Banking and finance are the fueling power of today’s generation.

Whether it is related to loans, credit card services, or other financial aid, or simple banking operations such as maintaining an account, checking available funds, transferring/receiving money, people are always looking for ways to improve their banking and financial experience.

If we talk about traditional banking, they offer different benefits and an expanded reach through branches that can be reached by the user at a convenient time.

However, when things go online, it can be difficult to give the same experience, especially to customers who are a part of a specific branch.

Well, that is where core banking comes into play. Don’t know what core banking is? No worries, as in this post, we have covered everything you need to know about core banking, from how it works to what features it offers. So make sure you read this one till the end.

Without further ado, let us begin by breaking down the concept of core banking!

What is Core Banking?

Core banking refers to the centralized system of a bank that allows easy management of essential operations for any bank.

It is often called the hub of all the operations and processes, as it is a backend system that supports all the banking functions from a single integrated system.

Sometimes the CORE in core banking is also referred to as Centralized Online Realtime Environment, which suggests that this backend is built to create a uniform experience for online users in real-time, irrespective of where they are and which branch their account was opened in.

It allows users to see bank services as a whole and offers more flexibility in terms of user experience, accessing their accounts, carrying out transactions, and more.

There are two types of Core Banking Solutions used worldwide –

- On-Premise Solution

- Cloud-Based Solution

While the on-premises solution works on a locally hosted infrastructure, the Cloud-Based Solution is directly available to be accessed from anywhere in the world. One has a one-time implementation cost while the other offers a pay-per-use basis.

How Does Core Banking Work?

Core banking is a system that comprises several backend components that handle the daily banking operations in such a way that the front-end operations appear seamless to the user, making it a great experience for the customers.

The idea of a Core Banking System implies that the entire banking system is run from a single place, irrespective of how many branches the bank caters to.

This also means that the location of the customer hardly matters, and they can easily use all the banking operations from anywhere across the world (in the regions where the bank offers its services).

To understand how Core Banking Systems function, let us take an example of an ATM transaction –

- Step 1 – A user initiates a transaction on an ATM at a remote location.

- Step 2 – The machine registers the request and sends it to the Core Banking System.

- Step 3 – The request is processed directly from the backend, rather than the ATM.

- Step 4 – Once the signal is received by the ATM, the request is processed, and money is dispensed.

Sure, if the ATM is out of service, it will not even ping the Core Banking System, however, any banking-related transaction can only go through when the system allows. This example establishes that the Core Banking System is the main brain behind every banking operation that you want to get done.

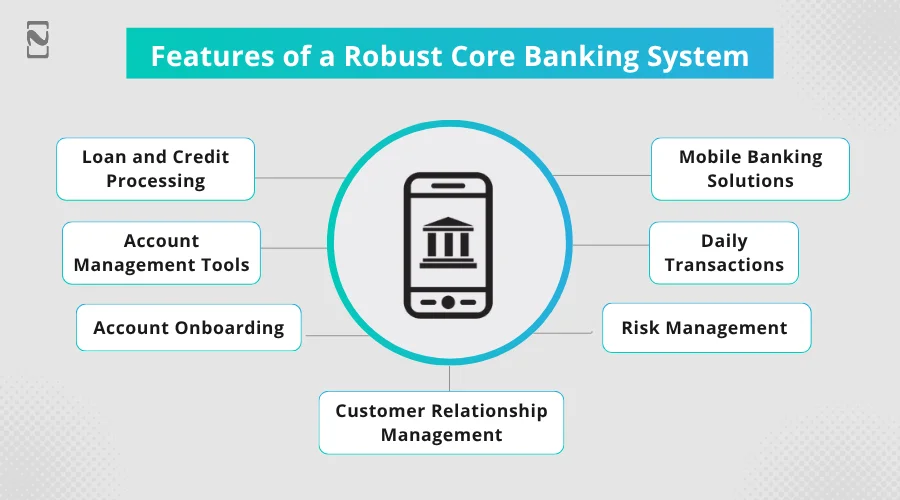

Features of a Robust Core Banking System

Any Core Banking System makes the entire functioning of your financial system centralized by taking charge of all the processes. It has certain properties and features that allow it to be more in control without compromising the performance and efficiency of your banking services.

To give you more clarity on what a Core Banking System does and what it offers to a financial institution.

Let’s take a look at some of the features that it offers.

- Loan and Credit Processing

- Mobile Banking Solutions

- Account Management Tools

- Daily Transactions

- Account Onboarding

- Customer Relationship Management

- Risk Management

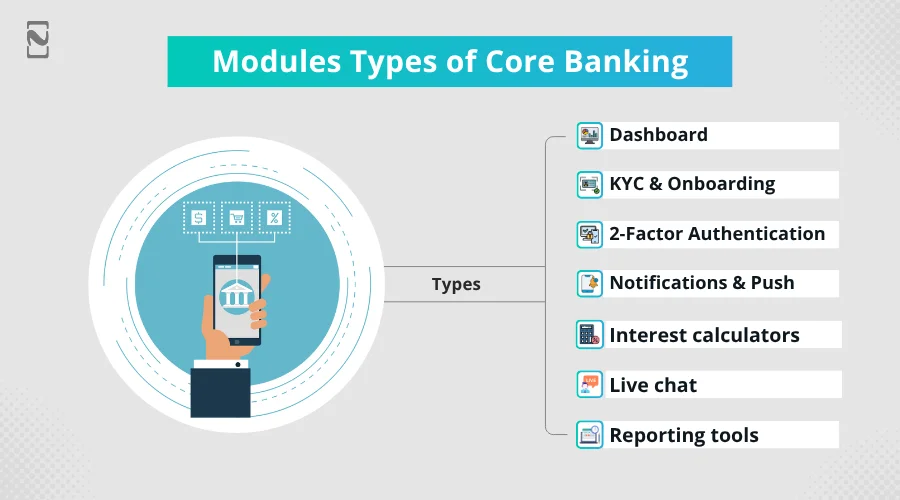

If we talk about the functionalities that a Core Banking System offers, they include all types of modules such as –

- Dashboard

- KYC & Onboarding

- 2-Factor Authentication

- Notifications & Push

- Interest calculators

- Live chat

- Reporting tools

All these features capture the essence of a complete financial institution, making the entire system responsible for managing the bank from the backend.

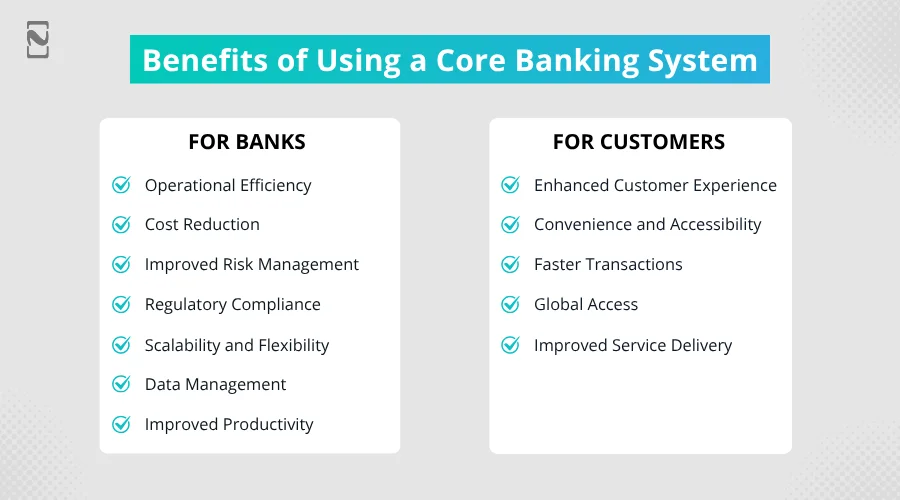

Benefits of Using a Core Banking System

These features make it clear that for any financial organization to be more streamlined, it will need a dedicated Core Banking system.

However, that is not the only reason why banks go for core banking. Several advantages come along with the implementation of Core Banking.

The best part is that the benefits are for both banks and their customers.

Check out the benefits that Core Banking offers below-

► For Banks

- Operational Efficiency: Makes planning and execution easier for any bank.

- Cost Reduction: Since all the processing is done via a single centralized system, the cost of execution for any bank is significantly reduced.

- Enhanced Security: Core Banking Systems uses advanced authentication and encryption techniques to keep all your operations secure.

- Improved Risk Management: A Core Banking Solution serves as the brain of the entire banking system. Once the brain is secure, the risks are significantly reduced, making it easier to manage at times of distress.

- Regulatory Compliance: A centralized system ensures that all compliance requirements are met, and once everything is resolved on the regulatory front in the Core Banking System, all the branches are automatically compliant.

- Scalability and Flexibility: The system is highly scalable, as all you need to do is expand the resources that power it. You can easily maintain the solution from anywhere, which enhances its usability and flexibility.

- Data Management: The Core banking system helps in managing the system data and keeps it streamlined for ease of access.

- Improved Productivity: The connectivity between multiple branches is improved as a centralized system reduces the time taken to confirm transactions. With all that time saved, the productivity of the bank is increased.

► For Customers

- Enhanced Customer Experience: Users can witness real-time transactions and instant settlements, which enhances the customer experience.

- Convenience and Accessibility: The flexibility of users making transactions from any branch and easily accessing funds from anywhere in the world makes a core banking solution more and more accessible and convenient.

- Faster Transactions: Routine operations such as deposits, withdrawals, balance checks, etc., are made significantly faster with a Core Banking System.

- Global Access: The application can be accessed from anywhere, allowing customers to be more closely connected with their banking services.

- Improved Service Delivery: Banking app features that users love, such as mobile banking, ATM, and Internet banking.

Benefits make it clear that implementing a core banking solution is worth the effort. But the real question that arises here is, what does it take to implement a core banking solution for your bank?

Check out the next section to find out more about the steps involved in implementing a Core Banking System.

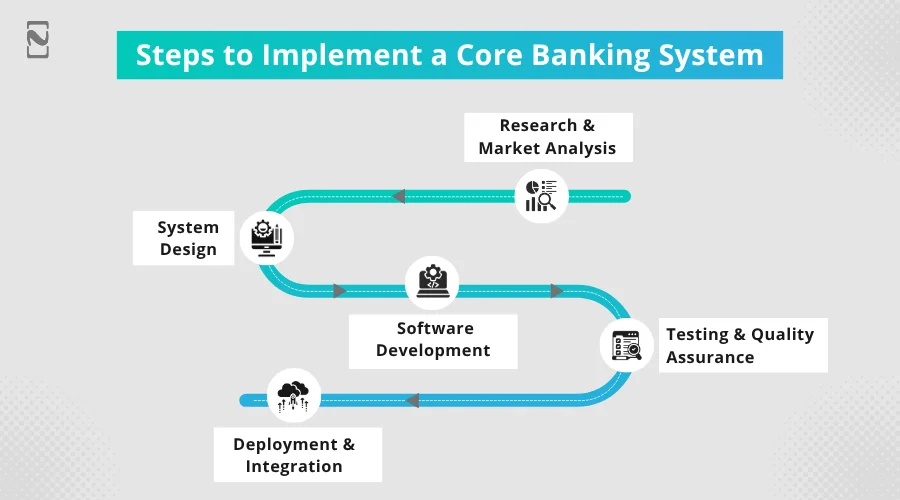

Steps to Implement a Core Banking System

The Core Banking System, as you already know, is the driving force behind every banking institution. Hence, implementing it properly is a must.

To ensure that there are no anomalies in the execution of the system, you need to hire professional developers who can get the job done for you.

Secondly, you need a roadmap, a series of steps that can lead you towards a well-defined Core Banking System.

Here are the steps that are generally followed by professionals –

-

Research & Market Analysis

Before starting the implementation, gather as much information as you can about Core Banking Systems. Identify how the existing systems work, what they offer, and where they lack. Identify all the gaps in the market and accordingly start with the process.

-

System Design

For any centralized system to be efficient and effective, it needs to be designed well. When building a Core Banking System, make sure that you design it properly.

Keep your functionalities in mind and identify the features that you want in your Core Banking System. Based on aesthetics and how you want all the features to be integrated, finish the system design.

-

Software Development

Once the design is established, it is time to bring all the marked functionalities and features to life. Use the technology that you have chosen as the Core Banking System tech stack and start developing the functionalities. These steps might take a bit longer, as this is the step where your system is made.

-

Testing & Quality Assurance

After the development phase, your core banking solution has already been developed. However, it is not yet ready to be pushed out to the public as it needs to be more and more refined for users to find it helpful.

The built application is tested thoroughly after subjecting it to all types of use cases to ensure that the app can withstand all types of user commands without crashing or glitching.

-

Deployment & Integration

After quality assurance is over, the build is ready for deployment. You can start using it with your bank services.

With all the necessary integrations to keep track of all the branches and operations related to them, you can start using the core banking solution that has been developed after all the steps.

Other than these, training and support are ongoing, where you teach your employees to operate the system, and a team of support executives is always on standby to guide you whenever you get stuck.

To execute all these steps properly, you need professional assistance and need to ensure that there are no loopholes left in the implementation. It can be difficult to find an expert

Nimble AppGenie: Your One-Stop Solution for All Banking Needs

If you are planning to go for a Core Banking System, Nimble AppGenie can offer some of the finest banking software development services to get the job done.

With years of experience and some of the best professionals to execute your vision, we can help you build a Core Banking System that not only streamlines the entire banking operations but also ensures that it is centralized and efficient.

You can also make the most out of a Core Banking System by customizing it as per your requirements with our custom app development services.

The entire idea of building a Core Banking System makes it easier for you to manage all the branches of your bank from a single management tool.

Connect with our experts today, and we will be more than happy to assist you with Core Banking System development.

Conclusion

Having a Core Banking System not only improves the performance of your banking business but also strengthens your network of branches.

It is also secure and highly efficient when it comes to offering banking services. Core banking systems ensure that every major and minor process related to banking goes through them. It is the centralized banking system that powers all your operations.

Hence, it only makes sense that you understand everything about it before investing in it. Hopefully, this post gives you enough insights into Core Banking Systems as a whole.

If you have any doubts or plan to get one built for your banking venture, feel free to connect with our experts.

That will be all for this one. Thanks for reading, good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.