Card payments have certainly become common in the past few years. From making big purchases online to paying for your groceries in a supermarket, cards can be used anywhere. This rise in usage has given a massive boost to the entire credit/debit card industry.

Financial institutions, banks & NBFCs are always looking for ways to offer a card to their customers, as users who have a card are more likely to use the service due to its convenient nature. However, what’s more interesting is the increasing number of card issuers in the market.

Card issuing is a critical part of the entire financial industry as it enables customers to pay for things conveniently, while assuring financial institutions that their services are being used properly, fetching them extra revenue in the form of interest and transaction fees.

While the name suggests that card issuing refers to entities that are responsible for issuing cards to bank users, the concept is not that simple. There are several layers to card issuing, and in this post, we are going to learn about all of them.

In this one, let’s take a look at the fintech market stats for card issuers, what exactly card issuing means, and most importantly of them all, how to launch a card issuer program for your business.

Without further ado, let’s begin by uncovering the current market stats about the card issuing market and the opportunities that it offers.

Card Issuing Market Overview

The global card issuance market is growing rapidly, and there is no denying it. Driven by financial freedom, inclusion, technology, and improved consumer spending.

The card issuance market is undergoing a complete technological revolution as it gets ready for newer features with the introduction of contactless payments, digital wallets, and embedded finance.

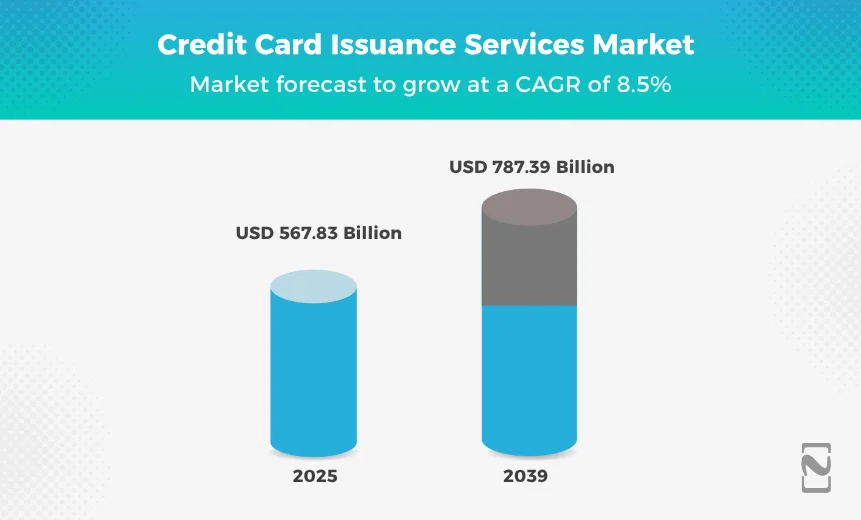

The market was valued at 567.83 billion in 2025 and is expected to grow and reach 787.39 billion by 2029, with a CAGR of 8.5%.

These trends are highly based on the way card issuance is changing with advancements in technology. The adoption of embedded finance, contactless payments, etc., has made card issuing a highly profitable market

The market is all set to grow and offers great incentives to organizations planning to start or expand into card issuance.

What is Card Issuing?

As the name suggests, card issuing is a service that allows financial institutions to issue cards on their behalf. These cards can vary as per the requirements of the user.

Generally, the most commonly in-demand cards are credit cards, debit cards, and prepaid cards. Card issuers, also known as issuer banks, are responsible for enabling banks to provide debit and credit cards.

These card-issuing companies serve as an intermediary between credit card companies and cardholders.

These organizations have direct tie-ups with major card schemes such as Mastercard, Visa, Discover, etc., which can be highly expensive and a lot of headache for the banks to acquire directly.

However, a card issuer ensures that it takes care of all the hassle and makes it easier for a banking/financial institution.

The services that issuer banks offer include –

- Issuing payments

- Account Services

- Transaction Management

- Merchant Services

- Overdraft Protection

And more…

The whole purpose of a card issuer is to ensure that all the operations related to any type of issued card, be it a prepaid, credit, or debit card. Some card issuers also offer banking services such as checking and savings accounts.

How Does Card Issuing Work?

Now that you are aware of what this service does, let’s take a look at how it works. Card issuers make it possible for a financial institution to provide credit or debit cards to its customers.

These cards can later be used by a user to pay for things, directly from their bank account or from the credit limit assigned to them.

While it may seem like a crystal clear process, there are several complexities associated with card issuing. You see, if we take a look at the bigger picture, the card issuer is a part of the larger card transaction lifecycle.

To understand the role of a card issuer or issuing bank, we first need to identify the role of the card issuer in the card transaction lifecycle.

Here’s the complete workflow

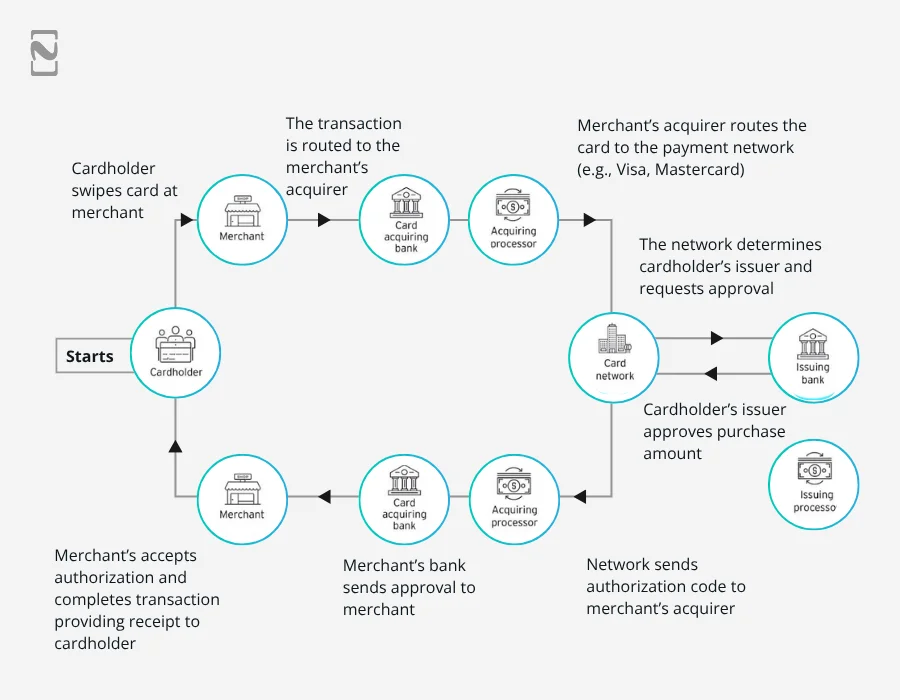

- Step 1 – The Cardholder initiates the transaction at a merchant.

- Step 2 – The merchant’s POS routes the transaction to the merchant’s acquirer.

- Step 3 – Once the acquirer bank recognizes the card, it requests the card from the payment network that the card uses.

- Step 4 – The network identifies the issuer of the card and requests approval from the same.

- Step 5 – The Card issuer sends confirmation or a declination of the payment.

- Step 6 – The authorization is shared with the acquiring processor of the merchant’s acquirer.

- Step 7 – The Merchant receives confirmation of the transaction from the acquirer bank.

- Step 8 – The authorization is accepted, and the transaction is completed. The merchant now shares the receipt with the cardholders.

With all those steps, you may have got an idea that the role of a card issuer is to manage the transaction and authorize it after identifying the user’s available funds in the account/credit limit.

The issuer helps the card network, merchant acquirer, and merchant bank quickly identify payment status and approval. This also makes the card issuer one of the most crucial parts of the entire card transaction cycle.

What Different Cards Can a Card Issuer Offer?

Card issuers like banks and credit unions have the option to offer a variety of payment cards, be it a virtual card or a physical one.

If we talk about the types, credit, debit, and prepaid cards are the most commonly used ones. However, the options do not end there as card issuers also offer virtual cards and charge cards.

All these cards are highly helpful and are differentiated based on whether they are funded.

For more information, check out the classification given below –

-

Debit Card

These types of cards allow a user to pay for things with the funds available in their bank account. The funds are withdrawn directly from the user’s savings or checking account to pay the merchant.

-

Credit Card

These cards offer a way to borrow money from the bank based on the credit limit associated with the user’s past credit usage record. The bank offers a set credit limit that can be used to make payments instantly. However, the funds that are used are to be repaid to the bank with a slight interest (depending on the bank).

-

Prepaid Card

People often confuse prepaid cards with debit cards, as in both cases, you need funds in advance that you can use via cards.

The main difference is that a debit card is linked directly to a bank account, allowing immediate access to funds, while a prepaid card requires you to manually add money by connecting it to an account.

Overall, a card issuer makes all of these transactions possible by implementing the correct network and transaction protocol.

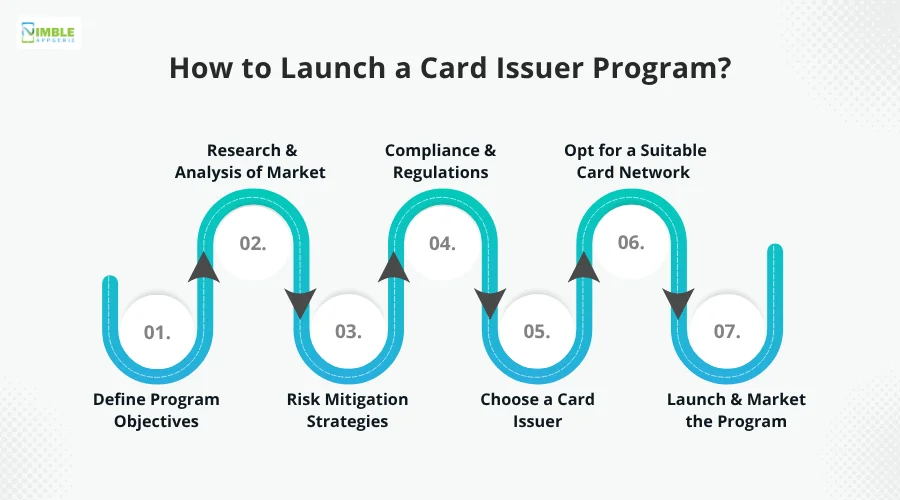

How to Launch a Card Issuer Program?

If you are a fintech business or a financial institution looking to launch a card issuer program of your own, then there are multiple steps that you need to identify.

For instance, the first thing you need to do is find a reputed card issuer who can help you with all the processes related to card operations, management, and all the operations, including Issuing payments.

Here are the steps that can help you launch a card issuer program –

Step 1: Define Program Objectives

You need to be sure you know what the goal of your card issuer’s program is. Identify and underline the goals that you want to achieve through this initiative, along with how things align with the core values of your current business model. The better you can define every goal of yours, the better you can execute the plan.

Step 2: Research & Analysis of Market

Understand the market thoroughly before starting the card issuer program, as you need to grasp the impact of your actions in this market.

Look for businesses similar to yours and check if they have also implemented card issuing and whether they have benefited from the step or not. This will also give you insights into things that you should not do in order to be successful.

Step 3: Risk Mitigation Strategies

All that research will help you identify the key risks that you are taking. Several things might cause the idea of card issuing to fail.

Hence, you should evaluate all the possible risks and situations that may arise due to them. This will help you work on devising mitigation strategies more easily. You should also prepare for all the possible risks that might appear.

Step 4: Compliance & Regulations

Check what type of compliance and regulations your solution should comply with. Ensure strict compliance with regulations in financial transactions to safeguard your business.

Generally, when we talk about card programs, there are two compliance PCI DSS (Payment Card Industry Data Security Standard) & SEPA Card Frameworks, that you should pay attention to.

Step 5: Choose a Card Issuer

Choose one of the top card issuer platforms so that you can start your program. Several card issuer programs can offer you open APIs and frameworks with all the necessary tools and features that you may require from your card issuer. Marqeta API is one of the most popular choices when it comes to building customized card issuing programs.

Step 6: Opt for a Suitable Card Network

Another crucial component you need to bring your card-issuing program to life is a card network. There are different options available when it comes to choosing a suitable card network. Some of the popular ones include Mastercard, Visa, Discover, etc.

These networks offer different features and convenience options. Hence, you should consider all of them and choose the one that aligns with your business objectives the best.

Step 7: Launch & Market the Program

With all the components sorted, you are all set to launch your card issuer program. Market it with all your heart to ensure it reaches the masses.

You can offer free card customization to entice new customers to onboard your services. Marketing the program will help you get more and more people to use your services, which means more revenue for your company.

With all these steps, what you have is a solid card issuer program that can be fruitful for your business. Things can get difficult if you have not chosen the correct card issuer.

There are multiple options, as there are several top players that you can choose from based on what you are looking to achieve from the program.

Where to Find Experts Who Can Help in Launching a Card Issuer Program?

From the entire process of building a card issuer program of your own, to garnering more customers and offering a better payment experience.

Things get even more crucial for you if you are a stand-alone financial service provider who plans to offer both credit and debit cards. Looking at the steps mentioned above, it is clear that you need a professional to design and develop this entire program for you.

If you are planning to start one but do not know where to find professionals who can help you with the launch of a card issuer program, then your search ends here!

We at Nimble AppGenie have decades of experience in delivering highly efficient fintech services and can help you integrate the best of open APIs for card issuing systems.

We can also help you develop a platform that you can use to expand your fintech services and reach more users. For any type of refined financial services, you can easily reach out to our fintech app development services and share what you are looking for.

Conclusion

Card issuing is one of the most crucial aspects of establishing a card transaction and card issuer program for your business.

If you want to offer customized payment cards for your business and offer a more personalized service to your users, you will need to use a card issuer program.

The market for card issuing is definitely on the rise. This shows that it will help you implement card payments easily with the right card issuers.

Hope this post helps you make all the right decisions. In case you have any doubts about finishing the process, feel free to reach out to our experts, as they can guide you through card issuance without any stress.

Thanks for reading, good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.