Insurance is not what it used to be, and that’s a good thing. With the advent of insurance data analytics, companies can now make smarter decisions and identify fraud faster.

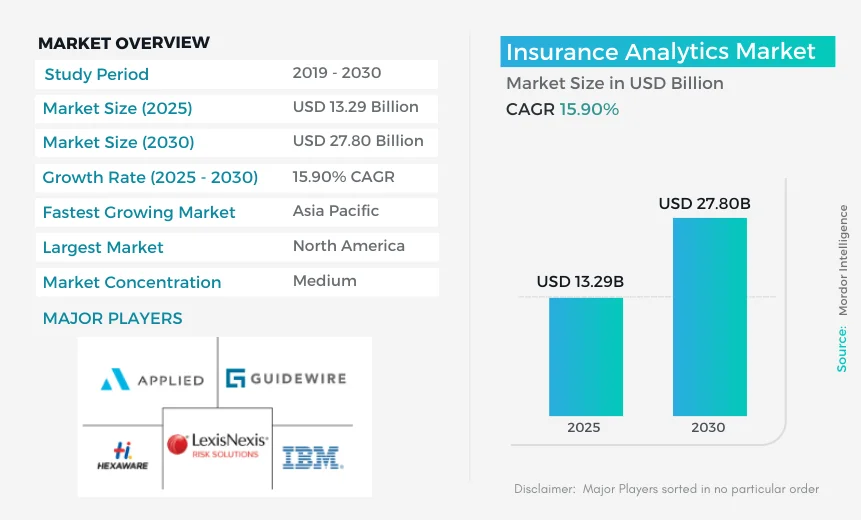

In fact, the global insurance analytics market was valued at $14.5 billion in 2024 and is forecast to reach $43.95 billion by 2032, at a 14.8% CAGR.

That kind of growth reflects a major shift in how insurers operate.

More than 90% of insurance firms use analytics to support digital transformation. One thing is clear: this isn’t just a trend, it’s the future.

So, if you have an insurance business, it’s time to take a serious look at insurance data analytics.

In this blog, we’ll take a closer look at how data analytics is driving real innovation, its key benefits, and how to implement data analytics in insurance.

So, let’s begin!

Market Overview of Insurance Data Analytics

Do you want to see where the insurance industry is headed? Just look at the global insurance market statistics. Really, it’s all right there.

Let’s break down what the numbers are showing us, and trust us, they’re not being quiet about it.

The market size of the global insurance analytics market was worth $14.50 billion in 2024. But the market size is forecasted to reach $16.70 billion and go to $43.95 billion by 2032.

This shows that the CAGR will grow to 14.8% in the same year.

As per Fortune Business Insights, more than 90% of insurers and enterprises’ analytics show the role of insurance data analytics in boosting their firms’ digital transformation efforts.

North America led the market with a 38.4% regional share in 2024, while Asia-Pacific is forecasted to lead the highest 16.5% CAGR by 2030.

Besides, life insurance companies using insurance predictive analytics say they’ve cut costs by 67%, boosted revenue by 60%, and saved over $300 billion each year by preventing fraud.

What is the Role of Data Analytics in Insurance?

Data analytics plays a crucial role in the work of insurance companies. In simple terms, it helps them make better decisions by using facts and numbers instead of guesses.

For example, when a user applies for insurance, companies look at different kinds of information. For example, their age, health history, driving habits, and so on.

With data analytics, they can simply go through all that information to figure out how risky it would be to insure them. This helps them set a fair price for their policy.

It’s not just about pricing. Insurance companies also use data to spot fake claims, understand customer needs, and predict future trends.

For example, if they notice many claims in one area due to floods, they can adjust their coverage or warn customers.

All of this is part of the broader digital transformation in insurance, where traditional processes are being upgraded with modern technology and smarter insurance analytics tools.

Data analytics is a big part of that shift, and it helps companies work faster, reduce risk, and offer better service.

Insurance With Data Analytics vs Traditional Insurance

The way a company makes decisions reveals more than just its strategy. It reflects its mindset.

In insurance, some still depend on outdated, traditional playbooks, inflexible models, and disconnected systems.

But the ones leading the way are taking a smarter approach. They are not just calculating risk. They are stimulating it.

Here’s how the two approaches compare:

| Aspects | Traditional Insurance | Insurance with Data Analytics |

| Risk Check | Uses old data and basic information | Uses smart data and tools |

| Policy pricing | Same price for similar groups | Personalized based on real behavior |

| Claim process | Slower and manual | Fast and mostly automatic |

| Data used | Paper forms and records | Real-time data like apps |

| Customer service | Mostly phone or office visits | More digital and faster assistance |

| Fraud detection | Found later through checks | Uses AI to find fraud early |

| Updates | Only at renewal or claim time | Real-time updates and alerts |

| Tools | Excel spreadsheets and solid systems | Business intelligence platforms and automated pipelines |

What are the Benefits of Insurance Data Analytics?

Data analytics is not just about improving how things run. It actually helps insurers see real results. That’s why it makes sense to invest in life insurance data analytics to grow.

Let’s take a look at the benefits of data analytics in the insurance industry.

1. Helps Find Risks Early

Insurance companies use data from the past to figure out who might be a bigger risk. This helps them decide who to cover and at what price.

2. Speeds up Claims

Data tools help check claims faster, so people get paid faster without unnecessary delays.

3. Make Policies More Personal

With AI in insurance, companies can better understand each customer’s needs and create plans that fit them perfectly.

4. Catches Fake Claims

Insurance data analytics can find odd patterns that might mean a claim is fake and help stop fraud.

5. Improves Customer Service

It is vital to know the customers in a better way so that companies can offer faster and friendlier assistance.

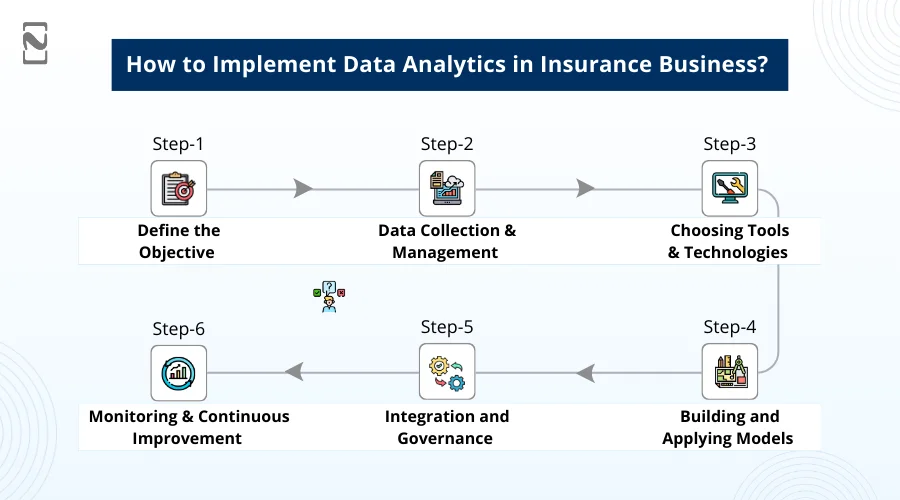

How to Implement Data Analytics in the Insurance Business?

To successfully integrate data analytics within insurance companies, it’s essential to follow a well-structured approach.

Let’s break down the process into key stages to provide a clearer understanding:

Step 1: Define the Objective

To start implementing data analytics in your insurance app, you need to clearly define your business goals.

No matter if it is improving risk assessment, detecting fraud, optimizing claims, or enhancing customer retention, these objectives will guide your data collection and analysis efforts.

Step 2: Data Collection and Management

Now you can gather relevant data from internal sources like customer profiles, policies, and claims, as well as external data. For example, economic trends or telematics.

It is vital to ensure the data is clean, accurate, and stored in a central system like a data warehouse for easy access.

Step 3: Choosing Tools and Technologies

Once the data is collected, you can select the right analytics tools based on your needs.

This could include technologies like Python for modeling, visualization tools like Tableau, and big data platforms or cloud services for managing large datasets.

AI and ML can help build predictive models and automate decisions for data analytics in insurance.

Step 4: Building and Applying Models

Now, an insurance app development company can start developing models that describe past trends, predict future outcomes, and suggest optimal actions.

For example, you can use predictive analytics in the insurance industry to forecast claims or customer churn, and fraud detection models to identify suspicious activity.

Step 5: Integration and Governance

You can integrate analytics into your daily processes, such as underwriting and claims handling, to improve efficiency.

At the same time, establish data governance to ensure compliance with regulations and protect customer privacy.

Step 6: Monitoring and Continuous Improvement

Finally, insurance and data analytics are not a one-time project but an ongoing journey. Monitoring KPIs allows the company to measure the effectiveness of analytics initiatives and identify areas for improvement.

Models must be regularly updated with new data to maintain accuracy, and feedback from users should be incorporated to refine analytical strategies.

Use Cases of Data Analytics in the Insurance Industry

Insurance data analytics is changing the whole insurance industry scenario. From spotting fake claims to offering better prices,

Here are some crucial use cases of how data is being used in the insurance world.

-

Fraud Detection

Insurance companies use data analytics to spot unusual patterns or suspicious claims that might be fraudulent. This helps them stop fake claims and save money.

For example, the use of AI and ML has increased detection rates of insurance fraud by over 30%.

-

Risk Assessment

If we look at the past information, insurers figure out how risky it is to cover someone or something. This helps them decide what to charge.

If you want to build a car insurance app like The General, having good risk assessment tools is really important.

For Example, High-performing ML models can predict high-cost claimants with an area under the receiver operating characteristic curve of 91.2%.

-

Customer Personalization

Data helps insurance companies understand what customers really want, so they can offer plans that actually fit their requirements.

For example, 85% of insurance companies that prioritise customer experience see increased revenue.

-

Claim Management

Analytics helps speed up claims by predicting how long they’ll take and finding the best way to handle them.

If you’re planning to develop an app like Progressive Insurance, making claims easy and fast is a big plus.

For example, Claims processing times dropped by 59% in 2025 for firms using AI, speeding up payouts and enhancing operational efficiency.

Key Challenges in Insurance Data Analytics Implementation

Implementing data analytics in insurance provides major potential for improving risk assessment, customer experience, fraud detection, and operational efficiency.

However, the path to successful implementation is often fraught with challenges.

Let’s take a look at the key challenges in insurance data analytics implementation.

1. IT Bottlenecks and Legacy Systems

Despite huge investments in technology, insurers face substantial delays in implementing rule changes and modernizing legacy systems.

Around 58% of insurance companies report that it takes more than 5 months to implement a rule change, with 21% experiencing timelines longer than 7 months.

Additionally, 49% acknowledge that their firms are behind in updating legacy systems.

2. Slow Adoption of Advanced Analytics

While insurers express a strong desire to integrate advanced analytics across various functions, actual implementation lags behind expectations.

In 2021, 36% of carriers reported using advanced analytics for claims triage. By 2024, this figure had decreased to 33%, with only 40% expecting to implement it by 2026.

3. Data Privacy and Security Concerns

The integration of Gen AI in insurance raises significant data privacy and security issues. It is especially concerning the use of sensitive customer data.

Around 75% of insurance professionals cited data protection in the insurance sector, and 73% cited data security, as their primary concerns related to the use of GenAI in their firms.

Why Choose Nimble AppGenie as Your Reliable Analytics Partner?

At Nimble AppGenie, we focus on assisting insurance companies, including those in the health insurance space, to make better use of their data.

From health insurance app development to improving backend analytics, we leverage modern analytics tools and smart processes to help you offer more personalized service, manage risk better, and make stronger business decisions.

We are committed to practical, data-driven innovations. We believe insurance companies should not be left behind.

They should be leading the way. Our experienced team understands how the insurance industry works.

We do not just offer the same old approach. Our team provides you with world-class data analytics solutions for insurance companies that align with your budget.

If you’re looking to cut through the noise and start making real progress with your data, let’s connect.

Final Thoughts

Data analytics for insurance is not a nice-to-have anymore. It is a must for today’s insurance companies. From smarter decisions and faster operations to improved customer service, using data gives insurers a real edge.

It helps cut costs, spot fraud early, and build products that truly match what customers need. If you are ready to move beyond trial-and-error and want data solutions that deliver real results, we are here to support you.

Contact us right away to turn your data into action.

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.