The Fintech app market is booming with popular apps becoming a household name, being used in our day-to-day lives, and in the process making billions.

PayPal, Chime, and Robinhood are just a few examples of these.

This begs the question “How Does Fintech Apps Make Money?”

Well, this is a question asked by both curious readers and fintech app company runners who want to join the ranks. Now, if you are either one of those, this blog is for you.

Here, we shall be discussing everything you need to know about fintech app monetization models and more.

So with that being said, let’s get right into this complete guide to fintech monetization models, starting with:

Fintech App Market Overview

Whether you have a fintech app idea that you want to turn into reality or are just curious about why the market is booming, it’s a good idea to look at fintech statistics.

- The Fintech Market is Worth More Than $194 Billion and is Expected to Reach $492 Billion by 2028

- The User Base for Digital Payments is Expected to Cross 5,480.00 Million by 2027

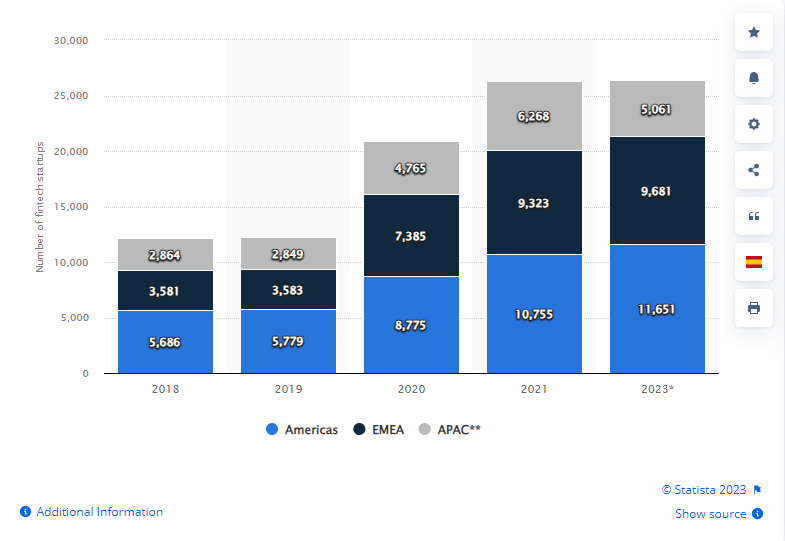

- With Over 11,651 Fintech Start-Ups Today, This Number has More Than Doubled Since 2019

This clearly shows why so many people want to create their own fintech app today. But this leaves us with an important question, how fintech platforms make money?

Well, let’s look at all of that and more in the next section of the blog.

App Monetization Strategy: A Deep Dive

The answer to the question “how fintech apps makes money” is app monetization strategy.

So, what are they?

App monetization strategies refer to different ways and models through which a mobile application generates money. This can be anything from direct sales to a sophisticated one like the Zelle Business model.

The point is, that any strategy that lets a business generate money is a monetization strategy.

Often also known as monetization channels, these are implied by almost every mobile application to make revenue. However, it’s more important to apply the “right” strategy as compared to just applying.

You see, it is with fintech app monetization models that you generate revenue that drives ROI, justifies fintech app development cost, and makes the fintech app a success.

In addition to this, generating revenue ( or rather a profit) is also important to keep delivering constant innovation in the market.

Speaking of which, now that you know what fintech app monetization strategies, it’s time to discuss those.

How Do FinTech Solutions Make Money?

Most FinTech solutions make money through subscriptions, third-party financial services, and advertising.

Ironically, most FinTech startups aren’t even breaking even. Even Monzo and N26, which have been valued at multi-billions, aren’t profitable yet.

Although some FinTech apps are changing the banking industry, ROI is slow, they’ll eventually obtain the break-even and soon be profitable.

Take a look at some of the most successful Monetization Strategies for Fintech Apps that you can use for your next project.

1. Data and Information

One of the popular reasons why FinTech solutions are so successful among people is that they can gather customer data and offer more personalized services.

FinTech apps can easily know where their customers are spending their money, how they receive salaries, and who their favorite merchants are.

This data can then be monetized to improve user experience, personalization, and recommendation engine. It can also be used in the form of big data that is sold to lenders, which is completely legal.

More and more FinTech solutions are taking on this strategy to earn revenue.

For example, the budgeting app Yolt has tons of user data pertaining to its budgeting habits. Thus, the data can be a goldmine for third parties, including credit score companies, loan lenders, and others.

This is what makes it one of the most popular fintech app revenue models.

2. Subscription Fee: “Freemium”

Let us introduce you to the method used by “subscription apps”

With this fintech app monetization model, the money comes directly from the end customer’s pocket.

Either on a monthly, quarterly, or yearly basis, FinTech bills users a certain regular amount as a subscription fee.

This app monetization model is very effective for FinTech solutions, as free trials allow users to try their hands on the product before paying a premium.

Another way this strategy can be implemented is ‘Freemium,’ where the FinTech solutions provide users with limited feature access to the FinTech apps for an unlimited period.

However, for features that provide a greater amount of value, the users have to pay a subscription fee.

While this might not be something that you often see in fintech apps, you may recognize them from on-demand apps like Hulu.

3. Advertising

Advertising products and services is one of the simplest forms of how fintech makes money.

The revenue model for Fintech works fine as the users don’t have to pay subscription fees to access FinTech’s products or services. Fintech mobile apps can sell user’s attention or data to advertisers to earn revenue.

The best part is, it can also be combined with the free version of the Freemium model and double the revenue generation, while also giving the user a reason to subscribe (i.e. get rid of ads.)

An example of this revenue model is NerdWallet.

NerdWallet is a website that helps individuals make smart financial decisions. The website makes money from ads and has also partnered with third-party service providers to promote its products.

That’s not all, this is something often seen in top eWallet apps.

4. Third-Parties

This is among the most lucrative and effective revenue strategies in our Fintech app monetization guide.

With this mode, the FinTech apps partner with other third-party institutions to offer value via other means. For instance, an app can also provide health insurance, credit scoring, accounting services, and many more.

In fact, when we talk about the eWallet niche, this is one of the most popular eWallet app monetization strategies.

The concept is very straightforward.

FinTech directs customers to third-party services, and in return, the third-party service provider offers a certain percentage to the FinTech app.

As per a report by Oliver Wyman, only 26% of FinTech solutions rely on third-party services. However, 43% of the FinTech solutions for the mass market use third parties as revenue streams.

5. APIs

In the 5th part of “How Do Fintech Apps Make Money”, we have APIs. There is a very innovative revenue model that has emerged in recent years.

Open banking APIs offer FinTech organizations opportunities to partner with other companies in the ecosystem and share relevant data and features.

For example, if FinTech A builds a cool feature, it can share that feature with FinTech B via API development.

A white paper from FIS Global suggests that API sharing is a fertile ground for FinTech solutions to improve productivity.

Since open banking is very new to the FinTech ecosystem, this model is still questionable. However, experts believe that this revenue model is very practical.

Considering the market is filled with Fintech APIs, it can deliver monetary benefits too.

6. Robo-Advisors

Robo-advisors are platforms that eliminate the need for investment advisors.

The platform uses advanced technologies such as AI and ML to build algorithms that can effectively manage portfolios.

Fintech apps that provide such capabilities to their customers are investment platforms like Robinhood, Betterment, and Moneyfarm.

Although the users don’t have to pay large amounts for the robo-insurance advisory, they pay a certain percentage of their financial assets as a fee, but the charge is significantly lower.

For example, the investment managers charge 1% or more for advisory, whereas Betterment charges only 0.25%.

This is how AI-powered chatbots in fintech are changing the market.

7. Interest Driven by BNPL and Cash Advances

Do you want to make money with fintech apps?

It’s time to start charging interest. Well, what we have learned from loan lending apps is, people are crazy about soft loans.

Now, you can take loan lending app development forward with new trends, answering people’s demands and generating endless revenue.

We are talking about BNPL integration, which is another form of soft loan that is offered to help users pay on the eCommerce platform. This collaborative integration lets users lend small amounts which can be paid back to EMIs.

Another popular solution is that you can do what top cash advance apps are doing. It is one of the best ways to earn revenue and monetize a fintech app.

8. Transaction Fee

Another fintech app monetization strategy used in top eWallet apps is transaction fees. In fact, this is so popular that it has become the norm in eWallet app development

These fintech platforms have an option to charge a flat fee, also known as the transactional approach.

With this approach, the FinTech Company earns money every time that the user makes a transaction. The charges vary between 1% and 4% per transaction.

And with cross-border apps like Transferwise getting popular in recent years, a door to even greater monetization opportunities has opened.

Using this, you can make money with fintech apps that will last generations.

9. Payment for Order Flow

Want to learn how to make money with fintech apps? Let us introduce you to one of the most unique ones.

Here’s how it works: the platform Instead of charging you commissions, your broker receives a tiny kickback (fractions of a penny per share) from market makers to send your order their way. Think of it as a referral fee.

Monetizing your fintech app with Payment for Order Flow (PFOF) is tempting, offering lucrative rebates from market makers for routing client orders.

However, it’s a minefield.

There have been concerns over prioritizing revenue over best execution for users, coupled with tightening regulations, which cast a shadow.

When going for stock trading app development, there are other models that you may prefer over this one due to its controversial nature.

In any case, when done right be door to making money with fintech apps.

10. Crowd Funding

Crowdfunding is a monetization channel you can apply to regardless of the fintech business model you are following.

For those who don’t know what this is, here’s how it works. In order to secure funding for mobile apps, the fintech platform will ask people for funding.

This can be done for an entirely new company, a product, or just a specific cause.

People who invest in your platform in monetary form will be offered some sort of benefit. When speaking of fintech monetization, crowdfunding can be of the following type.

- Reward-based crowdfunding.

- Equity-based crowdfunding.

- Debt-based crowdfunding.

While this is not something that we commonly see in fintech apps, the answers to a much-asked question “How do FinTech startups make money?”

With this out of the way, it’s time to look at the popular fintech apps and their monetization strategies in the section below:

Popular Fintech Apps & Their Monetization Strategies

The market is filled with remarkable fintech apps.

And one way to answer “How does fintech apps make money?” is, by learning from the best.

That’s why in this section of the blog, we shall be looking at popular fintech apps and how they make money in the market.

These are, as mentioned below:

| App | Category | Monetization |

| Venmo | P2P Payments | Transaction/Interchange fees and Data monetization |

| Mint | Personal Finance | Advertising, Affiliate marketing, Premium features |

| Robinhood | Investment & Trading | Payment for order flow, Margin lending, Crypto fees |

| Chime | Digital Banking | Interchange fees, Subscription fees, Partnerships |

| Zelle | P2P Payments | Merchant interchange fees (no user fees) |

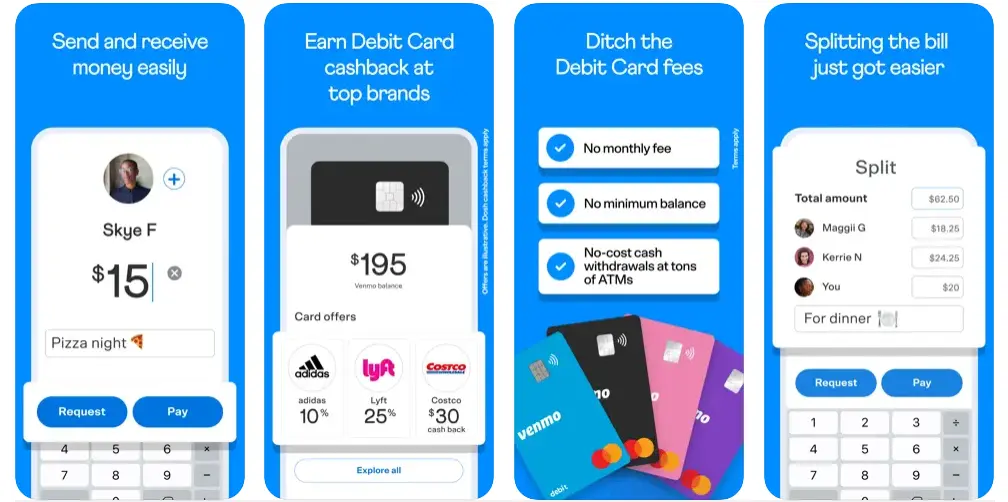

1. Venmo – Payment & Money Transfer

Venmo is one of the most popular fintech apps in the market, especially in the United States of America today.

If you want to create a money transfer app, you can learn from this platform how to make money.

Monetization Models of Venmo:

- Transaction fees: Charges a small fee for certain transactions, like instant transfers.

- Interchange fees: Earn income from merchants when users pay with Venmo.

- Data monetization: Analyzes user data (anonymously) to personalize offers and target advertising.

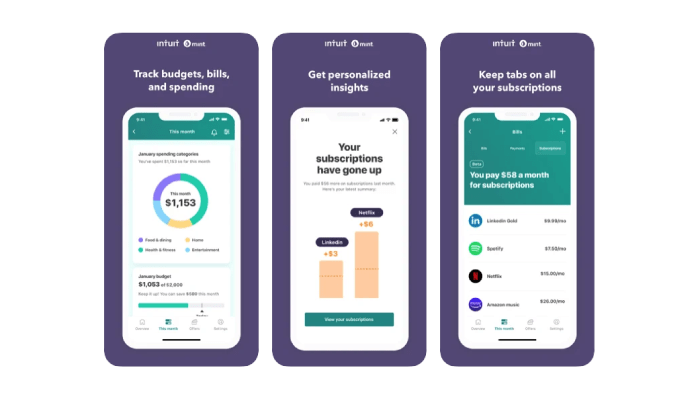

2. Mint – Personal Finance Management

Mint is the perfect example of expense manager app development done right!

Equipped with features like aggregating accounts and budgets, tracking spending, and offering financial insights, it has all you can ask from such an app.

So, how does a fintech app like Mint make money?

Well, here’s how:

Monetization Models of Mint:

- Advertising: Displays targeted ads based on user data and financial habits.

- Affiliate marketing: Earns commissions when users sign up for partner financial products via Mint.

- Premium features: Offers subscription plans with exclusive features like investment tracking and credit monitoring.

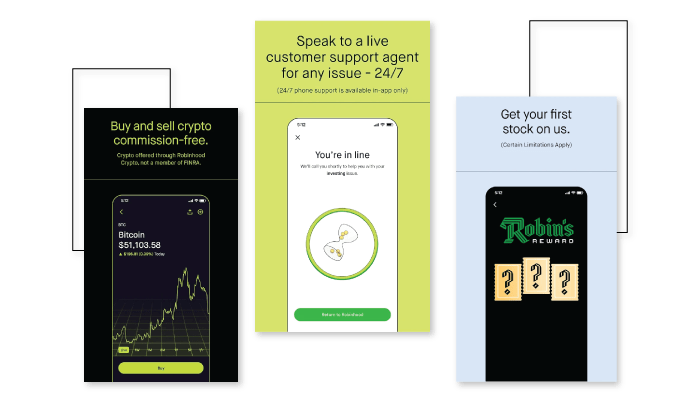

3. Robinhood – Investment & Trading

Do you want to build a platform like Robinhood that provides Commission-free stock and cryptocurrency trading, investing in fractional shares?

Well, let’s look at the monetization strategies of one of the most popular investment platforms in the market.

Monetization Models of Robinhood:

- Payment for Order Flow (PFOF): Receives payments from market makers to route users’ trades.

- Margin lending: Charges interest on margin loans provided to users for leveraged trading.

- Cryptocurrency trading fees: Charges fees for cryptocurrency trades.

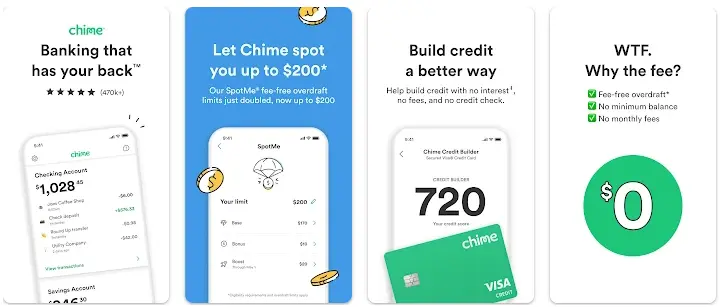

4. Chime – Digital Banking

Here’s how we have Chime.

Well, as a general rule, whoever wants to build a mobile banking app, you learn from this market leader.

Being a top digital banking app, it offers you amazing features like free online banking, direct deposit, no-fee ATM access, and early paycheck access.

And here’s how it makes money.

Monetization Models of Chime:

- Interchange fees: Earn income from merchants when users pay with Chime debit cards.

- Subscription fees: Offers optional premium features like priority customer support and overdraft protection.

- Partnerships: Earns revenue from partner financial products like credit card and savings accounts, offered within the app.

5. Zelle: Free P2P payments

Lastly, we have Zelle.

While a lot of people ask How to Make Money Through Fintech Apps, even more are asking “How does Zelle Make money?”

After all, despite being free for users, it is making millions in profit.

So, let’s shed some light on Zelle’s business model.

Monetization Models of Zelle:

Takes a slice of interchange fees merchants pay when users use Zelle for purchases. No fees for users, unlike some competitors.

How to Choose the Right Monetization Strategies for Fintech Apps?

Now that we know everything you need to know about How to Generate Revenue Through Fintech Apps, how do you select the right monetization strategy?

This is a very prevalent question among fintech startups.

Well, while there is no set path to it, here are some considerations that you can make:

- Conduct thorough app market research and find your target audience.

- Generate a unique value proposition and sale that

- Learn from other apps in the same niche

- Ask what users are willing to pay and how much you can charge them.

- Focus on delivering value before monetization.

- Test monetization strategies and adapt as time goes on.

This is how you can find the right way to make money with fintech apps and become the next market leader.

Nimble AppGenie – Your Fintech App Development Partner

Fintech market is lucrative, filled with platforms that are pushing the numbers when it comes to revenue generation.

If you are inspired by this to create your own fintech app or an already established player who wants to become future-ready, we can help you.

Nimble AppGenie is a well-known fintech app development company that has worked with some of the biggest names in the market including:

- Pay By Check– Ewallet Mobile App

- DafriBank– Digital Bank Of Africa

- SatPay– Ewallet Platform

- CUT–E-Wallet Mobile App

- SatBorsa– A Currency Exchange Fintech App

Apart from this, we have worked on more than 700 projects and clients love us. So do top platforms like Clutch.co, DesignRush, and Good Firms.

Hire App Developers within 24 hours to start working on your tech dream with Nimble AppGenie.

Conclusion

There is no doubt that the fintech app landscape is rapidly evolving, and with it, the ways in which fintech apps earn money. As technology advances and user expectations change, we can expect to see even more innovative monetization strategies emerge.

By understanding the current landscape and the key considerations for choosing the right strategy, you can position your fintech app for success in a competitive market. Remember, the most successful apps will be those that deliver genuine value to their users while finding sustainable ways to generate revenue.

So, whether you’re a curious reader or a fintech entrepreneur, it’s an exciting time to be part of this dynamic and innovative industry with your own fintech app and make millions.

FAQs

Payment and remittance FinTech solutions generate revenue through transaction fees, foreign exchange markups, subscription plans, merchant fees, licensing partnerships, and value-added services such as data analytics.

Peer-to-peer lending platforms make money by charging fees or commissions from borrowers and lenders, loan origination fees, late payment penalties, and interest rate spreads.

Robo-advisors typically charge a management fee based on a percentage of the assets under management (AUM). Some may also offer premium subscription plans or charge additional fees for certain services.

Neobanks generate revenue through various channels, including interchange fees from card transactions, overdraft fees, lending interest, foreign exchange fees, premium subscription plans, and partnerships with third-party financial service providers.

Yes, FinTech solutions can explore additional revenue streams like advertising partnerships, data monetization, white-label solutions for other businesses, strategic collaborations, and cross-selling complementary financial products or services.

No, revenue models can vary among fintech companies depending on their specific business model, target market, services offered, and competitive landscape. Each fintech may employ different monetization strategies.

There is no one-size-fits-all answer to this question, but you should consider your target audience, the value proposition of your app, what users are willing to pay for, and how you can deliver value before monetizing.

Common mistakes include focusing on monetization too early, charging too much for features, and not delivering enough value to users.

Niketan Sharma is the CTO of Nimble AppGenie, a prominent website and mobile app development company in the USA that is delivering excellence with a commitment to boosting business growth & maximizing customer satisfaction. He is a highly motivated individual who helps SMEs and startups grow in this dynamic market with the latest technology and innovation.

Table of Contents

No Comments