Digital payments have completely changed the way people make payments. Gone are the days when people had to stand in long queues with cash in their wallets, waiting for their turn to pay. Today, everyone has a credit/debit card that they can simply tap and pay for services.

Not to forget, even smartphones serve as smart wallets that can be used to make a payment instantly.

All of these cases are possible, thanks to the contactless payment system.

Contactless payments have become so common that we do not even realize that a lot of technology is involved in the process.

It all comes so naturally; however, there is a complete chain of events that makes these payments so convenient.

In this post, let’s take a closer look at how contactless payments work, how they came into existence, what benefits they offer, and where the technology is headed.

If you are looking to implement contactless payments in your business, or want to understand how it works, then make sure you read this article till the end.

Without further ado, let’s get started!

Contactless Payment and Its Rise in Popularity

Contactless payments have been around for a while. In the late 90s, contactless payments were implemented with the help of Radio Frequency Identification technology (RFID).

These cards can be considered as a part of a closed-loop payment system as they could only be used for a particular service, in a particular environment.

The best example of these payments can be a prepaid travel card used to access buses and subways.

However, with the advancement of technology, contactless payment systems spread across the globe, and today they are used for all sorts of payments, with different technologies.

Today, contactless payments are being used by more than 50% of users across the globe, making it one of the most preferred payment systems in the world.

That is because contactless payments have become mainstream due to their implementation in an open-loop payment system, making them useful globally.

While a bus pass or subway card would be used at a single outlet, modern-day cards enabled by Visa, MasterCard, and other payment networks can be used to pay for anything, anywhere.

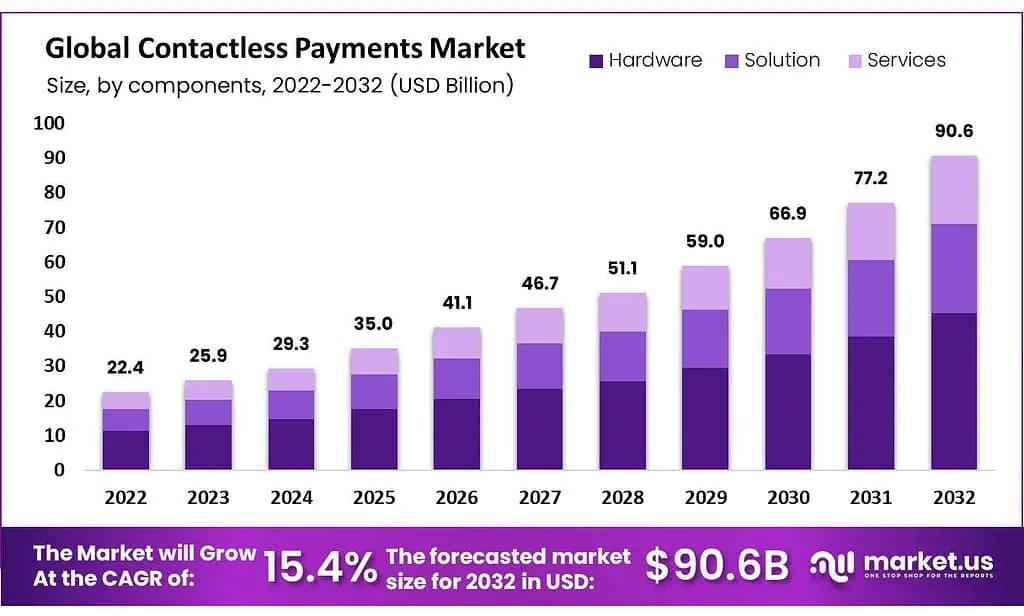

If we take a look at the rise of contactless payment systems, they are already going places.

It is one of the most commonly used payment methods in both the US and the UK, with more than 50% of people using it daily.

The contactless payment market is also growing consistently. It was valued at $2.4 trillion in 2022 and is consistently increasing at a CAGR of 18.3%, headed to touch 12.5 trillion by 2032.

What is Contactless Payment? How Does it Work?

So, what exactly is a contactless payment system?

As the name suggests, contactless payment is a method of paying for something without having to be in direct contact with it.

It is a safe and touchless method that allows a user to tap their smartphone or payment card to make payments.

This method uses a dedicated POS system, which has technology enabled to capture the signals shared by the card or smartphone.

Usually, contactless payments use technologies like NFC and RFID to allow contactless payments. It is quite simple to understand how exactly contactless payments work.

There are 3 steps:

- Step 1 – Customer taps the card/smartphone on the payment terminal or card reader.

- Step 2 – The POS terminal or the card reader receives the signal from the card and verifies the information from the customer’s bank account.

- Step 3 – Once the information is authenticated, the transaction is complete, and the money is shared with the merchant.

All of this happens in a matter of seconds, making the transaction instant. Since the bank is directly involved, the trail for the transaction makes it more reliable.

However, it is not necessary that only tapping a card can trigger a contactless transaction.

Contactless payments have found new interesting ways, where QR codes have also become a prominent method to carry out contactless payments.

There are different types of payment methods that are used in a contactless payment method that are used in this system. In the next section, let’s take a look at all of them.

Types of Contactless Payment Methods

What started with limited use cases and technologies has now become a highly advanced payment system.

Yes, today, contactless payments have taken over the entire realm of transactions, thanks to the digital transformation of fintech.

If we talk about the types of contactless payments, there are 3 of them:

► Cards

You can use the card to make contactless payments simply by tapping it on the point-of-sale machine. There are different types of cards, powered by payment networks to enable these transactions.

► Digital Wallets

Mobile wallets are another type of contactless payment method that can be used to make payments. These digital wallets are available on smartphones, making them easily accessible.

A user can easily scan a code through their phone to initiate a transaction, or simply save their payment information on it and tap it on a POS, similar to a card.

► Biometric Payments

These types of contactless payments require biometric authorization for a transaction to go through. You can use your smartphone as a payment device and enable your biometric verification if your device has appropriate hardware to support the same.

While the types of contactless payment methods are mentioned above, they use different technologies and devices through which contactless payments of any type can be implemented.

Here are the methods that power contactless payments:

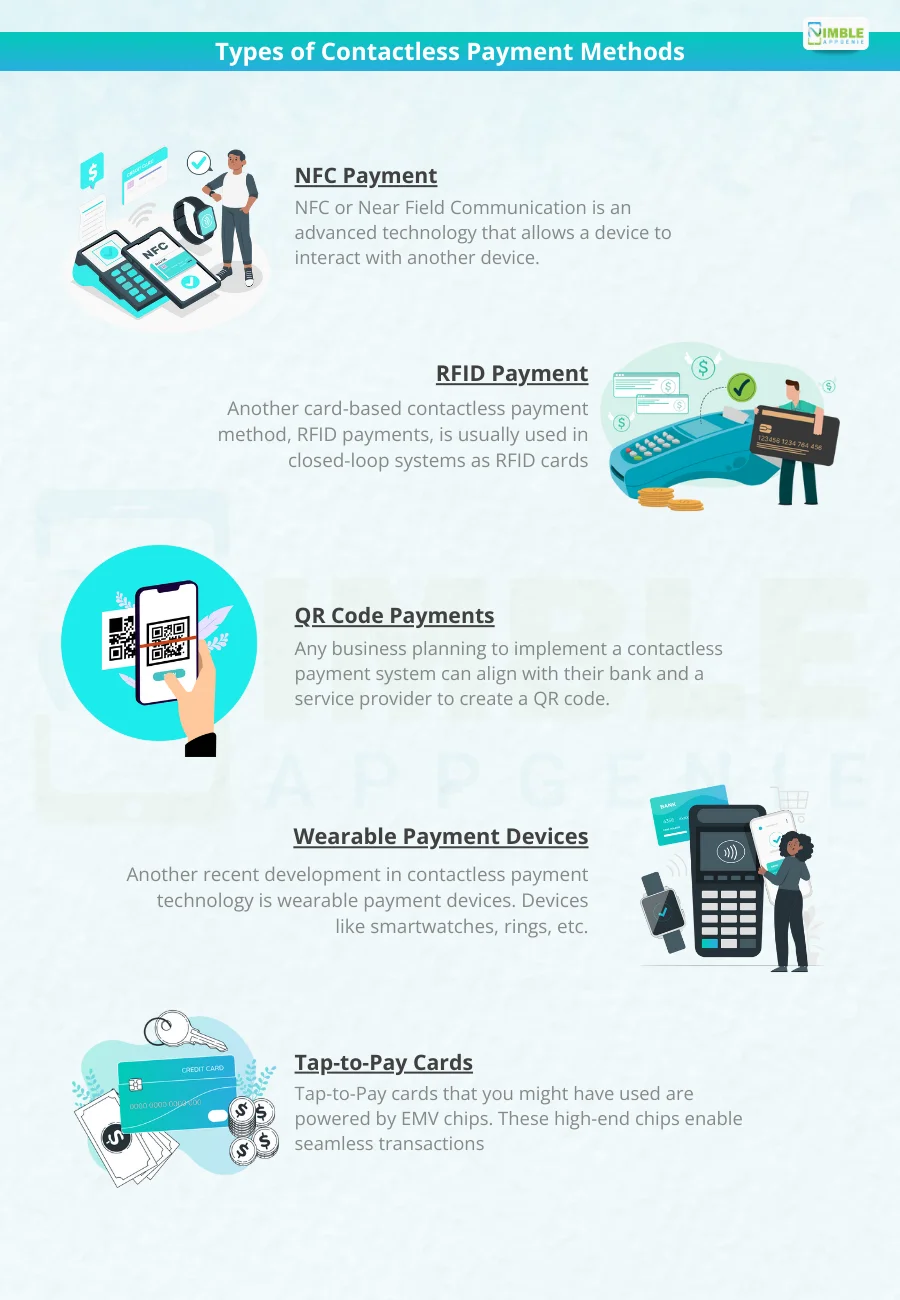

1. NFC (Near Field Communication) Payments

NFC or Near Field Communication is an advanced technology that allows a device to interact with another device. This allows a transaction to go through simply by tapping an NFC-enabled device, usually a POS.

2. RFID (Radio Frequency Identification) Payments

Another card-based contactless payment method, RFID payments, is usually used in closed-loop systems as RFID cards are not directly connected to a bank.

They can be used in a closed environment and can only be used to transmit payment information from one device to another.

3. QR Code Payments

Any business planning to implement a contactless payment system can align with their bank and a service provider for QR code payments.

Users who want to pay contactless can easily use their smartphones to scan this code, and it automatically feeds the banking information of the recipient.

A user only has to use a smartphone, and the payment can be done electronically. Beyond facilitating payments, businesses can also use tools to track QR codes, measure engagement and understand how customers interact with their payment links.

4. Wearable Payment Devices

Another recent development in contactless payment technology is wearable payment devices. Devices like smartwatches, rings, etc., are being used to carry out contactless transactions easily.

Powered by NFC, these devices can be easily used to verify a transaction, making it more convenient for users by offering features like contactless ring payments and contactless phone payments.

5. Tap-to-Pay Cards (EMV Contactless Cards)

Tap-to-Pay cards that you might have used are powered by EMV chips. These high-end chips enable seamless transactions when combined with NFC technology.

The majority of payment networks and providers, such as MasterCard, Visa, American Express, etc. use EMV cards, which shows their reliability.

Other than these technologies like Blockchain, AI, ML, and IoT in fintech are also making contactless payments more efficient and secure.

With all these different technologies powering contactless payments, the use cases for this system are endless.

The potential contactless payment offers are worth exploring. If you are a business owner planning to integrate a payment system, make sure you consider going for a contactless payment system.

Advantages of Contactless Payment Systems

After looking at all the types of payment apps that support contactless payment, you might have made up your mind. Well, just to give you some more assurance.

Here are the advantages of implementing a contactless payment system.

1] Faster Transactions

One of the proven advantages of deploying a contactless payment system is the speed of transactions. It hardly takes a few seconds, and the transaction is completed.

There are no unnecessary steps involved; all you have to do is tap your NFC/RFID-enabled card or smartphone, and the transaction goes through.

2] Enhanced Security

With the latest technology powering our contactless payment system, you can rely on the latest encryption and blockchain technology to keep your transactions secure.

The chip technology used in your card helps keep you secure from data breaches and fraudulent transactions.

3] Reduced Physical Contact

When you use a contactless payment system, there is hardly any physical contact involved. You simply tap your smartphone or card to the POS hardware, and the payment is done.

This reduced physical contact can save a lot of time and require an additional resource to manage your cash collection. This is the machine that does it for you!

4] Support Business Growth

For any business to grow, it is necessary that its customers stay happy and keep returning.

By offering a contactless payment solution, you simplify the user checkout, making it more convenient for the customer.

Not to mention, you can easily start offering discounts and launch loyalty programs, supporting your business growth.

5] More Sanitary than Cash

With the outbreak of a pandemic, everyone has become a bit disciplined and cautious about what they touch or access.

Contactless payments are more sanitary than cash. This may not seem ideal for you, but you may be shocked that the majority of users have tap and pay enabled just so that they can skip unnecessary physical contact.

Knowing the advantages that contactless payments offer, one can identify the real-life use cases and benefits that setting up this system can yield.

Needless to say, a contactless transaction is surely a beneficial payment method.

Disadvantages of Contactless Payment Systems

Yes, there are a few disadvantages associated with contactless payment systems. It is just not possible to have a system that doesn’t have its drawbacks, and similarly, the contactless payment system also has a few areas where it lacks.

The disadvantages of implementing contactless payment systems are:

♦ Transaction Limits

Contactless payments come with a transaction limit. This means you can only pay for basic, everyday things with a single tap.

When you purchase something expensive, you need to authorize the transaction with a signature or PIN.

This can cause a bit of inconvenience as the whole idea behind creating a contactless payment system is to make payments faster and hassle-free.

♦ Dependency on Technology & Internet

Card payments are still dependent on tech-enabled point-of-sale infrastructure that requires power and an internet connection.

Since all the transactions are done after verification from the bank, the process depends on the Internet, which may not be available every time, everywhere.

A lot of contactless transactions fail due to the unavailability of the internet, which is a major concern for users.

♦ Privacy Concerns

When using a card, the chances of your personal information and card details leaking are always high.

That is because, while cash transactions are limited to the exchange of currency, cashless transactions exchange information related to the bank used for the transaction and an identifier from both the payer and the recipient, proving to be a major privacy concern.

♦ Higher Fees for Businesses

Contactless payment systems are not at all cheap to set up and maintain.

Sure, they are not too high as well, but think about it, there are different fees that you have to pay as a business while using a contactless payment system.

These charges include POS charges, transaction fees, etc. These charges often demotivate a business from opting for the service.

♦ Limited Acceptance

While contactless payments are catching up, the acceptance of these transactions is still a point of concern.

Not every business accepts contactless payments, which means you cannot simply rely on this mode of payment for all your expenses.

This is a disadvantage for contactless payment users as they might get stuck while paying with a card.

While not all users may think of these disadvantages as a deal breaker, some might have usage issues. It is truly a matter of perception.

For instance, transaction limits often serve as a security measure so that if the card is misplaced and someone else finds it, they do not get access to the entire limit unless they have the security PIN.

How Nimble AppGenie Helps Businesses Adopt Contactless Payment Technology

Don’t let the disadvantages stop you from implementing a robust contactless payment system for your business.

One of the primary reasons that startups avoid using the latest payment method is that they do not get enough support to set up and execute the entire system.

Well, if you, too, are facing a similar issue, then do not worry, as we at Nimble AppGenie are here to help you! Our experts can help your business adopt contactless payment technology, offering robust e-wallet app development services that help you implement the system faster.

Our professional team of quality analysts can be of great help in reducing bugs in the executed contactless payment solution, making it more and more refined.

Reach out today if you plan to get started with a contactless payment solution!

Conclusion

It is clear that contactless payments are no longer an advanced solution and are available all around the world.

The system has found its applications in every transaction, making it a part of daily life. Needless to say, it makes the entire process streamlined for a business and offers massive benefits to the users.

In the upcoming days, contactless payment systems can be seen implemented in different ways, revolutionizing the way transactions work.

If you plan to be a part of this revolution, then this may be your chance.

Hope this post gives you enough information on the contactless payment system. Reach out to experts for more information on how you can implement a robust payment system for your business.

Good luck!

FAQs

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.