In this day and age, consumers want their payment experience to not only be secure, but also hands-free and effortless.

So they are shifting from cash and cards to taps and now voice commands. Voice payments in FinTech meet the surging demands for convenience, speed, and accessibility.

By 2025, the voice-based payments market valuation will increase, reaching $10.94 billion at a compound annual growth rate (CAGR) of 16.2%, up from $9.42 billion as recorded in 2024.

Voice payment technology leverages the potential of Artificial Intelligence (AI), Natural Language Processing (NLP), and the Internet of Things (IoT) to empower users to speak to pay, reshaping the way they interact with banking and commerce.

The giants ruling the world of smart devices and voice assistants such as Alexa, Google Assistant and Siri, making transactions even smoother and accessible.

As Fintech is advancing consistently, voice payment app development is becoming a major fintech trend, helping users to boost user engagement, enhance security, and lead the pack in the fierce digital economy.

Before you move ahead with a development plan for a voice recognition payment app or a voice-enabled payment system, you should know the ropes of voice payment technology, how it works, real-world examples, voice payment trends, and how you can reap the rewards of fintech voice payment solutions in your business.

Let’s get started!

What are Voice Payments?

Voice Payments in FinTech is a groundbreaking digital payment method, utilizing which users complete their transactions just by giving simple voice commands, without entering any details manually or touching a screen at all.

When integrated with Artificial Intelligence (AI), secure authentication technologies, and voice recognition, FinTech voice payment solutions enable frictionless and safe financial interactions.

Top Use Cases of Voice Payments

- In-app purchases and eCommerce transactions

- Money transfers between accounts or users

- Bill payments and mobile recharges

- Smart device transactions, like ordering groceries through voice assistants

How Does Voice Payment Technology Work?

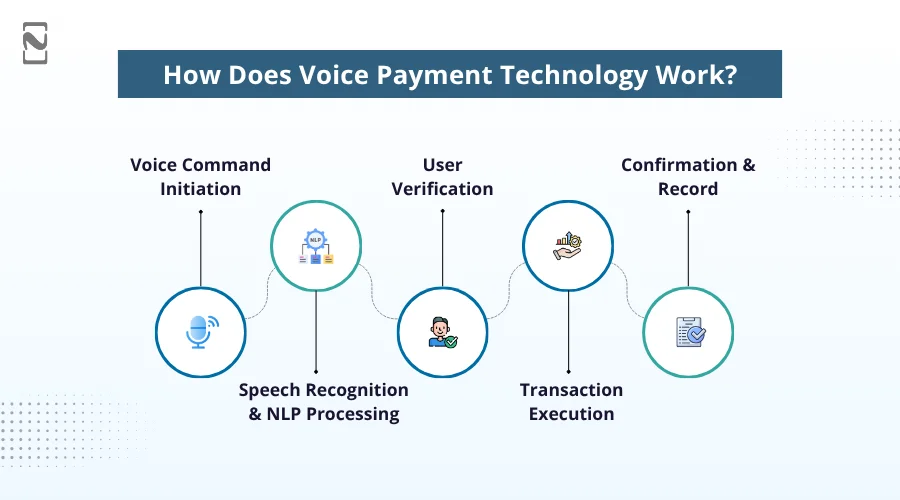

Below are a few steps stating the working of voice payment technology:

-

Voice Command Initiation

Initially, the user activates a voice assistant and gives a payment command, like “Pay $10 to Whataburger” or “Transfer $250 to my savings account”.

-

Speech Recognition & NLP Processing

The system utilizes speech-to-text conversion and Natural Language Processing (NLP) to come up with the user’s intent and transaction details accurately.

-

User Verification

The voice-enabled payment system conducts identity verification through different modes, such as multi-factor authentication, PIN, and voice biometrics.

In addition, voice biometrics scans the speakers’ unique traits, such as pitch, tone, and rhythm, to authenticate their identity.

-

Transaction Execution

On successful verification and secure voice authentication, the digital wallet API or payment gateway integrated with the system processes the transaction in real time.

-

Confirmation & Record

In turn, the user receives a visual or voice confirmation on their device, ensuring security and transparency in all the transactions.

Thus, seamless integration of AI-powered intelligence and advanced encryption leads to fast and secure voice payments that enable users to complete their digital transactions anytime, anywhere.

Key Benefits of Voice Payments

Voice payment technology adoption brings distinct advantages.

Let’s check out the benefits of voice-enabled payments in FinTech.

1. Hands-Free Convenience

As we read above, users don’t have to put extra effort into typing the details or even touch a device.

Therefore, voice payment is perfect for on-the-go situations, hands-free transactions, or multitasking.

Just a single command from the users’ side, and witness the transactions done in seconds.

2. Enhanced Accessibility

Voice payments ease financial services accessibility, especially for the specially-abled, elderly, and visually impaired users who struggle navigating traditional payment interfaces.

3. Faster and More Efficient Transactions

Reduced transaction time is one of the top factors making users adopt FinTech voice payment solutions.

It reduces multiple manual steps and streamlines the complete payment experience.

4. Personalized User Experience

AI-powered, smart payment solutions analyze user preferences and behavior and accordingly enable contextual payment options and personalized suggestions, boosting satisfaction and engagement.

5. Improved Security Through Voice Biometrics

Through biometric authentication and voice recognition, voice payments verify the speaker’s specific vocal patterns and minimize unauthorized access and fraud risks, making transactions more secure.

6. Brand Differentiation and Innovation

Digital transformation in Fintech demands brands to stay competitive and integrate voice payment technology in their businesses, so voice payment technology integration differentiates them.

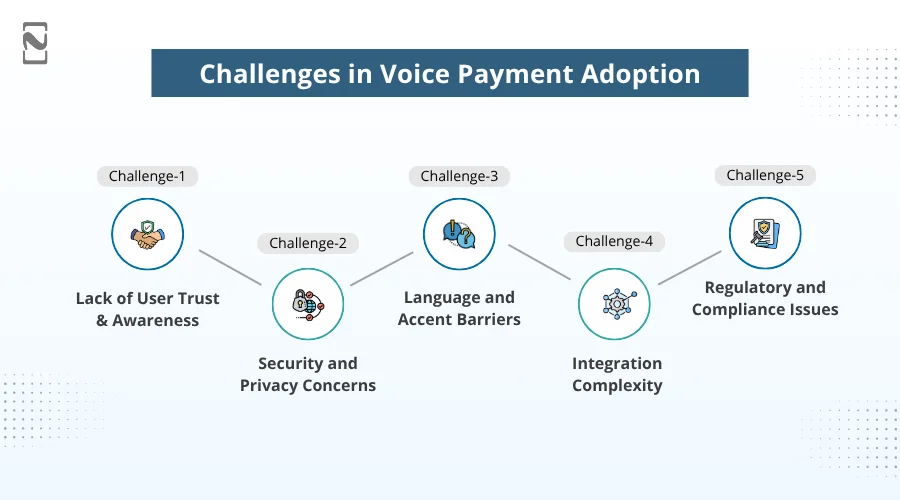

Challenges in Voice Payment Adoption

Until now, we have learned that voice payments hold immense potential. But, do you know, it becomes tough for enthusiasts to deal with its technical and security-relevant aspects.

Challenges in implementing voice payments are one of the major concerns.

Therefore, as a business owner or developer, you should effectively implement voice-enabled payment systems, considering the following factors.

1. Lack of User Trust and Awareness

Many users remain suspicious when they are introduced to voice commands, specifically for financial operations.

Consistent education, demonstrations, and transparency of security standards can help foster consumer confidence.

2. Security and Privacy Concerns

Obviously, users will be hesitant to believe in voice-based transactions if it’s exposed to the risk of data breaches, voice spoofing, and unauthorized access.

Voice data, which can be any biometric information, should be safely stored and processed in the device.

Furthermore, multi-layer authentication and advanced encryption implementation ensure safety.

3. Language and Accent Barriers

Inaccurate interpretation by your system will surely result in failed transactions or a poor user experience.

If you are serving multicultural or global user base, your FinTech voice payment solutions should precisely interpret varied languages, dialects, and accents.

4. Integration Complexity

How to integrate voice payments into mobile apps?

However, it can be technically tough to integrate voice payment solutions with your existing payment gateways, Fintech APIs, and digital wallets.

You should hire mobile app developers who have proficiency in AI, NLP, and FinTech infrastructure. Thereby, you can attain seamless interoperability.

5. Regulatory and Compliance Issues

Voice payments require meticulous legal adherence as they involve different data handling layers.

FinTech solutions should be compliant with financial compliance standards (like GDPR, PCI DSS, etc.) and regional data protection.

Future Trends in Voice Payment Technology

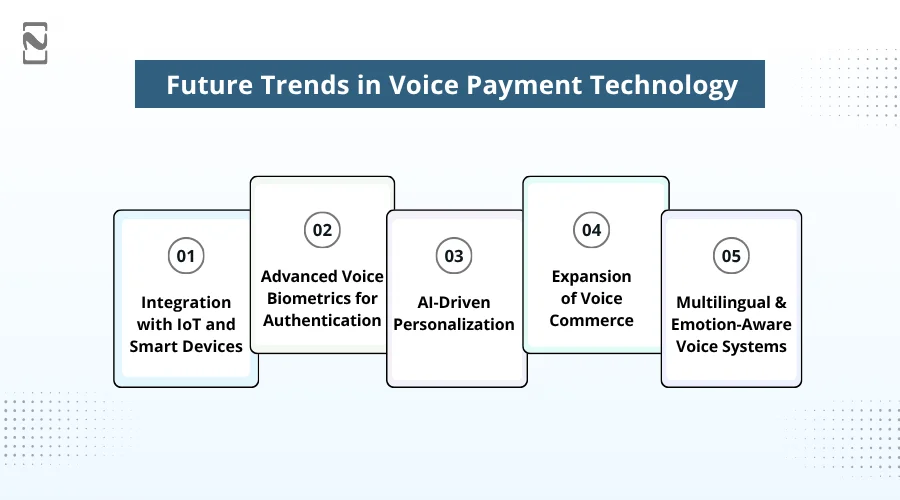

The future of digital payments is bright, and you are going to witness numerous innovations reshaping it.

With the continuous innovation of biometric technologies, NLP in payments, and AI, voice payments technology is on its way to becoming the chief mode of digital transactions.

Future trends in voice payment systems include:

1. Integration with IoT and Smart Devices

Soon, we will see voice payments embedded into wearables, IoT-enabled home devices, and smart cars.

Just imagine, you are paying for groceries and fuel only by speaking to your smart speaker or car. Isn’t it dreamy?

2. Advanced Voice Biometrics for Authentication

By analyzing vocal attributes like rhythm, tone, and pitch variations, next-gen voice biometrics will boost security.

So forth, users can get a safer transaction ecosystem with rapid fraud detection and ultimate accuracy.

3. AI-Driven Personalization

The role of AI in Fintech will empower voice payment systems to give a hyper-personalized financial experience. How?

Well, the voice-enabled payment system learn user preferences, to send them reminders automatically, suggest payment options, and personalize offers, thus enabling context-aware transactions.

4. Expansion of Voice Commerce

Shortly, FinTech solutions providers and eCommerce platforms are likely to welcome new opportunities by strengthening their voice assistants with voice commerce technology that helps with shopping and paying via voice.

5. Multilingual and Emotion-Aware Voice Systems

FinTech voice payment solutions will enable smoother interactions and boost adoption across global markets, supporting several dialects, languages, and emotional tones. As the FinTech market continues to expand rapidly, voice-enabled technologies are set to play a crucial role in enhancing accessibility and personalization across diverse regions.

Real-World Examples of Voice Payments

Voice payment technology is modernizing the way people shop and transact.

While casting a glance around, you will notice that various global tech giants and startups are already elevating customer convenience and engagement, integrating voice-enabled payment systems in their businesses.

Let’s discuss some major ones:

1. Alexa Pay

Alexa Pay by Amazon permits users to purchase and pay bills just by leveraging the caliber of voice commands.

Users can link Alexa with their Amazon account or any supported payment card to instantly complete their transactions, just by saying, “Alexa, pay for my purchase from Myntra.”

2. Google Assistant Payments

Payment functionality integration with Google Assistant allows users to pay for services, purchase items, or send money via voice.

It utilizes Google Pay’s multi-factor authentication and secure infrastructure for seamless and safe transactions.

3. PayPal Voice Integration

By partnering with voice assistants like Siri, PayPal now permits users to request and send money through voice commands.

Commands such as “Hey Siri, request $50 from Alex via PayPal” make regular payments effortless and quick.

Why Choose Nimble AppGenie for Voice Payment App Development

We read about the ruling platforms that made voice-powered payments widespread, leading the way for more secure and advanced voice payment app development in the FinTech industry.

With the growing demand for AI-powered payment solutions, businesses should collaborate with a development partner to build FinTech voice payment solutions.

Nimble AppGenie outshines its competitors as a reliable partner, a FinTech app development company that combines the power of innovation, technical proficiency, and compliance to build intelligent payment solutions.

Key Highlights of the Voice Payment App Development Company You Should Consider

- Expertise in FinTech and AI Integration

- Proven FinTech Development Experience

- Focus on Security and Compliance

- End-to-End Development Support

- Custom, Scalable Solutions

Looking to integrate voice-enabled payments into your FinTech app, or need to know the cost of developing a voice payment app? Nimble AppGenie can help you develop AI-powered solutions tailored to your business needs.

Conclusion

Reaping the benefits of AI, NLP, and voice biometrics, voice payment technology, a contactless payment innovation, is coming to the surface with faster and smarter digital transactions.

By shifting to voice payments, FinTechs, retailers, and service providers can capitalize on the expanding voice payment market and future-proof their payment solutions.

Being an expert in FinTech Solutions, secure payment systems, and AI integration, Nimble AppGenie helps global clientele utilize voice technology to stay abreast in the digital economy.

Ready to take the next step? Hire our voice payment app developers to build a scalable voice payment app that transforms the user experience and drives business growth.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.