Nowadays, people check their credit scores like they check the weather. With more than 36 million monthly active users, Credit Karma has become a trusted name in personal finance.

The demand for credit monitoring and financial tools is growing fast. It shows a great future for businesses in this industry.

So if you are a business looking to become the next industry leader, this is your chance to develop an app like Credit Karma. This blog will guide you through the crucial Credit Karma app development process, along with features, costs, and monetization models.

So, let’s begin!

What is the Credit Karma App?

Credit Karma is a credit scoring app that helps users check and understand their credit scores. It gives users updates on their credit report and shows them what’s helping or hurting their score.

The app also suggests credit cards, loans, or financial products that match their credit profile. Users can see their credit score anytime without hurting it. This is helpful if users are planning to apply for a loan or a credit card.

Credit Karma also alerts them if there are any changes to their credit report, which helps them spot fraud or mistakes. It even provides tips to improve their credit. The app is safe to use and doesn’t charge any money.

Credit Scoring Market Overview, Size, and Growth

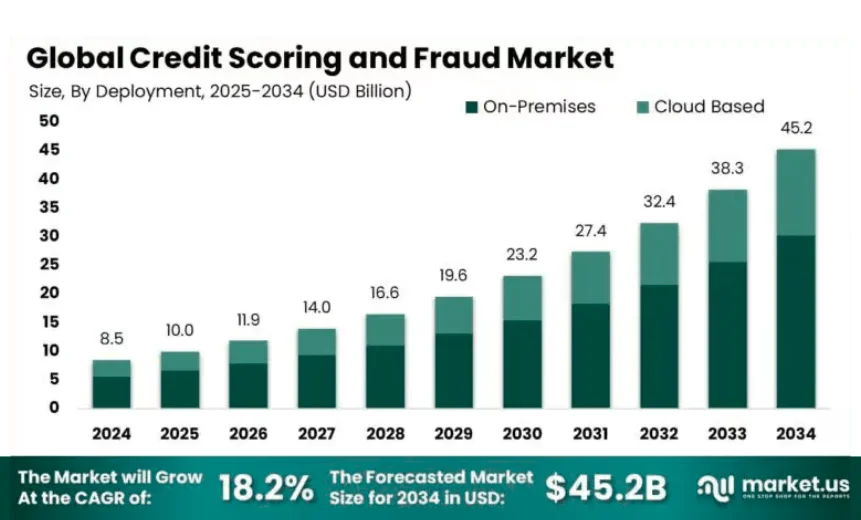

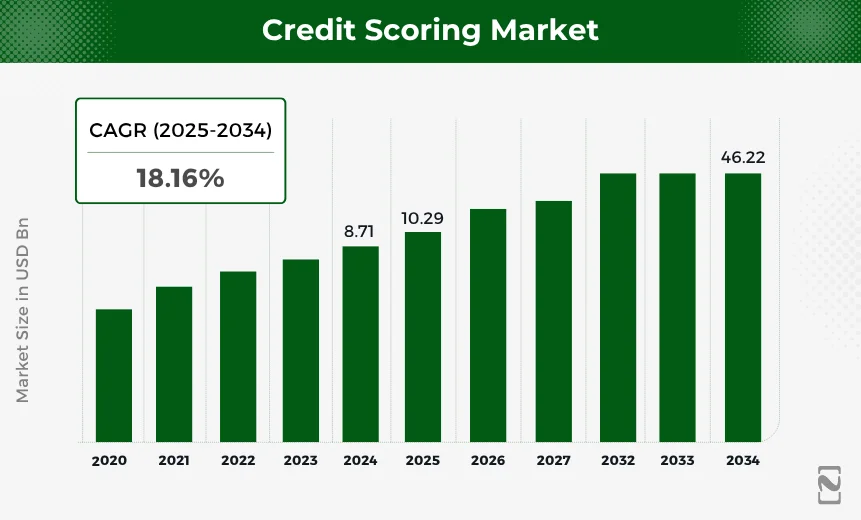

If you’re planning to create a credit monitoring app, it’s important to understand fintech app statistics. So, let’s look at a quick overview of the market.

Source: Market Research Future

- As per market.us, the US fraud detection and credit scoring market is expected to hit $3.23 billion by 2034 with a CAGR of 19.3%.

- In 2024, North America led the global credit scoring and fraud detection market, holding over 7% of the total market share.

- In 2024, the Banking, Financial Services, and Insurance sector held a major portion of the credit scoring and fraud detection market, accounting for over 7% of the total share.

How Does the Credit Karma App Work?

Once you know about the Credit Karma app, it is vital to fully understand its working mechanism. This will help you in creating a credit scoring app like Credit Karma.

Below is the workflow that Credit Karma mentioned.

- Users first download the Credit Karma app from the App Store for iPhone devices or Google Play for Android devices.

- Now they can sign up using their email and answer some simple questions to confirm their identity.

- They can check their credit score at any time. It’s free and updates regularly, usually once a week.

- Now users can see their full credit history, including credit cards, loans, payment history, and any missed payments.

- Credit Karma gives them easy tips to help them raise their score, like paying on time or using less of their credit limit.

- Now the app shows users some credit cards, personal loans, or auto loans they may qualify for, based on their credit profile.

- Users can see how their score changes over time and understand what causes it to go up or down.

- Lastly, the app notifies users if something new appears on their credit report, like a new account or any suspicious activity.

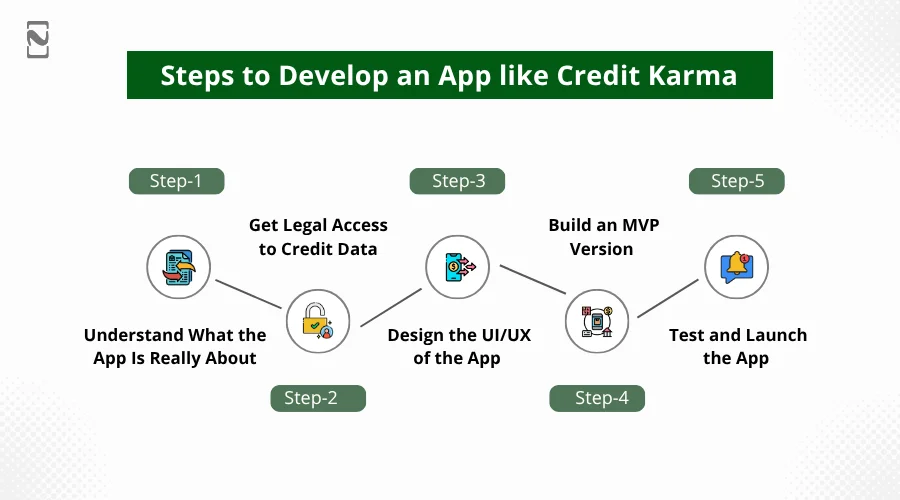

Steps to Develop an App like Credit Karma

Developing an app like Credit Karma requires a combination of financial knowledge, technical expertise, and strong planning.

Credit Karma provides credit score checking, financial advice, loan options, and personalized offers.

So, if you want to build a similar app, follow these steps:

Step 1: Understanding What the App Is About

First, you need to know what Credit Karma does. It’s not just a credit score app. It assists users in checking their credit reports for free and getting loan and credit card suggestions. Also, it can track their financial health and receive alerts about changes in their credit profile. Being one of the best fintech app ideas, you need to validate it with experts.

Now, the first stage is to decide what your app will offer, like Credit Karma. Will it cover credit score checks, loan recommendations, or just basic tracking? You also need to figure out who you’re building this for.

Are your users in the US, UAE, or somewhere else? Do they want basic credit reports or also want features like alerts, loan offers, or tax filing help? Once you get this clarity, it will help you decide what features to build.

Step 2: Get Legal Access to Credit Data

Getting access to a user’s credit data is not simple, and that is a good thing. You will need to legally connect with the credit bureau. You just can’t develop an app like Credit Karma without getting legal access to such information.

Reach out to credit bureaus and fintech regulations and compliances like GDPR, and work on data-sharing agreements. In the USA, this involves strong privacy laws and user permission.

Credit card data is sensitive and confidential, so your mobile app should follow strict security rules. Without their permission, your app, like Credit Karma, will not function, so do not skip this step.

Step 3: Design the UI/UX of the App

Once you know what an app like Credit Karma will do and how you will get the data, it is time to design the app. A Credit Karma-like app should be simple to use. The dashboard should show credit scores, explain what affects the score, and recommend actions.

Your target audience should feel comfortable while using the app when viewing their financial data. So, keep it simple and visually appealing. Now create wireframes for a clear roadmap for each screen, like the login page or the credit score dashboard.

Besides, you can keep the navigation simple and use calming colors. If the app design feels confusing or cluttered, your potential audience will stop using the app. Thus, you aim to make it easy for users to check their credit score.

Step 4: Build an MVP Version

Now it is time to develop an app like Credit Karma. But before developing a fully-functional app, start with an MVP version. Don’t try to add all the features at once. You should only add the core features like user registration, linking to credit data, and so on.

When you build an MVP app will help you test your app idea. For example, whether it works well or if users find it useful or not. Just try out secure, fast, and reliable technologies. Also, you may want to develop separate apps for Android and iOS.

At this stage, your main focus should be on functionality and not on perfection. You’ll need to build a robust backend system that can handle many users safely. It also covers setting up encryption and other safety steps to protect personal data.

Step 5: Test and Launch the App

Last but not least, you can test your app like Credit Karma with real users to catch bugs and get feedback. Just ensure that the credit score updates work well, the data is accurate, and your app feels secure.

In the fintech app testing stage, testers fix the bugs, make changes, and check that everything is secure. Once your credit karma-like app works properly, you can launch it on the app stores.

Also, it is vital to timely maintain and update your credit score app with security checks, bug-fixing, and feature enhancements. Mobile app maintenance checklist can really help your app to run faster and smoother.

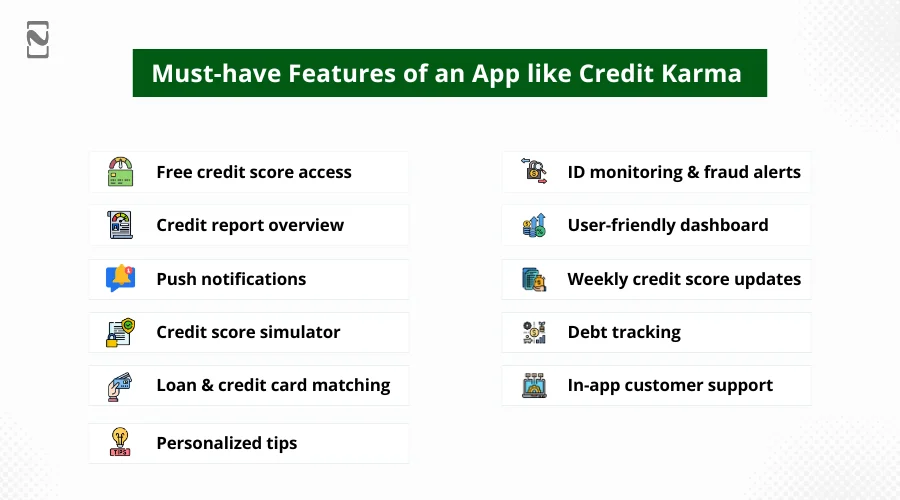

Crucial Features of an App like Credit Karma

Features make your app more engaging and successful, but only if they are useful. So, when you develop an app like Credit Karma, try to integrate only the useful fintech app features into it.

Here are some of the crucial features of an app like Credit Karma.

► Must-have Features

The must-have features are the core features that are critical for the basic functionalities of an app.

Check them out.

- Free credit score access

- Credit Report Overview

- Push notifications

- Credit score simulator

- Loan and credit card matching

- Personalized tips

- ID monitoring and fraud alerts

- User-friendly dashboard

- Weekly credit score updates

- Debt tracking

- In-app customer support

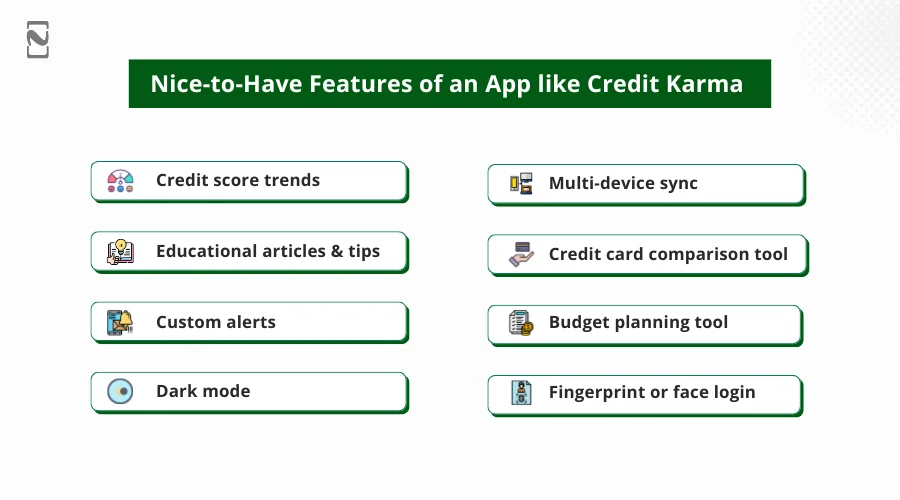

► Nice-to-Have Features

These features are advanced features, or we can say extra features, that are helpful, but not essential for basic use.

Let’s have a look at them.

- Credit score trends

- Educational articles and tips

- Custom alerts

- Dark mode

- Multi-device sync

- Credit card comparison tool

- Budget planning tool

- Fingerprint or face login

How Much Does it Cost to Develop an App like Credit Karma?

The cost to develop an app like Credit Karma can range between $23,000 – $190,000, depending on how detailed your app is. If you want a simple app with basic features like credit score tracking, loan and card offers, user accounts, and strong security, the cost to build a fintech app like Credit Karma will be less.

But if you want more features like credit monitoring, financial tips, loan offers, and advanced security, the Credit Karma app development costs more. In short, the more features and better design you want, the higher the cost will be.

| App Complexity | Cost Breakdown | Time Estimation |

| Simple App | $23000 – $90000 | 2-4 months |

| Intermediate App | $90000 – $140,000 | 4-7 months |

| Complex App | $190,000+ | 9 months+ |

Also, if you develop a Credit Karma clone app for both iOS and Android platforms, it will cost more than developing for one.

So, basically, the cost to build an app like Credit Karma depends on your project requirements. It is vital to consult with an app development company that can offer a complete quotation on it.

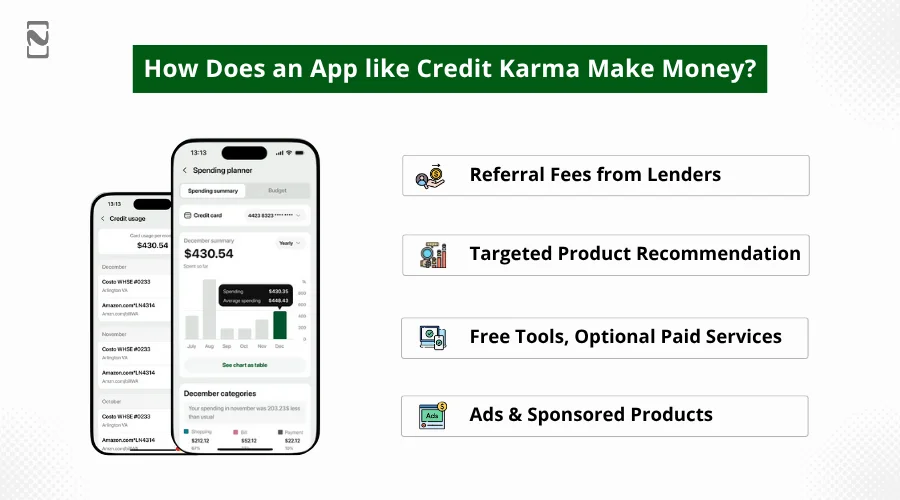

How Does an App Like Credit Karma Make Money?

Credit Karma earns money from multiple income sources. From recommending financial products like credit cards to earning a commission when users are approved.

If you, too, want to earn money from an app like Credit Karma, then check out the points below.

-

Referral Fees from Lenders

Credit Karma makes money from referral fees from lenders. When a user applies for a credit card or loan through the application, Credit Karma gets a commission or referral fee from the bank or lender.

This is just like a reward for sending them a new customer. Users do not have to pay anything; the bank pays for it. That’s the main way an app like Credit Karma earns money. Similarly, you can earn a huge revenue from referrals.

-

Targeted Product Recommendation

Credit Karma uses users’ credit data to show personalized financial offers. It does not sell your data, but it uses it to match you with products you are most likely to qualify for.

This helps boost conversions, which means more approved signups and more referral money. For example, if your credit score is 650, you won’t see cards requiring 750+. You will only see ones where approval is more likely.

-

Free Tools and Optional Paid Services

Did you know that most of Credit Karma’s tools are free to use? For example, credit monitoring, tax filing, and score tracking. However, sometimes, the app showcases users some extra services that cost money, like instant help or extra insurance.

These are provided by partner companies. If you choose to buy them, an app like Credit Karma can earn a small portion of that payment. So, while a basic app is free, they can even earn some amount of revenue from these offers.

-

Ads & Sponsored Products

Credit Karma makes money by showing different ads for financial products in the application. These advertisements can be for credit cards, insurance, loans, or tax services. Many companies pay Credit Karma some amount for showing these ads.

They know popular apps like Credit Karma have a huge audience that is interested in money-related services. Since the application knows your credit score and financial habits, it can show users ads that are most useful.

Why Choose Nimble AppGenie for Credit Karma App Development?

Nimble AppGenie is the best choice for creating an app like Credit Karma, as we have 8+ years of experience in fintech solutions. Since 2017, we have been the number one fintech app development company in the USA.

Our qualified developers can create a credit karma-like apps that manage a personal finance app along with credit scores and money management. We work closely with clients and provide regular updates during the project.

Additionally, we also provide post-launch support services. So, if you are looking to turn your vision into reality, Nimble AppGenie is the right place for you. Contact us right away!

Final Thoughts

Developing a credit monitoring app like Credit Karma is a smart move to help users manage their finances easily. We hope you get great insight from this blog. Now that you know the process of developing an app like Credit Karma, it is time to turn your idea into reality.

Working with the right development team can make it easier and help you. They can design a simple and useful app that lets you stay focused on your idea. So, what are you up to? Get in touch with us right away and get an outstanding credit scoring app solution.

FAQs

To create an app like Credit Karma, you should follow the steps below:

- Study Credit Karma’s features

- Choose the main services

- Hire app developers

- Design simple user screens

- Use secure login and data protection

- Connect with credit bureaus

- Test the app well

- Launch on app stores

You should integrate the following features into your Credit Karma-like app:

- Credit score tracking

- Credit report updates

- Personalized loan and card offers

- Tips to improve credit

- Identity theft alerts

- Bill reminders

- Easy sign-up and login

- Secure data handling

Yes, there are multiple apps similar to Credit Karma available on the app stores. Let’s have a look at them:

- CreditWise

- Experian

- Credit Sesame

- Credit Score

- ClearScore

Niketan Sharma, CTO, Nimble AppGenie, is a tech enthusiast with more than a decade of experience in delivering high-value solutions that allow a brand to penetrate the market easily. With a strong hold on mobile app development, he is actively working to help businesses identify the potential of digital transformation by sharing insightful statistics, guides & blogs.

Table of Contents

No Comments

Comments are closed.