In a Nutshell:

- Learn how a health insurance app development company can help you build secure, scalable, and user-friendly apps tailored for insurers, policyholders, and healthcare providers.

- From insurance policy management app functionality to claims processing software, check out the must-have health insurance app features that improve customer engagement and automate operations.

- Explore a robust tech stack for health insurance software development, including HIPAA-compliant insurance app practices and seamless insurance app API integration.

- Understand the development cost, project timeline, and various monetization models that make custom health insurance app development profitable for businesses and startups.

- Nimble AppGenie offers complete insurance app development services, from concept and design to deployment, compliance, and ongoing support.

Today, when every second industry has shifted towards digital-first experiences, the health insurance industry is also witnessing the same driving increased regulatory changes, customer expectations, and the need for rapid claims processing.

| According to a GlobeNewswire study, the health insurance market valuation will increase by 2028 and reach $3.619 trillion with a CAGR of around 9.50%. |

With the expanding healthcare insurance market, healthcare institutions, insurance companies, and healthcare providers are increasingly moving ahead to capitalize on this surge through health insurance app development.

Besides revenue-focused aspects, users are also more and more adopting health insurance solutions to reap the benefits of simple policy management, customer support, renewals, and claims with reduced operational costs for insurers.

If you are also running a health insurance company or institution, go for health insurance software development.

How to build a health insurance app?

This guide breaks down the insurance app development process you should follow, budget to keep aside, core features to include, how health insurance app development can help you make money, and launch a solution that aligns with modern healthcare and compliance standards.

Let’s get started!

What is a Health Insurance App?

Health insurance apps allow users to manage their health insurance by using a mobile phone. Users can easily check their health insurance policy, find hospitals or doctors, submit claims, and so on.

For example, if a user goes to the hospital, they can submit a claim directly through a mobile app and simply track its status.

The health insurance app also provides them access to a digital health card, so they do not need to carry a physical one. Users can also chat with customer service within the app.

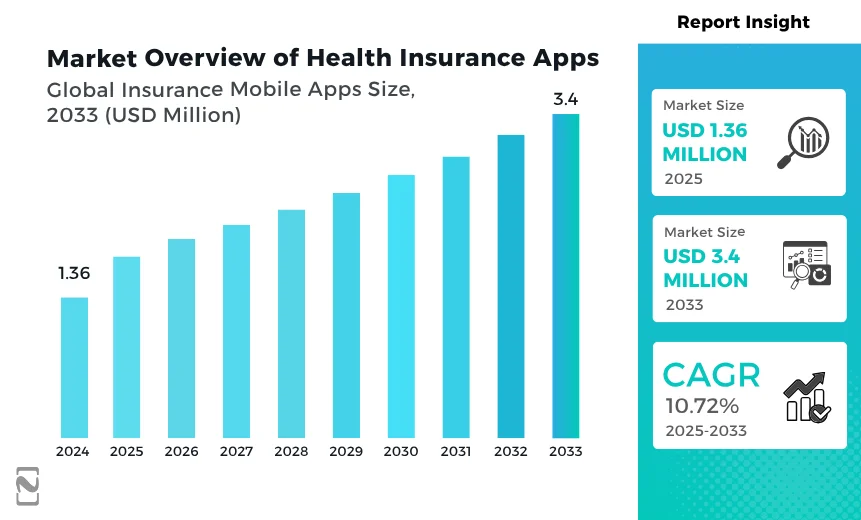

Market Overview of Health Insurance App Development

Health insurance apps are becoming mandatory for insurers, health-tech startups, and TPAs.

Here, let’s check the facts and figures showcasing the rise in health insurance mobile apps adoption to reap the advantage of automated claims processing, improved customer engagement, and streamlined policy management.

- The global market size of the health insurance sector is expected to hit $3.4 billion by 2033.

- As per Statista, on average, each person is likely to spend around $320.48 on health insurance.

- From 2025 to 2029, the market is forecast to grow by about 3.90% every year.

- Among all regions, the USA is forecast to have the largest share with a total health insurance premium of $1.8 trillion in 2025.

- Health insurance is the largest contributor to insurance markets.

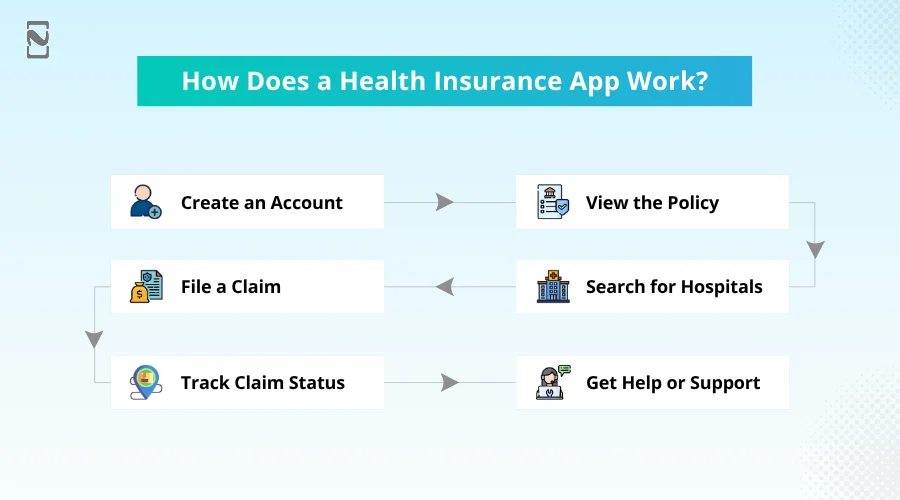

How Does a Health Insurance App Work? Architecture & Workflow Explained

An insurance mobile app development helps connect users, hospitals, insurers, and third-party services on a single digital platform.

Thus, users can leverage the potential of health insurance app features to the fullest, purchase policies, track approvals, file claims, access policy details, and make payments in real time through automated workflows and secure integrations.

You can also go for an insurance claims management app for your users and boost engagement and thereby ROI.

A health insurance app assists users in managing their policies and claims from their mobile devices. It makes the process faster, removes paperwork, and gives users a quick update. Now, let’s have a look at the working mechanism of a health insurance app.

Step 1: Create an Account

Users can first make an account by using their phone number, email, or policy number. If they are already a customer, they can just log in.

Step 2: View the Policy

After logging in, users can check all health insurance details like coverage amount, what is included, and expiry date.

Step 3: Search for Hospitals

The app shows a list of hospitals or clinics near them that accept their insurance. Some apps show cashless hospitals.

Step 4: File a Claim

If a user goes to the hospital, they can submit a claim through the health insurance app by uploading documents like bills and reports.

Step 4: Track Claim Status

The health insurance app showcases updates on users’ claims. For example, it is approved, rejected, or still being checked.

Step 6: Get Help or Support

If users have any problems, they can chat or call customer support directly from the health insurance app.

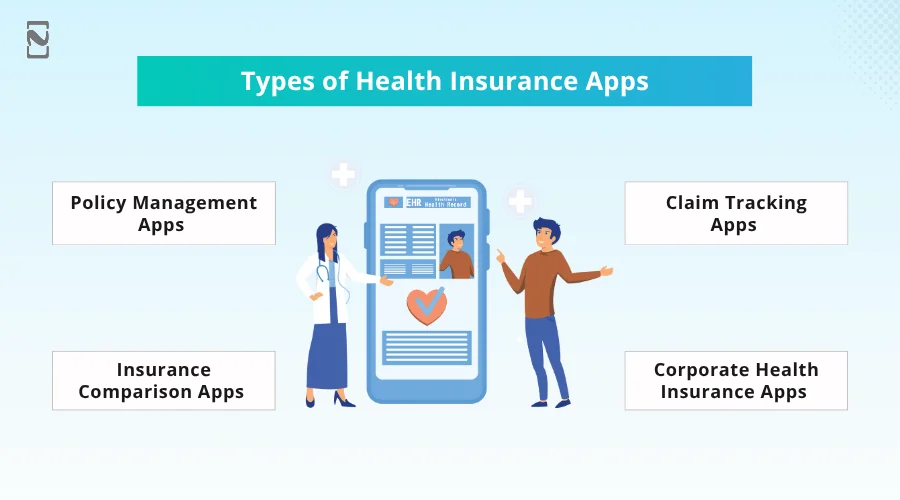

Types of Health Insurance Apps

There are multiple types of health insurance applications. Each one helps users in different ways. If you are planning to develop a health insurance app, it is vital to know which type of insurance you want to build.

Check out the main types of health insurance apps in the section below.

1. Policy Management Apps

These policy management applications help users manage their health insurance policies. They can check what their plan covers, download their health card, update their details, or renew their policy.

Also, some applications remind them of payment due dates. For example, users can buy a health policy from a company. Instead of calling them for every small detail, they can use the app to check everything.

Popular App: Star Health, Max Bupa

2. Claim Tracking Apps

The claim tracking app assists users in tracking their insurance claims. They can upload hospital bills and other documents through the app.

It shows the status of their claim, no matter if it is approved, under review, or rejected. For example, if users go to a hospital and submits a claim for treatment, they can check how it is being processed through the app.

Popular App: Care Health

3. Insurance Comparison Apps

It is the most popular insurance comparison app that helps users compare different health insurance policies. They can see the prices, features, and benefits of various companies and select the best one.

For example, a user wants to purchase health insurance but does not know which is better. This insurance comparison app can compare and choose simply.

Popular Apps: CoverFox, Turtlemint

4. Corporate Health Insurance Apps

These are developed for employees who get health insurance from their company or office. The corporate health insurance app shows details of the group policy, coverage, and claim policy.

For instance, they can work in a company that provides them with free health insurance. The app tells them what is covered and how to use it.

Popular Apps: MediBuddy, Plum

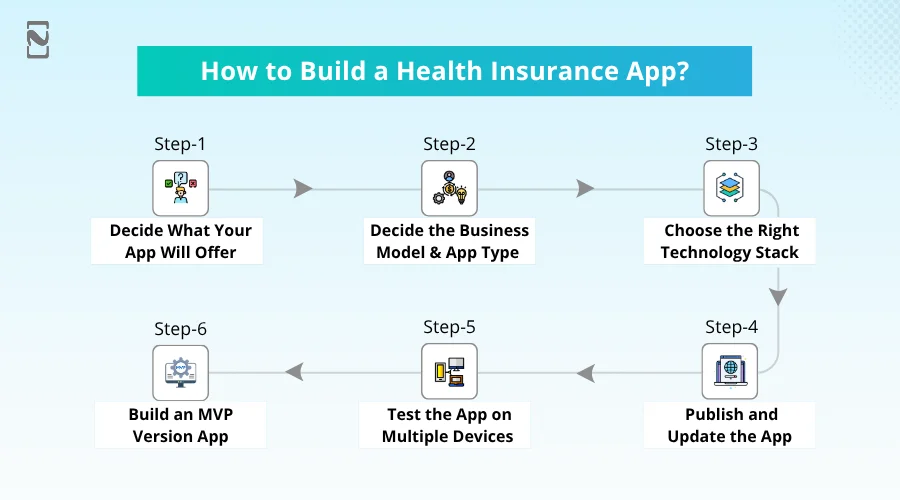

How to Build a Health Insurance App: Step-by-Step Development Process

Custom health insurance app development includes defining business objectives, choosing the right features, creating a secure architecture, and ensuring regulatory compliance.

A phased approach in insurance app development involves beginning with an MVP and improving through user feedback, which assists in diminishing cost, risk, and time to market.

How to build a health insurance app?

Let’s take a look at the process of health insurance application development.

Step 1: Decide What Your App Will Offer

Before you begin with health insurance app development, you need to think about what your app should do. Most users want to see their insurance plans, renew them, check claim status, and get customer support.

Also, some people want to locate nearby hospitals or download e-health cards. Now you should look at competitors’ health insurance apps. You need to decide whether your app will be for one insurance company or work like a comparison platform.

Step 2: Decide on the Business Model and App Type

Now you need to decide what type of app you are developing and how it will work as a business. Will your insurance app be for one insurance company, or will it show and compare plans from multiple companies?

Will users just view policy information, or also buy insurance through apps? You should also plan how the app will earn money.

Either through commission, subscription, or direct sales. This stage helps shape the full plan for health insurance mobile app development, design, and cost.

Step 3: Choosing the Right Technology Stack

The next stage is to choose the right tech stack to develop a health insurance app. You can select the technologies that work on both Android and iOS platforms.

Also, when you select the right stack for your app, it can affect the total cost of creating a health insurance app, especially with the incorporation of AI in insurance.

Let’s understand this with the tech stack table.

| Component | Technology |

| Front-end | Flutter or React Native |

| Back-end | Node.js, Python |

| Database | PostgreSQL or Firebase |

| Authentication | Firebase Auth and OAuth 2.0 |

| Payments | RazorPay or Stripe |

| Maps Integration | Google Maps API |

| Push Notifications | Firebase Cloud Messaging |

| Analytics | Google Analytics |

This tech stack will help you build a custom health insurance app. It is also suitable for MVP apps and full-featured applications.

Step 4: Build an MVP Version App

Here comes the main stage, which is MVP app development. To save time and budget, a healthcare app development company can begin by developing an MVP app. It is just a simple version of your app that only includes core features.

This allows you to launch faster and get early feedback. After your MVP is developed, you can integrate more advanced or customized features like hospital search, payments, push notification, chatbot, and document uploads.

Each part should be properly linked to the backend. For custom health insurance app development, an MVP assists in reducing the cost of building an app while still delivering value.

Step 5: Test the App on Multiple Devices

Once your MVP is created, it is time to test your health insurance app. You can test the app on multiple screen sizes, devices, and network conditions.

Just ensure that the app protects user data and handles errors correctly. Besides, you can do one thing–ask the real-time users to try your app and share their feedback.

If you find any errors, fix the confusing parts and slow-loading screens. Proper testing reduces future problems and enhances user satisfaction.

Step 6: Publish and Update the App

Once your health insurance app is tested successfully, you can now publish your app on the respective platforms. You just inform users through email, ads, or, of course, social media.

After deployment, it is vital to regularly update your app. You can read reviews, track app usage, and note down which features are highly used. You should thoroughly test the bugs regularly.

If you plan for future growth, you can later add features such as telemedicine and wellness tracking. Continuous updates help keep your health insurance app development bespoke.

Technology Stack for Health Insurance App Development

Health insurance software development demands a meticulously chosen technology stack.

A perfect combination of frontend, backend, security protocols, and cloud services ensures your application is compliant, scalable, and delivers an effortless user experience.

Modern HIPAA-compliant insurance apps also need secure insurance app API integrations with hospital networks, payment gateways, and analytics platforms.

Prioritize picking the right tech stack to help insurers automate operations, streamline claims processing, and maintain applicable regulatory compliance while offering real-time insights.

| Category | Technologies / Tools |

| Frontend Development | React Native, Flutter, Swift (iOS), Kotlin (Android) |

| Backend Development | Node.js, Python (Django/Flask), Java (Spring Boot), .NET |

| Database | PostgreSQL, MySQL, MongoDB, Firebase |

| Cloud & Hosting | AWS, Google Cloud, Microsoft Azure |

| API & Integrations | REST APIs, GraphQL, Payment gateways, Hospital networks, Telemedicine APIs |

| Security & Compliance | HIPAA/GDPR compliance, SSL/TLS, OAuth 2.0, JWT encryption |

| Analytics & Monitoring | Google Analytics, Firebase Analytics, Power BI, Tableau |

| Notifications & Messaging | Firebase Cloud Messaging, Twilio, OneSignal |

| DevOps & CI/CD | Jenkins, Docker, Kubernetes, GitHub Actions |

| Testing & QA | Selenium, Appium, JMeter, Postman |

Must-Have Features of a Health Insurance Mobile App

Not just being a digital policy portal, a modern health insurance app is a comprehensive ecosystem for insurers, policyholders, and healthcare providers.

The app should fuse automation, compliance, and convenience to deliver maximum value.

Prioritize integrating essential health insurance app features to streamline operations, escalate customer engagement, and ensure rapid claim settlements.

Key components embrace insurance policy management app functionality to enable users to update, access, and track their policies flawlessly and claims processing software features to ease approval, filing, and claims of payment in real-time.

We have curated a list of health insurance app features that will help make your app secure, user-friendly, and scalable for startups and insurance giants.

| Features | Description |

| User Onboarding & Profile Management | Easy registration, document upload, and profile setup |

| Policy Management | View, renew, or update policies; track coverage |

| Claims Filing & Tracking | Submit, review, and track claims digitally |

| Premium Payment & Billing | In-app payment options, reminders, and history |

| Notifications & Alerts | Policy updates, premium reminders, and claim status alerts |

| Document Management | Upload and store insurance documents, ID proofs |

| Customer Support & Chat | Chatbot or live support |

| Analytics & Dashboard | Personalized dashboards for users and insurers |

| Multi-User & Role Management | Separate views for policyholders, agents, and admins |

| Integration with Healthcare Providers | Hospital and pharmacy networks, telemedicine |

| Security & Compliance | HIPAA/GDPR compliance, encryption, and authentication |

How Much Does it Cost to Develop a Health Insurance App?

To provide you with a rough estimate, the health insurance app development cost can be around $25,000 – $200,000. However, various factors affect the cost of developing insurance apps, like app complexity, features, platform choice, tech stack, etc.

In other words, if you develop a highly advanced app with customized features, it increases the cost to build a health insurance app compared to a simple app with minimal features. Let’s understand this with a cost table below.

| App Complexity | Cost Estimations |

| Simple Health Insurance App | $25,000 – $70,000 |

| Intermediate Health Insurance App | $70,000 – $150,000 |

| Complex Health Insurance App | $200,000+ |

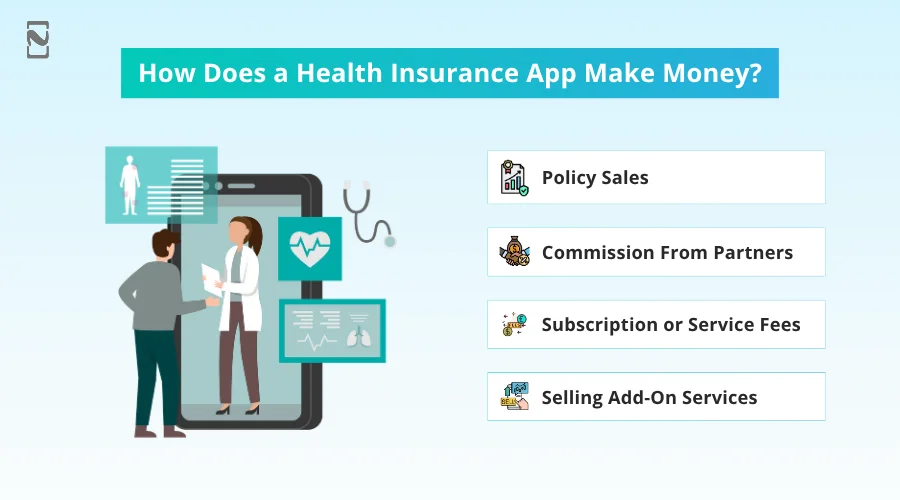

How Does a Health Insurance App Make Money? Monetization Models

Health insurance applications generate revenue through several channels, like subscription plans, policy commissions, partnerships with healthcare providers, data-driven value-added services, and in-app services.

The monetization model relies on whether the app targets insurers, customers, or enterprise clients.

The health insurance app makes money in various ways. For example, charging for extra health services, showing ads, freemium features, and so on.

If you are planning to create a health insurance app, it is vital to monetize your app for better ROI.

Here are the best monetization strategies that you should implement in your app.

-

Policy Sales

The biggest way a health insurance app earns money is by selling insurance plans to users. The app shows different health insurance policies and assists people in choosing and buying one.

When a user purchases a plan through the app, the company earns money. It can be from their insurance plans by working with other insurance companies and earning a share or commission on each sale.

-

Commission From Partners

Multiple health insurance apps work as a middleman between users and bigger insurance companies. When someone buys a policy from one of these partners through the app, the app earns a fixed amount or a percentage as commission. It means the health insurance app does not always have to create its own insurance plans. You can make money just by helping others sell theirs.

-

Subscription or Service Fees

Once a user buys a health insurance plan, they usually pay for it every month or annually. These payments are called premiums. If the health insurance company owns the app, then it earns regular income from these premium payments. It is a steady way for the app to earn money since users keep paying as long as they stay tuned.

-

Selling Add-On Services

Some health insurance apps provide extra paid services to assist users in better managing their health.

It might cover services like online doctor visits, lab test bookings, medicine delivery, and so on. Users can pay extra for these services, and this money goes to the app.

Why Choose Nimble AppGenie as Your Health Insurance App Development Company

Well, it’s crucial to partner with a trusted health insurance app development company to build a compliance-ready solution aligned with the business objectives of insurers and regulatory requirements.

Nimble AppGenie offers insurance app development services to deliver feature-rich custom health insurance apps.

We bring on board a team of skilled designers, developers, and QA engineers who combine modern tech stacks, industry best practices, and compliance knowledge to help startups, insurers, and healthcare enterprises launch apps that drive engagement.

Choose custom health insurance app development and meet your required project specifications.

Key Reasons to Choose Nimble AppGenie

- Expertise in Health Insurance Apps

- Custom App Development

- Agile & Collaborative Approach

- End-to-End Development Services

- Integration Capabilities

Real-Time Case Study – How Nimble AppGenie Can Help You With Health Insurance App Development

Case Study: Digital Health Insurance App for a Regional Insurer

A regional health insurance provider partnered with Nimble AppGenie to improve its customer experience and diminish claim settlement time.

The objective was to create a HIPAA-compliant mobile app that can help users digitally submit claims, manage policies, and track claim status in real-time.

Solution We Offered:

- Developed a secure health insurance mobile app ( Android & iOS)

- Implemented role-based access for agents, customers, and admins

- Integrated policy renewal, claims management, and premium payments

- Added analytics dashboard for claim performance and user behavior

Results Obtained:

- 40% faster claim processing

- 30% reduction in customer support queries

- Improved customer retention and app adoption

Nimble AppGenie delivered a compliance-ready solution aligned with the insurer’s business objectives and regulatory requirements.

Conclusion

In the modern insurance ecosystem, health insurance apps play a crucial role. A well-crafted health insurance app delivers lasting value for users and insurers.

Whether you are a startup, insurer, or healthcare enterprise, collaborating with an experienced health insurance app development company like Nimble AppGenie ensures the development of a secure and scalable solution.

FAQs

1. Identify target users and their needs.

2. Research market trends and regulations.

3. Define features, architecture, and integrations.

4. Design user experience and interface.

5. Choose a suitable tech stack.

6. Plan deliverables, timeline, budget, and risks.

7. Develop back-end and role-based interfaces.

8. Test, launch the app, and market it.

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.