The Fintech revolution has taken the market by leaps and bounds. Gone are the days when using financial services felt like a tedious job.

Today, everything from your basic account details to advanced loan processing and other banking services is available on your smartphone.

However, the shift from traditional banking to digital is certainly not an easy one.

One of the biggest challenges was getting rid of manual processes like assessing a customer’s financial habits, generating new offers, and taking care of the paper trail.

While digital documents have certainly played a role in simplifying the process, another technology has made this digital transformation simple, i.e., Machine Learning.

With the help of machine learning algorithms, banks today are able to deploy services better, without worrying about potential risks.

But how does it all happen? How has a single technology created an impact that big? Well, that is exactly what we are going to understand through this post.

In this one, let us take a look at the uses of machine learning in banking and understand its role in revolutionizing the financial services industry.

We will also try and identify how an existing banking app or a new banking app can integrate machine learning into their operations for a better experience.

Without further ado, let’s get started!

Adoption of ML in Banking: Stats & Market Trends

Before we jump into the intricacies of how ML in banking works and what it does for the consumer, let’s first understand the role that the technology plays in the market today.

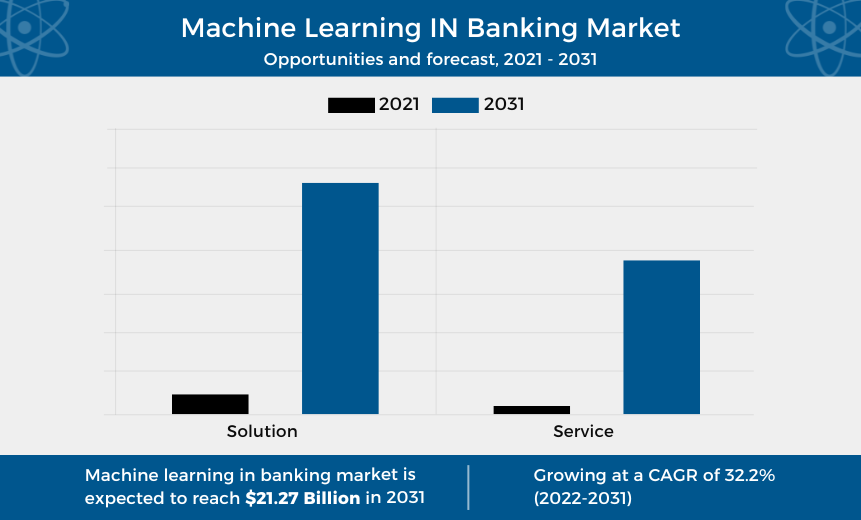

The market for machine learning technology in banking was evaluated back in 2021 to be at $1.33 billion, and is expected to touch a whopping $21.27 billion by 2031 with a CAGR of 32.2%.

This stat gives you a clear picture of how fast the adoption of ML is growing in the banking sector.

However, what’s more crucial to know is that ML can be a lot more effective when combined with artificial intelligence.

The adoption of machine learning has increased rapidly with the introduction of AI in fintech.

The impact is so high that the growth trajectory of ML in the market shows a 50.37% boost in the overall search interest of the users.

The technology has also seen a whopping 155.28% funding growth in the past 5 years, showing that the technology certainly has investment potential, also referring to the overall opportunities that one might expect to come with implementing ML in their banking setup.

Another key trend that has been pushing the use of ML is the reduction of overall operational costs in banking.

With the implementation of ML in the banking sector, one can easily save money on manual processes through automation.

Use Cases of Machine Learning in Banking

Some of the biggest challenges in banking have been addressed with the implementation of machine learning.

The banking sector has consistently faced challenges in assessing a user’s creditworthiness, risk assessment, and personalizing the user experience.

With the help of machine learning, these issues can be easily resolved.

How? Well, there are several use cases that the implementation of ML brings along.

These include –

► Risk Mitigation & Management

The first thing that machine learning helps with is risk management in various banking scenarios.

You see, banking involves a lot of financial risks, considering unknown individuals are involved in the exchange of funds and bonds.

The first risk that banks must minimize when establishing a relationship with a client is identifying the credit risk associated with them.

Here are the possible risks ML can help you mitigate-

- Identifying factors like how the applicant has behaved with past loans and their utilization of the credit limit assigned to them helps in understanding their creditworthiness and whether they are a good prospect for lending funds.

- The current banking market is highly volatile, which means several potential fluctuations must be predicted in terms of asset prices, or else it can cause serious losses and unintended interest rate changes.

- Use of ML also helps in understanding the user patterns and takes care of the current operations to ensure that they are always in line with the current compliance and regulatory requirements. This helps in reducing the risk of a bank becoming non-compliant, which can have its own downsides.

► Fraud Detection

One of the key aspects that makes machine learning a technology of the future is that it is highly dynamic and works in real-time.

One of the best use cases of the technology is in fraud detection, as it can monitor the operations and highlight any anomalies that a regular system may not be able to detect.

Some of the ways machine learning helps in fraud detection when used in banking software include-

- If a customer who doesn’t usually use their bank account for a large transaction suddenly transfers a large amount to someone else, ML can detect this and ask for a second-step verification before completing the transaction. This is the power of ML’s real-time monitoring as it understands the pattern and gets active as soon as something unusual takes place.

- When we talk about fraudulent activities, it is surprising how the fraudsters always keep changing their tactics and come up with new ways to execute an attack. Machine Learning makes your security ready to identify these issues and change your security measures as per the evolving techniques of the attackers.

- With the deployment of machine learning algorithms, you can improve the onboarding process, as it uses computer vision to verify the biometric authentication information of the user. This means that the identification of the user is faster, and hence, they can get into your application faster.

► Personalized Customer Experience

Personalization is all the buzz these days. Even with banking, users only want to interact with offers and services that are made especially for them and fulfill their requirements.

You might have seen dedicated credit cards, bank offers on bookings, and special interest rates on loan products.

It is all a result of machine learning, as it allows the bank to understand the usage and craft offers that a user might grab.

Here’s how personalization powered by ML is being used in banking –

- The first use case of ML in personalization is the virtual assistant that is made available to the customer through a banking app. With the help of NLP combined with ML, customers can get personalized answers to their questions, and that too anytime!

- Personalization also helps the bank identify the interests of the user and whether they might leave the bank or shift their banking to another option. This is also when you can generate more enticing offers to make them stay your customers.

- Another interesting way banks can utilize personalization introduced by ML is by observing user behavior to add new features to the banking application. Without user feedback, there’s no point in updating the application.

Other than this, ML in banking is being used to power robotic process automation and efficient document management.

Generally, machine learning is used in combination with AI in banking, as it enhances the impact of the technology for the betterment of the user experience.

However, the question that arises after identifying these use cases is how one implements machine learning into banking.

Well, check out the next section where we have discussed steps that can help you integrate ML and make the most out of it.

How to Implement Machine Learning in Banking?

Integrating machine learning in banking can be an intricate process, considering that your current platform should be open to this integration.

There are a series of steps that can help you implement AI into your banking services.

These steps include –

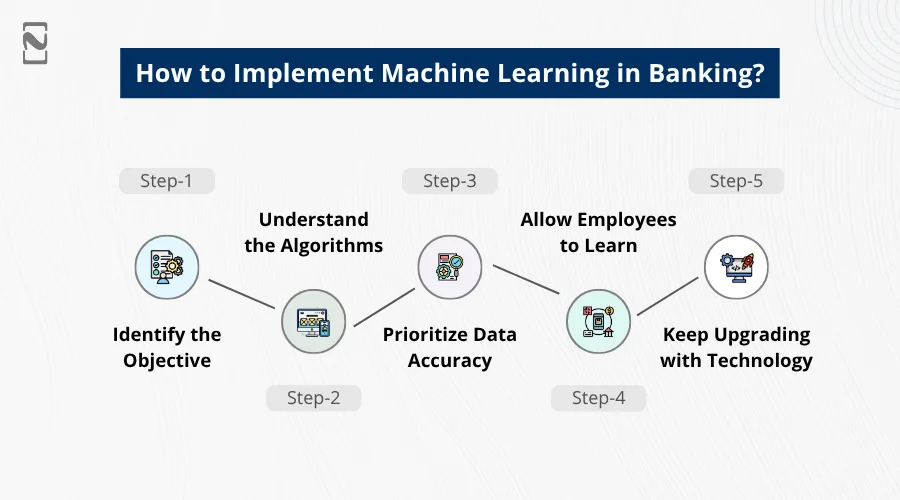

Step 1 – Identify the Objective

The first thing you should do is identify why exactly you want to implement ML in your system.

What is the objective of this step? Is it to improve automation? That is because if you have clarity of your objective, you can plan the implementation better.

Step 2 – Understand the Algorithms

Take a closer look at the different algorithms that you can use and understand them so that you can deploy them in your banking solution more efficiently.

Algorithms such as Decision Trees, Random Forest, Support Vector Machines, Neural Networks, Naive Bayes, Anomaly Detection, etc., are a few types that you should consider implementing.

Step 3 – Prioritize Data Accuracy

All the Machine Learning algorithms require loads and loads of data to run and learn. Hence, you must ensure that the data you feed your algorithm is accurate.

Take care of the data accuracy, only yield data that is from a reliable source, and ensure that the data is available in bulk.

Step 4 – Allow Employees to Learn

If you think machine learning is something new for your users, you must consider that it is also new for your employees.

Hence, let them explore the features that are added with the implementation of ML into your banking solution. This way, they will be able to adapt and deploy the services better.

Step 5 – Keep Upgrading with Technology

Lastly, to make sure that ML is implemented properly and is yielding the best results, make sure you keep upgrading your existing technology.

Find the right tools to complement your existing solution and adapt technologies like AI, IoT, Blockchain & more for a more efficient banking ecosystem.

With the help of these steps, you will be able to implement ML into your banking systems. Keep in mind that as much as ML helps you improve the experience for the users, it also helps your internal systems to be more efficient and productive.

Hence, the benefits of implementing ML into your business are endless.

However, that never means that there are no limitations when trying to implement ML into your banking business.

In the next section, let us try and identify both the benefits and limitations of implementing ML in banking.

Benefits & Drawbacks of Using Machine Learning in Banking

Let’s start with the benefits first.

As the use cases clearly indicate, your banking system becomes more efficient, risk-free, and future-ready. Several benefits come with the integration of machine learning.

These benefits include –

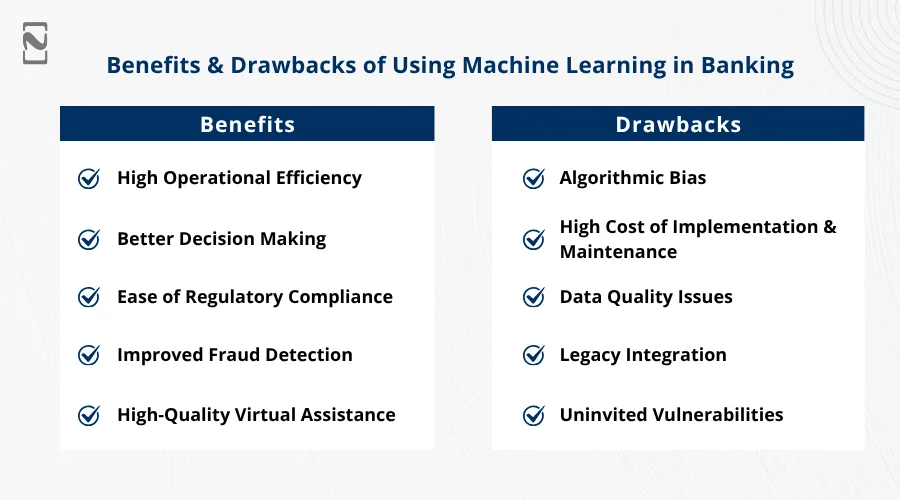

Benefits

- High Operational Efficiency

- Better Decision Making

- Ease of Regulatory Compliance

- Improved Fraud Detection

- High-Quality Virtual Assistance

With the benefits out of the way, let’s take a look at the drawbacks of implementing ML in banking –

Drawbacks

- Algorithmic Bias

- High Cost of Implementation & Maintenance

- Data Quality Issues

- Legacy Integration

- Uninvited Vulnerabilities

With all these benefits and drawbacks, implementing machine learning always seems like a tricky decision.

However, with proper experts overseeing the integration, you can easily make the most of the benefits and reduce the impact of drawbacks.

If you are wondering where to find the right experts, do not worry, as we might have just the solution you are looking for.

Check out the next section to find out more!

Nimble AppGenie: Your Partner for Integrating Machine Learning in Banking

Implementing machine learning in any banking solution requires a lot of hands-on experience and understanding of how the features can be designed.

Not every individual can help you achieve the best results with machine learning, as it is relatively new and more challenging than traditional API integrations.

Hence, hiring a banking software development professional is just not enough.

What you need is an ML specialist who understands development and can break down the scenarios where you can use machine learning to boost the operational efficiency of the banking solution that you plan to design.

With decades of experience and hands-on understanding of machine learning implementation in the banking sector, our developers are well-equipped to handle your requirements and offer you a hassle-free ML experience.

If you are looking for ways to implement ML into your business, Nimble AppGenie is the right choice! Reach out today.

Conclusion

Machine learning is a great technology to embed into a banking system, provided it is done correctly.

With the rise in adoption and the growth in the market, it is clear that banks are moving towards implementing ML and AI into their system and are getting the results as expected.

Machine Learning, over the past few years, has proven to be highly effective and has found its way into various sectors of banking operations.

Not only does ML help in automation, but it also helps in making the banking experience secure.

If you plan to integrate ML in your banking solution, then you must complete a series of steps. However, an inexperienced team can’t implement ML properly.

Hence, reaching out to experts at Nimble AppGenie can be a vital option!

With that said, we have reached the end of this post. Hope the information shared in this one comes in handy for you! Thanks for reading, good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.