Insurance has become an integral part of every society. People today are opting for insurance plans more than ever, thanks to the improved awareness about this.

While there was a time when people from tier 2 and 3 cities used to think of it as an added expense, today everyone is more aware of the product and understands the protection that an insurance policy offers them.

This awareness and openness about the market have also been reflected in the global insurance market. People from all walks of life are looking for a convenient way to get a hassle-free insurance experience, and to cater to their demands, several insurance apps have emerged.

With the emergence of these mobile insurance applications, getting a plan or renewing your existing plan has certainly become simpler. And with simplification, the insurance app market has gone through the roof.

In this post, let us take a look at some of the assuring global insurance market statistics and identify the key growth opportunities.

Key Market Stats for the Global Insurance Industry

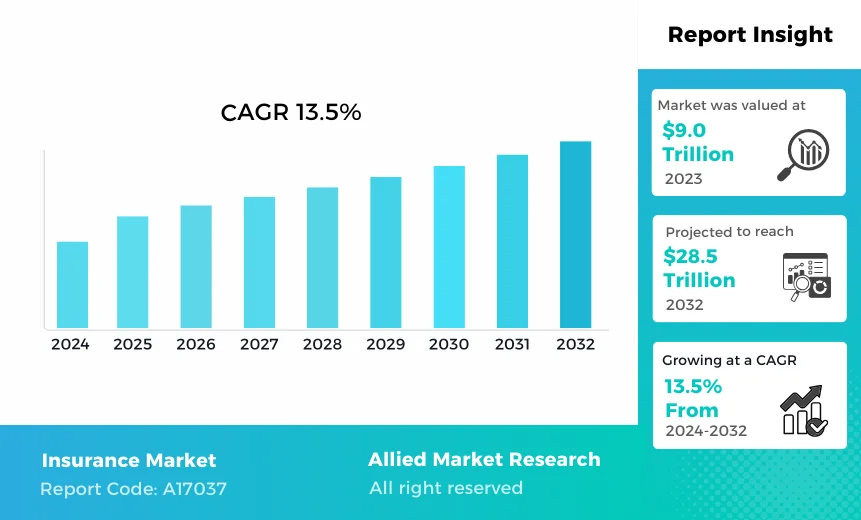

If we talk about the global insurance market, it is certainly a promising field. Valued at $9 trillion in 2024, the market is on a growth trajectory estimated to touch $28.5 trillion by 2032 with a CAGR of 13.5%.

The stats indicate how the market is turning into a lucrative opportunity, especially in the digital space, considering insurance app development has also gained immense popularity.

Today, almost every niche, be it automobile insurance, health insurance, property insurance, or even the most basic term insurance, has its applications, allowing the masses to access them as they see fit. This has led to a lot of money coming into the insurance industry in the form of premiums and assets held.

Here are some statistics that will give you an idea of how the global fintech market is generating billions of dollars in revenue each year.

- The global premium pool (2024) is €7.0 trillion (~USD 7.8T). The industry added about €557 billion of premiums in 2024, a standout year of growth.

- Global premiums (USD basis, 2024) USD 7.8 trillion (reporting range ~USD 7.8T). Swiss Re and other trackers put 2024 global premiums near USD 7.8–7.8T (nominal).

- Total assets held by insurers are USD 40 trillion (end-2023/2024 reporting). Insurers’ aggregate assets were reported at about $40T, underscoring the sector’s scale as a global institutional investor.

- Industry profitability (ROE) is 10% in 2024 10.7% forecast for 2025. Industry outlooks project ROE rising from roughly 10% (2024) to about 10.7% (2025) as underwriting and investment conditions improve.

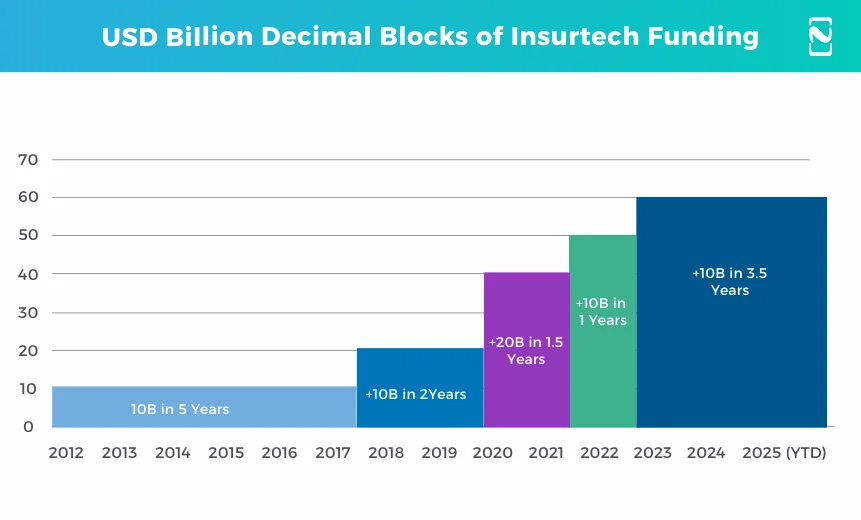

- InsurTech funding & investment (2024–Q2 2025): funding recovered variably — quarterly InsurTech funding was $1.1B in Q2 2025 (Q-on-Q dips and volatility remain). AI-focused deals captured a large share of investment in recent quarters.

Through all these stats, it is clear that insurance apps are on a steady path of growth, making it a much lucrative industry in the long run. Let’s dig a bit deeper and identify insurance industry stats based on the segments that are available in the insurance realm.

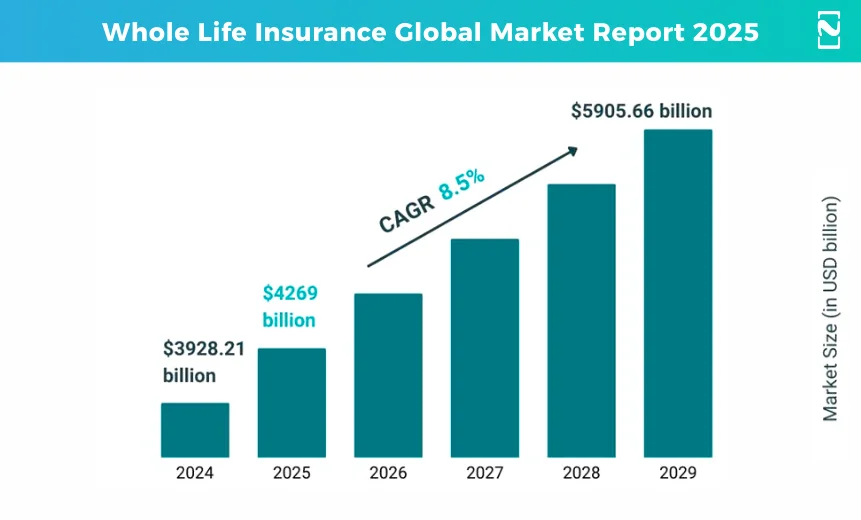

You see, one of the core reasons behind this growth is the fact that people today are interested in using insurance products other than life insurance. For a long time, life insurance has been the largest segment of the global insurance market where 50-60 percent of the market accounted for the same.

However, in the past few years, this has changed, and more users have explored the non-life insurance verticals of the service. This change first appeared in the market in 2017, where the non-life insurance captured 53% of the market.

Types of Insurance and How They Have Grown Over the Years

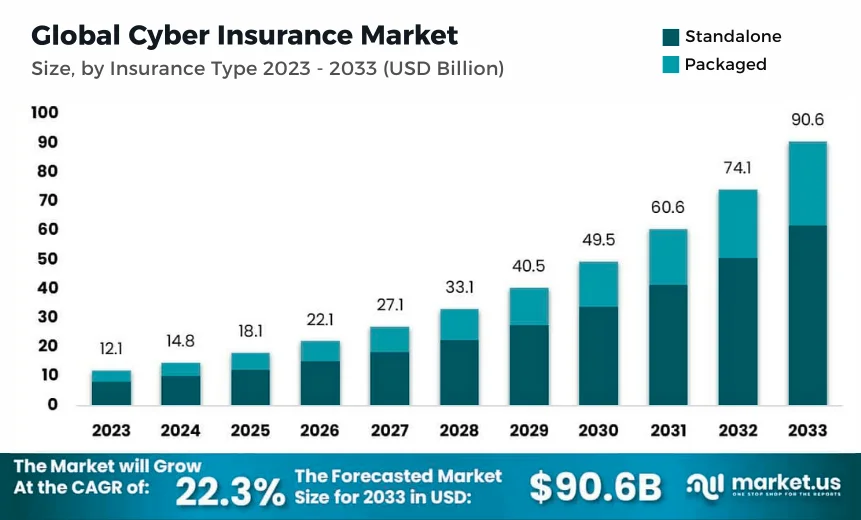

- The cyber insurance market is another emerging market, on its way to touch $22.5 billion by the end of 2025.

- The life-insurance market is again set to see steady growth, thanks to higher interest rates and a comparatively older (aging) world population.

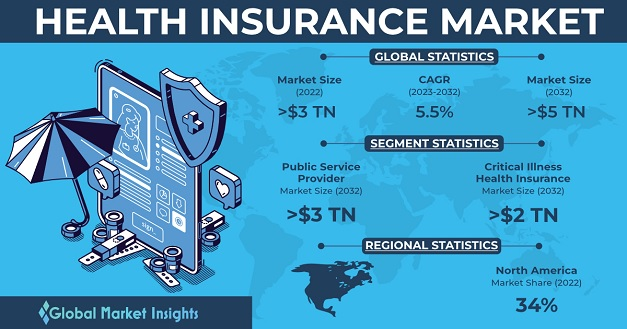

- The health insurance market is also picking up the pace, especially in markets like the US. This is due to high demand and less insurance penetration.

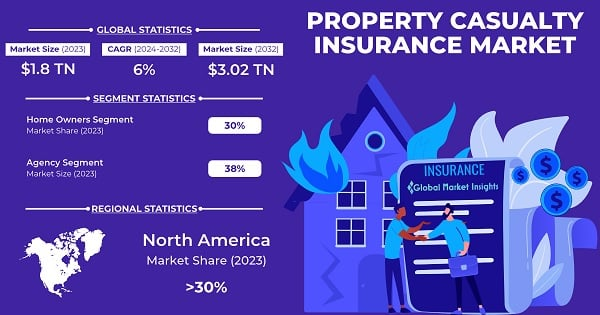

- The property and casualty, P&C Insurance, is the second largest segment with $2.66 trillion in premiums in 2024 alone.

With all these stats backing the insurance market, one can surely consider entering the market with a solution of its own.

The stats indicate that the market is on the right track and can give you great returns if you plan to launch an insurance start-up of your own.

Not to mention, if you are already in the traditional insurance business, opening a digital outlet for the same can also be a great option, as it will expand your reach.

5 Insurance Industry Trends You Should Know Before Investing

Breaking down the stats helps you understand where the market is headed; however, what it holds next is something that can be identified through various fintech trends.

Let’s take a look at some different insurance industry trends, based on different classifications.

► Regional Trends

The global market is certainly contributing to the overall growth of the insurance market as economies are stabilizing in emerging nations.

If we talk about the market share, North America accounts for 33.03% of the global revenue of the insurance market. Asia is also catching up, as it is one of the fastest-growing regions and boasts the largest share of international life insurance premiums in the market.

Moving towards Europe, it has shown steady growth; however, it is trailing behind Asia in the life insurance market and is not even close to North America’s P&C market.

► Market Acceptance

The insurance industry is certainly a growing one. However, there are different types of players in the market. Market leaders or the established ones in the market include Allianz, UnitedHealth Group, and AXA.

While these organizations have been around for decades and have dominated the market for years, there are several startups that are emerging, too.

The market is certainly accepting even the latest members of the market as they offer more and more convenience to the users. All in all, the market acceptance has certainly grown due to trusted companies leading from the front.

► Technological Advancements

In the growth of the insurance industry as a whole, technology has played a pivotal role over the years. With digitisation, insurance services have become easily accessible to millions of users.

More importantly, it has eliminated the hassle from a user’s life, breaking down the wall of inconvenience and unawareness, which were the prime reasons why insurance, especially P&C services, were not popular.

With Artificial Intelligence in insurance and several other tools, one can only see these solutions being better with time.

► Digital Transformation & Ecosystems

Creation of policies, pricing, claim processing, and several other operations related to insurance can be easily executed through APIs.

Leveraging that, the advancements in cloud-native platforms for insurance can be seen, which further offer benefits such as quicker product launches, easier scaling, faster innovation, and more responsive platforms.

This trend certainly allows an insurance company to push more and reach the masses better and faster. Insurance digital ecosystems are a game-changer, considering you can easily enter into Insurance-as-a-Service (IaaS)

► Economic & Market Trends

The insurance market is certainly affected by several economic factors, including inflation, market volatility, increased competition, and so on.

When the cost of materials, labor, and healthcare increases, it directly impacts the premiums of customers, as the final bills that the insurers settle are also significantly high.

Not to mention the increased competition in the insurance market requires the current players to use analytics and data to make the best solution that meets the market requirements and fulfills the market gap.

Not only do these trends share the market situation in different regions, acceptance towards the companies, and the impact of technology, but they also give clarity on which region you can choose and what tech you should use to build an insurance app of your own.

With more and more people learning about the necessity of having an insurance policy, it is certainly the right time to enter the market.

Key Insurance Industry Market Insights to Help You Succeed

The insurance industry is a dynamic market that is certainly taking its course towards digital transformation.

The idea of building a business of your own in the insurance industry is something that can prove to be highly lucrative if you plan your steps correctly.

And planning your penetration requires you to have a deeper market understanding.

Here are some key insurance industry insights that you should refer to:

- In the beginning, the insurance services were created with a one-size-fits-all approach. However, today, insurers are more and more focused on custom-specific plans that address the preferences of the customer, making the entire service more customer-centric.

- Brokers and insurance agents have been key components of the insurance industry for ages. However, the approach of new businesses has changed. Today, businesses are working on the consolidation of operations in order to streamline the experience by leveraging technology.

- With the evolution of the risk landscape and the type of challenges that society faces today, the demand for different new insurance services is significantly growing. People are looking for cybersecurity insurance, parametric insurance, travel insurance, and more.

- While everything seems to be going the right way for entering the insurance market as an insurer, you must stay aware that the regulators are strictly focusing on your compliance and other areas, such as AI bias, risk disclosures, and data protection practices. Hence, it can be a challenge to meet all of them from the get-go.

Keep these insights in mind, and you will certainly be able to manage the execution accordingly. The global insurance industry market is not only evolving, but is also constantly looking for better ways to simplify the insurance experience.

The current insurance market is transforming with a primary focus on the user’s experience.

Nimble AppGenie: Helping Insurance Businesses Leverage Technology

Going through all the stats, trends, and insights so far, you might have understood where the market is headed. You might also have identified that the key to a solid insurance business in 2026 is technology.

The better the platform you can build, the wider the reach you get. Hence, you must partner with an insurance app development company to build a solution for yourself.

Nimble AppGenie is a leading name in building mobile insurance applications that not only give your business a digital front but also provide your customers with the best features and experience.

With years of experience and hands-on expertise, our developers are highly qualified to guide you through the entire development and deployment process. Start your insurance app today and become a part of this growing industry with Nimble AppGenie.

Conclusion

The insurance industry market is certainly going through a shift from traditional services to modern-day user-centric solutions.

What makes the industry a great stream for revenue is the fact that even though it is undergoing a digital transformation, it is still generating trillions in revenue, keeping the entire market afloat.

The current market is growing, and based on the available insights, you can identify the upcoming opportunities in the market. Non-Life insurance services have certainly experienced massive growth and are yet to see their peak.

With that said, we have reached the end of this post. Hope you find it helpful and informative. In case you are confused about any of the insights, feel free to connect with us.

Thanks for reading, good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.