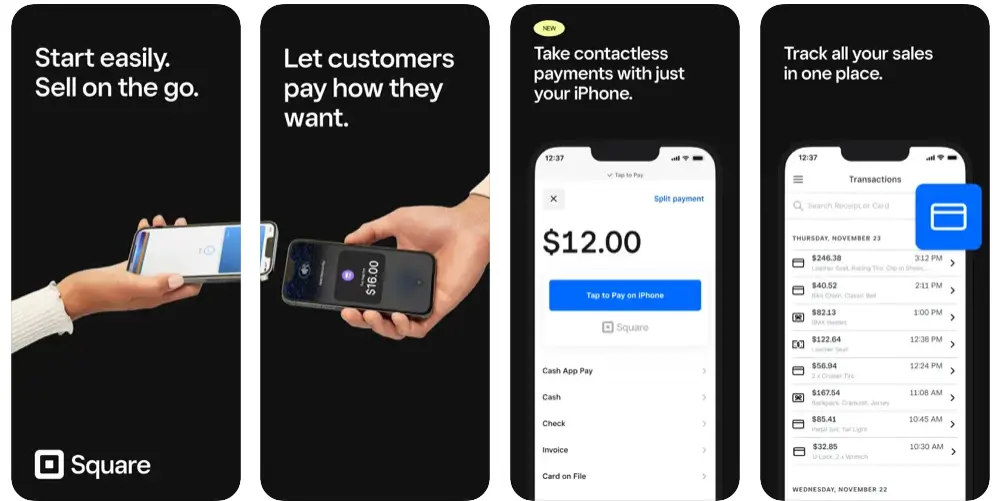

4. Square

Square is one of the best alternatives to PayPal for businesses of any size. The app is quite known for its point–of–sale system, which is affordable and easy to use. It helps to keep track of customers and accepts cards, cash, and more.

Another outstanding feature that differentiates it from other payment apps like PayPal is its credit card swiper, which allows it to securely accept payments from other parties. You can also swipe cards without any internet.

Features of Square:

- Plug it into a mobile device and it becomes a cash register.

- You can connect it to different channels such as PayPal, Google Wallet, and more.

- Make payments in online and offline stores.

- Provide payroll tools and invoicing.

Fees:

- 6% + 15 cents per transaction for in-person payments.

- ACH transfers cost 1% or a minimum of $1 per transaction.

- Invoices can come out to be 3.3% + 30 cents per transaction.

Security:

- Payment data is encrypted to ensure discreet transactions.

- Square offers account transactions.

- The solution is already PCI compliant, ready for integration.

Ease of Use:

- No monthly fees or setup charges for the users.

- Businesses can easily sign up online.

- Square offers direct phone support for assistance.

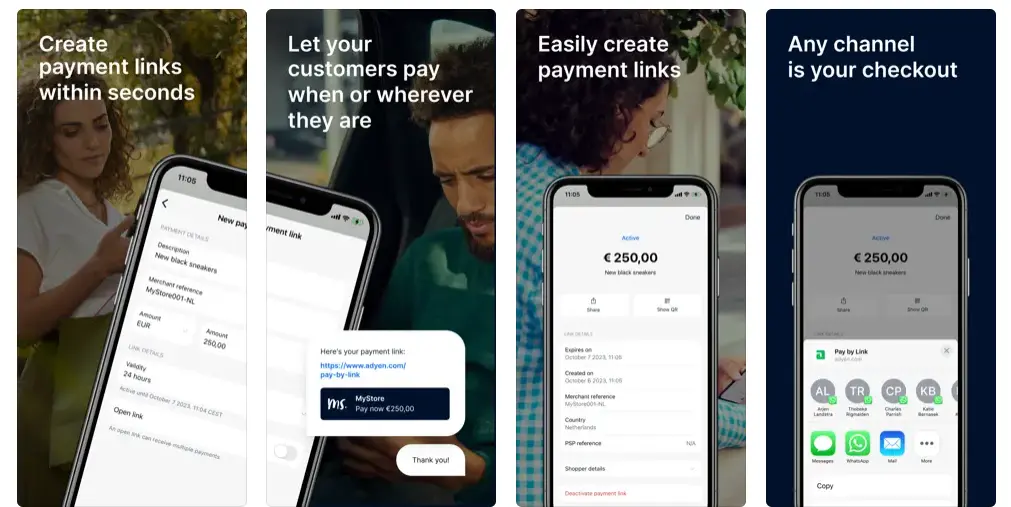

5. Adyen

Adyen is on a list of international money apps like PayPal that help ventures accept and make payments online and in person. The platform helps businesses accept a wide variety of payments, including eCommerce, POS systems, and mobile.

The Dutch company is a financial technology platform that helps businesses achieve their goals faster with data-driven insights and better payment processes. Adyen has 1700+ clients around the globe, including eBay, Uber, Bank of America, and more.

Features of Adyen

- Easy and instant payment.

- Support debit/credit card transactions.

- Win exciting rewards, coupons, and gift cards.

- Plug and play payment packages.

Fees:

- Charges an interchange fee + a variable markup for card transactions.

- An ACH transaction fee of 40 cents per transaction is charged.

- Often charges additional fees related to interchange, markup fees, scheme fees, and others.

Security:

- Advanced fraud prevention tools such as ML-based risk scoring and real-time data analysis.

- Regular security audits are carried out by independent third-party firms to keep Adyen’s security in check.

- It is considerably compliant with all the stringent security measures.

Ease of Use:

- Adyen offers pre-built e-commerce integrations.

- Easily customizable for integration with different businesses.

- Optimizes the entire payment solution with the Adyen Uplift program.

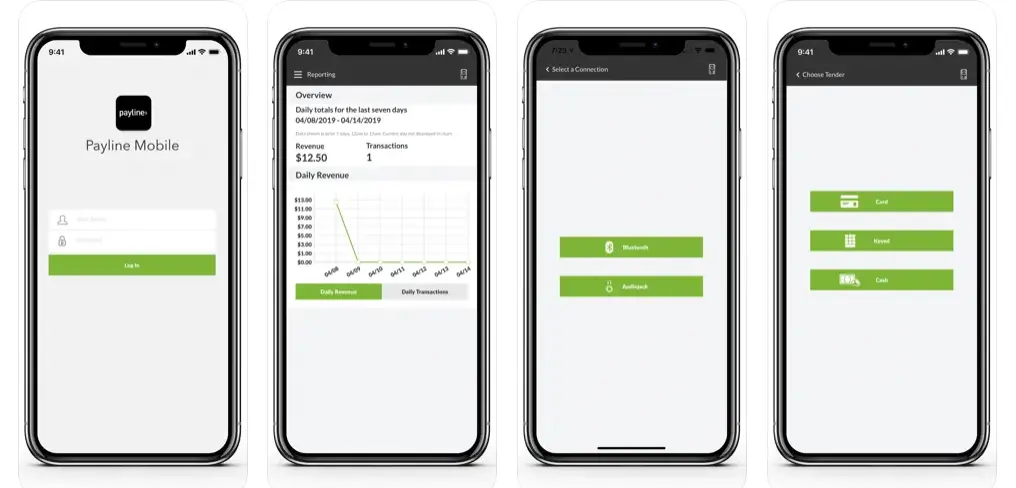

6. Payline

On the list of similar apps like PayPal, another name is Payline.

Payline is a payment app like PayPal that helps businesses with better payment solutions. The app provides top-notch eWallet app security with features like fraud detection, integrated payment gateways, and much more.

It offers a flexible payment processor that accepts credit/debit cards, ACH transfers, and e-checks that streamline payment processing. Moreover, you can utilize a POS system that helps to get better insights into inventory, customer data, and more.

Features of Payline:

- Prevention of fraud.

- Enhanced mobile payment capabilities.

- Offers transparent pricing.

- All-in-one solution.

Fees:

- Payline charges 0.2% of the transaction amount + 10 cents per transaction.

- $25 of chargeback fees is also levied.

- A specific monthly plan fee is also applied based on your choice of plan and features. (variable)

Security:

- Allows the use of biometric data (Face ID or Touch ID) to secure transactions.

- Dedicated compensation support for third-party fraud.

- Keeps your financial information safe with encryption and other security measures.

Ease of Use:

- Offers a centralized dashboard for ease of access.

- Streamline payment processing with POS integration & invoice dispatching.

- Easy-to-navigate user interface, making the application easy for new users.

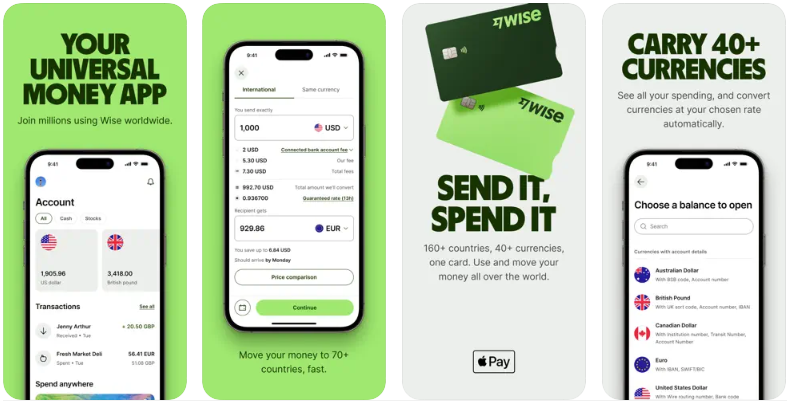

7. Wise

Focusing on international payments and offering the best exchange rates for individuals and businesses, Wise is another great alternative that you can go for. Instead of taking the banking route, Wise is considered more of a Money Service Business Provider that helps in facilitating both individual and business transactions internationally.

If you are looking for a PayPal alternative payment method for international payments, then Wise can be a good choice for you.

Features of Wise:

- Multicurrency Wallet with Local Details in 23 Countries

- Batch Payments via CSV

- 5 Percent Cashback on Wise Debit Cards

- No recurring costs, only one-time setup fee.

Fees:

- No hidden costs.

- No fixed fees on international transactions, as it keeps varying based on value and currency.

- Offers a multicurrency card with 0 fees; however, it might cost in case of ordering a replacement card.

Security:

- A money transmitter license allows them to safeguard your funds.

- Wise offers dedicated fraud prevention and security teams to guide you.

- Customer money stays intact as Wise does not lend it out to others, instead converting it into high-quality liquid assets.

Ease of Use:

- Clear and intuitive user interface for easy onboarding.

- All functionality is entirely online and available 24/7.

- Offers a multi-currency physical card that can be used to withdraw money abroad.

Other than these 7 alternatives, you always have the option to choose the usual, Google Pay, Apple Pay, and Amazon Pay wallets, as they are some of the best digital wallets available in the market.

Conclusion

The idea of finding the perfect PayPal alternative payment method varies for different users. That is because some look for an alternative for international payments, while some look for an app like PayPal for personal use. Either way, all these 7 listed apps can help you out.

If you are wondering which of these is suitable for you, you should identify your key requirements by going through all the features, fees, security, and ease of use, and choose accordingly.

Hopefully, this list gives you an alternative to PayPal for whatever reason you are looking for. Thanks for reading, good luck.

FAQs

We believe we have covered all the vital details. But. If you have any doubts, then these FAQs will help you-

Some of the best alternatives to PayPal are

- Stripe

- Payoneer

- Venmo

- Square

- Wise

- Payline

- Adyen

Any alternative is best if it helps you with your requirements and needs. However, these are some of the top apps that provide an all-in-one solution.

It is not necessary that if an app is popular, every user will be satisfied with the app. Poor customer service, strict rules, and hidden fees are some of the reasons people look for PayPal alternatives.

Some of PayPal’s biggest competitors are Stripe, Payoneer, and Authorize.Net, which have an amazing market share and are found in users’ smartphones.

Both have their advantages. PayPal is a well-known and familiar platform for sending and receiving payments for users, whereas Stripe is good for bulk payment processing and is used by businesses when there is a high sales volume.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.